Elektroimportøren Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elektroimportøren Bundle

Elektroimportøren navigates a market shaped by intense rivalry and the significant bargaining power of its buyers. Understanding these forces is crucial for any player in the electrical wholesale sector.

The complete report reveals the real forces shaping Elektroimportøren’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Elektroimportøren's private label, Namron, is a significant factor in its supplier relationships. Namron represents over one-third of the company's total sales, giving Elektroimportøren substantial leverage in managing its supply chain for these products.

This strong internal brand allows Elektroimportøren to dictate terms related to product development, manufacturing, and pricing for a considerable part of its offerings. Consequently, the bargaining power of external suppliers for these Namron products is considerably diminished, enabling competitive pricing and robust profit margins for the company.

Elektroimportøren likely sources non-private label goods from a wide array of manufacturers and distributors specializing in electrical equipment, lighting, heating, and smart home technology. This broad supplier network is key to preventing an over-dependence on any single entity, thereby diminishing their individual leverage. In 2023, the global electrical equipment market was valued at approximately $270 billion, highlighting the vastness of potential suppliers available.

The potential for specialized manufacturers to integrate forward into retail, like Elektroimportøren, is quite limited. While a few might consider direct sales for niche products, Elektroimportøren's existing strong presence across Norway and Sweden, with its established omnichannel strategy, presents a significant hurdle. This network, built over years, represents a considerable investment in logistics and customer reach, making it difficult and expensive for new entrants to replicate.

Global supply chain complexities can increase supplier leverage

Elektroimportøren navigates a global and intricate value chain, relying on manufacturers worldwide, notably in China for its Namron brand. This extensive sourcing network, while offering diverse options, also introduces complexities that can amplify supplier bargaining power.

Geopolitical shifts, persistent logistics hurdles, and volatile raw material prices are significant factors that can empower upstream suppliers. These disruptions can directly impact the availability and cost of essential components, giving suppliers greater leverage over Elektroimportøren. For instance, disruptions in semiconductor manufacturing in 2024, driven by trade tensions and capacity constraints, significantly increased lead times and prices for electronic components across many industries.

- Global Sourcing: Elektroimportøren sources from numerous international manufacturers, including significant production in China for its Namron brand, creating a complex web of supplier relationships.

- Geopolitical Impact: International trade policies and regional instability can disrupt supply lines, enhancing the leverage of suppliers in affected regions.

- Logistics Challenges: Shipping delays and increased freight costs, prevalent throughout 2023 and continuing into 2024, directly affect component availability and pricing, strengthening supplier positions.

- Raw Material Volatility: Fluctuations in the prices of key materials, such as copper and rare earth elements, directly influence manufacturing costs and empower suppliers who control these inputs.

Switching costs for Elektroimportøren related to supplier relationships

Switching major suppliers for Elektroimportøren can incur significant costs. These include expenses for negotiating new contracts, implementing rigorous quality assurance checks for new products, reconfiguring logistics and supply chains, and managing the potential for temporary product unavailability. For instance, if Elektroimportøren were to switch from a key electronics component supplier, the integration of new technical specifications and testing protocols could add substantial overhead.

While Elektroimportøren’s private label strategy can mitigate some switching costs by standardizing product requirements, the situation changes for branded products. For these items, existing suppliers often have established, integrated systems and long-standing relationships. These factors create implicit switching costs for Elektroimportøren, as the effort to replicate or replace these established operational efficiencies with a new supplier can be considerable. In 2024, many retailers found that the cost of onboarding new suppliers for specialized electronics components, particularly those with unique certifications, could range from 5% to 15% of the initial order value.

- Contractual Obligations: Existing contracts may include penalties for early termination, increasing the cost of switching.

- Integration Costs: New suppliers may require significant IT system integration and staff training, adding to the financial burden.

- Quality Control & Testing: Ensuring the quality and compliance of products from new suppliers requires investment in new testing procedures and personnel.

- Supply Chain Disruption: The transition period can lead to stockouts or delays, impacting sales and customer satisfaction, which represents an indirect cost.

While Elektroimportøren benefits from its private label, Namron, which reduces supplier power for those specific products, its reliance on external suppliers for branded goods presents a different dynamic. The vast global market for electrical components, valued at around $270 billion in 2023, means many suppliers exist, but specialized components can still lead to concentrated power. Disruptions in 2024, such as semiconductor shortages, highlighted how global events can empower suppliers by increasing lead times and prices, impacting Elektroimportøren's ability to negotiate favorable terms.

The costs associated with switching suppliers for Elektroimportøren can be substantial, potentially ranging from 5% to 15% of the initial order value for specialized electronics in 2024. These costs encompass new contract negotiations, rigorous quality assurance, IT integration, and the risk of supply chain disruptions during the transition. Even with its strong Namron brand, replacing established suppliers for branded items, with their integrated systems and relationships, presents significant implicit switching costs.

| Factor | Impact on Supplier Bargaining Power | Example for Elektroimportøren |

| Supplier Concentration | High concentration increases power. | Reliance on a few key manufacturers for specialized smart home components. |

| Switching Costs | High switching costs empower suppliers. | Costs of integrating new technical specifications for electronic components (5-15% of order value in 2024). |

| Availability of Substitutes | Few substitutes increase power. | Limited availability of unique, high-performance LED lighting components. |

| Threat of Forward Integration | Low threat reduces supplier power. | Suppliers are unlikely to enter Elektroimportøren's retail market. |

What is included in the product

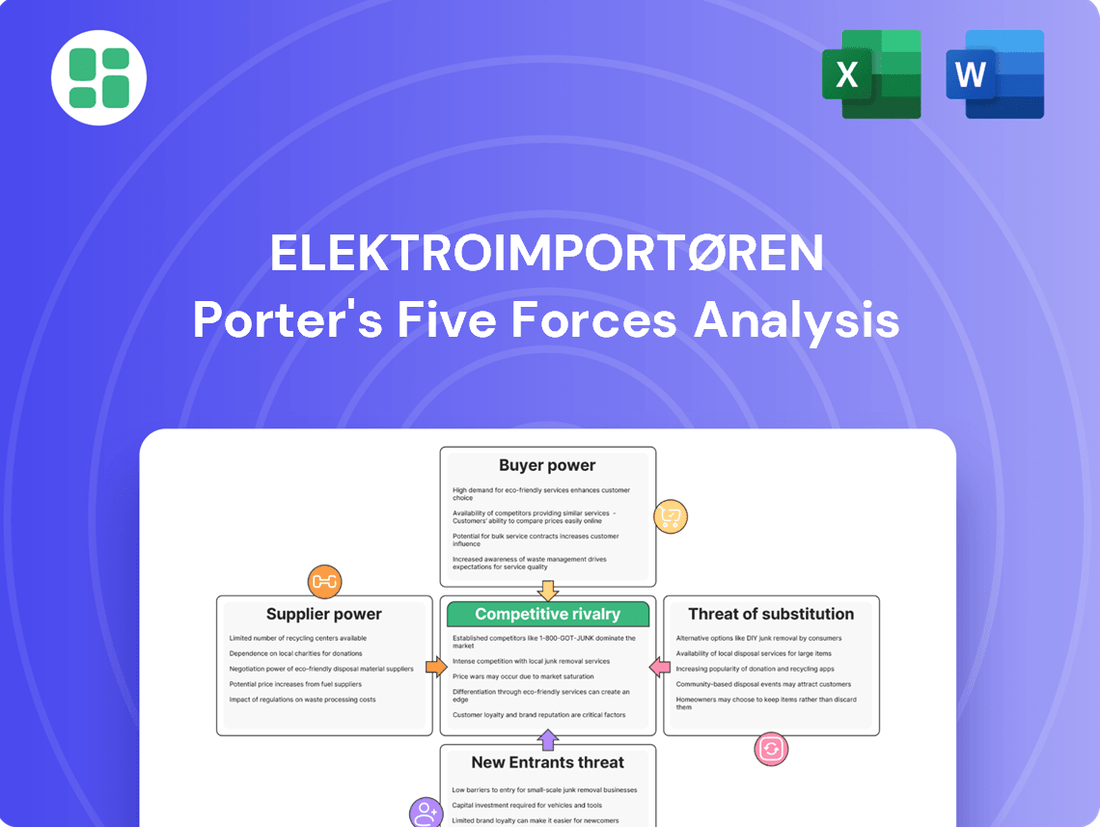

This analysis meticulously dissects the competitive forces impacting Elektroimportøren, examining the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Elektroimportøren's competitive landscape.

Customers Bargaining Power

Both professional electricians and individual consumers in Norway tend to be quite sensitive to prices when buying electrical goods, especially standard items. This means Elektroimportøren must keep its prices competitive to attract and retain customers.

The Norwegian market offers a wide array of retailers and wholesalers for electrical products, which further amplifies this customer price sensitivity. For instance, in 2023, the average price for electrical installation materials saw fluctuations, with some basic components experiencing a slight increase of 2-3% year-over-year, making price a critical factor for buyers.

Customers in the Norwegian electrical retail market experience minimal friction when switching between retailers. This ease of transition, driven by readily available alternatives and comparable product offerings, significantly amplifies their influence.

During 2024, price sensitivity remained a key driver for consumer behavior in Norway's electronics sector. Reports indicated that customers actively compared prices across multiple online and brick-and-mortar stores, with a noticeable uptick in sales for retailers offering competitive pricing or promotional discounts.

The bargaining power of customers for Elektroimportøren is significantly influenced by the sheer number of electricity retailers and wholesalers operating in Norway. This includes both traditional brick-and-mortar establishments and increasingly sophisticated online marketplaces.

Customers can readily switch between numerous providers, easily comparing prices, product availability, and service offerings. Competitors such as Onninen.no and Ahlsell.no, for instance, present extensive product catalogs, making it straightforward for consumers to find alternative suppliers and leverage competitive pricing.

Increased customer knowledge and access to information

Customers in Norway's electricity market are much more informed now, thanks to simpler contracts and better transparency. This means they can easily compare products, read reviews, and check prices online. This knowledge boost gives them more power when deciding where to buy their electricity, directly impacting Elektroimportøren's pricing and service strategies.

The rise of comparison websites and readily available product data has significantly shifted the balance of power towards consumers. For instance, by mid-2024, a significant portion of Norwegian households actively used online comparison tools before switching electricity providers, demonstrating a clear trend towards informed decision-making.

- Enhanced Consumer Awareness: Norwegian electricity consumers are better informed due to simplified contracts and greater market transparency.

- Digital Information Access: Online platforms provide easy access to product details, customer reviews, and price comparisons, empowering consumers.

- Increased Bargaining Power: Informed customers can negotiate better terms or switch providers more readily, increasing their leverage over electricity retailers.

- Impact on Retailers: This heightened customer knowledge forces companies like Elektroimportøren to offer competitive pricing and superior service to retain market share.

Demand for comprehensive electrical solutions and services

Customers, especially businesses, are no longer content with just purchasing electrical components. They are actively seeking comprehensive solutions that include installation, maintenance, and smart home integration. This shift means that companies like Elektroimportøren must offer more than just products to retain their customer base.

Elektroimportøren's 'SpotOn' service platform is a direct response to this evolving demand. However, the bargaining power of customers can increase if competitors provide more attractive or cost-effective bundled offerings. For instance, if a competitor can offer a seamless smart home installation package at a lower price point, customers may be swayed, increasing competitive pressure on Elektroimportøren.

In 2024, the demand for integrated smart home technology saw significant growth, with reports indicating a substantial increase in consumer adoption. This trend underscores the importance of service offerings in the electrical solutions market. Companies that fail to adapt to this demand for end-to-end services risk losing market share to more agile competitors.

The ability of customers to easily switch providers based on superior bundled solutions directly impacts Elektroimportøren's pricing power and profitability. This highlights the need for continuous innovation in service delivery and competitive pricing strategies to maintain customer loyalty.

Customers in Norway's electrical market possess significant bargaining power due to high price sensitivity and the ease of switching between numerous retailers and wholesalers. This is amplified by readily available information, allowing consumers to compare prices and offerings extensively. For example, during 2024, online price comparison tools were widely used, with customers actively seeking out competitive pricing and promotional discounts, putting pressure on companies like Elektroimportøren to maintain aggressive pricing strategies.

The market's transparency, coupled with a broad selection of suppliers such as Onninen.no and Ahlsell.no, empowers customers to negotiate better terms or switch providers with minimal friction. This trend is further supported by the growing demand for integrated solutions, where customers can leverage competitor bundled offerings to gain an advantage, directly impacting Elektroimportøren's pricing and service strategies.

| Factor | Impact on Elektroimportøren | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High | Customers actively compared prices, favoring promotional discounts. |

| Availability of Alternatives | High | Numerous online and physical retailers offer easy comparison and switching. |

| Customer Information | High | Widespread use of online comparison tools and product data. |

| Switching Costs | Low | Minimal barriers to changing suppliers. |

| Demand for Bundled Solutions | Increasing | Customers seek integrated services, influencing purchasing decisions. |

Preview the Actual Deliverable

Elektroimportøren Porter's Five Forces Analysis

This preview showcases the complete Elektroimportøren Porter's Five Forces Analysis, offering a thorough examination of competitive pressures within the electrical import industry. You're seeing the exact, professionally formatted document you'll receive instantly upon purchase, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive analysis is ready for immediate use, providing valuable strategic insights without any hidden surprises.

Rivalry Among Competitors

Elektroimportøren operates in a highly competitive Norwegian market, boasting numerous domestic and international players. This includes large, established firms and nimble local businesses, alongside a growing contingent of online-only retailers.

Key rivals such as Onninen and Ahlsell, with their significant Nordic presence, intensify this rivalry. For instance, in 2023, the Norwegian electrical wholesale market saw strong performance from major players, indicating a robust competitive landscape where market share is actively contested.

Elektroimportøren operates in a market where a few major electricity suppliers hold significant market shares, despite the presence of many smaller retailers. This concentration means that while the overall competitive landscape is broad, the direct rivalry among these dominant players is particularly fierce. For instance, in the Norwegian electricity market as of early 2024, the top three suppliers often collectively control over 60% of the residential customer base, highlighting this concentrated structure.

Elektroimportøren is doubling down on an omnichannel approach, seamlessly blending its online presence with a growing network of physical stores. This strategy directly fuels competitive rivalry as the company actively expands its retail footprint.

In 2024, Elektroimportøren continued its physical store expansion across Norway and Sweden, a move that intensifies competition for market share and customer attention within the electronics retail sector. This expansion challenges rivals to match their own physical and digital integration efforts.

Product differentiation through private labels and service offerings

Elektroimportøren actively combats competitive rivalry by focusing on product differentiation. Their private label, Namron, offers unique electrical products, while the SpotOn service platform provides installation, adding significant value beyond basic product sales. This strategy aims to shift competition away from pure price wars and cultivate customer loyalty.

This differentiation strategy is crucial in a market where competitors can also develop their own unique offerings. For instance, in 2024, the electrical wholesale market saw continued investment in proprietary brands and bundled service packages as key competitive tools. Elektroimportøren's approach positions them to capture market share by offering a more integrated and specialized solution.

- Private Label Strength: Namron provides Elektroimportøren with exclusive product lines, reducing reliance on third-party suppliers and offering distinct choices to customers.

- Service Integration: The SpotOn platform enhances customer value by offering convenient installation services, a key differentiator in the electrical sector.

- Reduced Price Sensitivity: By emphasizing unique products and services, Elektroimportøren aims to lessen customer focus on price alone, mitigating direct price competition.

- Potential for Imitation: While effective, this strategy requires ongoing innovation as competitors may seek to replicate or counter similar differentiation tactics.

Impact of market conditions and economic fluctuations on competition

The electrical equipment market, intrinsically linked to construction and housing, faced significant headwinds in 2024. A notable slowdown in new housing starts, with some regions reporting declines of over 15% year-over-year, directly impacted demand for Elektroimportøren's products.

This challenging market environment amplified competitive rivalry. As the overall pie shrunk, companies like Elektroimportøren found themselves competing more fiercely for available projects. This often translates into aggressive pricing strategies and increased promotional efforts to secure market share.

- Market Downturn: Challenging conditions in the construction and housing sectors in 2024 directly affected demand for electrical equipment.

- Intensified Rivalry: A shrinking market led to companies vying more aggressively for projects.

- Price Competition: Increased competition often results in pressure on pricing and a rise in promotional activities.

Elektroimportøren faces intense competition from established Nordic players like Onninen and Ahlsell, alongside a growing number of online retailers in Norway. This rivalry is further fueled by a market structure where a few dominant electricity suppliers, often controlling over 60% of residential customers as of early 2024, engage in fierce competition. Elektroimportøren's omnichannel expansion and differentiation through its Namron private label and SpotOn service are key strategies to navigate this challenging environment, aiming to reduce price sensitivity and build customer loyalty amidst ongoing market shifts.

SSubstitutes Threaten

The burgeoning smart home market in Norway, fueled by consumer interest in energy savings and enhanced convenience, presents a significant threat of substitution for traditional electrical components. For instance, in 2023, the Norwegian smart home market experienced substantial growth, with an estimated 25% of households having at least one smart device installed, indicating a clear consumer shift.

This increasing adoption of integrated smart systems, which often replace multiple individual electrical items, could directly impact Elektroimportøren's sales of conventional products. The convenience and interconnectedness offered by smart solutions may diminish the appeal and demand for standalone electrical articles, forcing a re-evaluation of product offerings and market strategy.

The growing emphasis on energy-efficient technologies and renewable sources, like solar panels and battery storage, poses a significant threat of substitution for traditional energy consumption. While Elektroimportøren provides some of these emerging solutions, a swift market transition could potentially reduce demand for their more conventional product lines.

For individual consumers, the rising availability of DIY guides and increasingly user-friendly electrical products presents a potential substitute for professional installation services. This trend could impact demand for certain B2B products that previously required expert handling. For instance, a significant portion of the home improvement market, estimated to be worth billions globally, is increasingly leaning towards DIY projects.

However, Elektroimportøren is actively addressing this threat through its 'SpotOn' service. This initiative offers professional assistance, effectively capturing a segment of the DIY market by providing the expertise that consumers might lack. In 2024, the demand for skilled tradespeople in Norway, where Elektroimportøren operates, remained strong, with reports indicating a shortage in qualified electricians, underscoring the continued value of professional services.

Technological advancements leading to entirely new solutions

Technological advancements are a significant threat, as they can introduce entirely new ways of managing and consuming electrical power, potentially bypassing traditional supply methods. For instance, the development of highly efficient, integrated building management systems could reduce overall energy demand and the reliance on conventional electrical infrastructure. By 2024, the global smart building market was valued at approximately $80 billion, demonstrating a clear trend towards such integrated solutions.

Disruptive technologies, such as advanced wireless power transfer or novel energy storage solutions that eliminate the need for grid connection for certain applications, represent a potent substitute threat. These innovations could fundamentally alter how electricity is delivered and utilized, impacting companies like Elektroimportøren that operate within the conventional electrical supply chain. Investments in energy storage technologies saw a substantial increase in 2024, with global spending projected to reach over $100 billion, indicating strong market interest in alternatives.

- Emergence of wireless power: Technologies that allow for power transmission without physical cables could reduce the demand for traditional wiring and electrical components.

- Integrated building management systems: Advanced systems that optimize energy usage within buildings might decrease overall consumption and the need for extensive electrical installations.

- Decentralized energy generation and storage: Widespread adoption of solar panels and battery storage at the consumer level can create microgrids, lessening dependence on central electrical suppliers.

- New materials and energy efficiency: Innovations in materials science leading to more energy-efficient appliances and lighting can also reduce the overall market size for electrical supplies.

Shifts in consumer behavior towards minimalism and reduced consumption

A growing societal embrace of minimalism and reduced consumption presents a potential threat of substitution for new electrical goods. This trend encourages consumers to buy less and make do with existing appliances for longer periods, or to prioritize repair and reuse.

This shift could dampen demand for Elektroimportøren's core offerings over time. For instance, a 2024 survey indicated that 45% of consumers are actively seeking ways to reduce their environmental footprint, which often translates to buying fewer new products.

- Minimalism Trend: Increasing consumer preference for fewer possessions and a focus on experiences over material goods.

- Reduced Consumption: A conscious effort by individuals to decrease their overall purchasing of new items, including electronics.

- Repair and Reuse: Growing interest in extending the lifespan of existing appliances through repair services and second-hand markets.

- Market Demand Impact: Potential long-term reduction in the overall market size for new electrical equipment as these substitute behaviors gain traction.

The threat of substitutes for Elektroimportøren is multifaceted, stemming from technological advancements and shifting consumer preferences. Smart home technologies, for example, are increasingly replacing traditional electrical components, with about 25% of Norwegian households having at least one smart device by 2023. Furthermore, the rise of decentralized energy generation, like solar and battery storage, lessens reliance on conventional electrical infrastructure, a trend supported by over $100 billion in global investment in energy storage technologies in 2024.

| Substitute Category | Description | Impact on Elektroimportøren | Supporting Data/Trend |

|---|---|---|---|

| Smart Home Technology | Integrated systems replacing standalone electrical items | Reduced demand for conventional products | 25% of Norwegian households had smart devices in 2023 |

| Decentralized Energy | Solar panels, battery storage | Lessened dependence on traditional supply chains | Global energy storage investment exceeded $100 billion in 2024 |

| Minimalism & Reduced Consumption | Focus on repair, reuse, and buying less | Potential long-term market size reduction | 45% of consumers sought to reduce environmental footprint in 2024 |

| Wireless Power Transfer | Power transmission without cables | Reduced demand for traditional wiring | Emerging technology with significant R&D investment |

Entrants Threaten

The significant capital needed to build a physical store network and maintain substantial inventory across Norway presents a formidable barrier to entry for new competitors. For instance, establishing even a modest regional presence can easily run into millions of Norwegian Kroner, encompassing real estate, store fit-outs, and initial stock. This high upfront cost deters many potential entrants who lack the financial muscle to compete with established players like Elektroimportøren on an omnichannel basis.

New entrants into the electrical wholesale market would find it difficult to establish the necessary supplier relationships. Elektroimportøren has cultivated long-standing partnerships with key electrical product manufacturers, allowing for favorable terms and reliable access to inventory. These established ties are a significant barrier for newcomers seeking to secure comparable supply chains.

Furthermore, Elektroimportøren's robust distribution network, built over years of operation, presents another hurdle. New entrants would need substantial investment and time to replicate the logistical efficiency and market reach that Elektroimportøren currently enjoys. This established infrastructure makes it challenging for new players to compete on delivery speed and cost-effectiveness.

The presence of Elektroimportøren's private label, Namron, further solidifies its market position. Developing a comparable private label requires significant capital, product development expertise, and market acceptance, all of which are difficult and time-consuming for new entrants to achieve. This proprietary brand offers a competitive edge that is not easily replicated.

Elektroimportøren benefits from a strong brand reputation and a loyal customer base in Norway, catering to both business and individual consumers. This established trust, particularly in a sector where product quality and safety are critical, presents a substantial barrier for any new companies attempting to enter the market.

Regulatory hurdles and safety standards in the electrical industry

The electrical products market in Norway is heavily regulated, presenting a significant barrier for potential new entrants. Compliance with stringent safety standards and obtaining necessary certifications requires substantial investment and expertise, making it difficult for less established companies to compete. For instance, in 2023, the Directorate for Civil Protection (DSB) continued its rigorous enforcement of electrical safety regulations, with inspections often leading to product recalls or market withdrawals for non-compliant items.

Navigating these complex requirements can be particularly challenging and costly for new businesses lacking prior experience in the sector. The time and resources needed for product testing, documentation, and approval processes can delay market entry and drain capital. This regulatory landscape effectively limits the threat of new entrants by raising the cost and complexity of establishing a presence in the Norwegian electrical market.

- Stringent Safety Standards: Norwegian regulations mandate adherence to specific safety norms for all electrical products.

- Certification Processes: New entrants must undergo rigorous certification, which is both time-consuming and expensive.

- DSB Enforcement: The Directorate for Civil Protection actively monitors and enforces these standards, increasing compliance costs.

- Market Entry Barriers: The combined effect of regulations and certification costs significantly deters new competition.

Growth of e-commerce lowering entry barriers for online-only players

The expansion of e-commerce significantly reduces the hurdles for new businesses wanting to enter the electrical retail market, particularly those operating solely online. These digital-first companies can bypass the substantial costs associated with physical stores, such as rent and staffing. For instance, in 2024, the global e-commerce market reached an estimated $6.3 trillion, showcasing the vastness of the digital arena where lower overheads can translate to more aggressive pricing strategies.

This shift means that online-only electrical retailers can enter the market with considerably less capital investment compared to traditional brick-and-mortar establishments. Their leaner operational models allow them to compete on price, potentially drawing customers away from established players. The ease of setting up an online storefront, coupled with access to a global customer base, amplifies the threat of new entrants in the digital electrical goods sector.

- E-commerce growth: Global e-commerce sales are projected to continue their upward trajectory, creating more opportunities for online-only entrants.

- Lower overheads: Online retailers avoid costs like physical store maintenance, utilities, and extensive in-store staffing.

- Competitive pricing: Reduced operational expenses enable new online entrants to offer more attractive prices.

- Digital reach: E-commerce platforms provide immediate access to a broad customer base, bypassing geographical limitations.

While Elektroimportøren benefits from established infrastructure and brand loyalty, the burgeoning e-commerce landscape in Norway presents a notable avenue for new entrants. Online-only businesses can bypass the significant capital outlays for physical stores and extensive inventory, thereby lowering their operational overheads. This allows them to compete aggressively on price, potentially capturing market share from established players.

The ease of establishing an online presence and reaching a broad customer base digitally means that new competitors can emerge with a leaner operational model. For instance, in 2024, e-commerce sales continued their robust growth, indicating a receptive market for digital retail solutions. This trend reduces the traditional barriers to entry, such as the need for widespread physical distribution networks.

| Factor | Impact on New Entrants | Elektroimportøren's Position |

|---|---|---|

| E-commerce Growth | Lowers entry barriers, enabling online-only players | Requires adaptation to digital competition |

| Capital Investment (Physical) | High for traditional retail, low for online | Established physical network is a strength but costly |

| Brand Reputation & Loyalty | Challenging to replicate | Strong advantage, but can be eroded by price competition |

| Regulatory Compliance | Costly and time-consuming | Established compliance processes are an advantage |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Elektroimportøren is built upon a foundation of publicly available financial statements, industry-specific market research reports from firms like Euromonitor and Statista, and relevant trade publications. This blend ensures a comprehensive understanding of the competitive landscape, including supplier and buyer power, threat of new entrants, and substitute products.