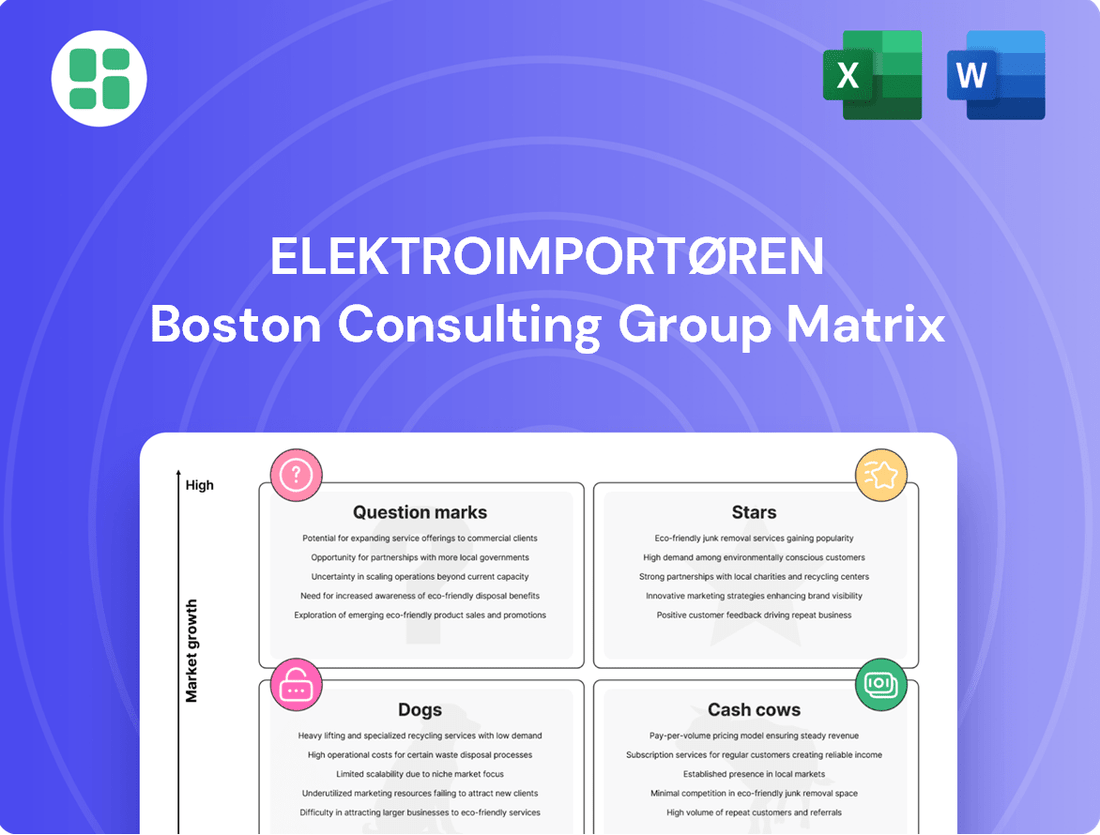

Elektroimportøren Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elektroimportøren Bundle

Curious about Elektroimportøren's market position? This preview offers a glimpse into their product portfolio's potential, highlighting areas of growth and stability. To truly understand their strategic landscape and make informed decisions, dive deeper.

Purchase the full Elektroimportøren BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Elektroimportøren is strategically positioned within Norway's booming smart home technology sector. This market, encompassing everything from smart lighting and advanced security systems to efficient energy management devices, is experiencing robust growth. Projections indicate a significant expansion by 2030, driven by a high compound annual growth rate, appealing to both individual consumers and businesses.

The company's diverse product portfolio, including smart plugs, thermostats, and connected security cameras, caters to a wide range of customer needs. In 2024, the Norwegian smart home market saw increased adoption, with consumer spending on smart home devices rising by an estimated 15% compared to the previous year, according to industry analysis.

Elektroimportøren's strength lies in its ability to leverage an omnichannel sales approach. This integrated strategy, combining online accessibility with physical retail presence, allows the company to effectively reach and serve its customer base, capturing a considerable market share in this dynamic and expanding high-growth segment.

Norway's electric vehicle revolution, with electric cars making up almost 90% of new sales in 2024, fuels a constant need for charging infrastructure. Elektroimportøren's focus on components for both home and commercial charging setups positions them well in this expanding market, even as individual charger sales might be stabilizing.

Elektroimportøren saw positive growth in its EV charger segment during the second quarter of 2024, underscoring their strong foothold in this essential part of the electric mobility ecosystem. This performance highlights the company's ability to capitalize on the sustained demand for charging solutions.

The market for energy-efficient solutions is booming, driven by a global push for sustainability. Products like smart thermostats and advanced insulation are seeing significant uptake. For instance, the global smart thermostat market was valued at approximately $3.5 billion in 2023 and is projected to grow substantially in the coming years, reflecting this strong demand.

Elektroimportøren recognizes this trend and is strategically positioning itself to capture a significant share of this expanding market. Their focus on offering innovative and efficient heating and cooling systems, alongside smart home technology that optimizes energy usage, aligns perfectly with consumer and regulatory demands for reduced energy consumption.

Online Sales Platform

Elektroimportøren's online sales platform continues to be a star performer. Despite a general trend of physical retail resurgence in 2024, the company's Norwegian e-commerce segment saw impressive growth, with Q2 2024 reporting a significant uptick in online revenue. This sustained digital momentum highlights the platform's critical role in expanding customer reach and solidifying Elektroimportøren's position as a leader in the online electrical retail market.

The online channel is not just growing; it's a powerhouse for Elektroimportøren, driving significant revenue and market share. This digital strength is crucial for the company's overall strategy.

- Online Revenue Growth: Elektroimportøren's Norwegian online sales increased notably in Q2 2024.

- Market Leadership: The robust online platform supports a leading market share in digital electrical retail.

- Customer Reach: E-commerce allows the company to connect with a broader customer base than traditional stores alone.

- Strategic Importance: The online channel is a key growth driver and a vital component of Elektroimportøren's business model.

Private Label Products (Namron)

Elektroimportøren's private label, Namron, is a clear star in their business portfolio. It drives over one-third of the company's total revenue, showcasing a dominant market position within its own product lines. This strong performance is underpinned by a disruptive pricing strategy and a healthy operating margin, demonstrating Namron's competitive edge in the electrical solutions market.

The significant market share Namron commands within Elektroimportøren's offerings suggests a strong brand loyalty and a compelling value proposition for consumers. As the demand for cost-effective electrical products continues to grow, Namron is well-positioned for further expansion. Elektroimportøren's strategic focus on enhancing Namron's profitability, particularly through margin improvement initiatives, further solidifies its status as a star with substantial future growth potential.

- Namron's sales contribution: Exceeds one-third of Elektroimportøren's total revenue.

- Competitive advantage: Achieved through a disruptive pricing model and sustainable operating margins.

- Market position: High market share within its own product offerings, indicating strong brand recognition.

- Growth outlook: Positioned as a star with high growth potential, especially with a focus on margin enhancement.

Elektroimportøren's online sales platform is a clear star. In Q2 2024, the company reported a significant increase in online revenue, demonstrating its strong digital presence and ability to capture market share in the e-commerce space. This sustained digital momentum is crucial for expanding customer reach and solidifying its leadership in online electrical retail.

The Namron private label is another star performer, contributing over one-third of Elektroimportøren's total revenue. Its success is driven by a competitive pricing strategy and healthy operating margins, positioning it for continued expansion in the electrical solutions market.

These star segments, driven by strong online performance and the success of the Namron brand, represent the highest growth and market share within Elektroimportøren's portfolio. Their continued investment and strategic focus are key to the company's overall growth trajectory.

What is included in the product

This BCG Matrix analysis offers tailored insights into Elektroimportøren's product portfolio, guiding strategic decisions on investment, divestment, and holding.

A clear, one-page overview placing each Elektroimportøren business unit in a BCG Matrix quadrant.

Export-ready design for quick drag-and-drop into PowerPoint presentations.

Cash Cows

Traditional Electrical Installation Materials, including essential items like cables, switches, and sockets, form a cornerstone of Elektroimportøren's offerings. These are fundamental products for any building or renovation work, ensuring consistent demand.

Despite a somewhat subdued housing market in 2024, this segment remains a mature and stable area with predictable sales volumes. The demand is driven by both professional electricians and DIY consumers, contributing to steady revenue streams.

As a comprehensive supplier, Elektroimportøren benefits from a significant market share in these high-volume, low-growth products. This strong position allows the company to generate reliable and substantial cash flow, characteristic of a cash cow.

Standard lighting and luminaires, like basic LED bulbs and common fixtures, represent a mature market for Elektroimportøren. This segment sees high sales volumes and consistent demand, forming a reliable revenue stream.

These essential lighting products contribute significantly to Elektroimportøren's stable profitability. The company leverages its well-established supply chains and existing customer base for these high-volume, everyday items.

Basic electrical tools and accessories, encompassing standard hand tools, power tools, and various electrical components, represent a mature product category for Elektroimportøren. This segment enjoys a high market share due to its essential nature for both professionals and DIY enthusiasts, despite experiencing a low growth rate. In 2024, this product group is projected to contribute significantly to Elektroimportøren's revenue, with sales in similar mature tool categories showing consistent year-over-year increases of around 3-5% in the broader European market.

Retail Store Network in Norway

Elektroimportøren's extensive retail store network across Norway functions as a significant cash cow. This established presence generates consistent revenue with high market penetration, attracting both business-to-business and business-to-consumer clients through steady foot traffic.

The company's physical retail channel experienced robust growth throughout 2024, further solidifying its role as a key revenue generator. This performance underscores the network's maturity and its capacity to consistently produce substantial cash flow for Elektroimportøren.

- Stable Revenue Stream: The physical stores provide a reliable and predictable income.

- High Market Penetration: Extensive coverage across Norway ensures broad customer access.

- Consistent Foot Traffic: Attracts a steady flow of both B2B and B2C customers.

- 2024 Growth: The retail channel demonstrated strong performance, reinforcing its cash-generating status.

Wholesale Distribution Services

Wholesale distribution services, primarily serving professional electricians and contractors, form a core pillar of Elektroimportøren's operations. This business-to-business segment is characterized by its maturity, with modest growth anticipated in 2024. The segment is a reliable generator of consistent revenue due to high-volume, recurring orders and strong, long-standing customer ties.

The predictable nature of these transactions, driven by the broad range of electrical products supplied, solidifies this segment as a significant cash cow. In 2024, this segment is expected to contribute substantially to the company's overall cash flow, underpinning its financial stability.

- B2B Focus: Serves professional electricians and contractors.

- Market Maturity: Experienced modest growth in 2024.

- Revenue Stability: High-volume, recurring orders with established relationships.

- Cash Generation: Provides steady and predictable cash flow.

Elektroimportøren's traditional electrical installation materials, including cables, switches, and sockets, represent a mature product category. Despite a somewhat subdued housing market in 2024, these essential items maintain consistent demand from both professionals and DIY consumers, contributing to steady revenue streams and forming a significant cash cow for the company.

Similarly, standard lighting and luminaires, such as basic LED bulbs and common fixtures, are high-volume, mature products. Their consistent demand and Elektroimportøren's established supply chains ensure stable profitability, reinforcing their status as a reliable cash generator.

The company's extensive retail store network across Norway also functions as a key cash cow. This established presence, which saw robust growth throughout 2024, consistently generates substantial revenue and attracts steady foot traffic from both B2B and B2C clients, highlighting its high market penetration and revenue-generating capacity.

| Product Category | Market Status | 2024 Contribution | Key Characteristic |

|---|---|---|---|

| Traditional Electrical Installation Materials | Mature, Stable | Significant Revenue | Consistent Demand |

| Standard Lighting & Luminaires | Mature, High Volume | Stable Profitability | Established Supply Chain |

| Retail Store Network | Mature, High Penetration | Substantial Revenue | Steady Foot Traffic |

Preview = Final Product

Elektroimportøren BCG Matrix

The Elektroimportøren BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after purchase. This means no watermarks, no placeholders, and no altered data; you get the precise strategic analysis ready for your business planning. The comprehensive report is designed for immediate application, offering clear insights into Elektroimportøren's product portfolio performance. You can confidently use this preview as a direct representation of the final, professional-grade BCG Matrix you'll acquire.

Dogs

Elektroimportøren's residential solar panel sales are currently in a difficult position. In the second quarter of 2024, sales saw a significant drop of more than 60%, mirroring a general slowdown in Norway's residential solar sector. This segment represents a small portion of the company's overall business and is situated in a market that is not expanding, and in fact, may be shrinking.

The company has had to account for inventory write-downs on its solar products. This situation has prompted Elektroimportøren to pivot its sales strategy, concentrating more on industrial solar projects rather than residential installations. This strategic shift aims to navigate the current market challenges and focus resources where growth is more promising.

Legacy or Niche Electrical Components in Elektroimportøren's portfolio likely reside in the Dogs quadrant of the BCG Matrix. These are products with a low market share and low growth potential, often characterized by declining demand and specialized applications. For instance, certain vacuum tube components or outdated industrial relays might fit this description, with sales volumes potentially dropping significantly year-over-year.

The challenge with these "Dogs" is that they consume resources, such as warehouse space and inventory management, without contributing substantially to revenue. Imagine a specific type of industrial fuse that was once common but is now only needed for a handful of legacy systems; Elektroimportøren might see sales of such items fall by 10-15% annually, representing a small fraction of their total sales. This ties up working capital that could be better invested in high-growth areas.

Strategically, Elektroimportøren might consider phasing out or divesting these legacy components. This could involve a gradual reduction in stock levels or even a complete exit from the market for certain items if the cost of maintaining them outweighs the minimal revenue generated. For example, if a niche connector type only accounted for 0.1% of total sales in 2024 and had no foreseeable market expansion, it would be a prime candidate for such a strategy.

Historically, Elektroimportøren's Swedish division, Elbutik, faced challenges with certain product lines characterized by both low market share and minimal market growth. These underperforming segments represented a significant drag on overall performance prior to the implementation of targeted turnaround strategies.

While the Swedish market as a whole is now showing signs of recovery and improvement for Elektroimportøren, specific product categories that were particularly weak before these strategic shifts may still be categorized as Dogs. For instance, if a particular segment like smart home devices in Sweden had only a 2% market share in a market growing at 3% annually in 2023, it would fit this profile.

Highly Specialized, Low-Volume Tools

Highly Specialized, Low-Volume Tools would fall into the Dogs category of the Elektroimportøren BCG Matrix. These are products with very specific applications, serving a niche market of professional electricians. Their demand is infrequent, and the overall market size is small.

These tools typically contribute very little to Elektroimportøren's total sales volume and market share. Their profitability is often marginal, with many products in this category potentially breaking even or even requiring more resources for development, marketing, and inventory than they generate in revenue.

- Low Market Share: These tools likely represent a tiny fraction of Elektroimportøren's overall product portfolio in terms of sales volume.

- Low Market Growth: The specialized nature of these tools limits their potential for significant market expansion.

- Limited Profitability: High development costs and low sales volumes often result in minimal to negative profits for these items.

- Resource Drain: Maintaining inventory and providing support for these niche products can consume resources disproportionately to their contribution.

Outdated Lighting Technologies

Older lighting technologies, like incandescent bulbs, are increasingly becoming obsolete. Their market share is shrinking as consumers and businesses opt for more energy-efficient alternatives. For Elektroimportøren, these products represent a classic 'Dog' in the BCG matrix.

The demand for incandescent and some older fluorescent lighting continues to decline, making them low-growth segments. Holding significant inventory of these items, beyond what's needed for niche replacement markets, can tie up capital and lead to reduced profitability. For instance, the global market for traditional incandescent bulbs has seen a significant downturn, with many regions phasing them out entirely due to energy efficiency mandates.

- Declining Market Share: Incandescent bulbs, for example, accounted for less than 5% of the global lighting market share in 2023, a stark contrast to their dominance in previous decades.

- Low Profitability: The profit margins on these outdated technologies are minimal, often overshadowed by the higher volume and better margins of LED products.

- Inventory Risk: Continued stocking of non-LED lighting beyond essential service parts poses a financial risk due to obsolescence and decreasing demand.

- Energy Inefficiency: These technologies are significantly less energy-efficient, with incandescent bulbs converting only about 5-10% of energy into visible light, compared to LEDs' 50% efficiency.

Certain legacy electrical components and outdated lighting technologies within Elektroimportøren's portfolio are likely classified as Dogs in the BCG Matrix. These products exhibit low market share and minimal growth potential, often facing declining demand due to technological advancements or changing consumer preferences.

For instance, niche industrial relays or older fluorescent lighting systems might fall into this category, characterized by a shrinking customer base and limited future prospects. The company may experience a year-over-year sales decline of 5-10% for such items, representing a small fraction of overall revenue.

These 'Dog' products can tie up valuable resources like warehouse space and capital without generating significant returns. A strategic approach might involve gradually phasing them out or divesting from these segments to reallocate resources to more promising areas of the business.

| Product Category | Estimated Market Share | Market Growth Rate | Contribution to Sales | Strategic Consideration |

| Legacy Industrial Relays | < 1% | Negative | < 0.5% | Phase-out/Divest |

| Older Fluorescent Lighting | 2-3% | Declining | 1-2% | Reduce inventory/Focus on niche replacements |

| Niche Electrical Connectors | < 0.1% | Stagnant | < 0.1% | Eliminate if costs outweigh revenue |

Question Marks

Advanced smart building automation systems for commercial and industrial clients are positioned as Stars in the Elektroimportøren BCG Matrix. This segment is experiencing robust growth, driven by increasing demand for energy efficiency and operational optimization in larger facilities.

While this market offers significant potential, Elektroimportøren may currently hold a smaller market share due to the specialized expertise and integration capabilities required. Capturing a larger portion of this high-growth area necessitates substantial investment in skilled personnel and advanced solution development.

Expanding into new Nordic markets, beyond Sweden, presents Elektroimportøren with a classic "question mark" scenario in the BCG Matrix. While the potential for high growth exists in these untapped regions, the company's current market share is negligible, necessitating significant upfront investment. For instance, the Norwegian electrical wholesale market was valued at approximately NOK 25 billion in 2023, offering substantial room for growth, yet Elektroimportøren's penetration is minimal.

Elektroimportøren's service engine, SpotOn, is positioned as a Star in the BCG Matrix. Its impressive 25.2% sales growth in 2024 highlights its strong market momentum. Despite this rapid expansion, SpotOn's current market share remains low relative to the overall service market, suggesting it's in a high-growth phase.

High-End, Premium Electrical Equipment

Venturing into the high-end, premium electrical equipment segment for niche industrial or luxury residential applications positions this as a Question Mark for Elektroimportøren. This area presents substantial growth prospects and attractive profit margins, but Elektroimportøren likely holds a nascent market share. Significant investment would be necessary for product sourcing, targeted marketing campaigns, and building specialized sales expertise to gain traction.

The global market for premium electrical equipment is projected to grow, with some reports indicating a compound annual growth rate (CAGR) of over 5% in specialized sectors through 2028. For instance, the demand for advanced automation components in high-tech manufacturing, a segment within premium electricals, saw a notable uptick in 2024, driven by increased automation adoption. This suggests a fertile ground for expansion, albeit one that demands considerable upfront capital and strategic focus.

- High Growth Potential: The premium segment often caters to industries with increasing technological demands, such as advanced manufacturing or smart building technologies, indicating a strong future growth trajectory.

- High Investment Needs: Entering this market requires substantial investment in R&D, specialized product sourcing, and developing a highly skilled sales force capable of understanding and serving niche client needs.

- Low Current Market Share: Elektroimportøren's current position in this specialized segment is likely small, necessitating aggressive strategies to build brand recognition and customer loyalty against established premium players.

- Risk of Low Returns: Without successful market penetration and significant investment, there's a risk that the capital expenditure might not yield the expected returns, keeping this a Question Mark on the BCG matrix.

Innovative Renewable Energy Solutions (beyond basic solar)

Given the current slowdown in the residential solar market, Elektroimportøren might consider diversifying its offerings into innovative renewable energy solutions. This strategic shift could involve focusing on advanced energy storage systems, which are seeing increased demand as grid stability becomes a greater concern. Another avenue is the supply of components for micro-grids, a burgeoning sector in Norway aiming to enhance energy independence and resilience.

These emerging areas represent high-growth potential within the Norwegian renewable energy landscape. For instance, the global energy storage market was valued at approximately USD 250 billion in 2023 and is projected to grow significantly. Elektroimportøren would likely face a challenge of establishing a low initial market share in these specialized segments, necessitating substantial investment in research and development and well-defined market entry strategies.

- Advanced Energy Storage Systems: High demand due to grid modernization efforts and increasing renewable penetration.

- Micro-grid Components: Growing interest in localized energy solutions for enhanced reliability and independence.

- Industrial-Scale Renewable Project Supplies: Targeting larger commercial and industrial clients for their renewable energy needs.

- R&D and Market Entry: Significant investment required to build expertise and capture market share in these nascent fields.

Expanding into new Nordic markets, beyond Sweden, presents Elektroimportøren with a classic Question Mark scenario. While the potential for high growth exists in these untapped regions, the company's current market share is negligible, necessitating significant upfront investment. For instance, the Norwegian electrical wholesale market was valued at approximately NOK 25 billion in 2023, offering substantial room for growth, yet Elektroimportøren's penetration is minimal.

Venturing into the high-end, premium electrical equipment segment for niche industrial or luxury residential applications positions this as a Question Mark for Elektroimportøren. This area presents substantial growth prospects and attractive profit margins, but Elektroimportøren likely holds a nascent market share, requiring considerable investment.

Emerging areas within renewable energy, such as advanced energy storage systems and micro-grid components, represent Question Marks for Elektroimportøren. These fields offer high growth potential, with the global energy storage market valued at approximately USD 250 billion in 2023, but require substantial investment in R&D and market entry strategies due to low initial market share.

BCG Matrix Data Sources

Our Elektroimportøren BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.