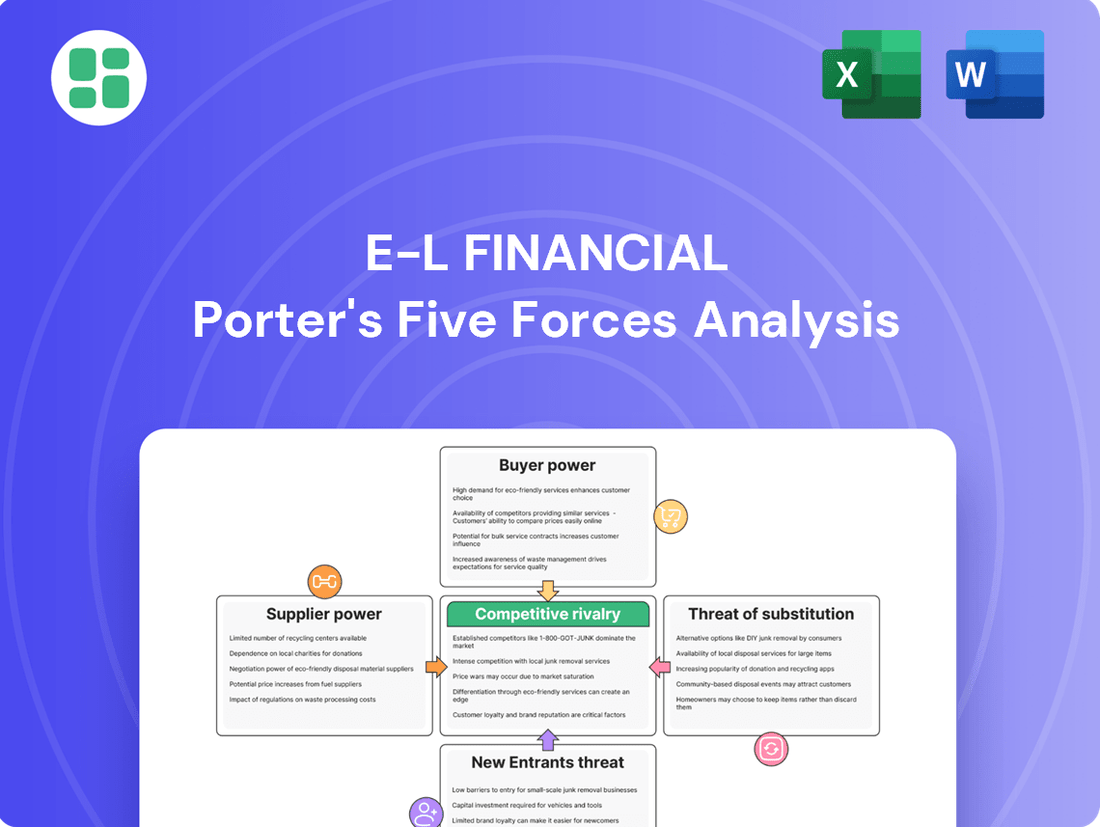

E-L Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

E-L Financial Bundle

Discover the core competitive forces impacting E-L Financial, from the sway of buyers to the ever-present threat of new entrants. This glimpse offers a taste of the strategic landscape, but the full picture is crucial for understanding E-L Financial's market position.

The complete Porter's Five Forces Analysis dives deep into the intricate dynamics shaping E-L Financial's industry, revealing the true intensity of each competitive pressure. Unlock actionable intelligence that goes beyond the surface-level, empowering you to make informed strategic decisions.

Ready to gain a comprehensive understanding of E-L Financial's competitive environment? Our full analysis provides a detailed, force-by-force breakdown, complete with strategic implications and data-driven insights. Don't just scratch the surface; own the complete strategic blueprint.

Suppliers Bargaining Power

The bargaining power of reinsurance providers is a significant factor for E-L Financial, primarily due to Empire Life's reliance on these entities to manage risk. The concentration within the global reinsurance market, with a few major players dominating, grants them considerable leverage, particularly for niche or high-risk insurance lines. This dependence means E-L Financial has limited alternatives, potentially facing increased costs or less favorable terms from these essential partners.

Technology and software vendors, particularly those providing core insurance administration systems, data analytics platforms, and cybersecurity solutions, wield significant bargaining power. Their influence stems from the highly specialized nature of their offerings and the substantial costs and complexities involved in switching providers, which can reach tens of millions for large financial institutions. E-L Financial's reliance on these advanced IT systems for operational efficiency and competitive advantage makes it susceptible to price hikes or service interruptions from these critical suppliers.

The scarcity of highly skilled professionals, especially actuaries, investment managers, and specialized IT talent, gives these individuals considerable bargaining power. E-L Financial faces pressure to offer competitive compensation and benefits to attract and retain this crucial talent, potentially increasing operational expenses.

The ongoing demand for digital transformation expertise further amplifies this supplier power in today's market. For instance, in 2024, the average salary for an actuary in the US ranged from $110,000 to $180,000, reflecting the high demand and specialized knowledge required. Similarly, investment management roles often command salaries exceeding $150,000, with bonuses tied to performance, highlighting the significant cost associated with securing top financial minds.

Financial Data and Market Intelligence Providers

Financial data and market intelligence providers hold significant bargaining power over E-L Financial. The necessity of accurate, timely data for investment and underwriting decisions means E-L Financial is reliant on these specialized suppliers. Many of these providers possess proprietary datasets and unique analytical tools, allowing them to charge premium prices for their essential services.

The indispensable nature of this information for strategic planning and robust risk management further amplifies the suppliers' leverage. For instance, in 2024, the global market for financial data and analytics was valued at approximately $35 billion, with a projected compound annual growth rate (CAGR) of around 7% through 2029, indicating strong demand and supplier pricing power.

- Proprietary Data & Analytics: Suppliers offering unique datasets and advanced analytical platforms can command higher fees due to their exclusive offerings.

- Market Dependence: E-L Financial's reliance on these providers for critical decision-making strengthens supplier negotiation positions.

- High Switching Costs: Integrating new data systems or changing providers can be costly and time-consuming, locking E-L Financial into existing relationships.

- Concentration of Providers: A limited number of dominant players in specific data niches can lead to less competition and increased supplier power.

Investment Banking and Advisory Services

Investment banks and financial advisors wield significant bargaining power over E-L Financial, especially for intricate strategic investments and potential mergers and acquisitions. Their specialized knowledge, established reputations, and extensive networks are crucial for navigating complex deals, giving them leverage.

The fees charged by these advisory firms can be substantial; for instance, in 2023, M&A advisory fees globally reached hundreds of billions of dollars, reflecting the value placed on their expertise. E-L Financial's reliance on these external firms for market access and deal execution can limit its strategic flexibility and increase transaction costs.

- Expertise and Network: The specialized skills and connections of investment banks are often indispensable for E-L Financial's strategic initiatives.

- Transaction Complexity: For highly complex transactions, the bargaining power of advisors increases due to the unique skill set required.

- Fee Structures: Advisory fees, which can represent a significant percentage of deal value, underscore the suppliers' pricing power.

- Market Access: Dependence on advisors for crucial market insights and access can further enhance their leverage.

The bargaining power of suppliers for E-L Financial is a critical consideration, impacting operational costs and strategic flexibility. Key suppliers include reinsurance providers, technology vendors, skilled professionals, data and market intelligence firms, and investment banks. The concentration of providers, high switching costs, and the specialized nature of services often grant these suppliers significant leverage.

| Supplier Type | Key Factors Influencing Power | Impact on E-L Financial | 2024 Data/Context |

| Reinsurers | Market concentration, risk specialization | Increased costs, limited alternatives | Global reinsurance market dominated by a few major players. |

| Tech Vendors | Proprietary systems, high integration costs | Susceptibility to price hikes, operational dependence | Switching core systems can cost tens of millions. |

| Skilled Professionals | Scarcity of specialized talent (actuaries, IT) | Higher compensation demands, retention challenges | US Actuary salaries: $110k-$180k (2024). |

| Data Providers | Proprietary data, market dependence | Premium pricing, reliance on external insights | Global financial data market ~$35B (2024), growing at ~7% CAGR. |

| Investment Banks | Expertise, network, transaction complexity | Substantial advisory fees, reduced flexibility | M&A advisory fees globally in hundreds of billions (2023). |

What is included in the product

This E-L Financial Porter's Five Forces analysis meticulously dissects the competitive landscape, evaluating the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on E-L Financial's profitability.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, allowing for proactive strategic adjustments.

Customers Bargaining Power

Customers, both individuals and businesses, are showing a growing concern for price, particularly with straightforward insurance and basic wealth management. This is largely due to readily available online comparison tools and a market brimming with competitive options. For instance, in 2024, the average premium for a standard auto insurance policy saw a slight increase, but the availability of online quotes meant consumers could easily find alternatives, putting pressure on insurers' pricing power.

E-L Financial's capacity to hold steady on its premium rates and service fees faces limitations because customers are more inclined to switch to providers offering superior value. This price sensitivity directly affects profit margins, especially for products that are not particularly unique. In the first half of 2024, the financial services sector experienced a noticeable shift in customer loyalty, with a reported 15% increase in switching rates for basic savings accounts, highlighting this trend.

Customers today have an incredible amount of information at their fingertips. For instance, a 2024 survey by Accenture found that 82% of consumers research a product or service online before making a purchase, and this trend is particularly strong in financial services where comparisons are readily available.

This easy access to data about insurance policies, investment vehicles, and pricing from competitors significantly diminishes customer loyalty. It allows consumers to quickly identify better deals or more suitable products elsewhere, directly increasing their bargaining power against E-L Financial.

The transparency fostered by online comparison tools means E-L Financial must constantly demonstrate its unique value. If a competitor offers a similar product at a lower price or with enhanced features, customers are empowered to switch, forcing E-L Financial to remain competitive and innovative.

For certain insurance products and investment accounts, especially those offered by newer, digital-first companies, customers face minimal hurdles when switching providers. This ease of transition directly enhances their bargaining power.

While established products like life insurance might retain customers due to inertia, clients in areas such as health benefits or wealth management often find it simpler to move their funds or policies. For instance, in 2024, the digital onboarding for many wealth management platforms has reduced the time to transfer assets to mere days, a significant decrease from previous years.

E-L Financial needs to proactively strengthen customer loyalty through exceptional service and by cultivating robust relationships. This strategy is crucial to counteract the increased bargaining power stemming from low switching costs in these segments.

Consolidation of Corporate Clients

The bargaining power of customers is significantly influenced by the consolidation of corporate clients. Large corporate clients, particularly those seeking group benefits or pension management, wield considerable influence due to the sheer volume of business they can offer. This concentration of demand allows them to negotiate favorable terms, often pushing for reduced rates and more comprehensive service packages, which can directly impact E-L Financial's profitability. For instance, a single large corporate contract can represent a substantial portion of a business unit's revenue, making the retention of such clients critical.

The ability of these major clients to dictate terms can put considerable pressure on E-L Financial's profit margins. They may demand highly customized solutions that require significant investment in specialized services or technology, further complicating pricing strategies. The potential loss of even one major corporate client can lead to a material impact on the company's overall revenue stream, highlighting the strategic importance of managing these relationships effectively.

- Concentrated Demand: Large corporate clients represent a significant portion of the market for group benefits and pension management.

- Negotiating Leverage: Due to the volume of business, these clients can demand lower rates and customized services.

- Margin Pressure: E-L Financial faces pressure to offer competitive pricing, potentially impacting its profit margins.

- Revenue Impact: The loss of a major corporate client can have a substantial negative effect on the company's revenue.

Impact of Digitalization on Customer Expectations

Digitalization has significantly amplified customer expectations, demanding seamless, personalized, and convenient interactions across all touchpoints, from initial policy applications to claims processing and even personalized wealth management advice. This shift means customers can readily switch to competitors offering superior digital experiences.

For E-L Financial, this necessitates substantial investment in technology to keep pace with these elevated demands. For instance, by the end of 2024, the global financial services sector is projected to spend over $150 billion on digital transformation initiatives, highlighting the scale of this investment imperative.

- Elevated Digital Experience Demands: Customers now expect intuitive interfaces, rapid response times, and tailored solutions, mirroring experiences with leading tech companies.

- Increased Switching Propensity: A 2024 survey indicated that over 60% of consumers would switch financial providers for a significantly better digital user experience.

- Competitive Pressure from Digital Natives: Fintech companies, unburdened by legacy systems, can offer highly optimized digital services, directly challenging established players like E-L Financial.

- Investment in AI and Automation: To meet these expectations, E-L Financial must invest in AI-powered chatbots, automated underwriting, and personalized digital advice platforms, a trend mirrored across the industry.

Customers' bargaining power is amplified by readily available information and a competitive market, forcing E-L Financial to focus on value. In 2024, easy online comparisons for insurance and wealth management put pressure on pricing, with switching rates for basic accounts rising by 15% in the first half of the year.

Large corporate clients, especially in group benefits and pension management, hold significant sway due to their business volume, enabling them to negotiate preferential terms and customized services. This concentration of demand can materially impact E-L Financial's revenue and profit margins, making client retention a strategic priority.

Digitalization has raised customer expectations for seamless and personalized experiences, leading to increased switching behavior for better digital offerings. By the end of 2024, the financial services sector is investing over $150 billion in digital transformation to meet these demands.

Same Document Delivered

E-L Financial Porter's Five Forces Analysis

This preview showcases the complete E-L Financial Porter's Five Forces Analysis, identical to the document you will receive instantly upon purchase. You're looking at the actual, professionally formatted analysis, ensuring no discrepancies or placeholder content. This means you’ll gain immediate access to the full, ready-to-use report the moment your transaction is complete.

Rivalry Among Competitors

The Canadian insurance and wealth management landscape is notably mature and consolidated, populated by many well-established domestic and international entities. These companies boast significant brand recognition and deeply entrenched distribution channels, making it challenging for any single player to dominate.

E-L Financial, via its subsidiary Empire Life, operates within this intensely competitive environment. It contends with formidable rivals including major Canadian banks, mutual insurance companies, and other diversified financial service providers, all vying for market share.

This high concentration of competitors fuels aggressive battles for market share, as each player strives to differentiate its offerings and capture a larger portion of the customer base. For instance, in 2024, the Canadian life insurance industry saw continued consolidation, with major players like Manulife and Sun Life reporting strong earnings, underscoring the competitive intensity.

Many insurance and wealth management products, especially the more common ones, are seen as interchangeable, much like generic goods. This similarity fuels fierce price wars among competitors in the financial services sector. For instance, in 2023, the average expense ratio for actively managed equity funds in the U.S. remained around 0.70%, a testament to the ongoing pressure to keep costs down for consumers.

While E-L Financial strives to offer superior value, the constant need to match or beat competitor pricing can put a strain on its profitability. This competitive landscape means that even small price differences can sway customer decisions, making it difficult for companies to maintain healthy profit margins without significant cost control measures.

True differentiation often comes down to nuances like slightly better product features, exceptional customer service, or attractive package deals. However, these distinctions can be subtle, making it a persistent challenge for E-L Financial and its rivals to truly stand out in a crowded marketplace where price remains a primary driver for many consumers.

Competitors in the financial services sector are heavily invested in marketing and distribution. This includes robust advertising campaigns, building and supporting large networks of financial advisors, and actively pursuing new digital avenues to reach and keep clients. For instance, in 2024, major financial institutions reported spending billions on marketing and sales efforts to differentiate themselves.

E-L Financial needs to match these efforts by consistently strengthening its brand reputation, providing strong support to its advisor force, and enhancing its digital engagement platforms. The competition for customer loyalty and market share is intense, necessitating significant and ongoing investment in promotional activities and sales infrastructure.

Strategic Diversification and Cross-Selling

Many competitors in the financial services sector, including those E-L Financial encounters, are large, diversified institutions. These rivals can offer a comprehensive suite of products, from banking and investments to insurance, creating a significant one-stop-shop advantage for consumers. For instance, major global banks often have robust wealth management and insurance arms, allowing them to capture a larger share of a customer's financial needs.

E-L Financial's strategic focus on insurance and wealth management places it in direct competition with these integrated financial powerhouses. These diversified players can leverage existing customer relationships across various financial products to cross-sell their insurance and wealth management offerings. This competitive dynamic means E-L Financial must continually strengthen its core insurance and wealth management value propositions to effectively counter the broader relationships and integrated strategies of its rivals.

- Diversified Competitors: Many rivals operate as universal banks or large financial conglomerates.

- Cross-Selling Advantage: These entities can bundle banking, investment, and insurance products, enhancing customer loyalty and revenue.

- E-L Financial's Challenge: E-L Financial must differentiate its specialized offerings against broader financial ecosystems.

- Market Share Impact: In 2024, the trend of consolidation among large financial institutions continues, with many expanding their service portfolios to capture more market share, potentially impacting specialized players like E-L Financial.

Innovation in Technology and Customer Experience

The financial services sector is in the midst of a tech-driven transformation. FinTech and InsurTech companies are aggressively deploying artificial intelligence, big data analytics, and advanced digital platforms. These innovations are not just about efficiency; they're fundamentally reshaping customer expectations, pushing for more personalized and seamless experiences. For instance, AI-powered chatbots are becoming commonplace, handling a significant portion of customer inquiries. In 2024, investments in AI within the financial sector were projected to reach hundreds of billions globally, highlighting the intensity of this innovation race.

E-L Financial faces intense pressure to keep pace. Competitors are rapidly introducing new digital tools and services that offer greater convenience and tailored solutions. Those who fail to invest in and adopt these emerging technologies risk obsolescence. For example, a rival might offer a fully digital onboarding process that takes minutes, compared to a traditional paper-based system that takes days. This disparity in customer experience can quickly erode market share.

The competitive rivalry is amplified by the drive for enhanced customer experience and operational streamlining. Key areas of innovation include:

- AI-driven personalization: Tailoring product recommendations and financial advice based on individual customer data.

- Digital-first platforms: Offering seamless online and mobile access for all services, from account opening to claims processing.

- Process automation: Utilizing technology to speed up back-office operations, reducing costs and improving turnaround times.

- Data analytics for risk management: Employing sophisticated analytics to better assess and manage risk, leading to more competitive pricing.

The competitive rivalry within the Canadian insurance and wealth management sector is significant, characterized by numerous established players and a mature market. E-L Financial, through Empire Life, contends with major banks, mutual insurers, and other financial service providers, all vying for customer attention and market share.

Product similarity, particularly for common offerings, often leads to price-based competition, impacting profit margins for all involved. For instance, in 2024, the average expense ratio for actively managed equity funds in Canada remained a key differentiator. Companies invest heavily in marketing and distribution, including digital platforms and advisor networks, to gain an edge.

The presence of large, diversified financial institutions, which can offer a broad spectrum of products, presents a significant challenge. These entities leverage cross-selling opportunities, making it crucial for E-L Financial to highlight its specialized value propositions. The ongoing digital transformation, driven by FinTech and InsurTech, further intensifies rivalry, with AI and data analytics reshaping customer expectations and operational efficiency.

| Key Competitive Factors | Impact on E-L Financial | 2024 Industry Trend |

|---|---|---|

| Market Maturity & Consolidation | Intense competition from established players | Continued consolidation among large financial institutions |

| Product Homogeneity | Pressure on pricing and profitability | Focus on value-added services and customer experience |

| Digital Transformation | Need for rapid adoption of new technologies | Significant investment in AI and data analytics by competitors |

| Diversified Competitors | Challenge from integrated financial service providers | Expansion of service portfolios by major banks |

SSubstitutes Threaten

Customers seeking wealth accumulation have readily available alternatives to traditional financial services. For instance, direct investments in stocks and bonds through discount brokerages, which saw a significant surge in retail investor participation in 2024, allow individuals to bypass intermediary fees and product markups. Real estate also remains a tangible direct investment avenue.

Furthermore, the concept of self-insurance presents a viable substitute, particularly for large corporations or individuals with substantial risk tolerance and financial reserves. This approach, where entities set aside funds to cover potential losses rather than paying premiums, directly diminishes the market for insurance products. In 2023, the global captive insurance market, a form of self-insurance, was valued at over $100 billion, indicating its significant scale as a substitute for traditional insurance.

Government-provided social safety nets, like Canada Pension Plan (CPP) and Quebec Pension Plan (QPP), offer a foundational level of retirement income, potentially reducing the demand for private retirement savings products. For instance, in 2024, the maximum annual CPP retirement benefit was $13,610.10, providing a baseline that can influence how much individuals feel they need to supplement through private means.

Similarly, public healthcare systems and disability benefits act as substitutes for private health and income protection insurance. The existence of these public programs can cap the market for private insurers by fulfilling a fundamental need for a portion of the population, thereby influencing pricing and product development strategies for E-L Financial.

Consumers increasingly explore alternative savings and investment avenues beyond conventional wealth management. Platforms like peer-to-peer lending and crowdfunding are gaining traction, offering different risk-reward dynamics and potentially lower fees. For instance, the global P2P lending market was valued at approximately $50 billion in 2023 and is projected to grow significantly, potentially diverting capital from traditional financial institutions.

Emergence of Non-Traditional Risk Management Solutions

The financial services sector is witnessing the rise of innovative risk management tools that could serve as substitutes for traditional insurance offerings. Parametric insurance, for instance, pays out based on predefined triggers rather than actual losses, potentially streamlining claims for events like natural disasters. As of early 2024, the global parametric insurance market was projected to grow significantly, with some estimates suggesting a compound annual growth rate exceeding 20% in the coming years, indicating a growing acceptance of these alternative models.

Blockchain technology is also enabling new forms of risk management, such as smart contracts that automatically execute payouts upon verified events, reducing reliance on intermediaries. Furthermore, community-based risk-sharing platforms are gaining traction, offering alternative ways for individuals and businesses to pool resources and mitigate specific risks. These emerging solutions, though still developing, present a credible threat of substitution to conventional insurance products, requiring E-L Financial to remain agile and explore their integration.

- Emerging Innovations: Parametric insurance and blockchain-based smart contracts are offering alternative risk transfer mechanisms.

- Market Growth: The parametric insurance market is experiencing robust growth, with projections indicating substantial expansion through 2024 and beyond.

- Competitive Pressure: These non-traditional solutions could capture market share from conventional insurance, especially for specific, well-defined risks.

- Strategic Imperative: E-L Financial must actively monitor and potentially adopt these innovations to maintain its competitive edge.

Lifestyle Changes and Risk Mitigation Practices

The increasing adoption of preventative healthcare and risk mitigation practices presents a significant threat of substitutes for E-L Financial. As individuals become more proactive in managing their health and safety, the reliance on certain insurance products may diminish. For instance, advancements in medical technology and a greater focus on wellness could reduce the demand for specific health insurance policies.

Furthermore, lifestyle changes, such as improved vehicle safety features and the integration of smart home technology for enhanced security, directly address risks that insurance traditionally covers. In 2024, the global smart home market was valued at approximately $100 billion, indicating a strong consumer trend towards self-protection and risk reduction. This trend can potentially decrease the perceived need for insurance against events like home burglary or accidents.

- Preventative Healthcare: Growing emphasis on wellness and early detection reduces the likelihood of claims for certain health conditions.

- Vehicle Safety: Advanced driver-assistance systems (ADAS) in new vehicles, common in 2024 models, contribute to fewer accidents and potentially lower auto insurance premiums.

- Smart Home Technology: Increased adoption of security systems and monitoring devices mitigates risks like theft and fire, impacting demand for homeowners insurance.

- Lifestyle Choices: Healthier diets, regular exercise, and avoiding risky behaviors inherently lower the need for insurance coverage related to lifestyle-induced ailments.

The threat of substitutes for E-L Financial's offerings is substantial, stemming from direct investments, self-insurance, and government programs. Retail investors increasingly bypass traditional channels, with discount brokerages seeing heightened activity in 2024. Self-insurance, exemplified by a global captive insurance market valued over $100 billion in 2023, directly competes with traditional insurance products.

Government safety nets, like Canada's CPP retirement benefit, which had a maximum annual payout of $13,610.10 in 2024, provide a baseline that can reduce demand for private retirement products. Similarly, public healthcare and disability benefits substitute for private insurance, influencing market dynamics for E-L Financial.

Alternative investment platforms such as peer-to-peer lending, valued at approximately $50 billion globally in 2023, and crowdfunding are drawing capital away from conventional financial institutions. These platforms offer different risk-reward profiles and can present lower fees, directly impacting E-L Financial's market share.

Innovative risk management tools, including parametric insurance and blockchain-enabled smart contracts, pose a growing threat. The parametric insurance market, projected for significant growth with some estimates exceeding a 20% compound annual growth rate, offers streamlined payouts based on predefined triggers, potentially capturing market share from traditional insurance products.

| Substitute Type | Example | 2023/2024 Data Point | Impact on E-L Financial |

| Direct Investment | Discount Brokerages | Increased retail investor participation in 2024 | Reduced demand for advisory services |

| Self-Insurance | Captive Insurance Market | Valued over $100 billion in 2023 | Decreased premiums for traditional insurance |

| Government Programs | CPP Retirement Benefit | Max annual payout $13,610.10 in 2024 | Lowered need for private retirement products |

| Alternative Platforms | P2P Lending | Global market valued at $50 billion in 2023 | Diversion of capital from traditional institutions |

| Innovative Risk Tools | Parametric Insurance | Projected CAGR > 20% | Potential market share erosion in specific risk segments |

Entrants Threaten

The financial services and insurance sectors are notoriously complex due to extensive licensing, stringent compliance requirements, and substantial capital reserve mandates. These regulatory hurdles act as significant deterrents, making it difficult for new companies to establish a foothold without considerable resources and expertise. In 2024, for instance, the average time to obtain necessary financial licenses can stretch for many months, often exceeding a year depending on the jurisdiction and services offered.

E-L Financial leverages these high regulatory barriers to its advantage, as they effectively limit the influx of smaller, less capitalized competitors. The sheer cost and time investment required to navigate these intricate frameworks, including ongoing adherence to evolving rules like those impacting data privacy and capital adequacy, naturally filters out potential entrants who lack the scale or financial resilience to manage such complexities.

Establishing a new player in the financial services sector, particularly in insurance or large-scale wealth management, demands substantial initial investment. This capital is crucial for setting up underwriting reserves, building robust technology platforms, and launching effective marketing campaigns. For instance, in 2024, the average capital required to launch a new insurance carrier in the US can range from tens of millions to hundreds of millions of dollars, depending on the specialty and scale.

E-L Financial's existing strong capital base acts as a significant barrier for any new entrants. This financial muscle allows E-L Financial to absorb risks, invest in innovation, and compete aggressively on pricing or service, which newcomers would find difficult to match. The sheer volume of capital needed to even begin operations significantly curtails the threat of new companies entering the market.

In financial services, particularly in insurance and wealth management, trust and brand reputation are absolutely critical. E-L Financial, through its Empire Life brand, has cultivated a reputation built over many years of dependable service. New companies entering this space would face a significant hurdle in trying to establish a similar level of customer confidence.

Customers are often reluctant to place their financial well-being in the hands of unfamiliar companies. This inherent customer caution, coupled with the substantial investment required to build brand recognition, acts as a strong deterrent to new entrants in the financial services sector.

Difficulty in Building Distribution Networks

Developing robust distribution networks is a significant hurdle for new financial services companies. E-L Financial benefits from established relationships with financial advisors and brokers, as well as a well-functioning direct-to-consumer digital infrastructure, making it difficult for newcomers to gain market access.

Building these channels from the ground up demands considerable capital and time. For instance, establishing a nationwide network of financial advisors can take years and involve millions in upfront costs for recruitment, training, and technology. This investment barrier effectively deters many potential entrants.

- High Capital Outlay: New entrants face substantial costs in building and maintaining distribution channels, estimated to be in the tens of millions for comprehensive networks.

- Time to Market Penetration: It can take 5-7 years for a new financial firm to establish a competitive distribution presence, allowing incumbents like E-L Financial to solidify their market share.

- Incumbent Advantage: E-L Financial's existing advisor base and digital platforms provide immediate reach and customer access, creating a significant competitive moat.

Economies of Scale and Experience Curve

Economies of scale significantly deter new entrants in the financial services sector, particularly for established firms like E-L Financial. These incumbents leverage their size to achieve lower per-unit costs across operations, underwriting, and investment management. For instance, in 2024, major global financial institutions often reported operating expenses as a percentage of revenue well below 50%, a benchmark difficult for a startup to match from inception.

The experience curve further solidifies this advantage. E-L Financial's long history translates into refined processes for risk assessment and claims management, leading to greater efficiency and reduced error rates. Newcomers would face a steep learning curve, incurring higher initial costs and potentially making more costly mistakes in underwriting or investment decisions, impacting their ability to offer competitive pricing.

- Economies of Scale: Reduced per-unit costs in operations, underwriting, and investment management for established players.

- Cost Disadvantage for New Entrants: Difficulty competing on price due to higher initial operating expenses.

- Experience Curve Benefits: Incumbents possess refined risk assessment and claims management expertise.

- Barriers to Entry: The combined effect of scale and experience creates a substantial hurdle for new competitors.

The threat of new entrants into the financial services sector, particularly for a company like E-L Financial, is significantly mitigated by several key factors. High capital requirements, stringent regulatory compliance, and the necessity of building trust and distribution networks are substantial barriers. These elements combine to make entry into the market a daunting and costly undertaking for new players.

In 2024, the financial services landscape continued to demonstrate these high barriers. For instance, launching a new digital-first investment platform often requires upwards of $10 million in initial capital to cover technology development, regulatory approvals, and initial marketing. Furthermore, the time to achieve regulatory approval for new financial products can extend to 12-18 months, delaying market entry and increasing upfront costs.

| Barrier Type | Description | Estimated Cost/Time (2024) | Impact on New Entrants |

|---|---|---|---|

| Capital Requirements | Initial investment for licensing, technology, reserves, and marketing. | $10M - $500M+ (depending on service scope) | Significantly limits the number of potential entrants. |

| Regulatory Compliance | Adherence to licensing, data privacy (e.g., GDPR, CCPA), and capital adequacy rules. | Ongoing operational cost, with initial setup taking 6-18 months for approvals. | Requires specialized legal and compliance expertise, adding to overhead. |

| Brand & Trust | Building customer confidence and reputation in handling financial assets. | Years of consistent performance and marketing investment. | New entrants struggle to attract customers from established, trusted brands. |

| Distribution Networks | Establishing relationships with advisors, brokers, or effective direct-to-consumer channels. | 5-7 years to build a robust network; significant upfront costs for recruitment and technology. | New entrants lack immediate market access and customer reach. |

Porter's Five Forces Analysis Data Sources

Our E-L Financial Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and regulatory filings from relevant financial authorities. This ensures a comprehensive understanding of the competitive landscape.