Elevance Health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elevance Health Bundle

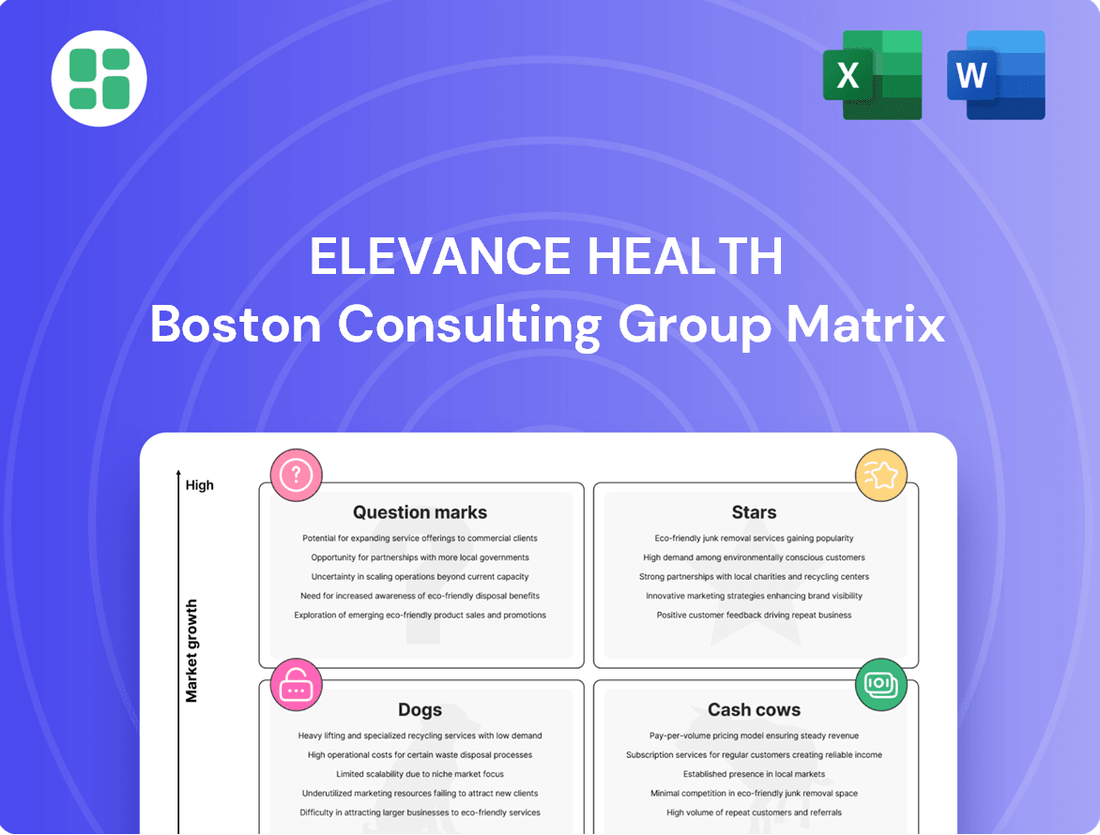

Curious about Elevance Health's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio of health services and products are performing in the market. Understand which areas are driving growth and which might require a closer look.

Don't settle for a partial view. Purchase the full Elevance Health BCG Matrix to unlock detailed quadrant placements, identify their Stars, Cash Cows, Dogs, and Question Marks, and gain actionable insights to optimize your investment and product strategies.

Stars

Elevance Health's Medicare Advantage (MA) segment is a significant growth engine, with the company anticipating a 7-9% membership increase for 2025. This robust growth is occurring even as other players in the market are reducing their MA presence.

The MA business has demonstrated impressive enrollment momentum, adding around 249,000 beneficiaries between March 2024 and March 2025. This expansion highlights Elevance's strategic focus on achieving profitable growth within the MA space.

Elevance is capitalizing on strong member retention rates and strategically expanding in markets that show favorable demographic and competitive conditions. This approach is designed to ensure sustainable and profitable expansion in its Medicare Advantage offerings.

Carelon Services, a key component of Elevance Health's services arm, is showing robust expansion. In 2024, its revenue saw a substantial jump, and it's expected to maintain a compound annual growth rate in the high teens to low twenties.

This upward trajectory is significantly supported by strategic moves like the acquisition of CareBridge, a company focused on value-based care within home and community settings. This acquisition is designed to strengthen Carelon's integrated care models and broaden its capacity for risk-based arrangements.

CarelonRx, Elevance Health's pharmacy benefit manager, is a significant driver of revenue, demonstrating mid-teens growth. This segment is projected to achieve a low double-digit compound annual growth rate (CAGR), fueled by rising prescription volumes and a beneficial drug formulary.

The growth in CarelonRx is intrinsically linked to Elevance Health's strategy of offering integrated medical and pharmacy solutions. Elevance is committed to scaling CarelonRx's capabilities, reinforcing its pivotal role within the broader healthcare landscape.

Integrated Commercial Offerings for National Accounts

Elevance Health is seeing significant traction with its integrated commercial offerings, especially among national accounts. This strategy is proving to be a key differentiator in the market.

The company's success in securing 18 new national accounts for 2025 highlights the market's appetite for comprehensive solutions. Many of these new partners have opted for Elevance as their single provider for both medical and pharmacy benefits, underscoring the value of this integrated approach.

- Strong Growth in National Accounts: Secured 18 new national accounts for 2025.

- Integrated Solutions Demand: Many new accounts chose Elevance for both medical and pharmacy benefits.

- Competitive Advantage: The integrated model drives sustained growth in the commercial segment.

Dual-Eligible Special Needs Plans (D-SNPs)

Dual-Eligible Special Needs Plans (D-SNPs) are a key growth driver within Elevance Health's Medicare Advantage offerings. These plans serve individuals eligible for both Medicare and Medicaid, a population often requiring more comprehensive care. Elevance is strategically increasing enrollment in D-SNPs, aligning with its broader goal of addressing the complete health needs of its members.

In 2024, the dual-eligible population continues to present a significant opportunity. These beneficiaries often have complex health conditions, leading to higher utilization but also offering the potential for better health outcomes and cost management through coordinated care. Elevance Health's focus on D-SNPs reflects a commitment to serving this vulnerable group effectively.

- High Growth Potential: D-SNPs are identified as a high-growth segment within Medicare Advantage.

- Targeted Population: Plans cater to individuals eligible for both Medicare and Medicaid.

- Strategic Focus: Elevance Health is prioritizing enrollment and development in D-SNPs.

- Whole Health Alignment: D-SNPs support Elevance's strategy of addressing members' complete health needs.

Elevance Health's Medicare Advantage (MA) segment is a star performer, projected to grow membership by 7-9% in 2025. This segment is a significant revenue driver, with strong enrollment momentum, adding approximately 249,000 beneficiaries between March 2024 and March 2025.

The company's integrated commercial offerings, particularly for national accounts, are also stars. Elevance secured 18 new national accounts for 2025, with many opting for combined medical and pharmacy benefits, highlighting the strength of this integrated approach.

Dual-Eligible Special Needs Plans (D-SNPs) represent another star segment within Elevance's MA portfolio. These plans cater to a complex but high-potential population, and Elevance is strategically focused on increasing enrollment to address the complete health needs of these members.

| Segment | Growth Projection | Key Drivers | 2024/2025 Data Points |

| Medicare Advantage | 7-9% Membership Increase (2025) | Strong retention, favorable market expansion | Added ~249,000 beneficiaries (Mar 2024 - Mar 2025) |

| Integrated Commercial (National Accounts) | Sustained Growth | Demand for integrated medical & pharmacy solutions | Secured 18 new national accounts for 2025 |

| Dual-Eligible Special Needs Plans (D-SNPs) | High Growth Potential | Serving complex, dual-eligible population | Strategic focus on enrollment and development |

What is included in the product

The Elevance Health BCG Matrix offers a visual framework for assessing its business units based on market share and growth potential.

It guides strategic decisions on investing in Stars, milking Cash Cows, nurturing Question Marks, and divesting Dogs.

The Elevance Health BCG Matrix offers a clear, one-page overview, simplifying complex strategic decisions.

Cash Cows

Elevance Health's established commercial self-funded plans for employer groups are definite cash cows. This segment boasts a high market share and reliably churns out substantial cash, largely due to strong client loyalty and predictable administrative fees. For instance, in 2024, Elevance reported significant revenue from its employer group offerings, underscoring the stability of these fee-based arrangements.

Elevance Health's traditional commercial risk-based plans are its cash cows. These mature offerings, boasting a significant market share in established regions, consistently generate substantial premium revenue. For instance, in 2023, Elevance reported total revenue of $171.3 billion, with its commercial segment contributing a significant portion, reflecting the stability of these established products.

While not experiencing rapid expansion, these plans benefit from optimized operational efficiencies and robust competitive moats. This steady income stream acts as a reliable funding source, enabling Elevance to strategically allocate capital towards more dynamic growth ventures or return value to its investors.

Elevance Health's Federal Employee Program (FEP) represents a significant cash cow within its portfolio. This long-standing business boasts a high market share, translating into stable and predictable revenue streams. The established presence and consistent demand from federal employees ensure reliable cash generation.

In 2023, Elevance Health reported approximately $20.5 billion in revenue from its FEP business, highlighting its substantial contribution. This segment operates in a mature market, characterized by low volatility, which further solidifies its role as a consistent cash generator for the company.

BlueCard Business

The BlueCard program, a core offering of Elevance Health, functions as a robust cash cow within its business portfolio. This initiative allows Elevance to service members of other Blue Cross Blue Shield plans when they travel outside their usual service regions, generating a steady stream of administrative fees. Its high volume and stability, coupled with low growth expectations, are characteristic of a mature, reliable business segment.

Leveraging an already established and extensive network, along with strong brand recognition, the BlueCard business ensures a predictable and consistent inflow of revenue. This existing infrastructure significantly boosts its efficiency, making it a highly profitable cash generator for Elevance Health.

In 2023, Elevance Health reported significant revenue from its various segments, and while specific BlueCard figures are often embedded within broader reporting, the program's operational efficiency and consistent fee structure contribute substantially to the company's overall financial health. For instance, in the first quarter of 2024, Elevance Health reported total revenue of $42.2 billion, demonstrating the scale of operations within which BlueCard plays a vital role.

- BlueCard's Role: Facilitates out-of-area service for other Blue Cross Blue Shield members.

- Revenue Stream: Primarily driven by administrative fees.

- Market Position: High volume, low growth, high stability.

- Efficiency: Benefits from existing infrastructure and brand recognition.

Dental, Vision, and Supplemental Health Insurance

Elevance Health's dental, vision, and supplemental health insurance products are classic cash cows. These benefits are in mature markets, meaning most people who want them already have them, leading to stable demand. For instance, in 2023, the U.S. dental insurance market alone was valued at over $70 billion, demonstrating its significant size and established nature.

These offerings provide Elevance Health with consistent revenue streams and healthy profit margins. Because the demand is stable and the products are well-understood, they don't require massive new investments in marketing or product development. This allows them to generate significant cash flow with minimal ongoing capital expenditure.

The predictable nature of these supplemental benefits contributes to Elevance Health's diversified revenue. They act as reliable cash generators, supporting investments in other areas of the business. In 2024, Elevance Health reported continued growth in its "Diversified Business" segment, which includes these specialty benefits, indicating their ongoing strength.

- Mature Markets: Dental and vision insurance operate in markets with high penetration rates, ensuring stable demand.

- Stable Revenue & Profitability: These products contribute consistent revenue and healthy profit margins due to predictable demand and lower investment needs.

- Diversified Income: They enhance Elevance Health's revenue diversification, providing a reliable income stream.

- Low Investment Needs: Minimal ongoing investment in promotion and placement makes them efficient cash generators for the company.

Elevance Health's established commercial self-funded plans for employer groups are definite cash cows. This segment boasts a high market share and reliably churns out substantial cash, largely due to strong client loyalty and predictable administrative fees. For instance, in 2024, Elevance reported significant revenue from its employer group offerings, underscoring the stability of these fee-based arrangements.

Elevance Health's traditional commercial risk-based plans are its cash cows. These mature offerings, boasting a significant market share in established regions, consistently generate substantial premium revenue. For instance, in 2023, Elevance reported total revenue of $171.3 billion, with its commercial segment contributing a significant portion, reflecting the stability of these established products.

While not experiencing rapid expansion, these plans benefit from optimized operational efficiencies and robust competitive moats. This steady income stream acts as a reliable funding source, enabling Elevance to strategically allocate capital towards more dynamic growth ventures or return value to its investors.

Elevance Health's Federal Employee Program (FEP) represents a significant cash cow within its portfolio. This long-standing business boasts a high market share, translating into stable and predictable revenue streams. The established presence and consistent demand from federal employees ensure reliable cash generation.

In 2023, Elevance Health reported approximately $20.5 billion in revenue from its FEP business, highlighting its substantial contribution. This segment operates in a mature market, characterized by low volatility, which further solidifies its role as a consistent cash generator for the company.

The BlueCard program, a core offering of Elevance Health, functions as a robust cash cow within its business portfolio. This initiative allows Elevance to service members of other Blue Cross Blue Shield plans when they travel outside their usual service regions, generating a steady stream of administrative fees. Its high volume and stability, coupled with low growth expectations, are characteristic of a mature, reliable business segment.

Leveraging an already established and extensive network, along with strong brand recognition, the BlueCard business ensures a predictable and consistent inflow of revenue. This existing infrastructure significantly boosts its efficiency, making it a highly profitable cash generator for Elevance Health.

In 2023, Elevance Health reported significant revenue from its various segments, and while specific BlueCard figures are often embedded within broader reporting, the program's operational efficiency and consistent fee structure contribute substantially to the company's overall financial health. For instance, in the first quarter of 2024, Elevance Health reported total revenue of $42.2 billion, demonstrating the scale of operations within which BlueCard plays a vital role.

Elevance Health's dental, vision, and supplemental health insurance products are classic cash cows. These benefits are in mature markets, meaning most people who want them already have them, leading to stable demand. For instance, in 2023, the U.S. dental insurance market alone was valued at over $70 billion, demonstrating its significant size and established nature.

These offerings provide Elevance Health with consistent revenue streams and healthy profit margins. Because the demand is stable and the products are well-understood, they don't require massive new investments in marketing or product development. This allows them to generate significant cash flow with minimal ongoing capital expenditure.

The predictable nature of these supplemental benefits contributes to Elevance Health's diversified revenue. They act as reliable cash generators, supporting investments in other areas of the business. In 2024, Elevance Health reported continued growth in its Diversified Business segment, which includes these specialty benefits, indicating their ongoing strength.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approximate) | 2024 Performance Indicator |

| Commercial Self-Funded Plans | Cash Cow | High market share, stable fees, strong client loyalty | Significant portion of total revenue | Continued revenue stability |

| Traditional Commercial Risk-Based Plans | Cash Cow | Mature offerings, established regions, consistent premium revenue | Substantial contributor to $171.3 billion total revenue | Reliable cash generation |

| Federal Employee Program (FEP) | Cash Cow | High market share, stable and predictable revenue streams | ~$20.5 billion | Low volatility, consistent cash flow |

| BlueCard Program | Cash Cow | Administrative fees, high volume, low growth, high stability | Embedded within broader reporting, significant operational efficiency | Contributes to overall financial health |

| Dental, Vision, Supplemental Health | Cash Cow | Mature markets, stable demand, healthy profit margins | Part of growing Diversified Business segment | Ongoing strength and diversification |

Preview = Final Product

Elevance Health BCG Matrix

The Elevance Health BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means you get direct access to a professionally designed analysis, ready for immediate strategic application without any watermarks or demo content. The comprehensive report, crafted with expert insights, will be instantly downloadable, allowing you to seamlessly integrate it into your business planning and decision-making processes. You're seeing the exact, analysis-ready file that will empower your strategic clarity and competitive positioning.

Dogs

Elevance Health's Medicaid business is experiencing considerable headwinds. Membership has declined due to ongoing redeterminations, and rising medical costs are impacting profitability. This has led Elevance to lower its profit forecasts, specifically pointing to a disconnect between member health needs and what states are paying.

The company acknowledges the long-term promise of the Medicaid market but is currently seeing this segment act as a drain on resources. Unprecedented challenges and a shrinking market share are contributing factors to this situation, making it a key area of concern for Elevance.

Elevance Health’s strategic decision to exit certain underperforming Medicare Advantage plans and specific counties aligns with the 'Dog' quadrant of the BCG matrix. This move signifies a recognition of segments with low market share and profitability that were not meeting strategic objectives or return expectations.

These divested plans, often characterized by low star ratings, were consuming valuable resources without generating adequate returns, a classic indicator of a 'Dog' product. For instance, in 2024, Elevance reported a focus on optimizing its Medicare Advantage portfolio, which included a deliberate reduction in exposure to markets where competitive pressures and operational challenges led to suboptimal performance.

Certain legacy individual health insurance plans, not integrated with the Affordable Care Act (ACA) marketplaces, could be categorized as 'Dogs' within Elevance Health's portfolio. These plans often experience shrinking membership and face limited future expansion opportunities.

The administrative burden for these older plans can be disproportionately high, especially if they rely on legacy systems or offer less competitive benefits compared to current market standards. In 2024, such plans likely represent a small fraction of Elevance's total individual market enrollment, with a declining trend observed over recent years.

Given their low market penetration and stagnant growth, these legacy plans may be candidates for a strategic review, potentially leading to a managed decline or eventual discontinuation to focus resources on more promising product lines.

Small, Unprofitable Niche Acquisitions

Small, unprofitable niche acquisitions represent a potential concern within Elevance Health's portfolio, akin to Dogs in the BCG Matrix. These might be smaller companies or service lines that, despite initial strategic intent, struggle to achieve profitability or significant market penetration. For instance, if Elevance acquired a specialized digital health platform in 2023 that didn't gain user adoption or integrate smoothly with existing offerings, it could fall into this category. Such ventures might consume resources without delivering the expected financial returns or strategic advantages.

These underperforming niche acquisitions necessitate rigorous ongoing evaluation. If a particular acquisition, perhaps a niche pharmacy benefit management service acquired in late 2023, consistently fails to meet profitability targets or contribute meaningfully to Elevance's overall market share, its future becomes questionable. The company must assess whether continued investment is warranted or if divesting the asset would be a more prudent financial decision, freeing up capital for more promising ventures.

- Potential for Capital Drain: Small, niche acquisitions that don't achieve profitability can tie up capital without generating commensurate returns, impacting overall financial health.

- Integration Challenges: Difficulties in integrating smaller, specialized entities into Elevance's broader operational framework can hinder their success and lead to underperformance.

- Market Traction Issues: A lack of significant market adoption or competitive positioning for these niche acquisitions can limit their growth potential and profitability.

- Strategic Review Necessity: Consistent underperformance necessitates regular strategic reviews to determine if divestiture or a significant turnaround strategy is the most effective path forward.

Certain Geographically Limited or Low-Enrollment Plans

Certain health plans within Elevance Health, particularly those operating in very specific, limited geographic areas or experiencing consistently low enrollment, can be classified as Dogs in the BCG Matrix. These niche plans often struggle to achieve the necessary economies of scale, which can drive up their operational costs and consequently reduce their profitability. For instance, a plan with fewer than 10,000 members in a small, rural county might face higher per-member administrative expenses compared to a large metropolitan plan.

The lack of significant market share or growth potential is a key indicator. If these plans do not exhibit a clear path toward increasing enrollment or improving their competitive position, they become candidates for strategic review, which could lead to reduction in investment or even complete exit from the market. For example, a plan that has seen its enrollment decline by 5% year-over-year and has no clear strategy to reverse this trend would be a prime example.

- Low Enrollment Impact: Plans with consistently low enrollment, for example, under 5,000 members, often cannot leverage bulk purchasing power for medical services or administrative efficiencies, leading to higher per-member costs.

- Geographic Limitations: Health plans concentrated in very specific, smaller geographic regions may face limited growth opportunities and intense competition from larger, more diversified insurers.

- Profitability Challenges: The inability to achieve economies of scale directly impacts profitability. A plan with high fixed costs and low membership may operate at a loss, requiring ongoing subsidies.

- Strategic Review: Such plans are often evaluated for potential divestiture or consolidation if they do not show a viable strategy for improving market share or achieving sustainable profitability.

Elevance Health's 'Dog' category encompasses segments with low market share and profitability, often requiring careful management or divestiture. This includes specific underperforming Medicare Advantage plans and certain legacy individual health insurance products that face shrinking membership and limited growth prospects. These areas consume resources without delivering adequate returns, necessitating strategic reviews to optimize the overall portfolio.

The company's strategic exits from certain low-performing Medicare Advantage plans in 2024 exemplify this. These plans, often characterized by lower star ratings and intense competition, were divested to reallocate capital to more promising areas. Similarly, legacy individual health plans, not aligned with ACA marketplaces, represent a shrinking segment with high administrative costs, making them prime candidates for a managed decline.

Small, unprofitable niche acquisitions also fall into the 'Dog' quadrant. These ventures, if they fail to gain market traction or achieve profitability, can drain resources. For instance, a specialized digital health platform acquired in 2023 that did not see user adoption would be a prime example, requiring evaluation for divestiture.

Health plans with consistently low enrollment, such as those with under 5,000 members in limited geographic areas, also fit the 'Dog' profile. These plans struggle with economies of scale, leading to higher per-member costs and reduced profitability, often prompting strategic reviews for potential divestiture or consolidation.

Question Marks

Elevance Health's individual ACA exchange plans operate in a dynamic, high-growth market. The company saw robust membership increases in 2024, with projections indicating continued expansion into 2025, reflecting strong demand for these essential health coverage options.

Despite this growth, the segment faces headwinds. Elevated medical cost trends and a slowdown in effectuation rates have contributed to membership churn and a recalibration of profit expectations. These challenges necessitate substantial investment to secure a stronger market position and long-term profitability.

Elevance Health's digital health solutions, including the Sydney Health app and its AI/data analytics initiatives, are positioned as Stars in the BCG matrix. The company is targeting $1 billion in annual revenue from these digital solutions by 2025, indicating strong growth potential in a rapidly expanding market focused on member engagement and care coordination.

These ventures require substantial investment, reflecting their position as high-growth, high-investment areas. While their current market share and direct profitability are still maturing, the significant cash consumption is justified by their strategic importance and the anticipated future returns from these innovative digital platforms.

Mosaic Health, launched in 2024 by Elevance Health, represents a significant new primary care delivery platform. It's designed to innovate clinical and digital care across 19 states, aiming to serve close to 1 million consumers with a value-based model.

As a nascent venture in a competitive and evolving healthcare landscape, Mosaic Health is positioned as a Question Mark in the BCG matrix. It demands considerable investment to establish market presence and demonstrate future profitability, aligning with the characteristics of this strategic category.

Community Connected Care Programs

Elevance Health's Community Connected Care Programs are positioned as question marks in the BCG matrix. These programs focus on addressing social determinants of health through partnerships with local entities, aiming to improve health equity and long-term patient outcomes.

While these initiatives show significant potential for growth within the expanding health and social care integration market, they are currently in early stages of development and scaling. This means they have a relatively low direct market share but require strategic investment to broaden their impact and reach.

- Investment Focus: Addressing social determinants of health through local partnerships.

- Market Position: Nascent stage of market development and scaling.

- Growth Potential: High potential in health and social care integration.

- Current Share: Relatively low direct market share, requiring strategic investment.

Home Health Business Expansion

Elevance Health is actively growing its home health segment, building upon the foundation laid by the CareBridge acquisition to bolster Carelon's home health offerings. This strategic move targets a rapidly expanding market, fueled by demographic shifts towards an older population and a growing consumer demand for care delivered within the comfort of their own homes.

The home health market is experiencing significant tailwinds. For instance, the U.S. home healthcare market size was valued at approximately $130.1 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2030, according to Grand View Research. This growth underscores the substantial opportunity for Elevance Health.

- Market Growth: The aging U.S. population, with individuals aged 65 and over projected to reach 80.8 million by 2050, is a primary driver for increased demand in home health services.

- CareBridge Acquisition: This acquisition provided Elevance Health with a significant initial footprint and operational expertise in the home health space.

- Organic Expansion: Elevance is investing in developing new, organic home health capabilities to complement its acquisitions and capture a larger market share.

- Investment Focus: Continued investment is crucial for Elevance to establish dominance in this competitive and evolving sector, aiming to solidify its position as a leading provider.

Elevance Health's nascent ventures, such as Mosaic Health and Community Connected Care Programs, are currently categorized as Question Marks in the BCG matrix. These initiatives, launched or expanded in 2024, are in early stages, requiring significant investment to build market share and prove their long-term viability.

While they operate in high-growth potential areas like primary care innovation and addressing social determinants of health, their current market impact is limited. The substantial capital allocated to these segments reflects the strategic bet on their future success and ability to capture significant market share in evolving healthcare landscapes.

The success of these Question Marks hinges on effective execution and adaptation to market needs. Elevance Health's commitment to these areas underscores a strategy of investing in future growth engines, even as they demand considerable resources for development and scaling.

The company is actively investing in these new ventures, aiming to establish them as future Stars or Cash Cows. For example, Mosaic Health aims to innovate clinical and digital care across 19 states, and Community Connected Care Programs focus on health equity through local partnerships, both requiring substantial upfront capital.

| Business Unit | BCG Category | Key Characteristics | Investment Focus | Market Potential |

| Mosaic Health | Question Mark | Nascent primary care platform, launched 2024, value-based model | Establish market presence, demonstrate profitability | High, in primary care innovation |

| Community Connected Care Programs | Question Mark | Focus on social determinants of health, early stage | Broaden impact and reach, scale operations | High, in health and social care integration |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.