Eltel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eltel Bundle

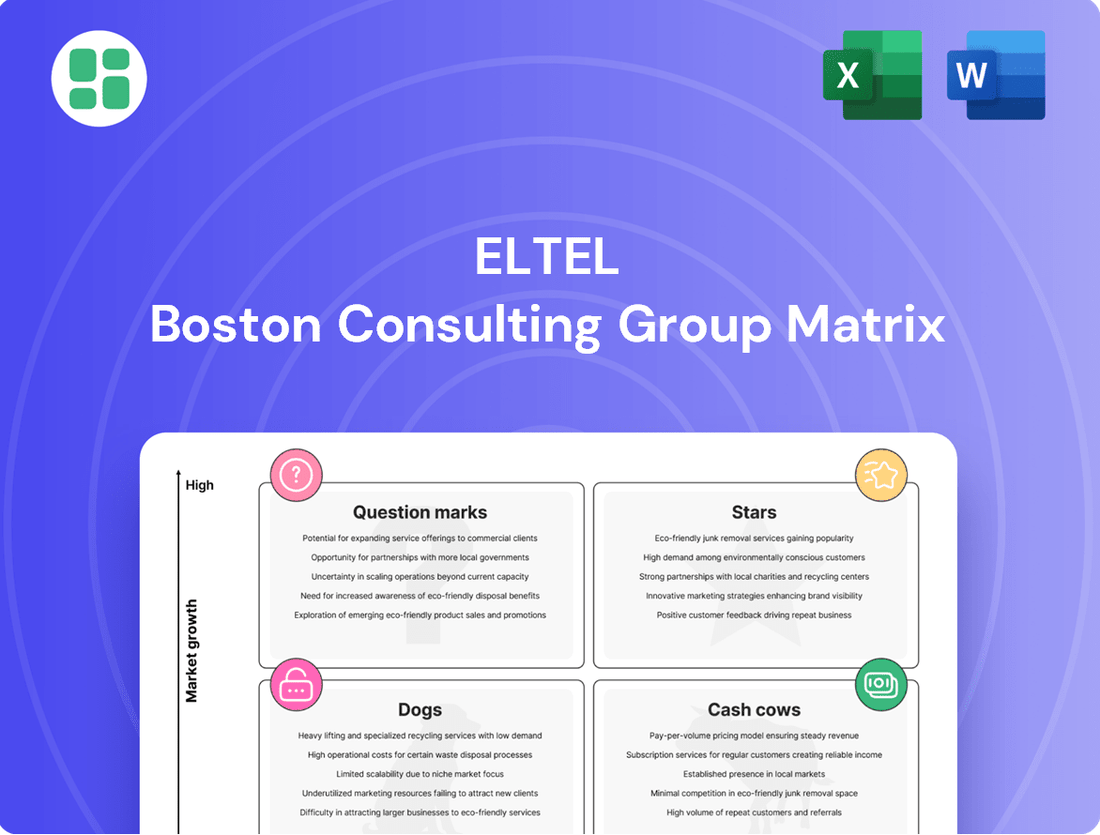

See where Eltel's offerings fit within the iconic BCG Matrix – are they market-leading Stars, reliable Cash Cows, underperforming Dogs, or promising Question Marks? This initial glimpse offers a strategic overview, but the true power lies in understanding the detailed analysis and actionable insights.

Unlock the complete Eltel BCG Matrix to gain a comprehensive understanding of each product's market share and growth rate. Purchase the full report to receive data-driven recommendations for optimizing your portfolio and making informed investment decisions.

Stars

Green Energy Transition Projects are Eltel's Stars, showcasing substantial growth potential. The company is actively securing new contracts, such as the construction of Finland's second-largest solar power plant, demonstrating tangible progress in this high-growth sector. This strategic focus aligns with ambitious EU renewable energy targets, creating a favorable market environment for Eltel's expansion.

Battery Energy Storage Systems (BESS) represent a star in Eltel's portfolio, with significant growth anticipated, especially in Denmark and Finland. This segment is booming due to the increasing need for grid stability as renewable energy sources like wind and solar become more prevalent. Eltel's strategic focus on expanding its BESS capabilities positions it well to capitalize on this escalating demand.

Data Center Infrastructure Services represent a burgeoning area for Eltel, evidenced by a substantial €16 million contract secured with Hyperco. This deal highlights Eltel's strategic move into a sector experiencing robust growth due to escalating data demands.

The global data center market is projected to reach over $300 billion by 2027, underscoring the significant opportunity for infrastructure providers like Eltel. Eltel is poised to capitalize on this expansion by applying its established expertise in critical infrastructure projects to capture a meaningful share of this dynamic market.

Power Grid Modernization

Investments in modernizing existing power grids are booming, fueled by the drive towards digitalization and electrification. Eltel's expertise in upgrading and maintaining these vital networks is a key differentiator. For instance, in 2023, Eltel secured a significant contract to modernize Sweden's power grid, a project valued at over €100 million, highlighting the substantial market opportunities.

Eltel's comprehensive service offering, from initial upgrades to ongoing operational support, is essential for utilities navigating this complex transformation. The company's commitment to enhancing grid reliability and capacity directly addresses the growing demand for stable power in an increasingly electrified world. This strategic focus positions Eltel favorably within the evolving energy infrastructure landscape.

- High Growth Potential: The global smart grid market is projected to reach over $100 billion by 2027, driven by modernization efforts.

- Eltel's Core Competencies: The company offers end-to-end solutions for power network upgrades, including substation automation and grid control systems.

- Strategic Importance: Reliable and modernized power grids are fundamental for integrating renewable energy sources and supporting electric vehicle charging infrastructure.

- Market Recognition: Eltel's consistent performance in securing large-scale grid modernization projects underscores its strong market position.

Advanced Fiber Optic Deployments

Advanced Fiber Optic Deployments represent a key growth area for Eltel. While older communication technologies may be fading, the construction of modern fiber-to-the-home (FTTH) networks is still a major focus for investment across Europe. Eltel is well-positioned to benefit from this trend, securing business in regions actively expanding their high-speed networks.

Eltel's involvement in these advanced fiber optic projects is driven by the ongoing demand for faster internet speeds and increased bandwidth. This strategic focus allows the company to capitalize on new network build-outs rather than relying on the maintenance of legacy infrastructure.

- Market Growth: Europe saw significant investment in FTTH in 2024, with projections indicating continued expansion.

- Eltel's Position: The company's specialized skills in communication infrastructure enable it to capture market share in these high-growth deployment zones.

- Strategic Focus: Eltel prioritizes new, high-speed network expansions over the upkeep of older systems.

- Investment Trends: Telecommunication infrastructure spending remains robust, particularly for fiber optic upgrades.

Eltel's Stars are its high-growth segments, including Green Energy Transition Projects and Battery Energy Storage Systems (BESS). Data Center Infrastructure Services and Modernizing Power Grids are also identified as stars, demonstrating strong market demand and Eltel's strategic positioning. Advanced Fiber Optic Deployments further contribute to this star category, driven by the need for high-speed connectivity.

These segments are characterized by substantial investment and evolving market needs, such as the global smart grid market projected to exceed $100 billion by 2027. Eltel's expertise in these areas, including securing a €16 million contract for Data Center Infrastructure, highlights its ability to capitalize on these opportunities.

| Star Segment | Key Growth Drivers | Eltel's Strategic Focus | Market Data/Contracts |

|---|---|---|---|

| Green Energy Transition Projects | EU renewable energy targets | Securing new solar power plant contracts | Finland's second-largest solar plant |

| Battery Energy Storage Systems (BESS) | Grid stability with renewables | Expanding BESS capabilities | Significant demand in Denmark and Finland |

| Data Center Infrastructure Services | Escalating data demands | Leveraging expertise for critical infrastructure | €16 million contract with Hyperco; Global market >$300B by 2027 |

| Modernizing Power Grids | Digitalization, electrification | Upgrading and maintaining vital networks | >€100 million Swedish grid modernization contract (2023) |

| Advanced Fiber Optic Deployments | Demand for faster internet | Focus on new, high-speed network build-outs | Continued expansion of FTTH in Europe; Robust telecom infrastructure spending |

What is included in the product

Eltel BCG Matrix analyzes its business units by market share and growth, guiding investment decisions.

The Eltel BCG Matrix offers a clear, quadrant-based overview, instantly relieving the pain of strategic uncertainty.

Cash Cows

Nordic Power Network Maintenance represents a significant Cash Cow for Eltel. The company is a dominant player in maintaining essential power infrastructure throughout the Nordic region, a market characterized by its maturity and the stable, recurring revenue streams it generates. These long-term agreements for continuous maintenance and operational support are the bedrock of Eltel's consistent cash flow generation.

Eltel's deep-seated expertise and its vast operational network across the Nordics solidify its high market share and ensure robust profitability in this segment. For instance, in 2023, Eltel reported strong performance in its Power segment, which is heavily influenced by such maintenance activities, contributing significantly to the company's overall financial stability and its ability to fund growth initiatives in other areas.

Eltel's core communication network maintenance in established Nordic markets like Sweden and Finland represents a classic Cash Cow. These services, crucial for ongoing operations, consistently generate strong profits with minimal need for significant new capital expenditure.

The essential nature of maintaining existing telecom infrastructure ensures steady demand, allowing Eltel to maintain a high market share in these mature regions. For instance, in 2024, Eltel reported continued robust performance in its Nordic operations, with maintenance services forming a stable revenue base.

Eltel's long-term public infrastructure frame agreements are its cash cows, offering predictable, recurring revenue. These multi-year contracts with utilities and public sector clients ensure a stable financial foundation. For instance, in 2023, Eltel reported that framework agreements contributed significantly to its order backlog, demonstrating their ongoing importance.

Emergency and Fault Repair Services

Emergency and fault repair services for critical infrastructure represent a core strength for Eltel, functioning as a classic Cash Cow within its business portfolio. This segment benefits from a non-discretionary demand, meaning customers require these services consistently, irrespective of broader economic conditions. Eltel's established infrastructure and rapid response mechanisms allow it to maintain a significant market share in this essential area.

The reliability of demand in this sector translates into a stable and predictable cash flow for Eltel. For instance, in 2024, Eltel reported continued robust performance in its infrastructure services, which heavily includes these repair and maintenance operations, underscoring their role as a consistent revenue generator. This stability is crucial for funding other, more growth-oriented segments of the company.

- Consistent Demand: Essential infrastructure repair is a non-negotiable service, ensuring stable revenue streams.

- Market Leadership: Eltel's operational efficiency and network coverage secure a strong position in this segment.

- Cash Flow Generation: This service line reliably contributes to Eltel's overall financial health, supporting investments elsewhere.

Infrastructure Operational Support

Eltel's Infrastructure Operational Support segment, a key component of its business, functions as a Cash Cow within the BCG Matrix. This designation stems from its strong market position coupled with operation in a mature, slow-growing market. These services, focused on maintaining existing power and communication networks, are essential for the continued reliability of critical infrastructure.

The operational support services are characterized by their steady revenue generation and lower capital expenditure requirements compared to new construction projects. This stability allows Eltel to leverage its high market share to consistently generate profits. For instance, in 2024, Eltel reported a significant portion of its revenue derived from these ongoing maintenance and operational contracts, underscoring their Cash Cow status.

- Mature Market Dominance: Eltel holds a substantial market share in the ongoing operational support for established power and communication networks.

- Stable Profitability: These services require less new capital investment, leading to consistent and reliable profit generation for the company.

- Essential Infrastructure Maintenance: The focus is on ensuring the sustained functionality and longevity of critical infrastructure, a non-discretionary spend for many clients.

- 2024 Performance Indicator: Eltel's financial reports for 2024 highlighted the robust contribution of its operational support services to overall profitability, reinforcing its Cash Cow designation.

Eltel's Nordic power network maintenance is a prime example of a Cash Cow. This segment benefits from a mature market with stable, recurring revenue from long-term maintenance contracts, ensuring consistent cash flow. Eltel's strong market position and operational expertise in this area translate into high profitability with minimal need for new investment.

Similarly, core communication network maintenance in established Nordic markets, like Sweden and Finland, functions as a Cash Cow. These essential services for existing telecom infrastructure generate reliable profits, supported by Eltel's significant market share in these mature regions.

Eltel's long-term frame agreements for public infrastructure are also Cash Cows, providing predictable, recurring revenue streams. These multi-year contracts with utilities and public sector clients form a stable financial base, as evidenced by their significant contribution to Eltel's order backlog in 2023.

Emergency and fault repair services for critical infrastructure are another Cash Cow for Eltel, driven by non-discretionary demand. Eltel's established network and rapid response capabilities maintain a strong market share, leading to stable and predictable cash flow, which supported its infrastructure services in 2024.

| Service Area | BCG Matrix Category | Key Characteristics | 2024 Relevance |

| Nordic Power Network Maintenance | Cash Cow | Mature market, recurring revenue, high market share, stable profitability | Significant contributor to overall financial stability |

| Nordic Telecom Network Maintenance | Cash Cow | Essential services, low capex, consistent profits, established market | Forms a stable revenue base for operations |

| Public Infrastructure Frame Agreements | Cash Cow | Long-term contracts, predictable revenue, stable financial foundation | Contributed to a robust order backlog in 2023 |

| Emergency & Fault Repair Services | Cash Cow | Non-discretionary demand, operational efficiency, stable cash flow | Underpinned robust performance in infrastructure services in 2024 |

Delivered as Shown

Eltel BCG Matrix

The Eltel BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no demo content—just the comprehensive strategic analysis ready for your immediate use and integration into your business planning.

Dogs

Eltel's traditional telecommunication services in Norway are facing significant headwinds, characterized by falling net sales and diminishing profitability. Despite initiatives to expand their customer reach, these efforts have not offset the overall decline in traditional telecom service volumes.

This segment operates within a low-growth market, and Eltel's position appears to be weakening, with a market share that is either low or on a downward trend. For instance, in 2023, the Norwegian telecommunications market saw a slight contraction in revenue for legacy services, impacting companies like Eltel.

Maintaining legacy copper networks is becoming a less attractive business as fiber optics take over. This segment of the market is shrinking, with very little expectation of future growth. For Eltel, continuing to invest heavily in these older systems likely offers low profitability and diverts valuable resources from more promising areas.

Eltel's divestment of its High Voltage Poland operations in 2024 strongly suggests this business unit was categorized as a 'Dog' within the BCG Matrix. This move typically signals a strategic decision to exit a market segment with low growth prospects and potentially weak competitive positioning or profitability, allowing Eltel to reallocate resources more effectively.

The High Voltage Poland segment likely exhibited characteristics of low market share and low growth, aligning with the 'Dog' profile. Such units often drain capital without significant return potential, making divestment a prudent step to improve overall portfolio performance and reduce financial risk for Eltel.

Low-margin, Volume-driven Communication Contracts

Low-margin, volume-driven communication contracts can be categorized as Dogs within Eltel's BCG Matrix. These agreements, often characterized by intense competition and slim profit potential, represent a segment where Eltel may be generating revenue but not significant profits. For instance, in 2023, Eltel reported that its Network business segment, which includes communication infrastructure, saw revenue growth but faced margin pressures due to the nature of these contracts.

These contracts typically involve large-scale deployments where the primary competitive factor is price, leading to thin margins. While they contribute to overall activity and market presence, their low profitability makes them less attractive for resource allocation. Eltel's strategic direction emphasizes a focus on profitable growth and higher-margin services, indicating a potential divestment or reduced focus on such Dog-like business areas.

- Low Profitability: Contracts focused on volume often yield minimal profit margins, potentially below Eltel's target for sustainable operations.

- Market Competition: These segments are frequently characterized by intense price competition, limiting pricing power.

- Strategic Shift: Eltel's stated strategy aims to improve profitability, suggesting a move away from reliance on low-margin, high-volume projects.

- Resource Allocation: Resources invested in these contracts could be better utilized in higher-growth, higher-margin areas of the business.

Outdated Infrastructure Upgrade Projects

Projects focused on upgrading or maintaining infrastructure with outdated technologies, or in sectors with diminishing future relevance, are categorized as Dogs in the Eltel BCG Matrix. These initiatives often tie up capital and resources without generating substantial returns or contributing to the company's strategic growth objectives.

Eltel’s strategy is to pivot away from such legacy projects, which may represent a significant portion of older contracts. For instance, in 2024, Eltel continued its divestment from non-core or low-margin infrastructure segments, aiming to reallocate resources towards more promising areas.

- Resource Drain: These projects consume valuable resources, including skilled labor and capital, which could be better utilized in growth-oriented ventures.

- Low ROI: Investments in outdated infrastructure upgrades typically yield minimal returns, failing to generate significant profit margins.

- Strategic Misalignment: Such projects do not align with Eltel's stated goal of focusing on future-proof solutions and sustainable growth in evolving markets.

- Market Obsolescence: The technologies or services involved may be nearing or have already reached market obsolescence, limiting long-term viability.

Eltel's legacy telecommunication infrastructure projects, particularly those involving older technologies like copper networks, are classified as Dogs. These ventures are characterized by low market growth and often a declining market share for Eltel, as seen in the overall contraction of legacy telecom service revenues in markets like Norway during 2023.

These segments typically demand significant capital investment for maintenance and upgrades but offer minimal returns, making them poor candidates for resource allocation. Eltel's strategic divestment of its High Voltage Poland operations in 2024 exemplifies this classification, signaling a move away from low-growth, low-profitability areas.

The continued focus on these legacy projects diverts resources from more promising, high-growth segments, impacting overall profitability. Eltel's stated strategy to prioritize profitable growth and exit low-margin businesses reinforces the categorization of such projects as Dogs within its portfolio.

| Business Segment | BCG Classification | Key Characteristics | 2023/2024 Relevance |

| Legacy Telecom Infrastructure (Copper Networks) | Dog | Low growth, declining demand, high maintenance costs, low margins | Continued pressure on profitability; strategic divestment focus |

| High-Margin Communication Contracts | Dog | Intense price competition, low profit margins, volume-driven | Revenue generation but limited profit contribution; margin pressures reported |

| Outdated Technology Upgrades | Dog | Low ROI, resource drain, market obsolescence risk | Strategic shift away from legacy projects; resource reallocation ongoing |

Question Marks

Eltel is strategically venturing into new digital domains, tapping into the significant societal digitalization trend. These new ventures, while promising high growth, represent nascent markets where Eltel's current market share is minimal. For instance, in the smart grid technology sector, a key area of digitalization, global market growth was projected to reach USD 33.4 billion by 2024, indicating substantial opportunity.

These expansion efforts are currently classified as Question Marks within the BCG Matrix framework, primarily because they are cash-intensive. Significant upfront investments are necessary for research, development, and market penetration to establish a foothold in these emerging digital solutions. This cash consumption is typical for businesses aiming to capture market share in new, high-potential areas.

Smart city infrastructure development is a burgeoning sector, fueled by the increasing need for integrated, intelligent solutions. This represents a significant growth opportunity. For instance, global smart city spending was projected to reach $189.5 billion in 2023, with a forecast of $327 billion by 2026, indicating a strong upward trend that Eltel can leverage.

Eltel's involvement in these projects is likely in its nascent stages, suggesting a relatively low current market share. This positions smart city infrastructure development as a potential question mark in the Eltel BCG Matrix. The company needs to carefully assess its current capabilities and market penetration in this evolving landscape.

To capture a larger share of this high-growth market, substantial investment will be crucial for Eltel. This includes investing in new technologies, talent, and strategic partnerships to enhance its competitive edge and scale operations effectively within the dynamic smart city ecosystem.

Eltel's specific IoT integration services for critical infrastructure represent a promising, albeit nascent, segment within the smart technology landscape. While the overall market for IoT in critical infrastructure is experiencing robust growth, Eltel's specialized solutions in this niche are likely still building their market share.

These innovative services, though positioned for future expansion, currently hold a relatively low market share. This necessitates significant investment in research and development to refine offerings and dedicated efforts towards market penetration to capture a larger portion of this expanding sector.

Cybersecurity for Operational Technology (OT)

The escalating cyber threats targeting critical infrastructure, such as energy grids and transportation systems, are fueling a significant surge in demand for Operational Technology (OT) cybersecurity solutions. Eltel, as a key player in infrastructure services, is strategically positioned to capitalize on this trend, likely increasing its focus on this high-growth sector.

While the OT cybersecurity market presents substantial growth opportunities, Eltel's current market share within this specialized niche is relatively modest. This necessitates strategic investments in developing deep expertise and cultivating a robust client base to effectively compete and expand its presence.

- Market Growth: The global OT cybersecurity market was projected to reach approximately $25.9 billion in 2024, with an anticipated compound annual growth rate (CAGR) of around 12.5% through 2029, indicating a robust expansion driven by increasing digitalization and vulnerability.

- Eltel's Position: As an infrastructure service provider, Eltel's entry or increased focus on OT cybersecurity aligns with industry trends but requires building specialized capabilities to gain significant market traction.

- Strategic Imperative: To succeed, Eltel must invest in talent acquisition, technology development, and strategic partnerships to establish a strong foothold and competitive advantage in this critical and evolving cybersecurity domain.

Early-stage Renewable Energy Niche Projects

Early-stage niche renewable energy projects represent potential Question Marks for Eltel. While large-scale solar and Battery Energy Storage Systems (BESS) are maturing into Stars, specialized areas like offshore wind foundation installation or advanced geothermal drilling services are emerging as high-growth opportunities. Eltel's current market share in these specific niches is likely small, necessitating strategic investment to explore their future growth trajectory.

These specialized sectors, though nascent, could offer significant returns if Eltel can establish a strong foothold. For instance, the global offshore wind market is projected to grow substantially, with investments in new installations and maintenance services expected to reach hundreds of billions of dollars by 2030. Similarly, advancements in geothermal technology are unlocking new potential for reliable, baseload renewable power.

- Niche Growth Potential: Emerging renewable energy segments like specialized offshore wind components or advanced geothermal infrastructure exhibit high growth potential.

- Low Current Market Share: Eltel's current market penetration in these specific, early-stage niches is likely limited, classifying them as Question Marks.

- Strategic Investment Required: Targeted capital allocation is crucial to thoroughly assess the viability and potential market leadership of these specialized renewable energy projects.

- Future Star Potential: Successful development and market entry in these niches could transform them into future Stars within Eltel's portfolio.

Question Marks in Eltel's portfolio represent new ventures in high-growth, emerging markets where the company currently holds a small market share. These initiatives, such as smart grid technology and smart city infrastructure, demand significant cash investment for research, development, and market penetration. The success of these ventures hinges on Eltel's ability to effectively capture market share and transition them into Stars or Cash Cows.

Eltel's strategic focus on digitalization, including smart city infrastructure, highlights its pursuit of high-growth opportunities. For example, global smart city spending was projected to reach $189.5 billion in 2023, with forecasts indicating continued expansion. Eltel's current market share in these nascent areas is likely modest, necessitating substantial investment to build capabilities and establish a competitive presence.

The company's involvement in specialized renewable energy projects, like offshore wind foundation installation, also falls into the Question Mark category. While these niches offer substantial growth potential, with the global offshore wind market attracting hundreds of billions in investment by 2030, Eltel's current market share is limited. Strategic capital allocation is crucial to evaluate and potentially lead in these emerging sectors.

Operational Technology (OT) cybersecurity is another key area for Eltel, driven by increasing threats to critical infrastructure. The OT cybersecurity market was projected to reach approximately $25.9 billion in 2024, with a strong CAGR. Eltel's position here requires investment in specialized talent and technology to gain significant traction and competitive advantage.

| Eltel's Question Marks | Market Growth Driver | Estimated Market Size (2024) | Eltel's Current Market Share | Investment Need |

|---|---|---|---|---|

| Smart Grid Technology | Societal Digitalization | USD 33.4 billion | Low | High |

| Smart City Infrastructure | Urbanization & Technology Integration | USD 189.5 billion (2023) | Low | High |

| OT Cybersecurity | Critical Infrastructure Protection | USD 25.9 billion | Modest | High |

| Niche Renewables (e.g., Offshore Wind Foundations) | Renewable Energy Transition | Hundreds of billions (by 2030 for offshore wind) | Limited | Strategic |

BCG Matrix Data Sources

This Eltel BCG Matrix leverages financial disclosures, industry growth forecasts, and competitor performance data to provide a comprehensive strategic overview.