EnBW Energie Baden-Wurttemberg PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnBW Energie Baden-Wurttemberg Bundle

Navigate the complex external forces shaping EnBW Energie Baden-Württemberg's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, social trends, technological advancements, environmental regulations, and legal frameworks create both challenges and opportunities for this energy giant. Gain the strategic foresight needed to make informed decisions and stay ahead of the curve.

Unlock actionable intelligence with our expertly crafted PESTLE analysis for EnBW Energie Baden-Württemberg. This detailed report dives deep into the critical external factors impacting the company's operations and growth potential. Equip yourself with the insights to anticipate market shifts and refine your own strategic planning. Download the full version now for immediate access to invaluable market intelligence.

Political factors

The German government's Energiewende, or energy transition, is a cornerstone of EnBW's strategy, driving significant investment in renewables like wind and solar. This policy mandates a shift away from fossil fuels, directly shaping EnBW's asset management and future operational planning.

Political shifts, such as adjustments to the coal phase-out timeline or revised renewable energy targets, have a direct impact on EnBW's investment decisions and the overall profitability of its green energy ventures. Government incentives and subsidies play a vital role in ensuring the financial feasibility of these new renewable energy projects, with Germany aiming for 80% renewable electricity by 2030.

The regulatory landscape in Germany and the EU significantly shapes EnBW's financial performance and strategic direction. Authorities like the Bundesnetzagentur (BNetzA) and the European Commission dictate rules for grid operation, energy market structures, and electricity pricing, directly impacting EnBW's revenue. For instance, the German government's Renewable Energy Sources Act (EEG) and its subsequent amendments influence the profitability of renewable energy projects, a key growth area for EnBW.

Critical to EnBW's distribution network business are policies governing grid expansion and the integration of decentralized renewable energy sources. In 2024, Germany continued its push for grid modernization, with significant investment planned to accommodate the growing share of renewables. EnBW’s ability to adapt to these evolving requirements, such as new unbundling rules or adjustments to network charges, necessitates continuous recalibration of its operational and financial strategies to maintain competitiveness and compliance.

Geopolitical instability, such as the ongoing conflict in Eastern Europe, continues to be a significant concern for energy security. This instability directly impacts energy supply chains and price volatility, affecting EnBW's procurement costs for fossil fuels and the overall economic viability of its operations. For instance, in 2023, European natural gas prices, while lower than their 2022 peaks, remained elevated compared to pre-crisis levels, influencing operational expenses.

Germany's commitment to energy transition and diversification, with a strong focus on domestic renewable energy sources, directly supports EnBW's strategic expansion in this area. The German government's targets for renewable energy expansion, aiming for a significant increase in wind and solar power capacity by 2030, create a favorable regulatory environment for EnBW's investments in green energy projects.

Political decisions regarding international energy alliances and infrastructure projects, such as the development of new LNG terminals or cross-border grid connections, are crucial. These decisions can influence the availability and cost of energy imports and exports, impacting EnBW's market access and competitive positioning within the European energy landscape.

Subsidies and Incentives for Renewables

Government support through subsidies and incentives remains a critical driver for EnBW's renewable energy business. The German government, for instance, has consistently provided feed-in tariffs and investment grants to bolster renewable energy deployment. For example, in 2023, Germany's Renewable Energy Sources Act (EEG) continued to offer market premiums and feed-in tariffs for solar and wind power, ensuring a stable revenue stream for projects.

These financial mechanisms directly influence the profitability and attractiveness of EnBW's investments in wind farms and solar parks. A shift towards reduced subsidies or a change in their structure, perhaps favoring auctions over fixed tariffs, could alter the return on investment calculations for future projects. Policy stability is therefore paramount for EnBW's long-term strategic planning in the green energy sector.

The evolution of these support schemes is closely watched by industry players. For instance, the trend in Germany has been towards competitive auctions for larger renewable projects, which can drive down costs but also introduce greater price volatility. EnBW's ability to adapt to these evolving incentive structures, such as securing successful bids in recent offshore wind auctions, is key to maintaining its growth trajectory.

- Feed-in Tariffs: Continued availability of feed-in tariffs or similar revenue support mechanisms directly impacts EnBW's profitability from renewable assets.

- Investment Incentives: Tax credits, grants, and accelerated depreciation for green energy projects enhance the financial viability of EnBW's capital expenditures.

- Policy Stability: Predictable and consistent government policy regarding renewable energy support is crucial for EnBW's long-term investment planning and risk management.

- Auction Mechanisms: EnBW's success in securing contracts through competitive auctions, like those for offshore wind, demonstrates its ability to operate within evolving incentive frameworks.

Public and Political Pressure

Growing public and political demand for decarbonization is a significant driver for EnBW. This pressure compels the company to accelerate its shift from traditional power generation to renewable energy sources and new energy services. For instance, Germany's commitment to achieving 80% renewable electricity by 2030, as outlined in the Renewable Energy Sources Act (EEG), directly impacts EnBW's strategic planning and investment in wind and solar projects.

The ongoing political conversation about climate change and environmental protection directly shapes public opinion and can result in more stringent regulations or a surge in demand for environmentally friendly products. EnBW's proactive engagement in communicating its sustainability efforts and aligning its business strategies with evolving societal expectations is crucial for maintaining positive political relationships and public trust.

- Decarbonization Mandate: Germany aims for 80% renewable electricity by 2030, a key political driver for EnBW's renewable investments.

- Public Perception: Climate discourse influences consumer choices, pushing companies like EnBW towards greener offerings.

- Regulatory Environment: Stricter environmental laws, often a response to political pressure, necessitate adaptation in EnBW's operational and investment strategies.

- Corporate Social Responsibility: EnBW's public image is increasingly tied to its perceived commitment to sustainability and climate action.

Political factors significantly influence EnBW's strategic direction, particularly through Germany's commitment to the Energiewende, aiming for 80% renewable electricity by 2030. This transition necessitates substantial investment in wind and solar, directly shaping EnBW's asset management and operational planning.

Government incentives, such as feed-in tariffs and investment grants, remain critical for the financial viability of EnBW's renewable projects. For instance, Germany's Renewable Energy Sources Act (EEG) continued to provide market premiums and feed-in tariffs in 2023, ensuring stable revenue streams for solar and wind power, a key growth area for EnBW.

The regulatory framework, managed by bodies like the Bundesnetzagentur, dictates grid operations, market structures, and pricing, directly impacting EnBW's revenue. Policies on grid expansion and integrating decentralized renewables are vital, with Germany planning significant grid modernization investments in 2024 to accommodate increased renewable capacity.

Geopolitical events, such as the conflict in Eastern Europe, affect energy security and price volatility, impacting EnBW's fossil fuel procurement costs. In 2023, European natural gas prices, though down from 2022 peaks, remained elevated, influencing operational expenses for companies like EnBW.

| Political Factor | Impact on EnBW | Relevant Data/Target |

| Energiewende (Energy Transition) | Drives investment in renewables, shapes asset strategy | Germany aims for 80% renewable electricity by 2030 |

| Government Incentives (EEG) | Ensures financial viability of green projects | Market premiums and feed-in tariffs provided in 2023 |

| Regulatory Framework (BNetzA) | Dictates grid operations, pricing, and market structure | Significant grid modernization investment planned for 2024 |

| Geopolitical Instability | Impacts energy security and operational costs | Elevated European natural gas prices in 2023 |

What is included in the product

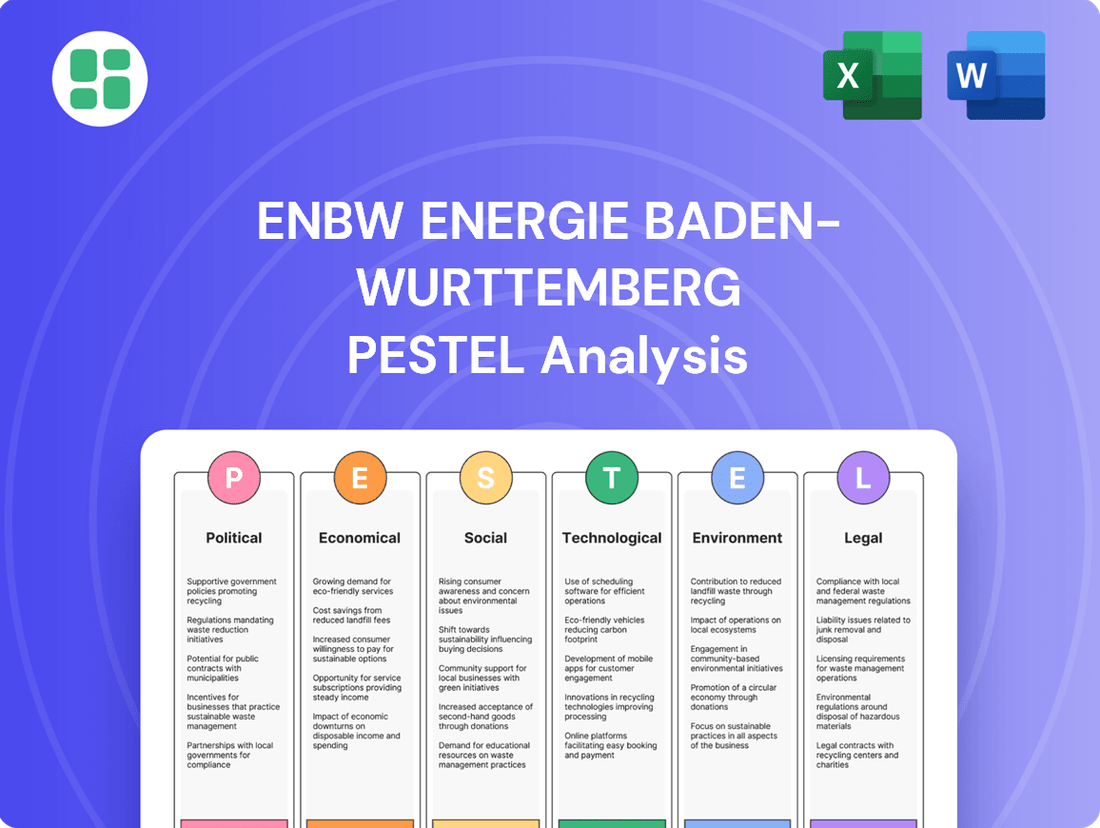

This PESTLE analysis examines the external macro-environmental factors influencing EnBW Energie Baden-Württemberg across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of the opportunities and challenges shaping the company's strategic landscape.

A concise PESTLE analysis for EnBW acts as a pain point reliever by offering clear, actionable insights into external factors, streamlining strategic decision-making and mitigating potential risks.

Economic factors

Fluctuations in wholesale electricity, gas, and carbon prices significantly influence EnBW's profitability, particularly for its conventional generation assets and energy trading operations. For instance, the average German wholesale electricity price for baseload power in 2024 has seen considerable movement, influenced by factors like renewable energy output and gas prices.

High volatility in energy markets, stemming from supply-demand imbalances, geopolitical tensions, or severe weather events, presents both potential gains and substantial risks to EnBW's financial results. The European Union Emissions Trading System (EU ETS) carbon price, a key factor for fossil fuel generation, experienced a notable average of around €65 per tonne in early 2024, impacting operational costs.

EnBW employs sophisticated hedging strategies and maintains a diversified energy portfolio, encompassing renewables, grid operations, and customer solutions, to cushion the impact of this price volatility. This diversification is crucial as the company navigates the evolving energy landscape, aiming to balance the financial performance of its various business segments.

Rising inflation in Germany, with the Harmonised Index of Consumer Prices (HICP) at 2.8% in April 2024, directly impacts EnBW's operational expenses. Increased costs for materials like copper for grid expansion and labor can pressure profit margins if these are not fully recoverable through energy tariffs.

The European Central Bank's (ECB) monetary policy, which has seen interest rates at 4.50% as of May 2024, raises EnBW's cost of capital. Financing large renewable projects, such as offshore wind farms, becomes more expensive, potentially slowing down investment in critical energy transition infrastructure.

Germany's economic growth is a key driver for EnBW. In 2023, the German economy experienced a slight contraction of 0.3%, impacting industrial output. However, forecasts for 2024 suggest a modest recovery, with projections around 0.2% to 0.5% GDP growth, which should translate into increased industrial energy demand for EnBW.

The broader European Union's economic performance also directly influences EnBW's industrial and commercial customer base. A stronger EU economy generally means higher manufacturing activity and, consequently, greater energy consumption. For instance, if industrial production in key EU markets rises by a projected 1.5% in 2024, EnBW could see a corresponding uptick in its energy sales volumes.

Conversely, economic slowdowns, like the challenges faced in late 2023, can dampen energy demand and put downward pressure on prices. This was evident when industrial energy prices saw volatility due to reduced manufacturing activity across the continent, impacting EnBW's revenue streams during those periods.

Investment Climate and Capital Availability

The investment climate significantly impacts EnBW's capacity to finance its extensive renewable energy and grid modernization initiatives. Investor confidence, a key driver of capital availability, directly influences EnBW's ability to secure necessary funding. For instance, in 2024, the global renewable energy sector saw substantial investment, with projections indicating continued growth, although interest rate environments remain a consideration for capital-intensive projects.

Access to favorable financing, such as green bonds and project finance, is paramount for EnBW's infrastructure development. The company's robust financial performance and commitment to sustainability are critical in attracting these specialized funding sources. EnBW's successful issuance of green bonds in recent years, often oversubscribed, highlights strong market appetite for its sustainable projects.

Market perceptions of EnBW's creditworthiness and its strong sustainability profile directly affect its cost of capital. A higher credit rating and a positive ESG (Environmental, Social, and Governance) reputation can lead to lower borrowing costs, making its ambitious expansion plans more financially viable. For example, EnBW's credit ratings from agencies like Moody's and S&P, which have remained solid, are vital for securing competitive financing terms.

- Investor Confidence: Global investor confidence in the energy transition remains high, supporting capital flow into renewable projects.

- Capital Availability: Despite some macroeconomic headwinds, significant capital is available for green infrastructure, including from institutional investors and specialized funds.

- Financing Terms: EnBW leverages green bonds and project finance, benefiting from competitive terms due to its strong credit and sustainability ratings.

- Cost of Capital: A strong credit rating and a favorable ESG profile help EnBW minimize its cost of capital for large-scale investments.

Carbon Pricing and Emissions Trading

The European Union Emissions Trading System (EU ETS) is a cornerstone of the bloc's climate policy, directly influencing EnBW's operational expenses for its fossil fuel power generation. As of early 2024, carbon prices within the EU ETS have been trading in the range of €60-€90 per tonne of CO2, a significant figure that directly adds to the cost of emitting greenhouse gases.

These evolving carbon pricing mechanisms are a powerful incentive for EnBW to accelerate its strategic shift towards lower-carbon generation. The rising cost of carbon allowances compels the company to invest more heavily in renewable energy sources and cleaner technologies to mitigate its exposure to these expenses.

EnBW's financial planning must therefore incorporate the management of its carbon allowance portfolio and the fluctuating costs associated with emissions. This includes strategic decisions on acquiring allowances, optimizing the emissions intensity of its existing fleet, and factoring these costs into the economic viability of future investments in new power generation capacity.

- EU ETS Carbon Price Range (Early 2024): €60-€90 per tonne of CO2.

- Impact on Fossil Fuels: Directly increases operational costs for EnBW's coal and gas power plants.

- Strategic Incentive: Drives investment in renewables and lower-emission technologies.

- Financial Planning: Necessitates active management of carbon allowances and emission cost forecasting.

Economic factors significantly shape EnBW's performance, with energy market volatility being a primary concern. Fluctuations in wholesale electricity and gas prices, driven by supply, demand, and geopolitical events, directly impact profitability. For instance, German wholesale electricity prices for baseload power in early 2024 have shown considerable movement, influenced by renewable energy generation levels and natural gas costs.

The cost of carbon emissions under the EU Emissions Trading System (EU ETS) is another critical economic variable. With average prices around €65 per tonne in early 2024, this directly increases operational expenses for EnBW's fossil fuel power plants, incentivizing a faster transition to renewables.

Inflation and interest rates also play a crucial role. German inflation stood at 2.8% in April 2024, raising operational costs for materials and labor. The European Central Bank's interest rate of 4.50% as of May 2024 increases EnBW's cost of capital, making large renewable project financing more expensive.

Economic growth in Germany and the wider EU directly affects energy demand. While Germany experienced a slight contraction in 2023, modest growth is projected for 2024, potentially boosting industrial energy consumption. A stronger EU economy generally translates to higher manufacturing activity and increased energy sales for EnBW.

| Economic Factor | Key Data Point (Early/Mid-2024) | Impact on EnBW |

|---|---|---|

| Wholesale Electricity Prices (Germany) | Volatile, influenced by renewables and gas prices | Affects profitability of conventional generation and trading |

| EU ETS Carbon Price | Approx. €60-€90 per tonne CO2 | Increases operational costs for fossil fuel generation; drives renewable investment |

| German Inflation (HICP) | 2.8% (April 2024) | Raises operational expenses (materials, labor) |

| ECB Interest Rate | 4.50% (May 2024) | Increases cost of capital for new projects |

| German GDP Growth (Projected 2024) | 0.2% - 0.5% | Potential increase in industrial energy demand |

Same Document Delivered

EnBW Energie Baden-Wurttemberg PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of EnBW Energie Baden-Württemberg. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning. You'll gain immediate access to this insightful analysis upon completing your purchase.

Sociological factors

Public acceptance is a significant hurdle for energy infrastructure development, impacting EnBW's ability to execute its strategic expansion plans. Projects like new wind farms or solar parks often face local opposition stemming from environmental concerns or aesthetic objections. For instance, in 2023, Germany saw increased public debate around the visual impact and ecological footprint of renewable energy installations, which can translate into project delays and increased costs for developers like EnBW.

EnBW's success in achieving its renewable energy targets, such as its goal to have 100% of its electricity supply from renewables by 2035, hinges on navigating these public sentiment dynamics. Delays caused by community resistance can directly affect EnBW's investment recovery timelines and its competitive positioning in the rapidly evolving energy market. Proactive community engagement, including transparent communication and benefit-sharing initiatives, is therefore essential for mitigating these risks and ensuring project viability.

Consumer environmental awareness is a significant driver, with a growing preference for green energy tariffs and sustainable offerings. Surveys in 2024 indicate that over 60% of German households are willing to pay a premium for renewable energy. EnBW's strategic investments in wind and solar, which accounted for approximately 40% of its electricity generation in 2024, directly address this trend, positioning them to capture this expanding market segment.

The ongoing energy transition is fundamentally altering the skills landscape within the energy sector. EnBW, like its peers, faces a surging demand for professionals adept in renewable energy technologies, digital transformation, and the intricacies of smart grid management. This necessitates significant investment in upskilling its current workforce and actively recruiting new talent to bridge these emerging skill gaps.

Demographic shifts, including an aging workforce and a shrinking pool of younger workers, coupled with intense competition for specialized technical skills, present considerable challenges for EnBW's recruitment and retention strategies. For instance, in Germany, the average age of employees in the energy sector has been steadily increasing, putting pressure on companies to attract and retain younger, skilled individuals.

Energy Affordability and Equity

Societal concerns about energy affordability and energy poverty significantly shape political decisions regarding energy pricing and the implementation of support mechanisms for vulnerable households. For instance, in Germany, the government has introduced measures like the energy price brake to mitigate the impact of high energy costs on consumers, a direct response to widespread affordability concerns that have intensified following global energy market volatility.

EnBW, as a prominent energy provider, must navigate a complex landscape where its economic viability is intrinsically linked to its social responsibility. This involves balancing the need for profitable operations with the imperative to ensure equitable access to energy for all segments of the population. The company's strategies are therefore influenced by the understanding that managing the impact of energy prices on consumers is a critical societal consideration.

Ensuring equitable access to energy and effectively managing price impacts on consumers are crucial societal considerations that can directly affect regulatory scrutiny and public relations for companies like EnBW. For example, reports from organizations like the German Institute for Economic Research (DIW Berlin) often highlight the disproportionate burden of energy costs on lower-income households, prompting calls for more targeted support and influencing public perception of energy companies.

- Energy Poverty Concerns: Societal pressure to address energy poverty, where households struggle to afford adequate heating and electricity, influences policy.

- Government Support Mechanisms: The existence and design of government subsidies or price caps directly impact energy providers' operational environment.

- Public Perception: EnBW's ability to maintain positive public relations is tied to its perceived fairness in pricing and its contributions to energy equity.

- Regulatory Scrutiny: Affordability issues can lead to increased regulatory oversight and potential interventions aimed at protecting consumers.

Stakeholder Engagement and Corporate Social Responsibility

EnBW's license to operate and its public image are significantly shaped by its dedication to corporate social responsibility (CSR) and how it engages with stakeholders. This means being open and honest with everyone involved, from customers and employees to investors and the communities where it operates, while also acting ethically in all its business dealings.

Strong CSR efforts directly boost customer loyalty and attract investors who prioritize sustainability, while also helping to avoid damage to the company's reputation, which is crucial in the energy sector. For instance, EnBW's commitment to renewable energy projects, such as its offshore wind farms, has been a key part of its CSR strategy, aligning with societal demands for a cleaner energy future.

- Stakeholder Alignment: EnBW's 2023 sustainability report highlighted increased dialogue with local communities regarding its renewable energy projects, aiming to address concerns and build trust.

- Employee Engagement: The company reported a high employee satisfaction rate in its 2024 internal survey, partly attributed to its clear sustainability goals and ethical workplace practices.

- Investor Confidence: EnBW's inclusion in several sustainability indices, recognized for its environmental, social, and governance (ESG) performance, signals growing investor confidence in its long-term strategy.

- Brand Reputation: Positive media coverage of EnBW's community investment programs in 2024 has contributed to a stronger brand image, particularly in regions where it is expanding its renewable energy infrastructure.

Societal expectations regarding energy affordability and the impact of energy costs on vulnerable populations significantly influence government policy and public perception of energy companies like EnBW. For example, in response to high energy prices in 2023-2024, Germany implemented measures such as the energy price brake, directly addressing widespread concerns about energy poverty and affordability.

These affordability concerns can lead to increased regulatory scrutiny and shape public opinion, impacting EnBW's operational environment and its social license to operate. The company must balance profitability with ensuring equitable energy access, a critical consideration for maintaining positive public relations and avoiding potential government interventions. Reports from institutions like DIW Berlin in 2024 highlighted the disproportionate burden of energy costs on lower-income households, underscoring the societal demand for targeted support.

EnBW's commitment to corporate social responsibility (CSR) is paramount for its reputation and stakeholder relationships. In 2023, EnBW actively engaged with local communities regarding renewable energy projects, aiming to build trust and address concerns, as noted in their sustainability report. This focus on ethical practices and community involvement, exemplified by their investment in offshore wind farms, aligns with societal demands for a cleaner energy future and contributes to investor confidence, with EnBW being recognized in several sustainability indices in 2024.

| Societal Factor | Impact on EnBW | Supporting Data/Examples (2023-2025) |

|---|---|---|

| Energy Affordability & Poverty | Influences government policy, regulatory scrutiny, and public perception. | German energy price brake (2023-2024) implemented due to affordability concerns. DIW Berlin reports in 2024 highlight disproportionate impact on low-income households. |

| Corporate Social Responsibility (CSR) | Enhances brand reputation, stakeholder trust, and investor confidence. | EnBW's 2023 sustainability report detailed increased community engagement for renewable projects. Inclusion in sustainability indices in 2024 signals growing investor confidence. |

| Public Acceptance of Infrastructure | Affects project timelines, costs, and EnBW's renewable energy targets. | Increased public debate in Germany (2023) on visual and ecological impacts of renewables can cause project delays. EnBW aims for 100% renewable supply by 2035, requiring public support. |

Technological factors

Technological advancements are rapidly reshaping the energy landscape, directly influencing EnBW's strategic direction. For instance, the efficiency of offshore wind turbines has seen substantial gains, with new models exceeding 15 MW capacity, significantly boosting energy output per turbine and improving project economics. Similarly, solar photovoltaic panel performance continues to climb, with commercial panels now regularly achieving over 22% efficiency, driving down the levelized cost of electricity (LCOE) for solar projects.

Battery storage solutions are also evolving at an impressive pace, with energy density increasing and costs falling by an estimated 10-15% annually. This trend makes grid-scale storage more viable, enabling better integration of intermittent renewables like wind and solar into the grid. EnBW must actively monitor and integrate these innovations to maintain its competitive edge and accelerate its transition towards a sustainable energy future.

EnBW is heavily invested in smart grid development, a critical move for integrating fluctuating renewable energy sources like wind and solar. By 2024, Germany's renewable energy share in gross electricity consumption reached approximately 52%, highlighting the need for advanced grid management. EnBW's rollout of smart meters, part of its digitalization strategy, aims to improve grid stability and efficiency, with over 1.5 million smart meter installations planned by 2025.

Digitalization across EnBW's operations, from network management to customer interfaces, is key to unlocking new revenue streams and boosting efficiency. For instance, their investments in digital platforms for energy trading and grid optimization are designed to streamline operations. However, this increased reliance on digital systems brings cybersecurity to the forefront, with the company dedicating significant resources to protecting its infrastructure against evolving threats.

The burgeoning field of green hydrogen production and Power-to-X (PtX) technologies offers substantial long-term prospects for EnBW. These advancements are key to decarbonizing heavy industry and enabling long-duration energy storage solutions, areas where EnBW can leverage its expertise.

EnBW's strategic investments in research, development, and pilot projects for green hydrogen and PtX are crucial for its future growth trajectory and diversification efforts. For instance, Germany's National Hydrogen Strategy aims for a domestic production capacity of up to 10 GW by 2030, with significant public funding supporting these initiatives, which EnBW is well-positioned to capitalize on.

The ultimate impact of these technologies on EnBW's future energy portfolio hinges on their scalability and economic feasibility. As of early 2024, the cost of green hydrogen production remains a challenge, but ongoing technological advancements and economies of scale are expected to drive down costs, making it a competitive energy carrier.

Energy Efficiency Solutions and Decentralization

Technological advancements are significantly reshaping the energy landscape, particularly in energy efficiency and decentralization. Innovations like smart home systems, improved insulation, and optimized industrial processes are actively cutting down overall energy consumption. For instance, the global smart home market was valued at approximately $84.5 billion in 2023 and is projected to grow substantially, indicating a strong consumer push towards efficiency.

The move towards decentralized energy generation, exemplified by rooftop solar installations and localized combined heat and power units, is empowering consumers and fundamentally altering EnBW's role. This trend requires EnBW to pivot from its traditional centralized provider model to becoming an integrated energy service partner. This adaptation necessitates the development of new service portfolios and sophisticated network management approaches to accommodate distributed energy resources.

Key technological factors influencing EnBW include:

- Smart Grid Technologies: Investments in smart grids are crucial for managing bidirectional energy flows from decentralized sources, improving grid stability, and enabling dynamic pricing.

- Digitalization and AI: The integration of artificial intelligence and digital platforms allows for predictive maintenance, optimized energy trading, and personalized customer energy solutions.

- Battery Storage Solutions: Advancements in battery technology are vital for storing excess renewable energy and providing grid services, supporting the integration of intermittent renewable sources.

- Energy Efficiency Software: Sophisticated software platforms help businesses and households monitor, analyze, and optimize their energy usage, driving demand for efficiency solutions.

Cybersecurity and Data Analytics

EnBW's increasing integration of digital infrastructure and smart technologies, like those used in smart grids and renewable energy management, heightens its exposure to sophisticated cyber threats. A significant data breach could cripple operations, compromise critical infrastructure, and damage customer trust. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the scale of this risk.

To mitigate these risks, EnBW must invest heavily in advanced cybersecurity protocols and continuous threat monitoring. This includes protecting sensitive customer data and ensuring the resilience of its energy supply chain against potential attacks. The company's ability to maintain operational integrity hinges on its cybersecurity posture.

Simultaneously, EnBW can leverage data analytics to its advantage. By analyzing vast datasets from smart meters and grid operations, the company can achieve significant efficiencies. For example, predictive analytics can optimize energy distribution, forecast demand with greater accuracy, and enable proactive maintenance, thereby reducing costs and improving service reliability. This data-driven approach can also unlock new revenue streams through personalized energy solutions and enhanced customer engagement.

- Cybersecurity Threats: EnBW's digital transformation exposes it to escalating cyber risks, potentially disrupting operations and compromising sensitive data, with global cybercrime costs predicted to reach $10.5 trillion by 2025.

- Data Protection Imperative: Robust cybersecurity is crucial for safeguarding EnBW's critical energy infrastructure and customer information against sophisticated attacks.

- Data Analytics Opportunities: Advanced analytics offer EnBW avenues to optimize grid management, predict energy demand, and develop personalized customer services, boosting efficiency and satisfaction.

Technological advancements are fundamentally reshaping EnBW's operational landscape, particularly in renewable energy generation and grid management. The increasing efficiency of offshore wind turbines, with new models exceeding 15 MW capacity, and solar panel performance reaching over 22% efficiency, are driving down costs and boosting output. Furthermore, battery storage solutions are becoming more viable, with costs falling annually, enabling better integration of renewables.

EnBW's commitment to smart grid development is crucial, especially as Germany's renewable energy share reached approximately 52% of gross electricity consumption by 2024. The company's digitalization strategy, including smart meter rollouts, aims to enhance grid stability and efficiency, with over 1.5 million smart meters planned by 2025. This digital transformation, however, necessitates robust cybersecurity measures to protect against evolving threats, with global cybercrime costs projected to reach $10.5 trillion by 2025.

The company is also exploring the potential of green hydrogen and Power-to-X technologies, aligning with Germany's National Hydrogen Strategy targeting up to 10 GW of domestic production capacity by 2030. While green hydrogen production costs remain a challenge as of early 2024, ongoing technological progress is expected to improve its economic feasibility.

| Key Technological Factor | Description | Impact on EnBW | Relevant Data/Trend |

| Renewable Energy Efficiency | Improvements in wind turbine and solar panel technology | Increased energy output, improved project economics | Offshore wind turbines >15 MW capacity; Solar panel efficiency >22% |

| Battery Storage | Advancements in energy density and cost reduction | Enhanced grid stability, better renewable integration | Annual cost reduction of 10-15% |

| Smart Grid & Digitalization | Development of smart grids and digital platforms | Improved grid management, new revenue streams, operational efficiency | Germany's renewables share ~52% (2024); >1.5 million smart meters planned by EnBW by 2025 |

| Green Hydrogen & PtX | Development of hydrogen production and Power-to-X technologies | Decarbonization of industry, long-duration storage solutions | Germany's National Hydrogen Strategy: up to 10 GW domestic capacity by 2030 |

| Cybersecurity | Protection of digital infrastructure and data | Mitigation of operational disruptions and data breaches | Global cybercrime costs projected to reach $10.5 trillion by 2025 |

Legal factors

EnBW operates under a stringent environmental regulatory landscape, with directives from both Germany and the European Union dictating emissions limits for greenhouse gases, air pollutants, and water discharge. For instance, the EU's Effort Sharing Regulation sets binding annual greenhouse gas emission targets for member states, directly influencing EnBW's carbon pricing and operational strategies.

Meeting these evolving standards requires continuous investment in advanced pollution control technologies and a strategic shift away from carbon-intensive assets, impacting capital expenditure. Failure to comply can lead to substantial financial penalties, such as those imposed under Germany's Federal Immission Control Act (Bundes-Immissionsschutzgesetz), and considerable damage to the company's public image.

EnBW operates in Germany's and the EU's liberalized energy market, where stringent competition laws are in place to prevent monopolies and foster fair competition. These regulations directly shape EnBW's strategies regarding market conduct, potential mergers, and pricing decisions. For instance, the German Federal Network Agency (Bundesnetzagentur) actively oversees market concentration, ensuring that companies like EnBW provide equitable access to essential energy infrastructure, which is crucial for maintaining a competitive environment.

The permitting processes for new energy infrastructure, including power plants and wind farms, present significant legal hurdles for companies like EnBW. These can involve extensive environmental impact assessments, lengthy public consultation periods, and a multitude of administrative approvals, directly influencing project timelines and overall investment costs. For example, in Germany, the average time to permit a new onshore wind farm has been reported to exceed two years, with some projects taking considerably longer due to complex legal challenges and local opposition.

This legal complexity acts as a substantial bottleneck, potentially delaying the realization of critical energy projects and impacting the pace of the broader energy transition. EnBW's ability to navigate these intricate regulatory landscapes, which often include regional and federal laws, requires substantial legal expertise and resources. Streamlining these permitting procedures is therefore a key factor in accelerating the deployment of renewable energy capacity and ensuring grid stability.

Consumer Protection and Data Privacy Laws

EnBW operates under a robust framework of consumer protection laws that govern everything from energy pricing and contract clarity to the quality of services provided to its millions of residential and commercial clients. These regulations are designed to ensure fair treatment and prevent deceptive practices in the energy market.

Furthermore, stringent data privacy regulations, most notably the General Data Protection Regulation (GDPR) which came into full effect in 2018 and continues to be a benchmark, impose strict requirements on how EnBW handles customer data. This includes the necessity for advanced data security measures and absolute transparency in data processing activities. Failure to comply can lead to significant financial penalties and damage to customer trust.

- GDPR Fines: Non-compliance with GDPR can result in fines of up to €20 million or 4% of annual global turnover, whichever is higher.

- Consumer Complaint Data: In 2023, German consumer protection agencies reported a continued high volume of inquiries related to energy contracts and billing, underscoring the importance of clear and compliant communication.

- Data Breach Impact: A significant data breach could lead to reputational damage and direct financial losses through regulatory fines and compensation claims.

- Regulatory Scrutiny: Energy providers are under constant scrutiny from bodies like the German Federal Network Agency (Bundesnetzagentur) to ensure adherence to consumer protection standards.

Energy Industry-Specific Legislation

EnBW operates within a complex web of energy industry-specific legislation. Key German laws like the Renewable Energy Sources Act (EEG) directly influence its investment in and revenue from renewables, with the EEG 2023 continuing to shape auction mechanisms and feed-in tariffs. Furthermore, regulations governing grid access and security of supply impose operational requirements and capital expenditure needs.

Recent legislative shifts are impacting the sector significantly. For instance, the German government's accelerated phase-out of coal, aiming for 2030, necessitates substantial investment in alternative energy sources, directly affecting EnBW's generation portfolio. The EU's Fit for 55 package also introduces stricter emissions targets, pushing for greater decarbonization across the energy value chain.

- EEG 2023: Continues to provide a framework for renewable energy deployment, influencing project economics for wind and solar.

- Coal Phase-Out: The accelerated timeline in Germany requires strategic adaptation and investment in new generation capacity.

- Fit for 55: EU-wide legislation driving decarbonization efforts and potentially increasing demand for green energy solutions.

- Grid Stability Regulations: Ongoing focus on ensuring reliable energy supply impacts infrastructure investment and operational planning.

EnBW must navigate Germany's and the EU's stringent environmental laws, such as the EU's Effort Sharing Regulation, which sets greenhouse gas emission targets. Compliance necessitates significant investment in cleaner technologies and a strategic shift away from carbon-intensive assets, with non-compliance risking substantial penalties.

The company also faces complex permitting processes for new energy infrastructure, with German onshore wind farm permits averaging over two years, impacting project timelines and costs. This legal complexity requires considerable expertise to accelerate renewable energy deployment and ensure grid stability.

Consumer protection laws dictate energy pricing and contract clarity, while GDPR mandates strict data handling and security. In 2023, German consumer agencies noted a high volume of energy contract inquiries, highlighting the need for compliant customer communication and robust data protection to avoid significant fines and reputational damage.

Key legislation like the Renewable Energy Sources Act (EEG 2023) shapes EnBW's renewable investments, while grid security regulations influence operational planning. Germany's accelerated coal phase-out by 2030 and the EU's Fit for 55 package further drive the need for investment in alternative energy sources and decarbonization efforts.

Environmental factors

Global and national climate targets, like the Paris Agreement's aim to limit warming to 1.5°C, significantly influence EnBW. Germany's own commitment to achieving climate neutrality by 2045 creates a strong imperative for the company to accelerate its decarbonization efforts.

This pressure compels EnBW to invest heavily in renewable energy sources and modernizing its grid infrastructure. For instance, EnBW aims to have 100% of its electricity generation from renewable sources by 2035, a strategic pivot driven by these environmental mandates.

Consequently, the company is actively phasing out its remaining fossil fuel power plants, such as the Heilbronn coal-fired power station, which is slated for closure by the end of 2025. This strategic shift directly aligns EnBW's long-term viability with meeting stringent environmental objectives.

EnBW's expansion into large-scale renewable projects, especially wind farms, necessitates careful consideration of biodiversity. These projects require substantial land and sea areas, potentially impacting habitats and natural landscapes. For instance, the development of offshore wind farms, like EnBW's recent investments in the Baltic Sea, must address the potential disruption to marine ecosystems and migratory bird routes.

To navigate these environmental challenges, EnBW is obligated to perform rigorous environmental impact assessments. These studies are crucial for identifying potential ecological risks and developing effective mitigation strategies. This includes measures to protect sensitive species and minimize habitat fragmentation, a key aspect of responsible development in 2024 and beyond.

Balancing the urgent need for energy transition with robust conservation efforts presents a significant environmental hurdle for EnBW. The company's commitment to sustainability means finding innovative solutions that allow for renewable energy growth while safeguarding biodiversity, a principle increasingly emphasized by regulators and the public.

The escalating demand for critical minerals like lithium and cobalt, essential for batteries and renewable energy components, presents a significant challenge. For instance, global lithium demand is projected to grow substantially, with some estimates suggesting it could more than double by 2030 compared to 2022 levels, impacting supply chains and pricing for companies like EnBW.

EnBW must integrate circular economy principles to mitigate resource scarcity. This involves prioritizing recycled materials in new projects and ensuring responsible sourcing of raw materials, a strategy that aligns with growing investor focus on ESG (Environmental, Social, and Governance) performance, which saw sustainable investment assets reach $37.7 trillion globally in 2024.

Furthermore, efficient water resource management is crucial, especially for thermal power plants that require significant water for cooling. Climate change projections indicate increased water stress in many regions, necessitating robust water stewardship strategies for operational continuity and environmental compliance.

Waste Management and Pollution Control

EnBW's extensive operations, spanning conventional power generation and the ongoing maintenance of its diverse energy infrastructure, inherently involve the generation of waste and the potential for pollutant emissions. This necessitates a robust approach to waste management and pollution control to comply with stringent environmental standards.

The company is subject to rigorous environmental regulations that mandate the implementation of advanced waste management practices and sophisticated pollution control technologies. For instance, in 2023, EnBW invested significantly in upgrading emission control systems at its thermal power plants to meet evolving air quality standards, a trend expected to continue through 2024 and 2025.

Furthermore, the planned decommissioning of older power generation facilities, including certain coal-fired plants and aging wind turbines, presents a complex challenge. EnBW must meticulously plan for the safe disposal of generated waste materials and maximize the recycling and reuse of components, aligning with circular economy principles. This includes managing materials like concrete, steel, and composite materials from wind turbine blades, with specific targets for recycling rates being a key focus for 2025.

- Waste Generation: EnBW's power plants and maintenance activities produce various waste streams, requiring specialized handling and disposal.

- Pollution Control: Investments in advanced technologies are crucial to minimize emissions from power generation, meeting strict regulatory limits.

- Decommissioning: The retirement of older assets necessitates comprehensive waste management and recycling strategies, with a growing emphasis on material recovery.

- Regulatory Compliance: Adherence to evolving environmental laws is a primary driver for EnBW's waste management and pollution control initiatives, impacting operational costs and investment decisions.

Extreme Weather Events and Climate Resilience

The increasing frequency and intensity of extreme weather events, such as the severe storms and heatwaves experienced in 2024, present significant operational risks to EnBW's extensive infrastructure. These events can disrupt power generation, damage transmission lines, and impact the performance of renewable energy assets like wind farms and solar parks. For example, prolonged heatwaves can reduce the efficiency of thermal power plants.

EnBW's commitment to climate resilience necessitates substantial investment in adaptive measures and infrastructure upgrades. This includes hardening power grids against storms, elevating substations in flood-prone areas, and developing strategies to manage the impact of extreme temperatures on energy demand and supply. The company's long-term planning must rigorously assess these climate-related risks to ensure the continued reliability of energy provision.

- Operational Disruption: Extreme weather can directly damage EnBW's power plants, grids, and renewable energy installations, leading to outages and service interruptions.

- Infrastructure Investment: Significant capital is required to build climate-resilient infrastructure, such as reinforced transmission towers and flood defenses for energy facilities.

- Adaptive Measures: Implementing strategies like advanced weather forecasting integration and flexible grid management are crucial for mitigating the impact of climate variability.

- Long-Term Planning: EnBW must incorporate climate change projections into its strategic planning, including site selection for new facilities and the decommissioning of vulnerable assets.

EnBW faces increasing pressure from global and national climate targets, such as Germany's 2045 climate neutrality goal, driving its accelerated decarbonization. This imperative fuels significant investment in renewables and grid modernization, with EnBW targeting 100% renewable electricity generation by 2035 and phasing out fossil fuels like the Heilbronn coal plant by end-2025.

The company must also address biodiversity concerns in its expansion of renewable projects, particularly offshore wind farms in the Baltic Sea, which require careful management of potential impacts on marine ecosystems and migratory birds. Rigorous environmental impact assessments are essential for identifying and mitigating these ecological risks.

Escalating demand for critical minerals like lithium, projected to more than double by 2030, alongside a global sustainable investment market valued at $37.7 trillion in 2024, necessitates EnBW's integration of circular economy principles and responsible sourcing to mitigate resource scarcity and enhance ESG performance.

Extreme weather events, more frequent in 2024, pose significant risks to EnBW's infrastructure, demanding substantial investment in climate resilience measures and adaptive strategies to ensure energy provision reliability. This includes hardening grids and managing extreme temperature impacts on energy demand and supply.

| Environmental Factor | Impact on EnBW | Key Initiatives/Data |

| Climate Change & Decarbonization | Regulatory pressure, investment in renewables, phase-out of fossil fuels. | Target: 100% renewable electricity by 2035. Heilbronn coal plant closure by end-2025. |

| Biodiversity & Habitat Protection | Need for environmental impact assessments for renewable projects. | Focus on mitigating impact of offshore wind farms on marine life. |

| Resource Scarcity & Circular Economy | Rising demand for critical minerals, need for responsible sourcing. | Lithium demand projected to double by 2030. Global sustainable investment: $37.7 trillion (2024). |

| Extreme Weather Events | Risk of operational disruption to infrastructure, need for resilience. | Investment in climate-resilient grids and adaptive measures. |

PESTLE Analysis Data Sources

Our EnBW PESTLE Analysis is informed by a comprehensive review of official government publications, reputable energy industry reports, and leading economic and environmental data providers. This ensures that our insights into political, economic, social, technological, legal, and environmental factors impacting EnBW are grounded in factual, current information.