Elior Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elior Group Bundle

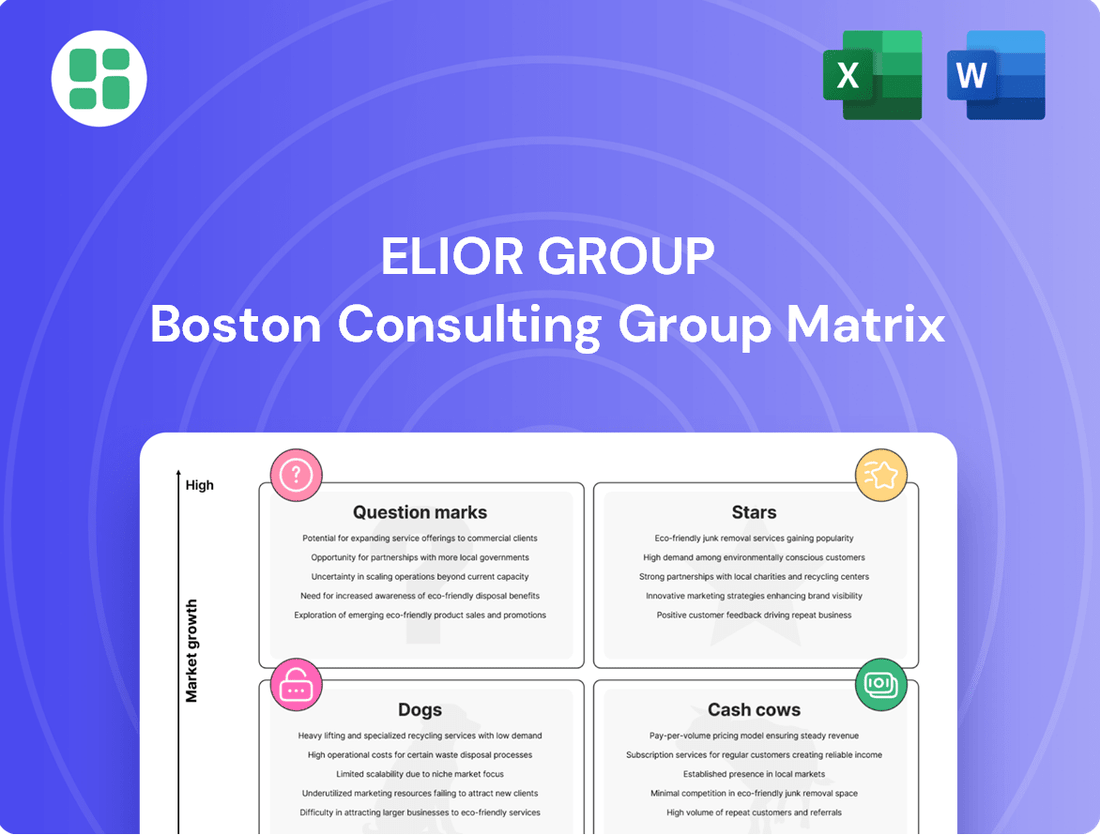

Curious about the Elior Group's strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse portfolio stacks up in the market. Understand which segments are driving growth and which might need a closer look.

Don't miss out on the full strategic picture. Purchase the complete Elior Group BCG Matrix to uncover detailed quadrant placements, actionable insights, and a clear roadmap for optimizing their business units and investments.

Stars

Elior Group commands leading positions in contract catering, particularly within the business, education, and healthcare sectors. These strongholds are crucial for its BCG Matrix assessment, reflecting significant market share and competitive advantage.

The overall contract catering market is experiencing consistent expansion, providing a favorable environment for Elior to capitalize on its established presence. For instance, the global contract catering market was valued at approximately $200 billion in 2023 and is anticipated to grow at a CAGR of around 5% through 2028, according to industry reports.

By concentrating on profitable expansion, Elior aims to reinforce its leadership in these key segments. This strategic focus is designed to drive sustained value and enhance its competitive standing within the dynamic contract catering landscape.

Elior's Education Catering Solutions holds a strong position, especially in North America, a key market for school and college dining. This segment benefits from consistent demand for quality meals, indicating a stable growth trajectory for Elior.

The company's focus on innovation and quality within this sector is crucial for maintaining its leadership. For instance, in 2024, Elior reported a 5% increase in its education sector revenue, driven by new contract wins and enhanced service offerings in the US and Canada.

Healthcare & Welfare Catering Services operates in a sector driven by non-cyclical demand, presenting a stable and predictable revenue stream. Elior Group's strong presence here, often secured through multi-year contracts, positions it as a reliable provider of essential services. For instance, in 2023, Elior reported significant revenue from its healthcare and welfare segments, underscoring the sector's resilience.

Digital Transformation & AI Integration

Elior Group's partnership with IBM France signals a strong commitment to digital transformation, particularly in leveraging artificial intelligence. This initiative is positioned as a star in the BCG matrix, indicating high growth potential and a significant market share in the evolving food services industry.

The collaboration focuses on integrating data, AI, and agentic AI to streamline operations and improve customer experiences. For instance, Elior's 2024 strategy emphasizes digital solutions to personalize service delivery, a key driver for growth in a competitive landscape.

- Focus on AI for operational efficiency: Implementing AI to optimize supply chains and reduce waste, contributing to cost savings and improved margins.

- Enhancing customer engagement: Utilizing data analytics and AI to understand customer preferences and tailor offerings, aiming for increased customer loyalty and spending.

- Strategic investment in technology: Elior's commitment to technological advancement, including AI, is crucial for maintaining a competitive edge and capturing market share in the digital era.

Sustainable & Plant-Based Menu Initiatives

Elior Group's commitment to sustainable and plant-based menus is a clear strategic move. They are actively investing in this area, recognizing the increasing demand from consumers and clients for eco-conscious dining options. This focus on plant-based offerings and food waste reduction is designed to capture a significant share of a rapidly expanding market segment.

This initiative places Elior at the forefront of food service innovation. By aligning with environmental responsibility, the company is not just meeting current trends but also anticipating future market shifts. For instance, in 2024, a significant portion of their menu development budget was allocated to sourcing and promoting plant-based ingredients, reflecting a tangible investment in this growth area.

- Investment in Plant-Based: Elior is channeling resources into developing and promoting diverse plant-based menu options.

- Food Waste Reduction: The group is implementing strategies to minimize food waste across its operations.

- Carbon Emission Targets: Elior has set ambitious targets for reducing its carbon footprint.

- Market Alignment: These initiatives directly address the growing consumer and client demand for sustainable food solutions.

Elior Group's strategic focus on digital transformation, particularly through its partnership with IBM France and the integration of AI, positions these initiatives as Stars in the BCG matrix. This segment exhibits high growth potential and a strong market share, driven by operational efficiency gains and enhanced customer engagement. Elior's 2024 strategy heavily emphasizes these digital solutions to personalize service delivery, a key differentiator in a competitive market.

The company's investment in sustainable and plant-based menus also represents a Star. This area taps into increasing consumer and client demand for eco-conscious dining, with Elior actively allocating resources to develop and promote these options. For instance, a significant portion of their 2024 menu development budget was dedicated to plant-based ingredients, reflecting a tangible commitment to capturing market share in this rapidly expanding segment.

These Star segments are characterized by their high growth prospects and Elior's strong competitive position, indicating substantial future revenue and profit potential. The group's commitment to innovation in both technology and sustainability is crucial for maintaining and expanding its leadership in these dynamic areas.

| Initiative | BCG Category | Key Drivers | 2024 Data/Outlook |

|---|---|---|---|

| AI Integration & Digital Transformation | Star | Operational efficiency, personalized customer experience | 5% revenue increase in education sector driven by enhanced services; emphasis on digital solutions in 2024 strategy |

| Sustainable & Plant-Based Menus | Star | Growing consumer demand for eco-friendly options, market differentiation | Significant allocation of 2024 menu development budget to plant-based ingredients; ambitious carbon emission reduction targets |

What is included in the product

The Elior Group BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis helps Elior Group identify which units to invest in, hold, or divest based on their market share and growth potential.

A clear Elior Group BCG Matrix visualizes business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Elior's core contract catering operations are firmly positioned as Cash Cows within its BCG Matrix. This segment represents the largest contributor to Elior's revenue, demonstrating a high market share in established, mature markets.

These operations consistently generate substantial cash flow, requiring minimal reinvestment for aggressive expansion. In 2024, Elior continued to leverage this stable income stream to support its strategic growth areas and manage its financial obligations effectively.

Elior Group's established multiservices portfolio, encompassing traditional cleaning and facility management, acts as a significant cash cow. These services are characterized by their stability, requiring relatively low capital investment for sustained operation and growth, especially within mature markets. This stability translates directly into consistent profitability and robust cash generation for the company.

Elior Group's long-term public sector contracts are a classic example of a Cash Cow. These agreements with governmental bodies and local authorities are characterized by their stability and predictability, often boasting high renewal rates. For instance, in fiscal year 2023, Elior reported continued strong performance in its public sector segments, contributing significantly to its overall revenue stability.

While the growth in these markets might not be explosive, Elior's established presence and robust relationships ensure a consistent and reliable stream of cash. This dependable revenue generation is crucial for funding other areas of the business, embodying the core principle of a Cash Cow within the BCG matrix framework.

French Market Operations

French Market Operations represent Elior Group's Cash Cows within its BCG Matrix framework. This segment is characterized by its significant contribution to the group's overall revenue, reflecting a mature and dominant market position.

France is Elior's largest geographic market, a fact underscored by its substantial revenue generation. In fiscal year 2023-2024, this market accounted for more than half of Elior's net sales, demonstrating its critical importance to the company's financial health. This strong performance highlights Elior's established and leading presence in the French market.

- Dominant Market Share: France is Elior's largest geographic market, contributing over 50% of net sales in fiscal 2023-2024.

- Mature Market Status: The French market is considered mature, indicating a stable and well-established operational environment for Elior.

- Strong Financial Performance: This segment consistently generates robust financial results and significant cash flow for the group.

- Underpinning Group Performance: Despite moderate growth prospects, the French operations are crucial in supporting Elior's overall financial stability and performance.

Large-Scale Corporate Dining Management

Elior Group's large-scale corporate dining management, often secured through long-term contracts with major corporations and industrial clients, represents a cornerstone of their business. These operations benefit from high volumes and remarkably stable demand, creating a predictable revenue stream.

This segment acts as a significant cash cow for Elior. The consistent revenue and healthy profit margins generated by these established dining services contribute substantially to the group's financial reserves. There's less pressure for radical innovation or aggressive expansion, allowing Elior to focus on operational efficiency and profitability.

In 2023, Elior Group reported a revenue of €6.2 billion, with contract catering, which includes large-scale corporate dining, forming a significant portion of this figure. This segment’s maturity means it requires minimal investment relative to its earnings, making it a reliable generator of free cash flow for the company.

- High Volume, Stable Demand: Manages dining for large corporations and industrial clients, ensuring consistent business.

- Consistent Revenue and Profitability: Generates predictable income and healthy profit margins due to established operations.

- Cash Generation: Significantly contributes to Elior's cash reserves with lower investment needs.

- Strategic Importance: Provides financial stability, allowing investment in other growth areas of the business.

Elior's established multiservices, particularly in its home market of France, function as significant cash cows. These operations, like cleaning and facility management, benefit from stable demand and mature market positions. In fiscal year 2023-2024, France accounted for over half of Elior's net sales, underscoring the financial strength derived from these mature segments.

The company's large-scale corporate dining management also falls into this category, providing consistent revenue streams from long-term contracts. These segments require less capital for expansion, allowing them to generate substantial and reliable cash flow. This dependable income is crucial for funding other strategic initiatives within the group.

| Segment | Market Position | Cash Flow Generation | Growth Outlook |

| French Contract Catering | Dominant, Mature | High, Stable | Low to Moderate |

| Multiservices (France) | Strong, Established | Consistent | Moderate |

| Corporate Dining Management | High Volume, Stable | Robust | Low |

What You See Is What You Get

Elior Group BCG Matrix

The BCG Matrix analysis of the Elior Group you are currently previewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive document, meticulously prepared by strategy experts, offers an in-depth look at Elior's business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs, all based on market share and growth rate. You can confidently expect this exact, analysis-ready file, free of watermarks or demo content, to be yours for immediate download and strategic application.

Dogs

Elior Group's temporary staffing services in France are currently positioned as a Dog in the BCG Matrix. This is due to an observed organic revenue retreat, signaling a decline in demand within this specific market segment.

The sub-segment exhibits characteristics of low market share coupled with declining growth, a common scenario for Dogs. This situation warrants a thorough strategic review, as it may be consuming valuable resources without generating sufficient returns for the company.

For instance, the broader French temporary staffing market experienced a contraction in demand in 2024, impacting players like Elior. This underperformance suggests the need for decisive action, potentially including divestiture, to reallocate capital towards more promising business areas.

Elior Group has experienced difficulties in certain markets, notably in Italy, where revenue saw a decrease following the non-renewal of key contracts. This situation reflects a position of low market share within potentially slow-growing or intensely competitive regional sectors, where these contracts act as resource drains rather than drivers of profitable expansion.

Elior Group might have legacy catering services, perhaps in sectors with declining demand like traditional corporate cafeterias in certain regions, that are now considered dogs. These services may be struggling to achieve profitability, potentially showing operating margins below the group's average or even negative returns, as seen in some mature markets where Elior operates.

Highly Competitive, Low-Margin Niche Catering

Highly competitive, low-margin niche catering segments within Elior Group's portfolio can be viewed as dogs in the BCG matrix. These are areas where Elior faces substantial competition, often from smaller, more agile players, leading to significant price pressure and thin profit margins. The lack of strong differentiation means that gaining substantial market share is a difficult and often unrewarding endeavor.

These segments typically exhibit sluggish growth and low profitability. For instance, in the broader contract catering market, which saw global revenues around $250 billion in 2023, smaller, highly fragmented niches like specialized event catering in less affluent regions might fit this description. Elior's presence in such areas, if it doesn't hold a leading position, would indicate a dog. The low returns make further investment questionable.

- Intense Price Competition: These niches force companies to compete primarily on price, eroding potential profits.

- Limited Differentiation: Services offered are often commoditized, making it hard to stand out and command premium pricing.

- Low Profitability: Margins are typically razor-thin, often in the low single digits, making significant returns difficult.

- Stagnant Growth: These segments rarely experience rapid expansion, offering little opportunity for substantial revenue increases.

Non-Core, Legacy Investments

Non-core, legacy investments within Elior Group's portfolio, as depicted by the BCG Matrix, represent historical ventures or smaller business segments that deviate from the company's primary focus on contract catering and strategic multiservices. These units typically exhibit both low market growth and a modest market share.

These "Dogs" are often candidates for divestment. By selling off these underperforming assets, Elior can unlock capital that can be strategically reinvested into business areas with higher growth potential and market dominance, thereby optimizing resource allocation and enhancing overall profitability. For instance, in 2024, Elior continued its strategic review of its portfolio, with a focus on divesting non-core activities to streamline operations and bolster investment in its core catering and services segments.

- Low Market Share: These legacy units typically hold a small percentage of their respective markets.

- Low Market Growth: The industries or segments these investments operate in are not experiencing significant expansion.

- Divestment Potential: They are often considered for sale to free up capital for more strategic initiatives.

- Capital Reallocation: Proceeds from divestment can be used to fund growth in "Stars" or "Cash Cows."

Elior Group's temporary staffing services in France are currently positioned as a Dog in the BCG Matrix, characterized by an observed organic revenue retreat and declining demand. This sub-segment exhibits low market share and declining growth, prompting a strategic review to potentially divest and reallocate capital. The broader French temporary staffing market experienced a contraction in demand in 2024, impacting players like Elior.

Non-core, legacy investments within Elior Group's portfolio, often smaller business segments deviating from their primary focus, also represent Dogs. These units typically exhibit low market growth and modest market share, making them candidates for divestment to unlock capital for reinvestment in higher-growth areas. In 2024, Elior continued its strategic review, focusing on divesting non-core activities to streamline operations.

| BCG Category | Elior Group Segment Example | Market Characteristics | Strategic Implication |

| Dogs | French Temporary Staffing | Low Market Share, Declining Growth (France) | Divestment or Harvest |

| Dogs | Legacy Catering Services (Declining Demand Sectors) | Low Market Share, Stagnant Growth, Intense Price Competition | Divestment or Harvest |

Question Marks

Elior Group's recent acquisitions in the Spanish cleaning market, finalized in October 2024, position these ventures as Question Marks in the BCG Matrix. Spain's cleaning sector is experiencing robust growth, and Elior is strategically investing to capture a larger share.

These new entities demand substantial capital infusion to achieve scale and market leadership, reflecting their high potential but also inherent uncertainty. For instance, the overall Spanish cleaning services market was projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% leading up to 2024, indicating a dynamic environment for these investments.

Emerging personalized nutrition and food tech solutions, like AI-driven meal planning and specialized dietary delivery services, represent a high-growth frontier. This sector is experiencing significant innovation, with market forecasts indicating substantial expansion in the coming years.

Elior Group's presence in these nascent, yet rapidly evolving, segments is likely minimal, reflecting their early-stage development. For instance, the global personalized nutrition market was valued at approximately $11.4 billion in 2023 and is projected to reach over $30 billion by 2028, demonstrating a compound annual growth rate (CAGR) exceeding 20%.

To capitalize on this potential, Elior would need to allocate significant resources towards research and development, strategic partnerships, and aggressive market entry strategies. This investment is crucial for establishing a foothold and transforming these emerging ventures into future market leaders, or stars, within Elior's portfolio.

Elior Group's expansion into untapped geographic markets presents a classic question mark in the BCG Matrix. While the company boasts strong positions in eleven countries, venturing into new, high-growth regions for contract catering where its presence is currently minimal requires substantial investment and a clear strategic roadmap. The success of such endeavors hinges on accurately assessing market potential and navigating local competitive landscapes.

These new market entries are capital-intensive, demanding significant upfront investment for infrastructure, talent acquisition, and brand building. For instance, entering a new continent might involve setting up regional offices, securing catering contracts, and adapting service offerings to local tastes and regulations. This makes them inherently riskier than strengthening existing market positions.

Elior's 2024 performance in its established markets, such as France and the UK, provides a benchmark for potential growth. However, the specific growth rates and competitive dynamics in nascent markets for contract catering, like parts of Southeast Asia or certain African nations, need thorough analysis. Without this granular data, these expansion plans remain speculative, hence their classification as question marks.

Development of Advanced Digital Client Platforms

Elior's strategic partnership with IBM, focusing on AI and data analytics, is poised to drive the creation of sophisticated digital client platforms. These platforms aim to revolutionize client interaction, streamline ordering processes, and enhance operational efficiency across Elior's services.

While the foodservice industry is experiencing significant growth in digital client solutions, Elior's current market share in providing these advanced, proprietary platforms is still in its nascent stages. This positions the development of these platforms as a key area for future investment and growth within Elior's BCG matrix.

- High Growth Potential: The digital transformation in foodservice is a rapidly expanding sector, with companies increasingly investing in technology to improve customer experience and operational workflows.

- Developing Market Share: Elior's investment in advanced digital platforms, leveraging AI and data, aims to capture a larger share of this growing market.

- Strategic Collaboration: The partnership with IBM provides the technological expertise necessary to build cutting-edge, client-centric digital solutions.

Innovative Concession Catering Formats

Elior Group's focus on innovative concession catering formats aligns with a strategic push into high-growth, underpenetrated markets. This involves exploring and investing in new concepts within dynamic sectors like leisure, travel, and retail, where expansion is rapid. These ventures represent significant capital outlays and strategic bets aimed at capturing future market share.

- Expansion into Emerging Travel Hubs: Elior is targeting airport and train station concessions in rapidly growing travel markets, aiming to leverage increased passenger traffic. For instance, airport passenger traffic globally saw a significant rebound in 2023, reaching 93.8% of 2019 levels, according to Airports Council International.

- Digital Integration in Retail Catering: The group is investing in technology to enhance the customer experience in retail environments, such as app-based ordering and loyalty programs. This digital push is crucial as e-commerce sales continued to grow, representing 21.4% of total retail sales in the US in Q4 2023.

- Partnerships for Unique Leisure Experiences: Elior is forming strategic alliances with entertainment venues and theme parks to offer bespoke catering solutions. The global theme park market was valued at approximately $51.4 billion in 2023 and is projected to grow further.

- Sustainable and Health-Conscious Offerings: A key innovation is the development of catering formats emphasizing locally sourced ingredients and healthy options, catering to growing consumer demand for sustainability. The market for healthy food is expanding, with plant-based food sales alone reaching over $8 billion in the US in 2023.

Elior Group's ventures into new geographic markets, such as potential expansion in Southeast Asia or Africa, are classic Question Marks. These require significant investment for infrastructure and market adaptation, making them inherently riskier than established operations.

The development of advanced digital client platforms, powered by AI and data analytics through their IBM partnership, also falls into the Question Mark category. While the foodservice industry is rapidly digitizing, Elior's market share in proprietary, advanced platforms is still developing.

Innovations in concession catering formats, particularly in emerging travel hubs and retail environments, represent further Question Marks. These capitalize on growing passenger traffic and e-commerce trends, but require substantial capital for new concepts and digital integration.

The company's acquisitions in the Spanish cleaning market in late 2024 are also classified as Question Marks. Spain's cleaning sector is growing, but these new entities need considerable investment to scale and achieve market leadership.

| Venture Category | Market Growth | Elior's Market Share | Investment Needs | BCG Classification |

| New Geographic Markets | High (e.g., emerging travel hubs) | Low/Nascent | High | Question Mark |

| Digital Client Platforms | High (digital foodservice) | Developing | High | Question Mark |

| Innovative Concession Formats | High (travel, retail) | Developing | High | Question Mark |

| Spanish Cleaning Acquisitions | Moderate (4.5% CAGR projected) | Developing | High | Question Mark |

BCG Matrix Data Sources

Our Elior Group BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry growth forecasts to provide an accurate strategic overview.