Equinix Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinix Bundle

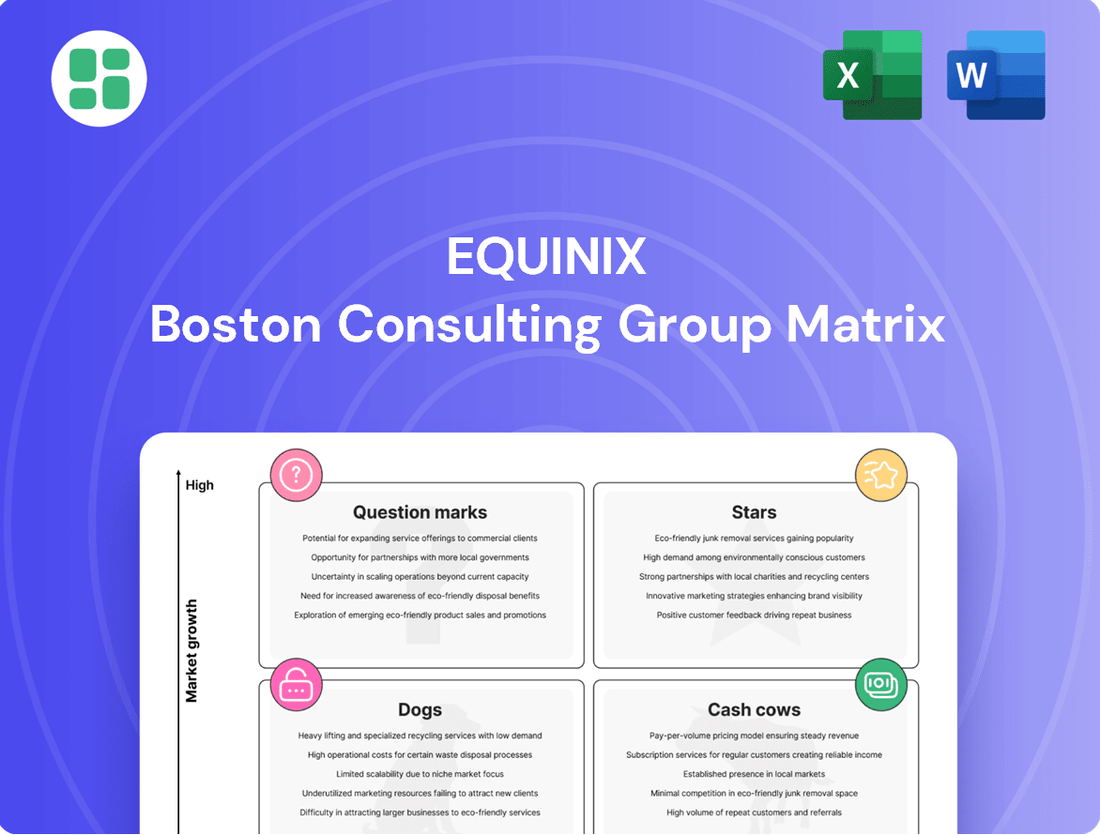

Curious about Equinix's strategic product positioning? Our BCG Matrix preview highlights their market share and growth potential across key segments, offering a glimpse into their portfolio's health.

Don't miss out on the full picture! Purchase the complete Equinix BCG Matrix for detailed quadrant analysis, actionable insights into their Stars, Cash Cows, Dogs, and Question Marks, and a clear roadmap for optimizing their business strategy.

Stars

Equinix is making substantial investments in infrastructure designed for AI and high-performance computing. This includes advanced cooling technologies, such as liquid cooling, to manage the significant power requirements of AI hardware. For instance, Equinix announced a $750 million expansion in the Dallas metro area in 2024, partly to accommodate AI demand.

Equinix Fabric, a cornerstone of Equinix's interconnection services, is a significant growth driver for the company. Its expansion is fueled by the escalating demand for hybrid multicloud architectures and the critical need for low-latency connections essential for burgeoning AI ecosystems. This service facilitates direct, secure links between enterprises, cloud service providers, and various networks, solidifying Equinix's position as a pivotal global interconnection hub.

The robust demand for Equinix Fabric signals its strong market position within a rapidly expanding sector. In the first quarter of 2024, Equinix reported that its interconnection revenues, largely driven by Equinix Fabric, continued to show strong growth, reflecting the increasing reliance on digital infrastructure for seamless data exchange and application performance.

Equinix's xScale program, focused on building hyperscale data centers through joint ventures, is a significant growth engine. These facilities cater to the immense needs of major cloud and hyperscale players, enabling their core infrastructure expansion. Equinix has earmarked substantial capital for xScale projects, underscoring its commitment to leadership and robust growth in this high-demand sector.

Global Platform Equinix Expansion in Key Digital Hubs

Equinix is aggressively expanding its global digital infrastructure, focusing on key metropolitan areas vital for digital growth. This expansion strategy, which includes building new International Business Exchange (IBX) data centers, reinforces Equinix's position as a leader in these high-demand markets. By consistently increasing its geographical reach and capacity, Equinix ensures its continued dominance within core digital ecosystems.

In 2024, Equinix continued its robust expansion, notably with significant investments in Europe and Asia-Pacific. For instance, the company announced plans for new IBX data centers in cities like Madrid and Sydney, further strengthening its presence in rapidly growing digital economies. These expansions are crucial for supporting the increasing demand for cloud connectivity, content delivery, and digital services.

- Expansion in Key Markets: Equinix's 2024 expansion efforts included new data center builds in Madrid, Spain, and Sydney, Australia, enhancing its global footprint.

- Strategic Investments: The company allocated substantial capital towards these new facilities, underscoring its commitment to high-growth regions.

- Market Leadership: These expansions solidify Equinix's role in enabling digital transformation by providing critical infrastructure in major economic hubs.

- Capacity Growth: The addition of new IBX data centers directly addresses the escalating demand for interconnection and digital services worldwide.

Sustainable Digital Infrastructure Solutions

Equinix is making significant strides in sustainable digital infrastructure. Their commitment is evident in their impressive renewable energy coverage, which reached 96% globally by the end of 2023, a substantial increase from previous years. This focus on green energy and operational efficiency, reflected in their consistently low Power Usage Effectiveness (PUE) ratings, positions them as a strong contender in the Stars category.

This dedication to sustainability isn't just about environmental responsibility; it's a strategic advantage. As businesses increasingly prioritize eco-friendly partners, Equinix's green credentials attract a growing customer base. For instance, their ongoing investments in advanced cooling technologies and on-site solar generation contribute to their market leadership and appeal.

- Global Renewable Energy Coverage: Equinix achieved 96% renewable energy coverage globally in 2023.

- Improved PUE: The company consistently maintains industry-leading low PUE ratings, demonstrating operational efficiency.

- Customer Demand: Growing client preference for sustainable data center solutions fuels Equinix's market position.

- Strategic Investment: Investments in green technologies like solar and advanced cooling enhance their competitive edge.

Equinix's commitment to sustainability, evidenced by its 96% global renewable energy coverage in 2023 and consistently low PUE ratings, positions it strongly as a Star in the BCG matrix.

This focus on green infrastructure not only addresses environmental concerns but also attracts a growing segment of environmentally conscious customers, enhancing its market appeal.

Investments in advanced cooling and on-site solar generation further bolster Equinix's competitive advantage in the sustainable digital infrastructure space.

The company's strategic alignment with increasing client demand for eco-friendly data center solutions solidifies its leadership and growth trajectory.

| Metric | 2023 Data | Significance |

|---|---|---|

| Global Renewable Energy Coverage | 96% | Demonstrates strong commitment to sustainability, attracting eco-conscious clients. |

| Power Usage Effectiveness (PUE) | Industry Leading Low | Highlights operational efficiency and reduced environmental impact. |

| Investments in Green Tech | Advanced Cooling, On-site Solar | Enhances competitive edge and market leadership in sustainable infrastructure. |

What is included in the product

The Equinix BCG Matrix offers a strategic framework to analyze its data center and interconnection services by market share and growth rate.

It guides decisions on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

The Equinix BCG Matrix offers a clear, one-page overview, simplifying complex portfolio decisions and alleviating the pain of strategic uncertainty.

Cash Cows

Equinix's core retail colocation in established markets represents its most robust cash cows. These mature segments, found in places like Northern Virginia, Silicon Valley, and London, contribute significantly to the company's recurring revenue. In 2023, Equinix reported that its colocation segment, which heavily features these established markets, generated the vast majority of its over $10 billion in total revenue.

These operations are characterized by high utilization rates and a stable, predictable cash flow, requiring less capital for aggressive expansion compared to newer ventures. The extensive global footprint and deep-rooted customer relationships in these markets provide a competitive moat, ensuring consistent demand and profitability for Equinix.

Basic cross connects, the fundamental physical links within Equinix's IBX data centers, are a mature and deeply ingrained service. Their widespread adoption makes them a consistent, high-margin revenue stream. These essential connections facilitate customer interconnections, requiring minimal further investment for growth.

Equinix's long-standing enterprise customer relationships are a prime example of a Cash Cow. These clients, deeply embedded in Equinix's colocation services for their critical IT needs, generate highly predictable and stable recurring revenues. This loyalty, evidenced by strong customer retention, means Equinix spends less on acquiring and retaining these valuable accounts.

Global Data Center Network (Existing Portfolio)

Equinix's global data center network, representing its existing portfolio, functions as a significant cash cow within its BCG Matrix. This extensive network of operational facilities, spanning numerous metropolitan areas worldwide, consistently generates substantial revenue and robust operating margins. The mature nature of these assets allows Equinix to capitalize on economies of scale and a broad, diversified customer base, leading to predictable and strong cash flows.

The established global footprint means that capital expenditure is primarily focused on expansion and upgrades rather than market entry, further enhancing cash generation. For instance, in 2023, Equinix reported a significant portion of its revenue, approximately $7.2 billion, stemming from its colocation services, which are directly tied to its existing data center infrastructure. This demonstrates the consistent and reliable income stream these assets provide.

- Consistent Revenue Generation: Equinix's existing data centers are mature assets that provide a stable and predictable revenue stream.

- High Operating Margins: Economies of scale and a diverse customer base contribute to strong profitability for these facilities.

- Reduced Capital Intensity: Less need for aggressive market establishment capital allows for greater cash generation from the existing portfolio.

- Significant Contribution to Revenue: Colocation services, largely driven by the existing network, represent a major portion of Equinix's overall income.

Managed Infrastructure Services for Stable Workloads

Equinix's managed infrastructure services for stable workloads are a prime example of a Cash Cow. These offerings cater to clients with predictable IT needs, ensuring consistent demand and revenue. For instance, in 2024, Equinix continued to see strong uptake in colocation and interconnection services for businesses with established, non-volatile infrastructure requirements.

These services are characterized by their reliability and operational efficiency, generating steady income without the need for substantial reinvestment in new technologies. Equinix leverages its extensive global footprint and established operational expertise to deliver these stable solutions, contributing significantly to its overall financial health.

- Stable Revenue Streams: These services provide a predictable and consistent income for Equinix, underpinning its financial stability.

- Leveraging Existing Assets: Equinix utilizes its vast existing infrastructure and operational capabilities, minimizing incremental investment needs.

- Customer Loyalty: Clients seeking stability and operational simplicity often form long-term relationships with providers of these managed services.

- Contribution to Profitability: While not high-growth, these Cash Cows are vital for generating consistent profits that can fund growth initiatives in other areas.

Equinix's established retail colocation services in mature markets, such as Northern Virginia and London, are key cash cows. These operations, benefiting from high utilization and deep customer relationships, generated a substantial portion of Equinix's revenue, with colocation services contributing approximately $7.2 billion in 2023.

Basic cross-connects, essential for customer interconnections within Equinix's data centers, represent another mature and highly profitable service. Their widespread adoption and minimal reinvestment requirements solidify their status as a consistent, high-margin revenue generator for the company.

Long-term enterprise customer relationships, deeply integrated into Equinix's colocation offerings, provide highly predictable recurring revenue. The strong customer retention in these segments means Equinix can rely on these accounts with less expenditure on acquisition, boosting profitability.

Equinix's existing global data center portfolio functions as a significant cash cow, consistently delivering robust operating margins. In 2024, the company continued to leverage this extensive network, with colocation and interconnection services remaining core revenue drivers, underscoring the stability of these mature assets.

| Key Cash Cow Areas | Description | Financial Impact (Illustrative) | Key Characteristics |

| Established Retail Colocation | Mature markets with high demand and utilization. | Significant portion of over $10 billion total revenue (2023). | Stable recurring revenue, high utilization, deep customer relationships. |

| Basic Cross-Connects | Essential physical links for customer interconnections. | Consistent high-margin revenue stream. | Widespread adoption, minimal reinvestment, operational efficiency. |

| Long-Term Enterprise Relationships | Deeply embedded clients with ongoing IT needs. | Predictable and stable recurring revenue. | High customer retention, lower acquisition costs, embedded services. |

| Existing Global Data Center Network | The full portfolio of operational facilities. | Robust operating margins and substantial revenue generation. | Economies of scale, diversified customer base, predictable cash flows. |

Preview = Final Product

Equinix BCG Matrix

The Equinix BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This analysis is meticulously crafted to provide actionable insights into Equinix's diverse portfolio of data center and interconnection services, categorizing them into stars, cash cows, question marks, and dogs to guide strategic decision-making. The preview accurately represents the professional formatting and depth of information contained within the final report, ensuring you get exactly what you need for your business strategy.

Dogs

Outdated low-density colocation facilities in stagnant niche markets represent a potential challenge for Equinix, even as the company prioritizes growth. These assets, often found in regions with limited demand for advanced connectivity or expansion, might struggle to generate substantial revenue. In 2024, such facilities could face increasing pressure as newer, higher-density options become more prevalent, potentially leading to declining utilization rates.

Equinix's legacy acquisitions that haven't integrated well or gained traction could be classified as Dogs. These are typically characterized by low market share and low growth potential within the broader data center industry. For instance, if Equinix acquired a regional data center provider in 2022 that has since struggled to achieve profitability or contribute meaningfully to its global network, it might fall into this category.

These underperforming assets often demand significant capital and operational resources for maintenance, yet yield minimal returns. In 2024, Equinix continued its strategic focus on integrating its larger, more impactful acquisitions, such as the remaining assets from its Verizon data center portfolio, while potentially re-evaluating or divesting smaller, non-strategic legacy holdings that drain resources without clear strategic benefit.

Highly commoditized, standalone connectivity services within Equinix's portfolio likely fall into the Dogs category of the BCG Matrix. These are services that are not integrated into the more advanced Equinix Fabric or digital services platform and are subject to intense price competition in a saturated market.

These offerings typically have minimal differentiation and consequently, low profit margins. They consume resources without demonstrating significant growth potential, especially as customers increasingly favor more sophisticated, integrated solutions.

The value proposition of these basic connectivity services may be diminishing as the market evolves. For instance, while Equinix's overall revenue grew by 9% in 2023 to $11.5 billion, the growth in these standalone, commoditized segments is likely much lower, contributing to their classification as Dogs.

Underutilized or Obsolete Equipment Leasing Programs

Legacy equipment leasing programs, particularly those focused on hardware that doesn't align with Equinix's current digital infrastructure and subscription-based services, would likely fall into the Dogs category of the BCG Matrix. This is because the underlying technology may be becoming obsolete, leading to declining demand and low returns.

These underutilized programs can tie up significant capital. For instance, if a company has a substantial portfolio of older server or networking hardware leases that are no longer in high demand, the associated capital expenditure and maintenance costs would represent a drain on resources. In 2024, the trend towards cloud adoption and as-a-service models continues to accelerate, further marginalizing traditional hardware leasing.

- Obsolete Technology: Hardware leasing programs for equipment no longer aligned with modern, scalable digital infrastructure solutions.

- Low Market Share & Growth: These programs likely have a diminishing share in a market increasingly favoring subscription and cloud-based services.

- Capital Tie-up: Significant capital is immobilized in assets with declining utility and demand.

- Low Profitability: Expected to generate minimal or negative returns due to low utilization and high maintenance costs.

Divested or Phased-Out Non-Core Business Units

Divested or phased-out non-core business units in Equinix's portfolio would be categorized as Dogs. These are segments with low market share and limited growth potential, where the company has opted to cease operations or sell off assets to focus on more promising ventures. For instance, if Equinix had a niche data center service that was not gaining traction, it would be a prime candidate for this quadrant.

While specific divestitures are not always highlighted in broad financial reports, Equinix has historically focused on its core colocation and interconnection services. Any smaller, ancillary services that did not align with this strategic direction and showed minimal revenue contribution would be considered Dogs. The company's strategy often involves pruning underperforming assets to reinvest capital into areas like expanding its global footprint or enhancing its digital services.

- Strategic Divestitures: Equinix may have divested smaller, non-core technology solutions or regional data center assets that did not meet growth expectations.

- Resource Reallocation: The company's focus on high-growth segments like hyperscale and enterprise colocation implies a deliberate shift away from less profitable or stagnant business lines.

- Market Share Decline: Any business unit experiencing a consistent drop in market share and unable to compete effectively would be classified as a Dog.

- Profitability Concerns: Units consistently operating at a loss or with very low profit margins, despite efforts to improve, would also fall into this category.

Dogs in Equinix's BCG Matrix represent business segments or assets with low market share and low growth prospects. These are typically legacy offerings or underperforming acquisitions that consume resources without generating significant returns. For instance, outdated colocation facilities in stagnant markets or commoditized standalone connectivity services fit this description, as they face declining demand and intense price competition.

These segments require ongoing investment for maintenance but offer minimal strategic advantage or revenue potential. In 2024, Equinix's strategic focus on high-growth areas like hyperscale and digital transformation services implies a continuous evaluation and potential divestment of these Dog assets to reallocate capital more effectively.

The company's overall revenue growth, such as the 9% increase to $11.5 billion in 2023, is driven by its Stars and Cash Cows, while Dogs represent a drag on overall performance, necessitating careful management or exit strategies.

Equinix's approach involves identifying and addressing these underperforming areas, which could include divesting non-core business units or phasing out legacy hardware leasing programs that no longer align with its evolving digital infrastructure strategy.

Question Marks

Equinix is making significant moves into emerging markets such as Malaysia, Indonesia, and the Philippines, recognizing the burgeoning digital economies within these regions. For instance, in 2024, Equinix announced plans to build its first data center in Jakarta, Indonesia, a move signaling strong commitment to this high-growth market.

These new ventures, while holding substantial growth potential, represent early-stage investments for Equinix. The company is working to build its presence and market share in these nascent digital landscapes, aiming to replicate the success seen in more established markets.

Substantial capital expenditure is necessary to solidify Equinix's position in these emerging territories. This strategic investment is crucial for capturing market opportunities and transforming these new expansions into future market leaders, or Stars, within the Equinix portfolio.

Edge computing is a rapidly expanding sector, with Asia-Pacific showing significant growth. Equinix is strategically placing its infrastructure to cater to this demand, enabling localized data processing and applications that require minimal delay. For instance, in 2023, the global edge computing market was valued at approximately $23.4 billion and is projected to reach $176.6 billion by 2030, demonstrating substantial growth potential.

Within the BCG matrix, advanced edge computing solutions would likely be categorized as a 'Question Mark'. This is because while the market is experiencing high growth, Equinix is still in the process of developing and solidifying its specific service portfolio and market share in this dynamic area. Significant strategic investments are necessary for Equinix to effectively differentiate its offerings and achieve scalable success in this evolving technological landscape.

Equinix is moving beyond simply offering colocation for AI by exploring specialized AI-as-a-Service (AIaaS) solutions. These initiatives are likely in their early stages, focusing on niche industry AI requirements where Equinix aims to build market presence and demonstrate its unique value.

For instance, Equinix's 2024 strategy could involve partnerships with AI software providers to offer integrated platforms. This allows customers to deploy AI models more easily within Equinix's secure and interconnected data centers, potentially reducing their time-to-market for AI-driven applications.

These nascent AIaaS offerings are positioned to capture emerging demand, allowing Equinix to establish itself as a key enabler of advanced AI deployments. The company's extensive global footprint and robust network connectivity provide a strong foundation for delivering these specialized services.

New Digital Services and Platform Capabilities

Equinix is actively enhancing Platform Equinix with innovative digital services, including advanced virtual routing and software-defined interconnection features, designed to streamline hybrid multicloud networking. These offerings represent significant growth opportunities, though customer adoption is still in its early stages.

To capture these high-potential markets, Equinix requires substantial investment in both product development and marketing initiatives. This strategic focus is crucial for driving widespread adoption and solidifying its position in the evolving digital infrastructure landscape.

- Digital Services Growth: Equinix's focus on advanced virtual routing and software-defined interconnection aims to simplify hybrid multicloud networking, a rapidly expanding segment of the IT market.

- Investment Needs: Significant investment in research, development, and marketing is necessary to achieve broad market penetration for these new digital services.

- Market Penetration: While customer adoption is currently ramping up, Equinix's strategic investments are designed to accelerate this process and establish market leadership.

Strategic Partnerships in Nascent Technologies (e.g., Quantum Computing Interconnection)

Equinix's involvement in nascent technologies like quantum computing interconnection aligns with the 'Question Marks' quadrant of the BCG matrix. These ventures are characterized by high potential growth but currently low market share due to the technology's early stage. For instance, Equinix's focus on enabling secure and low-latency connections for quantum computing research and development positions them to capture future market dominance.

The quantum computing market, while nascent, is projected for significant expansion. Estimates suggest the global quantum computing market could reach tens of billions of dollars by the early 2030s, with interconnection being a critical enabler. Equinix's strategic partnerships in this area, such as collaborations with quantum technology providers, are investments in building the necessary infrastructure for this future market.

- High Growth Potential: The quantum computing sector is anticipated to experience exponential growth, driven by advancements in algorithms and hardware.

- Low Current Market Share: As a nascent technology, quantum computing interconnection has minimal current market penetration, reflecting its developmental phase.

- Strategic Investment: Equinix's partnerships in this space represent speculative investments aimed at securing a future leadership position.

- Infrastructure Enablement: Equinix's role is crucial in providing the physical and network infrastructure required for the secure and efficient interconnection of quantum systems.

Equinix's ventures into emerging markets like Malaysia and its development of advanced edge computing solutions and AI-as-a-Service are classic examples of Question Marks in the BCG matrix. These areas show high growth potential but currently have a low market share for Equinix. Significant investment is needed to build out infrastructure, develop offerings, and gain customer traction.

The company is strategically investing in these nascent sectors, recognizing their future importance. For instance, Equinix's 2024 expansion into Indonesia with a new data center highlights its commitment to high-growth emerging markets. These investments are crucial for transforming these early-stage initiatives into future market leaders.

The challenge lies in converting these potential growth areas into established revenue streams. Equinix must effectively differentiate its services and achieve scalable adoption to move these Question Marks towards becoming Stars. This requires sustained capital expenditure and focused market development strategies.

The company's strategic focus on quantum computing interconnection also falls into this category. While the quantum computing market is projected for substantial growth, estimated to reach tens of billions of dollars by the early 2030s, Equinix's current market share in this specific niche is minimal.

BCG Matrix Data Sources

Our BCG Matrix is informed by Equinix's financial disclosures, market growth data for colocation and interconnection services, and industry analyst reports on digital infrastructure trends.