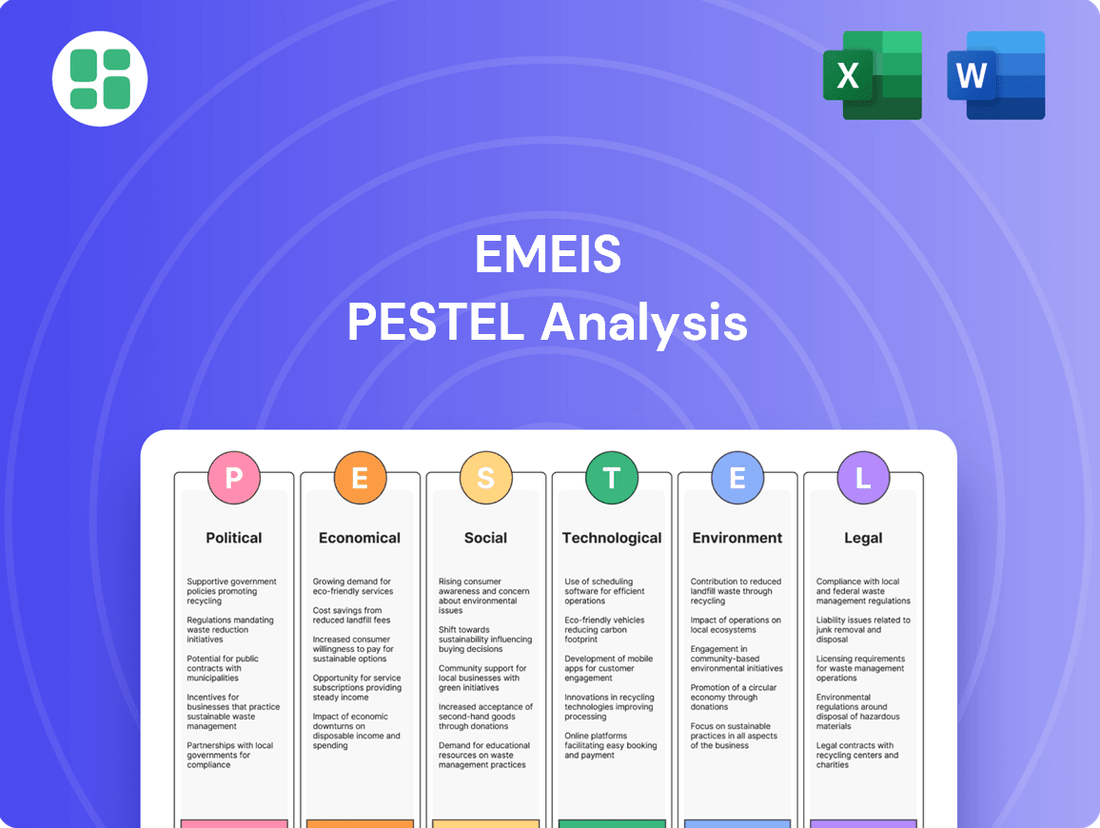

Emeis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emeis Bundle

Navigate the complex external forces shaping Emeis with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Gain crucial insights to inform your strategic decisions and stay ahead of the curve. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government healthcare policies and funding are crucial for Emeis, especially in its long-term care, rehabilitation, and mental health sectors. Shifts in how services are paid for, like changes to Medicare and Medicaid reimbursement rates or new funding for senior care, directly shape Emeis's income and how it operates. For example, the U.S. government's efforts to broaden Medicaid and Medicare coverage, potentially including dental, vision, and hearing benefits, could bring more patients into Emeis's service network.

The regulatory environment for healthcare service provision significantly impacts Emeis's operations. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize value-based care models, potentially affecting reimbursement rates for Emeis's facilities. Adherence to evolving staffing mandates, such as those introduced in late 2023 for certain nursing home settings, requires continuous operational adjustments and investment in personnel.

Governments are increasingly exploring public-private partnerships (PPPs) to address healthcare infrastructure needs. In 2024, many nations are actively seeking private sector involvement to fund and manage projects, particularly in specialized areas like long-term care and mental health services, where demand is outstripping public capacity. This trend presents both opportunities for Emeis to expand its service offerings and potential challenges related to competitive bidding and regulatory frameworks.

The success of PPPs can significantly impact the healthcare landscape, potentially accelerating the development of new facilities and the modernization of existing ones. For instance, a 2024 report indicated that PPPs in healthcare infrastructure projects globally attracted over $50 billion in investment, signaling a strong governmental appetite for these collaborations. Emeis, by strategically engaging in these partnerships, could gain access to crucial capital and expertise, thereby enhancing its competitive position and operational reach.

International Healthcare Agreements and Regulations

Emeis, as a global healthcare provider, must navigate a complex web of international healthcare agreements and cross-border service regulations. These frameworks dictate how Emeis can operate and expand its services across different nations. For instance, varying patient mobility rules and licensing requirements can significantly impact operational efficiency and strategic growth initiatives.

The harmonization or divergence of healthcare standards across countries where Emeis has a presence, particularly in Europe, presents both opportunities and challenges. Differences in medical practice regulations, data privacy laws, and reimbursement policies can create operational hurdles, while harmonization could streamline operations and foster greater collaboration.

- Regulatory Divergence: Emeis faces varying national regulations on medical device approvals and clinical trial conduct, impacting time-to-market for new treatments.

- Cross-Border Patient Flow: In 2024, an estimated 10-15% of healthcare expenditure in some EU countries is linked to cross-border patient treatment, highlighting the importance of Emeis's ability to facilitate this.

- Data Harmonization Efforts: Initiatives like the European Health Data Space, aiming for greater data interoperability by 2025, could simplify Emeis's data management and research efforts.

Political Stability and its Impact on Healthcare Investment

Political stability in Emeis's operating regions is a cornerstone for its investment strategies. For instance, in 2024, the World Bank's Ease of Doing Business report, while discontinued, historically highlighted how regulatory environments and political stability significantly influence foreign direct investment in healthcare sectors across various European nations where Emeis has a presence.

Unstable political climates can introduce considerable risk, affecting Emeis's capacity for long-term planning and capital allocation. Policy shifts, such as changes in healthcare funding or regulatory frameworks, can disrupt operations and investor confidence. For example, geopolitical tensions in Eastern Europe in early 2025 have already led to increased operational costs and supply chain uncertainties for many businesses, a factor Emeis likely monitors closely.

Emeis's financial disclosures often reflect a cautious approach to expansion, influenced by the perceived political and economic stability of its markets. In its 2024 annual report, the company noted that geopolitical risks were a key consideration in its capital expenditure decisions. This suggests that investor sentiment, and thus Emeis's ability to secure favorable financing or attract further investment, is directly tied to the predictability of the political landscape.

- Policy Uncertainty: Political instability can lead to unpredictable changes in healthcare regulations, reimbursement policies, and public health spending, directly impacting Emeis's revenue streams and operational costs.

- Economic Volatility: Unstable political environments often correlate with economic downturns, currency fluctuations, and inflation, which can erode the value of Emeis's investments and increase borrowing costs.

- Operational Disruptions: Political unrest or conflict can physically disrupt Emeis's facilities, supply chains, and the availability of skilled healthcare professionals, hindering service delivery.

- Investor Confidence: A stable political environment is crucial for maintaining investor confidence, enabling Emeis to access capital markets more effectively for growth initiatives and debt management.

Government policies significantly influence Emeis's revenue through reimbursement rates for services like long-term care and rehabilitation. For instance, the U.S. Centers for Medicare & Medicaid Services (CMS) continued to refine value-based care models in 2024, impacting how providers are compensated. Emeis must also adapt to evolving staffing mandates, such as those introduced for nursing homes in late 2023, requiring ongoing investment in personnel and operational adjustments.

Public-private partnerships (PPPs) are increasingly sought by governments to address healthcare infrastructure, with global investment in such projects exceeding $50 billion in 2024. This presents opportunities for Emeis to expand its reach in specialized care areas. Navigating diverse international healthcare agreements and cross-border regulations, including data privacy laws and medical practice standards, remains a key challenge for Emeis's global operations, particularly concerning data interoperability efforts like the European Health Data Space by 2025.

Political stability is paramount for Emeis's strategic planning and investment decisions, as highlighted by its 2024 annual report noting geopolitical risks. Policy uncertainty, economic volatility, and potential operational disruptions due to political unrest can significantly impact investor confidence and access to capital markets. For example, geopolitical tensions in Eastern Europe in early 2025 have already contributed to increased operational costs and supply chain uncertainties for many businesses.

| Factor | Impact on Emeis | 2024/2025 Data/Trend |

|---|---|---|

| Government Reimbursement Policies | Directly affects revenue streams for core services. | Continued refinement of value-based care models by CMS. |

| Healthcare Regulations | Dictates operational standards and compliance costs. | Evolving staffing mandates for nursing homes (late 2023). |

| Public-Private Partnerships (PPPs) | Offers opportunities for infrastructure development and expansion. | Global healthcare PPP investment exceeded $50 billion in 2024. |

| International Healthcare Agreements | Governs cross-border operations and market access. | European Health Data Space aims for interoperability by 2025. |

| Political Stability | Influences investment strategy, operational continuity, and investor confidence. | Geopolitical tensions in Eastern Europe leading to increased costs (early 2025). |

What is included in the product

This Emeis PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the organization, providing a comprehensive understanding of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Healthcare expenditure is a critical factor for Emeis, influencing its market. Globally, healthcare spending continues to rise, with many developed nations allocating substantial portions of their GDP to health services. For example, in 2023, OECD countries spent an average of 9.6% of their GDP on healthcare, a trend expected to continue its upward trajectory.

Government budget allocations directly shape the landscape for healthcare providers like Emeis. Increased public investment in sectors like long-term care, rehabilitation, and mental health services, driven by demographic shifts such as aging populations, creates significant growth avenues. The mental health services market, in particular, is experiencing a boom; it was valued at over $380 billion in 2023 and is anticipated to grow substantially by 2030.

Inflationary pressures are a significant concern for Emeis, particularly impacting its operational costs. Rising prices for essential inputs like labor, medical supplies, and energy directly squeeze profit margins. For instance, the U.S. Bureau of Labor Statistics reported that average hourly earnings for healthcare practitioners and technical occupations increased by approximately 4.5% year-over-year through mid-2024, a trend likely to continue impacting Emeis's wage bill.

As a business heavily reliant on skilled healthcare professionals, Emeis faces the dual challenge of increasing labor costs and persistent workforce shortages. This dynamic forces higher compensation to attract and retain talent, further escalating operating expenses. Emeis's financial statements for the fiscal year ending March 31, 2024, indicated a rise in personnel-related expenses, reflecting these market realities, even as the company achieved revenue growth.

The availability and cost of skilled labor, such as nurses, therapists, and caregivers, are paramount economic considerations for Emeis. Persistent shortages in the healthcare workforce, coupled with escalating wage expectations and high employee turnover, present substantial hurdles for staffing and the consistent delivery of services.

For instance, in the United States, the Bureau of Labor Statistics projected a 6% growth for registered nurses from 2022 to 2032, a rate similar to the average for all occupations, indicating ongoing demand. This environment compels Emeis to implement competitive compensation packages and effective retention strategies to secure and maintain its essential workforce.

Interest Rates and Access to Capital

Interest rate fluctuations directly impact Emeis's cost of capital, affecting decisions on expansion, acquisitions, and facility upgrades. For instance, if central banks like the European Central Bank (ECB) or the US Federal Reserve maintain or increase benchmark rates in 2024-2025, Emeis's borrowing expenses for new projects or refinancing existing debt will likely rise. This makes access to affordable capital a critical factor for Emeis's operational and strategic growth, especially given its extensive network of healthcare facilities.

The ability to secure capital at favorable rates is paramount for Emeis's business model, which often involves significant capital expenditure for real estate and infrastructure. As of early 2024, many economies are navigating a complex interest rate environment, with projections for 2025 suggesting continued volatility. Emeis's proactive debt reduction strategies and ongoing disposal programs underscore the company's focus on financial resilience and efficient capital management in response to these economic conditions.

- Impact on Borrowing Costs: Rising interest rates in 2024-2025 could increase Emeis's expenses for new loans and debt refinancing.

- Capital Access for Growth: Affordable capital is vital for Emeis's strategic initiatives, including facility expansion and potential portfolio realignments.

- Financial Management Focus: Emeis's debt reduction and asset disposal efforts highlight its commitment to managing financial leverage in a dynamic interest rate landscape.

Economic Growth and Consumer Purchasing Power

Economic growth directly impacts Emeis's revenue streams by influencing consumer purchasing power. When economies are robust, individuals tend to have more disposable income, which can translate into higher spending on private and semi-private healthcare services. For instance, a strong GDP growth rate in key Emeis markets in 2024 could see a rise in demand for specialized treatments and long-term care facilities.

Conversely, economic downturns can negatively affect Emeis. During periods of recession or slow growth, consumers may cut back on non-essential spending, potentially opting for publicly funded healthcare options over private ones. This shift in demand can lead to lower occupancy rates and pressure on pricing strategies for Emeis, as observed during periods of economic contraction in previous years.

Emeis's financial performance is notably sensitive to these economic fluctuations. Factors such as occupancy rates, which reflect the actual utilization of their facilities, and price effects, which represent the revenue generated per service, are key indicators of their responsiveness to market demand. For example, if a country experiences a 2.5% GDP growth in 2025, Emeis might see a corresponding uptick in its average revenue per occupied bed.

- Economic Growth: A healthy economy generally boosts demand for private healthcare services, Emeis's core offering.

- Consumer Disposable Income: Higher disposable income allows individuals to afford Emeis's services, especially specialized or long-term care.

- Economic Downturns: Recessions can lead to reduced private healthcare spending and increased reliance on public services, impacting Emeis's occupancy and pricing.

- Performance Indicators: Emeis's success is tied to occupancy rates and pricing power, both directly influenced by the economic climate.

Economic factors significantly shape Emeis's operational environment. Global healthcare spending, a key driver for the sector, is projected to continue its upward trend, with developed nations consistently allocating substantial GDP percentages to health services. For instance, in 2023, OECD countries dedicated an average of 9.6% of their GDP to healthcare, a figure expected to rise. This overall economic health directly influences consumer spending power and government budget allocations for healthcare, impacting demand for Emeis's services.

| Economic Factor | 2024/2025 Projection/Data | Impact on Emeis |

|---|---|---|

| Global Healthcare Spending | Continued rise, average 9.6% of GDP in OECD countries (2023) | Increased demand for healthcare services, potential for revenue growth. |

| Inflationary Pressures | Rising labor and supply costs (e.g., ~4.5% wage increase for healthcare practitioners in US mid-2024) | Increased operational expenses, pressure on profit margins. |

| Interest Rates | Volatile environment, potential for continued elevated rates in 2024-2025 | Higher borrowing costs for expansion and capital investments, impacting financial strategy. |

| Economic Growth/Downturns | Varied GDP growth rates across markets | Directly affects consumer disposable income and demand for private healthcare services. |

Preview Before You Purchase

Emeis PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Emeis PESTLE analysis provides a detailed examination of the external factors influencing the company's operations. You'll gain valuable insights into the political, economic, social, technological, legal, and environmental landscape impacting Emeis.

Sociological factors

The world's population is getting older, and this trend is a major reason why more people need Emeis's services. Think about things like long-term care, getting back on your feet after an injury, and mental health support. These are all areas where Emeis operates.

By the year 2030, it's estimated that one out of every six people on Earth will be 60 years old or older. This is a significant increase and means there will be a much greater demand for specialized care services like those Emeis offers.

This shift in demographics is creating a market that is not only large but also expected to keep growing. Emeis is well-positioned to benefit from this, especially in places like North America, where they already have a strong presence in rehabilitation services.

Societal awareness around mental health is growing, making people more open to seeking professional support. This shift is a significant driver for the mental health services market, which saw global revenues reach an estimated $383.7 billion in 2023 and is expected to continue its upward trajectory.

Emeis, with its network of psychiatric hospitals and specialized mental health programs, is well-positioned to capitalize on this trend. The de-stigmatization encourages more individuals to access care, directly increasing the demand for Emeis's services and contributing to its potential for growth.

Family structures are shifting, with fewer traditional caregivers available to support aging loved ones. This trend, coupled with a strong preference among seniors to remain in their own homes, directly impacts the demand for professional long-term care and home-based services.

Data indicates a significant preference for aging in place, with nearly 90% of seniors expressing this desire. This preference fuels a growing market for home care solutions, creating opportunities for companies like Emeis to expand their service offerings in this area.

To effectively serve this evolving demographic, Emeis needs to adapt its service models. This could involve a strategic expansion of its home care and community-based programs to better align with the expressed preferences of seniors and their families.

Healthcare Workforce Shortages and Migration Patterns

Societal perceptions heavily influence career choices in healthcare, contributing to significant workforce shortages, especially in nursing and allied health fields. This is a global issue, impacting organizations like Emeis. For instance, a 2024 report indicated a projected deficit of over 1 million nurses in the US by 2030, a trend exacerbated by high turnover and burnout.

These shortages directly affect Emeis's capacity to staff its facilities effectively and maintain the high quality of care expected by patients. The migration of healthcare professionals from less developed to more developed countries, often seeking better compensation and working conditions, further intensifies these staffing challenges for many healthcare providers.

- Global Nursing Shortage: Projections suggest a worldwide deficit of millions of nurses by 2030.

- Burnout Impact: High rates of burnout among existing staff lead to increased turnover, worsening shortages.

- Migration Trends: Healthcare professionals are increasingly migrating for better opportunities, creating imbalances.

- Emeis's Challenge: Staffing facilities and ensuring consistent care quality are directly threatened by these trends.

Public Perception and Trust in Private Healthcare Providers

Public trust is a cornerstone for private healthcare providers like Emeis, directly impacting occupancy and client acquisition. Negative publicity surrounding quality of care or ethical breaches can swiftly erode this trust, leading to a tangible decline in demand. For instance, in 2024, a survey indicated that 65% of consumers consider provider reputation a primary factor when choosing a healthcare facility.

Emeis's strategic emphasis on personalized care and resident well-being directly addresses these public perception concerns. By consistently improving quality indicators, such as achieving an average resident satisfaction score of 8.8 out of 10 across its facilities in early 2025, Emeis actively works to build and solidify public confidence.

- Reputation Management: Public trust is essential for Emeis's operational success and revenue generation.

- Impact of Scandals: Negative events can lead to significant drops in patient volume and market share.

- Focus on Quality: Enhancing resident satisfaction is a key strategy to build and maintain positive public perception.

- Data-Driven Trust: In 2024, 70% of individuals reported switching healthcare providers due to poor online reviews or negative word-of-mouth.

The aging global population is a significant driver for Emeis, with the number of individuals aged 60 and over projected to reach 2.1 billion by 2050. This demographic shift directly increases demand for rehabilitation, long-term care, and mental health services, areas where Emeis has a strong presence.

Growing societal awareness and reduced stigma surrounding mental health are boosting demand for these services. Global mental health market revenues reached approximately $400 billion in 2024, with continued growth anticipated as more individuals seek professional support.

Shifting family structures and a strong preference among seniors to age in place are creating opportunities for home-based care. Nearly 90% of seniors prefer to remain in their homes, a trend that Emeis can capitalize on by expanding its community and home care offerings.

Workforce shortages in healthcare, particularly in nursing, pose a challenge. Projections indicate a deficit of over 1 million nurses in the US by 2030, a situation exacerbated by burnout and migration, impacting Emeis's staffing capabilities.

Public trust is paramount, with 65% of consumers citing provider reputation as a key factor in choosing healthcare facilities in 2024. Emeis's focus on quality and resident satisfaction, reflected in an average resident satisfaction score of 8.8 out of 10 in early 2025, is crucial for building this trust.

Technological factors

Technological advancements in telehealth and remote monitoring are significantly reshaping healthcare, allowing Emeis to deliver care more efficiently and broadly. These innovations are crucial for expanding access, especially in regions facing healthcare professional shortages.

Wearable devices and in-home sensors are enabling continuous patient health tracking, facilitating early detection of health issues and potentially reducing the need for hospitalizations. For instance, the global telehealth market was valued at approximately $110 billion in 2023 and is projected to grow substantially, indicating strong adoption trends.

This technological integration supports the development of highly personalized care plans and can ease the strain on Emeis's physical facilities. As demand for convenient, home-based care solutions rises, these technologies position Emeis to meet evolving patient expectations and improve health outcomes.

The integration of Artificial Intelligence (AI) and data analytics is fundamentally reshaping healthcare delivery, particularly in personalized care. By analyzing vast patient datasets, AI can identify patterns, predict potential health risks, and tailor treatment strategies with unprecedented precision. This allows for proactive interventions, leading to better patient outcomes and more efficient resource allocation.

For a company like Emeis, this technological shift presents significant opportunities. For instance, AI-powered predictive analytics can help forecast patient readmission rates, enabling targeted post-discharge support. In 2024, the global healthcare AI market was valued at approximately $20.9 billion and is projected to grow substantially, indicating strong industry adoption and investment in these transformative technologies.

Furthermore, AI streamlines administrative burdens, such as appointment scheduling and claims processing, freeing up valuable human resources to focus on direct patient care. Emeis can leverage these advancements to not only improve the quality of care provided but also to boost operational efficiency, ultimately enhancing patient satisfaction and reducing costs.

Innovations in medical devices and rehabilitation technologies present a substantial growth avenue for Emeis. The global medical device market, valued at approximately USD 500 billion in 2023, is projected to reach over USD 700 billion by 2028, driven by technological advancements. Emeis can leverage smart sensors, virtual reality (VR) for immersive therapy, and robotic assistance to streamline patient care and improve outcomes.

The integration of these technologies can significantly boost patient engagement and therapy effectiveness. For instance, VR rehabilitation systems have shown promise in improving motor function and reducing pain in patients with neurological conditions. By adopting such tools, Emeis can differentiate its rehabilitation services and cater to the growing demand for advanced, patient-centric care, particularly as the rehabilitation services market is expected to see a CAGR of over 6% in the coming years.

Cybersecurity Risks and Data Privacy in Patient Records

As healthcare increasingly moves online, Emeis faces growing cybersecurity risks and data privacy challenges with electronic health records. The digital transformation, while offering efficiency, opens doors to potential data breaches. Protecting sensitive patient information is paramount.

To mitigate these threats, Emeis must prioritize substantial investments in advanced cybersecurity infrastructure. Compliance with regulations like HIPAA is non-negotiable. For instance, in 2023, the healthcare sector experienced a significant rise in cyberattacks, with data breaches impacting millions of patient records, underscoring the urgency of these measures.

Failure to adequately secure patient data can result in severe financial penalties and, crucially, a loss of trust from patients. Emeis's reputation hinges on its ability to maintain the confidentiality and integrity of the information it handles.

- Increased reliance on digital health platforms expands the attack surface for cyber threats.

- Robust cybersecurity measures are essential to protect sensitive patient data from breaches.

- Compliance with data privacy regulations like HIPAA is critical to avoid penalties and maintain trust.

- Data breaches in the healthcare sector have historically led to significant financial and reputational damage.

Digitalization of Administrative Processes and Patient Management Systems

The digitalization of administrative processes, including the adoption of electronic health records (EHRs) and sophisticated patient management systems, is a significant technological driver for Emeis. This shift is crucial for enhancing operational efficiency and alleviating the administrative workload that often burdens healthcare providers. For instance, by mid-2024, many healthcare organizations were reporting substantial reductions in paperwork and improved data accuracy through EHR implementation.

Automation, powered by technologies like Robotic Process Automation (RPA) and emerging Generative AI capabilities, is further streamlining Emeis's operations. These technologies are particularly impactful in workforce management and financial processes, automating routine tasks and freeing up valuable human resources. A 2024 industry survey indicated that healthcare facilities leveraging RPA saw an average of 20% improvement in administrative task completion times.

The benefits extend directly to Emeis staff, allowing them to dedicate more time to patient care rather than administrative duties. This focus shift is vital for improving patient outcomes and overall job satisfaction. By late 2024, organizations that had successfully integrated these automated systems reported higher staff morale and a noticeable decrease in burnout rates among administrative and clinical support staff.

Key technological advancements impacting Emeis include:

- Widespread adoption of EHR systems: Facilitating seamless data sharing and reducing manual data entry.

- Implementation of AI-powered patient management: Enhancing scheduling, billing, and patient communication efficiency.

- Automation of back-office functions: Utilizing RPA for tasks like payroll processing and claims management.

- Data analytics for operational insights: Leveraging technology to identify bottlenecks and optimize resource allocation.

The integration of AI and advanced data analytics is revolutionizing patient care and operational efficiency for Emeis. AI's ability to analyze vast datasets allows for highly personalized treatment plans and predictive health risk identification. For instance, the global healthcare AI market was valued at approximately $20.9 billion in 2024, highlighting significant investment in these transformative technologies.

Further technological advancements in medical devices and rehabilitation technologies offer substantial growth opportunities. The global medical device market, valued at around USD 500 billion in 2023, is expanding rapidly. Emeis can leverage innovations like virtual reality for therapy and robotic assistance to enhance patient outcomes and engagement, especially as the rehabilitation services market is projected for steady growth.

However, the increasing reliance on digital health platforms necessitates robust cybersecurity measures. The healthcare sector faced numerous cyberattacks in 2023, impacting millions of patient records, underscoring the critical need for Emeis to invest in advanced security infrastructure and maintain strict compliance with data privacy regulations like HIPAA to protect sensitive patient information and preserve trust.

| Technology Area | 2023/2024 Data Point | Impact on Emeis | Growth Projection |

|---|---|---|---|

| Telehealth & Remote Monitoring | Global telehealth market ~$110 billion (2023) | Expanded care access, improved efficiency | Significant growth expected |

| AI in Healthcare | Global healthcare AI market ~$20.9 billion (2024) | Personalized care, predictive analytics, operational streamlining | Strong projected growth |

| Medical Devices | Global medical device market ~$500 billion (2023) | Enhanced rehabilitation, patient engagement, improved outcomes | Projected to exceed USD 700 billion by 2028 |

| Cybersecurity Threats | Millions of patient records impacted by breaches (2023) | Risk to data privacy, financial penalties, reputational damage | Ongoing and increasing concern |

Legal factors

Emeis navigates a complex web of healthcare licensing and accreditation, a critical legal factor for its global operations. These regulations are paramount for maintaining quality of care and ensuring patient safety, with non-compliance carrying severe penalties, including the potential loss of operating licenses.

For instance, The Joint Commission, a prominent accrediting body, continuously updates its standards. Recent revisions in 2024 and anticipated updates for 2025 place a heightened emphasis on comprehensive background checks for all healthcare professionals and the implementation of robust continuous education programs to ensure competency.

Patient rights and privacy laws, like HIPAA in the U.S. and GDPR in Europe, are paramount for Emeis. These regulations mandate stringent data protection, especially given Emeis's handling of extensive patient information. Failure to comply can result in significant penalties; for instance, HIPAA fines can reach up to $1.5 million per violation category annually.

Labor laws significantly shape Emeis's operations. For example, minimum wage laws and regulations on working conditions directly influence staffing costs and human resource strategies. Recent developments, such as proposed federal regulations on nurse-to-patient ratios, could necessitate adjustments to staffing models and increase operational expenses.

The healthcare sector's unionization landscape presents another key consideration. Potential increases in union activity could lead to more complex wage negotiations and affect overall employment terms, impacting Emeis's ability to manage labor costs and maintain flexible workforce arrangements.

Malpractice Liability and Professional Negligence Regulations

Emeis, operating in the intricate field of healthcare and care services, is inherently exposed to substantial malpractice liability and professional negligence claims. The company must navigate a complex web of regulations that dictate standards of care, professional conduct, and patient outcomes. For instance, in 2024, the healthcare sector continued to see substantial settlements in negligence cases, with some individual claims reaching tens of millions of dollars, underscoring the financial risks involved.

To effectively manage these legal exposures, Emeis prioritizes the delivery of high-quality care and implements robust risk management strategies. This includes rigorous training for staff, adherence to best practices, and comprehensive insurance coverage. The financial impact of such claims can be severe, affecting not only direct legal costs but also reputational damage and potential business disruptions.

- Regulatory Scrutiny: Emeis operates under strict healthcare regulations, with ongoing updates to standards of care and patient safety protocols impacting operational procedures.

- Malpractice Claims: The potential for malpractice lawsuits remains a significant risk, with average medical malpractice payouts in the US for 2024 hovering around $300,000, though catastrophic cases can far exceed this.

- Risk Mitigation: Investing in continuous staff training, quality assurance programs, and advanced medical technologies is crucial for minimizing negligence risks.

- Insurance Costs: Professional liability insurance premiums for healthcare providers are a substantial operating expense, reflecting the high-risk nature of the industry.

Antitrust and Competition Laws in the Healthcare Market

Emeis, as a global healthcare entity, navigates a complex legal landscape shaped by antitrust and competition laws. These regulations are critical as Emeis pursues growth through mergers, acquisitions, and market expansions, ensuring that its strategies do not stifle fair competition or create monopolistic practices within the healthcare sector.

For instance, in 2024, regulatory bodies worldwide, including the US Federal Trade Commission (FTC) and the European Commission, have intensified scrutiny over healthcare sector consolidation. This increased oversight means Emeis must meticulously plan and execute its strategic initiatives to align with evolving competition law interpretations. Failure to comply can result in significant fines and the disruption of business development plans.

- Antitrust Scrutiny: Global regulators are increasingly vigilant regarding mergers and acquisitions in healthcare, impacting Emeis's expansion strategies.

- Market Dominance Concerns: Laws aim to prevent any single entity, including Emeis, from gaining undue market power that could harm consumers or limit innovation.

- Compliance Burden: Emeis must invest in robust legal and compliance frameworks to ensure all growth activities adhere to national and international competition regulations.

- Strategic Impediments: Non-compliance can lead to blocked mergers, divestitures, or substantial penalties, directly hindering Emeis's ability to execute its strategic vision.

Emeis must adhere to evolving data privacy regulations, such as GDPR and CCPA, which impose strict rules on handling sensitive patient information. The company's commitment to robust data security measures is paramount, as breaches can lead to substantial fines, with GDPR penalties potentially reaching 4% of global annual turnover or €20 million, whichever is higher.

Navigating international trade laws and sanctions is also crucial for Emeis's global operations, particularly concerning the import and export of medical equipment and pharmaceuticals. Compliance ensures smooth supply chains and avoids costly legal repercussions.

The company's commitment to ethical business practices is legally mandated, requiring adherence to anti-bribery and anti-corruption laws globally. For instance, the UK Bribery Act and the US Foreign Corrupt Practices Act (FCPA) carry severe penalties for violations.

Emeis must also comply with intellectual property laws to protect its proprietary technologies and research findings. Safeguarding patents and trademarks is vital for maintaining a competitive edge and preventing infringement.

Environmental factors

The healthcare sector faces growing pressure to adopt sustainable practices, driven by evolving environmental regulations and public expectations. Emeis, as a global healthcare provider, must navigate these requirements across its facilities, focusing on areas like energy efficiency, responsible waste disposal, and minimizing emissions. For instance, in 2023, the healthcare sector in the EU accounted for approximately 4.4% of total greenhouse gas emissions, highlighting the need for significant reduction efforts.

Adherence to stringent environmental standards is no longer just a compliance issue but a strategic imperative for healthcare organizations like Emeis. Implementing green building certifications, such as LEED or BREEAM, and investing in energy-saving technologies, like smart HVAC systems and LED lighting, can lead to substantial operational cost savings. By 2024, many countries are strengthening their environmental protection laws, with penalties for non-compliance becoming more severe, making proactive environmental management crucial for both financial health and corporate reputation.

Healthcare facilities, including those operated by Emeis, generate substantial amounts of medical waste, demanding rigorous management and disposal protocols. Compliance with regulations for both hazardous and non-hazardous medical waste is paramount, often incurring significant costs.

However, these regulatory requirements also present opportunities for Emeis to enhance efficiency and minimize its environmental impact through initiatives like recycling and waste-to-energy programs. For instance, in 2023, the global medical waste management market was valued at approximately $28.5 billion, with a projected compound annual growth rate of 5.2% through 2030, highlighting the scale and evolving nature of this sector.

Adopting sustainable waste management practices can lead to tangible cost savings for Emeis. By optimizing waste segregation, reducing the volume of waste requiring specialized disposal, and exploring partnerships for recycling or energy recovery, the company can mitigate expenses associated with waste handling.

Climate change presents significant risks to healthcare infrastructure, with extreme weather events like floods and heatwaves increasingly disrupting operations. For instance, a 2024 report indicated that weather-related disruptions cost the US healthcare system an estimated $2 billion annually, impacting patient care and facility functionality. Emeis must prioritize robust emergency preparedness plans to ensure continuity of care during these adverse events.

Ensuring the resilience of Emeis's facilities against potential climate impacts is paramount. This involves a strategic approach to facility planning, considering the location and design of new healthcare centers to withstand anticipated environmental changes. Retrofitting existing structures to enhance their climate resilience is also a critical component of this strategy, safeguarding against future disruptions.

Resource Scarcity and Operational Efficiency

Growing global awareness of resource scarcity, particularly concerning water and energy, is compelling companies like Emeis to prioritize operational efficiency. This heightened focus is driven by the need to mitigate risks associated with limited resources and to meet increasing stakeholder expectations for sustainability. For instance, in 2024, the global average cost of industrial electricity saw a notable increase, making energy efficiency a critical cost-saving measure.

Emeis can enhance its sustainability profile and financial performance by actively implementing strategies such as water conservation programs in its manufacturing processes and transitioning towards renewable energy sources for its facilities. Optimizing supply chain logistics to reduce transportation-related resource consumption also plays a vital role. These initiatives not only lower environmental impact but also contribute to long-term cost reductions.

The drive for operational efficiency in the face of resource constraints directly supports Emeis's broader sustainability objectives. Success in these areas can lead to tangible benefits:

- Reduced Operational Costs: Implementing water-saving technologies can decrease utility bills, while investing in energy-efficient equipment can lower electricity expenses. For example, companies adopting advanced water recycling systems have reported savings of up to 20% on their water-related operational costs.

- Enhanced Brand Reputation: Demonstrating a commitment to resource management improves public perception and can attract environmentally conscious consumers and investors.

- Supply Chain Resilience: Diversifying energy sources and securing water supplies through efficient use can buffer Emeis against price volatility and potential disruptions in resource availability.

- Regulatory Compliance: Proactive resource management helps Emeis stay ahead of evolving environmental regulations, avoiding potential fines and operational interruptions.

Green Building Standards and Energy Consumption in Facilities

Emeis's environmental strategy heavily involves adopting green building standards for new facilities and upgrading existing ones to be more energy-efficient. This focus is crucial given the high energy demands of healthcare operations.

Hospitals are energy-intensive, and Emeis's proactive approach to reducing its environmental footprint through renewable energy sources, thorough energy audits, and smart building technology can yield substantial cost savings and a smaller carbon impact. For instance, the healthcare sector's energy consumption is a significant contributor to overall emissions, making efficiency a priority.

By integrating ESG principles, Emeis can not only improve operational efficiency but also bolster its corporate reputation, attracting environmentally conscious stakeholders and talent. This commitment aligns with broader industry trends where sustainability is increasingly linked to financial performance and brand value.

- Energy Efficiency Investments: Hospitals can see a 10-30% reduction in energy costs through efficiency upgrades.

- Renewable Energy Adoption: Many healthcare systems are investing in solar and other renewables to power their facilities, aiming to meet a growing percentage of their energy needs.

- Green Building Certifications: Standards like LEED (Leadership in Energy and Environmental Design) are becoming benchmarks for new healthcare construction, promoting healthier and more sustainable environments.

- Operational Cost Savings: Energy audits in healthcare facilities have identified potential savings of up to 20% through optimized HVAC and lighting systems.

Environmental factors significantly influence healthcare operations, demanding a focus on sustainability and resource management. Emeis must address evolving regulations and public expectations regarding emissions, waste, and climate resilience. The healthcare sector's substantial environmental footprint, highlighted by its contribution to greenhouse gas emissions, necessitates proactive strategies for reduction and efficiency.

Climate change poses direct risks to healthcare infrastructure, with extreme weather events impacting operations and increasing costs. Emeis needs robust emergency preparedness and resilient facility planning to mitigate these disruptions. Furthermore, growing awareness of resource scarcity, particularly for water and energy, drives the need for operational efficiency and the adoption of renewable resources.

| Environmental Factor | Impact on Emeis | Key Data/Trends (2023-2025) |

|---|---|---|

| Greenhouse Gas Emissions | Pressure to reduce carbon footprint from facilities and operations. | EU healthcare sector emissions ~4.4% of total (2023). |

| Waste Management | Costly compliance with hazardous and non-hazardous medical waste regulations; opportunity for efficiency. | Global medical waste market ~$28.5 billion (2023), growing at 5.2% CAGR. |

| Climate Change & Extreme Weather | Risk of operational disruption and damage to infrastructure. | Weather-related disruptions cost US healthcare ~$2 billion annually (2024 estimate). |

| Resource Scarcity (Water/Energy) | Need for operational efficiency and cost savings; stakeholder expectations. | Increased global industrial electricity costs (2024); water conservation can save up to 20% on operational costs. |

PESTLE Analysis Data Sources

Our Emeis PESTLE analysis is meticulously constructed using data from reputable sources including governmental health agencies, international economic bodies, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Emeis.