Elior Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elior Group Bundle

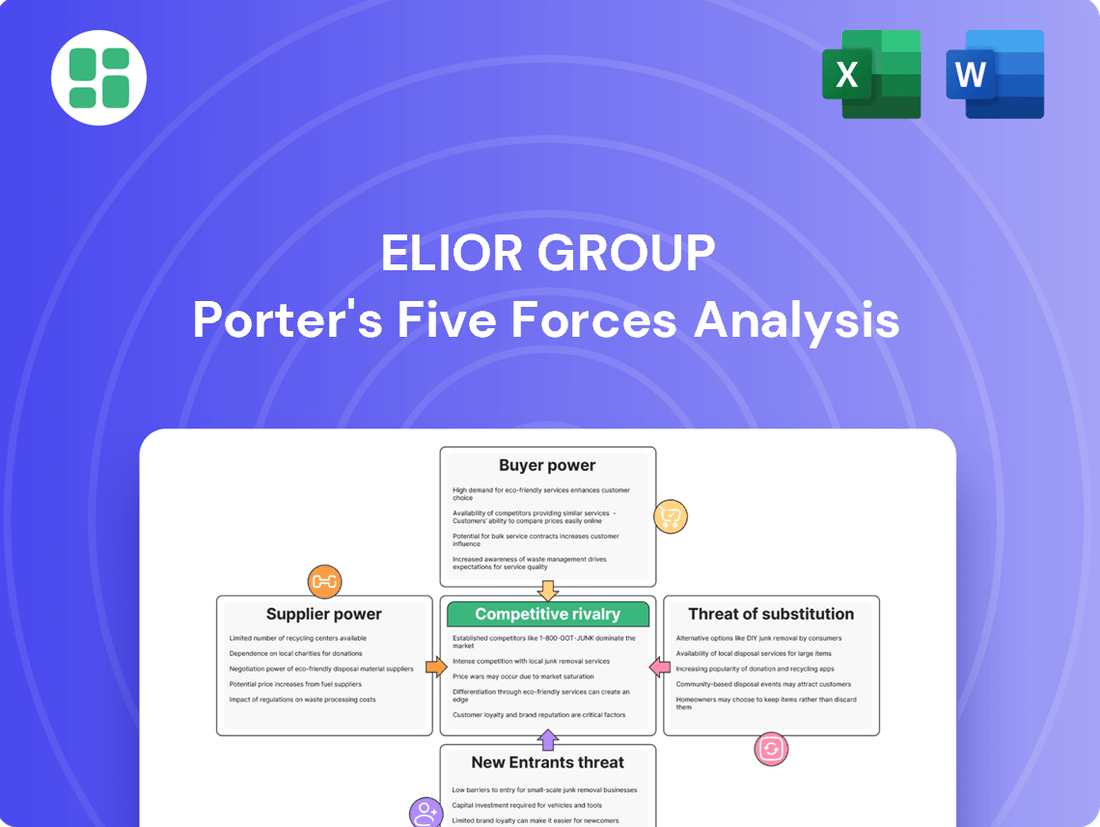

Elior Group faces a dynamic competitive landscape shaped by intense rivalry among existing players and the constant threat of new entrants disrupting the market. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this environment effectively.

The complete report reveals the real forces shaping Elior Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers significantly influences Elior Group's bargaining power. When Elior depends on a small number of providers for critical food ingredients or specialized catering equipment, these suppliers gain considerable leverage. This can translate into higher purchasing costs for Elior, as seen in the broader food service industry where key ingredient prices can fluctuate based on supplier market share. For instance, if a major supplier of a unique spice or a specialized piece of kitchen machinery faces limited competition, they can command higher prices, directly impacting Elior's operational expenses and profit margins.

Suppliers offering unique or highly differentiated inputs, such as specialized sustainable ingredients or cutting-edge kitchen technology, can exert significant bargaining power. Elior Group's focus on customized culinary experiences and potentially eco-friendly offerings means it might depend more heavily on these niche suppliers, enabling them to charge higher prices. For instance, the growing consumer preference for plant-based and health-conscious food options in 2024 has amplified the influence of suppliers within these particular market segments.

Elior Group's bargaining power with its suppliers is significantly influenced by switching costs. If Elior faces substantial expenses, such as those incurred from renegotiating contracts, reconfiguring its extensive supply chain, or retraining staff on new equipment and processes, its ability to change suppliers diminishes. This inflexibility grants existing suppliers greater leverage, potentially leading to less favorable terms for Elior.

Supplier's Importance to Elior

Elior's bargaining power with its suppliers is influenced by its size and the supplier's reliance on its business. If Elior constitutes a small fraction of a supplier's revenue, that supplier likely holds more sway over pricing and terms. However, given Elior's status as a global contract catering leader, it often represents a substantial portion of its suppliers' sales, which can shift the balance of power.

For instance, in 2023, the global food service market, where Elior operates, saw significant price fluctuations for key commodities like beef and dairy, impacting supplier cost structures. Elior's purchasing volume, estimated in the billions of euros annually across its diverse operations, allows it to negotiate more favorable terms than smaller competitors, thereby mitigating some supplier leverage.

- Supplier Dependence: Elior's scale means it's often a key customer, reducing supplier independence.

- Commodity Markets: Fluctuations in food prices in 2023 directly affect supplier costs and Elior's negotiation leverage.

- Purchasing Power: Elior's substantial annual expenditure grants it significant influence over supplier pricing.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into contract catering for Elior Group is generally considered low. While some specialized food producers could theoretically offer direct catering services, this path requires a distinct business model and substantial operational capabilities that most primary food ingredient suppliers lack. For instance, a dairy producer or a produce wholesaler typically doesn't possess the logistics, staffing, and culinary expertise needed for large-scale event catering.

This low threat means suppliers are less likely to leverage forward integration as a tactic to gain leverage over Elior. For Elior, a major player in contract catering, this reduces a potential pressure point that could otherwise drive up costs or reduce flexibility. The barriers to entry for a food supplier to become a direct competitor in contract catering are significant, often involving substantial capital investment in facilities, equipment, and skilled personnel.

The bargaining power of suppliers is therefore not significantly amplified by a credible threat of forward integration in Elior's case.

- Low Threat of Forward Integration: Suppliers of food ingredients to Elior Group generally lack the capabilities and business models to directly enter the contract catering market.

- Operational Differences: The operational requirements for food production differ significantly from those of contract catering, including logistics, staffing, and service delivery.

- Limited Impact on Bargaining Power: This low threat means suppliers cannot easily use forward integration as a means to increase their leverage over Elior.

Elior Group's supplier bargaining power is influenced by the concentration of its suppliers and the uniqueness of the inputs they provide. When Elior relies on a few suppliers for critical items, or when those suppliers offer specialized, differentiated products like sustainable ingredients, their leverage increases, potentially leading to higher costs for Elior. For instance, the growing demand for plant-based options in 2024 has given these specific ingredient suppliers more pricing power.

Switching costs also play a role; if it's expensive for Elior to change suppliers due to contract terms or operational adjustments, existing suppliers gain an advantage. While Elior's large purchasing volume, estimated in the billions of euros annually, generally gives it significant negotiating power against most suppliers, this can be tempered by the supplier's own market position and reliance on Elior's business. The threat of suppliers integrating forward into catering is low, as most lack the necessary operational capabilities.

| Factor | Impact on Elior | Example/Data Point |

|---|---|---|

| Supplier Concentration | Increases supplier power if few suppliers exist. | Limited number of providers for specialized catering equipment. |

| Input Differentiation | Increases supplier power for unique or specialized inputs. | Growing demand for sustainable or niche food ingredients in 2024. |

| Switching Costs | Reduces Elior's ability to change suppliers, increasing supplier leverage. | Costs associated with renegotiating contracts and reconfiguring supply chains. |

| Supplier Reliance on Elior | Decreases supplier power if Elior is a major customer. | Elior's global scale means it often represents a significant portion of its suppliers' sales. |

| Forward Integration Threat | Low, as suppliers typically lack catering operational capabilities. | Food producers generally do not have the logistics or staffing for large-scale event catering. |

What is included in the product

This analysis dissects the competitive forces impacting Elior Group, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Quickly identify and mitigate competitive threats by visualizing the Elior Group's Porter's Five Forces with an intuitive, interactive dashboard.

Customers Bargaining Power

Elior Group's customer base is notably concentrated with large entities like corporations, universities, and hospitals. These significant clients, often bound by lengthy contracts, wield considerable influence due to the sheer volume of business they provide. For instance, a major corporate client's decision to switch providers can represent a substantial revenue shift, amplifying their leverage in price negotiations and service customization demands.

While Elior Group's customers are often bound by lengthy agreements, the actual cost for them to switch to a different catering service can be a significant hurdle. This involves not just the administrative effort of setting up a new procurement process but also the potential for operational hiccups and even employee or student discontent during the changeover, which can range from moderate to quite high.

Despite these switching costs, the competitive landscape is a crucial factor. With major players like Sodexo and Compass Group actively vying for market share, their presence inherently limits the bargaining power Elior's customers might otherwise wield. For instance, in 2024, the global contract catering market was valued at approximately $220 billion, with these three companies being prominent participants, indicating a robust competitive environment.

Customers in sectors like education and healthcare, often operating under strict budget constraints, exhibit high price sensitivity. This sensitivity directly translates into increased bargaining power for these customer segments. For instance, in 2024, many educational institutions faced tighter funding, prompting them to scrutinize every expense, including catering services.

Corporate clients also represent a significant force, frequently leveraging their volume of business to negotiate favorable terms and bulk discounts. This negotiation power is a key factor in Elior Group's strategy. In the first half of fiscal year 2024, Elior reported that a substantial portion of its revenue came from large corporate contracts, underscoring the importance of managing these relationships effectively.

Elior's success in retaining these valuable clients hinges on its capacity to deliver cost-effective and precisely tailored solutions. The company must continually demonstrate value beyond just price, offering services that align with the specific needs and financial realities of its diverse customer base, especially in a competitive 2024 market.

Customer's Ability to Self-Provide

Many of Elior Group's larger clients, especially corporations and educational institutions, possess the capability to manage their catering services internally. This potential for backward integration significantly bolsters their bargaining power, allowing them to negotiate more favorable terms or consider bringing services in-house if Elior's offerings or pricing are not perceived as competitive.

For instance, a large corporation might assess the cost savings and control gained by operating its own cafeteria versus outsourcing to Elior. In 2024, the trend of companies re-evaluating outsourcing strategies across various functions, including support services like catering, continued. While specific figures for Elior's clients shifting to self-provision are not publicly detailed, the broader economic climate encourages such evaluations.

- Client Self-Provision Capability: Large corporate and institutional clients can opt to manage catering internally.

- Threat of Backward Integration: This capability empowers clients to negotiate better terms with Elior.

- Competitive Pricing Pressure: Clients can credibly threaten to self-provide if Elior's prices or service levels are not met.

- Market Trend Influence: Economic conditions in 2024 encouraged many organizations to review their outsourced service arrangements.

Availability of Information

The increased availability of information significantly bolsters customer bargaining power in the contract catering sector. Customers can readily access and compare pricing, service packages, and client testimonials from multiple providers, a trend amplified by digital platforms. For instance, by mid-2024, online comparison tools and industry review sites have become commonplace, allowing clients to meticulously evaluate options before making a decision.

This transparency empowers clients to negotiate more favorable terms, as they can easily identify providers offering superior value or more competitive pricing. The ease with which customers can switch suppliers, driven by readily available information on alternative options, further intensifies this pressure on contract caterers like Elior Group. In 2024, many clients leverage this to secure better service level agreements and cost reductions.

- Increased Market Transparency: Digital platforms and industry reports in 2024 provide clients with detailed insights into pricing structures and service quality across the contract catering market.

- Ease of Comparison: Customers can effortlessly compare offerings from various providers, identifying best-in-class services and competitive pricing.

- Enhanced Negotiation Leverage: Access to comprehensive market data allows clients to negotiate more effectively for better terms and pricing.

- Reduced Switching Costs: Information availability simplifies the process of identifying and engaging with alternative catering providers, increasing client mobility.

Elior Group faces moderate bargaining power from its customers, largely due to the concentration of large clients like corporations and institutions. These entities, often operating under tight budgets in 2024, have the potential to bring catering services in-house, increasing their negotiation leverage. The global contract catering market’s competitive nature, with key players like Sodexo and Compass Group, also moderates this power by offering clients alternatives.

| Factor | Impact on Elior Group | 2024 Context |

|---|---|---|

| Client Concentration | High | Large corporate and institutional clients represent significant revenue streams, giving them leverage. |

| Switching Costs | Moderate to High | While contracts exist, the operational disruption of switching can deter some clients. |

| Competitive Intensity | Moderate | The presence of major competitors like Sodexo and Compass Group provides clients with alternatives. |

| Price Sensitivity | High | Sectors like education and healthcare, facing budget constraints in 2024, are highly sensitive to pricing. |

| Backward Integration Capability | Moderate to High | Clients' ability to self-manage catering services strengthens their negotiation position. |

Full Version Awaits

Elior Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for the Elior Group, detailing the competitive landscape and strategic implications within the catering and facility management sectors. The document you see here is the exact, professionally formatted analysis you'll receive immediately after purchase, offering actionable insights without any placeholders or alterations.

Rivalry Among Competitors

The contract catering landscape is intensely competitive, with a handful of global powerhouses like Elior Group, Sodexo, Compass Group, and Aramark leading the charge. This oligopolistic structure fuels fierce competition as these major players battle for dominance and lucrative long-term contracts, especially in well-established markets.

For instance, in 2023, Compass Group reported revenues of approximately £32.1 billion, while Sodexo's revenue for the fiscal year ending August 31, 2023, reached €22.05 billion, highlighting the substantial scale of these key rivals and the significant resources they deploy in their competitive efforts.

The global contract catering market is expected to experience a compound annual growth rate of 5.29% between 2025 and 2033. This expansion, while generally positive for the industry, still fuels significant competition among established players and new entrants alike.

Despite this growth, the market's moderate pace means companies like Elior Group must remain highly competitive to secure new business and retain existing clients. Aggressive strategies are often employed to capture market share, intensifying the rivalry.

While basic catering can be seen as a commodity, Elior Group distinguishes itself by offering customized culinary experiences. This includes a strong emphasis on healthy eating, with a growing portfolio of plant-based options, and a commitment to sustainable practices. For instance, Elior has set targets to reduce food waste across its operations, a key differentiator in today's market.

The integration of technology, such as artificial intelligence for optimizing logistics and service delivery, further sets Elior apart. These advanced features can lead to greater efficiency and a more personalized customer experience, thereby reducing the pressure of direct price wars. However, it's important to note that competitors are quick to adopt and replicate successful innovations.

High Fixed Costs and Exit Barriers

The contract catering sector, where Elior Group operates, is characterized by substantial fixed costs. These include investments in state-of-the-art kitchens, specialized catering equipment, extensive logistics networks, and a sizable workforce. For instance, establishing a new catering facility can easily run into millions of euros, creating a significant financial hurdle for new entrants.

Furthermore, high exit barriers are prevalent in this industry. Long-term contracts with clients, often spanning several years, lock companies into specific operational commitments. Additionally, the specialized nature of catering assets means they have limited resale value if a company decides to withdraw from the market. These factors can force businesses to continue operating even when profitability is low, as they strive to cover their fixed costs and avoid substantial losses on asset disposal. This dynamic intensifies competitive rivalry, as players fight to maintain capacity utilization and secure ongoing revenue streams.

- Significant Capital Investment: The contract catering industry demands considerable upfront investment in infrastructure and equipment, often running into millions for large-scale operations.

- Long-Term Contractual Obligations: Many contracts in the sector have durations of three to five years or more, making it difficult for companies to exit quickly.

- Specialized Asset Depreciation: Catering equipment and facilities are highly specialized, leading to significant depreciation and low salvage value, discouraging premature exit.

- Capacity Utilization Pressure: High fixed costs necessitate high capacity utilization, driving intense competition among players to secure and retain contracts to cover operational expenses.

Strategic Stakes

The competitive rivalry within the contract catering sector is intense, with global players prioritizing market share and reputation. These are not just abstract concepts; they translate directly into tangible financial benefits. For instance, a significant contract loss can severely dent a company's revenue stream and damage its brand perception, prompting aggressive tactics to secure and retain business. Elior Group's strategic focus on profitable growth and deleveraging in 2024 underscores this reality, highlighting an operational emphasis on efficiency and enhancing shareholder value amidst this competitive landscape.

The stakes are remarkably high for major industry participants. Losing a substantial contract, which could represent millions in annual revenue, directly impacts profitability and can signal weakness to potential clients. This pressure forces companies to engage in aggressive bidding wars and implement robust retention strategies to safeguard their existing business. Elior's financial reports for 2024, showing a commitment to deleveraging, suggest a strategic shift towards strengthening its financial foundation to better withstand these competitive pressures and pursue sustainable growth.

- Market Share as a Key Metric: In 2024, major contract catering firms actively pursued market share gains, recognizing its direct correlation with revenue stability and bargaining power.

- Reputation's Financial Impact: A strong reputation, built on consistent service delivery, is crucial. A single high-profile contract loss can negatively affect brand image and future sales prospects.

- Aggressive Bidding and Retention: Companies are observed to engage in highly competitive bidding processes and invest heavily in client retention programs to mitigate the risk of contract attrition.

- Elior's Strategic Priorities: Elior's stated goals for 2024 included achieving profitable growth and reducing debt, indicating a strategic response to competitive pressures by focusing on operational efficiency and financial health.

Competitive rivalry is a defining characteristic of the contract catering market, where global giants like Elior Group, Sodexo, and Compass Group vie for dominance. This intense competition is driven by the pursuit of market share and reputation, with significant financial implications tied to contract wins and losses. For instance, in 2024, Elior Group's strategic focus on profitable growth and deleveraging highlights the need for operational efficiency to navigate this demanding landscape.

The substantial scale of major players, exemplified by Compass Group's 2023 revenues of approximately £32.1 billion and Sodexo's fiscal year 2023 revenue of €22.05 billion, underscores the resources deployed in this rivalry. These financial strengths enable aggressive bidding and investment in client retention, crucial for maintaining capacity utilization given the industry's high fixed costs and specialized assets.

Companies like Elior differentiate themselves through customized offerings, such as healthy eating options and sustainable practices, and technological integration to reduce direct price competition. However, the rapid adoption of innovations by rivals means continuous strategic adaptation is necessary to maintain a competitive edge in a market projected to grow at a 5.29% CAGR between 2025 and 2033.

| Key Competitor | Approximate 2023 Revenue | Strategic Focus (2024/Recent) |

|---|---|---|

| Compass Group | £32.1 billion | Market share expansion, operational efficiency |

| Sodexo | €22.05 billion | Profitability, client retention, sustainable solutions |

| Elior Group | (Not publicly specified in billions for 2023) | Profitable growth, deleveraging, customized offerings |

SSubstitutes Threaten

The most direct substitute for Elior Group's catering services is for organizations to manage their own catering operations in-house. This option becomes particularly attractive for larger clients who might find external contract caterers too costly or inflexible. For instance, a large corporation with significant dining needs and a dedicated facilities management team might opt to build its own catering infrastructure, especially if they believe it offers better cost control and customization.

The decision to bring catering in-house often boils down to a thorough cost-benefit analysis. Clients will weigh the perceived expense and potential rigidity of Elior's offerings against the investment and operational challenges of establishing and running their own catering department. Factors like the client's core competencies and whether catering aligns with their primary business objectives also play a crucial role in this strategic choice.

For Elior Group's corporate and educational clients, the threat of substitutes from external commercial restaurants and cafes is a significant consideration. Employees and students often have the flexibility to purchase meals from nearby eateries or food trucks, especially if these options offer greater variety, higher perceived quality, or more competitive pricing than Elior's on-site catering services.

In 2024, the growth of the quick-service restaurant (QSR) sector, with many brands expanding their reach and delivery options, intensifies this threat. For instance, the global QSR market was projected to reach over $900 billion in 2024, indicating a substantial and accessible alternative for consumers seeking convenient and often more affordable meal solutions outside of contract catering.

The proliferation of online food delivery services like Uber Eats and DoorDash poses a significant threat to Elior Group. These platforms offer unparalleled convenience, allowing individuals, including employees in business settings, to order a vast array of cuisines directly to their location, bypassing traditional catering arrangements. This direct-to-consumer model fragments demand that Elior Group traditionally captures through contract catering services.

In 2024, the global online food delivery market was valued at over $200 billion, showcasing the immense scale and consumer adoption of these substitutes. This trend directly challenges contract caterers by offering a more personalized and often immediate dining solution, particularly for smaller or less formal gatherings within corporate environments.

Self-prepared Meals and Meal Kits

The threat of substitutes for Elior Group, particularly from self-prepared meals and meal kits, is significant. Consumers increasingly opt for home-cooked meals or convenient meal kit services, driven by a desire for cost savings and greater control over ingredients. For example, the meal kit market saw substantial growth, with some reports indicating global revenues reaching tens of billions of dollars by 2023 and projected continued expansion.

This trend directly impacts Elior's catering and contract food services by offering individuals alternatives to dining out or relying on contracted food providers. These substitutes cater to specific dietary needs and preferences, a factor that can be challenging for large-scale food service providers to match consistently.

- Cost Efficiency: Home-prepared meals often present a lower cost per serving compared to professionally catered options.

- Dietary Customization: Meal kits and home cooking allow for precise control over ingredients, catering to allergies, intolerances, and specific nutritional goals.

- Market Growth: The meal kit industry, a prime example of this substitute, has demonstrated robust growth, with projections suggesting continued upward trajectories in the coming years, indicating a strong consumer shift.

- Convenience Factor: While professional catering offers convenience, the increasing sophistication and delivery options of meal kits also provide a high level of convenience for consumers.

Vending Machines and Grab-and-Go Options

Vending machines and readily available grab-and-go food options represent a significant threat of substitutes for Elior Group. These alternatives offer immediate convenience, particularly for snacks and light meals, potentially siphoning off demand that might otherwise go to traditional catering services.

While not a direct replacement for full-service catering, these substitutes can erode market share. For instance, the global vending machine market was valued at approximately $25.7 billion in 2023 and is projected to grow, indicating a substantial and expanding alternative for consumers seeking quick food solutions.

- Convenience Factor: Vending machines and grab-and-go counters provide instant access to food, bypassing the need for pre-ordering or waiting for service.

- Cost-Effectiveness: Often, these options can be more budget-friendly for consumers compared to catered meals, especially for individual purchases.

- Market Growth: The increasing popularity of convenience stores and automated retail solutions, including advanced vending machines offering fresher options, signals a growing competitive landscape for Elior.

The threat of substitutes for Elior Group is multifaceted, encompassing in-house catering, external food providers, and evolving consumer habits. Organizations can opt for self-managed catering, especially when seeking greater cost control or customization, a trend that gained traction as businesses re-evaluated operational efficiencies in 2024. The convenience and variety offered by commercial restaurants and food delivery platforms, with the global online food delivery market exceeding $200 billion in 2024, also present a significant challenge by fragmenting demand.

Furthermore, the rise of meal kits and home-prepared meals, driven by a desire for cost savings and dietary control, directly competes with contract catering services. The meal kit market alone has seen substantial growth, reaching tens of billions of dollars by 2023, indicating a strong consumer preference for alternatives. Even vending machines and grab-and-go options, representing a market valued at approximately $25.7 billion in 2023, chip away at Elior's potential market share by offering immediate convenience for snacks and light meals.

| Substitute Category | Key Characteristics | 2024 Market Relevance/Data |

|---|---|---|

| In-house Catering | Cost control, customization, flexibility for large organizations | Businesses re-evaluating operational costs and flexibility. |

| Commercial Restaurants & Food Delivery | Variety, convenience, perceived quality, competitive pricing | Global online food delivery market > $200 billion (2024). |

| Meal Kits & Home Cooking | Cost savings, dietary control, ingredient transparency | Meal kit market valued in tens of billions by 2023, continued growth. |

| Vending Machines & Grab-and-Go | Immediate convenience, cost-effectiveness for individuals | Global vending machine market ~$25.7 billion (2023), projected growth. |

Entrants Threaten

The contract catering sector, particularly for large-scale operations comparable to Elior Group, demands substantial upfront capital. Newcomers must invest heavily in state-of-the-art kitchen facilities, specialized catering equipment, efficient logistics networks, and advanced technology for operations and client management. For instance, establishing a catering operation capable of serving thousands daily can easily run into millions of dollars, creating a formidable financial barrier.

Established players in the contract catering sector, such as Elior Group, leverage significant economies of scale. This allows them to negotiate better prices for food, supplies, and equipment, and to spread fixed operational and administrative costs over a larger volume of business. For instance, in 2023, Elior reported revenues of €4.7 billion, demonstrating a substantial operational footprint that new entrants would find difficult to match quickly.

New entrants face a considerable hurdle in achieving comparable cost efficiencies. Without the established infrastructure and purchasing power, they would likely incur higher per-unit costs for everything from ingredients to marketing. This cost disadvantage makes it challenging for newcomers to compete on price with incumbents like Elior, who have honed their procurement and operational processes over many years.

Securing long-term contracts with major institutions and corporations is paramount in the contract catering sector. Newcomers often struggle to establish the necessary relationships and build trust to compete effectively with established players who possess extensive client portfolios and a history of successful service delivery. For instance, in 2024, the contract catering market continues to be dominated by a few key players who have cultivated deep ties with large corporate clients, making it difficult for new entrants to gain a foothold.

Brand Loyalty and Reputation

Elior Group and its main rivals have cultivated robust brand loyalty and reputations through decades of dependable, high-quality service delivery. This established trust makes it challenging for newcomers to gain traction.

New entrants would require substantial financial investment and a considerable timeframe to build a brand image and reputation that rivals Elior Group's existing market standing. Overcoming established client inertia is a significant hurdle.

- Brand Loyalty: Elior Group benefits from long-standing customer relationships, making it difficult for new companies to attract and retain clients.

- Reputational Capital: Decades of consistent service quality have built a strong reputation, a valuable asset that new entrants struggle to replicate quickly.

- Client Inertia: Existing contracts and satisfaction levels create a barrier, as clients are often reluctant to switch to unproven providers.

- Investment Required: Reaching a comparable level of brand recognition and trust necessitates significant upfront investment in marketing and service development.

Regulatory Hurdles and Food Safety Standards

The contract catering industry faces significant regulatory hurdles, particularly concerning health, safety, and hygiene. In 2024, compliance with these stringent standards, especially within sensitive sectors like healthcare and education, requires substantial investment and specialized knowledge. New entrants must navigate complex legal frameworks and demonstrate robust safety protocols, creating a considerable barrier to entry.

These regulatory demands translate into tangible costs for new businesses. For instance, obtaining necessary certifications and maintaining compliance with evolving food safety legislation, such as HACCP (Hazard Analysis and Critical Control Points), can be resource-intensive. Elior Group, like other established players, invests heavily in training and quality assurance to meet these requirements, a financial commitment that deters smaller, less capitalized competitors.

- Stringent Health and Safety Regulations: Contract caterers must adhere to strict guidelines to prevent foodborne illnesses and ensure safe working environments.

- Sector-Specific Compliance: Catering for healthcare and educational institutions involves additional, often more rigorous, safety and hygiene standards.

- Investment in Expertise and Infrastructure: New entrants need to invest in skilled personnel and compliant facilities, adding to initial setup costs.

- Evolving Food Safety Standards: Continuous updates to regulations necessitate ongoing adaptation and investment from all industry participants.

The threat of new entrants for Elior Group is moderate. While the contract catering market requires significant capital for facilities and logistics, and established players benefit from economies of scale and brand loyalty, regulatory hurdles and the need for extensive client relationships present substantial barriers. For instance, Elior's 2023 revenue of €4.7 billion highlights its scale, making it difficult for newcomers to compete on cost or reach.

New companies must overcome high initial investment costs, estimated to be in the millions for large-scale operations, and build trust to secure contracts, a process that takes considerable time and effort. The need for specialized knowledge in navigating stringent health and safety regulations, particularly in sectors like healthcare in 2024, further elevates the entry barrier.

| Factor | Impact on Elior Group | Evidence/Data |

| Capital Requirements | High Barrier | Millions of dollars needed for facilities and equipment. |

| Economies of Scale | Protective Advantage | Elior's €4.7 billion revenue (2023) allows for better pricing and cost absorption. |

| Brand Loyalty & Reputation | Strong Defense | Decades of service build trust, making client switching difficult. |

| Regulatory Compliance | Significant Barrier | Strict health/safety standards require investment and expertise, especially in 2024. |

| Switching Costs for Clients | Moderate Barrier | Existing contracts and satisfaction create inertia, though not insurmountable. |

Porter's Five Forces Analysis Data Sources

Our Elior Group Porter's Five Forces analysis is built upon a robust foundation of data, including Elior's official annual reports, investor presentations, and publicly available financial statements.

We supplement this with insights from leading industry research firms, competitor analysis reports, and relevant trade publications to provide a comprehensive view of the competitive landscape.