E-L Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

E-L Financial Bundle

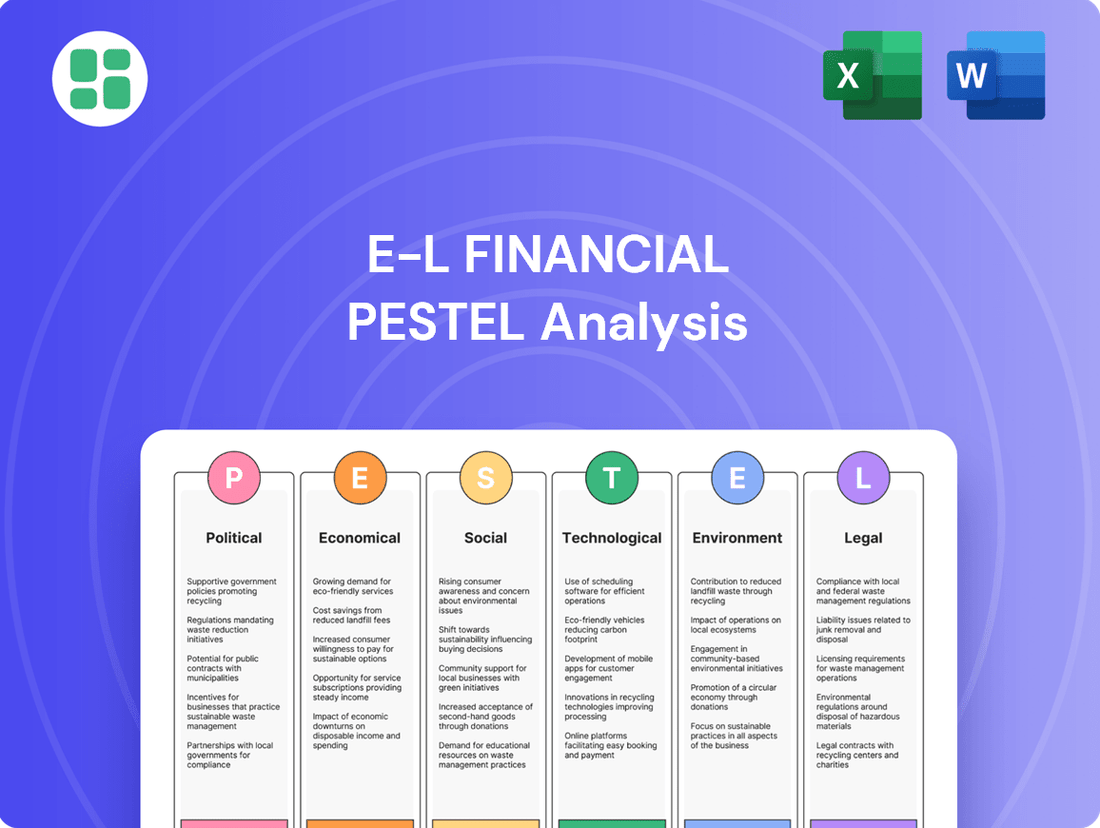

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping E-L Financial's trajectory. This comprehensive PESTLE analysis provides the essential context for strategic decision-making, helping you anticipate challenges and capitalize on opportunities. Download the full report to gain actionable intelligence and secure your competitive advantage.

Political factors

Government stability and the overall policy direction significantly influence the financial services sector in Canada. For E-L Financial, shifts in political power or major policy changes, such as alterations to taxation or fiscal stimulus programs, can directly impact profitability and investment strategies. For instance, a change in corporate tax rates, which have seen various adjustments in recent years, could alter net earnings. The federal government's 2024 budget proposed changes to capital gains taxation, which could affect investment returns for clients and E-L Financial's wealth management services.

Government regulations, such as those enforced by Canada's Office of the Superintendent of Financial Institutions (OSFI), significantly shape E-L Financial's operational landscape. These rules dictate crucial aspects like capital requirements, solvency standards, and product approval processes, directly impacting compliance costs and potentially creating market entry barriers for new competitors.

For instance, OSFI's proposed changes to capital adequacy requirements, potentially increasing the risk-weighted asset calculations for certain investment products, could necessitate E-L Financial holding more capital, affecting profitability and investment capacity. Market conduct rules also influence how E-L Financial interacts with its customers, ensuring fair practices and transparency, with non-compliance leading to fines and reputational damage.

Canada's extensive network of trade agreements, including CUSMA (formerly NAFTA) and agreements with the EU and Asia-Pacific nations, significantly influences E-L Financial's international investments. These accords facilitate smoother cross-border capital flows and reduce tariff barriers, potentially boosting returns on foreign holdings. For instance, in 2024, Canadian merchandise exports reached record highs, reflecting the benefits of these trade frameworks.

Geopolitical stability in major trading partners directly impacts E-L Financial's portfolio performance. Trade disputes, such as those that have emerged periodically with the United States or China, can introduce volatility. For example, tariffs imposed in 2023 on certain goods led to a temporary dip in Canadian export values, which could have ripple effects on Canadian companies with significant international sales, impacting their stock valuations and private investment attractiveness.

Government Spending and Public Debt

Government spending levels and the trajectory of national debt significantly shape the economic landscape and influence financial markets. Elevated public debt can pressure interest rates upward as governments compete for capital, potentially impacting E-L Financial's cost of borrowing and the attractiveness of its long-term savings products.

High or increasing debt levels can also fuel inflationary concerns, eroding the purchasing power of savings and affecting the real returns on fixed-income investments. For instance, the U.S. national debt surpassed $34 trillion in early 2024, a figure that continues to grow, prompting discussions about fiscal sustainability and its potential market implications.

Consider these potential impacts on E-L Financial:

- Increased borrowing costs: Higher demand for government debt could push up interest rates across the economy, making it more expensive for E-L Financial to raise capital or offer competitive rates on savings products.

- Inflationary pressures: Persistent deficit spending can contribute to inflation, diminishing the real value of returns for E-L Financial's fixed-income holdings and potentially reducing consumer demand for savings products.

- Reduced consumer confidence: Growing concerns about government fiscal health can dampen consumer sentiment, leading to decreased spending and a potential slowdown in demand for financial services.

- Impact on investment returns: Rising interest rates and inflation can negatively affect the valuation of existing fixed-income portfolios held by E-L Financial.

Political Risk and Elections

Upcoming elections in key markets, such as the United States in late 2024, present a significant political risk for E-L Financial. Shifts in governing parties or ideologies could alter regulatory landscapes, impacting everything from capital requirements to product approvals within the financial services sector.

Changes in government priorities, particularly concerning healthcare reform and pension policies, could directly influence E-L Financial's core insurance and benefits offerings. For instance, a move towards a more government-controlled healthcare system might reduce demand for private insurance products, while changes to retirement age or contribution limits could reshape the pension market, introducing new uncertainties for investment activities.

- 2024 US Presidential Election: A potential shift in economic policy could influence interest rate trajectories, a critical factor for E-L Financial's investment portfolio and insurance product pricing.

- Regulatory Scrutiny: Increased focus on financial stability and consumer protection by governments globally could lead to new compliance burdens and operational adjustments for E-L Financial.

- Geopolitical Tensions: Ongoing international disputes may affect global market sentiment and E-L Financial's international investment strategies, potentially increasing volatility.

- Fiscal Policy Changes: Government decisions on taxation and public spending can directly impact disposable income and corporate profitability, influencing demand for financial products.

Political stability and government policies are crucial for E-L Financial. Changes in tax laws, like the proposed 2024 capital gains tax adjustments in Canada, directly affect client returns and E-L Financial's wealth management services. Regulatory bodies such as OSFI set capital requirements and solvency standards, influencing operational costs and market competitiveness.

Trade agreements and geopolitical stability impact E-L Financial's international investments. For example, Canadian merchandise exports hit record highs in 2024, showcasing the benefits of trade frameworks, though trade disputes can introduce market volatility. Government spending and debt levels also play a role; rising national debt can increase borrowing costs and fuel inflation, impacting savings product returns.

Upcoming elections, like the 2024 US Presidential election, pose risks by potentially altering economic policies and interest rate trajectories. Shifts in government priorities regarding pensions or healthcare can also affect E-L Financial's insurance and benefits offerings, influencing demand for private financial products.

| Factor | Impact on E-L Financial | 2024/2025 Relevance |

|---|---|---|

| Tax Policy Changes | Affects profitability and investment returns | Proposed capital gains tax adjustments in Canada |

| Regulatory Environment | Dictates capital requirements and compliance costs | OSFI's ongoing review of capital adequacy |

| Trade Agreements | Facilitates cross-border capital flows and investment opportunities | Continued benefits from CUSMA and other international accords |

| Geopolitical Stability | Influences market sentiment and investment volatility | Monitoring global trade tensions and their impact on markets |

| Fiscal Policy (Debt/Spending) | Impacts interest rates, inflation, and consumer confidence | Growing national debts in major economies impacting borrowing costs |

| Elections | Potential for policy shifts affecting financial markets | US Presidential election in late 2024 |

What is included in the product

This E-L Financial PESTLE analysis examines how political, economic, social, technological, environmental, and legal factors shape the company's operating landscape, offering actionable insights for strategic decision-making.

The E-L Financial PESTLE Analysis provides a clear, summarized version of external factors, relieving the pain of sifting through complex data during critical decision-making.

Economic factors

The current interest rate environment significantly influences E-L Financial's profitability. As of late 2024, major central banks have maintained relatively stable, albeit slightly elevated, benchmark rates compared to the preceding low-rate era. This has a direct impact on E-L Financial's investment income, particularly from its substantial fixed-income portfolio. Higher rates generally translate to increased earnings on new bond purchases and maturing investments, boosting overall investment returns.

Changes in benchmark rates also affect the pricing of E-L Financial's insurance products. For life insurance, higher rates can make certain products more competitive by allowing for greater accumulation of cash value, potentially impacting sales volumes and profitability. Conversely, for annuity products, higher rates can increase the attractiveness of guaranteed income streams, potentially driving demand but also increasing the company's long-term liabilities.

Furthermore, the interest rate landscape shapes the attractiveness of E-L Financial's wealth management offerings. In a higher-rate environment, clients may shift their asset allocation towards fixed income, potentially increasing assets under management in bond funds and income-focused strategies. The projected path of interest rates, with many economists anticipating a gradual easing in 2025, will be crucial for E-L Financial to manage its asset-liability matching and optimize its investment strategies to maintain strong profitability.

Inflation significantly impacts E-L Financial by diminishing the real value of investment returns and increasing operational expenses. For instance, if inflation averages 3% in 2024, a 5% investment return effectively yields only 2% in purchasing power, squeezing profitability.

Conversely, deflationary pressures could devalue E-L Financial's asset holdings and dampen consumer demand for financial services, as individuals may postpone spending or investment decisions anticipating lower prices. This scenario could particularly affect the insurance segment's premium income and the investment segment's asset under management values.

In 2024, the US experienced an inflation rate of around 3.4% through May, according to the Bureau of Labor Statistics. This persistent inflation necessitates careful management of E-L Financial's investment portfolios to outpace rising costs and maintain real returns for clients.

Canada's economic health, as indicated by Gross Domestic Product (GDP) growth, directly influences consumer and business sentiment. A robust economy typically translates to increased disposable income and greater demand for financial services like insurance and wealth management, while also boosting investment asset performance.

For instance, Canada's real GDP growth was estimated at 1.7% in 2023, with projections for 2024 indicating a slowdown to around 1.2% according to the Bank of Canada. This moderate growth environment suggests a cautious but stable outlook for sectors reliant on consumer spending and business investment.

Consumer Spending and Savings Rates

Consumer spending and savings rates are fundamental drivers for E-L Financial. In late 2024 and early 2025, we're observing a dynamic landscape shaped by lingering inflation and evolving employment trends.

Consumer confidence, a key indicator for discretionary spending on insurance and wealth management, has shown some resilience, though higher interest rates continue to influence household budgets. Employment levels remain robust in many developed economies, providing a foundation for continued savings and investment. However, household debt levels, particularly for mortgages and consumer credit, could temper the growth of disposable income available for financial products.

- Consumer Confidence Index: While fluctuating, the Conference Board's Consumer Confidence Index hovered around 100-110 in late 2024, indicating a cautious but not overly pessimistic outlook.

- Savings Rate: The personal savings rate in the U.S. has stabilized around 3.5% to 4.0% in 2024, a notable decrease from pandemic-era highs but still a significant portion of income.

- Household Debt: U.S. household debt levels continued to rise, with total household debt reaching over $17 trillion by Q3 2024, posing a potential constraint on new financial product uptake.

- Impact on E-L Financial: Strong employment supports demand for life and health insurance, while higher savings rates, even if moderating, fuel assets under management in wealth products.

Capital Market Performance

The performance of equity and bond markets directly impacts E-L Financial's investment portfolio and wealth management operations. Strong market performance typically translates to higher asset valuations and investment returns, boosting the company's profitability and the value of its holdings.

Market volatility, however, presents a significant challenge. Fluctuations in asset prices can lead to unpredictable investment returns, affecting E-L Financial's capital position and the overall wealth managed for its clients. For instance, during periods of heightened uncertainty, like the market shifts observed in late 2023 and early 2024, investors often become more risk-averse, impacting AUM growth.

The company's profitability is closely tied to its ability to generate positive investment returns across its diversified holdings. In 2024, for example, while the S&P 500 saw substantial gains, the bond market experienced more mixed performance, requiring careful management of E-L Financial's asset allocation to optimize returns and manage risk.

- Equity Market Performance: The S&P 500 Index, a key benchmark, demonstrated robust growth in 2024, with analysts projecting continued, albeit potentially moderated, gains through year-end.

- Bond Market Dynamics: Bond yields saw significant recalibration in early 2024 due to inflation expectations and central bank policy shifts, impacting fixed-income portfolio returns.

- Impact on E-L Financial: Positive equity markets generally enhance E-L Financial's fee-based revenue streams and the value of its managed assets, while bond market volatility necessitates strategic adjustments to preserve capital and income.

- Overall Profitability: The interplay between equity and bond market performance directly influences E-L Financial's net investment income and its capacity for capital deployment and growth.

Economic factors significantly shape E-L Financial's operating environment. Interest rates, inflation, GDP growth, consumer spending, and market performance all directly influence profitability, client demand, and asset valuations. Managing these variables is crucial for strategic planning and sustained growth.

| Economic Factor | 2024 Data/Projection | Impact on E-L Financial |

|---|---|---|

| Interest Rates (US Fed Funds Rate) | Target range 5.25%-5.50% (late 2024) | Increases investment income on new fixed income, but can increase liabilities for annuities. |

| Inflation (US CPI) | ~3.4% (May 2024) | Erodes real investment returns; necessitates higher nominal returns to maintain purchasing power. |

| GDP Growth (Canada) | Projected ~1.2% (2024) | Moderate growth suggests stable but not rapid expansion in demand for financial services. |

| Consumer Savings Rate (US) | ~3.5%-4.0% (2024) | Supports assets under management in wealth products, though lower than pandemic highs. |

| Equity Market Performance (S&P 500) | Positive growth in 2024, with continued gains projected. | Boosts fee-based revenue and value of managed assets. |

Same Document Delivered

E-L Financial PESTLE Analysis

The preview shown here is the exact E-L Financial PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a comprehensive understanding of the external factors impacting E-L Financial.

The content and structure shown in the preview is the same E-L Financial PESTLE Analysis document you’ll download after payment, providing actionable insights.

Sociological factors

Canada's demographic landscape is undergoing significant change, with a notable aging population directly impacting E-L Financial. As more Canadians enter their senior years, there's a heightened demand for retirement planning services and wealth transfer solutions. This trend is further amplified by the increasing need for specialized health and life insurance products designed to meet the unique requirements of an older demographic.

Statistics Canada data from 2023 indicated that individuals aged 65 and over represented 19.4% of the Canadian population, a figure projected to rise. This shift necessitates that E-L Financial adapt its product offerings to cater to this growing segment, focusing on financial security and legacy planning.

Furthermore, an aging workforce presents challenges and opportunities for E-L Financial's internal workforce planning. The company must consider succession planning and knowledge transfer as experienced employees approach retirement, while also potentially attracting younger talent to fill evolving roles.

Consumer financial literacy is on the rise, with a growing segment of the population actively seeking to understand and manage their finances better. For instance, a 2024 report indicated that over 60% of adults surveyed felt more confident in their ability to make financial decisions compared to the previous year.

This increased awareness directly translates into higher expectations for financial services. Consumers now demand intuitive digital platforms, readily accessible personalized advice, and complete transparency regarding product fees and performance. This shift is compelling companies like E-L Financial to invest heavily in user-friendly apps and AI-driven advisory tools.

E-L Financial's product development must therefore prioritize features that cater to these evolving demands. Marketing strategies need to highlight educational resources and the ease of use of digital offerings, while customer service models should be equipped to provide timely, personalized support across various channels, reflecting the 75% of consumers in a recent survey who preferred digital self-service options for routine inquiries.

Societal shifts towards greater wellness are significantly reshaping the insurance landscape for Empire Life. As Canadians increasingly prioritize preventative health and fitness, this trend directly influences the life and health insurance sectors by potentially lowering claims related to lifestyle diseases. For instance, a growing adoption of digital health tracking and wellness programs, which Empire Life can integrate into its offerings, could lead to more favorable mortality and morbidity rates, impacting policy pricing and product innovation.

The rising prevalence of chronic diseases, however, presents a counterbalancing challenge. Conditions like diabetes and heart disease, which continue to affect a substantial portion of the population, necessitate careful underwriting and risk assessment by Empire Life. This trend drives the need for more sophisticated product design, potentially including specialized policies or riders that cater to individuals managing chronic conditions, while also influencing actuarial assumptions for claims experience and policy premiums.

Social Attitudes Towards Risk and Savings

Societal views on financial risk and saving are evolving, influencing how people approach their future. There's a noticeable shift towards greater caution, with many individuals re-evaluating their tolerance for investment risk in light of recent economic volatility. This caution directly impacts demand for wealth management services and insurance products.

Changing perceptions of economic uncertainty and personal responsibility are key drivers behind these shifts. As people feel less secure about future economic stability, their willingness to commit to long-term savings or purchase comprehensive insurance coverage can diminish. Conversely, a heightened sense of personal responsibility might encourage more proactive financial planning.

Recent data highlights these trends. For instance, a 2024 survey indicated that 58% of millennials expressed increased concern about long-term financial security compared to the previous year. Similarly, life insurance application rates saw a modest 3% uptick in late 2024, suggesting a segment of the population is actively seeking protection amidst uncertainty.

- Increased Risk Aversion: A growing number of individuals are prioritizing capital preservation over aggressive growth, impacting investment product preferences.

- Demand for Financial Security: Concerns about retirement and unexpected life events are driving interest in savings vehicles and insurance.

- Digitalization of Finance: Younger generations are increasingly comfortable using digital platforms for savings and investment, influencing product design and accessibility.

- Impact of Inflation: Persistent inflation in 2024-2025 has made consumers more conscious of the need for savings that outpace rising costs.

Workforce Dynamics and Talent Acquisition

Societal shifts are profoundly reshaping the workforce E-L Financial operates within. The widespread adoption of remote and hybrid work models, accelerated by recent global events, has broadened the talent pool but also intensified competition for skilled professionals. This trend is particularly pronounced in financial services and technology sectors, where E-L Financial seeks specialized expertise.

The burgeoning gig economy and the increasing demand for flexible work arrangements are altering traditional employment structures. Employees now prioritize work-life balance, purpose-driven work, and continuous learning opportunities, influencing E-L Financial's talent acquisition and retention strategies. Failure to adapt to these evolving expectations could hinder operational efficiency and the capacity for innovation.

E-L Financial faces a dynamic talent landscape. For instance, a late 2024 survey indicated that over 60% of financial services professionals prefer hybrid work arrangements, impacting recruitment efforts. Furthermore, the demand for cybersecurity and AI specialists in finance continues to outpace supply, creating significant hiring challenges.

- Remote Work Prevalence: Post-2023 data suggests a sustained preference for hybrid models, with many financial firms reporting over 40% of their workforce operating remotely at least part-time.

- Gig Economy Impact: The use of contract and freelance workers in specialized roles, such as data analytics and software development within financial institutions, has grown by an estimated 15% year-over-year.

- Employee Expectations: Surveys from early 2025 reveal that career development and flexible scheduling are now primary motivators for job changes, often ranking above salary alone for experienced professionals.

- Talent Shortages: Critical skill gaps persist in areas like blockchain development and advanced financial modeling, leading to longer hiring cycles and increased compensation demands for qualified candidates.

Societal attitudes towards financial planning and risk tolerance are shifting, with a notable increase in risk aversion observed throughout 2024 and into early 2025. This heightened caution stems from economic uncertainties, leading individuals to prioritize capital preservation over aggressive investment growth. Consequently, demand for stable savings vehicles and robust insurance coverage is on the rise, influencing product development and marketing strategies for firms like E-L Financial.

Consumer expectations for financial services are increasingly shaped by digital advancements and a demand for personalized, transparent interactions. A significant portion of the population, particularly younger demographics, prefers digital self-service options and intuitive platforms for managing their finances. This trend necessitates E-L Financial’s investment in user-friendly apps and AI-driven advisory tools to meet these evolving demands and maintain competitive relevance.

The growing emphasis on wellness and preventative health is reshaping the insurance sector, potentially leading to improved health outcomes and altered risk profiles. While this presents opportunities for innovative product design, the persistent prevalence of chronic diseases requires careful underwriting and risk assessment. E-L Financial must navigate these dual trends by offering products that support wellness while also addressing the needs of those managing ongoing health conditions.

| Societal Factor | Trend (2024-2025) | Impact on E-L Financial | Supporting Data |

|---|---|---|---|

| Risk Aversion | Increased | Higher demand for capital preservation products and insurance. | 58% of millennials expressed increased concern about long-term financial security (2024 survey). |

| Digital Adoption | Continued Growth | Need for enhanced digital platforms and AI advisory tools. | 75% of consumers prefer digital self-service for routine inquiries (recent survey). |

| Wellness Focus | Growing | Opportunity for wellness-integrated insurance; need for chronic disease management products. | Adoption of digital health tracking influencing mortality/morbidity rates. |

| Financial Literacy | Rising | Higher expectations for transparency, personalized advice, and ease of use. | Over 60% of adults felt more confident in financial decision-making (2024 report). |

Technological factors

E-L Financial is navigating a significant digital transformation, with automation increasingly streamlining operations. This shift is evident in areas like back-office processing and claims management, where advancements aim to boost efficiency and cut costs. For instance, the global financial services automation market was valued at approximately $30 billion in 2023 and is projected to grow substantially, indicating a strong industry-wide trend E-L Financial is part of.

The adoption of automation technologies is directly impacting E-L Financial's ability to reduce operational expenses and enhance customer service. By automating repetitive tasks, the company can reallocate resources to more strategic initiatives and improve response times for clients. This focus on digital efficiency is crucial for maintaining competitiveness in a rapidly evolving financial landscape, with many firms reporting double-digit percentage reductions in processing times after implementing automation.

Advanced data analytics and AI are revolutionizing E-L Financial's operations, enabling more sophisticated decision-making. These technologies are crucial for enhancing underwriting precision, personalizing customer experiences through tailored product recommendations, and bolstering fraud detection systems. For instance, AI-driven risk assessment models can process vast datasets to identify subtle patterns, leading to more accurate pricing of insurance policies and loans.

The application of AI extends to optimizing investment strategies. By analyzing market trends, economic indicators, and proprietary data, AI algorithms can identify lucrative opportunities and manage portfolio risk more effectively. This data-driven approach is projected to improve investment returns, with some financial institutions reporting a 10-15% increase in portfolio performance through AI-powered strategies in 2024. Furthermore, AI's ability to detect anomalies in real-time significantly strengthens E-L Financial's defenses against sophisticated financial fraud.

Cybersecurity and data privacy are paramount for E-L Financial, given the sensitive nature of the financial and personal information it handles. The company must invest heavily in robust measures to safeguard against increasingly sophisticated cyber threats, which cost global businesses an average of $4.35 million per incident in 2024, according to IBM's Cost of a Data Breach Report.

Ensuring compliance with evolving data protection regulations, such as GDPR and CCPA, presents a significant challenge. Failure to comply can result in substantial fines and, more importantly, a severe erosion of client trust. For instance, the EU's GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, highlighting the financial imperative for stringent data privacy protocols.

Fintech Innovation and Competition

Fintech innovation is rapidly reshaping the financial services sector, with new companies challenging traditional models. E-L Financial must actively monitor and integrate these advancements to maintain its competitive edge.

The rise of online wealth platforms, for instance, offers personalized investment advice and management at lower costs, directly competing with traditional advisory services. Similarly, insurtech solutions are streamlining the insurance process through digital channels and data analytics, potentially reducing operational overhead for incumbents like E-L Financial.

Blockchain technology presents opportunities for enhanced security, transparency, and efficiency in transactions and record-keeping. E-L Financial could leverage these trends by:

- Developing or partnering with online wealth management platforms to attract a broader, digitally-native client base.

- Exploring insurtech solutions to streamline claims processing and policy management, improving customer experience and reducing costs.

- Investigating blockchain applications for areas like cross-border payments or digital asset management to enhance operational efficiency and explore new revenue streams.

The global fintech market was valued at approximately $7.2 trillion in 2023 and is projected to grow significantly, indicating the substantial impact of these technological shifts.

Customer Relationship Management (CRM) Technologies

The increasing sophistication and widespread adoption of Customer Relationship Management (CRM) technologies are significantly shaping E-L Financial's operational landscape. These advancements allow for more granular tracking and management of client interactions across various touchpoints, from initial sales inquiries to ongoing policy servicing and investment advice.

E-L Financial leverages these tools to personalize communication, offering tailored product recommendations and proactive support. For instance, by analyzing client data, the company can anticipate needs, such as offering life insurance adjustments based on life events or suggesting portfolio rebalancing during market shifts. This data-driven approach fosters deeper client engagement and loyalty.

Furthermore, the integration of self-service portals and AI-powered chatbots within CRM frameworks empowers clients with immediate access to information and transaction capabilities. This not only improves customer satisfaction but also optimizes resource allocation by reducing the burden on human support staff. By mid-2024, many leading financial institutions reported a 20-30% increase in customer self-service adoption for routine queries.

- Enhanced Personalization: CRM systems enable E-L Financial to segment clients and deliver highly personalized communications, increasing engagement rates.

- Improved Customer Service: Advanced CRM features, including AI chatbots, provide 24/7 support and faster resolution of client inquiries.

- Data-Driven Insights: The analysis of customer interaction data provides valuable insights for product development and service improvement.

- Increased Client Loyalty: By fostering stronger relationships through personalized and efficient service, E-L Financial aims to boost client retention and lifetime value.

Technological advancements are fundamentally reshaping E-L Financial's operations, driving efficiency through automation and AI. The global financial services automation market, valued at approximately $30 billion in 2023, is expected to see substantial growth, underscoring this trend. These technologies are key to reducing operational costs and enhancing customer service by automating repetitive tasks.

AI and advanced analytics are crucial for improving underwriting, personalizing customer experiences, and strengthening fraud detection. For example, AI-driven risk assessment models can process vast datasets to identify subtle patterns, leading to more accurate pricing. In 2024, some financial institutions reported a 10-15% increase in portfolio performance through AI-powered strategies.

Cybersecurity remains a critical concern, with data breaches costing global businesses an average of $4.35 million per incident in 2024. Fintech innovation, with the global market valued at $7.2 trillion in 2023, also presents both challenges and opportunities for E-L Financial to integrate new solutions.

Customer Relationship Management (CRM) systems, enhanced by AI, are vital for personalized client interactions and improved service. By mid-2024, many financial institutions saw a 20-30% increase in customer self-service adoption for routine queries, a trend E-L Financial is leveraging.

Legal factors

E-L Financial operates within a stringent legal framework, heavily influenced by the Office of the Superintendent of Financial Institutions (OSFI) and provincial insurance regulators. These bodies mandate compliance with capital adequacy rules, such as the Life Insurance Capital Adequacy Test (LICAT), and solvency requirements to ensure financial stability. For instance, OSFI's 2023 annual report highlighted the continued focus on robust capital management across the sector.

The ongoing burden of compliance with market conduct guidelines and detailed reporting standards represents a significant operational cost. Failure to adhere to these regulations, including those concerning consumer protection and data privacy, can result in substantial fines and reputational damage. In 2024, several financial institutions faced penalties for non-compliance, underscoring the critical importance of maintaining rigorous internal controls.

Stringent privacy laws like Canada's PIPEDA significantly impact E-L Financial by dictating how client data is handled. New provincial privacy legislation, such as Quebec's Law 25, further tightens these requirements, demanding meticulous attention to data protection. Failure to comply can result in substantial penalties, with PIPEDA fines reaching up to $100,000 for individuals and $500,000 for organizations in certain cases.

E-L Financial faces legal obligations covering the entire lifecycle of client data: collection, storage, use, and disclosure. This necessitates the development and maintenance of robust data governance frameworks to ensure compliance and safeguard sensitive information. A strong framework is crucial for building and maintaining client trust in an increasingly data-conscious regulatory environment.

Consumer protection legislation plays a crucial role in shaping E-L Financial's operations. Laws mandating clear disclosures, fair lending practices, and robust dispute resolution mechanisms directly impact how E-L Financial markets its products, structures its sales processes, and handles customer complaints. For instance, regulations like the Consumer Financial Protection Bureau's (CFPB) oversight in the US, which saw a record $3.7 billion in consumer relief in 2023, underscore the need for transparency and fairness in all financial dealings.

Investment Regulations and Securities Law

E-L Financial operates under a stringent legal framework governing its investment activities. Securities laws dictate requirements for both public and private investment portfolios, ensuring fair practices and investor protection. For instance, the Securities Exchange Act of 1934 in the U.S. outlines rules for market conduct and prohibits insider trading, critical for maintaining market integrity.

Compliance with disclosure obligations for publicly traded companies is paramount. E-L Financial must adhere to regulations like Regulation Fair Disclosure (Reg FD), which mandates that material non-public information be broadly disseminated. This ensures all investors receive information simultaneously, fostering a level playing field. Furthermore, adherence to investment mandates for various funds and assets, such as those managed for retirement plans, is legally binding.

- Securities Act of 1933: Governs the initial offering and sale of securities, requiring registration and full disclosure.

- Securities Exchange Act of 1934: Regulates secondary market trading, including rules against market manipulation and insider trading.

- Investment Company Act of 1940: Oversees mutual funds and other investment companies, setting standards for their operation and disclosure.

- Dodd-Frank Wall Street Reform and Consumer Protection Act (2010): Introduced significant reforms to financial regulation, impacting areas like derivatives and systemic risk.

Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) Laws

E-L Financial operates under stringent Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) laws. These regulations mandate rigorous customer due diligence, transaction monitoring, and the reporting of suspicious activities to relevant authorities. Failure to comply can result in severe penalties, including substantial fines and reputational damage.

The company actively invests in robust compliance programs to meet these legal obligations. This includes advanced Know Your Customer (KYC) procedures and continuous transaction monitoring systems designed to detect and prevent illicit financial flows. For instance, in 2024, global AML fines reached an estimated $5.5 billion, underscoring the critical importance of adherence.

- Customer Due Diligence: E-L Financial implements multi-layered identity verification processes for all new and existing clients.

- Transaction Monitoring: Sophisticated software flags unusual or high-risk transaction patterns for further investigation.

- Suspicious Activity Reporting: Timely and accurate reporting of any identified suspicious activities to regulatory bodies is a core function.

- Compliance Training: Regular training ensures all relevant staff are up-to-date on AML/ATF regulations and internal policies.

E-L Financial is subject to evolving data privacy laws, including Canada's PIPEDA and provincial legislation like Quebec's Law 25, which impose strict rules on client data handling. Non-compliance can lead to significant penalties, with PIPEDA fines potentially reaching $500,000 for organizations. These regulations necessitate robust data governance frameworks to ensure client trust and legal adherence.

Environmental factors

Climate change presents a dual-edged sword for E-L Financial's investments. Physical risks, like increased frequency of extreme weather events, could devalue assets in vulnerable regions, impacting real estate and infrastructure holdings. For example, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $159 billion in damages, a trend expected to continue.

Transition risks, stemming from evolving climate policies and technological advancements, also pose challenges. Companies heavily reliant on fossil fuels may face declining valuations due to carbon pricing or shifts towards renewable energy sources. Conversely, the burgeoning green economy offers significant growth opportunities. Investments in renewable energy, sustainable agriculture, and green technology are projected to attract substantial capital, with the global green hydrogen market alone anticipated to reach $75 billion by 2030, according to some market analyses.

ESG investing is no longer a niche trend; it's a mainstream force shaping financial markets. By 2024, global sustainable investment assets reached an estimated $150 trillion, reflecting a significant shift in investor priorities. E-L Financial recognizes this momentum, integrating ESG factors into its decision-making processes to align with client values and identify long-term value creation opportunities.

Investors are increasingly demanding sustainable products, and E-L Financial is responding by developing and offering wealth management solutions that prioritize environmental, social, and governance criteria. This includes incorporating ESG screening into portfolio construction and actively seeking out companies with strong sustainability practices, aiming to meet the growing demand for responsible investment options.

Regulatory bodies globally are increasingly mandating climate-related financial disclosures, often drawing from the Task Force on Climate-related Financial Disclosures (TCFD) framework. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) is expanding reporting requirements for a vast number of companies, with many needing to comply by 2024 or 2025.

E-L Financial is actively enhancing its reporting capabilities to align with these evolving standards, recognizing that robust climate disclosures are crucial for investor confidence and risk management. This includes integrating climate risk assessments into its financial planning and stress testing scenarios, aiming for greater transparency by the 2025 reporting cycle.

Operational Sustainability and Carbon Footprint

E-L Financial is actively working to shrink its environmental impact. The company has set targets to reduce its carbon emissions from operations, focusing on energy efficiency in its buildings and promoting sustainable travel for its employees. For instance, in 2024, E-L Financial invested in upgrading its headquarters' HVAC systems, leading to an estimated 15% reduction in energy consumption at that site.

Beyond energy, E-L Financial is implementing waste reduction programs across its offices. This includes enhanced recycling initiatives and a move towards digital documentation to minimize paper usage. These efforts not only support environmental responsibility but also contribute to operational cost savings through reduced resource consumption.

- Energy Efficiency: Aiming for a 20% reduction in building energy consumption by 2026 through smart technology integration.

- Waste Reduction: Targeting a 25% decrease in office waste sent to landfills by the end of 2025.

- Sustainable Procurement: Increasing the proportion of goods and services sourced from environmentally certified suppliers.

- Carbon Footprint: Committing to a 10% reduction in Scope 1 and 2 emissions by 2025 compared to a 2023 baseline.

Natural Catastrophes and Insurance Liabilities

The increasing frequency and severity of natural catastrophes, driven by climate change, pose a significant risk to E-L Financial's insurance liabilities, especially within its property and casualty (P&C) portfolios. Extreme weather events like hurricanes, floods, and wildfires directly impact claims payouts, potentially eroding underwriting profitability. For instance, the 2023 hurricane season saw insured losses from major storms estimated to be in the tens of billions of dollars, a trend expected to continue or worsen in 2024 and 2025.

These events can lead to substantial increases in claim volumes and severity, straining reserves and potentially requiring higher premiums. E-L Financial's exposure through its investments in P&C insurers or its own direct insurance operations means that a surge in payouts due to climate-related disasters could negatively affect its financial performance. The reinsurer Swiss Re projected global insured losses from natural catastrophes to reach $110 billion in 2023, highlighting the growing financial burden.

- Increased Claims: Greater frequency of severe weather events directly translates to more insurance claims filed, particularly for property damage.

- Underwriting Profitability: Higher claim payouts can significantly reduce or eliminate underwriting profits for E-L Financial's P&C-related business lines.

- Reserve Adequacy: Insurers must maintain adequate reserves to cover future claims; escalating catastrophe losses can strain these reserves.

- Reinsurance Costs: The rising cost of reinsurance, a crucial tool for managing catastrophe risk, can further impact E-L Financial's profitability.

The increasing focus on environmental sustainability presents both risks and opportunities for E-L Financial. Regulatory bodies are implementing stricter climate disclosure requirements, with many companies needing to comply by 2024 or 2025, often referencing frameworks like the TCFD. This necessitates robust climate risk assessments and transparent reporting to maintain investor confidence.

The financial sector is witnessing a significant shift towards ESG investing, with global sustainable investment assets reaching an estimated $150 trillion by 2024. E-L Financial is integrating these factors into its decision-making to align with client values and identify long-term growth, particularly in areas like renewable energy which is projected for substantial capital inflow.

Physical climate risks, such as extreme weather events, can devalue assets and increase insurance claims, impacting property and casualty portfolios. For instance, U.S. billion-dollar weather and climate disasters in 2023 alone exceeded $159 billion in damages, a trend expected to persist, directly affecting underwriting profitability and reserve adequacy.

| Environmental Factor | Impact on E-L Financial | Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased insurance claims, asset devaluation, potential underwriting losses. | Global insured losses from natural catastrophes reached $110 billion in 2023 (Swiss Re). U.S. billion-dollar disasters in 2023 totaled over $159 billion (NOAA). |

| Transition to Green Economy | Opportunities in renewable energy, sustainable tech; risks for fossil fuel-dependent assets. | Global green hydrogen market projected to reach $75 billion by 2030. |

| ESG Investing Growth | Growing investor demand for sustainable products; integration into investment strategies. | Global sustainable investment assets estimated at $150 trillion by 2024. |

| Climate Disclosure Regulations | Mandatory reporting requirements, need for enhanced climate risk assessment. | EU's CSRD expanding reporting requirements, with compliance deadlines in 2024/2025. |

PESTLE Analysis Data Sources

Our E-L Financial PESTLE Analysis is built on a robust foundation of data from leading financial institutions, regulatory bodies, and reputable market research firms. We leverage official economic reports, legislative updates, and industry-specific trend analyses to ensure comprehensive and accurate insights.