EPAM Systems Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EPAM Systems Bundle

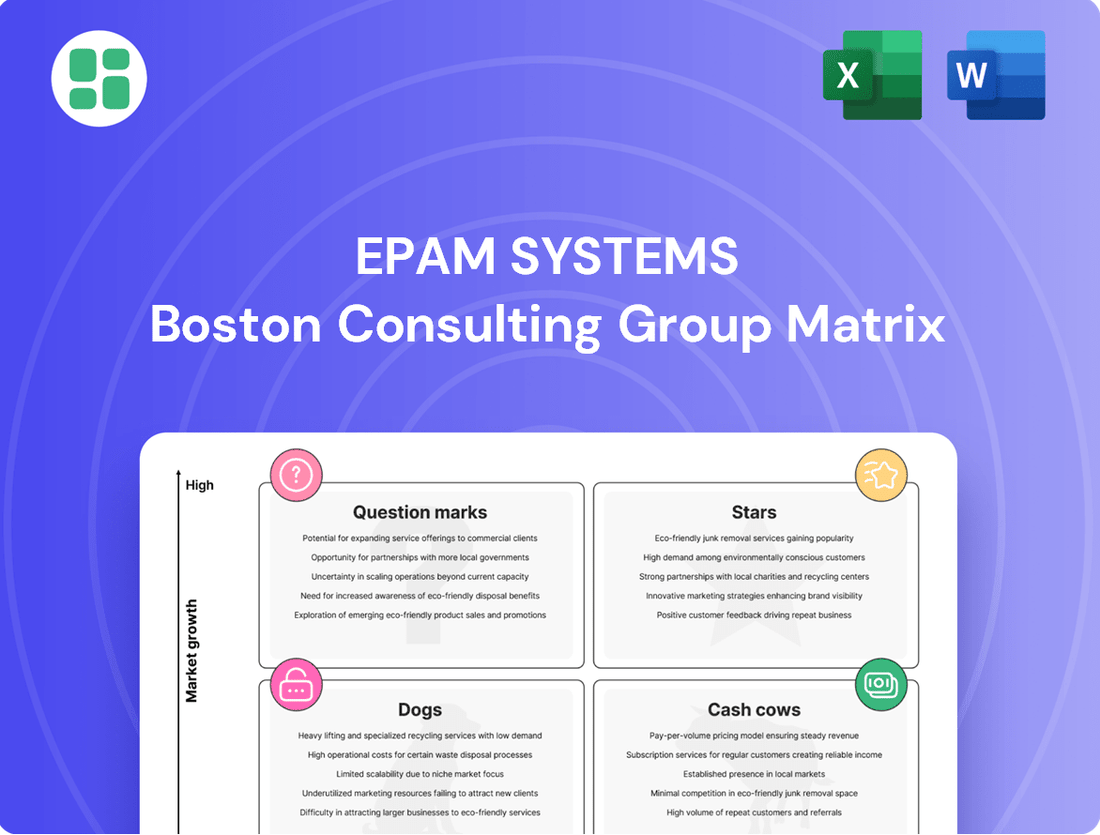

Curious about EPAM Systems' strategic positioning? Our BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full potential of this analysis by purchasing the complete EPAM Systems BCG Matrix, which provides detailed quadrant placements and actionable insights to guide your investment and product development strategies.

Don't miss out on the comprehensive breakdown and expert recommendations that will empower you to make informed decisions and drive EPAM Systems' growth. Get the full report today!

Stars

EPAM is experiencing robust double-digit growth in its Generative AI (GenAI) and AI-native offerings, reflecting substantial client investment in these transformative technologies. This surge is driven by an increasing demand for enhanced productivity and streamlined operations, with AI solutions at the forefront of delivering these benefits.

The company's strategic initiatives, including the development of platforms like DIAL 3.0 and collaborations with major cloud providers such as AWS and Google Cloud, solidify EPAM's position as a key player in the rapidly expanding AI market. These efforts are designed to equip clients with cutting-edge AI capabilities.

EPAM Systems holds a dominant position in digital product and platform engineering, a segment that remains a significant revenue driver. This core competency is fueled by the ongoing global need for businesses to innovate and create cutting-edge digital solutions to stay ahead. EPAM's extensive engineering talent and proven track record solidify its leadership in this dynamic market.

EPAM's Advanced Cloud Transformation services are a cornerstone of their BCG Matrix positioning, reflecting the ongoing, robust demand for cloud-native solutions. This segment capitalizes on the critical need for enterprises to modernize applications and migrate infrastructure, a key driver of digital transformation. EPAM's established market share in this high-growth area highlights their expertise in enabling scalability, resilience, and efficiency for their clients.

Financial Services Industry Solutions

EPAM's Financial Services vertical is a star performer, showcasing impressive growth. In Q1 2025, this sector saw a significant expansion of 29.3%, highlighting its robust market position.

The financial services industry is in the midst of a major digital overhaul, with artificial intelligence leading the charge. EPAM's tailored solutions and extensive sector knowledge are key to their success in capturing a considerable portion of this evolving market.

EPAM is a crucial partner for financial institutions aiming to stay ahead in the rapidly advancing technological landscape. Their expertise helps clients navigate and implement cutting-edge solutions effectively.

- Q1 2025 Financial Services Growth: 29.3%

- Key Industry Trend: Digital transformation, including AI adoption

- EPAM's Competitive Advantage: Specialized solutions and deep industry expertise

- Client Benefit: Ability to keep pace with emerging technologies

Cybersecurity Services

As businesses increasingly rely on digital infrastructure, the demand for robust cybersecurity solutions continues to surge. EPAM Systems addresses this critical need by providing a suite of cybersecurity services, including expert advisory, cloud and data security, and managed detection and response. This segment operates within a high-growth market, fueled by escalating cyber threats and evolving regulatory landscapes. EPAM's integrated strategy aims to safeguard client digital assets and operational continuity.

The cybersecurity market experienced significant growth, with global cybersecurity spending projected to reach $250 billion in 2024, a notable increase from previous years. This expansion is directly linked to the rising sophistication of cyberattacks and the growing emphasis on data privacy and compliance. EPAM's offerings are well-positioned to capitalize on this trend.

- Market Growth: The global cybersecurity market is expanding rapidly, driven by increasing cyber threats and digital transformation initiatives.

- EPAM's Offerings: EPAM provides comprehensive cybersecurity advisory, cloud and data security, and managed detection & response services.

- Key Drivers: Rising cyber threats and stringent regulatory demands are significant factors propelling market growth.

- Strategic Importance: EPAM's integrated approach helps clients secure their digital assets and maintain operational resilience in an evolving threat landscape.

EPAM's Generative AI and AI-native offerings are clear stars, experiencing robust double-digit growth driven by significant client investment. This segment is a key growth engine, reflecting the widespread demand for AI-powered productivity and operational enhancements. EPAM's strategic platform development and cloud partnerships further solidify its leading position in this high-potential market.

| BCG Category | EPAM Segment | Growth Driver | Key Data Point |

|---|---|---|---|

| Stars | Generative AI & AI-Native Offerings | Client investment in productivity and operational efficiency | Double-digit growth |

| Stars | Financial Services Vertical | Digital transformation and AI adoption in finance | 29.3% growth in Q1 2025 |

| Stars | Digital Product & Platform Engineering | Global need for innovation and digital solutions | Significant revenue driver, leadership position |

| Stars | Advanced Cloud Transformation | Enterprise need for application modernization and cloud migration | Robust demand, established market share |

| Stars | Cybersecurity Solutions | Rising cyber threats and data privacy concerns | Global cybersecurity spending projected at $250 billion in 2024 |

What is included in the product

This BCG Matrix analysis for EPAM Systems categorizes its business units to guide strategic decisions.

It highlights which units EPAM should invest in, hold, or divest based on market share and growth.

EPAM Systems BCG Matrix provides a clear, actionable overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

EPAM's traditional software development and engineering services form the bedrock of their business, consistently generating significant cash flow. These mature services, honed over decades, benefit from deep client integration and ongoing demand for maintenance and upgrades. For instance, in 2023, EPAM reported that its digital engineering and platform services, which encompass these core offerings, continued to be a major revenue driver.

EPAM Systems' legacy system modernization efforts cater to a stable, mature market where large enterprises need to update outdated infrastructure for digital integration. This involves expertise in cross-platform migration and re-platforming, addressing a consistent demand. For instance, in 2023, EPAM reported significant revenue from its digital transformation services, a segment that heavily includes modernization projects, demonstrating the ongoing financial viability of these offerings.

EPAM's Managed Services and Application Support acts as a classic Cash Cow. These offerings generate consistent, recurring revenue streams, a hallmark of strong Cash Cows. In 2023, EPAM reported that its Digital Platform Engineering segment, which includes managed services, saw significant growth, contributing substantially to the company's overall profitability. This stability allows for minimal reinvestment, freeing up capital for other strategic initiatives.

Enterprise Digital Consulting

EPAM Continuum, the consulting division of EPAM Systems, offers a comprehensive suite of services blending business strategy, customer experience design, and technology implementation. Established consulting relationships, particularly those focused on optimizing ongoing operations and providing strategic direction within mature markets, function as dependable revenue streams.

These mature consulting engagements capitalize on EPAM's extensive industry knowledge and the strong relationships built with its clientele, positioning them as cash cows within the BCG matrix. For instance, in 2024, EPAM reported significant revenue from its consulting services, reflecting the stability and consistent demand for these strategic advisory roles.

- EPAM Continuum's integrated approach

- Consulting for mature industries as cash generators

- Leveraging broad expertise and client trust

- Contribution to stable revenue streams in 2024

Custom Application Development for Established Industries

EPAM Systems leverages its custom application development expertise within established sectors such as Business Information & Media. This strategic focus targets mature client relationships where consistent, albeit evolutionary, software solutions are paramount.

These engagements are characterized by dependable revenue streams, stemming from ongoing client needs for enhancements and maintenance rather than rapid market penetration. This stability makes them a classic example of a cash cow within EPAM's portfolio.

- Focus on Established Industries: EPAM's custom application development for sectors like Business Information & Media represents a core strength in mature markets.

- Predictable Revenue: These services generate stable, recurring income from long-standing clients requiring continuous support and incremental upgrades.

- Low Market Growth, High Market Share: This aligns with the definition of a cash cow, signifying strong performance in a non-expanding or slowly growing market.

- Client Retention: The emphasis is on nurturing existing client partnerships, ensuring sustained demand for EPAM's development capabilities.

EPAM's core software development and engineering services are its primary cash cows, consistently providing substantial cash flow due to deep client integration and sustained demand for maintenance. These mature offerings, honed over years, benefit from ongoing client needs for upgrades and support. In 2023, EPAM highlighted digital engineering and platform services, which include these core areas, as significant revenue contributors.

Legacy system modernization projects for large enterprises also function as cash cows for EPAM. These services address a stable market need for updating outdated infrastructure, generating consistent revenue. EPAM's 2023 financial reports showed strong performance in digital transformation services, a segment that heavily features modernization, underscoring the ongoing financial strength of these mature offerings.

Managed services and application support represent classic cash cows, delivering predictable, recurring revenue streams. EPAM's Digital Platform Engineering segment, encompassing these services, experienced notable growth in 2023, significantly boosting overall profitability and allowing for minimal reinvestment due to their stable nature.

EPAM Continuum's consulting services, particularly those focused on optimizing operations in mature industries, are dependable revenue generators. These engagements leverage EPAM's extensive industry knowledge and strong client relationships, reinforcing their status as cash cows. EPAM reported robust revenue from consulting in 2024, indicating the consistent demand for these strategic advisory roles.

| EPAM Service Area | BCG Matrix Classification | Revenue Driver | 2023/2024 Data Point |

|---|---|---|---|

| Core Software Development & Engineering | Cash Cow | Stable demand for maintenance, upgrades, and integration | Digital Engineering & Platform Services major revenue driver in 2023 |

| Legacy System Modernization | Cash Cow | Enterprise need for updating outdated infrastructure | Digital Transformation Services showed strong performance in 2023 |

| Managed Services & Application Support | Cash Cow | Recurring revenue from ongoing support and maintenance | Digital Platform Engineering segment grew significantly in 2023 |

| Consulting for Mature Industries | Cash Cow | Strategic advisory and operational optimization for established clients | Consulting services reported significant revenue in 2024 |

What You’re Viewing Is Included

EPAM Systems BCG Matrix

The EPAM Systems BCG Matrix preview you're viewing is the complete, unwatermarked document you will receive immediately after your purchase. This means you're seeing the final, professionally formatted analysis, ready for immediate integration into your strategic planning processes without any additional editing or setup. It's the exact same comprehensive report that will be delivered to you, ensuring full transparency and immediate utility for your business decisions.

Dogs

Commoditized IT staff augmentation services, if present within EPAM Systems' portfolio, would likely fall into the Dogs quadrant of the BCG Matrix. These are services characterized by low market share and low growth potential, often operating in highly competitive, low-margin environments.

For EPAM, which generally emphasizes complex engineering and digital transformation, these undifferentiated staffing services would represent a weak market position. Such offerings might struggle to gain significant traction against specialized competitors, leading to minimal returns or even losses, as evidenced by the typical low profitability of commoditized IT labor markets.

EPAM Systems' support for outdated niche technologies, like legacy mainframe systems or highly specialized software platforms with limited current demand, represents a potential Dogs category. These services likely hold a small market share in a declining sector, as businesses increasingly migrate to modern, cloud-based solutions. For instance, while specific figures for EPAM's niche tech support aren't publicly broken down, the broader trend shows a decline in demand for COBOL maintenance, a common indicator of such niche areas.

Underperforming regional operations within EPAM Systems, such as specific delivery centers that haven't captured substantial market share or reached profitability, would likely fall into the Dogs category of the BCG Matrix. These segments might be absorbing capital and management attention without yielding proportionate returns, potentially hindering the company's overall growth trajectory.

Generic Infrastructure Management Services

Generic infrastructure management services within EPAM Systems, when viewed through the lens of a BCG matrix, likely fall into the question mark or potentially dog category. While EPAM is renowned for its advanced digital engineering capabilities, these more basic, commoditized IT infrastructure management services often struggle to achieve significant competitive differentiation. This is particularly true when compared to larger, specialized IT outsourcing firms that benefit from economies of scale in these areas.

These types of services typically operate in a highly competitive market characterized by intense price pressure and consequently, lower profit margins. For EPAM, focusing resources on these less differentiated offerings might detract from their core strengths in innovation and custom software development, which command higher value and margins. In 2024, the global IT infrastructure management market was valued at approximately $40 billion, but the segment for generic services is highly fragmented and price-sensitive.

- Low Differentiation: Lacks unique selling propositions compared to specialized IT outsourcing providers.

- Price Sensitivity: Operates in a market where cost is a primary driver for clients, leading to thin margins.

- Limited Growth Potential: Mature market segment with slower adoption rates for basic services.

- Resource Allocation Concern: Investment in these areas may divert focus from higher-margin, innovative offerings.

Experimental Services with No Market Adoption

EPAM Systems, like many technology service providers, has likely explored various experimental services that, despite initial investment, failed to gain significant market traction. These ventures, often pilots or early-stage offerings, represent a challenge in portfolio management. For instance, a hypothetical AI-driven analytics platform launched in 2023 might have faced low adoption due to market immaturity or insufficient client understanding of its value proposition, consuming resources without generating substantial revenue or market share.

These underperforming experimental services can become significant drains on company resources, acting as cash traps. If not strategically divested or repurposed, they can divert capital and talent from more promising initiatives. A case in point could be a specialized cloud migration service for a niche industry that didn't materialize as anticipated, leading to a write-off of development costs and unrecouped R&D expenditure.

- Unadopted AI Solutions: EPAM may have piloted AI-powered customer service chatbots or predictive maintenance tools that saw limited enterprise adoption, failing to capture a meaningful market share by late 2024.

- Niche Platform Development: Investments in bespoke blockchain solutions for supply chain management or IoT platforms for specific industrial sectors could have struggled to find broad client buy-in, resulting in minimal revenue generation.

- Failed Digital Transformation Pilots: Experimental digital transformation frameworks or methodologies, tested with a few clients, may not have demonstrated sufficient ROI or scalability to warrant wider rollout, leaving them as costly R&D projects.

EPAM Systems' offerings in commoditized IT staff augmentation and support for legacy technologies, particularly those with declining market demand, represent potential Dogs in the BCG Matrix. These segments are characterized by low market share and low growth, often facing intense price competition and limited differentiation.

Generic infrastructure management services, while potentially present, also lean towards the Dog quadrant if they lack unique value propositions against larger, scaled competitors. Investments in these areas may divert resources from EPAM's core strengths in advanced digital engineering and transformation.

Underperforming regional operations or experimental services that fail to gain market traction can become cash traps, consuming capital and talent without generating significant returns. For example, a hypothetical AI platform launched in 2023 that saw low adoption by late 2024 would fit this description.

The global IT infrastructure management market, valued around $40 billion in 2024, highlights the price sensitivity in the commoditized segment, where EPAM's less differentiated services might struggle.

Question Marks

EPAM's quantum computing consulting services are positioned as a Question Mark within the BCG Matrix. This classification reflects its status as an emerging technology with substantial future growth potential, but currently, EPAM holds a low market share in this highly specialized sector.

Significant investment is required for EPAM to develop expertise and secure early-stage consulting or exploratory projects in quantum computing. This strategic focus is crucial for the company to potentially transition its quantum computing offerings from a Question Mark to a Star in the future market.

Niche Generative AI vertical applications represent EPAM's potential "Question Marks" in the BCG Matrix. These are highly specialized AI solutions targeting unique, often unproven, industry challenges. Think of AI for hyper-specific drug discovery in rare diseases or AI-powered predictive maintenance for niche manufacturing equipment.

While the overall Generative AI market is booming, these early-stage vertical applications are in their infancy. They exhibit high growth potential, mirroring the broader GenAI trend, but EPAM is still establishing its expertise and market footprint. Significant investment is needed to develop these capabilities, refine the AI models, and build a customer base, much like a startup entering a new market segment.

For instance, consider EPAM's work in developing AI for personalized learning platforms in specialized vocational training. The market for such tailored educational tools is projected to grow significantly, with some reports indicating a compound annual growth rate exceeding 20% for AI in education by 2025. However, EPAM's current market share and proven success in this specific niche are still developing, requiring substantial R&D and go-to-market strategy investment.

EPAM Systems is likely positioning itself in the Web3 and blockchain space, a sector characterized by rapid innovation and significant growth potential, though it remains nascent and somewhat unpredictable. This emerging market presents a classic BCG Matrix dilemma: high potential, but currently low market share.

While specific 2024 market share figures for EPAM within Web3 and blockchain services are not publicly detailed, the overall blockchain market was projected to reach over $100 billion by 2024, indicating substantial opportunity. EPAM's investment in this area could be seen as a strategic move to capture future market leadership, akin to developing a "Star" from a "Question Mark".

Failure to adequately invest and develop expertise in these decentralized technologies could see EPAM's offerings in this niche stagnate, potentially classifying them as "Dogs" if they don't gain traction against more established players or if the market shifts away from their current approach.

IoT Solutions for Uncharted Industrial Sectors

EPAM Systems is strategically venturing into uncharted industrial sectors with its IoT solutions, targeting niche applications where IoT adoption is nascent. These new frontiers represent significant growth potential, but also necessitate substantial upfront investment to cultivate expertise and secure market dominance.

These ventures into specialized industrial IoT, such as advanced predictive maintenance for offshore wind farms or real-time environmental monitoring in remote mining operations, are positioned as EPAM's 'Question Marks' in the BCG matrix. The global Industrial IoT market is projected to reach $1.1 trillion by 2028, growing at a CAGR of 15.5%, highlighting the immense opportunity in these emerging areas.

- Niche Market Focus: EPAM is developing tailored IoT platforms for sectors like precision agriculture and specialized logistics, where existing solutions are limited.

- High Growth Potential: These segments are expected to experience rapid expansion as industries recognize the efficiency and safety benefits of IoT integration.

- Investment Requirements: Establishing a strong foothold requires significant R&D, talent acquisition in specialized engineering, and building robust client partnerships, characteristic of Question Mark strategies.

- Market Penetration Strategy: EPAM aims to become a key player by offering unique, data-driven insights and operational improvements in these underserved industrial landscapes.

New Geographic Market Expansion

EPAM Systems is actively pursuing new geographic markets, notably India and Latin America, as part of its growth strategy. These ventures are considered stars in the BCG matrix, representing high-growth potential markets where EPAM is investing to build its presence.

EPAM's expansion into India, for instance, is driven by the country's vast IT talent pool and growing demand for digital transformation services. By 2024, India has become a significant hub for IT services, and EPAM's investment there aims to leverage this. Similarly, Latin America presents an opportunity for EPAM to tap into emerging markets and diversify its global delivery capabilities.

However, these new markets often require considerable upfront investment. EPAM needs to build local talent, establish robust infrastructure, and cultivate client relationships, which can lead to initial lower market share and profitability. For example, in 2023, EPAM continued to invest in its global delivery centers, including those in emerging regions, to support its expansion plans.

- EPAM's focus on India and Latin America signifies a strategic move into high-growth, emerging markets.

- These regions offer significant potential for talent acquisition and service delivery diversification.

- Substantial investment in talent, infrastructure, and market penetration is crucial for success in these new territories.

- EPAM's 2023 and 2024 financial reports highlight ongoing investments in expanding its global delivery footprint, underscoring the star nature of these initiatives.

EPAM's investments in niche Generative AI applications, such as AI for hyper-specific drug discovery or specialized vocational training platforms, are positioned as Question Marks. These represent high-growth potential areas within the booming AI market, but EPAM is still building its expertise and market share in these early-stage verticals.

Significant investment in research and development, model refinement, and client acquisition is necessary for these niche AI solutions to mature. For example, the AI in education market was projected for strong growth by 2025, with EPAM aiming to capture a piece of this expanding segment.

The success of these Question Marks hinges on EPAM's ability to develop unique capabilities and secure early adoption, potentially transforming them into Stars as the market solidifies.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.