EPAM Systems SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EPAM Systems Bundle

EPAM Systems leverages its strong engineering talent and global delivery model to capitalize on digital transformation trends, but faces challenges from intense competition and economic volatility. Our analysis reveals how these factors shape their strategic landscape.

Want the full story behind EPAM's market position, competitive advantages, and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

EPAM Systems boasts a truly global footprint, operating in over 50 countries. This extensive reach allows them to tap into diverse markets and serve a wide array of clients worldwide. Their strategic expansion, notably making India their second-largest global delivery center by March 2025, underscores this commitment.

This broad geographic presence is a significant strength, acting as a buffer against localized economic challenges. It also grants EPAM access to a vast and varied talent pool, crucial for delivering complex solutions to their international clientele.

EPAM Systems stands out due to its profound technical acumen in digital platform engineering and software development. This deep expertise is a key differentiator, allowing them to tackle complex projects and consistently deliver high-quality solutions.

Their commitment to engineering excellence underpins their value proposition, ensuring they remain competitive in the fast-paced technology services landscape. EPAM's strengths are particularly evident in product and platform engineering, cloud data solutions, and their proficiency with open-source technologies.

EPAM Systems is strongly positioned with its focus on AI and digital transformation, making strategic investments, particularly in generative AI. This focus is resonating with clients, as evidenced by increasing demand for these specialized services.

The company's comprehensive AI service offerings, spanning LLM orchestration, testing, and engineering, place it at the leading edge of technological innovation. This capability directly addresses the market's growing need for AI-powered business transformations.

This strategic emphasis on AI has proven effective in counteracting the broader demand slowdown observed in the IT services sector during 2024, showcasing the resilience and forward-thinking nature of EPAM's business strategy.

Robust Financial Health and Profitability

EPAM Systems demonstrates robust financial health, underscored by a strong balance sheet featuring more cash than outstanding debt. This financial stability, maintained over more than 16 years of consistent profitability, empowers the company to pursue strategic investments in innovation and acquisitions, crucial for sustained growth and resilience.

The company's financial performance continues to impress, with Q1 2025 reporting an 11.7% year-over-year revenue increase. Furthermore, EPAM has proactively raised its full-year revenue outlook for 2025, signaling confidence in its ongoing market position and operational execution.

- Strong Balance Sheet: EPAM consistently maintains more cash than debt, indicating financial prudence.

- Sustained Profitability: The company has a proven track record of over 16 years of consistent profitability.

- Strategic Investment Capacity: Financial stability enables investments in R&D and potential acquisitions.

- Positive Revenue Growth: Q1 2025 revenue increased by 11.7% year-over-year, with an upward revision of the 2025 full-year revenue forecast.

Strong Client Relationships and Brand Reputation

EPAM Systems cultivates enduring partnerships with its clientele, a testament to exceptional service delivery and a robust client retention rate. These deep-seated relationships provide a predictable and stable revenue base, a critical advantage in the dynamic IT services sector.

The company’s strong brand equity is a significant asset, bolstered by consistent industry accolades and awards. This recognition validates EPAM's commitment to quality and its prowess in attracting and retaining top-tier engineering and technology talent, which is crucial for innovation and client success.

- Client Retention: EPAM’s ability to maintain long-term client relationships, often exceeding five years, highlights deep trust and satisfaction.

- Brand Recognition: The company is frequently cited in industry reports and has received numerous awards for its digital engineering and consulting services, enhancing its market standing.

- Talent Attraction: A strong brand reputation directly contributes to EPAM's success in attracting highly skilled professionals, a key differentiator in a competitive talent market.

EPAM's global presence is a significant strength, allowing it to serve clients across over 50 countries and tap into diverse markets. This expansive reach is complemented by strategic growth, such as establishing India as its second-largest delivery center by March 2025, ensuring access to a vast talent pool and mitigating risks from localized economic downturns.

The company's deep technical expertise in digital platform engineering and software development sets it apart, enabling it to handle complex projects and deliver high-quality outcomes. This engineering prowess is a core differentiator, particularly in areas like product engineering, cloud data solutions, and open-source technologies.

EPAM's strategic focus on AI and digital transformation, with significant investments in generative AI, positions it at the forefront of technological innovation. This specialization is driving demand and helping to offset broader IT sector slowdowns, as seen in its Q1 2025 revenue growth of 11.7% year-over-year.

Financially, EPAM is robust, maintaining more cash than debt and a history of over 16 years of consistent profitability. This financial stability supports its capacity for innovation and strategic acquisitions, further solidifying its market position and resilience.

| Metric | Value (as of Q1 2025) | Significance |

|---|---|---|

| Global Delivery Centers | 50+ Countries | Market diversification and talent access |

| India Delivery Center Growth | Second largest by March 2025 | Leveraging global talent and cost efficiencies |

| Revenue Growth (YoY) | 11.7% (Q1 2025) | Demonstrates strong market demand and execution |

| Cash vs. Debt | Cash exceeds debt | Financial stability and investment capacity |

| Years of Profitability | 16+ | Proven business model and operational efficiency |

What is included in the product

Delivers a strategic overview of EPAM Systems’s internal and external business factors, highlighting its strong market position and skilled workforce while acknowledging potential integration challenges and competitive pressures.

Highlights EPAM's competitive advantages and areas for improvement, simplifying complex strategic challenges.

Weaknesses

EPAM's reliance on inorganic growth is a notable weakness. While acquisitions have bolstered revenue, the company's organic constant currency revenue growth was a modest 1.0% in Q4 2024. This suggests that a substantial part of its recent expansion, especially in 2024 and early 2025, stems from acquiring other businesses rather than from its core operations growing naturally.

This dependence on mergers and acquisitions to achieve growth targets presents potential integration hurdles and raises questions about the long-term sustainability of this strategy if organic expansion doesn't pick up pace. Without a stronger organic engine, meeting future revenue goals might become increasingly challenging and costly.

EPAM Systems is quite vulnerable to broader economic shifts. Things like persistent inflation and rising interest rates can make businesses hesitant to spend on technology, slowing down their digital transformation projects. This directly impacts EPAM's revenue streams.

The company's own outlook for 2025, as indicated in its guidance, painted a cautious picture. This caution was borne out by a revenue decline in the first quarter of 2024, highlighting the real-world effect of a tougher market where clients are spending less.

This susceptibility to macroeconomic factors means EPAM's financial results can swing more significantly, making it harder to predict performance consistently.

EPAM Systems anticipates its operating margins to face pressure in 2025, a direct result of significant investments in talent development and cutting-edge technology. These strategic outlays, alongside the costs associated with integrating recent acquisitions, are projected to impact short-term profitability.

The company's non-GAAP operating margins are expected to contract, signaling that while these investments are crucial for long-term expansion and competitive positioning, they will temporarily reduce immediate earnings. This trend could be a point of concern for investors prioritizing near-term margin growth.

Geographic Concentration Risk in North America

EPAM's significant reliance on North America for revenue, consistently around 60% as of early 2024, creates a notable geographic concentration risk. This dependence means that economic headwinds or intensified competition within this key market can have a disproportionately large impact on the company's financial health. Addressing this vulnerability through further global revenue diversification remains a critical strategic imperative for EPAM.

This concentration exposes EPAM to the volatility of a single major economic region. For instance, a recession in the United States or Canada could directly and severely affect a substantial portion of EPAM's client base and, consequently, its revenue streams. The challenge lies in effectively expanding its presence and client acquisition in other regions to balance this geographical skew.

- Revenue Concentration: Approximately 60% of EPAM's revenue originated from North America in early 2024.

- Economic Sensitivity: Vulnerability to economic downturns or shifts in the North American market.

- Diversification Need: Ongoing challenge to broaden revenue sources globally.

Competitive Landscape and Pricing Power

The IT services sector is crowded, featuring many global and local competitors. This intense rivalry can dilute pricing power, particularly when clients are hesitant to spend. EPAM must consistently highlight its unique capabilities and technological superiority to fend off price wars and retain its market standing against nimble rivals.

For instance, in the first quarter of 2024, EPAM reported revenue of $1.17 billion. While this shows scale, the pressure from competitors like Accenture, which reported $16.1 billion in revenue for the same period, underscores the need for strong differentiation. The ability to command premium pricing is directly challenged by the sheer volume of service providers vying for client attention.

- Intense competition limits pricing flexibility.

- Maintaining a technical edge is crucial for differentiation.

- Agile competitors pose a constant threat to market share.

EPAM's reliance on inorganic growth is a notable weakness. While acquisitions have bolstered revenue, the company's organic constant currency revenue growth was a modest 1.0% in Q4 2024. This suggests that a substantial part of its recent expansion, especially in 2024 and early 2025, stems from acquiring other businesses rather than from its core operations growing naturally.

EPAM Systems is quite vulnerable to broader economic shifts. Things like persistent inflation and rising interest rates can make businesses hesitant to spend on technology, slowing down their digital transformation projects. This directly impacts EPAM's revenue streams.

EPAM anticipates its operating margins to face pressure in 2025 due to significant investments in talent and technology, alongside integration costs from acquisitions. This could impact short-term profitability, with non-GAAP operating margins expected to contract.

EPAM's significant reliance on North America for revenue, consistently around 60% as of early 2024, creates a notable geographic concentration risk. This dependence means that economic headwinds or intensified competition within this key market can have a disproportionately large impact on the company's financial health.

Preview the Actual Deliverable

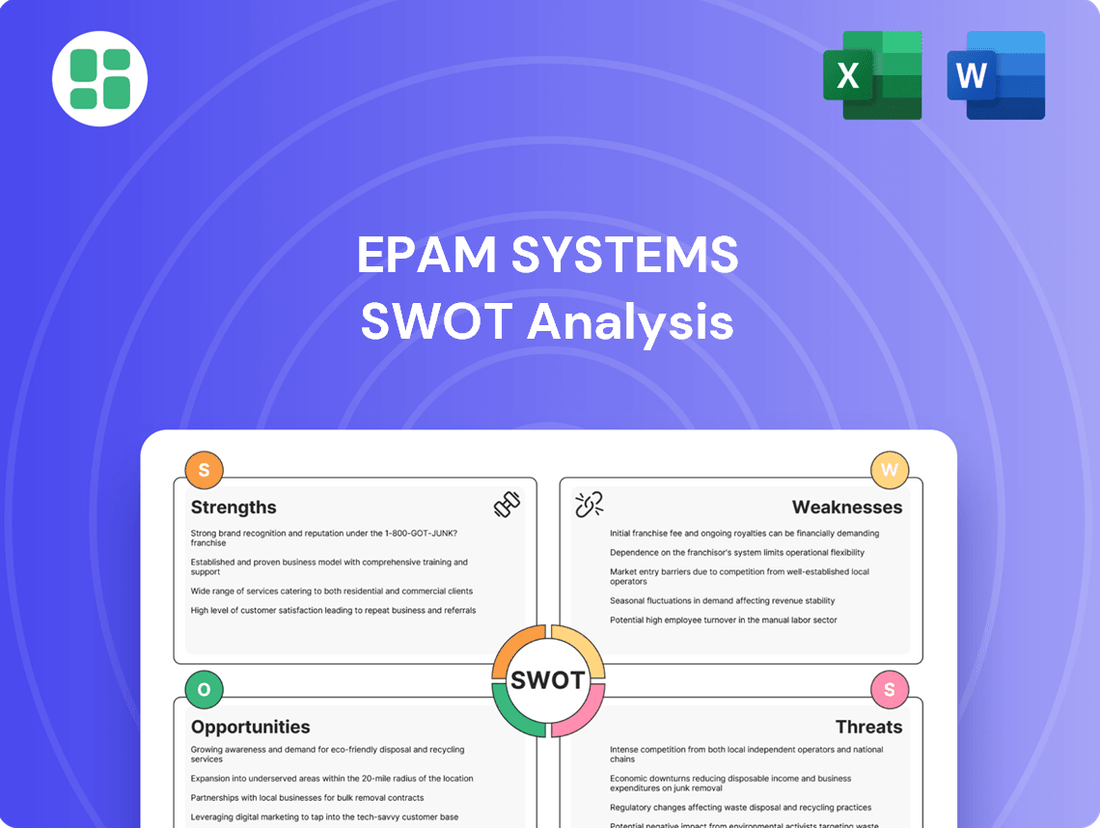

EPAM Systems SWOT Analysis

The preview you see is the same EPAM Systems SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report offers a comprehensive look at EPAM's Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights for strategic planning.

Opportunities

The increasing demand for AI, particularly generative AI, is a major opportunity for EPAM. This surge is fueled by businesses looking to automate tasks and innovate. EPAM's focus on AI-native platforms and methods is a key advantage.

EPAM's strategic investments in AI are paying off. Their AI-native programs brought in about $50 million in revenue during the fourth quarter of 2024. This segment is anticipated to be a significant growth engine for the company throughout 2025 and into the future.

EPAM Systems has a significant opportunity to grow by entering new geographic markets. They are actively targeting high-growth areas, with plans to significantly increase their workforce in India to 10,000 employees by March 2025. This strategic move aims to lessen dependence on established markets and spread out revenue sources, which helps manage risks associated with any single region.

Furthermore, EPAM's growth strategy includes acquiring companies that bolster its global presence. Recent acquisitions, such as NEORIS and First Derivative, have been instrumental in expanding their reach, particularly into the Latin American market. These acquisitions not only add new talent and capabilities but also provide immediate access to new customer bases and revenue streams in diverse geographical locations.

EPAM's robust financial health in 2024 provides a solid foundation for pursuing strategic acquisitions. This allows the company to broaden its service portfolio, acquire specialized talent, and extend its global footprint. For instance, the acquisitions of NEORIS and First Derivative in recent years have demonstrably bolstered revenue and augmented EPAM's core competencies.

Further strategic acquisitions remain a key opportunity for EPAM. By integrating companies with complementary skills or market access, EPAM can accelerate its growth trajectory and solidify its competitive advantage in the evolving digital transformation landscape. These moves are crucial for staying ahead of industry trends and meeting diverse client needs.

Beyond acquisitions, forging new strategic partnerships presents another significant avenue for growth. Collaborations can unlock access to new client segments, emerging technologies, and innovative solutions, thereby strengthening EPAM's market positioning. Such alliances are vital for expanding market reach and enhancing service delivery capabilities.

Increasing Demand for Digital Transformation Services

Businesses globally are accelerating their digital transformation, fueling a consistent need for EPAM's expertise in product development, digital platform engineering, and strategic consulting. This ongoing shift towards modernization, even amidst economic uncertainties, presents a significant opportunity for EPAM to capitalize on its core competencies.

The market for digital transformation services is substantial and growing, projected to reach an impressive $2.1 trillion by 2027. This expansion underscores the sustained demand for the very services EPAM excels in delivering.

- Sustained Demand: Businesses continue to invest heavily in digital modernization initiatives.

- Market Growth: The digital transformation services market is expected to reach $2.1 trillion by 2027.

- EPAM's Core Strength: EPAM is well-positioned to meet this demand with its product development and digital platform engineering capabilities.

Upskilling and Talent Development in Niche Areas

EPAM Systems can significantly boost its service offerings and competitive edge by investing in employee development, especially in high-demand, specialized fields such as prompt engineering and AI consulting. This strategic focus on upskilling ensures EPAM stays ahead in a rapidly evolving digital environment.

By prioritizing talent development that aligns with client needs, EPAM can effectively address emerging market demands and maintain its growth trajectory. This client-centric approach to skill enhancement is crucial for sustained success.

- Enhanced Service Capabilities: Investing in specialized training, like AI and prompt engineering, directly improves EPAM's ability to deliver cutting-edge solutions.

- Competitive Advantage: A highly skilled workforce in niche areas differentiates EPAM from competitors, attracting more complex and lucrative projects.

- Client Satisfaction and Retention: Meeting evolving client needs through targeted talent development fosters stronger relationships and ensures high-quality project delivery.

- Future-Proofing the Workforce: Proactive upskilling prepares EPAM's talent pool for future technological shifts, ensuring long-term relevance and resilience.

EPAM's focus on AI, particularly generative AI, presents a substantial growth opportunity, with AI-native programs generating approximately $50 million in Q4 2024 revenue and projected to be a key growth driver through 2025. Expanding into new geographic markets, such as significantly increasing their Indian workforce to 10,000 by March 2025, diversifies revenue and mitigates regional risks. Strategic acquisitions, like NEORIS and First Derivative, bolster global presence and access new customer bases, further strengthening EPAM's market position in the rapidly expanding digital transformation services sector, which is anticipated to reach $2.1 trillion by 2027.

| Opportunity Area | Key Data Point | Impact |

|---|---|---|

| AI and Generative AI | $50 million Q4 2024 revenue from AI-native programs | Significant growth engine for 2025 and beyond |

| Geographic Expansion | Targeting 10,000 employees in India by March 2025 | Diversifies revenue, reduces regional dependency |

| Digital Transformation Services | Market projected to reach $2.1 trillion by 2027 | Capitalizes on sustained global demand for modernization |

| Strategic Acquisitions | Acquisitions like NEORIS and First Derivative | Expands global footprint and customer access |

Threats

EPAM Systems faces significant threats from established global IT service providers such as Accenture, Cognizant, and Infosys, all vying for market share. The presence of these large, well-funded competitors, alongside a multitude of smaller, specialized firms, creates a challenging landscape. This intensified competition can directly impact EPAM's ability to secure new business and maintain its pricing power, particularly in a market that experienced a projected 1.5% growth in IT services spending in 2024.

Persistent macroeconomic uncertainties, such as elevated inflation and higher interest rates, pose a significant threat by potentially causing clients to scale back or postpone their technology investments. This directly dampens the demand for EPAM's core services.

The challenging demand environment experienced in 2024, coupled with a cautious outlook for 2025, underscores this threat. For instance, EPAM noted in its Q1 2024 earnings call that clients were exercising greater scrutiny over discretionary spending, impacting project pipelines.

EPAM's extensive global footprint, with a significant portion of its talent historically based in Eastern Europe, makes it particularly vulnerable to geopolitical risks and regional instability. The ongoing conflict in Ukraine, for instance, has underscored the potential for such events to disrupt operations and negatively affect financial results, despite EPAM's efforts to diversify its delivery centers.

Talent Attrition and Wage Inflation

The intense demand for IT specialists, especially in high-growth sectors like AI and cloud computing, presents a significant threat. This demand fuels talent attrition as skilled professionals are lured by better offers elsewhere, and it drives wage inflation. For EPAM, this means higher operational expenses and a squeeze on profitability. For instance, in 2024, the global IT talent shortage was estimated to affect over 85% of companies, leading to average salary increases of 10-15% for in-demand roles.

EPAM faces the ongoing challenge of attracting and retaining top-tier talent in a fiercely competitive global labor market. This constant battle for skilled individuals impacts project timelines and the ability to deliver on client expectations. The cost of recruitment and onboarding also escalates, further pressuring margins.

- High demand for AI and cloud engineers: These specialized skill sets are particularly sought after, driving up competition.

- Increased attrition rates: As demand surges, employees are more likely to leave for better compensation and opportunities.

- Wage inflation pressure: EPAM must contend with rising salary expectations to retain its workforce, impacting cost structures.

Cybersecurity and Data Breaches

As a leading digital platform engineering provider, EPAM Systems, like all companies in the tech sector, faces substantial risks from evolving cybersecurity threats and potential data breaches. A significant incident could disrupt operations, impact financial performance, and severely damage its reputation, potentially leading to a loss of client confidence. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a figure that underscores the potential financial fallout from such events.

EPAM actively manages these risks through a comprehensive cybersecurity program. However, the company acknowledges that the threat landscape is constantly changing, requiring continuous adaptation and investment. The increasing sophistication of cyberattacks means that even robust defenses can be challenged. For example, ransomware attacks, a prevalent threat in 2024, continue to target organizations of all sizes, aiming to disrupt services and extort payments.

- Cybersecurity threats pose a material risk to EPAM's operations and client trust.

- A data breach could result in significant financial losses and reputational damage.

- The global average cost of a data breach in 2023 was $4.45 million, highlighting the financial impact.

- EPAM invests in a robust cybersecurity program to mitigate ongoing and evolving threats.

EPAM's competitive landscape is intense, with major players like Accenture and Cognizant vying for market share, potentially impacting pricing power in a market with projected 1.5% IT services growth for 2024.

Macroeconomic headwinds, including inflation and higher interest rates, threaten to curb client technology spending, a concern highlighted by EPAM's Q1 2024 observations of client caution on discretionary investments.

Geopolitical instability, particularly in regions with significant talent pools like Eastern Europe, remains a vulnerability that can disrupt operations, as evidenced by the ongoing conflict in Ukraine.

The high demand for specialized IT skills, such as AI and cloud engineering, fuels talent attrition and wage inflation, increasing operational costs for EPAM. In 2024, an estimated 85% of companies faced IT talent shortages, leading to 10-15% salary increases for in-demand roles.

Cybersecurity threats represent a material risk, with the global average cost of a data breach reaching $4.45 million in 2023, posing a threat to operations and client trust.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from EPAM Systems' official financial reports, comprehensive market intelligence, and expert industry analyses to ensure a well-informed strategic perspective.