EnBW Energie Baden-Wurttemberg Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnBW Energie Baden-Wurttemberg Bundle

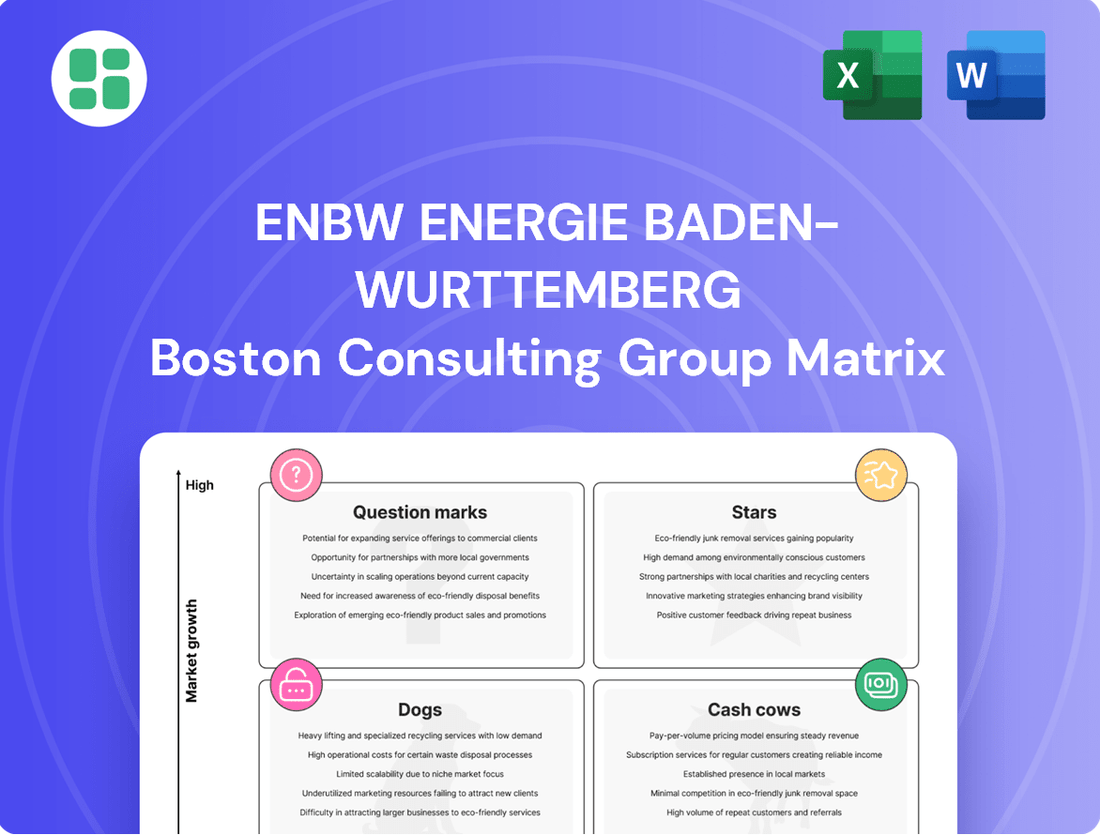

Curious about EnBW's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly understand the dynamics driving EnBW's success and challenges, you need the full picture. Purchase the complete BCG Matrix report for detailed quadrant analysis and actionable insights that can inform your own strategic decisions.

Don't miss out on the opportunity to gain a comprehensive understanding of EnBW's market standing. Get the full BCG Matrix today and unlock the strategic roadmap you need to navigate the energy landscape with confidence.

Stars

EnBW's He Dreiht offshore wind farm, a prime example of a Star in the BCG matrix, is currently under construction, with work beginning in May 2024. This ambitious project is slated to commence operations by the end of 2025.

The He Dreiht wind farm boasts an impressive 960 MW capacity, positioning it as one of Germany's largest offshore wind installations. Upon completion, it will be capable of powering approximately 1.1 million German households, effectively doubling EnBW's existing offshore wind energy portfolio.

A key indicator of He Dreiht's Star status is its development without reliance on state subsidies. This achievement underscores its robust market position and significant growth potential within the booming renewable energy sector, a market characterized by increasing demand and technological advancement.

EnBW is aggressively growing its large-scale solar park business, a clear 'Star' in its BCG matrix. The company secured seven new projects in July 2024, underscoring its commitment to this high-growth area.

Construction is underway for major sites like the 87.6 MW Görlsdorf solar park and the 80 MW Langenenslingen project, both slated for operation by mid-2025.

EnBW's strategic goal is to reach 1.2 GW of photovoltaic capacity by 2025, showcasing significant expansion and market leadership in renewable energy generation.

EnBW's HyperNetwork is a clear Star in the BCG matrix. Operating Germany's largest fast-charging network with over 6,000 points as of early 2024, EnBW is capitalizing on the booming e-mobility market. This segment exhibits robust growth, and EnBW's significant market share positions it as a leader.

The company's ambitious plan to more than double its charging points to over 20,000 by 2030 underscores its commitment to maintaining this dominant Star status. As electric vehicle adoption continues to accelerate globally, EnBW's investment in its charging infrastructure is a strategic move to capture future market share.

Transmission and Distribution Grids Expansion

EnBW is heavily investing in expanding and strengthening its electricity transmission and distribution grids. This is crucial for integrating more renewable energy sources and maintaining a reliable power supply. These grids are considered a strong contender in the BCG matrix due to EnBW's existing infrastructure in Baden-Württemberg and the significant growth opportunities presented by the increasing need for grid capacity during the energy transition.

The company has ambitious plans to significantly increase its grid capacity.

- Grid Capacity Growth: EnBW aims to more than double its grid capacity by 2030, using 2023 as a baseline year.

- Investment Focus: This expansion is a key part of EnBW's strategy to support the energy transition and ensure supply security.

- Market Position: The established infrastructure in Baden-Württemberg provides EnBW with a high market share in this segment.

- Growth Potential: The increasing demand for robust grid infrastructure driven by renewable energy integration offers substantial growth potential.

Renewable Energy Generation Capacity Growth

EnBW is aggressively pursuing a strategy to significantly increase its renewable energy generation capacity. By 2030, the company targets 75% to 80% of its installed capacity to come from renewables, a notable increase from approximately 60% in 2024.

This ambitious growth is fueled by substantial investments in wind, solar, and hydropower, positioning EnBW's renewable portfolio as a key Star in its business. The company already holds a considerable market share and is continuously developing new projects to expand its footprint.

- Target Capacity: 75-80% renewables by 2030.

- 2024 Baseline: ~60% of installed capacity from renewables.

- Growth Drivers: Expansion in wind, solar, and hydropower.

- Market Position: Significant existing share with ongoing project investments.

EnBW's offshore wind projects, like He Dreiht, represent significant Stars due to their high growth and market share in the expanding renewable energy sector. The company's aggressive expansion in solar parks, with multiple projects underway and a clear capacity target for 2025, also firmly places them in the Star category.

Furthermore, EnBW's HyperNetwork is a leading Star in the burgeoning e-mobility market, evidenced by its extensive charging network and ambitious expansion plans. The company's substantial investments in upgrading and expanding its electricity transmission and distribution grids are also classified as Stars, given their critical role in the energy transition and EnBW's strong existing infrastructure.

EnBW's overall strategy to increase its renewable energy generation capacity to 75-80% by 2030, up from approximately 60% in 2024, highlights its renewable portfolio as a dominant Star. This growth is supported by significant investments across wind, solar, and hydropower, reinforcing EnBW's market leadership.

| Business Area | BCG Category | Key Metrics/Facts |

| Offshore Wind (He Dreiht) | Star | 960 MW capacity, operational by end 2025, powers ~1.1 million households, developed without subsidies. |

| Solar Parks | Star | Secured 7 new projects (July 2024), Görlsdorf (87.6 MW) and Langenenslingen (80 MW) under construction, target 1.2 GW capacity by 2025. |

| HyperNetwork (EV Charging) | Star | Over 6,000 charging points (early 2024), target >20,000 by 2030, capitalizing on e-mobility growth. |

| Electricity Grids | Star | Aim to double grid capacity by 2030 (vs. 2023), crucial for renewables integration, strong existing infrastructure in Baden-Württemberg. |

| Renewable Energy Generation | Star | Target 75-80% renewables by 2030 (from ~60% in 2024), significant investments in wind, solar, hydropower. |

What is included in the product

This BCG Matrix overview details EnBW's business units, identifying Stars for growth and Dogs for divestment.

The EnBW BCG Matrix offers a clear, one-page overview, instantly clarifying the strategic position of each business unit to alleviate decision-making paralysis.

Cash Cows

EnBW's regulated electricity and gas distribution networks, largely managed by Netze BW, are firmly positioned as Cash Cows. This segment benefits from a mature, regulated market environment, ensuring consistent and predictable revenue streams.

These essential infrastructure assets boast high market share within their operational territories, a testament to their established presence and reliability. For instance, in 2023, Netze BW managed approximately 115,000 kilometers of electricity grids and 50,000 kilometers of gas grids, serving a significant portion of Baden-Württemberg.

The low-growth but highly stable nature of these operations, coupled with their indispensable role in the energy supply chain, makes them a foundational element of EnBW's financial strength, consistently generating substantial cash flow.

EnBW's conventional electricity and gas supply to residential and commercial customers is a classic cash cow. This mature segment, while experiencing low market growth, is where EnBW holds a substantial market share, leveraging long-standing customer relationships and the consistent demand for essential utilities.

In 2024, the German energy market, including residential and commercial supply, continued to be characterized by stable, albeit low, growth. EnBW's strong position in Baden-Württemberg, its core region, ensures a reliable revenue stream from these established customer bases.

This segment is a significant generator of cash flow for EnBW, providing the financial backbone to invest in and support its more dynamic growth areas, such as renewable energy expansion and grid modernization. The predictability of demand in this sector makes it a dependable contributor to the company's overall financial health.

EnBW's existing hydroelectric power plants are classic cash cows. These are mature, stable assets operating in a market with limited growth potential, but they reliably churn out cash. Their long operational lives and low running costs mean they generate significant revenue without needing large new investments to expand.

In 2024, EnBW continued to benefit from these established facilities. For instance, their hydroelectric capacity, a significant portion of their renewable energy mix, consistently contributes to earnings. The predictability of hydroelectric output, even with seasonal variations, ensures a steady cash flow, supporting other strategic initiatives within the company.

Pumped Storage Power Plants

EnBW's pumped storage power plants, often operated in partnership with entities like Vorarlberger Illwerke vkw and Schluchseewerk AG, represent a vital component of grid stability within a mature, low-growth sector. These facilities are indispensable for providing flexibility and crucial balancing services to the electricity grid, thereby generating a consistent and reliable income stream.

While the financial performance of these assets can fluctuate with electricity price levels, their fundamental role in maintaining grid equilibrium guarantees sustained demand and predictable cash flow generation. For instance, in 2023, the German electricity market saw significant price volatility, yet the need for grid balancing services remained constant, underscoring the resilience of pumped storage operations.

- Grid Stability: Pumped storage plants are essential for managing the intermittent nature of renewable energy sources, ensuring a stable power supply.

- Steady Income: These facilities generate predictable revenue through flexibility and balancing services, contributing to EnBW's cash flow.

- Market Role: Despite low market growth, the critical function of pumped storage in grid management ensures ongoing demand and profitability.

- Partnerships: Collaborations with companies like Vorarlberger Illwerke vkw and Schluchseewerk AG enhance operational efficiency and market reach.

Established Conventional Power Generation (Baseload Operation)

EnBW's established conventional power generation, primarily coal-fired plants operating in baseload mode, represents a significant cash cow despite the company's strategic shift away from coal by 2028. These facilities, though slated for decommissioning or conversion, continue to provide essential, stable power to the grid, ensuring consistent revenue streams. Their high operational uptime in 2024, even as the phase-out progresses, translates into substantial earnings before their eventual retirement.

The market for baseload power, while facing decarbonization pressures, remains relatively stable, allowing these assets to generate predictable cash flow. EnBW's commitment to a managed phase-out ensures that these plants continue to contribute financially during their remaining operational life. This strategy allows for the maximization of returns from these legacy assets.

- Continued Baseload Contribution: Despite the 2028 coal phase-out, EnBW's conventional plants provided crucial baseload power throughout 2024.

- Earnings Generation: These assets generated significant earnings before their eventual decommissioning or conversion, underscoring their cash cow status.

- High Utilization: High utilization rates in 2024 ensured consistent cash flow generation from these operational conventional power plants.

EnBW's regulated electricity and gas distribution networks, managed by Netze BW, are prime examples of cash cows within the company's BCG Matrix. These mature, low-growth assets benefit from a stable, regulated market environment, ensuring consistent and predictable revenue. In 2023, Netze BW managed a substantial 115,000 kilometers of electricity grids and 50,000 kilometers of gas grids, highlighting their extensive reach and market dominance in Baden-Württemberg.

The company's conventional electricity and gas supply to customers also functions as a cash cow. Despite low market growth, EnBW leverages its significant market share and established customer relationships to generate reliable income. In 2024, this segment continued to provide a stable revenue stream, acting as a crucial financial backbone for investments in renewable energy and grid modernization.

EnBW's existing hydroelectric power plants are also classified as cash cows. These mature assets operate with low running costs and long operational lives, reliably generating significant cash flow with minimal new investment. Their consistent contribution to earnings in 2024 underscores their stable and dependable nature within EnBW's portfolio.

The company's established conventional power generation, primarily coal-fired plants, served as significant cash cows throughout 2024, even with the planned 2028 phase-out. These plants provided essential baseload power, ensuring consistent revenue streams and high utilization rates before their eventual retirement or conversion, maximizing financial returns from these legacy assets.

| Segment | BCG Classification | Key Characteristics | 2023/2024 Data Point | Financial Contribution |

| Regulated Grids (Netze BW) | Cash Cow | Mature, low-growth, high market share, stable revenue | 115,000 km electricity grids managed (2023) | Consistent, predictable cash flow |

| Conventional Energy Supply | Cash Cow | Mature, stable demand, strong customer base | Stable revenue in 2024 | Financial backbone for growth areas |

| Hydroelectric Power Plants | Cash Cow | Mature, low investment needs, long operational life | Consistent contribution to earnings (2024) | Reliable cash flow generation |

| Conventional Power Generation (Coal) | Cash Cow | Essential baseload, high utilization, planned phase-out | High utilization in 2024 | Significant earnings before retirement |

Full Transparency, Always

EnBW Energie Baden-Wurttemberg BCG Matrix

The EnBW Energie Baden-Württemberg BCG Matrix preview you are currently viewing is the definitive, fully formatted report you will receive immediately after purchase. This means no watermarks, no incomplete sections, and no demo content—just the comprehensive strategic analysis ready for your immediate use.

Rest assured, the BCG Matrix document you are examining is the exact same high-quality, professionally designed file that will be delivered to you upon completing your purchase. It has been meticulously crafted to provide actionable insights into EnBW's business units, ensuring you receive a complete and polished strategic tool.

What you see here is not a sample, but the actual EnBW Energie Baden-Württemberg BCG Matrix report that you will own after your purchase. This means you'll gain instant access to a fully editable and presentable document, perfect for informing your strategic decision-making.

This preview accurately represents the final BCG Matrix report for EnBW Energie Baden-Württemberg that you will download once your purchase is confirmed. You can be confident that the content and formatting are precisely as they will appear in the delivered file, ready for integration into your business planning.

Dogs

EnBW's commitment to phasing out coal by the end of 2028 positions its remaining coal-fired power plants squarely in the Dogs category of the BCG Matrix. Having already retired or idled ten coal, oil, and gas plants since 2013, these assets are now in a declining market with severely limited future prospects.

These facilities likely hold a minimal share in EnBW's future energy portfolio and continue to incur operational expenses, making them strong candidates for divestment or outright decommissioning to conserve resources and focus on growth areas.

Legacy IT systems and outdated infrastructure are often found in established utilities like EnBW. These systems, while functional, typically exhibit low growth potential and can be costly to maintain, often consuming resources without providing a competitive edge. For instance, in 2024, many utility companies reported that a significant portion of their IT budget was allocated to maintaining these older systems, with estimates suggesting this could reach 70% in some cases, diverting funds from innovation.

Small, non-strategic niche ventures within EnBW's portfolio could be characterized as early-stage projects or pilot initiatives that haven't achieved significant market penetration or demonstrated alignment with the company's primary strategic growth objectives. These ventures might consume valuable resources without yielding substantial returns, potentially hindering overall profitability.

While specific publicly identified 'dog' ventures for EnBW are not readily available, this classification typically encompasses initiatives that are underperforming and lack a clear path to future growth or strategic importance. For instance, a hypothetical venture in a very niche renewable energy technology that has not attracted significant investment or customer adoption would fit this description.

Outdated or Inefficient Distributed Generation Projects

Outdated or inefficient distributed generation projects, such as very old, small-scale solar installations or combined heat and power (CHP) units, can be considered as EnBW's Dogs in a BCG Matrix framework. These ventures often struggle with cost-effectiveness and strategic relevance due to rapid technological advancements and shifting market dynamics.

These types of projects typically exhibit a low market share within EnBW's broader portfolio and contribute minimally to the company's overall growth trajectory. For instance, older, smaller solar farms might produce significantly less energy per installed capacity compared to newer, more efficient models, leading to a lower return on investment.

- Low Growth Potential: These projects operate in a mature or declining segment of the distributed generation market, where innovation has outpaced their capabilities.

- Low Market Share: Their limited scale and outdated technology prevent them from capturing a significant portion of the market compared to more modern solutions.

- Minimal Contribution to Profitability: The operational costs and lower energy output often result in slim or negative profit margins, making them a drag on overall financial performance.

Residential Water Supply (if not integrated with energy services)

If EnBW's residential water supply operations are siloed, serving mature, localized markets with minimal expansion potential and lacking integration into wider smart city or energy grids, these specific segments could be categorized as dogs in a BCG matrix. Such units would likely exhibit low market growth and potentially low market share, especially if encountering entrenched local competitors.

While EnBW's overall strategy emphasizes integrated energy and infrastructure solutions, any standalone water supply ventures not benefiting from these synergies would face challenges. For instance, a small municipal water contract in a region with declining population and no further development plans would fit this profile. Without specific disclosures from EnBW identifying such isolated ventures as of early 2024, this remains a hypothetical classification based on BCG matrix principles.

Consider these hypothetical characteristics for such 'dog' segments:

- Low Market Growth: Operating in areas with stagnant or declining populations, limiting demand for new connections or increased usage.

- Low Market Share: Facing established, dominant local water providers or municipal utilities that are difficult to compete against.

- Lack of Integration: Not being part of broader smart grid initiatives, renewable energy projects, or digital infrastructure development that could create new revenue streams or efficiencies.

- Limited Investment Potential: Offering little prospect for significant return on investment due to market saturation and lack of innovation opportunities.

EnBW's legacy coal-fired power plants, slated for closure by the end of 2028, are prime examples of 'Dogs' in the BCG Matrix. These assets operate in a declining market with minimal future prospects and low growth potential, often requiring significant maintenance without contributing to strategic objectives.

Similarly, older, less efficient distributed generation projects, such as small-scale solar farms with outdated technology, also fall into this category. They typically have a low market share and minimal profitability due to higher operational costs and lower energy output compared to newer installations.

Hypothetical isolated water supply ventures in mature, non-expanding local markets without integration into broader smart city or energy initiatives would also be classified as Dogs. These segments often face low market growth and share, limiting investment potential and contributing little to overall profitability.

| BCG Category | EnBW Examples (Hypothetical/Likely) | Market Growth | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Dogs | Legacy Coal Power Plants (pre-2028) | Declining | Low | Divestment or Decommissioning |

| Dogs | Outdated Distributed Generation Projects | Low/Mature | Low | Resource Reallocation |

| Dogs | Isolated, Mature Water Supply Segments | Low/Stagnant | Low | Focus on Core Synergies |

Question Marks

EnBW's ambitious plan to invest around one billion euros in developing a national hydrogen core network by 2032 positions it within a high-growth sector. This strategic move, while promising substantial future potential, currently represents a significant investment with uncertain near-term returns.

The development of this hydrogen infrastructure fits the Question Mark category within the BCG matrix due to its substantial capital requirements and the nascent stage of EnBW's market share in this emerging industry. The company is essentially betting on future growth, requiring significant cash outlay without guaranteed immediate profitability.

EnBW is investing in hydrogen-ready gas-fired power plants, a strategic move to secure energy supply during Germany's coal phase-out. These plants are designed to be flexible, a crucial element as the country integrates more renewables into its grid. This initiative positions EnBW in a potentially high-growth market, driven by national decarbonization goals.

However, these facilities fall into the Question Mark category within the BCG Matrix. Their future success hinges significantly on the availability and cost-effectiveness of green hydrogen. While Germany aims to be a leader in hydrogen technology, the widespread and affordable supply of green hydrogen by 2030 remains a key variable. For instance, Germany's National Hydrogen Strategy targets 10 GW of electrolyzer capacity by 2030, but the actual ramp-up and cost reduction are still developing.

EnBW's CASCADE project, a pioneering effort in direct lithium extraction from geothermal brines, secured the European Geothermal Innovation Award 2025, highlighting its significant technological advancement. This positions the project as a potential game-changer in a market fueled by the burgeoning electric vehicle sector, which saw global EV sales surpass 13 million units in 2024.

While the technology itself represents a high-growth potential area, EnBW's current market share in lithium production remains negligible. The CASCADE project is characterized as a capital-intensive, R&D-focused endeavor, demanding substantial investment for its development and scaling.

The project's classification within the BCG Matrix would likely place it in the 'Question Mark' category. It exhibits high market growth prospects due to the increasing demand for battery materials, but EnBW's current low market share and the project's early-stage, cash-consuming nature indicate uncertainty regarding its immediate commercial viability and future dominance.

Smart Metering and Dynamic Electricity Tariffs

EnBW is actively deploying smart meters and introducing dynamic electricity tariffs, a move designed to give customers greater control over their energy usage. This initiative taps into the burgeoning market for digital energy solutions, though EnBW's precise market standing and the overall pace of customer adoption in this dynamic sector are still being established.

The rollout of smart metering technology and the necessary customer education represent substantial investments, positioning this area as a Question Mark within EnBW's portfolio. While the potential for future value creation is significant, the current market penetration and competitive landscape require careful observation.

- Smart Meter Rollout: By the end of 2023, Germany had approximately 30 million smart meters installed, with a target of 50 million by 2032.

- Dynamic Tariff Growth: In 2024, the number of households in Germany with dynamic electricity tariffs is expected to grow, though specific figures for EnBW's customer base are not yet publicly detailed.

- Investment Needs: The German government has allocated significant funding to support the digital transformation of the energy sector, with smart meter infrastructure being a key component.

Home Energy Management Systems (HEMS)

Home Energy Management Systems (HEMS) represent a strategic move by EnBW towards innovative, customer-centric climate neutrality solutions. This burgeoning market, focused on integrated energy management at the household level, offers substantial growth potential.

EnBW's current market share in HEMS is likely modest, necessitating considerable investment in research, development, and market entry to establish a strong foothold. The company is actively developing new HEMS products and solutions to capitalize on this developing sector.

- Market Position: HEMS falls into the "Question Mark" category within the BCG Matrix for EnBW, characterized by low market share in a high-growth industry.

- Investment Needs: Significant capital expenditure is required for product development, marketing, and building brand awareness to compete effectively.

- Growth Potential: The increasing demand for smart home technology and energy efficiency solutions positions HEMS as a key future revenue driver.

- Strategic Focus: EnBW's commitment to climate neutrality aligns with the HEMS offering, creating a synergistic opportunity for growth and market leadership.

EnBW's investments in areas like the national hydrogen core network and lithium extraction through CASCADE exemplify its strategy in high-growth, but currently uncertain, markets. These ventures require substantial capital and are characterized by low current market share but significant future potential, fitting the 'Question Mark' profile in the BCG Matrix. The success of these initiatives hinges on technological advancements and market adoption, with Germany aiming for 10 GW of electrolyzer capacity by 2030. The global EV market's growth, surpassing 13 million units in 2024, underscores the potential for lithium extraction projects.

| Initiative | BCG Category | Key Characteristics | Relevant Data Points |

| Hydrogen Core Network | Question Mark | High growth potential, high investment, low current market share | €1 billion investment by 2032; Germany's National Hydrogen Strategy targets 10 GW electrolyzer capacity by 2030. |

| CASCADE (Lithium Extraction) | Question Mark | High growth potential, high R&D investment, negligible current market share | Awarded European Geothermal Innovation Award 2025; Global EV sales exceeded 13 million units in 2024. |

| Smart Meter Rollout & Dynamic Tariffs | Question Mark | Developing market, significant investment, evolving customer adoption | ~30 million smart meters installed in Germany by end of 2023; Target of 50 million by 2032. |

| Home Energy Management Systems (HEMS) | Question Mark | Nascent market, requires substantial development and marketing investment, low current share | Focus on customer-centric climate neutrality solutions; Increasing demand for smart home technology. |

BCG Matrix Data Sources

Our EnBW BCG Matrix is built on comprehensive data from financial disclosures, industry growth forecasts, and market share analyses to provide strategic direction.