Eltel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eltel Bundle

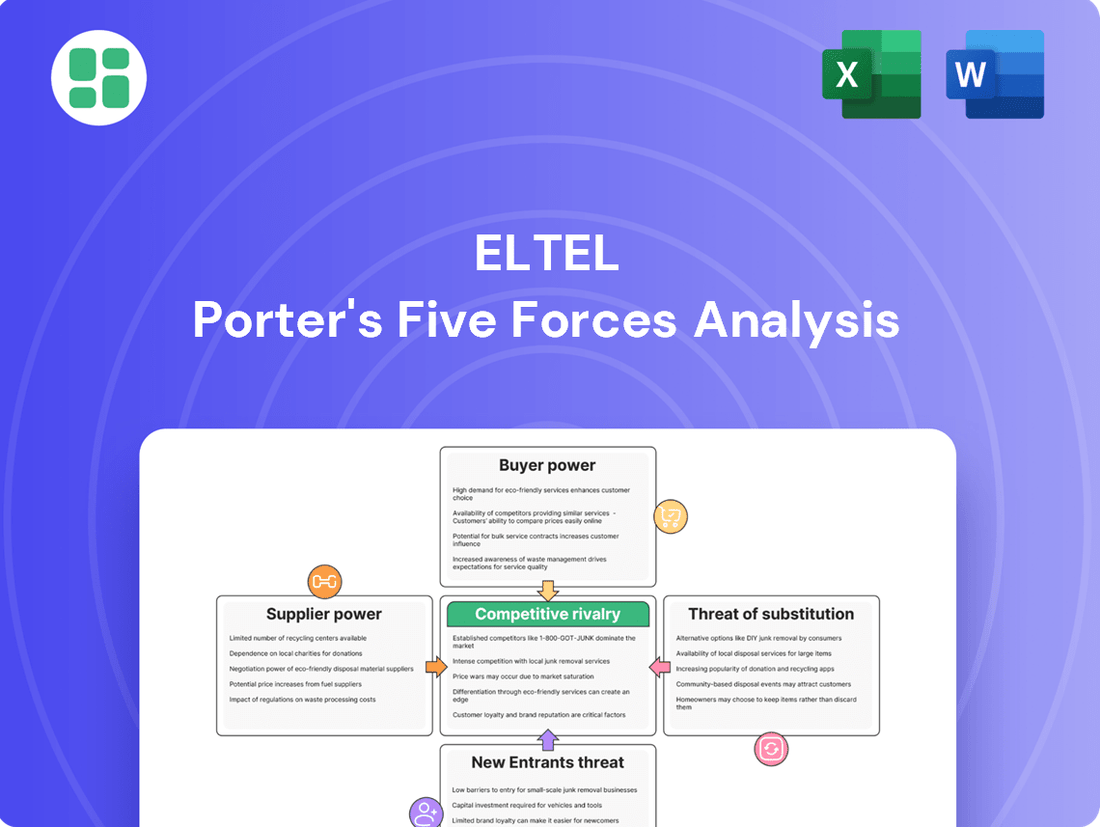

Eltel's competitive landscape is shaped by the interplay of five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for navigating the infrastructure services sector.

The complete Porter's Five Forces Analysis for Eltel delves deeper, revealing the specific strengths of each force and their implications for Eltel's profitability and strategic positioning. Gain a comprehensive view of the market pressures Eltel faces.

Ready to move beyond the basics? Get a full strategic breakdown of Eltel’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Eltel's reliance on specialized equipment and components for critical infrastructure projects, such as those in telecommunications and energy, can significantly influence supplier power. If these inputs are unique, scarce, or protected by patents, suppliers gain leverage. For instance, the limited availability of high-tech network components for 5G infrastructure or specialized machinery for advanced power grid maintenance can empower their providers.

Switching suppliers for Eltel can be a costly endeavor, especially when dealing with integrated systems or long-term maintenance agreements that necessitate specific vendor certifications and proprietary tools. These costs extend beyond mere financial expenditure, encompassing the time and operational disruptions tied to qualifying new vendors, retraining staff, and re-engineering processes for different technologies.

In 2023, Eltel reported a significant portion of its revenue was tied to long-term service contracts, highlighting the embedded nature of its supplier relationships. The complexity of these contracts, often involving specialized equipment and integrated software solutions, means that transitioning to a new supplier could incur substantial costs related to new system integration, compatibility testing, and potential project delays.

Suppliers might threaten Eltel by integrating forward, directly offering the infrastructure services Eltel currently provides. This is more likely for specialized technology providers or large equipment vendors who could move into installation or maintenance, becoming direct competitors. This threat is amplified if Eltel's services are viewed as a low-margin complement to a supplier's main offering.

Importance of Supplier's Input to Eltel's Cost or Differentiation

The bargaining power of suppliers for Eltel is significantly influenced by how critical their components are to Eltel's operations and its ability to stand out. When suppliers provide inputs that make up a large chunk of Eltel's expenses or are essential for delivering high-quality infrastructure, their leverage increases. For example, the price of specialized materials like fiber optic cables or advanced power grid components directly affects Eltel's project margins.

The performance and consistency of these supplier inputs are paramount for Eltel to ensure the reliability and quality of the critical infrastructure networks it builds and maintains. Any compromise in these materials could directly impact Eltel's reputation and its capacity to meet client expectations.

- Cost Impact: The cost of key components, such as high-capacity transformers or advanced telecommunication modules, can represent a substantial percentage of Eltel's project expenditures. For instance, in 2024, the global average cost for certain specialized power transmission components saw an increase of up to 8% due to raw material price fluctuations.

- Differentiation Factor: The quality and technological advancement of materials like specialized fiber optic cabling are crucial for Eltel to offer differentiated, high-performance network solutions, directly impacting service delivery and client satisfaction.

- Supply Chain Vulnerability: Geopolitical tensions and ongoing supply chain disruptions in 2024 have led to increased lead times and price volatility for critical electronic components, potentially raising supplier bargaining power due to scarcity.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences supplier bargaining power. If Eltel relies on specialized components or technologies with few alternatives, its suppliers gain considerable leverage. For instance, if Eltel's network infrastructure projects heavily depend on a single manufacturer's proprietary fiber optic cables, that supplier can command higher prices.

However, the landscape is dynamic. Emerging technologies and evolving industry standards can introduce new sourcing options. For example, the increasing adoption of open-source software in network management or the development of alternative materials for infrastructure deployment could provide Eltel with more choices, thereby reducing the power of existing suppliers.

- Limited Substitutes Increase Supplier Power: If Eltel has few alternative suppliers for critical components, such as specialized telecommunications equipment, the existing suppliers can dictate terms and prices.

- Technological Advancements Create Substitutes: Innovations in areas like 5G deployment or renewable energy integration can introduce new materials or technologies that serve as substitutes for traditional inputs, weakening incumbent supplier power.

- Diversification Reduces Reliance: Eltel's ability to source from multiple providers or adopt modular designs that allow for interchangeable parts directly counters supplier leverage.

- Industry Standards Impact Substitutability: The degree to which industry standards allow for interoperability of different components affects the ease with which Eltel can switch suppliers, thus influencing supplier bargaining power.

Eltel's suppliers hold significant bargaining power when their specialized components are critical and difficult to substitute, as seen in the telecommunications and energy sectors. This power is amplified by high switching costs for Eltel, which can involve substantial financial outlays, operational disruptions, and the need for new vendor qualifications. For instance, in 2023, Eltel's reliance on long-term service contracts with integrated systems meant that transitioning suppliers incurred significant costs beyond mere financial expenditure.

| Factor | Impact on Eltel | 2024 Data/Trend |

|---|---|---|

| Component Criticality & Differentiation | Suppliers of unique or high-performance inputs (e.g., advanced fiber optics) gain leverage. | Quality of specialized fiber optic cabling is crucial for Eltel's differentiated network solutions. |

| Switching Costs | High costs related to integration, training, and process re-engineering limit Eltel's flexibility. | Transitioning to new vendors for integrated systems can involve substantial project delays and compatibility testing. |

| Supply Chain Vulnerability | Geopolitical issues and disruptions can lead to scarcity and price volatility for key components. | Increased lead times and price volatility for critical electronic components in 2024 heightened supplier leverage. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Eltel's infrastructure services sector.

Instantly identify and quantify competitive pressures, allowing for targeted strategies to alleviate market friction.

Customers Bargaining Power

Eltel's customer base is characterized by a significant concentration among large entities like utilities, telecommunication operators, and public sector organizations. This concentration means that a few key clients can represent a substantial portion of Eltel's overall revenue. For example, in 2023, Eltel's top ten customers accounted for a notable percentage of its sales, highlighting the influence these major players wield.

When a small number of customers contribute heavily to a company's income, they gain considerable bargaining power. These large clients can use their substantial purchasing volume as leverage to negotiate for lower prices, more favorable contract conditions, or highly specialized service offerings. This dynamic directly impacts Eltel's profit margins and the terms under which it secures and retains business.

Customer switching costs for Eltel's clients, like major utilities and telecom companies, are substantial. This is largely because infrastructure projects are deeply integrated, and maintenance agreements are long-term commitments. For instance, a utility company might have a decade-long contract for network maintenance, making a switch midway incredibly complex.

Moving to a different service provider involves navigating intricate technical challenges, risking service interruptions, and undertaking extensive renegotiations. These hurdles mean clients can't easily switch, which in turn limits their power to demand lower prices or better terms from Eltel.

Eltel's customers, particularly large utilities and public sector entities, often face significant cost pressures. This makes them highly sensitive to the prices Eltel charges for its infrastructure services. For instance, in 2024, many European utility companies reported needing to reduce operational expenditures by 5-10% to meet regulatory targets, directly impacting their willingness to negotiate on service contracts.

The criticality of the services Eltel provides, such as maintaining power grids or telecommunication networks, can sometimes temper extreme price sensitivity. However, even for essential services, competitive bidding processes are common. In 2023, a significant portion of major infrastructure tenders in the Nordic region saw Eltel facing bids from at least three to five competitors, highlighting the ongoing need for competitive pricing strategies.

This customer price sensitivity directly influences Eltel's pricing strategies and can lead to compressed profit margins. When customers prioritize cost optimization, Eltel must remain competitive to secure contracts, even if it means accepting lower margins on projects, a trend observed across its European operations throughout 2024.

Threat of Backward Integration by Customers

Eltel's significant customers, such as major utility firms and national telecom providers, possess the potential to integrate backward. This means they could develop their own internal teams for tasks like infrastructure design, construction, and ongoing maintenance. This move becomes more probable if Eltel's services start to feel like standard commodities or if clients see a strategic benefit in managing these operations themselves.

However, the substantial specialized knowledge and the sheer scale of operations typically required for these infrastructure projects often make complete backward integration an impractical endeavor for many of Eltel's clients. For instance, a national communication operator might struggle to replicate Eltel's extensive network of skilled technicians and specialized equipment across its entire service area.

- Customer Size and Bargaining Power: Large utility and telecom companies often represent a significant portion of Eltel's revenue, giving them considerable leverage.

- Potential for In-House Capabilities: Customers can invest in their own engineering, construction, and maintenance departments if they deem it cost-effective or strategically advantageous.

- Service Commoditization Risk: As infrastructure services become more standardized, the incentive for customers to bring these functions in-house increases.

- Barriers to Integration: The high capital investment, specialized skills, and regulatory compliance needed for infrastructure management often act as deterrents to full backward integration by customers.

Availability of Substitute Service Providers

The availability of substitute service providers in Northern Europe significantly influences customer bargaining power. When numerous qualified companies can deliver similar critical infrastructure network services, clients gain more options, strengthening their negotiating position. For instance, in 2024, the Nordic energy infrastructure market saw increased activity from regional players and specialized firms, offering customers a broader choice beyond established giants like Eltel.

This competitive landscape means customers can more easily switch or demand better terms if they perceive a lack of unique value. While Eltel aims to counter this through specialized expertise, operational efficiency, and fostering long-term client relationships, intense competition in certain segments, particularly for standard maintenance or deployment tasks, can indeed amplify customer leverage.

- Increased Competition: In 2024, the Northern European market for critical infrastructure services, including power and telecom networks, experienced a notable rise in the number of specialized service providers.

- Customer Options: This proliferation of alternatives directly enhances the bargaining power of customers, allowing them to negotiate terms more aggressively.

- Eltel's Mitigation Strategy: Eltel focuses on differentiation through deep technical expertise, project execution efficiency, and building strong, enduring client relationships to offset the impact of readily available substitutes.

- Segment Vulnerability: However, segments with more commoditized service offerings remain susceptible to greater customer pressure due to the ease of finding alternative suppliers.

Eltel's bargaining power with customers is influenced by several factors, including customer concentration, switching costs, and price sensitivity. Large clients, such as major utility and telecom operators, hold significant sway due to their substantial purchasing volumes and the critical nature of the services provided. For example, Eltel's top ten customers represented a significant portion of its revenue in 2023, underscoring their influence.

While high switching costs for complex infrastructure projects generally limit customer power, intense competition in certain service segments can amplify it. For instance, the Nordic infrastructure market in 2024 saw increased competition from regional players, giving customers more options and strengthening their negotiating position. Eltel must therefore balance competitive pricing with its specialized expertise to maintain profitability.

| Factor | Description | Impact on Eltel | 2023/2024 Data Point |

| Customer Concentration | A few large clients account for a substantial portion of revenue. | Increases customer bargaining power. | Top ten customers represented a notable percentage of 2023 sales. |

| Switching Costs | High due to integrated infrastructure and long-term contracts. | Limits customer bargaining power. | Clients often have decade-long maintenance contracts. |

| Price Sensitivity | Customers, especially public sector, are cost-conscious. | Can lead to margin pressure. | European utility cost reduction targets of 5-10% in 2024. |

| Availability of Substitutes | Increased competition in Northern Europe. | Enhances customer bargaining power. | More specialized firms entered Nordic energy infrastructure market in 2024. |

Preview the Actual Deliverable

Eltel Porter's Five Forces Analysis

This preview showcases the comprehensive Eltel Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate usability for your business strategy. You're looking at the actual document, meaning no placeholders or generic content; it's ready for download and application the moment you buy.

Rivalry Among Competitors

The critical infrastructure services market in Northern Europe, where Eltel operates, is characterized by a moderate to high number of competitors. While it’s a specialized sector, several significant players vie for market share. These include companies like AFRY, Caverion, and Siemens, which have substantial operations and diverse service offerings across the region.

The competitive landscape is further shaped by the presence of both large, international conglomerates and agile, specialized local or regional firms. This diversity means Eltel faces a varied set of competitive pressures. For instance, in 2023, the European infrastructure market saw significant investment, with projects in renewable energy and digital networks driving demand, intensifying competition among established and emerging service providers.

The varied service portfolios, from grid construction to telecommunications network deployment, and differing geographic strengths mean that rivalry can be particularly fierce in specific segments or countries. For example, in Sweden, a key market for Eltel, local competitors often have deep-rooted relationships and a strong understanding of regional needs, presenting a distinct challenge.

The growth rate of Northern Europe's critical infrastructure market is a key driver of competitive rivalry. While investments in digital and green energy infrastructure are generally on the rise, slower expansion in some traditional areas can intensify competition for existing market share. Eltel's strategic emphasis on high-growth sectors such as renewable energy and data centers positions it to benefit from these expanding niches.

Competitive rivalry intensifies when services become commoditized, shifting the focus to price. Eltel strives to stand out through its full lifecycle services, deep technical knowledge, efficient operations, and strong, lasting customer connections. In 2023, Eltel reported revenues of €1,084.5 million, indicating a significant market presence, but the pressure to maintain pricing power remains.

However, if rivals can match Eltel's quality and service breadth, differentiation becomes a significant hurdle. This scenario heightens price-based competition, potentially eroding profit margins across the industry. The infrastructure services sector, where Eltel operates, often sees intense competition from both large established players and smaller, more agile local firms.

Exit Barriers

High exit barriers are a significant factor in the critical infrastructure services sector, where companies like Eltel operate. These barriers include substantial investments in specialized fixed assets, such as construction equipment and network testing tools, and the necessity of maintaining long-term contracts with clients. Furthermore, a highly skilled and specialized workforce, often with certifications and extensive training, adds another layer of commitment that makes exiting the market difficult and costly.

These elevated exit barriers can intensify competitive rivalry. When it's hard and expensive to leave a market, companies tend to stay and compete even when profitability is low or declining. This reluctance to exit can lead to sustained price wars and market overcapacity, as firms fight for market share rather than reducing their presence. For Eltel, this dynamic means facing persistent pressure on margins and potentially struggling with underutilized assets.

For instance, the infrastructure sector often involves long-term projects with significant upfront capital expenditure. Companies are committed to these projects for years, making a swift exit unfeasible. This commitment, coupled with the specialized nature of the work, means that even in challenging economic periods, firms must continue operating, contributing to a highly competitive landscape. In 2024, many infrastructure companies reported challenges in optimizing asset utilization due to these sticky market conditions.

- High Capital Investment: Significant outlays in specialized machinery and technology create substantial sunk costs.

- Long-Term Contracts: Commitments to clients often span multiple years, binding companies to ongoing service provision.

- Specialized Workforce: The need for highly trained and certified personnel makes rapid downsizing or reallocation difficult.

- Industry-Specific Assets: Equipment and infrastructure are often not easily repurposed for other industries, increasing exit costs.

Strategic Stakes and Aggressiveness of Competitors

The Northern European market for critical infrastructure services holds significant strategic importance, fueling aggressive competition among players like Eltel. Competitors are actively pursuing growth through acquisitions and employing aggressive pricing strategies to capture or protect market share, often with a long-term goal of regional dominance. This intense rivalry is evident as companies aim to leverage synergies across their broader business portfolios.

In 2024, the infrastructure sector in Northern Europe continued to see consolidation and strategic maneuvering. For instance, major players have been investing heavily in renewable energy infrastructure upgrades, a segment where market share gains are highly valued. Eltel's ability to maintain its competitive edge hinges on its continuous innovation and operational efficiency in this dynamic environment.

- Strategic Importance: Northern Europe's critical infrastructure market is a key battleground for service providers.

- Aggressive Tactics: Competitors employ growth strategies, M&A, and price competition to win market share.

- Long-Term Vision: The drive for regional dominance and synergy exploitation intensifies competitive pressures.

- Eltel's Response: Continuous innovation and operational optimization are crucial for Eltel to stay ahead.

Competitive rivalry within Eltel's operating environment is substantial, driven by a mix of large, established firms and agile regional players. This dynamic intensifies as companies vie for contracts in critical infrastructure, particularly in high-growth areas like renewable energy and digital networks. The market's strategic importance in Northern Europe fuels aggressive tactics, including acquisitions and price competition, as firms aim for regional leadership and operational synergies.

The intensity of competition is further amplified by high exit barriers, such as significant capital investments in specialized assets and long-term contractual commitments. These factors discourage companies from leaving the market, even during periods of low profitability, leading to sustained pressure on margins and a constant fight for market share. Eltel's 2023 revenue of €1,084.5 million underscores its presence, but also the ongoing challenge of differentiating and maintaining pricing power.

| Competitor | Primary Service Areas | 2023 Estimated Revenue (Northern Europe Focus) |

|---|---|---|

| AFRY | Consulting, Engineering, Project Management | Not Publicly Disclosed (Significant presence) |

| Caverion | Building Services, Industrial Services, Infrastructure | Not Publicly Disclosed (Significant presence) |

| Siemens | Energy, Mobility, Digitalization | Not Publicly Disclosed (Significant presence) |

SSubstitutes Threaten

Rapid technological advancements are introducing new ways to deliver essential services, potentially replacing traditional infrastructure. For example, the rollout of advanced 5G networks and burgeoning satellite internet services offer alternative connectivity solutions that could diminish the need for extensive fiber optic cable deployments in certain regions.

Decentralized energy solutions, like microgrids and advanced battery storage, are also emerging as substitutes for traditional, centralized power grids. These innovations could reduce reliance on established grid infrastructure, impacting demand for conventional power transmission and distribution services.

By mid-2024, global investment in 5G infrastructure was projected to exceed $1.5 trillion by 2025, highlighting the significant shift towards wireless technologies. Similarly, the renewable energy sector, particularly distributed generation, saw substantial growth, with solar and wind power capacity additions continuing to break records throughout 2023 and into 2024.

Large utility companies and communication operators, like Germany's E.ON or France's Orange, increasingly possess the financial muscle and technical expertise to bring infrastructure development and maintenance in-house. For instance, many national grid operators now manage significant portions of their network upgrades internally, a trend amplified by government initiatives promoting domestic job creation and technological self-sufficiency.

This shift is driven by a desire for greater operational control and potential cost savings, especially when considering the total cost of ownership versus outsourcing. If these clients perceive a significant cost advantage or a need for enhanced data security by managing operations internally, it directly reduces the market available for external providers such as Eltel.

The threat of substitutes for Eltel's services is growing as new, more efficient delivery models emerge. For instance, modular and pre-fabricated infrastructure solutions can bypass Eltel's traditional, labor-intensive installation methods. This could mean fewer large-scale projects for Eltel if clients opt for these faster, potentially cheaper alternatives.

Highly automated maintenance services also pose a significant substitute threat. While Eltel is investing in digitalization, the market could see new companies or existing players offering disruptive, tech-driven maintenance that requires less on-site human intervention. This shift could reduce the demand for Eltel's skilled workforce in certain areas.

Regulatory Changes Promoting New Solutions

Government policies and regulatory frameworks actively encouraging new technologies, such as renewable energy infrastructure or the expansion of 5G networks, can directly create substitutes for Eltel's traditional services. For instance, in 2024, many European nations increased subsidies for decentralized solar power installations, potentially reducing the need for grid infrastructure maintenance services that Eltel provides. These shifts can foster alternative service providers or operational models that bypass established players.

Incentives for emerging infrastructure types or entirely new service providers can also divert demand. For example, a 2024 European Union initiative offering grants for smart city sensor networks might lead to specialized companies offering integrated connectivity and maintenance, substituting Eltel’s broader telecom infrastructure services. This regulatory push can accelerate the adoption of novel solutions, impacting market share.

- Regulatory Push for Green Energy: In 2024, Germany's Renewable Energy Sources Act continued to incentivize distributed generation, potentially reducing reliance on traditional grid operators and their service partners.

- 5G Rollout Mandates: Several countries, including the UK, set targets for 5G coverage by 2025, encouraging new infrastructure deployment models that might favor specialized providers over established ones.

- Smart City Initiatives: Cities globally, like Singapore, are investing heavily in IoT and smart city technologies, creating opportunities for new integrated service providers that could substitute traditional infrastructure maintenance.

Cost-Performance Trade-off of Substitutes

The attractiveness of substitutes for Eltel's infrastructure services is heavily influenced by their cost-performance trade-off. If alternative solutions, such as in-house maintenance or different technology providers, can offer similar or even better outcomes at a reduced price point, the threat of substitution escalates.

For instance, consider the increasing adoption of predictive maintenance software, which might reduce the need for Eltel's traditional on-site repair teams. In 2024, the market for AI-driven predictive maintenance in infrastructure was projected to grow significantly, with some reports indicating a compound annual growth rate exceeding 20% for certain sectors.

Eltel needs to remain vigilant in monitoring these emerging alternatives. This includes understanding their pricing structures and the tangible benefits they deliver to clients.

- Cost Competitiveness: Evaluating if substitute solutions offer a lower total cost of ownership compared to Eltel's integrated service packages.

- Performance Benchmarking: Assessing whether alternatives can match or surpass Eltel's service reliability, speed, and quality.

- Technological Advancements: Monitoring innovations that could render Eltel's current service delivery methods less efficient or more costly.

- Client Value Proposition: Ensuring Eltel's offerings continue to provide superior value, justifying any price premium over substitutes.

The threat of substitutes for Eltel's services is amplified by emerging technologies and evolving client strategies. For example, advancements in wireless connectivity and decentralized energy solutions offer alternatives to traditional infrastructure. By mid-2024, global investment in 5G infrastructure was projected to surpass $1.5 trillion by 2025, indicating a significant shift towards wireless alternatives.

Furthermore, the increasing capability of large clients to manage infrastructure development and maintenance in-house presents a direct substitute. This trend, supported by government initiatives promoting domestic expertise, allows companies to potentially achieve greater control and cost savings. For instance, many national grid operators are increasingly handling their network upgrades internally, reducing the market for external providers like Eltel.

Modular infrastructure and automated maintenance services also represent significant substitute threats. These innovations can offer faster, potentially cheaper alternatives to Eltel's traditional methods, impacting demand for their skilled workforce. As of 2024, the market for AI-driven predictive maintenance was experiencing substantial growth, with some sectors seeing compound annual growth rates exceeding 20%.

| Substitute Area | Example | 2024 Market Trend/Data | Impact on Eltel |

|---|---|---|---|

| Connectivity | Satellite Internet, Advanced 5G | Global 5G investment projected to exceed $1.5 trillion by 2025. | Reduced demand for fiber optic deployment and maintenance. |

| Energy | Microgrids, Distributed Solar | Record solar and wind power capacity additions in 2023-2024. | Lower need for traditional grid infrastructure services. |

| Operations | In-house Maintenance, Predictive Software | AI-driven predictive maintenance market growth >20% (CAGR) in some sectors. | Decreased outsourcing opportunities, potential reduction in on-site workforce demand. |

Entrants Threaten

The critical infrastructure services sector, where Eltel operates, demands immense capital. Think about the specialized machinery, advanced technology, and highly trained workforce needed to build and maintain essential networks. For instance, companies involved in fiber optic deployment or renewable energy infrastructure projects often require hundreds of millions of euros in upfront investment.

These substantial financial barriers make it incredibly difficult for newcomers to even get a foot in the door. Establishing the necessary scale and expertise to compete with seasoned companies like Eltel demands a deep financial reservoir, effectively deterring many potential entrants and thereby reducing the threat.

Operating in critical infrastructure sectors like power and communication in Northern Europe means grappling with intricate regulatory landscapes. New entrants must secure numerous licenses and strictly adhere to demanding safety and environmental regulations. For instance, in 2024, the average time to obtain a major utility construction permit in Sweden could extend over 18 months, a significant deterrent.

These regulatory complexities erect substantial barriers. Companies like Eltel, with years of experience and robust compliance systems already in place, are far better positioned than newcomers who haven't yet built this essential operational foundation. This established expertise in navigating compliance is a key factor limiting the threat of new entrants.

Established players like Eltel leverage significant economies of scale in procurement and operations, leading to lower per-unit costs. For instance, in 2023, Eltel's revenue reached €1.1 billion, indicating a substantial operational footprint that smaller entrants cannot easily replicate.

Newcomers would find it challenging to match these cost efficiencies without achieving a comparable volume of business, creating a substantial barrier to entry. The experience curve in managing large-scale infrastructure projects, a core competency for Eltel, also presents a hurdle for nascent competitors.

Brand Loyalty and Customer Relationships

Eltel benefits from deeply entrenched brand loyalty and long-standing customer relationships, particularly with major utilities, communication operators, and public sector organizations. These partnerships are built on a foundation of trust, demonstrated reliability, and a nuanced understanding of client-specific operational requirements.

New entrants face a significant hurdle in replicating these established connections. Clients involved in critical infrastructure projects are inherently risk-averse, often prioritizing established, proven partners over newer, less-tested entities. This preference for reliability makes it difficult for newcomers to gain traction.

- Customer Retention: Eltel's strong client relationships contribute to high customer retention rates, a key factor in mitigating the threat of new entrants.

- Switching Costs: The complexity and criticality of infrastructure projects mean that switching providers involves substantial costs and risks for clients, further solidifying Eltel's position.

- Reputation: Eltel's established reputation for quality and dependability acts as a significant barrier, as new companies must invest heavily in building similar trust.

Access to Distribution Channels and Supply Chains

Newcomers often struggle to secure access to established distribution channels, particularly the direct procurement processes favored by large public and private clients. This can be a major hurdle, as Eltel benefits from its existing relationships and long-term contracts with these key customers.

Securing reliable supply chains for specialized components and skilled labor presents another significant barrier. Eltel's established network of suppliers and subcontractors provides a competitive advantage that is difficult for new entrants to replicate quickly, impacting their ability to deliver projects efficiently and cost-effectively.

- Limited Access to Key Client Procurement: New entrants face challenges in penetrating the direct procurement channels of major public and private sector clients, a segment Eltel actively serves.

- Supply Chain Dependencies: The specialized nature of components and the need for skilled labor in Eltel's operating sectors create supply chain vulnerabilities for new companies lacking established relationships.

- Replication Difficulty: Eltel's long-standing supplier and subcontractor networks represent a significant, time-consuming barrier for new entrants to replicate, impacting their operational capacity and cost structure.

The threat of new entrants in Eltel's critical infrastructure sector is generally low, primarily due to significant capital requirements and established regulatory hurdles. For instance, building a new high-voltage power line or a nationwide fiber optic network demands hundreds of millions in investment, a sum few new companies can readily access. Furthermore, navigating complex permitting processes, which can take over 18 months for major utility projects in Sweden as of 2024, adds another substantial barrier. Eltel's substantial 2023 revenue of €1.1 billion also highlights the economies of scale that are difficult for newcomers to match, further limiting competitive pressure from new players.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Requirements | High upfront investment for specialized equipment and technology. | Deters new firms lacking significant financial backing. | Hundreds of millions of euros for fiber optic or power infrastructure projects. |

| Regulatory Hurdles | Complex licensing, safety, and environmental compliance. | Requires extensive time and resources to navigate. | Average 18+ months for major utility construction permits in Sweden (2024). |

| Economies of Scale | Cost advantages from large-scale operations and procurement. | New entrants struggle to compete on price without comparable volume. | Eltel's €1.1 billion revenue in 2023 signifies a large operational footprint. |

| Customer Relationships & Reputation | Established trust and long-term contracts with key clients. | New entrants face difficulty in gaining access and trust from risk-averse clients. | Clients in critical infrastructure often prioritize proven, reliable partners. |

Porter's Five Forces Analysis Data Sources

Our Eltel Porter's Five Forces analysis is built upon a robust foundation of data, including Eltel's annual reports, industry-specific market research from firms like IHS Markit, and financial data from sources such as Refinitiv. This comprehensive approach ensures a thorough understanding of competitive pressures.