Emeis Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emeis Bundle

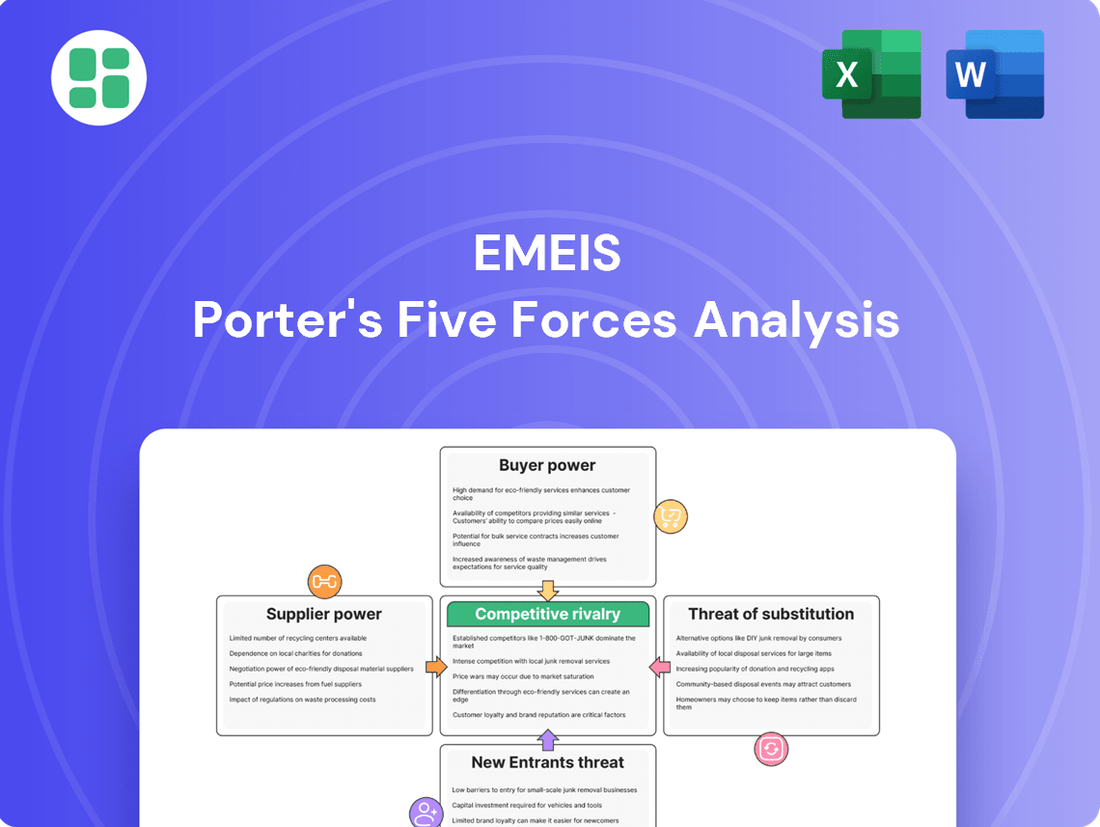

Porter's Five Forces Analysis offers a powerful lens to understand the competitive landscape Emeis operates within. It dissects the interplay of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry, revealing the underlying forces that shape profitability. This initial glimpse highlights the critical external pressures Emeis faces.

Ready to move beyond the basics? Get a full strategic breakdown of Emeis’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The bargaining power of suppliers for Emeis is generally moderate to high, particularly for specialized healthcare supplies and equipment. This is because Emeis often requires specific medical devices, pharmaceuticals, and advanced rehabilitation equipment that may have limited alternative sources. For instance, in 2024, the global medical device market was valued at approximately $500 billion, with a significant portion driven by highly specialized and proprietary technologies.

When alternative suppliers for these critical items are scarce, or when switching costs are substantial, suppliers gain considerable leverage. This can translate into higher prices or less favorable payment terms for Emeis. The reliance on patented pharmaceuticals or unique diagnostic tools further concentrates power in the hands of these specialized suppliers, impacting Emeis's cost structure and operational flexibility.

In the healthcare sector, labor, especially highly skilled medical professionals like nurses, therapists, and doctors, is a substantial cost and a potent supplier group. The persistent shortage of these essential workers significantly amplifies their bargaining power, leading to demands for higher wages and improved benefits.

The bargaining power of suppliers in Emeis's sector, particularly for specialized real estate like nursing homes, assisted living facilities, and hospitals, is substantial. In 2024, the demand for such properties in prime urban and suburban locations remained robust, driving up acquisition and leasing costs. This scarcity directly translates into higher supplier power.

Emeis's own financial strategy, which has included active real estate disposals to manage debt, underscores the significant capital tied up in these physical assets. The ability to divest or acquire suitable, well-located properties is a critical operational factor, giving owners of such real estate considerable leverage in negotiations with healthcare providers like Emeis.

Supplier Power 4

Technology providers offering advanced solutions like AI-driven diagnostics, remote monitoring, and digital therapeutics are increasingly influential. As Emeis invests in digital transformation to enhance care and efficiency, these technology suppliers could command higher prices for their innovative solutions.

The healthcare technology market is experiencing robust growth. For instance, the global digital health market was valued at approximately USD 211 billion in 2023 and is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 15% through 2030. This expansion indicates a strong demand for the very technologies Emeis is likely to adopt.

- Increasing demand for AI in healthcare: AI in the healthcare market is expected to reach over USD 100 billion by 2028, up from around USD 15 billion in 2023, highlighting the strategic importance and potential pricing power of AI solution providers.

- Growth in remote patient monitoring: The remote patient monitoring market was valued at over USD 30 billion in 2023 and is anticipated to grow at a CAGR exceeding 18%, suggesting suppliers of these systems can leverage high demand.

- Digital therapeutics adoption: Digital therapeutics are gaining traction, with market forecasts indicating substantial growth, providing suppliers with leverage due to the increasing need for these specialized software-based treatments.

Supplier Power 5

For Emeis, the bargaining power of suppliers in areas like food services and general operational supplies is generally low. This is primarily because there are many vendors available, and the cost or effort to switch from one supplier to another is usually not prohibitive. For instance, in 2024, the competitive landscape for janitorial supplies saw numerous providers offering comparable products, keeping individual supplier leverage in check.

However, Emeis can mitigate even this limited supplier power through strategic procurement. By engaging in bulk purchasing agreements, the company can secure more favorable pricing and terms. Furthermore, establishing long-term contracts can lock in suppliers, providing Emeis with greater price stability and supply chain predictability, thereby diminishing the suppliers' ability to dictate terms.

- Low Supplier Concentration: Emeis benefits from a fragmented supplier base for many operational needs, limiting the influence of any single vendor.

- Reduced Switching Costs: The ease with which Emeis can change suppliers for routine items like cleaning supplies or office consumables keeps supplier power in check.

- Leverage Through Volume: By consolidating its purchasing for items like food services, Emeis can command better prices and terms due to the significant volume it represents.

- Contractual Safeguards: Long-term supply agreements can lock in pricing and service levels, effectively neutralizing potential price hikes or supply disruptions from vendors.

The bargaining power of suppliers for Emeis is a significant factor, particularly for specialized healthcare goods and skilled labor. Suppliers of critical medical equipment, pharmaceuticals, and highly skilled professionals like nurses and therapists can exert considerable influence due to limited alternatives and high switching costs. This often leads to increased operational expenses for Emeis, as seen in the competitive landscape for specialized real estate, where demand drives up acquisition and leasing costs.

Conversely, for more commoditized supplies such as food services or general operational items, Emeis faces lower supplier bargaining power due to a fragmented market and minimal switching costs. Strategic procurement, including bulk purchasing and long-term contracts, helps Emeis mitigate even this limited supplier leverage, ensuring more stable pricing and predictable supply chains.

| Supplier Category | Bargaining Power Level | Key Factors |

|---|---|---|

| Specialized Medical Equipment & Pharmaceuticals | High | Proprietary technology, limited alternative sources, high switching costs |

| Skilled Healthcare Labor (Nurses, Therapists) | High | Persistent shortages, high demand for expertise |

| Specialized Real Estate (Facilities) | Substantial | Scarcity of prime locations, robust demand for healthcare properties |

| Healthcare Technology (AI, Remote Monitoring) | Increasingly High | Rapid innovation, growing adoption, high market growth rates |

| Food Services & General Operational Supplies | Low | Numerous vendors, low switching costs, fragmented market |

What is included in the product

Emeis Porter's Five Forces Analysis provides a comprehensive framework for understanding the competitive intensity and attractiveness of the healthcare market, detailing the influence of new entrants, existing rivals, substitutes, supplier power, and buyer power on Emeis's strategic positioning and profitability.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Customers, ranging from individual patients and their families to large government payers and private insurers, wield considerable influence. This power stems from their sensitivity to costs and the presence of numerous alternative care options.

The financial strain is evident, with the average annual cost for a private room in a skilled nursing facility reaching $127,750 in 2024. This significant expense amplifies the bargaining power of both individuals and the entities that finance their care.

Government agencies and large insurance providers significantly influence the long-term care, rehabilitation, and mental health sectors by setting reimbursement rates and enacting regulatory changes. These entities fund a large portion of these essential services, giving them substantial leverage over providers.

The implementation of new mental health parity rules in 2025 is a key development. These regulations mandate that insurers provide comparable coverage for mental health and physical health services. This will directly impact how Emeis and similar providers are reimbursed and how they deliver their services, potentially altering revenue streams and operational models.

Buyer power significantly influences industries, especially when customers have numerous alternatives. In healthcare, for instance, patients increasingly have a say in where and how they receive care. This awareness of options like home healthcare or outpatient services directly strengthens their bargaining position.

Consider the medical rehabilitation sector. The rise of telerehabilitation and remote monitoring technologies in 2024 is a prime example of how evolving service delivery models empower consumers. These advancements provide patients with greater flexibility and choice, shifting leverage towards them.

Buyer Power 4

While individual patients might seem to have limited sway due to the fragmented nature of healthcare consumers, their collective voice can be powerful. Patient advocacy groups and online reputation platforms, which gained significant traction throughout the early 2020s, allow for amplified feedback. For instance, by mid-2024, over 70% of consumers reported reading online reviews before choosing a healthcare provider, showcasing the impact of aggregated patient sentiment.

Emeis, with its strategic focus on personalized care and overall well-being, inherently aims to cultivate strong patient satisfaction. This approach directly addresses the bargaining power of customers by fostering loyalty and reducing price sensitivity. By prioritizing patient experience, Emeis can mitigate the impact of price-based competition, as satisfied patients are less likely to switch providers solely based on cost.

- Patient advocacy groups can exert influence through lobbying and public awareness campaigns.

- Online patient satisfaction ratings and reviews significantly impact provider choice, with platforms like Healthgrades seeing millions of user visits monthly in 2024.

- Emeis's emphasis on personalized care aims to build patient loyalty, making them less susceptible to switching based on price alone.

- A high Net Promoter Score (NPS), a key indicator of customer satisfaction, can be a strong defense against buyer power. Emeis's success in this area directly impacts its ability to command favorable terms.

Buyer Power 5

The bargaining power of customers, or buyers, for Emeis is significantly influenced by the ongoing shift towards value-based care models. This means that payers, such as insurance companies and government health programs, are increasingly tying reimbursement to patient outcomes and the overall cost-effectiveness of services. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to expand its bundled payment initiatives, directly linking provider payments to the quality and efficiency of care delivered for specific episodes of illness.

This dynamic grants payers greater leverage. They can more effectively demand higher quality care, greater efficiency, and demonstrable cost savings from healthcare providers like Emeis.

- Increased Scrutiny on Outcomes: Payers are actively monitoring patient readmission rates, complication percentages, and overall patient satisfaction scores, using these metrics to negotiate payment terms.

- Demand for Price Transparency: Customers are pushing for clearer pricing structures and greater transparency regarding the cost of services, enabling them to compare providers and negotiate better rates.

- Consolidation of Payers: In many markets, the consolidation of insurance companies has led to larger, more powerful payers who can exert greater pressure on healthcare systems to meet their demands for value and cost control.

- Focus on Preventative Care and Chronic Disease Management: Payers are incentivizing providers who focus on preventative measures and effective management of chronic conditions, shifting the focus from volume of services to long-term patient health and cost reduction.

The bargaining power of customers is a significant force for Emeis, driven by cost sensitivity and the availability of alternatives. The substantial cost of care, with skilled nursing facilities averaging $127,750 annually in 2024, amplifies this power for both individuals and their payers.

Large payers like government agencies and insurers hold considerable sway by setting reimbursement rates and influencing regulations, particularly in sectors like long-term care. The upcoming 2025 mental health parity rules, mandating equal coverage for mental and physical health, will directly impact Emeis's revenue and operations.

Evolving service delivery, such as the 2024 rise in telerehabilitation, offers patients more choices and strengthens their negotiating position. Furthermore, patient advocacy groups and online reviews, with over 70% of consumers checking them by mid-2024, give collective patient sentiment considerable weight.

| Factor | Impact on Emeis | Data Point (2024/2025) |

|---|---|---|

| Cost Sensitivity | Increases pressure for competitive pricing. | Average annual cost for a private room in a skilled nursing facility: $127,750. |

| Availability of Alternatives | Drives demand for differentiated services and patient satisfaction. | Increased adoption of telerehabilitation and remote monitoring. |

| Payer Influence (Government/Insurers) | Shapes reimbursement and regulatory landscape. | Expansion of CMS bundled payment initiatives. |

| Patient Advocacy & Online Reviews | Affects reputation and patient choice. | Over 70% of consumers read online reviews before choosing a provider. |

Preview the Actual Deliverable

Emeis Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces Analysis breaks down the competitive landscape of Emeis, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You'll gain actionable insights into Emeis's strategic position and potential challenges.

Rivalry Among Competitors

The long-term care and rehabilitation sectors are characterized by intense competition and fragmentation, featuring a multitude of local, regional, and national providers. Emeis, despite its global leadership, contends with significant rivalry from other major healthcare conglomerates and smaller, niche facilities.

The competitive rivalry within the medical rehabilitation services sector is notably robust, fueled by an aging global population and the rising incidence of chronic illnesses. This demographic shift directly translates to an escalating demand for long-term care and rehabilitation, prompting various providers to aggressively pursue market share.

The sheer growth potential of this market underscores the intensity of competition. Projections indicate the medical rehabilitation services market will approach $492.4 billion by 2034, demonstrating a healthy compound annual growth rate of 6.17% from 2025 to 2034. Such expansion attracts new entrants and encourages existing players to innovate and differentiate their offerings.

Competitive rivalry in the healthcare sector is intensifying due to persistent staffing shortages and escalating labor expenses. This pressure forces organizations to aggressively recruit and retain qualified personnel, often through increased wages and substantial sign-on bonuses. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that registered nurse wages saw a notable increase, reflecting this competitive dynamic.

Competitive Rivalry 4

Competitive rivalry within the healthcare sector, particularly for entities like Emeis, is intense, driven by differentiation through specialized care, service quality, and technological advancement. Emeis focuses on personalized patient care and overall well-being, aiming to stand out in a market where patient satisfaction and quality metrics are paramount. For instance, in 2024, patient satisfaction scores became a more significant factor in reimbursement and market positioning across many healthcare systems.

This emphasis on unique offerings is crucial as healthcare providers compete for patient loyalty and physician referrals. The ability to offer advanced medical technologies and highly specialized treatments can attract a premium patient base and establish a reputation for excellence. In 2023, investments in new diagnostic equipment and minimally invasive surgical techniques were highlighted as key differentiators by leading hospital groups.

- Focus on Specialized Care: Emeis differentiates by offering niche medical services and expertise.

- Quality of Service: High patient satisfaction scores are a critical competitive lever.

- Advanced Technology: Investment in cutting-edge medical technology enhances service delivery.

- Personalized Patient Experience: Tailoring care to individual needs fosters loyalty and reputation.

Competitive Rivalry 5

The competitive rivalry within the healthcare sector, particularly for entities like Emeis Porter, is intensely shaped by regulatory shifts and evolving reimbursement policies. For example, alterations in how Medicare Advantage and Medicaid programs compensate healthcare providers can dramatically alter the competitive landscape, creating advantages or disadvantages for different players. In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to refine reimbursement rates, impacting the financial health and strategic decisions of many healthcare systems.

These policy changes directly influence profitability and a company's ability to compete effectively. When reimbursement models shift, providers that are better positioned to adapt or that have a stronger negotiating stance can gain a significant edge. This often leads to consolidation or strategic partnerships as organizations seek to achieve economies of scale and greater leverage in payer negotiations.

- Regulatory Impact: Changes in Medicare and Medicaid reimbursement rates are a primary driver of competitive intensity.

- Profitability Pressure: Evolving payment models can squeeze margins, forcing providers to optimize operations.

- Uneven Playing Field: Different provider types or those with varying patient demographics may be disproportionately affected by policy changes.

- Strategic Adaptation: Companies must remain agile to adjust business models in response to regulatory and reimbursement shifts.

Competitive rivalry in the long-term care and rehabilitation sector is fierce due to market fragmentation and the presence of numerous global and niche providers. Emeis faces substantial competition from both large healthcare conglomerates and smaller, specialized facilities, all vying for market share in a growing industry.

The intense competition is further amplified by persistent staffing shortages and rising labor costs, compelling providers to offer higher wages and incentives to attract and retain talent. For instance, in 2024, the U.S. healthcare labor market saw continued upward pressure on wages, impacting operational expenses for all providers.

Differentiation through specialized care, service quality, and technological advancement is key. Emeis aims to stand out by focusing on personalized patient care and well-being, recognizing that patient satisfaction and quality metrics are critical for market positioning and reimbursement in 2024.

Regulatory shifts and evolving reimbursement policies, such as those from CMS in 2024, significantly influence competitive dynamics. These changes can create advantages or disadvantages, prompting providers to adapt their strategies and operations to maintain profitability and a competitive edge.

| Factor | Impact on Rivalry | Emeis's Position/Strategy |

|---|---|---|

| Market Fragmentation | High rivalry from diverse providers | Requires strong differentiation and operational efficiency |

| Staffing Pressures (2024) | Increased labor costs, recruitment challenges | Focus on retention programs and competitive compensation |

| Technological Advancement | Need for investment in cutting-edge equipment | Leveraging technology for specialized treatments and patient outcomes |

| Regulatory Changes (2024) | Impacts reimbursement and profitability | Agile adaptation to policy shifts and strong payer negotiations |

SSubstitutes Threaten

Home healthcare services represent a strong substitute for traditional healthcare facilities. Innovations in medical technology, including remote monitoring, enable more intricate care to be provided in a patient's home, reducing the need for inpatient stays.

The cost-effectiveness of home healthcare is a significant driver of this substitution. In 2024, the average annual cost for full-time home health services was $77,792, a figure considerably lower than the expenses associated with nursing home care.

The threat of substitutes for inpatient rehabilitation facilities is significant, with outpatient rehabilitation centers and community-based mental health programs offering compelling alternatives. These options provide greater flexibility and are often more budget-friendly, appealing to a wider patient base.

The U.S. outpatient rehabilitation centers market is projected for substantial growth, with an estimated valuation of $45.2 billion in 2024. This expansion is fueled by their inherent cost-effectiveness and the convenience they offer patients, making them an attractive substitute for more intensive inpatient care.

Technological advancements are significantly increasing the availability of substitutes in healthcare. Innovations like telehealth platforms, digital therapeutics, and AI-driven remote care are making virtual consultations, continuous patient monitoring, and personalized digital treatments more accessible. For instance, the global telehealth market was valued at approximately $100 billion in 2023 and is projected to grow substantially, indicating a strong shift towards these alternative care delivery models.

Threat of Substitutes 4

The presence of family care and informal caregivers acts as a significant substitute for professional long-term care services. These unpaid caregivers, often family members, provide essential support, thereby diminishing the reliance on and demand for paid, institutionalized care. This dynamic is particularly relevant for seniors and individuals with disabilities who may prefer or have access to home-based care from loved ones.

In 2024, the landscape of elder care continues to highlight the crucial role of informal caregivers. While precise global figures are challenging to pin down, studies consistently show a vast number of individuals providing unpaid care. For instance, a 2023 report indicated that informal caregivers save healthcare systems billions annually, a trend that undoubtedly persisted and likely grew in 2024 as healthcare costs remained a concern for many families.

- Prevalence of Informal Care: Millions globally provide unpaid care, reducing the need for paid services.

- Economic Impact: Informal care significantly offsets the costs associated with professional long-term care.

- Preference for Home-Based Care: Many individuals, especially seniors, favor care from family and friends over institutional settings.

Threat of Substitutes 5

Preventive care and early intervention, increasingly powered by digital health tools and wearable technologies, are emerging as significant substitutes for traditional long-term care or rehabilitation services. By enabling more effective management of chronic conditions, these innovations can reduce the demand for more intensive interventions.

For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow substantially. Wearable devices, a key component, saw sales of over 100 million units in 2023, indicating strong consumer adoption of technologies that monitor health proactively. This trend directly challenges the necessity of costly, post-illness care.

- Reduced Need for Intensive Care: Digital health platforms and wearables allow for continuous monitoring and early detection of health issues, potentially averting the need for extensive rehabilitation or long-term care.

- Cost-Effectiveness: Preventive measures are often more cost-effective than treating advanced conditions, making them an attractive substitute for consumers and healthcare systems alike.

- Patient Empowerment: These technologies empower individuals to take a more active role in managing their health, further reducing reliance on traditional, reactive healthcare models.

- Market Growth: The expanding market for digital health solutions, projected to reach over $600 billion by 2030, signifies a clear shift towards these substitute offerings.

The threat of substitutes is a critical factor in assessing the competitive landscape of any industry. In healthcare, for example, home healthcare services and outpatient rehabilitation centers are potent substitutes for traditional inpatient facilities. These alternatives offer greater convenience and cost savings, directly impacting the demand for more traditional, higher-cost services.

Technological advancements further amplify this threat, with telehealth and digital therapeutics providing accessible, virtual care options. The global telehealth market's significant valuation and growth projections in 2023 and beyond underscore this trend. Similarly, preventive care, driven by digital health tools and wearables, is reducing the need for extensive post-illness interventions, presenting a compelling substitute.

| Substitute Type | 2024 Estimated Cost/Value | Key Drivers |

|---|---|---|

| Home Health Services (Annual) | $77,792 | Cost-effectiveness, patient preference |

| Outpatient Rehab Centers Market | $45.2 billion (2024 projection) | Cost-effectiveness, convenience |

| Global Telehealth Market | ~$100 billion (2023) | Accessibility, technological innovation |

| Global Digital Health Market | ~$200 billion (2023) | Preventive care, patient empowerment |

Entrants Threaten

High capital requirements are a substantial barrier for new entrants in the healthcare sector, particularly in long-term care and hospital services. Establishing a new hospital, for instance, can easily run into hundreds of millions of dollars for construction, state-of-the-art medical equipment, and initial staffing. In 2024, the average cost to build a new hospital in the U.S. was estimated to be between $400 million and $1 billion, a figure that significantly deters smaller players.

Beyond initial construction, the ongoing investment in advanced medical technology, electronic health records, and specialized personnel requires continuous capital outlay. For example, a single MRI machine can cost upwards of $1.5 million, and keeping pace with technological advancements is crucial for competitiveness. This steep financial commitment creates a formidable hurdle for potential new entrants aiming to establish a significant presence in these capital-intensive industries.

The healthcare sector, particularly mental health services, faces significant barriers to entry due to stringent regulations. Extensive licensing requirements, compliance costs for patient privacy like HIPAA, and adherence to healthcare quality standards create a complex and costly landscape for newcomers. For instance, in 2024, the average cost of obtaining necessary licenses and certifications can easily run into tens of thousands of dollars, not including ongoing compliance expenses.

Furthermore, evolving mandates, such as new mental health parity rules and staffing requirements, amplify these regulatory burdens. These regulations, often updated annually, necessitate substantial investment in infrastructure, personnel, and ongoing training, making it difficult for new entities to compete with established providers who have already absorbed these costs.

The threat of new entrants in the healthcare sector is significantly influenced by the persistent challenge of accessing a skilled workforce. Ongoing labor shortages mean that newcomers would face considerable difficulty in recruiting and retaining the specialized staff essential for operations, such as nurses, physicians, and technicians. This scarcity of talent acts as a substantial barrier to entry, making it tough for new organizations to establish themselves and compete effectively.

Threat of New Entrants 4

The threat of new entrants into the healthcare sector, particularly for established players like Emeis, is generally moderate to low. Existing companies benefit from significant barriers to entry, such as the substantial capital required for infrastructure, advanced medical technology, and regulatory compliance. For instance, establishing a new hospital or a large-scale diagnostic center can easily run into hundreds of millions of dollars in upfront investment.

Furthermore, Emeis and similar organizations have cultivated strong brand recognition and patient loyalty over years of operation. Trust, built through consistent quality of care and positive patient experiences, is a powerful deterrent. Referral networks, both from satisfied patients and referring physicians, are also difficult for newcomers to replicate quickly. In 2024, the healthcare industry continued to see consolidation, further concentrating market power among larger, established entities.

To challenge established players, new entrants would need to make considerable investments in marketing and public relations to build brand awareness and trust. They would also need to demonstrate a commitment to high-quality patient care and outcomes, which requires robust quality assurance systems and experienced medical professionals.

- High Capital Investment: Building new healthcare facilities or acquiring advanced medical equipment demands substantial financial resources, often exceeding hundreds of millions of dollars.

- Brand Reputation and Patient Trust: Established healthcare providers like Emeis have spent years building trust and a positive reputation, which is difficult and costly for new entrants to match.

- Regulatory Hurdles: Navigating complex healthcare regulations, licensing, and accreditation processes presents a significant challenge for new market participants.

- Economies of Scale: Larger, established organizations often benefit from economies of scale in purchasing, operations, and administration, allowing them to offer services at competitive prices.

Threat of New Entrants 5

The threat of new entrants for Emeis is relatively low, primarily due to significant barriers to entry. Established players like Emeis benefit from substantial economies of scale in areas such as procurement of medical supplies and pharmaceuticals, as well as operational efficiencies across their vast network of facilities. For instance, in 2024, large healthcare providers often secure preferential pricing on medical equipment and drugs due to their high purchasing volume, a benefit unavailable to smaller, nascent competitors.

Furthermore, the experience curve plays a crucial role. Emeis has honed its operational processes and payer negotiations over years, leading to greater efficiency and stronger reimbursement rates. This accumulated expertise allows them to manage costs more effectively and offer competitive pricing, making it exceedingly difficult for new entrants to match their cost structure and achieve profitability from the outset.

Key barriers include:

- Capital Requirements: Establishing a healthcare network comparable to Emeis requires immense initial investment in facilities, technology, and staffing.

- Regulatory Hurdles: Navigating complex healthcare regulations and obtaining necessary licenses and accreditations presents a significant challenge for newcomers.

- Brand Loyalty and Reputation: Emeis has built a strong reputation and brand recognition, fostering patient and provider loyalty that new entrants must work hard to overcome.

- Access to Distribution Channels: Securing contracts with insurance providers and establishing efficient supply chains are critical and often difficult for new entrants to replicate.

The threat of new entrants in the healthcare sector is generally low for established players like Emeis. Significant capital investment, often in the hundreds of millions for new facilities and advanced technology, acts as a major deterrent. For example, building a new hospital in 2024 could cost upwards of $1 billion.

Stringent regulatory environments, including licensing and compliance with patient privacy laws like HIPAA, further complicate market entry. Newcomers also face challenges in building brand loyalty and trust, which Emeis has cultivated over years of operation.

The difficulty in replicating established referral networks and securing favorable contracts with insurers also limits new competition. In 2024, market consolidation continued, concentrating power among larger entities and increasing these barriers.

| Barrier Type | Description | Estimated Cost/Impact (2024) |

|---|---|---|

| Capital Investment | Establishing new healthcare facilities, acquiring advanced medical equipment. | Hospital Construction: $400M - $1B+; MRI Machine: $1.5M+ |

| Regulatory Hurdles | Licensing, certifications, HIPAA compliance, evolving healthcare mandates. | Licensing/Certifications: Tens of thousands of dollars (initial); Ongoing compliance costs |

| Brand Reputation & Trust | Building patient and provider loyalty, establishing referral networks. | Significant marketing and PR investment required; difficult to quantify but substantial |

| Economies of Scale | Preferential pricing on supplies, operational efficiencies. | Large providers can secure lower costs on equipment and pharmaceuticals due to high volume |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from company annual reports, industry-specific market research, and government regulatory filings. This comprehensive approach ensures a thorough understanding of competitive dynamics.