Elior Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elior Group Bundle

Elior Group's market position is shaped by its strong global presence and diversified service offerings, but also faces challenges from intense competition and evolving consumer preferences. Understanding these dynamics is crucial for any strategic investor or business leader.

Want the full story behind Elior Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Elior Group stands as a prominent global leader in contract catering and multiservices, with operations spanning eleven countries. This extensive international footprint, as of early 2024, allows the company to tap into diverse markets and customer needs.

Its diversified portfolio, encompassing sectors like business and industry, education, healthcare, and leisure, is a significant strength. This broad operational base, serving millions of meals daily across various segments, mitigates risks associated with economic downturns in any single sector, contributing to financial resilience.

Elior Group has achieved a remarkable turnaround in its financial results, with adjusted EBITA climbing to €238 million and net profit reaching €57 million in the first half of fiscal 2024-2025. This substantial improvement underscores the effectiveness of the strategic transformation initiated in April 2023, which has successfully shifted the focus towards profitable growth and enhanced operational efficiency across the organization.

Elior Group has made significant strides in its deleveraging strategy, successfully reducing its net debt. As of the first half of fiscal year 2024, the company reported a net debt of €1.1 billion, a notable decrease that strengthens its financial position.

This consistent focus on debt reduction, coupled with strong cash flow generation, has improved Elior's leverage ratio. The company's commitment to deleveraging signals enhanced financial resilience and a more attractive profile for investors looking at a healthier balance sheet.

High Contract Retention and Strategic Portfolio Management

Elior Group benefits from a robust contract retention rate, a testament to its ability to foster enduring client relationships and deliver consistent service quality. This high retention underpins stable revenue streams and reduces the cost and effort associated with acquiring new business. For instance, in their 2023 fiscal year, Elior reported a strong renewal rate across its key segments, demonstrating client loyalty.

The company's strategic approach to portfolio management involves actively pruning less profitable or loss-making contracts. This deliberate rationalization enhances overall profitability and shifts the business mix towards higher-margin opportunities. By focusing on value over volume, Elior aims to improve its financial performance and strengthen its competitive position, a strategy that has shown positive results in recent financial reporting, contributing to margin expansion.

- High Contract Retention: Demonstrates client satisfaction and loyalty, ensuring recurring revenue.

- Strategic Portfolio Rationalization: Exiting underperforming contracts to improve overall profitability.

- Margin Improvement: The focus on a healthier business mix directly contributes to better financial margins.

- Enhanced Business Mix: Shifting towards more profitable contracts strengthens the company's financial foundation.

Commitment to Social and Environmental Responsibility

Elior Group demonstrates a strong commitment to social and environmental responsibility. This is evident in their focused initiatives, such as significant reductions in food waste, which saw a 21% decrease in waste per cover in 2023 compared to 2022 across their French operations. They are also increasing their use of sustainable packaging solutions and expanding plant-based menu options, reflecting a growing market demand for healthier and more eco-friendly choices.

These proactive efforts not only align with prevailing global sustainability trends but also bolster Elior Group's brand reputation. This enhanced image is particularly appealing to clients who prioritize environmental consciousness, potentially leading to stronger partnerships and a competitive edge in the market.

- Food Waste Reduction: Achieved a 21% decrease in waste per cover in France (2023 vs. 2022).

- Sustainable Packaging: Increased adoption of eco-friendly packaging materials.

- Plant-Based Menus: Growing emphasis on offering diverse and appealing plant-based culinary options.

- Brand Enhancement: Improved reputation among environmentally conscious clients and stakeholders.

Elior Group's financial performance shows a robust recovery, with adjusted EBITA reaching €238 million and net profit hitting €57 million in H1 2024-2025. This turnaround, driven by a strategic focus on profitable growth and efficiency, has significantly strengthened the company's financial standing.

The company has successfully reduced its net debt to €1.1 billion as of H1 2024, a key achievement in its deleveraging strategy. This reduction, coupled with strong cash generation, has improved Elior's leverage ratio, enhancing its financial resilience and attractiveness to investors.

Elior Group boasts a high contract retention rate, a clear indicator of client satisfaction and service quality, which ensures stable, recurring revenue streams. This loyalty minimizes the need for costly new business acquisition, contributing to consistent financial performance.

Strategic portfolio rationalization, including exiting underperforming contracts, is a key strength, allowing Elior to focus on higher-margin opportunities. This shift enhances overall profitability and strengthens the company's competitive position, as evidenced by recent margin improvements.

| Financial Metric | H1 2024-2025 | FY 2023 |

|---|---|---|

| Adjusted EBITA | €238 million | N/A |

| Net Profit | €57 million | N/A |

| Net Debt | €1.1 billion (H1 2024) | N/A |

| Contract Retention Rate | Strong (reported FY 2023) | Strong |

What is included in the product

This SWOT analysis maps out Elior Group’s market strengths, operational gaps, and risks, providing a comprehensive view of its internal capabilities and external challenges.

Offers a clear breakdown of Elior Group's competitive landscape, simplifying complex market dynamics for strategic decision-making.

Weaknesses

Elior Group has revised its organic revenue growth forecast downwards for the 2024-2025 fiscal year, signaling a more cautious expansion trajectory than initially projected. This adjustment, prioritizing profitability, points to potential headwinds in achieving more robust market penetration.

Elior Group faced challenges with contract non-renewals in specific regions, contributing to a revenue dip. For instance, Italy experienced a decline due to the loss of key contracts, demonstrating a vulnerability to localized business developments.

The multiservices sector also encountered headwinds, with organic revenue contracting in France. This was largely attributed to a softening in demand for temporary staffing solutions, indicating sensitivity to shifts in the labor market and specific service needs.

Elior Group's reliance on sectors like automotive and aerospace makes it vulnerable to economic slowdowns. For instance, a significant contraction in global automotive production, which saw a decline in output in early 2024 due to supply chain issues and reduced consumer demand, directly impacts Elior's contract volumes in those areas. This sensitivity can stifle growth opportunities with existing clients as their own operational budgets tighten.

Increased Capital Expenditure

Elior Group anticipates a rise in capital expenditure as a proportion of its revenue for the 2024-2025 fiscal year. This increase is partly fueled by expansion efforts and strategic acquisitions, which are positive for long-term growth. However, the higher investment may strain free cash flow in the short term if the returns do not materialize as expected.

The company's strategy involves reinvesting in its operations and pursuing bolt-on acquisitions. For instance, in fiscal year 2023, Elior Group's capital expenditure was €238 million. The projected increase for 2024-2025, while not precisely quantified yet, signals a commitment to enhancing capabilities and market presence.

- Increased Investment: Capital expenditure is expected to grow as a percentage of revenue in FY2024-2025.

- Drivers: This growth is linked to business development and strategic bolt-on acquisitions.

- Potential Impact: Higher spending could create short-term pressure on free cash flow.

- Mitigation: The success hinges on achieving commensurate returns on these investments.

Share Price Volatility Linked to Growth Expectations

Elior Group's share price has shown considerable sensitivity to growth forecasts, with notable declines observed after the company adjusted its revenue growth expectations downwards. For instance, following their Q3 2023 results, the stock saw a dip as projections for the full year were tempered, highlighting investor focus on consistent expansion.

This volatility can undermine investor confidence, potentially making it more challenging and costly for Elior to raise capital in the future through equity issuances. Such price swings can also impact the company's ability to attract and retain talent who may be compensated with stock options.

- Investor Sensitivity: Share price reactions to revised growth forecasts demonstrate a clear investor focus on Elior's expansion trajectory.

- Confidence Impact: Significant price drops can erode investor trust, affecting the company's market perception.

- Capital Raising Challenges: Increased volatility may lead to higher borrowing costs or reduced attractiveness for equity financing.

Elior Group's revised organic revenue growth forecast for FY2024-2025 signals potential challenges in achieving ambitious market penetration, as the company prioritizes profitability. Contract non-renewals, particularly in Italy, have already impacted revenue, highlighting a vulnerability to localized business shifts. Furthermore, a contraction in multiservices revenue in France, driven by softening demand for temporary staffing, indicates sensitivity to labor market dynamics.

The company's exposure to cyclical sectors like automotive and aerospace presents a significant weakness. A downturn in these industries, such as the observed decline in global automotive production in early 2024, directly affects Elior's contract volumes and can limit growth opportunities. This reliance makes the group susceptible to broader economic slowdowns.

Increased capital expenditure, projected as a proportion of revenue for FY2024-2025, while aimed at growth, could strain free cash flow in the short term if returns are not realized promptly. For instance, FY2023 capital expenditure stood at €238 million, and the anticipated rise for the upcoming fiscal year underscores this potential pressure.

Elior's share price volatility, demonstrated by dips following downward revisions to growth forecasts, can negatively impact investor confidence and potentially increase the cost of future capital raising. This sensitivity to growth projections, as seen after Q3 2023 results, can also affect talent acquisition and retention if stock-based compensation is utilized.

What You See Is What You Get

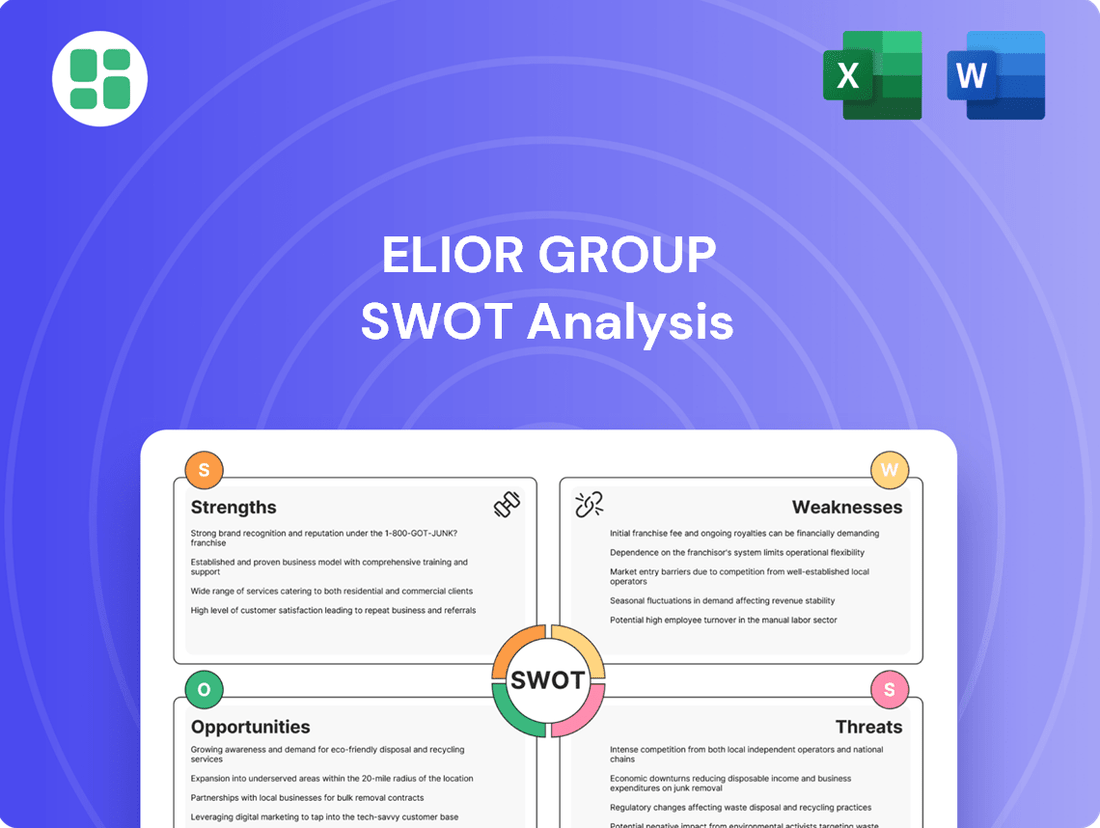

Elior Group SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive report delves into Elior Group's Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights for strategic planning. You'll gain a clear understanding of the competitive landscape and how Elior Group can leverage its advantages.

Opportunities

Elior Group's strategic transformation, launched in April 2023, is a significant opportunity to boost profitability. This initiative focuses on improving operational efficiency and margins, setting a clear path forward for financial health.

By continuing to emphasize margin enhancement and carefully selecting new business opportunities, Elior can solidify its financial standing. For instance, the Group's commitment to disciplined growth aims to build on the positive momentum seen in recent financial reports, with a target of achieving a 5% improvement in operating margin by 2025.

Elior Group's strategic alliance with Derichebourg Multiservices, finalized in 2023, alongside several targeted bolt-on acquisitions, creates a fertile ground for synergy realization. This integration offers a prime opportunity to unlock significant operational efficiencies and expand commercial reach.

By effectively merging operations and leveraging combined resources, Elior can drive substantial cost savings. For instance, the Derichebourg integration is projected to yield approximately €20 million in annual synergies by 2025, primarily through procurement optimization and administrative consolidation.

Furthermore, these combined entities can broaden their service portfolios and enhance market penetration. This strategic alignment allows Elior to offer a more comprehensive suite of services, potentially capturing a larger share of the facilities management market, which is expected to grow by 5% annually through 2027.

The demand for sustainable, locally sourced, and plant-based food options is significantly increasing. For instance, the global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected to reach USD 160.5 billion by 2030, growing at a CAGR of 27.4% during this period. Elior's commitment to reducing food waste, evident in its 2023 initiatives that reportedly saved 1,500 tons of food across its operations, and its development of greener menus, like introducing more vegetarian and vegan choices, directly addresses this burgeoning market. This strategic focus allows Elior to attract a wider customer base increasingly prioritizing environmental and health considerations in their dining choices.

Leveraging Data and Artificial Intelligence

Elior Group's strategic focus on becoming a data-driven company, incorporating artificial intelligence and agentic AI, represents a substantial opportunity. This digital transformation aims to optimize operations, personalize service delivery across its diverse segments, and significantly enhance decision-making capabilities. For instance, in 2024, the company has been investing in digital tools to improve customer experience and operational efficiency, with AI playing a key role in analyzing vast datasets to identify trends and improve resource allocation.

The integration of AI and agentic AI can unlock new levels of efficiency and innovation. This includes streamlining supply chain management, predictive maintenance for catering equipment, and tailoring menu offerings based on real-time customer feedback and dietary preferences. Elior's commitment to this path is underscored by ongoing pilot programs in various markets, demonstrating tangible improvements in service speed and waste reduction.

The benefits of this data-centric approach are multifaceted, potentially leading to:

- Enhanced Operational Efficiency: AI-powered analytics can optimize staffing, inventory management, and route planning, reducing costs and improving service delivery.

- Personalized Customer Experiences: Understanding customer preferences through data analysis allows for customized meal plans and service interactions, boosting satisfaction.

- Data-Driven Strategic Decisions: Real-time insights from AI can inform menu development, market expansion, and investment strategies, leading to more effective business planning.

- Innovation in Service Delivery: Agentic AI can automate routine tasks and support staff in delivering more complex and personalized services, driving innovation in the catering sector.

Strategic Growth through Sector-Specific Expansion

Elior Group can capitalize on opportunities for strategic expansion by focusing on high-growth sectors, even amidst broader economic headwinds. This targeted approach allows for more efficient resource allocation and a higher probability of success.

Developing and strengthening profitable business segments is key. Furthermore, selective acquisitions that align with Elior's strategic goals can accelerate growth and market penetration. For instance, in 2024, the food service industry saw continued demand in healthcare and education sectors, areas where Elior has a strong presence.

- Targeted Sector Growth: Focus on high-demand areas like healthcare and education catering, which demonstrated resilience in 2024.

- Niche Market Strengthening: Deepen penetration in specialized catering services, such as sustainable or plant-based offerings, catering to evolving consumer preferences.

- Acquisition Strategy: Pursue strategic acquisitions of companies with complementary services or strong footholds in underserved profitable niches.

- Profitability Focus: Prioritize business segments with proven profitability and scalability to ensure sustainable expansion.

Elior Group's strategic transformation, initiated in April 2023, presents a significant avenue for enhancing profitability by streamlining operations and improving margins. The Group's disciplined growth strategy, targeting a 5% operating margin improvement by 2025, aims to build on recent positive financial performance.

The integration with Derichebourg Multiservices, completed in 2023, alongside targeted acquisitions, offers substantial opportunities for synergy realization, expected to yield €20 million in annual savings by 2025 through procurement and administrative efficiencies. This alliance also broadens service portfolios and market reach, positioning Elior to capture a larger share of the facilities management market, projected to grow at 5% annually through 2027.

Elior's focus on data-driven operations, incorporating AI and agentic AI, is set to optimize services and decision-making, with investments in digital tools in 2024 enhancing customer experience and efficiency. This digital transformation supports personalized offerings and improved resource allocation, driving innovation in service delivery and catering.

Capitalizing on the growing demand for sustainable and plant-based options, evidenced by the global plant-based market's projected growth to USD 160.5 billion by 2030, is a key opportunity. Elior's commitment to sustainability, including saving 1,500 tons of food in 2023 and expanding greener menu choices, aligns with consumer preferences for environmentally conscious dining.

Strategic expansion into high-growth sectors like healthcare and education catering, which showed resilience in 2024, offers a pathway to strengthen profitable segments. Pursuing niche market penetration and selective acquisitions further supports sustainable expansion and market share growth.

Threats

The contract catering and multiservices sector is fiercely competitive, with major global entities like Sodexo and Compass Group dominating market share. This intense rivalry often translates into significant pricing pressures for companies like Elior Group, making it harder to win new business and retain existing contracts.

Persistent inflationary pressures, particularly in food, energy, and labor, present a significant challenge for Elior Group. These rising costs directly impact the company's operational expenses, potentially squeezing profit margins if they cannot be fully recouped from clients through contract adjustments. For instance, continued high energy prices, which saw headline inflation in the Eurozone reach 5.3% in April 2024 according to Eurostat, directly increase catering and facility management costs.

A general slowdown in global and regional economies, marked by subdued GDP growth, directly affects Elior's client base, particularly in business and industry sectors. This economic environment can lead to reduced demand for catering and support services as companies tighten their budgets. For instance, in early 2024, the IMF projected global growth to be around 3.1%, a modest figure that signals potential headwinds for sectors reliant on corporate spending.

Changes in Client Work Models and Demand

The growing prevalence of hybrid and remote work models presents a significant threat to Elior Group's traditional corporate catering business. As companies embrace flexible work arrangements, the daily demand for on-site meals and catering services is likely to decrease. For instance, a 2024 survey indicated that over 60% of companies expect to maintain hybrid work policies, directly impacting the volume of meals Elior might serve in corporate settings.

Adapting to these evolving client needs and maintaining relevance in a landscape where fewer employees are physically present in offices is a continuous challenge for Elior. This shift necessitates a strategic pivot to remain competitive.

- Reduced On-Site Demand: Hybrid work models directly decrease the number of employees requiring daily catering.

- Shift in Service Needs: Demand may move towards more flexible, smaller-scale, or specialized offerings rather than traditional bulk catering.

- Competitive Pressure: Competitors who adapt more quickly to these changes could gain market share.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical instability remains a significant threat, with ongoing conflicts and trade tensions creating volatile environments. These situations can severely disrupt global supply chains, impacting Elior's access to key ingredients and materials. For instance, the ongoing conflicts in Eastern Europe have led to significant price volatility for agricultural commodities and energy, directly affecting food service providers like Elior.

Supply chain disruptions can manifest as increased transportation costs, delays, or even outright shortages. In 2024, many companies reported increased logistics expenses due to these factors. Elior, reliant on a steady flow of diverse food products and operational supplies, is particularly vulnerable to such disruptions, potentially leading to higher operating costs and reduced service delivery efficiency.

- Increased Cost of Goods: Geopolitical events can drive up the price of raw materials and energy, directly impacting Elior's procurement expenses.

- Logistical Challenges: Disruptions to shipping routes and transportation networks can cause delays and increase freight costs, affecting timely delivery of supplies.

- Availability Issues: Certain regions experiencing instability may face production or export limitations, leading to shortages of specific food items or supplies critical for Elior's operations.

Elior faces intense competition from global players like Sodexo and Compass Group, leading to price wars and reduced profitability. Additionally, persistent inflation, particularly in food and energy costs, directly squeezes margins. For example, Eurozone inflation was 2.4% in May 2024, impacting operational expenses.

Economic slowdowns, with global growth around 3.1% projected for 2024 by the IMF, dampen demand from corporate clients. The rise of hybrid work also significantly reduces on-site catering needs, with over 60% of companies maintaining hybrid policies in 2024, impacting meal volumes.

| Threat | Impact on Elior | Supporting Data/Example |

|---|---|---|

| Intense Competition | Pricing pressure, difficulty winning/retaining contracts | Dominance of Sodexo and Compass Group |

| Inflationary Pressures | Increased operational costs, squeezed profit margins | Eurozone inflation at 2.4% (May 2024) impacting food/energy costs |

| Economic Slowdown | Reduced demand from corporate clients | IMF projects 3.1% global growth for 2024, indicating potential headwinds |

| Hybrid Work Models | Decreased on-site catering demand | Over 60% of companies expect hybrid policies (2024 survey) |

SWOT Analysis Data Sources

This SWOT analysis for Elior Group is built upon a foundation of robust data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analysis. These sources provide a well-rounded view of Elior's operational performance, market positioning, and the broader competitive landscape.