Elevance Health Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elevance Health Bundle

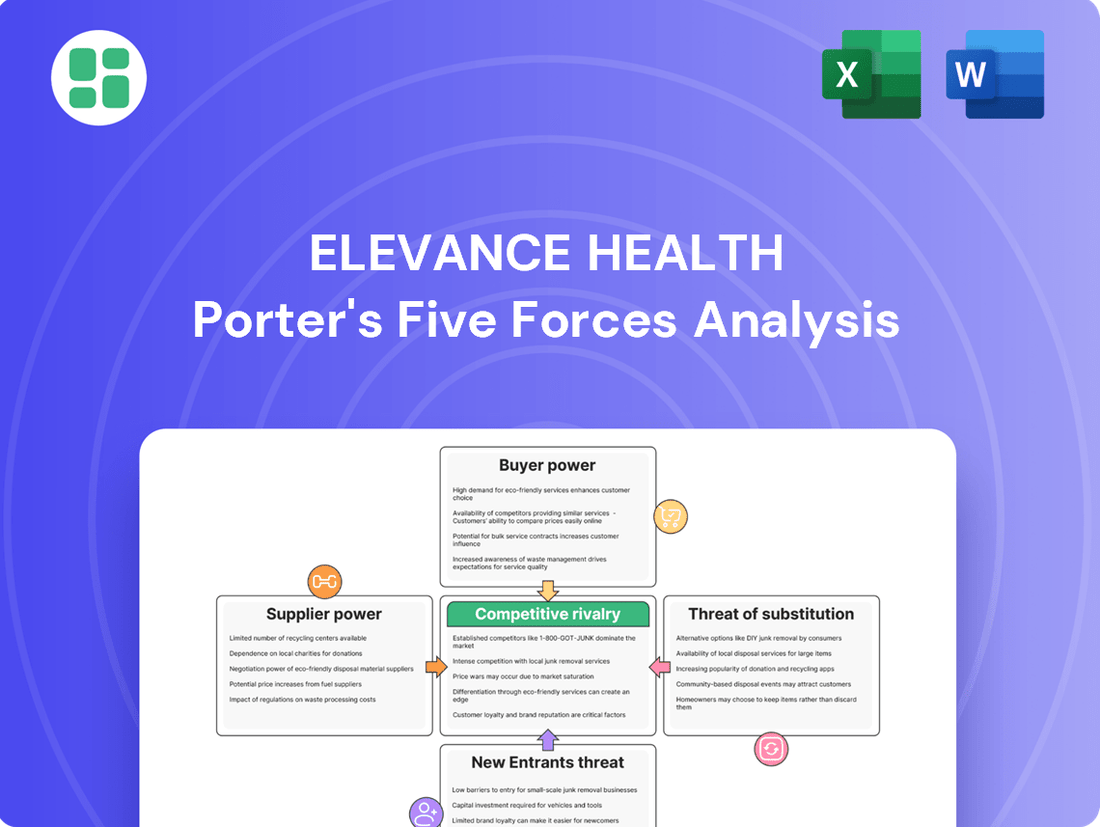

Elevance Health navigates a complex landscape shaped by powerful industry forces. Understanding the intensity of buyer power, the threat of new entrants, and the bargaining power of suppliers is crucial for strategic planning. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Elevance Health’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

While the healthcare sector often appears fragmented with many individual physicians and smaller clinics, limiting their individual bargaining power against giants like Elevance Health, the landscape is shifting. Highly specialized providers or dominant regional hospital systems can still wield considerable influence due to their unique offerings or market control. For instance, in 2024, the average hospital operating margin was around 3.5%, a figure that can fluctuate based on market concentration and payer mix, giving well-positioned hospitals more leverage.

For many healthcare providers, insurers like Elevance Health are a significant revenue stream, granting Elevance substantial leverage in negotiating reimbursement rates and contract terms. This financial dependence means suppliers, such as hospitals and physician groups, have less power to dictate terms.

Elevance Health's extensive network, covering over 45 million members as of early 2024, solidifies its position. This vast membership base makes Elevance a crucial partner for providers aiming for a steady influx of patients, further diminishing the bargaining power of individual suppliers.

Switching core suppliers for Elevance Health, especially major provider networks or complex technology providers, can be quite costly. These transitions often involve significant administrative work to renegotiate agreements, integrate new technological systems, and manage potential disruptions to member healthcare access. For instance, a shift in a large claims processing system could require extensive data migration and employee retraining.

The financial implications of such switches can be substantial, encompassing not only direct vendor fees but also the indirect costs of operational downtime and potential member dissatisfaction. While specific figures for Elevance Health's supplier switching costs aren't publicly detailed, the healthcare industry generally sees these expenses as a significant barrier to changing partners, often running into millions of dollars for large-scale operations.

Elevance Health's strategic moves, like expanding its Carelon brand to encompass care delivery and pharmacy services, are designed to mitigate these supplier dependencies. By building internal capabilities, Elevance aims to gain more control over its operational costs and reduce the financial and logistical hurdles associated with switching external suppliers in the future, thereby potentially lowering long-term switching costs.

Availability of Substitute Suppliers

The bargaining power of suppliers for Elevance Health is influenced by the availability of substitutes. While many individual healthcare providers exist, finding large-scale, high-quality substitute networks capable of serving Elevance Health's extensive membership can be challenging in specific regions or medical fields.

However, for other supplier categories, such as information technology vendors and administrative service providers, the market is generally more competitive. This increased competition means Elevance Health has a broader range of substitution options available, which can temper supplier power in these areas.

Elevance Health manages a significant global supply chain, with over $7 billion in indirect spending, demonstrating a broad but carefully managed supplier base. This scale suggests that while some suppliers may have considerable leverage, the company also possesses the capacity to negotiate and seek alternatives across many of its operational needs.

- Limited Substitutes for Core Healthcare Networks: Finding equivalent, large-scale healthcare provider networks to replace existing ones can be difficult for Elevance Health in certain markets.

- Higher Substitutability in IT and Admin Services: The market for IT and administrative support services offers more readily available substitute suppliers.

- $7 Billion in Indirect Spending: Elevance Health’s substantial indirect spending highlights the breadth of its supplier relationships and the potential for strategic sourcing.

Supplier's Ability to Forward Integrate

Suppliers, such as large hospital networks or pharmaceutical giants, generally possess limited capacity to move into direct health insurance provision. This is due to the substantial capital investment, intricate regulatory knowledge, and robust member management systems that are essential for operating as an insurer. For instance, while some healthcare providers might offer direct-to-consumer health services or niche insurance plans, these ventures typically do not represent a direct challenge to the fundamental business model of a broad-spectrum health insurer like Elevance Health.

The barriers to entry for forward integration into the insurance market are considerable.

- High Capital Requirements: Establishing and maintaining an insurance operation demands significant financial resources for reserves, claims processing, and administrative overhead.

- Regulatory Complexity: Navigating the dense and ever-changing landscape of health insurance regulations at both federal and state levels is a major hurdle.

- Member Management Infrastructure: Insurers require sophisticated systems for enrollment, billing, customer service, and network management, which are costly to develop and maintain.

- Limited Direct Threat: While providers may offer ancillary services, they generally lack the scale and scope to directly compete with established health insurance providers on core offerings.

The bargaining power of suppliers for Elevance Health is generally moderate, leaning towards lower in many areas due to Elevance's scale and member base. However, specialized healthcare providers or dominant regional systems can exert more influence. For example, in 2024, hospital operating margins hovered around 3.5%, giving well-positioned hospitals some leverage in negotiations with payers like Elevance.

Elevance's vast membership, exceeding 45 million in early 2024, makes it a critical revenue source for providers, thus reducing their individual negotiating power. While switching major suppliers like large provider networks can incur substantial costs for Elevance, estimated in the millions for complex transitions, the company actively works to mitigate these dependencies through strategies like expanding its Carelon brand.

The availability of substitutes varies; while many individual providers exist, finding large-scale, high-quality substitute networks can be challenging in specific markets. Conversely, the IT and administrative services sectors offer more substitutability, allowing Elevance to negotiate more effectively. Elevance's annual indirect spending of over $7 billion underscores its significant purchasing power across a broad supplier base.

| Supplier Category | Bargaining Power Factors for Elevance Health | Example Data/Context (2024) |

|---|---|---|

| Major Healthcare Provider Networks | Limited Substitutes, High Switching Costs | Average hospital operating margin: ~3.5% |

| Specialized Medical Services | High Bargaining Power due to Uniqueness | N/A (highly specific to service) |

| IT & Administrative Services | High Substitutability, Moderate Bargaining Power | Elevance's indirect spending: >$7 billion |

| Pharmaceutical Companies | Varies by drug patent status and competition | N/A (specific to drug contracts) |

What is included in the product

This analysis dissects the competitive forces impacting Elevance Health, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly identify and mitigate competitive threats with a comprehensive Porter's Five Forces analysis, revealing key pressure points within the healthcare landscape.

Customers Bargaining Power

Elevance Health's customers, encompassing individuals, families, and employers, demonstrate significant price sensitivity. This is driven by persistent increases in healthcare costs and insurance premiums. For instance, the average annual premium for employer-sponsored family health coverage in the U.S. reached an estimated $23,968 in 2023, a 6.5% increase from the previous year, as reported by the Kaiser Family Foundation.

The growing trend of higher deductibles and out-of-pocket expenses further amplifies customer concern over affordability. Many individuals are finding it challenging to manage these upfront costs, making the overall price of healthcare plans a critical decision factor. This heightened sensitivity empowers customers to seek out more cost-effective alternatives, putting pressure on providers like Elevance Health to offer competitive pricing.

Furthermore, customers are increasingly demanding greater transparency in healthcare pricing and the value they receive for their money. They are actively researching and comparing options, seeking to understand the true cost of services and the benefits provided. This push for transparency allows customers to make more informed choices, thereby strengthening their bargaining power.

Customers of Elevance Health possess significant bargaining power due to the wide array of available alternatives. These include major national competitors like UnitedHealth Group, CVS Health's Aetna, Cigna, and Humana, as well as numerous regional insurance providers and government-sponsored programs such as Medicare and Medicaid. The sheer volume of choice, especially in markets with a strong presence of multiple insurers, directly amplifies the ability of customers to negotiate better terms or switch providers if dissatisfied.

For individual consumers, the direct financial costs of switching health insurance plans are often minimal, particularly when occurring during the annual open enrollment period. This ease of transition for individuals contributes to lower switching costs.

However, for employer-sponsored health plans, the scenario is different. Switching insurers can involve substantial administrative burdens, including the effort of renegotiating contracts and managing new enrollment processes. In 2024, many large employers continue to prioritize stability and predictability in their benefits packages, making frequent switching less appealing due to the potential for employee dissatisfaction and operational disruptions.

These factors, especially the administrative complexities and potential employee impact for large groups, create a degree of customer stickiness for Elevance Health, thereby moderating the bargaining power of its corporate clients.

Customer Concentration and Volume

Elevance Health's customer base is quite varied, ranging from individuals to significant groups like large employers and government programs. The sheer volume of members these larger entities represent gives them considerable sway.

For instance, government programs, such as state-level Medicaid contracts, can significantly influence premium pricing and the specific services Elevance Health offers due to the substantial number of lives covered. This concentration of volume is a key factor in their bargaining power.

As of December 31, 2024, Elevance Health served 45.7 million members. This large membership pool means that even a small percentage of members concentrated within a single large contract represents significant revenue, amplifying the bargaining power of that specific customer group.

- Customer Concentration: Large employers and government entities represent concentrated customer groups.

- Volume Impact: The high volume of members within these groups grants them significant bargaining power.

- Influence on Terms: This power can be used to negotiate premium rates and dictate service offerings.

- Elevance Health Membership: As of year-end 2024, Elevance Health managed 45.7 million members.

Customer Information and Digital Tools

The growing prevalence of online comparison tools and digital health platforms significantly boosts customer bargaining power. These resources provide detailed insights into plan choices, expenses, and care quality, enabling consumers to make more informed decisions and negotiate better terms. In 2023, digital health adoption continued its upward trend, with a significant percentage of consumers actively using online resources to research healthcare options.

This enhanced transparency compels health insurers like Elevance Health to prioritize user-friendly digital interfaces and personalized offerings. Elevance Health's investment in platforms such as Sydney Health aims to directly address this by improving member engagement and providing accessible information. By 2024, the demand for seamless digital healthcare experiences is expected to be a key differentiator for insurers.

- Increased Information Access: Online tools and comparison sites empower customers with data on plan options, costs, and quality.

- Enhanced Negotiation: Greater information access allows customers to compare offerings and negotiate more effectively.

- Digital Experience Demand: Insurers are pushed to provide personalized and user-friendly digital interactions.

- Elevance Health's Strategy: Investment in digital solutions like Sydney Health to boost member engagement and information accessibility.

Customers of Elevance Health wield considerable bargaining power, largely due to the availability of numerous alternatives and their increasing price sensitivity. The rising cost of healthcare, exemplified by a 6.5% increase in average annual employer-sponsored family health coverage premiums in 2023, pushes consumers to seek more affordable options.

This power is further amplified by the ease with which individual consumers can switch plans during open enrollment, with minimal switching costs. For large employers, however, the bargaining power is moderated by the administrative complexities and potential employee disruption associated with changing providers, making stability a key consideration in 2024.

The concentration of membership within large employer groups and government programs grants them significant leverage. With Elevance Health serving 45.7 million members as of year-end 2024, even a small portion of these concentrated groups can influence pricing and service terms due to the substantial revenue they represent.

Digital tools and platforms enhance customer power by providing greater transparency into plan choices, costs, and quality. Elevance Health's investment in digital solutions like Sydney Health aims to meet the growing demand for accessible information and personalized digital experiences, a critical differentiator in the 2024 market.

| Factor | Impact on Elevance Health | Evidence/Data Point |

|---|---|---|

| Availability of Alternatives | High bargaining power for customers | Numerous national competitors (UnitedHealth, Aetna, Cigna, Humana) and regional providers. |

| Price Sensitivity | Customers seek cost-effective options | 2023 average annual employer-sponsored family health coverage premium: $23,968 (6.5% increase from 2022). |

| Switching Costs (Individual) | Low, increasing customer mobility | Minimal financial and administrative hurdles during open enrollment. |

| Switching Costs (Employer) | Moderate, creating some stickiness | Administrative burdens and potential employee impact discourage frequent switching for large employers in 2024. |

| Customer Concentration (Large Groups) | Significant leverage for major clients | Elevance Health's 45.7 million members (as of Dec 31, 2024) mean large contracts represent substantial revenue. |

| Digital Transparency | Empowers informed decision-making | Growing use of online comparison tools and digital health platforms. |

What You See Is What You Get

Elevance Health Porter's Five Forces Analysis

This preview shows the exact Elevance Health Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry within the health insurance industry. Understand the strategic positioning and potential challenges Elevance Health faces with this comprehensive, ready-to-use document.

Rivalry Among Competitors

The U.S. health insurance sector is characterized by significant concentration, with a handful of national giants like Elevance Health, UnitedHealth Group, CVS Health (Aetna), Cigna, and Humana vying for market dominance. This oligopolistic structure fuels intense competition.

Elevance Health's market share stood at approximately 22.26% as of the second quarter of 2025, demonstrating its substantial presence. While this indicates a leading position, it also highlights that the market is not monopolized, leaving room for other substantial players.

Beyond these major national insurers, a multitude of smaller regional companies and specialized insurers also compete. These entities often focus on specific demographics or geographic areas, adding another layer of complexity to the competitive rivalry.

The health insurance market, while mature, is still experiencing robust growth. Projections indicate a compound annual growth rate (CAGR) of 7.3% from 2024 to 2029. This expansion is fueled by heightened healthcare awareness and escalating medical expenses.

Despite this positive growth trajectory, the market remains intensely competitive. Established players like Elevance Health are locked in a constant battle for market share, particularly within high-demand segments such as Medicare Advantage and Individual Affordable Care Act (ACA) plans.

While basic health insurance might seem similar across providers, Elevance Health actively differentiates itself. They focus on value-based care, which rewards better health outcomes, and offer integrated services that coordinate care more effectively. For instance, their Sydney Health app provides members with digital tools and personalized support, aiming to make managing health easier and more engaging.

Exit Barriers and Fixed Costs

Elevance Health, like other major health insurers, faces substantial exit barriers. These are largely driven by the immense fixed costs embedded in maintaining extensive provider networks, sophisticated IT systems for claims processing and member management, and ongoing compliance with evolving healthcare regulations. For instance, in 2024, the healthcare IT spending for large insurers continues to be a significant investment, often running into hundreds of millions of dollars annually to support digital transformation and data analytics.

These high fixed costs create a strong incentive for companies to stay in the market and continue operating, even when profitability is challenged. This means Elevance Health and its competitors are likely to fight aggressively for market share rather than withdraw, intensifying competitive rivalry. The need to spread these fixed costs over a larger member base often leads to price competition and innovation efforts to attract and retain customers.

- High Fixed Costs: Significant investments in IT infrastructure, provider network development, and regulatory compliance create substantial sunk costs for health insurers.

- Incentive to Stay: The need to amortize these high fixed costs encourages companies to remain competitive rather than exit the market, even during periods of reduced profitability.

- Intensified Rivalry: This dynamic leads to fiercer competition among existing players, as they strive to capture market share and optimize their cost structures.

Regulatory Environment and Policy Changes

The health insurance sector operates under a dense web of federal and state regulations, directly influencing competitive intensity. Policies like the Affordable Care Act (ACA), adjustments to Medicare Advantage reimbursement rates, and ongoing Medicaid redeterminations create a dynamic landscape. For instance, the Centers for Medicare & Medicaid Services (CMS) announced a proposed 3.7% increase in Medicare Advantage payments for 2024, a figure that impacts revenue projections and strategic planning for insurers like Elevance Health.

These regulatory shifts can dramatically alter market attractiveness and impose significant compliance costs. Companies must continuously adapt their strategies to navigate these changes, which can lead to increased competition for profitable market segments and necessitate substantial investments in compliance infrastructure. The constant evolution of these rules means that staying ahead requires agility and a deep understanding of policy implications.

- Federal and State Oversight: The health insurance industry is heavily influenced by federal laws such as the ACA and state-specific mandates, creating a complex regulatory environment.

- Impact of Policy Adjustments: Changes in Medicare Advantage rates and Medicaid redetermination processes directly affect insurer profitability and competitive positioning.

- Strategic Adaptation: Regulatory shifts often compel companies to adjust their business models and strategies to maintain market share and profitability.

- Compliance Burden: Adhering to evolving regulations requires significant investment in compliance systems and personnel, impacting operational costs.

The competitive landscape for Elevance Health is defined by a few dominant national players and numerous smaller regional insurers, all vying for market share in a growing but mature industry. This intense rivalry is further fueled by high fixed costs associated with technology and compliance, creating significant exit barriers that encourage companies to remain competitive rather than withdraw.

Elevance Health's market share, around 22.26% in Q2 2025, shows it's a leader but not a monopolist, meaning substantial competition exists. The market is projected to grow at a 7.3% CAGR from 2024 to 2029, attracting continued aggressive competition as companies like Elevance Health focus on differentiated offerings like value-based care and integrated digital tools to attract and retain members.

Regulatory shifts, such as adjustments to Medicare Advantage payments, directly impact profitability and competitive dynamics, compelling insurers to adapt strategies and invest in compliance. For example, the proposed 3.7% Medicare Advantage payment increase for 2024 by CMS highlights how policy changes necessitate ongoing strategic adjustments.

| Competitor | Approx. Market Share (Q2 2025) | Key Focus Areas |

|---|---|---|

| Elevance Health | 22.26% | Value-based care, integrated services, digital tools |

| UnitedHealth Group | Significant | Diversified offerings, Optum health services |

| CVS Health (Aetna) | Significant | Pharmacy integration, retail health services |

| Cigna | Significant | Health services, employer-sponsored plans |

| Humana | Significant | Medicare Advantage, senior care |

SSubstitutes Threaten

Direct Primary Care (DPC) and concierge medicine models present a growing threat of substitutes for traditional health insurance providers like Elevance Health. These models allow patients to pay a flat monthly or annual fee directly to a physician for primary care services, often cutting out insurance for routine visits.

This approach appeals to individuals seeking enhanced patient-physician relationships and potentially more predictable healthcare costs for everyday needs. By offering a direct alternative for primary care, these models can siphon off a segment of the market that might otherwise rely on Elevance Health's network for these fundamental services.

For instance, the DPC model is gaining traction, with estimates suggesting that by 2024, the market size for DPC in the US could reach several billion dollars, indicating a significant shift in how some consumers access primary care. This trend directly challenges the traditional insurance-based model for basic health needs.

Medical cost-sharing programs, often faith-based, present a significant threat of substitutes for traditional health insurance. These programs operate on a communal principle, pooling member contributions to cover medical expenses, functioning as an alternative for individuals seeking options outside conventional plans, especially for major health events.

While not regulated as insurance, these non-traditional options appeal to a segment of the population looking for lower premiums or different coverage structures. For instance, some faith-based cost-sharing ministries have seen membership growth, indicating a market demand for alternatives to employer-sponsored or ACA-compliant plans.

Large employers increasingly opt for self-insurance, directly managing their employees' healthcare expenses instead of purchasing traditional insurance plans. This strategy allows them to retain financial risk, often leveraging third-party administrators (TPAs) for operational support, which can include services offered by companies like Elevance Health. In 2023, it's estimated that over 60% of American workers were covered by employer-sponsored health insurance that was self-funded, highlighting a significant shift away from fully insured products.

Government-Provided Healthcare Programs

Government-provided healthcare programs, like Medicare and Medicaid, act as potent substitutes for private health insurance offered by companies such as Elevance Health. These public programs cater to specific demographics, including seniors, individuals with disabilities, and low-income populations, offering comprehensive coverage that directly challenges private insurers for market share within these segments. For instance, in 2023, Medicare covered over 65 million Americans, while Medicaid provided coverage to roughly 80 million individuals, illustrating the substantial reach of these government alternatives.

The presence of these large-scale government programs significantly impacts the competitive landscape for private insurers. They can limit the growth potential for private plans targeting these eligible populations. Furthermore, government initiatives aimed at expanding access to these programs or increasing their benefits can further intensify this substitution threat. In 2024, projected federal spending on Medicare and Medicaid continues to represent a significant portion of the national budget, underscoring their ongoing role and competitive pressure.

The threat of substitutes from government programs is characterized by:

- Broad Coverage: Medicare and Medicaid offer extensive health benefits, making them attractive alternatives to private plans for eligible individuals.

- Cost-Effectiveness: For beneficiaries, these government programs often present lower out-of-pocket costs compared to private insurance premiums and deductibles.

- Market Share Capture: These programs directly compete for members, particularly in the senior and low-income markets, limiting the addressable market for private insurers.

- Policy Influence: Changes in government healthcare policy or expansions of program eligibility can directly shift market dynamics, increasing the substitution threat.

Wellness Programs and Preventive Care Focus

The growing emphasis on preventive care and wellness programs presents a significant threat of substitutes for traditional health insurance. As individuals increasingly adopt healthier lifestyles, aided by digital health tools and proactive health management, the perceived necessity for extensive insurance coverage diminishes. For example, a 2024 survey indicated that 65% of adults reported participating in at least one wellness activity weekly, a trend that could reduce reliance on insurance for managing common health concerns.

These wellness initiatives, while often complementary to insurance, can also act as substitutes by mitigating the financial burden of health issues through early intervention and lifestyle choices. This shift might encourage consumers to consider less comprehensive or alternative health plans, thereby impacting the market share of traditional insurers like Elevance Health. The direct-to-consumer market for personalized wellness plans and preventative health services saw a 15% growth in 2023, indicating a rising preference for these alternatives.

The threat is amplified as these substitutes offer a more personalized and often cost-effective approach to health maintenance.

- Growing adoption of digital health: Wearable technology and health apps are empowering individuals to monitor and manage their health proactively.

- Increased focus on lifestyle: A greater societal awareness of the impact of diet, exercise, and stress management on overall well-being is reducing the incidence of preventable diseases.

- Availability of direct-to-consumer services: Telehealth platforms and specialized wellness providers offer accessible alternatives for consultations and treatments, bypassing traditional insurance networks.

- Potential for cost savings: Consumers may perceive that investing in preventive measures directly is more economical than paying premiums for comprehensive insurance that might not be fully utilized.

Direct Primary Care (DPC) and concierge medicine models offer a distinct alternative to traditional health insurance by providing direct access to physicians for a flat fee. These models can attract patients seeking personalized care and predictable costs for routine services, potentially diverting market share from insurers like Elevance Health.

Medical cost-sharing programs, often faith-based, also serve as substitutes by pooling member contributions for medical expenses, appealing to individuals seeking alternatives to conventional insurance plans. For instance, some ministries have reported membership growth, indicating a demand for non-traditional health coverage options.

Self-insured employers represent a significant substitute, as they manage their employees' healthcare costs directly, often using third-party administrators. In 2023, over 60% of American workers were covered by self-funded employer health insurance, demonstrating a substantial shift away from fully insured products.

Government programs like Medicare and Medicaid are major substitutes, covering millions of Americans, particularly seniors and low-income individuals. In 2023, Medicare covered over 65 million people, and Medicaid provided coverage to approximately 80 million, highlighting their extensive reach and competitive pressure on private insurers.

The increasing focus on preventive care and wellness, supported by digital health tools, also acts as a substitute. By promoting healthier lifestyles, these initiatives can reduce the perceived need for extensive insurance coverage. A 2024 survey found that 65% of adults engaged in weekly wellness activities, suggesting a trend toward reduced reliance on traditional insurance for managing common health issues.

| Substitute Type | Market Trend/Data Point | Impact on Elevance Health |

|---|---|---|

| Direct Primary Care (DPC) & Concierge Medicine | DPC market size in the US projected to reach several billion dollars by 2024. | Siphons off patients seeking direct primary care, reducing demand for traditional insurance for routine needs. |

| Medical Cost-Sharing Programs | Reported membership growth in some faith-based cost-sharing ministries. | Appeals to individuals seeking lower premiums or different coverage structures outside conventional plans. |

| Self-Insured Employers | Over 60% of American workers covered by self-funded employer health insurance in 2023. | Reduces the market for fully insured products, shifting risk and administrative needs away from traditional insurers. |

| Government Programs (Medicare/Medicaid) | Medicare covered over 65 million Americans; Medicaid covered ~80 million in 2023. | Directly competes for market share in senior and low-income segments, limiting growth potential for private plans. |

| Preventive Care & Wellness | 65% of adults participated in at least one wellness activity weekly (2024 survey). | May reduce reliance on comprehensive insurance for managing common health concerns, potentially lowering demand for traditional plans. |

Entrants Threaten

Entering the health insurance sector demands significant financial outlay. Companies need to fund extensive IT systems, robust marketing campaigns, and crucially, substantial reserves to manage potential claims. For instance, in 2024, establishing a new health insurance provider often necessitates hundreds of millions of dollars in initial capital.

These high capital requirements act as a formidable barrier, effectively shielding established companies like Elevance Health from a flood of new, smaller competitors. This financial hurdle ensures that only well-capitalized entities can realistically consider entering the market, thereby preserving the competitive landscape for existing players.

The health insurance sector is a minefield of regulations, both federal and state. New companies must contend with intricate licensing, solvency rules, and consumer protection mandates, like those stemming from the Affordable Care Act (ACA). For instance, in 2024, the ACA continues to shape market dynamics, requiring insurers to meet specific benefit standards and network adequacy rules.

Established health insurers like Elevance Health possess substantial economies of scale, which are crucial for efficient operations. In 2024, large players benefit from lower per-member costs in areas like claims administration and network negotiations, creating a significant barrier for newcomers aiming to compete on price.

The experience curve also plays a vital role; as insurers gain more experience, they refine processes, leading to further cost reductions. For instance, Elevance Health's long history allows for optimized risk management and fraud detection, capabilities that new entrants would take years and substantial investment to replicate.

Difficulty in Building Provider Networks

Building and maintaining a strong network of healthcare providers is fundamental for any health insurer. New entrants face significant hurdles in establishing these relationships, which require extensive negotiations and complex contracting processes with hospitals, physicians, and various specialists.

The sheer scale and established nature of existing provider networks create a formidable barrier. For instance, in 2024, major health insurers like UnitedHealth Group boast contracts with hundreds of thousands of providers nationwide, a density that is incredibly difficult for a newcomer to replicate quickly.

- Network Density: New entrants must invest heavily to achieve a comparable provider density to established players.

- Negotiation Power: Incumbents leverage their size and market share for more favorable contract terms, a position new entrants struggle to attain.

- Provider Loyalty: Many providers have long-standing, profitable relationships with incumbent insurers, making them hesitant to partner with new entities.

Brand Loyalty and Trust

Existing health insurance giants like Elevance Health have cultivated significant brand loyalty, a formidable barrier for newcomers. This trust, built over decades of service, makes consumers hesitant to switch for critical healthcare needs. For instance, in 2023, Elevance Health reported a revenue of $171.3 billion, underscoring its established market presence and the deep-seated relationships it maintains with its customer base.

- Established Brand Recognition: Years of consistent service have cemented brand recognition for incumbents.

- Consumer Trust is Key: Healthcare decisions are high-stakes, making trust a primary factor for consumers.

- Credibility Challenge: New entrants must invest heavily to build the same level of credibility.

- Loyalty as a Moat: Brand loyalty acts as a significant deterrent to market entry.

The threat of new entrants in the health insurance market, including for a company like Elevance Health, is generally low. Significant capital requirements, often in the hundreds of millions of dollars for 2024, create a substantial initial hurdle, demanding investment in IT, marketing, and claim reserves. Furthermore, the complex web of federal and state regulations, such as ACA mandates on benefits and network adequacy, adds another layer of difficulty for potential newcomers.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High initial investment needed for operations, IT, marketing, and reserves. | Substantial financial barrier, limiting entry to well-funded entities. | Estimated $100M+ for a new regional insurer. |

| Regulatory Complexity | Navigating federal and state insurance laws, licensing, and compliance. | Time-consuming and costly to achieve compliance, requiring specialized expertise. | ACA compliance alone involves numerous reporting and operational standards. |

| Economies of Scale | Established players benefit from lower per-member costs due to size. | New entrants struggle to compete on price and operational efficiency. | Large insurers have significantly lower administrative costs per member. |

| Provider Networks | Building and securing relationships with a broad base of healthcare providers. | Difficult and time-consuming to match the density and breadth of incumbent networks. | Major insurers contract with hundreds of thousands of providers. |

| Brand Loyalty & Trust | Established reputation and customer trust built over time. | New entrants face a significant challenge in attracting customers for critical healthcare needs. | Insurers with decades of operation command higher consumer confidence. |

Porter's Five Forces Analysis Data Sources

Our Elevance Health Porter's Five Forces analysis is built upon a foundation of robust data, including publicly available financial statements, industry-specific market research reports, and regulatory filings from government agencies.