E-L Financial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

E-L Financial Bundle

E-L Financial's SWOT analysis reveals a company with significant market opportunities and a strong brand reputation. However, it also highlights potential challenges related to evolving regulatory landscapes and competitive pressures.

Want the full story behind E-L Financial's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

E-L Financial Corporation Limited boasts a diversified business model, primarily through its subsidiary Empire Life. This structure allows it to offer a comprehensive suite of financial services, including life insurance, health benefits, and wealth management. This broad offering reduces dependence on any single product line, creating a more resilient revenue base.

Beyond its insurance and wealth management arms, E-L Financial also manages a significant portfolio of public and private investments. This dual focus on stable financial services and opportunistic investment activities provides multiple avenues for growth and capital appreciation. For instance, as of the first quarter of 2024, Empire Life's assets under management reached $29.5 billion, showcasing the scale of its investment operations.

Empire Life, a significant part of E-L Financial, demonstrates a consistently strong capital position. Its Life Insurance Capital Adequacy Test (LICAT) total ratio has remained robust, significantly exceeding regulatory benchmarks.

For example, the LICAT ratio was reported at 151% as of December 31, 2024, and continued to be strong at 140% by March 31, 2025, and 142% at June 30, 2025. This sustained high ratio highlights a solid financial foundation, enabling the company to comfortably absorb potential financial stresses and supporting its ongoing business expansion efforts.

Empire Life's financial performance has been robust, with common shareholders' net income jumping 80% to $281 million for the full year 2024. This strong showing continued into the first quarter of 2025, where net income reached $70 million. These results were bolstered by favorable investment and insurance finance outcomes, alongside improved insurance service results.

Exceptional Investment Returns from E-L Corporate

The E-L Corporate segment has demonstrated exceptional investment performance, a significant strength for E-L Financial. In fiscal year 2024, this segment was a major contributor to the company's consolidated net income, posting record investment gains. This success highlights the effectiveness of their strategic investment approach.

The segment's global investment portfolio delivered a robust pre-tax total return of 26% in 2024. This impressive figure underscores the skill and strategic acumen employed in managing these assets.

- Record Investment Gains: E-L Corporate's performance in fiscal year 2024 led to record investment gains, boosting overall company profitability.

- Strong Portfolio Returns: The segment's global investment portfolio achieved a 26% pre-tax total return in 2024, demonstrating superior asset management.

- Capital Appreciation Driver: These high investment returns are crucial for E-L Financial's long-term capital appreciation goals and enhancing shareholder value.

Commitment to Shareholder Returns

E-L Financial consistently prioritizes shareholder value, a commitment underscored by its proactive capital management strategies. The company declared regular quarterly dividends throughout fiscal year 2024, demonstrating a steady return of profits to investors. Furthermore, a special dividend was approved in fiscal year 2024, reflecting the company's robust financial performance and confidence in its future earnings.

Further solidifying its shareholder-friendly approach, E-L Financial executed a significant 100-for-1 share split in May 2025. This move aims to increase the accessibility and liquidity of its stock for a broader investor base. The company also actively manages its capital through an automatic share purchase plan, signaling an ongoing dedication to enhancing shareholder returns and efficient capital allocation.

E-L Financial's strengths lie in its diversified business model, anchored by Empire Life's comprehensive offerings in insurance and wealth management, which creates a stable revenue base. The company's robust capital position, exemplified by Empire Life's consistently high LICAT ratios (151% at end-2024, 140% at Q1 2025, and 142% at Q2 2025), provides a solid foundation for growth and risk absorption.

Empire Life's strong financial performance, with common shareholders' net income increasing 80% to $281 million in 2024 and $70 million in Q1 2025, highlights operational efficiency and favorable market conditions. The E-L Corporate segment's exceptional investment performance, including a 26% pre-tax total return on its global portfolio in 2024, significantly contributes to the company's profitability and capital appreciation.

E-L Financial demonstrates a strong commitment to shareholder value through consistent dividend payouts and a 100-for-1 share split in May 2025, enhancing stock liquidity and accessibility. These combined strengths position E-L Financial for sustained growth and resilience in the financial services sector.

What is included in the product

Delivers a strategic overview of E-L Financial’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Simplifies complex financial data into actionable SWOT insights, reducing confusion and enabling clearer strategic direction.

Weaknesses

The E-L Corporate segment's performance, while strong in 2024, exhibits significant volatility. This segment is highly susceptible to market fluctuations, impacting its investment returns. For instance, E-L Corporate reported a net loss on investments of $70 million in Q1 2025, a stark contrast to a substantial net gain in Q1 2024.

Furthermore, the segment experienced a decline in net income in Q4 2024 when compared to the same period in 2023. This reliance on market-driven investment gains introduces an element of unpredictability to E-L Financial's overall consolidated results, posing a challenge for consistent financial planning.

E-L Financial's profitability is notably sensitive to shifts in interest rates, impacting both its investment and insurance finance segments. For instance, in the second quarter of 2025, the company observed a decline in these results, attributed to moderately unfavorable interest rate increases. This sensitivity means that fluctuations in the economic landscape can directly affect the company's bottom line and complicate financial forecasting.

The first quarter of 2025 also highlighted this vulnerability, as E-L Financial experienced a mix of positive and negative effects stemming from interest rate changes when compared to the prior year. Such volatility underscores a key weakness, as it introduces an element of unpredictability into financial performance, potentially hindering long-term strategic planning and capital management for both its insurance operations and investment portfolios.

E-L Financial experienced a slight dip in its net equity value per common share, falling to $23.29 as of June 30, 2025, from $23.36 at the close of 2024. This marginal decrease, though seemingly small, warrants attention as a potential indicator of challenges in consistently growing shareholder value over the long term. It suggests that even with overall increases in consolidated net income, the value attributed to each individual share faced some pressure.

Rising Operating Expenses

Empire Life has experienced a notable uptick in its operating expenses. For instance, Q1 2025 saw higher workforce costs to fuel business expansion. This trend continued into Q2 2025 with an increase in total other expenses.

While some of these rising costs are directly linked to strategic growth initiatives, a sustained increase in operational expenditures could potentially squeeze profit margins if not closely monitored and controlled. Effective expense management becomes crucial for maintaining financial efficiency.

- Increased Workforce Costs: Q1 2025 saw higher expenses related to staffing to support business growth.

- Rising Other Expenses: Q2 2025 indicated an overall increase in total other operating expenses.

- Margin Compression Risk: Persistent cost increases could negatively impact profitability if not offset by revenue growth or efficiency gains.

- Need for Expense Management: Proactive cost control measures are essential to ensure financial health and operational efficiency.

Adverse Claims Experience in Insurance Segment

Empire Life's insurance segment faced headwinds in 2024, with a notable dip in net insurance service results. This was largely driven by unfavorable claims experience across both individual insurance and group solutions. While stronger expense management helped to cushion the blow, a persistent pattern of higher-than-expected claims poses a risk to the core insurance business's profitability and overall stability.

- Adverse Claims Impact: Net insurance service results for Empire Life decreased in 2024 due to higher claims in individual and group insurance.

- Profitability Risk: Continued unfavorable claims trends could negatively affect the profitability of the company's foundational insurance operations.

- Underwriting Challenges: This situation underscores the inherent volatility and risks associated with insurance underwriting and claims handling processes.

E-L Financial's reliance on market performance creates inherent volatility, as seen with the Corporate segment's $70 million net investment loss in Q1 2025, a sharp reversal from Q1 2024 gains. This sensitivity to market swings and interest rate fluctuations, which impacted Q2 2025 results due to moderately unfavorable rate increases, poses a significant weakness for consistent financial planning and capital management.

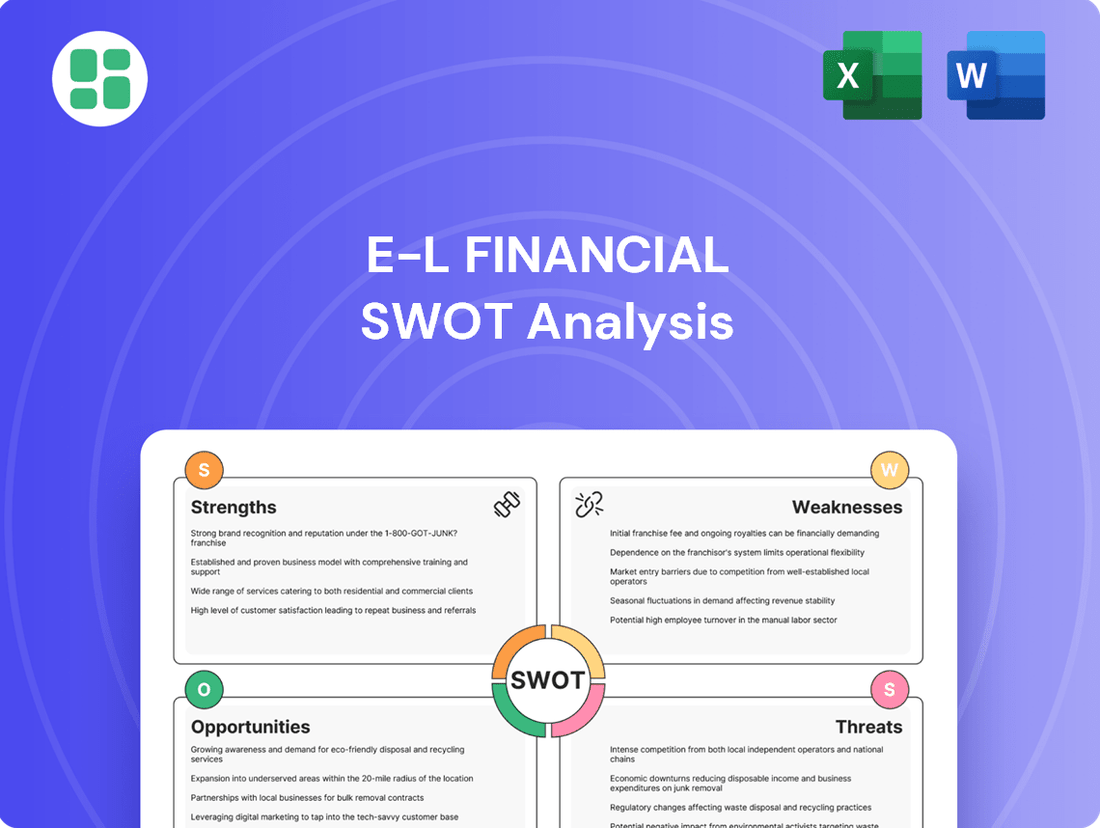

Preview Before You Purchase

E-L Financial SWOT Analysis

This is the actual E-L Financial SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You’re seeing the exact content that will be delivered, ensuring transparency and value. Invest with confidence knowing you’re getting the real deal.

Opportunities

The Canadian life insurance market is booming, with new annualized premiums hitting a record high in 2024. This surge is largely thanks to the popularity of whole life and universal life insurance policies. This presents a prime opportunity for Empire Life to expand its customer base and capture a larger slice of this growing market.

The sustained demand for permanent life insurance products, which offer lifelong coverage and cash value growth, creates a stable environment for continued premium increases. Empire Life can leverage this trend by focusing on its permanent product offerings to ensure long-term revenue streams and market relevance.

Canada's millionaire population saw a notable increase in 2024, with estimates suggesting a continued upward trend. This burgeoning wealth base, coupled with the anticipated intergenerational transfer of substantial assets, creates a fertile ground for wealth management services.

Empire Life, through E-L Financial, is well-positioned to capitalize on this growth. The firm can leverage its wealth management products to attract this expanding segment of high-net-worth individuals, aiming to significantly boost its assets under management.

Meeting the specific demands of younger, affluent clients, such as their embrace of digital platforms and interest in alternative investments, will be crucial for E-L Financial's success in this evolving market.

The financial services sector is rapidly embracing digital transformation, presenting a significant opportunity for E-L Financial to elevate its customer interactions and operational efficiency. By integrating cutting-edge fintech solutions, the company can unlock new avenues for innovative digital product development.

Harnessing technologies like artificial intelligence and advanced data analytics offers a pathway to boost operational effectiveness, craft highly personalized client offerings, and expand market penetration. For instance, the global fintech market was valued at approximately $110 billion in 2023 and is projected to grow substantially, indicating a strong demand for digital financial services.

While navigating the regulatory landscape is crucial, a strategic embrace of these technological advancements can solidify E-L Financial's competitive standing. Companies that effectively leverage AI in financial services are seeing significant gains; a 2024 report indicated that AI adoption in finance can lead to cost reductions of up to 30%.

Product Innovation and Market Expansion

Empire Life's recent launches, including segregated fund portfolios and the First Home Savings Account, signal a strong capacity for product innovation. These early successes highlight the company's ability to adapt to changing customer demands and tap into new markets. For instance, the segregated fund market in Canada saw significant growth in 2024, with assets under management increasing by approximately 8% year-over-year, indicating a receptive market for such offerings.

This innovative approach creates a clear pathway for further product development and market expansion. By continuing to introduce diverse financial solutions, Empire Life can solidify its competitive edge and unlock new avenues for revenue generation. The company's strategic focus on these areas is expected to contribute to its growth trajectory through 2025.

- Segregated Fund Market Growth: Canadian segregated fund assets grew by roughly 8% in 2024, demonstrating market receptiveness.

- FHSA Launch Success: The introduction of the First Home Savings Account aligns with government initiatives and addresses a key consumer need.

- Diversification Strategy: Expanding product offerings beyond traditional insurance can attract a broader client base.

- Revenue Potential: New products cater to evolving financial needs, offering significant future revenue growth opportunities.

Strategic Mergers and Acquisitions

The wealth management sector is anticipated to experience a surge in merger and acquisition (M&A) activity throughout 2024 and 2025. This heightened M&A trend is largely attributed to a more stable macroeconomic outlook and the ongoing need for consolidation within the industry.

For E-L Financial, this presents a significant strategic opening. The company can leverage this environment to acquire businesses that complement its existing services, thereby broadening its market reach. Furthermore, strategic acquisitions can introduce new technological capabilities or achieve greater operational efficiencies through economies of scale.

- Market Consolidation: The wealth management industry saw approximately $100 billion in assets change hands through M&A in 2023, a figure expected to grow in 2024-2025.

- Capability Expansion: Acquiring firms with specialized digital platforms or unique investment strategies can enhance E-L Financial's service offerings.

- Scale Economies: Integrating acquired entities can lead to cost savings in areas like technology, compliance, and back-office operations, improving profitability.

The increasing demand for permanent life insurance, like whole and universal life policies, offers Empire Life a chance to expand its customer base, as annualized premiums reached a record high in 2024. This trend, coupled with Canada's growing millionaire population and anticipated intergenerational wealth transfer, creates fertile ground for wealth management services, boosting assets under management.

Digital transformation in financial services presents a significant opportunity for E-L Financial to enhance customer interactions and operational efficiency through fintech solutions. Leveraging AI and data analytics can improve effectiveness and personalize offerings, as the global fintech market, valued at around $110 billion in 2023, shows strong demand for digital financial services.

Empire Life's recent product innovations, such as segregated funds and the First Home Savings Account, demonstrate adaptability to evolving customer needs, with segregated fund assets growing approximately 8% in 2024. This innovative approach allows for further product development and market expansion, contributing to growth through 2025.

The wealth management sector's anticipated M&A activity in 2024-2025, with an estimated $100 billion in assets changing hands in 2023, provides E-L Financial a strategic opening to acquire complementary businesses, expand capabilities, and achieve economies of scale.

| Opportunity Area | 2024/2025 Data Point | Impact on E-L Financial |

|---|---|---|

| Permanent Life Insurance Demand | Record annualized premiums in 2024 | Customer base expansion, increased market share |

| Wealth Growth | Rising millionaire population, intergenerational transfer | Growth in wealth management AUM |

| Digital Transformation | Global fintech market ~$110B (2023) | Enhanced customer experience, operational efficiency |

| Product Innovation | Segregated fund assets up ~8% in 2024 | New revenue streams, competitive edge |

| M&A in Wealth Management | ~$100B assets in M&A (2023) | Strategic acquisitions, capability expansion |

Threats

E-L Financial's substantial investment holdings, especially within its E-L Corporate division, face considerable risk from economic downturns and market swings. For instance, the S&P 500 experienced a notable decline of over 18% in 2022, a stark reminder of how quickly market sentiment can shift and impact portfolio values.

Factors like ongoing geopolitical instability, elevated U.S. stock market valuations, and general global economic uncertainty, as frequently cited in financial analyses throughout 2024 and early 2025, could significantly curb investment returns or even result in substantial losses. This directly affects E-L Financial's overall profitability and its equity valuation.

Prolonged periods of adverse market conditions pose a direct threat to E-L Financial's long-term strategy of capital appreciation. Should these conditions persist, the company's ability to meet its growth objectives and maintain its financial strength will be severely tested.

The Canadian life insurance market is a crowded space, with established giants like Manulife, Sun Life, and Canada Life dominating. This consolidation means intense rivalry for customers, particularly in sought-after products such as participating whole life insurance, where market share battles are fierce.

Beyond traditional insurers, the wealth management arena is equally competitive. Banks with their extensive client bases, a growing number of independent financial advisors, and disruptive fintech startups are all vying for investor dollars.

This heightened competition can squeeze profit margins and make client acquisition and retention a significant challenge. For E-L Financial, staying ahead requires constant innovation and a clear strategy to stand out from the crowd.

The financial services sector, including insurance, is heavily regulated, meaning E-L Financial, or Empire Life, faces constant risk from evolving rules. While Empire Life's capital position remains robust, new regulatory requirements or higher compliance expenses could squeeze profits and limit how easily they can operate. For instance, as of Q1 2024, the Office of the Superintendent of Financial Institutions (OSFI) in Canada continued to emphasize strong capital buffers, but any shifts towards more stringent solvency or reporting standards could increase operational costs.

Potential policy shifts, especially concerning trade, taxation, and financial regulations emanating from key international markets like the United States, can introduce significant volatility. These external policy changes can directly impact E-L Financial's compliance obligations and overall business environment, potentially leading to increased administrative burdens and unforeseen costs in navigating these new landscapes.

Rising Inflation and Operational Costs

Inflationary pressures are a significant threat, directly impacting E-L Financial's operational expenses. Increased costs for technology, reinsurance, and general administration can erode profit margins. For instance, in Canada, life insurance prices are projected to rise in 2025, driven by inflation and demographic shifts, which could dampen consumer demand and affordability.

This challenging economic climate forces insurers to navigate a dual pressure: rising input costs and potentially reduced sales volumes. Maintaining profitability becomes more difficult as the cost of doing business escalates.

- Increased operational expenses: Higher costs for technology, reinsurance, and administrative functions.

- Potential for reduced product affordability: Rising life insurance prices in Canada (expected in 2025) may deter consumers.

- Erosion of profit margins: The combination of increased costs and potentially lower demand creates a profitability squeeze.

Technological Disruption and Cybersecurity Risks

Rapid technological advancements, especially in AI and digital platforms, present a significant challenge. New fintech companies leveraging these technologies can quickly disrupt established players like E-L Financial by offering more agile and customer-centric solutions. For instance, by mid-2024, the global fintech market was projected to reach over $33 billion, indicating substantial growth and competitive pressure.

Cybersecurity risks are an ever-present and escalating threat. Sophisticated cyberattacks, targeting sensitive client data and critical operational infrastructure, could lead to severe financial losses and irreparable reputational damage for E-L Financial. In 2023 alone, the average cost of a data breach in the financial sector reached approximately $5.9 million, highlighting the potential financial impact.

The combination of technological disruption and cybersecurity threats creates a complex risk landscape. E-L Financial must continuously invest in and adapt its technological infrastructure and security protocols to stay ahead of emerging threats and maintain customer trust. Failure to do so could result in a loss of market share and a significant decline in customer confidence.

Key considerations for E-L Financial include:

- Adapting to AI-driven innovations: Integrating AI for enhanced customer service, risk management, and operational efficiency to counter fintech disruption.

- Strengthening cybersecurity defenses: Implementing advanced threat detection and response systems, with cybersecurity spending in the financial sector expected to increase by 10-15% annually through 2025.

- Protecting sensitive data: Ensuring robust data encryption and compliance with evolving data privacy regulations to maintain customer trust.

- Monitoring fintech landscape: Proactively identifying and responding to new fintech entrants and their disruptive business models.

E-L Financial operates within a highly competitive Canadian financial services landscape, facing pressure from established insurers and a growing number of wealth management firms, including banks and fintech startups. This intense rivalry can impact profit margins and client acquisition, necessitating continuous innovation to maintain market position.

The company is also exposed to significant regulatory risks. Evolving rules and compliance requirements, as emphasized by Canadian regulators like OSFI through early 2025 regarding capital buffers, could increase operational costs and potentially restrict business flexibility.

Economic headwinds, including inflation and potential market downturns, pose a threat to investment returns and operational expenses. For instance, rising life insurance prices in Canada, projected for 2025 due to inflation, could reduce consumer demand.

Technological disruption and escalating cybersecurity threats are also critical concerns. The rapid growth of fintech, with the global market projected to exceed $33 billion by mid-2024, coupled with increasing data breach costs (averaging $5.9 million in the financial sector in 2023), demands substantial investment in security and adaptation.

SWOT Analysis Data Sources

This E-L Financial SWOT analysis is built upon a robust foundation of data, including audited financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.