Elanders Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elanders Bundle

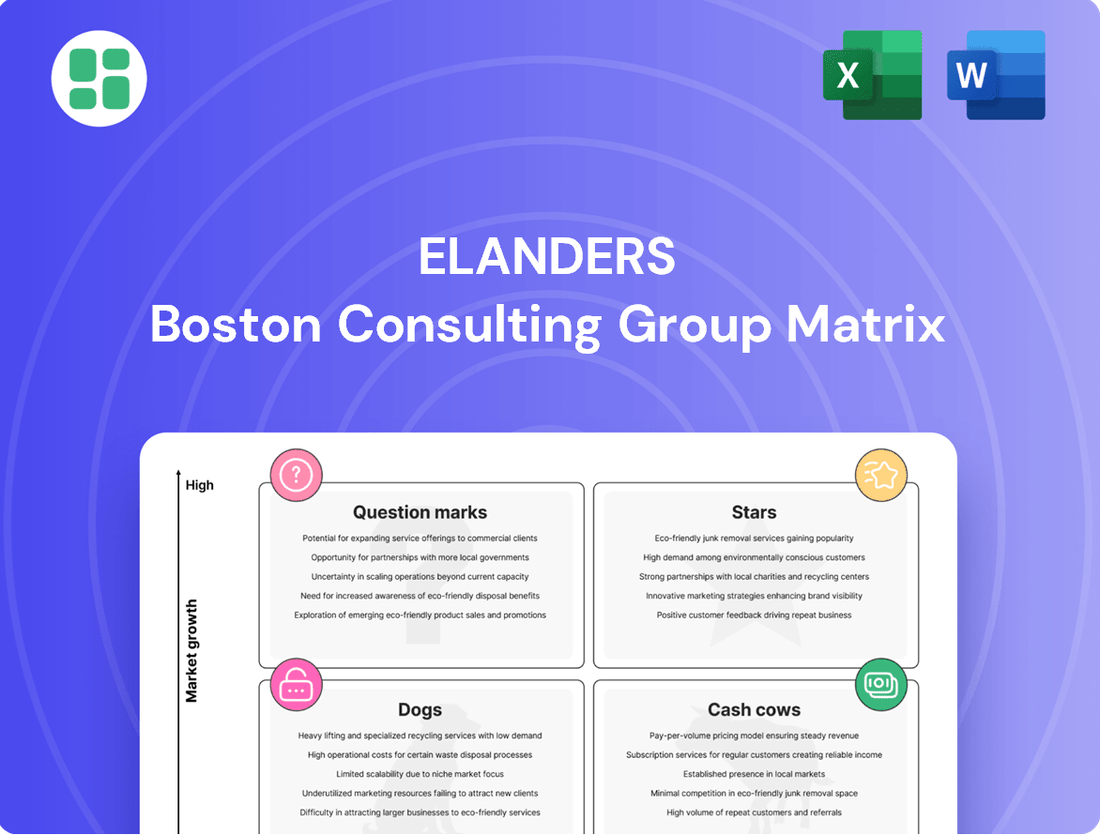

Uncover the strategic potential of this company's product portfolio with a glimpse into its BCG Matrix. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the fundamental dynamics at play. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your investment strategy and drive future growth.

Stars

Elanders' e-commerce fulfillment services are a burgeoning star in its BCG matrix, capitalizing on a market poised for substantial growth. This sector is expected to expand at a compound annual growth rate (CAGR) between 9.7% and 14.24% from 2025 onward, indicating robust demand.

The company is actively reinforcing its position by expanding its logistics network, notably with new facilities in Thailand, a move designed to capture a larger share of this dynamic market. This strategic expansion underscores Elanders' commitment to this high-potential segment.

Serving a diverse portfolio of international brands, Elanders has solidified its presence in e-commerce fulfillment, making it a critical engine for the company's overall growth trajectory. Continued investment in advanced technology and infrastructure will be vital to sustain its star performance.

Elanders' digital and online print services are a clear star within the print and packaging industry, fueled by the ongoing digital transformation and the pervasive influence of social media. This segment taps into a growing demand for personalized, on-demand printing solutions.

As one of the leading digital print providers in Europe, not directly linked to a specific e-commerce giant, Elanders holds a significant market advantage. This independent positioning allows for broader reach and service offerings across various industries.

The market is increasingly favoring flexible, high-quality, and short-run digital printing, a trend amplified by the robust growth of e-commerce. Elanders' strategic investments in cutting-edge digital technologies are key to maintaining its competitive edge, ensuring both cost-efficiency and superior output quality.

The Electronics sector represents a significant growth area for Elanders' Supply Chain Solutions, with notable expansion observed in the latter half of 2024 and into Q1 2025, especially within the Asian market. This robust performance is fueled by ongoing technological innovation and a consistent global appetite for electronic goods, underscoring the critical need for advanced supply chain capabilities.

Elanders' established proficiency and extensive international network within the electronics segment position it well to capitalize on this burgeoning market. The company's strategic emphasis on this high-margin area is a key driver of its star potential, as it leverages its strengths to secure a substantial market share.

Supply Chain Solutions for Health Care

Elanders has seen significant growth in its Supply Chain Solutions within the Health Care sector, especially during the latter part of 2024. This segment demands meticulous adherence to regulations and specialized logistics, areas where Elanders' comprehensive offerings provide a distinct advantage.

The healthcare industry's need for secure and compliant handling of medical supplies and pharmaceuticals fuels this growth. Elanders' capacity to manage these sensitive supply chains from start to finish solidifies its standing in this crucial market.

- Healthcare Sector Growth: Elanders experienced notable expansion in its healthcare supply chain solutions in the latter half of 2024.

- Specialized Logistics: The healthcare industry's stringent compliance and specialized logistics needs are met by Elanders' integrated solutions.

- Market Drivers: Global demand for medical supplies and pharmaceuticals underpins the strong growth prospects for this segment.

- End-to-End Capabilities: Elanders' ability to offer complete solutions for sensitive healthcare supply chains enhances its market position.

Renewed Tech Business

Elanders' Renewed Tech business, which focuses on reconditioning used IT equipment to give it a second life, is a clear contender for a star in the BCG Matrix. This segment is experiencing robust growth, driven by a global surge in demand for sustainable solutions and the principles of a circular economy. The company's strategic investment and expansion in this area indicate a strong ambition to capture a significant market share.

This particular business unit is well-positioned to capitalize on several key trends. For instance, the global IT asset disposition (ITAD) market, which includes reconditioning and recycling, was projected to reach over $19 billion by 2024, showcasing the substantial economic opportunity. Elanders' proactive approach in this space, offering environmentally conscious and cost-effective IT lifecycle management, directly addresses these growing market needs.

- Growing Market: The increasing emphasis on sustainability and the circular economy fuels demand for refurbished IT equipment.

- Strategic Investment: Elanders is actively developing and expanding its Renewed Tech services, signaling a commitment to leadership in this segment.

- Environmental Alignment: The business directly supports corporate environmental, social, and governance (ESG) goals by extending the lifespan of technology.

- Economic Drivers: Offering cost savings through reconditioned equipment appeals to businesses seeking to manage IT expenditures efficiently.

Elanders' e-commerce fulfillment services are a burgeoning star, benefiting from a market expected to grow significantly. The company's expansion into new regions like Thailand highlights its strategy to capture a larger share of this dynamic sector.

Digital and online print services also shine as stars, driven by digital transformation and the demand for personalized printing. Elanders' independent position as a leading European digital print provider offers a distinct advantage.

The Electronics sector within Supply Chain Solutions is a strong performer, with notable growth in Asia during late 2024 and early 2025. This is supported by technological advancements and global demand for electronics.

Healthcare supply chain solutions are another star, showing significant expansion in late 2024. This growth is fueled by the industry's need for specialized, compliant logistics for medical supplies and pharmaceuticals.

The Renewed Tech business, focusing on reconditioning IT equipment, is emerging as a star due to the increasing demand for sustainable and circular economy solutions. This segment aligns with corporate ESG goals and offers cost savings.

| Business Area | BCG Category | Key Growth Drivers | Elanders' Strategic Focus |

| E-commerce Fulfillment | Star | Growing e-commerce market, demand for logistics solutions | Network expansion (e.g., Thailand), technology investment |

| Digital & Online Print | Star | Digital transformation, personalized printing demand | Investment in digital technologies, independent market position |

| Electronics Supply Chain | Star | Technological innovation, global electronics demand | Leveraging international network, focus on high-margin segment |

| Healthcare Supply Chain | Star | Stringent regulations, demand for specialized logistics | End-to-end solutions for sensitive supply chains |

| Renewed Tech | Star | Sustainability, circular economy, ITAD market growth | Expansion of services, ESG alignment, cost-effectiveness |

What is included in the product

The Elanders BCG Matrix offers a visual framework to analyze product portfolio performance based on market share and growth, guiding strategic decisions.

A clear Elanders BCG Matrix visualizes business unit performance, alleviating the pain of unclear strategic direction.

Cash Cows

Elanders' established warehousing and distribution operations in Europe are a prime example of a cash cow within the BCG matrix. These mature businesses, benefiting from decades of investment and optimization, consistently deliver strong, predictable cash flows. For instance, in 2023, Elanders reported that its European segment, heavily reliant on these established networks, contributed significantly to the group's overall financial stability.

The high utilization rates and streamlined processes within these European hubs mean that minimal additional investment is required to maintain their output. This efficiency is further bolstered by strategic investments like the CloudX Warehouse Management System rollout, which enhances operational effectiveness and profitability. These robust operations act as a vital financial engine, providing the necessary capital to fuel growth in other areas of the business.

Elanders' integrated logistics for industrial customers represent a classic Cash Cow. The company caters to a wide array of industrial clients, offering comprehensive supply chain solutions. This often translates into stable, high-volume contracts that are the bedrock of consistent revenue generation.

Even if the industrial sector itself experiences moderate growth, Elanders' deep integration and established, long-term relationships with these clients secure a strong and defensible market share. These enduring partnerships are key to their predictable cash flow.

These established client relationships mean that Elanders doesn't need to spend heavily on marketing or sales to acquire new business within this segment. The consistent revenue and profit margins generated here are crucial for funding other areas of the business.

For instance, in 2023, Elanders reported that its business area Engineering & Manufacturing Services, which encompasses many of these industrial logistics operations, continued to show stable performance. This segment reliably generates the cash needed to support the group's investments in growth areas.

Elanders' Print & Packaging for Specific Industrial Applications likely serves as a robust Cash Cow. This segment, focusing on specialized packaging and manuals for industrial clients, benefits from long-term relationships and Elanders' extensive history in the graphic industry, spanning over a century.

These specialized services, despite broader print market pressures, typically command consistent demand and healthy profit margins. For instance, in 2024, Elanders reported a significant portion of its revenue stemming from these stable, high-share segments, demonstrating their maturity and sustained competitive advantage.

Lifecycle Management Services

Elanders' lifecycle management services, a key component of its Supply Chain Solutions, focus on comprehensive product management, particularly for electronics. This involves overseeing the entire product journey from sourcing raw materials to post-sales support, a crucial offering in industries with complex product lifecycles.

These services have demonstrated notable growth within the European market, indicating a strong demand and Elanders' ability to capture significant market share. The specialized nature of managing the full product lifecycle, especially for electronic goods, suggests a stable and recurring revenue stream.

Given the mature nature of many industries requiring such services, Elanders likely holds a high market share. This stability translates into reliable cash flow, reducing the need for substantial reinvestment compared to high-growth ventures.

- Market Share: High, due to specialized nature and established demand.

- Revenue Stream: Stable and recurring, driven by ongoing lifecycle management.

- Investment Needs: Lower compared to growth-stage products, focusing on efficiency.

- Growth: Demonstrated growth in Europe, indicating market penetration.

Logistics Operations in Core Markets (e.g., Sweden, Singapore)

Elanders views its logistics operations in core markets like Sweden and Singapore as significant strengths, highlighting their established and dominant presence. These mature markets likely translate to a substantial market share for Elanders, consistently generating robust cash flows.

The stability inherent in these operations enables Elanders to pursue optimization and efficiency improvements. These efforts directly contribute to the company's overall financial resilience, making these regions dependable cash cows that support wider strategic initiatives.

- Sweden and Singapore Identified as Key Markets: Elanders recognizes these regions as central to its operations, indicating a strong and mature market position.

- High Market Share and Consistent Cash Flow: In these established markets, Elanders likely commands a significant market share, leading to predictable and strong revenue generation.

- Optimization and Efficiency Gains: The maturity of these operations allows for continuous improvement, enhancing profitability and contributing to the company's financial stability.

- Underpinning Strategic Investments: These reliable cash cows provide the financial foundation necessary for Elanders to fund growth opportunities and other strategic ventures across the business.

Elanders' established warehousing and distribution in Europe, along with its integrated logistics for industrial customers, represent classic Cash Cows. These mature operations benefit from long-term client relationships and high market share, generating stable and predictable cash flows with minimal need for new investment. For example, in 2023, Elanders' European segment and its Engineering & Manufacturing Services business area, which includes many of these logistics operations, continued to demonstrate stable performance, contributing significantly to the group's financial stability.

| Segment | BCG Category | Key Characteristics | 2023 Performance Indicator |

| European Warehousing & Distribution | Cash Cow | Mature, high utilization, low investment needs | Significant contributor to group financial stability |

| Integrated Industrial Logistics | Cash Cow | Stable, high-volume contracts, strong client relationships | Continued stable performance in Engineering & Manufacturing Services |

| Print & Packaging (Industrial) | Cash Cow | Specialized, consistent demand, healthy margins | Significant portion of revenue from stable, high-share segments (2024 projection) |

| Lifecycle Management (Electronics) | Cash Cow | Recurring revenue, high market share in mature industries | Demonstrated growth in Europe, stable revenue stream |

Full Transparency, Always

Elanders BCG Matrix

The Elanders BCG Matrix you are previewing is the identical, fully formatted document you will receive upon purchase, ensuring immediate strategic application without any watermarks or demo content. This comprehensive report, meticulously crafted to provide clear market insights, will be directly delivered to you, ready for immediate integration into your business planning and presentations. You will gain access to the complete, analysis-ready BCG Matrix, empowering you to make informed decisions and effectively communicate your strategic direction. This is not a sample; it's the final, professional-grade tool designed to enhance your competitive analysis and drive business growth.

Dogs

Traditional commercial offset printing represents a mature market segment with continuously decreasing volumes. This low-growth or declining market dynamic suggests that companies heavily invested in this technology, like Elanders, likely possess a low market share within a contracting industry.

The diminishing returns from continued investment in offset printing highlight the need for strategic capital allocation. For instance, the global commercial printing market, which includes offset, saw a compound annual growth rate (CAGR) of approximately -1.5% between 2019 and 2024, underscoring the contraction.

This segment is a prime candidate for strategic decisions aimed at minimizing or divesting operations to enhance the overall portfolio's performance. Focusing resources on higher-growth areas can unlock greater value and improve capital efficiency.

Elanders' automotive logistics segment in Europe is currently classified as a 'dog' within the BCG matrix. This classification stems from the company's own acknowledgment of significant structural challenges and weakened demand within this sector. These headwinds have directly impacted the segment's performance negatively.

The situation points to Elanders holding a low market share within a European automotive logistics market that is either in decline or experiencing substantial volatility. In 2023, the automotive sector in Europe saw a slowdown in production growth compared to previous years, with some regions experiencing contraction, directly affecting logistics demand.

Elanders has implemented structural measures to address these issues, indicating a strategic effort to reduce its exposure or streamline operations in this underperforming area. These actions are typical for a dog in the BCG matrix, where resources are often divested or minimized due to a lack of significant returns and poor growth prospects.

Underperforming legacy print facilities within Elanders' Print & Packaging Solutions are those that haven't fully embraced digital transformation or adapted to evolving market demands. These sites often face high operational expenses and generate minimal returns because the demand for their traditional services is shrinking.

These facilities can become capital traps, necessitating substantial, and potentially unfeasible, turnaround investments. For instance, if a facility's revenue has declined by over 15% year-over-year and its profit margin is below 2%, it might be a prime candidate for restructuring.

Such underperforming units are strong contenders for consolidation with more efficient operations or outright divestment. This strategic move helps streamline Elanders' overall operational structure and improve financial performance by shedding underutilized assets.

Non-strategic or Peripheral Road Transportation Units

Elanders' road transportation units in Germany, particularly those tied to the automotive sector, can be classified as Dogs within the BCG Matrix. Their high exposure to a contracting German automotive industry, which saw a 4.7% decline in vehicle production in 2023 according to the VDA, positions them in a low-growth market.

If these operations are not strategically integrated into more dynamic, high-growth supply chain solutions, they risk becoming low-share businesses with limited potential. Such units often require significant capital investment without a strong competitive edge, potentially draining resources and offering minimal returns.

- Low Market Share: Operations serving niche or declining segments of the German automotive logistics market.

- Low Growth Market: The German automotive industry faced production challenges in 2023, impacting logistics demand.

- Capital Intensive: Road transportation fleets require ongoing investment in vehicles and maintenance.

- Divestment Potential: Rationalizing these non-core assets aligns with a 'Dogs' strategy to improve overall company focus and profitability.

Discontinued or Heavily Restructured Operations

Elanders has actively pursued extensive structural measures to consolidate its capacity and reduce its cost base. These actions are particularly evident in regions like China, Germany, the UK, and the USA, where operations have been scaled down or closed due to low profitability or declining market prospects.

These strategically managed units, characterized by their low market share and limited growth potential, are effectively categorized as 'dogs' within the Elanders BCG Matrix. This approach allows the company to reallocate valuable resources towards more promising and high-growth business areas.

- Consolidation Efforts: In 2023, Elanders reported that its extensive structural measures, including capacity consolidation and cost reduction initiatives, were progressing as planned, particularly impacting operations in key markets.

- Focus on Profitability: The company's strategy involves divesting or restructuring underperforming units to improve overall group profitability and financial health.

- Resource Reallocation: By addressing these 'dog' operations, Elanders aims to free up capital and management attention to invest in its 'stars' and 'question marks' with higher potential.

- Market Realities: These decisions reflect a pragmatic response to varying market dynamics and the need to maintain a competitive edge by focusing on areas with greater future returns.

Dogs in Elanders' portfolio represent business units with low market share in low-growth or declining markets. These segments, such as legacy offset printing and certain automotive logistics operations in Europe, are characterized by their inability to generate significant returns and often require substantial capital without commensurate growth prospects. For example, Elanders' road transportation units in Germany, tied to the automotive sector, are classified as Dogs due to the industry's 4.7% production decline in 2023.

The company's strategic response to these 'dog' segments involves consolidation, cost reduction, and potential divestment. These measures are designed to streamline operations, improve overall profitability, and reallocate resources towards more promising business areas. Elanders' extensive structural measures in 2023, including capacity consolidation in markets like Germany and the UK, exemplify this approach to managing underperforming assets.

By strategically addressing these low-performing units, Elanders aims to enhance capital efficiency and focus management attention on segments with higher growth potential, such as its 'stars' and 'question marks'. This pragmatic approach reflects a commitment to adapting to market realities and optimizing the company's business portfolio for long-term value creation.

| Business Segment | BCG Classification | Market Characteristic | Elanders' Share | Strategic Action |

|---|---|---|---|---|

| Traditional Offset Printing | Dog | Declining Market Volume (CAGR approx. -1.5% 2019-2024) | Low | Divestment/Minimization |

| Automotive Logistics (Europe) | Dog | Structural Challenges, Weakened Demand | Low | Streamlining/Divestment |

| Road Transportation (Germany - Auto Sector) | Dog | Contracting Automotive Industry (4.7% production decline in 2023) | Low | Rationalization/Integration |

Question Marks

Elanders launched its inaugural contract logistics operation in Thailand in the fourth quarter of 2024, marking an entry into a dynamic Asian market. This strategic move positions Elanders to tap into the expanding supply chain solutions sector across Asia.

While the Asian logistics market presents considerable growth opportunities, Elanders' new Thai unit is expected to have a nascent market share initially. This necessitates substantial investment to achieve economies of scale and establish a solid market presence, with profitability not guaranteed in the immediate future.

The unit's trajectory towards becoming a future market leader, or a 'star' in the BCG matrix, is contingent on rapid customer acquisition and effective deployment of resources. For instance, the global third-party logistics market was valued at approximately USD 1.1 trillion in 2023 and is projected to grow significantly, underscoring the potential for new entrants if they can capture market share effectively.

Elanders' fashion logistics in North America currently shows lower demand, but a notable increase in new customer inquiries and requests for 2025 signals significant growth potential. This positions the segment as a high-growth area where Elanders holds a relatively small market share.

To capitalize on this emerging opportunity, Elanders must make substantial investments in sales, marketing, and operational capacity. This strategic push is crucial to convert the growing interest into tangible market share gains.

Without dedicated investment, this promising segment could remain a financial burden or stagnate, potentially becoming a 'dog' in the BCG matrix. The key lies in aggressive expansion to capture this burgeoning market.

Elanders is strategically deploying its proprietary WMS CloudX and AI-powered solutions across its global operations. This move positions the company to capitalize on the burgeoning digital supply chain market, fueled by the increasing need for operational efficiency and real-time data visibility. In 2024, the global supply chain management market was valued at approximately $25.2 billion and is projected to grow significantly, underscoring the opportunity for Elanders' innovative offerings.

Despite the promising market outlook, the full market penetration and scaling of these advanced technologies are ongoing. Consequently, Elanders' current market share in this specific segment is likely modest. Significant investment in further development, marketing, and integration is crucial to accelerate adoption and establish a strong competitive foothold, aiming to elevate these offerings into future growth drivers.

Expansion into FMCG Logistics via Acquisitions (e.g., Kammac)

Elanders' acquisition of Kammac Ltd. in November 2023 marked a strategic move into the burgeoning FMCG logistics sector, notably including beverage logistics. This expansion positions Elanders to capitalize on a dynamic and growing market.

The FMCG logistics market is projected to experience significant growth, with estimates suggesting a compound annual growth rate (CAGR) of around 5% to 7% globally in the coming years, driven by increasing consumer demand and e-commerce penetration. For Elanders, this represents a substantial opportunity, though it is still early days for their integration and market share development in this segment.

- Strategic Entry: Elanders' acquisition of Kammac Ltd. in November 2023 is a deliberate step into the high-growth FMCG logistics market.

- Market Potential: The global FMCG logistics market is expanding, with projections indicating continued robust growth, offering Elanders a significant opportunity for market share capture.

- Integration Focus: The success of this venture, particularly its classification as a potential 'Star' in the BCG matrix, hinges on Elanders' ability to effectively integrate Kammac and penetrate the market.

- Investment Requirement: Achieving a leading position in this competitive sector will necessitate ongoing investment and a commitment to operational excellence.

Development of New Sustainable Packaging Solutions

Elanders' development of new sustainable e-commerce packaging solutions fits into the question mark category of the BCG matrix. This segment benefits from a high-growth market trend, fueled by increasing consumer demand for eco-friendly products and stricter environmental regulations. For instance, the global sustainable packaging market was valued at approximately USD 277.1 billion in 2023 and is projected to grow significantly, with some forecasts suggesting it could reach over USD 400 billion by 2028, indicating substantial growth potential.

While the market itself is expanding rapidly, Elanders' specific market share within these innovative sustainable packaging solutions is likely still in its nascent stages. This means the company has a low market share in a high-growth industry. For example, while specific figures for Elanders' share in this niche are proprietary, the overall market growth rate in sustainable packaging outpaces many traditional packaging segments.

- High Market Growth: The sustainable packaging market is experiencing robust growth, driven by environmental consciousness and regulatory mandates.

- Low Market Share: Elanders' position in specific sustainable packaging innovations is likely still developing, indicating a smaller current market share in this emerging area.

- Investment Needed: Significant investment in research and development (R&D) and targeted market penetration strategies are essential to capitalize on this growth.

- Potential for Stars: With successful execution, this segment has the potential to transition from a question mark to a star performer within Elanders' portfolio.

Elanders' new contract logistics operation in Thailand, launched in late 2024, signifies an entry into a high-growth Asian market. Despite the potential, this nascent unit holds a small market share, requiring substantial investment to achieve scale and profitability, characteristic of a question mark.

The fashion logistics segment in North America, while currently experiencing lower demand, shows significant future growth potential based on increased customer inquiries for 2025. Elanders' relatively small market share in this high-growth area necessitates strategic investment to convert interest into market share, placing it in the question mark category.

Elanders' deployment of WMS CloudX and AI-powered solutions targets the expanding digital supply chain market. Although the market is growing, Elanders' current penetration and market share for these technologies are modest, requiring significant investment to accelerate adoption and establish a strong competitive position.

The acquisition of Kammac Ltd. in November 2023 positions Elanders within the growing FMCG logistics sector. While the market offers substantial opportunity, Elanders' market share in this segment is still developing, requiring investment to achieve its full potential and move beyond the question mark classification.

Elanders' development of sustainable e-commerce packaging solutions operates within a rapidly expanding market driven by environmental concerns. However, Elanders' current market share in these specific innovations is likely small, classifying it as a question mark that requires significant R&D and marketing investment to become a star performer.

| Elanders Business Segment | BCG Category | Market Growth | Market Share | Investment Rationale |

| Thailand Contract Logistics | Question Mark | High | Low | Invest to gain scale and market share. |

| North America Fashion Logistics | Question Mark | High (projected) | Low | Invest in sales, marketing, and operations to capture growing demand. |

| Digital Supply Chain Solutions | Question Mark | High | Low | Invest in development, marketing, and integration for wider adoption. |

| FMCG Logistics (Kammac) | Question Mark | High | Low | Invest in integration and market penetration for growth. |

| Sustainable E-commerce Packaging | Question Mark | High | Low | Invest in R&D and market penetration to develop into a star. |

BCG Matrix Data Sources

Our BCG Matrix leverages Elanders' internal financial reports, market share data, and product lifecycle analysis to provide an accurate view of business unit performance.