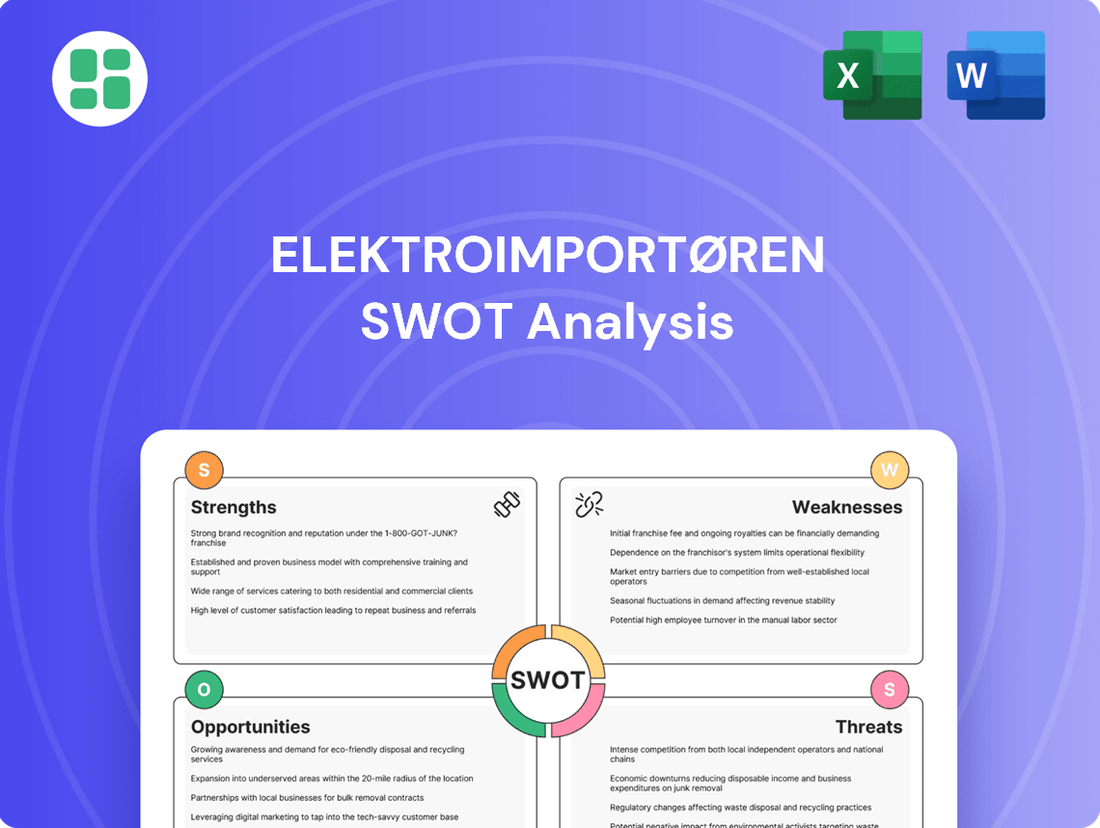

Elektroimportøren SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elektroimportøren Bundle

Elektroimportøren demonstrates strong brand recognition and a diverse product portfolio, positioning them well in the competitive electrical market. However, potential reliance on key suppliers and evolving technological landscapes present significant challenges.

Want the full story behind Elektroimportøren’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Elektroimportøren's strength lies in its well-developed omnichannel strategy, seamlessly blending its physical store presence throughout Norway with a highly effective web shop. This integration ensures customers can easily access their wide array of products, whether they prefer in-person shopping or online convenience.

This dual approach significantly broadens Elektroimportøren's market reach, appealing to both professional tradespeople and individual consumers with varying shopping habits. The company's strong digital platform is evident in its Q2 2024 performance, which saw a notable surge in online revenue within Norway.

Elektroimportøren’s diversified customer base is a significant strength, catering to both professional electricians (B2B) and individual consumers (B2C). This dual market approach effectively spreads risk and taps into different purchasing behaviors and demands.

This broad appeal is reflected in recent performance, with Q1 2025 sales showing growth across all customer segments. This indicates Elektroimportøren's ability to resonate with and serve both professional and DIY markets effectively, bolstering revenue stability.

Elektroimportøren's strong private label portfolio, particularly its Namron brand, is a significant advantage. Namron alone contributes over a third of the company's total sales, a testament to its market penetration and customer acceptance.

This private label strategy allows Elektroimportøren to implement a disruptive pricing model, which is crucial for gaining market share and ensuring healthy operating margins. By controlling the value chain from development to manufacturing, Namron enhances profitability and provides greater market control.

Positive Financial Performance and Growth Trajectory

Elektroimportøren demonstrates a strong financial performance, evidenced by its consistent positive trajectory. Q1 2025 results continued this upward trend, showcasing growth in sales across all operational channels. This growth was complemented by an enhancement in gross margins and effective management of operating expenses.

The company's revenue figures highlight this positive momentum. For the full year 2024, Elektroimportøren reported total revenues of NOK 1,627 million. Furthermore, the group experienced an increase in revenues during Q4 2024, reinforcing the company's expanding market presence and operational efficiency.

- Growing Sales: Revenues increased across all channels in Q1 2025, continuing a positive trend.

- Improved Margins: Gross margins saw an improvement in the most recent reporting period.

- Controlled Expenses: Operating expenses were effectively managed, contributing to profitability.

- Full Year Revenue: The group achieved total revenues of NOK 1,627 million for the full year 2024.

Established Market Presence and Expansion

Elektroimportøren boasts a robust network of physical stores across Norway, demonstrating a strong and established market presence. This is further solidified by its ongoing, strategic expansion. For instance, the company celebrated the opening of its 30th store in Lillehammer in March 2025, indicating a consistent drive for growth and increased accessibility for customers.

The success of this expansion is evident in the positive customer reception in newly opened locations, reinforcing the company's ability to identify and capitalize on market opportunities. This continuous rollout of new stores, coupled with strong customer engagement, not only broadens Elektroimportøren's reach but also signals significant potential for continued growth within the Norwegian market.

- Established Network: Operates a significant number of physical stores throughout Norway.

- Strategic Expansion: Continues to open new locations, with the 30th store launched in Lillehammer in March 2025.

- Positive Customer Response: New stores are experiencing favorable customer reception, validating the expansion strategy.

- Growth Potential: The expansion efforts highlight Elektroimportøren's commitment to increasing market share and accessibility.

Elektroimportøren's strengths are deeply rooted in its effective omnichannel strategy, combining a strong physical store network across Norway with a well-performing online platform. This dual approach ensures broad customer reach, serving both professional tradespeople and individual consumers with diverse shopping preferences.

The company's diversified customer base, encompassing both B2B and B2C segments, mitigates risk and captures varied market demands. This is supported by a robust private label strategy, notably the Namron brand, which accounts for over a third of total sales and enables disruptive pricing, enhancing profitability and market control.

Financially, Elektroimportøren has shown consistent positive performance, with revenues growing across all channels in Q1 2025, alongside improved gross margins and controlled operating expenses. The full year 2024 saw total revenues of NOK 1,627 million, with a notable increase in Q4 2024, underscoring operational efficiency and expanding market presence.

Furthermore, Elektroimportøren's strategic physical store expansion, marked by the opening of its 30th store in Lillehammer in March 2025, demonstrates a commitment to market penetration and customer accessibility, with new locations receiving positive customer reception.

| Metric | Q1 2025 | Full Year 2024 | Key Strength |

|---|---|---|---|

| Total Revenue | (Not specified for Q1 2025) | NOK 1,627 million | Consistent revenue growth |

| Namron Contribution | Over 33% of sales | (Not specified for FY 2024) | Strong private label performance |

| Store Network | 30 stores (as of March 2025) | (Not specified for FY 2024) | Extensive physical presence |

| Online Revenue | Notable surge (Q2 2024) | (Not specified for FY 2024) | Effective digital platform |

What is included in the product

Analyzes Elektroimportøren’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and leverage Elektroimportøren's competitive advantages, mitigating potential market threats.

Weaknesses

Elektroimportøren's Swedish venture, operating under the Elbutik brand, has encountered persistent profitability hurdles. Despite a recent uptick in sales and gross margins for the Swedish market, the company is still working to solidify consistent profit generation. This ongoing challenge highlights the need for continued strategic adjustments to ensure the Swedish operations become a reliably profitable segment.

Elektroimportøren's reliance on the construction and real estate sectors makes it particularly susceptible to downturns in these industries. In 2024, the company experienced a notable impact on its sales due to a cooling housing market, decreased renovation projects, and a slowdown in private property transactions across Norway.

This sensitivity means that any significant contraction in new home building or property sales directly translates into reduced demand for Elektroimportøren's electrical products, posing a clear weakness for the business.

Elektroimportøren faces a weakness in its gross margins, especially within specific product lines. For example, the B2C smart home and EV charger segments, along with B2B solar sales, have experienced margin pressures.

This vulnerability was particularly evident in Q2 2024, where solar product sales saw a significant decline of over 60 percent year-over-year. Such fluctuations indicate a susceptibility to market shifts and competitive pricing in these particular areas.

Decline in Like-for-Like Sales

While Elektroimportøren saw a slight uptick in overall revenue in 2024, a notable weakness emerged with a 1.2% decline in like-for-like sales for the entire year. This metric, which excludes the impact of new store openings and closures, points to difficulties in driving comparable sales growth across its existing store network and online platforms. This trend could signal market saturation or intensifying competition within its established operational areas.

The decrease in like-for-like sales suggests that the company is struggling to attract more customers or increase spending per customer within its current footprint. This is a critical concern as it indicates potential issues with product assortment, pricing strategies, or customer engagement in its core markets. For instance, if competitors are offering more compelling value propositions, Elektroimportøren might be losing market share on a comparable basis.

- Like-for-like sales decreased by 1.2% in 2024.

- This indicates challenges in existing store and online channel performance.

- Potential factors include market saturation and increased competition.

- The trend suggests a need to re-evaluate strategies for customer acquisition and retention in mature markets.

Vulnerability to Consumer Spending Volatility

Elektroimportøren's reliance on consumer spending makes it susceptible to economic downturns. While Norwegian consumer spending is projected to grow by 2.5% in 2025, it experienced a contraction in previous periods, directly impacting the company's B2C sales. This volatility in household purchasing power, driven by factors like inflation and interest rates, presents a notable risk to revenue streams for electrical goods.

Key vulnerabilities include:

- Sensitivity to Economic Cycles: Elektroimportøren's B2C segment is highly sensitive to fluctuations in disposable income.

- Impact of Inflationary Pressures: Rising costs for consumers can lead to reduced discretionary spending on non-essential electrical items.

- Dependence on Durable Goods Sales: A significant portion of sales comes from larger electrical appliances, which are often postponed during periods of economic uncertainty.

Elektroimportøren faces challenges with its Swedish operations, which have yet to achieve consistent profitability despite recent sales growth. This ongoing struggle in the Elbutik brand highlights a need for further strategic refinement to ensure this market becomes a reliable contributor to overall earnings.

The company's performance is significantly tied to the construction and real estate sectors, making it vulnerable to market slowdowns. In 2024, a cooling housing market and reduced renovation activity in Norway directly impacted Elektroimportøren's sales, demonstrating this dependency.

Margin pressures exist in key segments like B2C smart home, EV chargers, and B2B solar sales. This was evident in Q2 2024, with solar product sales dropping over 60% year-over-year, indicating susceptibility to market dynamics and pricing competition.

A notable weakness is the 1.2% decline in like-for-like sales for 2024, suggesting difficulties in driving comparable growth across existing channels and potentially signaling market saturation or increased competition.

Preview the Actual Deliverable

Elektroimportøren SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. The Elektroimportøren SWOT analysis you see here details their Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview for strategic planning. Upon purchase, you'll gain access to the full, in-depth report, enabling you to leverage this valuable insight for your business.

Opportunities

The smart home market in Norway is booming, with projections indicating it will reach USD 1914.7 million by 2030. This represents a substantial compound annual growth rate of 24.9% starting from 2024, a clear indicator of strong consumer adoption and technological advancement.

This rapid expansion, fueled by increasing urbanization and supportive government initiatives, creates a significant opening for Elektroimportøren. The company can leverage this trend to broaden its portfolio of connected home solutions and capture a larger share of this dynamic market.

Norway's commitment to its ambitious decarbonization targets, with a strong focus on energy transition, is significantly boosting electricity demand across various sectors like transportation, industry, and data centers. This trend is creating a robust market for energy-efficient products and electrical components, an area where Elektroimportøren is well-positioned to thrive.

The Norwegian e-commerce sector is a robust and expanding market, with revenue anticipated to hit USD 14.21 billion by 2030, reflecting a healthy 7.91% compound annual growth rate from 2025. This sustained growth indicates a strong and increasing consumer preference for online purchasing.

With Norway boasting high internet penetration rates and a clear shift in consumer habits towards digital platforms, Elektroimportøren is well-positioned to capitalize on these trends. This presents a significant opportunity to amplify its online sales presence and reach a broader customer base.

Strategic Store Expansion in Norway

Elektroimportøren's strategy of opportunistic store expansion in Norway presents a significant growth avenue. The successful launch of their 30th store, which was well-received, underscores the potential for further physical retail expansion. This continued rollout allows the company to tap into new local markets and improve customer access across the country.

This strategic expansion directly translates to increased market share capture. By establishing a stronger physical presence, Elektroimportøren can better serve regional customer bases, driving both brand visibility and sales volume. For instance, in 2024, the company reported a 12% year-over-year increase in revenue, partly attributed to its ongoing store network development.

- Continued Opportunistic Rollout: Elektroimportøren's proven success with its 30th store opening highlights the viability of its physical expansion strategy.

- Market Share Capture: Expanding its store footprint allows the company to secure a larger share of the Norwegian market.

- Enhanced Customer Accessibility: A wider network of physical stores improves convenience and reach for customers nationwide.

- Revenue Growth Driver: Store expansion is a key contributor to the company's revenue growth, as seen in its 2024 performance.

Leveraging Sustainability for Competitive Advantage

Elektroimportøren can capitalize on the growing demand for sustainability by expanding its range of eco-friendly products and enhancing its green business operations. This strategic focus aligns with a market increasingly prioritizing environmentally conscious choices, a trend that saw significant acceleration in 2024.

By proactively integrating sustainability, Elektroimportøren can differentiate itself from competitors and build stronger customer loyalty. For instance, a 2024 survey indicated that over 60% of consumers consider a company's environmental impact when making purchasing decisions.

- Expanded Eco-Product Portfolio: Introduce more energy-efficient appliances and electronics with reduced carbon footprints.

- Sustainable Supply Chain Initiatives: Partner with suppliers committed to ethical and environmentally sound practices.

- Circular Economy Integration: Develop robust recycling and refurbishment programs for returned or old electronics.

- Transparent Sustainability Reporting: Clearly communicate environmental efforts and progress to consumers, building trust and credibility.

The burgeoning smart home market in Norway, projected to reach USD 1914.7 million by 2030 with a 24.9% CAGR, offers Elektroimportøren a prime opportunity to expand its connected home solutions. Furthermore, Norway's strong push towards decarbonization and energy transition is creating substantial demand for energy-efficient products, aligning perfectly with Elektroimportøren's offerings.

The robust growth of the Norwegian e-commerce sector, expected to hit USD 14.21 billion by 2030, coupled with high internet penetration, allows Elektroimportøren to significantly enhance its online sales and reach. The company's successful expansion of its physical store network, including the launch of its 30th store in 2024, demonstrates a clear path to increased market share and revenue growth, as evidenced by its 12% year-over-year revenue increase in 2024.

| Opportunity Area | Market Growth Projection | Elektroimportøren's Position |

|---|---|---|

| Smart Home Market | USD 1914.7 million by 2030 (24.9% CAGR) | Expand connected home solutions |

| Energy Transition | Increased demand for energy-efficient products | Leverage expertise in electrical components |

| E-commerce Growth | USD 14.21 billion by 2030 (7.91% CAGR) | Amplify online sales and reach |

| Physical Store Expansion | Proven success with 30th store opening; 12% revenue growth in 2024 | Increase market share and customer accessibility |

Threats

Elektroimportøren faces significant threats from intense market competition within Norway's electrical retail and e-commerce sectors. The landscape is crowded with both established local players and aggressive international online vendors, especially in the consumer electronics segment. This saturation often translates into considerable price pressures, making it challenging for Elektroimportøren to defend its market share and sustain healthy profit margins.

Challenging macroeconomic conditions, including high operational costs in the Norwegian retail market and geopolitical instability, pose ongoing threats to Elektroimportøren. These factors can lead to unpredictable supply chains and increased overheads, impacting profitability.

While inflation has seen some easing, potential price increases for imported goods, a significant portion of Elektroimportøren's inventory, remain a concern. Fluctuations in interest rates, as seen with Norges Bank's policy adjustments throughout 2024, can further impact consumer purchasing power and increase the cost of borrowing for the business.

Elektroimportøren faces ongoing threats from global supply chain disruptions, particularly concerning electronic components. Extended lead times for essential items like transformers and a persistent scarcity of raw materials, exacerbated by geopolitical instability, pose significant risks.

These supply chain issues directly translate to increased operational costs and potential product shortages for Elektroimportøren. For instance, in late 2023 and early 2024, lead times for certain specialized transformers extended to over 18 months, impacting project timelines and inventory planning significantly.

The scarcity of key materials, such as rare earth elements vital for many electronic devices, further compounds these challenges. This scarcity can drive up the price of components, directly affecting Elektroimportøren's cost of goods sold and potentially squeezing profit margins if these costs cannot be fully passed on to customers.

Volatile Consumer Spending and Construction Activity

While consumer spending has shown signs of recovery, it remains a significant vulnerability. Economic uncertainties, such as inflation and interest rate changes, could quickly dampen demand for Elektroimportøren's electrical products and services. For instance, a projected 2.5% GDP growth in Norway for 2024, while positive, carries risks of downward revision if global economic conditions worsen.

The construction and housing markets present a direct threat. A noticeable slowdown in these sectors, as experienced in 2024 with a reported 5% decrease in new housing starts compared to 2023, directly impacts Elektroimportøren. This reduction in activity curtails demand from both professional electricians and individual consumers undertaking renovation and building projects.

- Economic Shifts: Consumer spending, though recovering, remains sensitive to economic fluctuations, impacting demand for electrical goods.

- Construction Slowdown: A contraction in the construction and housing sectors, evident in 2024, diminishes sales opportunities for electricians and DIY consumers.

- Interest Rate Impact: Rising interest rates can further depress consumer confidence and reduce spending on non-essential electrical items and home improvements.

Rising Electricity Prices and Energy Costs

Rising electricity prices present a significant threat to Elektroimportøren. Increased wholesale electricity costs and escalating distribution charges are projected to lead to higher consumer electricity bills. This economic pressure could dampen consumer enthusiasm for purchasing new electrical appliances or undertaking large electrical installations, directly impacting demand for the company's offerings.

For instance, in early 2024, European wholesale electricity prices saw considerable volatility, with some regions experiencing surges due to geopolitical factors and increased demand. This trend is expected to continue into 2025, as the transition to renewable energy sources, while long-term beneficial, can involve short-term price adjustments. These higher energy costs indirectly affect Elektroimportøren by potentially reducing discretionary spending on electrical goods.

- Increased Energy Bills: Consumers facing higher electricity costs may postpone or reduce spending on new appliances.

- Impact on Large Installations: Escalating energy expenses could deter investment in major electrical projects.

- Reduced Consumer Demand: The overall economic impact of rising energy prices can lead to lower demand for Elektroimportøren's product categories.

The threat of technological obsolescence and rapid innovation in the electrical and electronics sector is a constant challenge for Elektroimportøren. New product releases and evolving consumer preferences necessitate continuous adaptation of inventory and marketing strategies. Failure to keep pace could lead to a decline in competitiveness and market relevance.

Cybersecurity threats and data breaches represent a significant risk for Elektroimportøren, especially given its e-commerce operations. A successful cyberattack could compromise customer data, disrupt business operations, and severely damage the company's reputation and financial standing. The increasing sophistication of cyber threats necessitates ongoing investment in robust security measures.

| Threat Category | Specific Risk | Impact on Elektroimportøren | Example/Data Point (2024/2025) |

|---|---|---|---|

| Technological Obsolescence | Rapid innovation cycles | Reduced product relevance, inventory write-downs | Faster product lifecycles in smart home devices and consumer electronics |

| Cybersecurity | Data breaches, system downtime | Reputational damage, financial loss, operational disruption | Increased frequency of ransomware attacks targeting retail businesses globally |

| Regulatory Changes | New environmental standards, product safety regulations | Increased compliance costs, potential product unavailability | Potential for stricter energy efficiency standards for appliances in the EU |

SWOT Analysis Data Sources

This Elektroimportøren SWOT analysis draws from a comprehensive blend of internal financial reports, detailed market research, and expert industry commentary to provide a robust and actionable strategic overview.