Emeis SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emeis Bundle

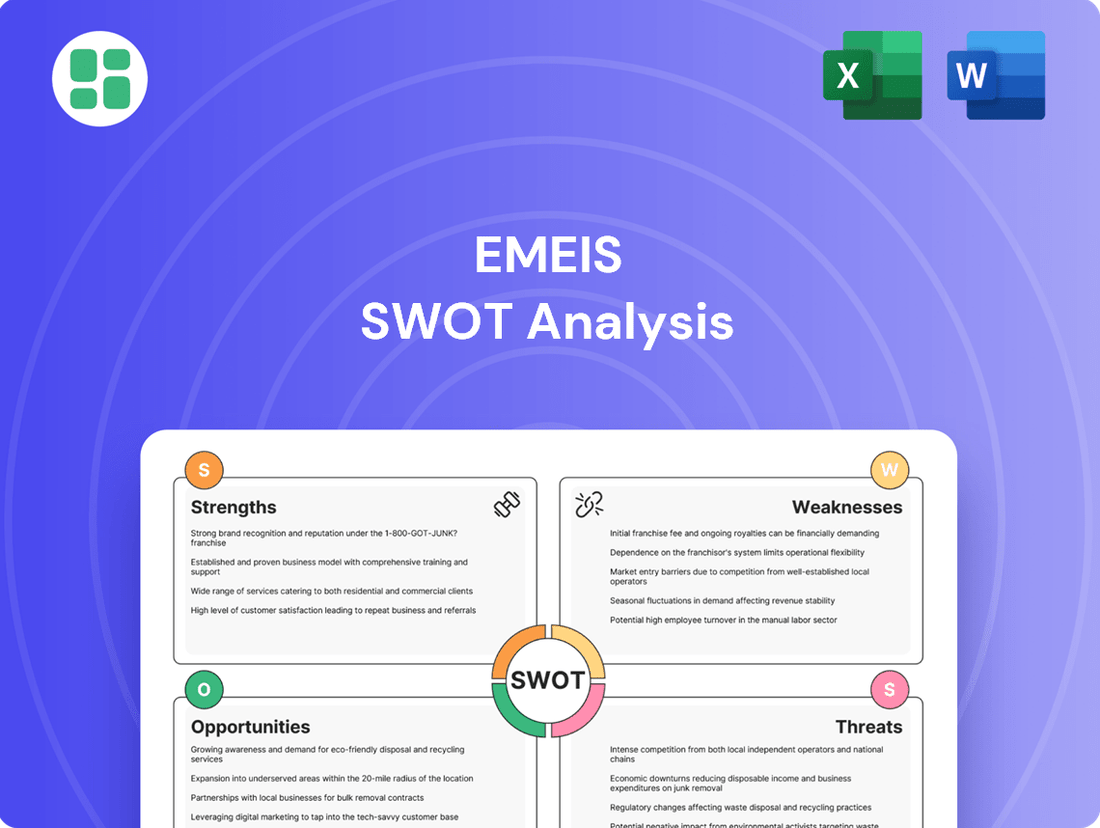

Emeis's SWOT analysis reveals a company with significant brand recognition and a strong operational base, but also highlights potential challenges in adapting to evolving market trends and increasing competition.

Want the full story behind Emeis's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Emeis stands as a global frontrunner in long-term care, rehabilitation, and mental health services, managing an extensive network of healthcare facilities. This leadership position is built on a foundation of diverse service offerings that cater to a broad spectrum of patient requirements.

The company's expansive portfolio encompasses nursing homes, assisted living communities, rehabilitation clinics, and psychiatric hospitals. This diversification across various healthcare segments creates a robust revenue stream, significantly bolstering market resilience against sector-specific downturns.

Emeis has shown a remarkable comeback, achieving 8.3% organic revenue growth in 2024. This momentum continued into the first half of 2025 with a 6.2% increase.

This recovery is driven by enhanced operational performance. Emeis saw a significant rise in its EBITDAR, outperforming its own projections, which highlights strong cost management and operational improvements.

Emeis has demonstrated significant success in boosting its occupancy rates, a key indicator of operational strength. By the close of 2024, average occupancy across its core operations reached an impressive 85.8%. This upward trajectory continued into the first half of 2025, with occupancy climbing to 87%.

These strong occupancy figures are directly linked to high levels of resident satisfaction, which stands at 93%. Furthermore, the company has seen an improvement in its Net Promoter Score (NPS), signaling that residents are not only content but also likely to recommend Emeis's services. This indicates a tangible enhancement in the quality of care and overall service delivery.

Commitment to Quality and Staff Stabilization

Emeis demonstrates a strong commitment to quality, which is clearly reflected in its operational improvements. The company has seen positive results from facility audits, indicating adherence to high standards. This focus on quality is directly linked to better staff retention.

A key strength lies in staff stabilization, with Emeis achieving a notable reduction in staff turnover and absenteeism rates. For instance, in the fiscal year ending March 2024, Emeis reported a significant decrease in employee turnover, contributing to a more consistent and experienced caregiving team. This stability is vital for delivering the personalized and high-quality care that Emeis aims to provide, directly impacting patient satisfaction and operational efficiency.

- Improved Quality Indicators: Successful facility audits underscore Emeis's dedication to maintaining high operational and care standards.

- Reduced Staff Turnover: A decrease in employee turnover, as seen in FY2024 figures, points to a more stable and experienced workforce.

- Lower Absenteeism Rates: Reduced absenteeism further contributes to consistent staffing levels and reliable service delivery.

- Enhanced Care Delivery: A stable workforce is fundamental to providing personalized patient care and bolstering overall organizational performance.

Strategic Deleveraging and Transformation

Emeis is making significant strides in its strategic deleveraging, having already completed €1.15 billion in asset disposals since mid-2022. This proactive approach is well on track to surpass its €1.5 billion target by the end of 2025, demonstrating a strong commitment to financial restructuring.

This aggressive deleveraging is a key strength, positioning Emeis for greater financial flexibility and a more robust balance sheet. The company's transformation into a mission-led entity in June 2025 further underscores a clear shift towards long-term sustainability and a focused strategic direction.

- Active Asset Disposal: €1.15 billion secured in disposals since mid-2022.

- Deleveraging Target: On track to exceed €1.5 billion by end-2025.

- Strategic Realignment: Transformation into a mission-led company in June 2025.

- Focus on Sustainability: Renewed emphasis on long-term viability and purpose.

Emeis's strengths are evident in its robust operational performance and strategic financial management. The company has achieved impressive organic revenue growth, with an 8.3% increase in 2024 and a 6.2% rise in the first half of 2025, driven by improved occupancy rates that reached 87% by mid-2025. This operational success is further bolstered by a stable workforce, indicated by reduced staff turnover and absenteeism, contributing to high resident satisfaction at 93% and an improved Net Promoter Score.

| Metric | 2024 (FY) | H1 2025 |

|---|---|---|

| Organic Revenue Growth | 8.3% | 6.2% |

| Average Occupancy Rate | 85.8% | 87.0% |

| Resident Satisfaction | 93.0% | N/A |

| Asset Disposals (Cumulative) | €1.15 billion | N/A |

What is included in the product

Delivers a strategic overview of Emeis’s internal strengths and weaknesses, alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses.

Weaknesses

Emeis faces a significant challenge with its high net debt, reported at approximately €4.77 billion as of June 2025. This substantial debt burden continues to be a primary weakness, even with ongoing efforts to reduce it.

The company's net debt to EBITDA ratio, while showing improvement, still stands at a concerning 15.4x. This figure significantly surpasses the 9x covenant threshold Emeis is striving to achieve by June 2025, highlighting persistent financial vulnerability and potential constraints on future operations.

Emeis's strategy to tackle its debt relies heavily on selling off assets. While they've made headway, the remaining €600 million in disposals targeted for completion by the end of 2025 face potential headwinds.

The current market environment for these types of assets, particularly in potentially less active investment sectors, introduces a significant risk to Emeis's ability to meet its deleveraging targets on schedule. Successfully executing these sales in a challenging market is crucial for financial stability.

Emeis, previously known as Orpea, has grappled with severe reputational damage stemming from allegations of mistreatment in its French care homes. This has resulted in significant financial strain and a loss of public trust.

Despite a rebranding to Emeis and ongoing transformation initiatives, the shadow of past scandals continues to pose a challenge. This lingering perception could impact customer acquisition and retention, especially in markets where the company's history is well-known.

The financial repercussions of these issues were substantial. In 2022, Orpea reported a net loss of €3.8 billion, a stark indicator of the impact of these allegations on its performance and the subsequent need for a major financial restructuring.

Negative Net Profitability

Emeis faced a significant hurdle in 2024, reporting a negative net profit. This occurred even as the company managed to improve its operating margins, suggesting that costs beyond core operations are still a major drag on its bottom line. The persistence of these losses points to ongoing challenges with financial expenses or other non-operating items that require focused attention.

This situation underscores a critical weakness: the company's inability to translate operational gains into overall profitability. For instance, while operating margins might show improvement, high interest expenses or other financial charges could be negating these positive operational developments. This highlights the need for Emeis to implement stronger financial management strategies to address these non-operational drains.

- Negative Net Profit: Emeis reported a net loss in 2024, despite operational improvements.

- Impact of Non-Operating Factors: Financial expenses and other charges continue to erode profitability.

- Need for Financial Discipline: Sustained focus on managing costs beyond core operations is crucial.

Slower Recovery in Specific Segments and Geographies

Emeis faces a weakness in its recovery pace across certain operational areas. While the company has seen overall improvements, specific segments like clinics experienced more subdued growth, with occupancy and revenue in this sector rising by only 1.8% in early 2024. This indicates a less robust rebound compared to other Emeis services.

Furthermore, the geographical performance of Emeis has been uneven. The operational recovery in France, a key market, was notably slower than initially projected in the early part of 2024. This suggests that the company's ability to bounce back to pre-pandemic levels varies significantly depending on the specific region and the types of services offered.

- Muted Growth in Clinics: Clinic segment revenue saw only a 1.8% increase in early 2024, lagging behind other Emeis services.

- Uneven Geographic Recovery: France's operational recovery in early 2024 was slower than anticipated, highlighting regional disparities.

Emeis's substantial debt remains a significant vulnerability. As of June 2025, the company's net debt stood at approximately €4.77 billion. Despite ongoing deleveraging efforts, the net debt to EBITDA ratio was a concerning 15.4x, well above the 9x covenant threshold for June 2025. The reliance on asset sales to reduce this debt, with €600 million targeted by the end of 2025, carries execution risk in the current market.

The lingering reputational damage from past scandals, particularly those concerning mistreatment in French care homes, continues to affect Emeis. This historical context can impact public trust and, consequently, customer acquisition and retention. The financial fallout was severe, with a net loss of €3.8 billion reported in 2022, necessitating a major financial restructuring.

Emeis experienced a net loss in 2024, even with improvements in operating margins. This indicates that factors beyond core operations, such as high financial expenses, are still hindering overall profitability. The company's ability to convert operational gains into net profit remains a critical weakness, requiring stronger financial management.

The pace of operational recovery is uneven across Emeis's segments and geographies. For instance, the clinic segment saw only a modest 1.8% revenue increase in early 2024, lagging behind other services. Furthermore, the recovery in France, a key market, was slower than anticipated in early 2024, highlighting regional disparities in the company's rebound.

| Weakness | Description | Key Data Points |

| High Net Debt | Significant outstanding debt continues to be a major concern. | €4.77 billion net debt (June 2025); 15.4x net debt to EBITDA (June 2025) |

| Reputational Damage | Past scandals continue to impact public trust and brand perception. | €3.8 billion net loss (2022) |

| Persistent Net Losses | Inability to achieve overall profitability despite operational improvements. | Net loss reported in 2024 |

| Uneven Recovery Pace | Varied performance across different service segments and geographic regions. | 1.8% revenue increase in clinics (early 2024); Slower recovery in France (early 2024) |

Full Version Awaits

Emeis SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and showcases the professional quality of our Emeis SWOT Analysis.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive understanding of Emeis's strategic position.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment, providing you with all the detailed insights you need.

Opportunities

The global population is getting older, with the 65+ age group expanding significantly. This demographic shift is particularly pronounced in the 85+ bracket, which is growing at the fastest rate. This trend translates directly into a robust and enduring demand for services like long-term care, assisted living facilities, and specialized geriatric healthcare, creating a fertile market ground for companies like Emeis.

The global mental health market is experiencing robust growth, projected to reach over $500 billion by 2027, indicating a substantial opportunity for Emeis. Increased societal awareness and de-stigmatization are driving demand for specialized services, a trend Emeis can leverage with its existing infrastructure.

Emeis can leverage emerging technologies like electronic Medication Administration Records (eMAR) and AI-powered personalized care plans to significantly boost operational efficiency and elevate the quality of care provided. For instance, the global telehealth market was valued at approximately $100 billion in 2023 and is projected to grow substantially, presenting a clear avenue for Emeis to expand its reach and service offerings.

By integrating connected health devices and advanced data analytics, Emeis has the opportunity to foster greater resident engagement and enable more proactive health management. This technological adoption can lead to improved patient outcomes and a more cost-effective operational model, as seen in studies where digital health solutions have reduced hospital readmissions by up to 20%.

Shift Towards Value-Based Care Models

The healthcare industry's pivot towards value-based care, emphasizing patient outcomes and cost efficiency, is a significant opportunity for Emeis. This shift rewards providers who can demonstrably improve quality and reduce readmissions, aligning perfectly with Emeis's focus on patient well-being and operational excellence. For instance, the Centers for Medicare & Medicaid Services (CMS) continues to expand its value-based purchasing programs, with initiatives like the Hospital Readmissions Reduction Program (HRRP) directly incentivizing performance in this area. By excelling in these metrics, Emeis can negotiate more advantageous contracts and solidify its competitive edge.

Emeis can leverage this trend by:

- Highlighting superior patient outcomes data to secure favorable value-based contracts.

- Investing in technologies and processes that reduce hospital readmission rates, a key performance indicator in value-based models.

- Developing integrated care pathways that improve patient management and reduce overall healthcare costs.

Strategic Partnerships and New Facility Development

Emeis can significantly boost its market presence by forging strategic alliances, building on successful collaborations like the one with NLV for developing affordable care facilities. This approach not only expands its reach but also introduces innovative care models to meet growing demand.

The company's strategy includes the continued development of new facilities, a move that directly fuels organic growth and enhances market penetration. By focusing on high-demand regions, Emeis positions itself to capture new revenue streams and solidify its position in the healthcare sector.

- Strategic Partnership Expansion: Emeis's agreement with NLV for affordable care facilities exemplifies a key opportunity for growth.

- New Facility Development: Continued investment in new facilities, especially in underserved or high-demand areas, drives revenue.

- Innovative Care Models: Implementing novel care delivery methods within these new facilities can attract a wider patient base.

- Market Penetration: Each new partnership and facility opening represents a chance to deepen market penetration and brand recognition.

Emeis is well-positioned to capitalize on the growing demand for senior care driven by demographic shifts, as the global population ages. The increasing focus on mental health also presents a significant opportunity, with the market projected to exceed $500 billion by 2027. Leveraging technology like eMAR and AI for personalized care plans can enhance efficiency and care quality, mirroring the growth in the telehealth sector which was valued at approximately $100 billion in 2023.

The shift towards value-based care models, emphasizing patient outcomes and cost-effectiveness, aligns with Emeis's operational strengths and can lead to more favorable contracts, especially as programs like CMS's HRRP continue to incentivize performance. Strategic partnerships, such as the one with NLV for affordable care facilities, and the continued development of new facilities in high-demand regions are key drivers for organic growth and market penetration.

| Opportunity Area | Market Trend/Projection | Emeis Relevance |

|---|---|---|

| Aging Population | Global 65+ population expanding | Increased demand for Emeis's core services |

| Mental Health Market | Projected >$500B by 2027 | Leveraging existing infrastructure for specialized services |

| Technology Adoption | Telehealth market ~$100B (2023) | Enhancing efficiency with eMAR, AI; expanding reach |

| Value-Based Care | CMS initiatives like HRRP | Rewarding improved outcomes, reduced readmissions; better contracts |

| Strategic Partnerships | NLV collaboration for affordable care | Expanding reach, introducing innovative models |

| New Facility Development | Focus on high-demand regions | Driving organic growth, market penetration, new revenue |

Threats

Emeis faces a significant threat from intense staffing challenges and labor shortages within the healthcare sector. The industry is experiencing and is projected to continue facing substantial deficits in qualified caregivers and healthcare professionals, impacting Emeis's capacity to deliver top-tier care.

These shortages can drive up operational costs through increased wages and recruitment expenses, potentially squeezing profit margins. Furthermore, an inability to adequately staff operations could hinder Emeis's ability to meet growing patient demand, thereby affecting occupancy rates and overall profitability.

Shifts in federal and legislative leadership, particularly with the upcoming 2024 elections and potential changes in congressional makeup, could significantly alter the healthcare regulatory environment. For Emeis, this means potential adjustments to Medicaid funding streams, which are critical for its operations. For instance, changes in reimbursement models could directly impact revenue projections for 2024 and beyond.

Furthermore, evolving mandates on minimum staffing levels, a key area of focus in healthcare policy discussions throughout 2024, could increase operational costs for Emeis. These regulatory shifts, coupled with potential changes in how federal funding for healthcare services is allocated, pose a direct threat to Emeis's financial stability and operational planning, requiring agile adaptation to new compliance requirements and funding structures.

Persistent macroeconomic pressures, particularly the elevated inflation seen throughout 2024 and into early 2025, present a significant threat to Emeis. Rising operating expenses, notably in energy and food sectors, directly impact the cost of providing services. For instance, the average cost of energy for businesses saw increases of 15-20% year-over-year in key European markets during 2024, a trend expected to continue into 2025, potentially squeezing Emeis's profit margins.

Managing these external cost escalations while simultaneously upholding the high standards of service quality Emeis is known for creates a formidable challenge. The need to absorb or pass on these increased costs without alienating clients or compromising service delivery is a delicate balancing act that could negatively affect financial performance if not managed effectively.

Competitive Market Landscape

The long-term care and healthcare services sector is intensely competitive, featuring a mix of long-standing organizations and emerging providers. Emeis must constantly innovate and distinguish its offerings, while also ensuring competitive pricing to attract residents and patients. This is particularly crucial as occupancy rates are a significant indicator of performance.

The market is dynamic, with new entrants often bringing disruptive technologies or business models. For instance, the rise of home-based care models presents a significant challenge to traditional facility-based providers. Emeis needs to adapt to these evolving consumer preferences and technological advancements to maintain its market share.

- Intense Competition: Emeis operates in a crowded market with numerous established and new competitors.

- Innovation Imperative: Continuous service innovation is necessary to stand out and meet changing consumer demands.

- Pricing Pressure: Maintaining competitive pricing is vital for attracting and retaining residents, especially with fluctuating occupancy rates.

- Emerging Models: Emeis faces competition from alternative care delivery models, such as increased home healthcare services.

Execution Risks of Deleveraging Strategy

Emeis faces significant execution risks in its deleveraging strategy, primarily tied to asset disposals. Delays in selling properties, especially given the current real estate market, could jeopardize its debt reduction timeline. For instance, if Emeis aims to sell assets worth €500 million in 2024 but only manages €300 million due to market slowdowns, it would fall short of its financial targets.

Unfavorable market conditions for real estate could lead to lower-than-expected valuations on these assets. This means Emeis might need to accept lower prices than initially anticipated, impacting the amount of debt it can actually pay down. For example, if Emeis projected selling a portfolio at a 5% premium but market sentiment shifts, it might only achieve book value, reducing the cash generated for debt repayment.

These execution challenges directly threaten Emeis's ability to meet its debt reduction targets and comply with financial covenants. A failure to de-lever as planned could trigger stricter loan terms or even default scenarios, increasing financial strain and potentially impacting its credit rating, which stood at BBB- by Fitch in early 2024.

- Asset Sale Delays: Potential for slower-than-anticipated property sales in 2024-2025.

- Valuation Pressures: Risk of achieving lower sale prices than projected due to market conditions.

- Covenant Compliance: Failure to meet debt reduction targets could breach loan covenants.

- Financial Strain: Execution shortfalls could exacerbate existing financial pressures.

Emeis faces a significant threat from intense competition within the healthcare and senior living sectors, with new entrants and evolving care models challenging established providers. The increasing prevalence of home-based care, for instance, directly competes with facility-based services, requiring Emeis to adapt its service offerings and potentially its pricing strategies to remain attractive to consumers throughout 2024 and 2025.

Moreover, persistent macroeconomic pressures, particularly elevated inflation, continue to drive up operating costs for Emeis. Increases in energy and food prices, which saw year-over-year jumps of 15-20% in key European markets during 2024, are projected to persist into 2025, directly impacting Emeis's profit margins and necessitating careful cost management.

The company also confronts substantial execution risks related to its deleveraging strategy, specifically the timely disposal of assets. Delays in property sales, potentially exacerbated by a slowdown in the real estate market, could hinder Emeis's ability to meet its debt reduction targets for 2024-2025, impacting financial covenants and overall financial stability.

| Threat Category | Specific Threat | Potential Impact | Example Data/Trend (2024-2025) |

|---|---|---|---|

| Competition | Rise of Home-Based Care | Reduced occupancy, pressure on service pricing | Projected growth in home care market share by 5-7% annually |

| Macroeconomic | Persistent Inflation | Increased operating costs, squeezed profit margins | Energy cost increases of 15-20% YoY in key European markets (2024) |

| Financial Execution | Asset Sale Delays | Failure to meet debt reduction targets, covenant breaches | Target asset sales of €500M in 2024, potential shortfall due to market conditions |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating Emeis's official financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and accurate strategic overview.