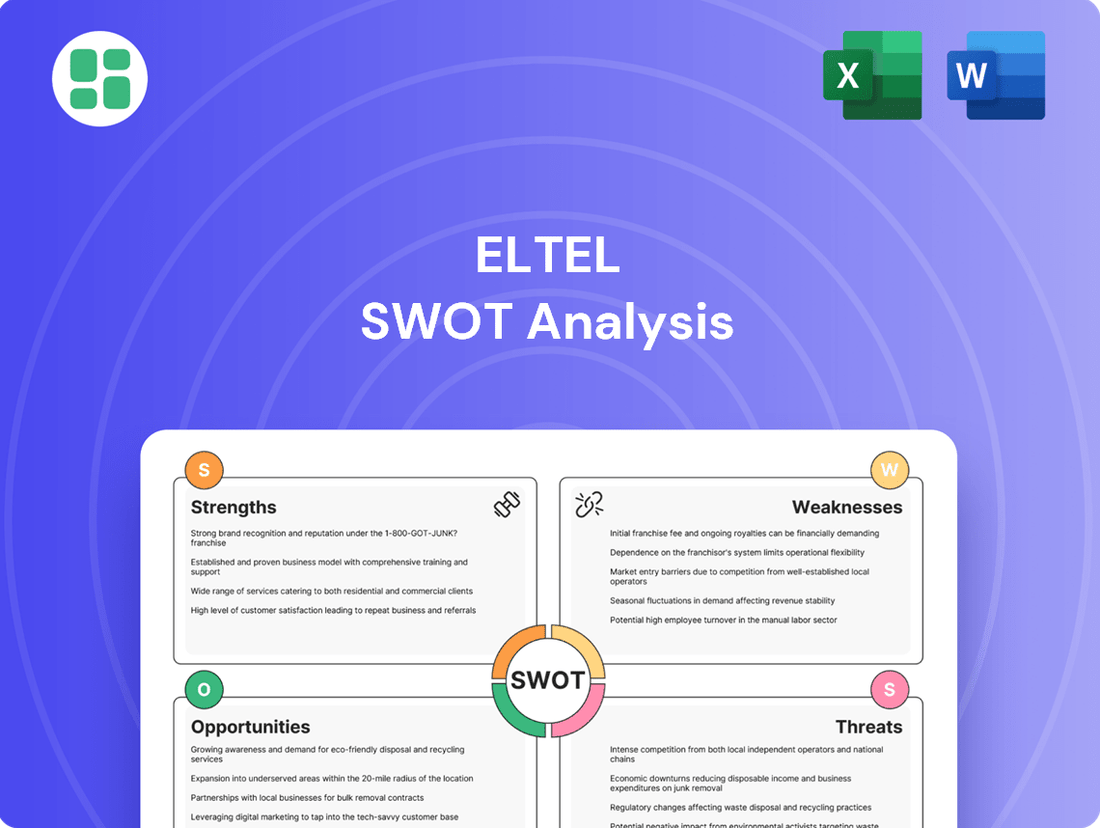

Eltel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eltel Bundle

Eltel's strategic position reveals a fascinating blend of robust operational strengths in critical infrastructure services, countered by potential market vulnerabilities and evolving industry challenges. Understanding these dynamics is key to navigating the competitive landscape.

Want the full story behind Eltel's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Eltel stands as a dominant force in Northern Europe, recognized as a leading provider of critical infrastructure services. This strong market position, particularly in the Nordics, Germany, and Lithuania, grants them significant advantages in securing large-scale projects and benefits from established brand trust.

Their deep expertise is fundamental to the development and maintenance of essential networks, a crucial role in today's interconnected world. This leadership allows Eltel to capitalize on ongoing infrastructure upgrades and digital transformation initiatives across these key regions.

Eltel's comprehensive service portfolio is a significant strength, encompassing the entire lifecycle of infrastructure projects. This end-to-end capability, from planning and construction to maintenance and upgrades, offers clients integrated solutions across power and communication sectors. This broad offering not only differentiates Eltel but also secures consistent revenue through long-term maintenance and upgrade agreements, a model that proved resilient in 2024.

Eltel has achieved a notable turnaround in profitability, reporting its first profitable first quarter in ten years in Q1 2025. This positive trend is further underscored by seven consecutive quarters of year-over-year adjusted EBITA improvement, showcasing a strong commitment to operational efficiency and cost control.

The company's strategic emphasis on margin enhancement rather than solely volume growth is clearly paying off, as evidenced by these consistent financial gains. Furthermore, Eltel has seen a substantial strengthening in its cash flow from operating activities, a key indicator of its improving financial health and operational effectiveness.

Strategic Focus on New Business Segments

Eltel is strategically broadening its horizons by investing in and developing capabilities within high-growth areas. This includes a significant push into solar photovoltaic (PV) installations, the construction of data centers, the integration of energy storage solutions, and the expansion of e-mobility infrastructure.

This diversification is not just theoretical; Eltel has secured substantial contracts in these emerging sectors. For instance, recent agreements with major players like E.ON for renewable energy projects and a significant contract for a data center with Hyperco underscore this strategic direction. These wins highlight Eltel's ability to compete and succeed in these new markets.

By focusing on these expanding segments, Eltel is actively positioning itself for sustained future growth and increased resilience against market fluctuations. This proactive approach to market trends is a key strength, allowing the company to tap into new revenue streams and build a more robust business model.

- Diversification into High-Growth Sectors: Eltel is actively expanding into solar PV, data centers, energy storage, and e-mobility.

- Significant Contract Wins: Recent successes include agreements with E.ON and a data center contract with Hyperco.

- Future Growth and Resilience: This strategic focus positions Eltel for expansion and strengthens its market resilience.

Financial Stability through Refinancing

Eltel's financial stability has been significantly bolstered by its recent debt refinancing activities. The company successfully completed a senior bond offering, which was met with strong investor demand, demonstrating a positive market perception of Eltel's financial health and future outlook. This strategic move has secured long-term funding and enhanced the company's liquidity position.

The refinancing efforts have directly translated into improved financial stability and reduced financial risk for Eltel. This enhanced financial footing is crucial for supporting ongoing investments in its core business operations and strategic growth initiatives. The company's ability to attract capital through debt instruments underscores its perceived creditworthiness and operational resilience.

- Enhanced Liquidity: The successful bond offering has provided Eltel with greater financial flexibility and improved access to capital.

- Reduced Financial Risk: Refinancing existing debt with new, potentially more favorable terms lowers interest expenses and mitigates refinancing risk.

- Investor Confidence: Strong demand for Eltel's debt instruments signals robust investor confidence in the company's financial stability and future prospects.

- Support for Investment: The strengthened financial position enables Eltel to continue investing in its infrastructure and service development.

Eltel's strong market position in Northern Europe, particularly in the Nordics, Germany, and Lithuania, is a significant asset, allowing them to secure large projects and leverage established brand trust. Their deep expertise in developing and maintaining critical infrastructure networks positions them to benefit from ongoing upgrades and digital transformation initiatives.

The company's profitability turnaround is notable, with seven consecutive quarters of year-over-year adjusted EBITA improvement leading up to Q1 2025, demonstrating a successful focus on margin enhancement and operational efficiency. This improved financial health is further evidenced by a substantial strengthening in cash flow from operating activities.

Eltel's strategic diversification into high-growth areas like solar PV, data centers, energy storage, and e-mobility is yielding results, with significant contract wins from major players such as E.ON and Hyperco. This expansion into new, dynamic sectors is crucial for Eltel's future growth and market resilience.

The company's financial stability has been enhanced through successful debt refinancing, including a senior bond offering that saw strong investor demand. This has improved liquidity and reduced financial risk, providing a solid foundation for continued investment in core operations and strategic growth initiatives.

| Metric | Value | Period | Notes |

|---|---|---|---|

| Adjusted EBITA Improvement | 7 consecutive quarters | Ending Q1 2025 | Indicates consistent operational efficiency gains. |

| First Profitable Quarter | Q1 2025 | First in ten years, signaling a significant turnaround. | |

| Cash Flow from Operations | Substantial Strengthening | Key indicator of improving financial health. | |

| Bond Offering Demand | Strong | Reflects positive investor confidence in financial stability. |

What is included in the product

Delivers a strategic overview of Eltel’s internal strengths and weaknesses, alongside external opportunities and threats within the infrastructure services market.

Identifies key Eltel strengths and weaknesses to proactively address market challenges.

Weaknesses

Despite efforts to improve profitability, Eltel has faced a significant downturn in its net sales. The company reported a 3.8% decrease in net sales for the first quarter of 2025, followed by a more substantial 6.9% decline in the second quarter of 2025.

This persistent decline in revenue is a key weakness, signaling potential issues with market demand or competitive positioning. Investor reaction has been negative, with stock performance reflecting concerns over this top-line contraction.

Maintaining profitability becomes increasingly difficult when sales are shrinking. This trend raises questions about Eltel's ability to achieve sustainable growth and expand its market share in the long term.

Eltel's performance shows significant regional disparities, impacting overall results. While Sweden demonstrated growth in Q2 2025, other vital markets like Finland and Denmark saw sales decrease during the same period. This unevenness necessitates a closer look at each region's unique challenges and opportunities.

Norway, for instance, is grappling with a shift in its customer base and a reduction in traditional telecommunication volumes. These localized issues highlight the need for Eltel to develop specific strategies for each operating area, rather than relying on a one-size-fits-all approach. Understanding these regional nuances is crucial for future growth and stability.

Investors have shown concern regarding Eltel's revenue performance. Despite reporting positive profitability, the company's stock has seen a negative reaction to announcements of declining net sales. This suggests a market apprehension about Eltel's future revenue growth, which can affect its share valuation and access to capital.

Ongoing Restructuring Activities

Eltel's ongoing restructuring, including employee reductions and fleet adjustments finalized in Q2 2025, presents a significant weakness. While these measures are intended to boost efficiency and profitability, they have historically led to substantial one-off costs, impacting short-term financial performance. For instance, the company reported restructuring costs of €25 million in the first half of 2025, directly attributable to these initiatives.

These operational shifts can also introduce temporary disruptions, potentially affecting project timelines and client satisfaction. The need for such continuous adaptation signals an underlying challenge in aligning Eltel's business structure with evolving market demands and competitive pressures.

- Restructuring Costs: €25 million in H1 2025.

- Operational Impact: Potential for project delays and client service disruptions.

- Strategic Signal: Highlights ongoing need for structural adaptation to market dynamics.

Elevated Net Debt to EBITDA Ratio

Eltel's net debt to EBITDA ratio, while improving, remains a point of concern. As of the first quarter of 2024, the ratio stood at 3.2x, which is still above their target of below 2.5x. This elevated leverage can restrict financial maneuverability, potentially leading to higher interest expenses on future borrowings and increased susceptibility to economic downturns.

- Elevated Leverage: Net debt to EBITDA at 3.2x in Q1 2024 exceeds Eltel's target of < 2.5x.

- Financial Flexibility: A higher ratio can limit the company's ability to take on new debt or invest in growth opportunities.

- Borrowing Costs: Increased leverage may result in higher interest rates on existing and future debt.

- Market Vulnerability: The company could be more exposed to financial distress during periods of economic instability.

Eltel's financial health is underscored by its persistent net debt. While efforts have been made to reduce it, the net debt to EBITDA ratio remained at 3.0x by the end of Q2 2025, still exceeding the company's target of below 2.5x. This sustained high leverage limits financial flexibility, potentially increasing borrowing costs and vulnerability during economic downturns.

The company's reliance on a few key markets also presents a weakness. For instance, the Nordic region, particularly Sweden, continues to be a dominant revenue contributor. However, significant sales declines in other key markets like Finland and Denmark during Q2 2025 highlight the risks associated with this regional concentration.

Eltel's operational efficiency is hampered by its ongoing restructuring efforts. The €25 million in restructuring costs incurred in H1 2025, while aimed at long-term improvement, create short-term financial strain and can lead to project disruptions, impacting client satisfaction and potentially delaying revenue realization.

| Financial Metric | Q1 2024 | Q2 2025 | Target |

|---|---|---|---|

| Net Debt to EBITDA | 3.2x | 3.0x | < 2.5x |

Same Document Delivered

Eltel SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

Opportunities

The global and European drive towards renewable energy and electrification offers a substantial growth avenue for Eltel. This transition fuels a rising need for infrastructure supporting solar, wind, battery storage, and e-mobility, areas where Eltel excels.

Significant investments are being channeled into new energy infrastructure across Northern Europe. For instance, the EU's REPowerEU plan aims to accelerate the rollout of renewable energy, with substantial funding allocated to grid modernization and expansion, directly benefiting Eltel's service offerings.

The continued expansion of 5G networks and the push for digitalization across Northern Europe is generating significant demand for communication infrastructure. Eltel's established capabilities in both wired and wireless telecom networks position them to benefit from this trend, particularly in the design, construction, and upkeep of sophisticated digital communication systems. This includes the crucial expansion of fiber optic networks and ensuring robust data center connectivity.

For instance, Sweden alone has seen substantial investment in 5G, with operators aiming for widespread coverage by 2025. Eltel's role in building out these networks, including the deployment of base stations and fiber-to-the-home solutions, directly addresses this market opportunity. The company's ability to manage complex infrastructure projects is a key asset in this evolving digital landscape.

Europe's aging infrastructure presents a significant, ongoing opportunity for Eltel. Many power grids and communication networks are decades old and in dire need of upgrades to meet modern demands for reliability and capacity. This creates a consistent pipeline of projects for companies like Eltel that specialize in infrastructure modernization.

The push for smart grids and enhanced grid resilience is a key driver. For instance, the European Union’s Recovery and Resilience Facility, with substantial funding allocated to green transition and digital infrastructure, directly benefits Eltel's core business. Investments in upgrading national power grids are expected to reach billions across the continent in the coming years, with smart grid technologies forming a substantial portion of this investment.

Expansion into High-Growth Adjacent Markets

Eltel's strategic push into high-growth adjacent markets like data centers and public infrastructure presents a significant opportunity. This diversification moves beyond their traditional telecom and power network services, tapping into rapidly expanding sectors. For instance, the global data center market was valued at approximately USD 276.7 billion in 2023 and is projected to grow substantially in the coming years.

Recent contract wins in these new areas, such as those secured in the Nordic region for data center build-outs, validate this strategic direction. These successes highlight Eltel's capability to leverage its existing expertise in complex project execution and infrastructure development for new applications. The increasing demand for digital services and the ongoing upgrades to public utility networks are key drivers fueling this expansion.

The growth in these adjacent markets is substantial:

- Data Centers: Driven by cloud computing and AI, this sector is experiencing double-digit annual growth.

- Public Infrastructure: Investments in smart city initiatives and the modernization of critical infrastructure are creating new project pipelines.

- Renewable Energy Integration: Eltel's expertise is also applicable to the growing need for grid modernization to support renewable energy sources, a market seeing increased government funding and private investment.

Leveraging Sustainability and ESG Mandates

The growing emphasis on sustainability and ESG mandates presents a significant opportunity for Eltel to enhance its market position. By actively participating in the development of green infrastructure, such as renewable energy networks and smart grids, Eltel can align itself with global decarbonization efforts. For instance, Eltel's involvement in projects supporting the transition to a low-carbon economy directly addresses the increasing demand for sustainable solutions from both governments and private enterprises.

Eltel can further capitalize on this trend by ensuring transparent reporting of its sustainability performance. This includes detailing its environmental impact, social responsibility initiatives, and corporate governance practices. Such transparency is crucial for attracting investors who prioritize ESG factors, as demonstrated by the continued growth in sustainable investment funds. For example, global sustainable investment assets reached an estimated $37.8 trillion in early 2024, indicating a strong investor appetite for companies with robust ESG credentials.

- Green Infrastructure Development: Eltel's expertise in building and maintaining infrastructure for renewable energy sources, such as wind and solar farms, directly supports the global shift towards cleaner energy.

- ESG Reporting and Transparency: Clear and consistent reporting on Eltel's environmental, social, and governance performance can attract ethically-minded investors and clients, differentiating it from competitors.

- Alignment with Market Trends: Eltel's focus on enabling a sustainable society resonates with increasing consumer and corporate demand for environmentally responsible services and products.

- Investor Attraction: Companies with strong ESG profiles are increasingly favored by institutional investors. Eltel's commitment to sustainability can therefore unlock access to a larger pool of capital.

Eltel is well-positioned to capitalize on the global energy transition, particularly the expansion of renewable energy sources and electrification. The increasing demand for robust infrastructure to support solar, wind, and e-mobility projects presents a significant growth avenue. For instance, the EU's REPowerEU plan, with substantial funding for grid modernization, directly benefits Eltel's core competencies in building and maintaining essential energy networks.

The ongoing digitalization and 5G rollout across Northern Europe create a strong demand for advanced communication infrastructure. Eltel's proven expertise in both wired and wireless telecom networks, including fiber optic expansion and data center connectivity, allows it to meet this evolving market need. Sweden's commitment to widespread 5G coverage by 2025 underscores the immediate opportunities for network deployment services.

The company's strategic expansion into high-growth adjacent markets like data centers and public infrastructure offers further substantial opportunities. The global data center market, valued at approximately USD 276.7 billion in 2023 and projected for robust growth, highlights the potential in this sector. Eltel's recent successes in Nordic data center build-outs validate this diversification strategy, leveraging its project execution capabilities for new applications.

Furthermore, Eltel can leverage the increasing focus on sustainability and ESG mandates to its advantage. By actively participating in green infrastructure development, such as renewable energy integration and smart grid projects, Eltel aligns with global decarbonization efforts. The estimated $37.8 trillion in global sustainable investment assets as of early 2024 indicates a strong investor preference for companies with strong ESG credentials, which Eltel can attract through transparent reporting.

Threats

Eltel faces significant pressure from a crowded critical infrastructure services market, where both established global corporations and agile local competitors actively pursue contracts. This intense rivalry, as evidenced by the fact that major players like Vinci Energies and Siemens Energy also operate in similar segments, directly impacts Eltel's ability to command premium pricing and sustain healthy profit margins. For instance, during 2023, the infrastructure services sector saw bidding wars for large-scale projects, often leading to tighter margins for all involved.

Global economic uncertainties, including potential downturns, directly threaten Eltel's revenue stability by causing delays or reductions in infrastructure spending from key clients like utilities and communication operators. Eltel has already observed that this global uncertainty has resulted in some project decision-making delays, which consequently impacts sales volumes.

The telecommunications and energy sectors are experiencing incredibly rapid technological shifts. Eltel must constantly adapt to advancements like technologies beyond 5G and new fiber optic solutions, as well as evolving grid technologies and innovative renewable energy systems. This pace means that what is cutting-edge today could be outdated very quickly.

Staying ahead requires significant and ongoing investment in research and development. For instance, the global telecom infrastructure market is projected to grow substantially, with 5G alone driving billions in investment, but Eltel needs to look even further to next-generation wireless and optical technologies. Failing to invest in and adopt these new technologies risks making Eltel's current expertise and offerings less competitive, impacting its market position and profitability.

Adverse Regulatory and Policy Changes

Eltel faces significant risks from evolving government regulations, especially concerning the pace of energy transition and environmental standards in its key Northern European markets. For instance, stricter emissions regulations or changes to renewable energy subsidy schemes could directly impact project pipelines and profitability. Telecommunications policy shifts, such as new spectrum allocation rules or net neutrality regulations, could also reshape market dynamics and operational requirements.

These regulatory shifts can lead to increased compliance costs, requiring Eltel to invest in new technologies or processes. Furthermore, altered project specifications or a sudden change in market priorities driven by policy could necessitate a rapid adaptation of Eltel's service offerings and operational strategies. For example, a slowdown in a country's commitment to 5G rollout due to policy uncertainty could directly affect Eltel's telecom infrastructure business segment.

- Increased Compliance Costs: New environmental or safety regulations may necessitate significant capital expenditure for Eltel.

- Shifting Market Demands: Policy changes favoring specific energy sources or network technologies could alter Eltel's project pipeline.

- Operational Adjustments: Adapting to new telecommunications standards or energy efficiency mandates requires agile operational planning.

Skilled Labor Shortages and Workforce Challenges

Eltel's reliance on a highly skilled workforce for its technical services presents a significant threat. Shortages of qualified engineers and technicians in key Northern European markets, particularly in areas like power transmission and telecommunications infrastructure, could lead to increased labor costs and project delays. For instance, a 2024 report indicated a growing deficit of specialized electrical engineers across the Nordic region, a core operational area for Eltel.

The company's ongoing restructuring efforts underscore the internal challenges in effectively managing and optimizing its workforce. This includes ensuring efficient deployment of personnel and improving overall productivity, which can be hampered by labor market tightness and the need for continuous upskilling to keep pace with technological advancements.

- Skilled Labor Gap: Projections suggest a widening gap in skilled technical roles across Europe, impacting Eltel's ability to secure necessary talent.

- Rising Labor Costs: Increased demand for specialized skills in Northern Europe is likely to drive up wages, affecting Eltel's project profitability.

- Operational Efficiency: Workforce challenges can directly impede Eltel's capacity to execute projects on time and within budget, impacting service delivery.

Intense competition within the critical infrastructure services market, featuring both global giants and local players, compresses Eltel's pricing power and profit margins. For example, the infrastructure services sector in 2023 saw intense bidding for major projects, leading to tighter margins for all participants.

Global economic instability poses a threat to Eltel's revenue by potentially slowing or reducing infrastructure investments from clients in utilities and telecommunications. This uncertainty has already caused some project decision delays, impacting sales volumes.

Rapid technological advancements in telecommunications and energy sectors require continuous adaptation and significant R&D investment. Failure to adopt new technologies, such as those beyond 5G or advanced grid solutions, risks making Eltel's current offerings less competitive.

Evolving government regulations, particularly regarding energy transition and environmental standards in Northern Europe, can increase compliance costs and necessitate agile operational adjustments. Policy shifts, like changes in renewable energy subsidies or telecommunications spectrum allocation, could reshape market dynamics and Eltel's project pipelines.

A shortage of skilled engineers and technicians in key markets, especially in power transmission and telecommunications, presents a significant threat. This skills gap can lead to higher labor costs and project delays, with a 2024 report highlighting a growing deficit of specialized electrical engineers in the Nordic region, a core market for Eltel.

SWOT Analysis Data Sources

This Eltel SWOT analysis is built upon a foundation of credible data, including Eltel's official financial statements, comprehensive market research reports, and expert industry analysis. These sources provide a robust understanding of the company's internal capabilities and the external market landscape, ensuring an accurate and actionable assessment.