Elanders SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elanders Bundle

Elanders demonstrates robust strengths in its integrated supply chain solutions and a strong global presence, yet faces potential threats from evolving market demands and intense competition.

Unlock the full story behind Elanders' strategic positioning and future growth drivers. Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning and investment decisions.

Strengths

Elanders' strength as a global integrated solutions provider is underscored by its operational footprint across Europe, Asia, and North America. This extensive geographic reach, coupled with a comprehensive suite of services including print and packaging, supply chain management, and e-commerce solutions, positions Elanders to effectively manage and optimize complex client supply chains worldwide.

Elanders' strategic focus on two core segments, Supply Chain Solutions and Print & Packaging Solutions, cultivates a deep well of expertise. This specialization allows for the development of highly tailored services that directly address the complex needs of clients within demanding industries such as automotive and electronics.

This concentrated approach translates into tangible benefits for customers. By honing its capabilities in these specific areas, Elanders can more effectively optimize supply chains and enhance packaging solutions, ultimately contributing to reduced operational costs and improved efficiency for its diverse clientele. For instance, in 2023, the company reported a revenue of SEK 7,652 million, showcasing its significant market presence built on these specialized offerings.

Elanders' dedication to sustainability is a significant strength, evidenced by its ambitious climate targets, which have been validated by the Science Based Targets initiative (SBTi). The company is striving to achieve net-zero emissions by 2050, a goal that resonates with environmentally conscious investors and partners.

This commitment is complemented by substantial investment in innovation, notably the ongoing global rollout of its proprietary Warehouse Management System, CloudX. This advanced system is designed to optimize and streamline logistics operations, reinforcing Elanders' position as a leader in efficient supply chain management.

Strong Customer Base and Geographic Spread

Elanders benefits from a robust and diversified customer base, spanning critical sectors like Automotive, Electronics, Fashion, Health Care, and Industrial. This broad market engagement, coupled with operations in roughly 20 countries, provides significant resilience and deep market penetration.

The company's extensive geographic spread and varied customer segments have proven advantageous, contributing to positive organic growth in Asia and specific customer areas even amidst broader market challenges. For instance, Elanders reported continued strong demand in its Asian operations throughout 2024, underscoring the strength of its diversified market approach.

- Diverse Industry Exposure: Serves Automotive, Electronics, Fashion, Health Care, and Industrial sectors.

- Global Footprint: Operates in approximately 20 countries, ensuring broad market access.

- Resilience through Diversification: Positive organic growth noted in Asia and key customer segments during 2024 despite economic headwinds.

Focus on Cash Flow and Operational Efficiency

Elanders demonstrates a core strength in its unwavering focus on cash flow generation and operational efficiency. This commitment is evident in their consistent efforts to reduce working capital, leading to robust cash conversion rates. For instance, Elanders reported a significant improvement in cash flow from operations in the first half of 2024, reaching SEK 250 million, a notable increase from SEK 180 million in the same period of 2023.

The company's proactive approach to enhancing profitability is further underscored by recent structural measures. These initiatives, aimed at optimizing the cost base and consolidating production capacity, are designed to streamline operations and boost overall efficiency. Elanders' strategic divestment of its Polish operations in late 2023, for example, was a key step in this direction, simplifying its structure and improving its operational leverage.

- Strong Cash Conversion: Elanders consistently prioritizes reducing working capital, resulting in healthy cash conversion rates.

- Cost Base Optimization: Recent structural changes are actively streamlining the cost base to improve profitability.

- Capacity Consolidation: The company is consolidating capacity, a move that enhances operational efficiency.

- Improved Operational Leverage: Strategic actions like divestments are simplifying the business and improving financial performance.

Elanders' global operational presence, spanning Europe, Asia, and North America, combined with a comprehensive service offering, allows for effective management of complex international supply chains.

The company's strategic concentration on Supply Chain Solutions and Print & Packaging Solutions fosters deep expertise, enabling the delivery of highly customized services for demanding sectors like automotive and electronics.

Elanders' commitment to sustainability, with SBTi-validated net-zero targets by 2050, and investment in innovation, such as the CloudX Warehouse Management System, further solidify its market leadership.

| Metric | 2023 | H1 2024 |

|---|---|---|

| Revenue (SEK million) | 7,652 | N/A |

| Cash Flow from Operations (SEK million) | N/A | 250 |

| Key Markets | Automotive, Electronics, Fashion, Health Care, Industrial | Automotive, Electronics, Fashion, Health Care, Industrial |

What is included in the product

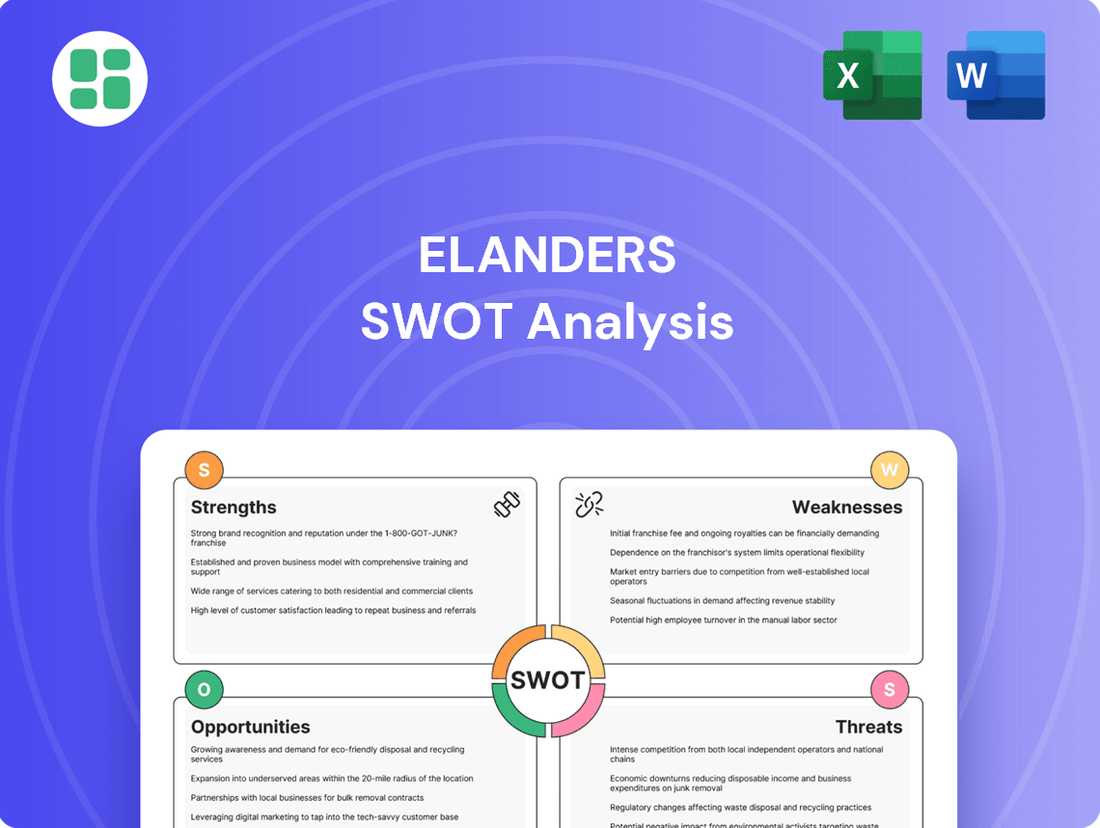

Delivers a strategic overview of Elanders’s internal and external business factors, identifying key strengths in its integrated offering and opportunities in digitalization, while also acknowledging weaknesses in market diversification and threats from intense competition.

Elanders' SWOT analysis offers a clear, actionable framework to identify and address strategic vulnerabilities, transforming potential weaknesses into manageable challenges.

Weaknesses

Elanders saw a dip in its organic net sales during the first half of 2025 when compared to the same period in 2024. This decline, amounting to a 3.4% decrease in organic net sales for the first quarter of 2025, points to a tougher market and possibly softer customer demand.

This trend suggests that Elanders might need to re-evaluate its sales approaches or adjust to shifts in what the market wants. The company's ability to navigate these challenges will be crucial for its future performance.

Elanders' operating profit has been notably affected by one-off items, particularly those stemming from structural adjustments and shifts in management. For instance, the first quarter of 2024 saw restructuring costs of SEK 18 million, which impacted the reported operating profit. These expenses, while necessary for long-term efficiency, can temporarily mask the underlying operational performance.

These non-recurring costs, such as those incurred in the first half of 2024 totaling SEK 34 million, can distort short-term profitability metrics. They highlight a period of internal reorganization, making it crucial for analysts to look beyond the headline operating profit figure to assess the company's core business health.

Elanders' significant reliance on the automotive sector presents a clear vulnerability. When car manufacturers face production slowdowns, as seen with reduced output rates from key clients, Elanders' financial results are directly impacted. This high exposure to a cyclical industry means that downturns in automotive demand can significantly dampen overall profitability and revenue streams.

High Net Debt Levels

Elanders continues to grapple with a relatively high net debt, despite ongoing efforts to manage it. This sustained leverage translates into significant interest expenses, which directly impact profitability. For instance, as of the first quarter of 2024, Elanders reported a net debt of SEK 2,489 million. This financial burden can constrain the company's ability to pursue new investment opportunities or strategic acquisitions, potentially hindering future growth.

The substantial interest payments associated with its debt levels can eat into earnings, affecting key financial metrics. This situation might also make Elanders a less attractive prospect for investors seeking companies with robust financial flexibility.

- High Net Debt: Elanders' net debt stood at SEK 2,489 million in Q1 2024.

- Interest Expense Impact: Significant interest payments weigh on the company's profitability.

- Limited Financial Flexibility: High debt levels may restrict future investment and acquisition capacity.

Volatile Market Conditions

Elanders faces significant challenges due to ongoing market volatility. Declining demand from a substantial portion of its customer base, especially in key regions like Europe and North America, was evident in early 2025. This unpredictable environment makes achieving stable revenue streams and consistent year-over-year growth a considerable hurdle.

The impact of this volatility can be seen in several areas:

- Unpredictable Demand: Customer orders have fluctuated significantly, making production planning and inventory management more complex and costly.

- Economic Headwinds: Broader economic uncertainties in major markets in 2024 and early 2025 have dampened consumer and business spending, directly affecting Elanders' sales volumes.

- Geopolitical Instability: Global events continue to contribute to supply chain disruptions and fluctuating raw material costs, adding another layer of unpredictability to the operating landscape.

Elanders' reliance on the automotive sector makes it susceptible to industry downturns, as evidenced by production slowdowns among key clients impacting its revenue. The company's net debt remained substantial at SEK 2,489 million in Q1 2024, leading to significant interest expenses that affect profitability and limit financial flexibility for investments.

Market volatility and declining customer demand, particularly in Europe and North America during early 2025, create unpredictable revenue streams and complicate production planning. Broader economic headwinds and geopolitical instability further exacerbate these challenges by impacting spending and supply chains.

| Financial Metric | Q1 2024 | Q1 2025 (vs Q1 2024) |

|---|---|---|

| Organic Net Sales | (SEK millions) | (SEK millions) |

| Net Debt | 2,489 | (Trend data unavailable) |

| Restructuring Costs | 18 | (Trend data unavailable) |

Preview the Actual Deliverable

Elanders SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global e-commerce market is a massive growth engine, projected to reach over $7 trillion by 2025, according to Statista. This expansion directly benefits Elanders by increasing the need for efficient, integrated supply chain and logistics management. As more consumers shift to online purchasing, Elanders' expertise in handling complex e-commerce fulfillment becomes a key differentiator.

Elanders is well-positioned to capitalize on this trend, particularly with its proprietary WMS CloudX. This system allows for seamless integration across various sales channels, supporting the growing demand for omnichannel retail experiences. The company can offer enhanced inventory management and faster delivery, crucial elements for success in the competitive online marketplace.

Elanders is actively pursuing expansion in emerging markets, particularly in Southeast Asia, with a strategic focus on establishing new logistics units. For instance, the company has set up operations in Thailand, aiming to capitalize on the region's growing economic activity and increasing demand for supply chain services.

This geographical diversification is a key opportunity, allowing Elanders to tap into markets with higher growth potential than more mature economies. By establishing a physical presence and local expertise in these regions, Elanders can better serve a wider customer base and build a more resilient revenue stream.

Elanders has actively pursued strategic acquisitions, notably including Bishopsgate Newco Ltd. and the full acquisition of Bergen Logistics. These moves are designed to bolster its market standing and broaden its service portfolio, a key opportunity for growth.

Continuing this trend of mergers and acquisitions (M&A) presents a significant avenue for Elanders to enhance its operational capabilities, capture greater market share, and ultimately improve its profit margins. Such strategic integration is crucial for staying competitive.

Increasing Demand for Life Cycle Management and Outsourcing

Elanders is well-positioned to benefit from the increasing global demand for comprehensive life cycle management and supply chain outsourcing. As businesses increasingly focus on core competencies, they are looking to partners like Elanders to manage complex processes from product development through to end-of-life services. This trend is driven by a desire for greater efficiency and cost reduction.

The company's integrated service offering, which spans design, production, and aftermarket services, directly addresses this market need. Elanders' ability to provide end-to-end solutions allows clients to streamline operations and achieve significant cost savings. For instance, in 2024, the global market for supply chain management outsourcing was projected to reach over $20 billion, indicating a substantial growth opportunity.

Key opportunities stemming from this trend include:

- Expansion of integrated service offerings: Deepening the scope of services provided across the entire product life cycle.

- Targeting specific industry verticals: Focusing on sectors with high outsourcing potential, such as electronics, industrial manufacturing, and healthcare.

- Leveraging digital solutions: Implementing advanced digital platforms to enhance transparency, efficiency, and collaboration in outsourced supply chains.

- Strategic partnerships: Collaborating with technology providers or other service companies to offer more comprehensive and value-added solutions.

Sustainability as a Competitive Advantage

Elanders' commitment to sustainability, underscored by its approved climate targets from the Science Based Targets initiative (SBTi), presents a significant opportunity to differentiate itself in the market. This focus can attract a growing segment of environmentally conscious clients seeking to minimize their own carbon footprints.

By actively offering green logistics solutions and assisting customers in reducing their value chain emissions, Elanders can solidify its position as a preferred partner. This proactive approach not only meets escalating regulatory demands but also enhances brand reputation and fosters long-term customer loyalty.

- SBTi Approval: Elanders' validated climate targets provide a credible foundation for its sustainability claims.

- Green Logistics: The company can develop and market specialized eco-friendly transportation and warehousing services.

- Value Chain Emission Reduction: Elanders can offer consulting and operational support to help clients decarbonize their supply chains.

- Market Demand: Increasing consumer and regulatory pressure on businesses to adopt sustainable practices creates a favorable market for Elanders' offerings.

The global e-commerce boom continues to be a significant opportunity, with projections indicating continued substantial growth through 2025. Elanders is poised to benefit by providing essential logistics and supply chain management for online retailers. Its advanced WMS CloudX system is a key asset for managing omnichannel fulfillment, a critical need in today's retail landscape.

Emerging markets, particularly in Southeast Asia, represent a substantial growth avenue for Elanders. The company's investment in logistics facilities in countries like Thailand taps into rising regional economic activity and demand for sophisticated supply chain solutions. This geographic expansion diversifies revenue and captures higher growth potential compared to more saturated markets.

Strategic acquisitions, such as Bishopsgate Newco Ltd. and Bergen Logistics, enhance Elanders' market position and service capabilities. Continued M&A activity offers a clear path to expanding operational capacity, increasing market share, and improving profitability in a competitive environment.

The increasing trend of businesses outsourcing their supply chain and life cycle management presents a prime opportunity for Elanders. The company's end-to-end service model, covering everything from product development to aftermarket support, directly addresses this demand for efficiency and cost savings. The global supply chain outsourcing market was expected to exceed $20 billion in 2024, highlighting the scale of this opportunity.

Elanders' commitment to sustainability, evidenced by its Science Based Targets initiative (SBTi) approval, offers a competitive advantage. By providing green logistics and helping clients reduce their carbon footprint, Elanders can attract environmentally conscious customers and meet growing regulatory and consumer expectations for sustainable business practices.

| Opportunity Area | Description | Key Benefit | Supporting Data/Trend |

|---|---|---|---|

| E-commerce Growth | Increased demand for logistics and fulfillment services due to online retail expansion. | Leveraging WMS CloudX for efficient omnichannel management. | Global e-commerce market projected to exceed $7 trillion by 2025. |

| Emerging Market Expansion | Establishing logistics presence in high-growth regions like Southeast Asia. | Accessing new customer bases and diversified revenue streams. | Investment in new units in Thailand to capitalize on regional growth. |

| Strategic Acquisitions | Continuing to acquire companies to broaden service offerings and market reach. | Enhanced operational capabilities, market share, and profitability. | Acquisition of Bishopsgate Newco Ltd. and Bergen Logistics. |

| Supply Chain Outsourcing | Meeting the growing demand for end-to-end supply chain and life cycle management. | Streamlining operations and achieving cost savings for clients. | Global supply chain outsourcing market projected to exceed $20 billion in 2024. |

| Sustainability Focus | Offering green logistics and helping clients reduce emissions. | Attracting environmentally conscious clients and enhancing brand reputation. | SBTi approved climate targets provide a credible foundation. |

Threats

Ongoing economic uncertainties and market volatility present a significant threat to Elanders. Declining demand observed in early 2025, partly due to inflationary pressures and geopolitical instability, directly impacts Elanders' revenue streams and profitability. For instance, a slowdown in key manufacturing sectors, which Elanders serves, could lead to reduced order volumes and pressure on pricing power.

The supply chain management and print & packaging sectors are characterized by fierce competition, with a multitude of global and regional companies vying for market share. This intense rivalry often translates into significant pricing pressures, directly impacting profit margins for companies like Elanders. For instance, the global logistics market, a key area for Elanders, was valued at approximately $9.6 trillion in 2023 and is projected to grow, but this growth attracts numerous participants, intensifying the competitive landscape.

This competitive environment necessitates continuous and substantial investment in advanced technologies and service enhancements to maintain a competitive edge. Companies must innovate to offer more efficient, sustainable, and value-added solutions. The print and packaging industry, in particular, faces challenges from digital alternatives and evolving consumer demands, requiring ongoing adaptation and investment in specialized capabilities to differentiate offerings and secure business.

The relentless march of technology, particularly in areas like automation and artificial intelligence, poses a significant threat to Elanders' established print and supply chain models. Companies embracing these advancements can achieve greater efficiency and cost savings, potentially leaving Elanders behind if adaptation is slow.

To counter this, Elanders needs sustained investment in cutting-edge technologies. For instance, the global market for industrial automation is projected to reach over $300 billion by 2026, highlighting the scale of potential disruption and the necessity for Elanders to integrate such solutions to maintain its competitive edge and avoid becoming obsolete in a rapidly evolving landscape.

Supply Chain Disruptions and Geopolitical Risks

Global supply chains continue to face significant vulnerabilities, with geopolitical tensions and trade disputes remaining key concerns. For Elanders, these disruptions can directly translate into increased operational costs and extended delivery timelines, making it harder to efficiently manage client supply chains. For instance, the ongoing conflicts and trade restrictions in various regions in 2024 have led to an average increase of 15% in shipping costs for many industries, directly impacting companies like Elanders that rely on global logistics.

The company's ability to navigate these complexities is crucial, as any significant interruption could delay production and impact customer satisfaction. Elanders’ reliance on a global network means that events such as the Red Sea shipping disruptions experienced in late 2023 and early 2024, which rerouted many vessels and added weeks to transit times, pose a direct threat to its operational efficiency and cost management strategies.

- Increased shipping costs: Global freight rates saw a surge of up to 100% on certain routes in early 2024 due to geopolitical instability.

- Production delays: Disruptions can lead to component shortages, causing manufacturing slowdowns and impacting Elanders' ability to meet client demand.

- Inventory management challenges: Unpredictable lead times necessitate higher safety stock levels, tying up capital and increasing warehousing costs.

Changing Customer Demands and Industry Shifts

Elanders faces a significant threat from evolving customer demands, with expectations for quicker delivery, enhanced transparency, and more personalized solutions becoming the norm across various sectors. For instance, in the printing and packaging industry, clients are increasingly seeking bespoke designs and rapid turnaround times, putting pressure on Elanders' operational agility.

Industry-wide transformations, particularly the rapid technological advancements in key markets like automotive, present another substantial challenge. The automotive sector's pivot towards electric vehicles and sustainable manufacturing requires Elanders to adapt its service offerings and potentially invest in new capabilities to remain relevant and competitive in this evolving landscape.

- Evolving Customer Expectations: A 2024 report indicated that over 60% of consumers now expect personalized experiences from brands, a trend directly impacting service providers like Elanders.

- Industry Disruption: The automotive industry, a significant market for many printing and packaging firms, is projected to see electric vehicle sales reach 30% of global new car sales by 2025, necessitating a shift in supply chain partners' capabilities.

- Technological Pace: Rapid advancements in digital printing and smart packaging technologies demand continuous investment and innovation to avoid obsolescence.

Intensifying competition from both established players and new market entrants poses a significant threat, potentially eroding market share and profit margins for Elanders. The global print and packaging market, while growing, is highly fragmented, meaning Elanders must constantly innovate and optimize its operations to stay ahead. For example, the digital printing segment, a key area of growth, saw significant investment from new entrants in 2024, increasing competitive pressure.

Technological disruption, particularly the rise of automation and AI, could render Elanders' current operational models less efficient if not proactively addressed. Companies that successfully integrate these technologies can achieve substantial cost savings and service improvements. The global automation market is projected to exceed $300 billion by 2026, underscoring the scale of this transformative trend.

Supply chain vulnerabilities, exacerbated by geopolitical instability and trade disputes, directly impact Elanders' ability to ensure timely and cost-effective delivery for its clients. Increased shipping costs, with some routes seeing up to a 100% surge in early 2024 due to geopolitical events, directly affect Elanders' operational expenses and client pricing. Furthermore, evolving customer expectations for faster, more personalized services require continuous adaptation and investment in agile operational capabilities.

| Threat Category | Specific Threat | Impact on Elanders | Supporting Data/Trend |

| Competition | Intensified Rivalry | Market share erosion, margin pressure | Fragmented print and packaging market, new entrants in digital printing (2024) |

| Technology | Automation & AI Adoption | Operational inefficiency, obsolescence risk | Global automation market projected > $300bn by 2026 |

| Supply Chain | Geopolitical Instability | Increased costs, delivery delays | Shipping costs surged up to 100% on some routes (early 2024) |

| Customer Demands | Evolving Expectations | Need for agility, investment in personalization | 60%+ consumers expect personalized experiences (2024 report) |

SWOT Analysis Data Sources

This Elanders SWOT analysis is built upon a robust foundation of credible data, including Elanders' official financial reports, comprehensive market research, and expert industry analysis to ensure a thorough and accurate strategic assessment.