Elanders Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elanders Bundle

Elanders operates within a competitive landscape shaped by several key forces. Understanding the intensity of rivalry among existing competitors, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Elanders’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Elanders, particularly concerning paper, ink, and specialized packaging, appears moderate. While the printing industry relies on these inputs, the market for paper and ink is generally competitive with multiple global and regional players. However, for highly specialized packaging materials or specific ink formulations, a degree of concentration among suppliers could exist, potentially granting them more leverage.

The bargaining power of suppliers for Elanders hinges on the availability of alternatives for crucial elements like logistics, supply chain software, and e-commerce tech. If Elanders can easily switch between providers for these essential services, supplier power diminishes.

For instance, the global logistics market is highly competitive, with numerous providers offering similar services, which generally keeps supplier power in check for Elanders' logistics needs. However, specialized software platforms for supply chain management or unique e-commerce technology might present fewer alternatives, potentially increasing supplier leverage.

In 2024, the digital transformation trend continues to drive demand for advanced supply chain software. Companies like Elanders that rely on sophisticated platforms for efficiency may find fewer readily available, equally capable substitutes, thus granting those specific software suppliers more bargaining power.

Elanders' suppliers possess moderate bargaining power, largely due to the specialized nature of some of its key inputs in the printing and packaging sectors. While many raw materials like paper are commoditized, suppliers of specialized inks, coatings, or advanced printing technologies can exert more influence. For instance, if a supplier offers a unique, proprietary coating that enhances product durability or visual appeal, Elanders would find it harder to switch without impacting product quality.

Supplier Power 4

Elanders faces moderate supplier power, largely influenced by the specialized nature of its printing and packaging materials. The cost for Elanders to switch suppliers can be significant, involving potential disruptions to production lines, the need for retraining staff on new material handling or integration processes, and the expense of re-validating or re-integrating supply chain systems. For instance, in 2024, the global paper and pulp industry experienced price volatility due to supply chain constraints and increased energy costs, which can directly impact Elanders' input prices and the associated switching costs if they were to seek alternative suppliers.

High switching costs can indeed make Elanders hesitant to change suppliers, even when faced with potentially more favorable terms elsewhere. This reluctance stems from the operational risks and upfront investments required for a transition. Consider the integration of new ink formulations or specialized paper stocks; these often require recalibration of printing presses and quality control measures.

- Switching Costs: Elanders incurs costs related to potential operational downtime, personnel retraining, and system re-integration when changing suppliers.

- Specialized Materials: The need for specific paper grades, inks, and finishing materials can limit the number of viable alternative suppliers.

- Supplier Concentration: In certain niche markets for printing supplies, a few dominant suppliers might exist, increasing their bargaining leverage.

- Impact of 2024 Market Conditions: Fluctuations in raw material prices and logistics challenges in 2024 highlighted the importance of stable supplier relationships and the potential costs associated with disruption.

Supplier Power 5

The bargaining power of suppliers for Elanders is a key consideration. A significant factor is the threat of forward integration, where suppliers might decide to offer Elanders' core services directly to Elanders' end-customers. This could involve specialized logistics providers moving into integrated print and distribution, or even raw material suppliers expanding into finishing services.

This potential for suppliers to bypass Elanders and serve the market directly can significantly shift negotiation leverage. If suppliers have the capability and inclination to integrate forward, they become less reliant on Elanders as a customer and can command better terms, potentially increasing Elanders' costs or reducing its margins.

- Supplier Forward Integration Threat: Suppliers in Elanders' value chain, such as those in specialized printing chemicals, paper, or even logistics, could potentially move into offering integrated solutions directly to Elanders' clients.

- Impact on Elanders' Margins: If suppliers successfully integrate forward, they could capture a larger portion of the value chain, potentially squeezing Elanders' profit margins on services they previously controlled.

- Negotiation Leverage Shift: The credible threat of forward integration by suppliers strengthens their bargaining position, allowing them to dictate terms and potentially increase prices for raw materials or components.

- Strategic Response: Elanders must monitor supplier capabilities and market trends to anticipate and mitigate the risks associated with supplier forward integration, possibly through strategic partnerships or diversification of its supplier base.

Elanders' suppliers hold moderate bargaining power, primarily due to the specialized nature of certain inputs and the associated switching costs. While general materials like paper are readily available from multiple sources, unique inks or advanced finishing technologies can concentrate power among fewer suppliers. In 2024, the printing industry saw continued price pressures on raw materials, making supplier relationships critical for cost management.

| Factor | Impact on Elanders | 2024 Relevance |

|---|---|---|

| Specialized Inputs | Increases supplier leverage due to limited alternatives. | Demand for unique finishes and eco-friendly materials grew. |

| Switching Costs | High costs for integration and potential downtime deter supplier changes. | Supply chain disruptions in 2024 emphasized the cost of switching. |

| Supplier Concentration | Niche markets can lead to a few dominant suppliers. | Consolidation in some chemical and paper sectors was observed. |

| Forward Integration Threat | Suppliers could bypass Elanders, impacting margins. | Digital service providers are increasingly offering end-to-end solutions. |

What is included in the product

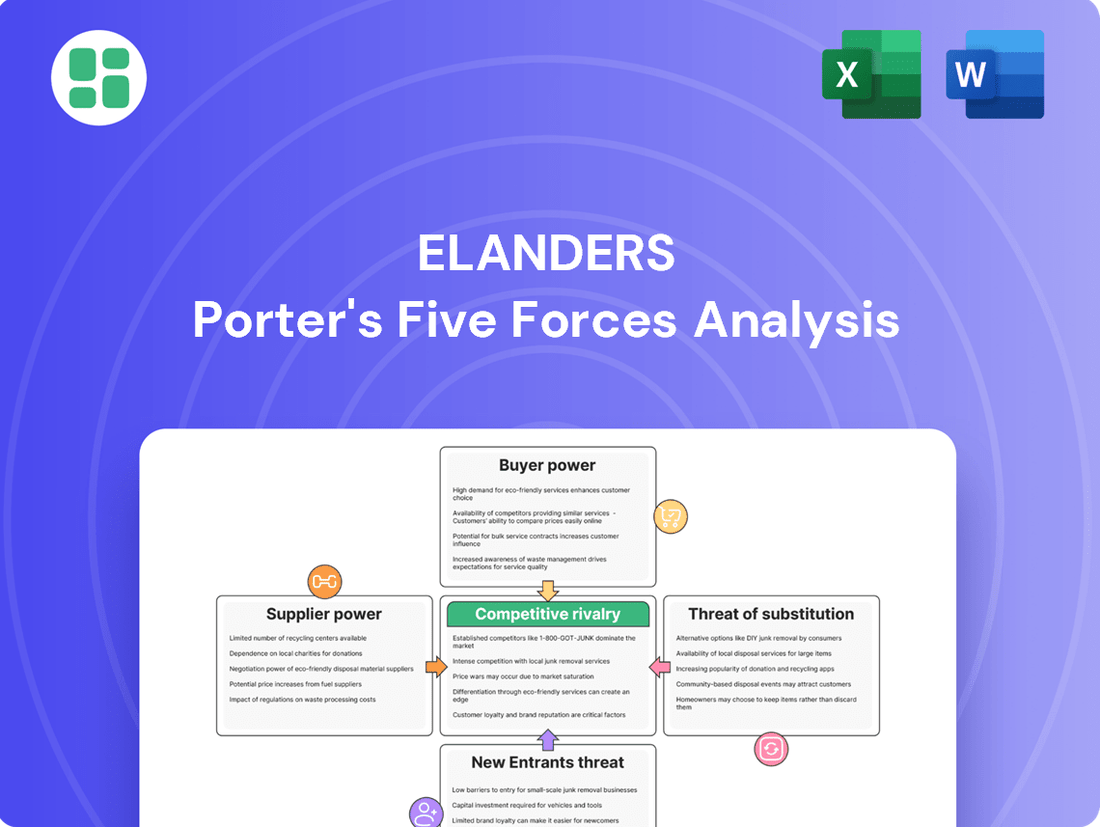

This analysis dissects the competitive forces impacting Elanders, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Effortlessly identify and mitigate competitive threats with a visual, easy-to-understand breakdown of Porter's Five Forces.

Customers Bargaining Power

Elanders' customer base is quite diverse across its printing and packaging solutions, but a concentration among a few major clients could amplify their bargaining power. For instance, if a significant percentage of revenue, say over 30%, comes from the top five customers, these clients would have more leverage to negotiate pricing and terms, potentially impacting Elanders' profitability.

Elanders' buyer power is influenced by the switching costs for its clients. If clients can easily transition to a competitor with minimal disruption or straightforward data migration, their bargaining power is amplified. This is particularly relevant for integrated solution providers like Elanders, where a client's investment in custom workflows or specialized integration could create significant switching hurdles.

In 2024, the printing and packaging industry, where Elanders operates, has seen a trend towards greater digitalization and automation. This can lower the technical barriers for new entrants and existing competitors, potentially reducing the perceived switching costs for clients if they can find providers offering similar digital integration capabilities. For instance, if a client's primary concern is seamless digital order processing, and multiple providers offer robust, easily adaptable platforms, their ability to negotiate better terms with Elanders increases.

Elanders faces significant buyer power due to the availability of numerous alternative service providers across print, packaging, supply chain management, and e-commerce. Customers can easily switch to specialized niche players or larger, integrated competitors, giving them leverage in negotiations. This competitive landscape means customers can demand lower prices or better terms, directly impacting Elanders' profitability.

Buyer Power 4

Elanders' customers exhibit varying degrees of price sensitivity. For those whose operations heavily rely on Elanders' printing and packaging solutions, or where these services significantly impact their product's marketability, price becomes a more critical factor. Customers for whom Elanders' offerings represent a substantial portion of their cost structure or a key differentiator are likely to be more inclined to seek competitive pricing.

The bargaining power of Elanders' customers is influenced by several factors:

- Customer Concentration: A few large customers could wield significant power if they represent a substantial portion of Elanders' revenue.

- Switching Costs: If customers can easily switch to alternative suppliers without incurring significant costs or disruptions, their bargaining power increases.

- Availability of Substitutes: The presence of readily available alternative printing and packaging providers can empower customers to negotiate better terms.

- Price Sensitivity: As noted, customers for whom Elanders' services are a major expense or critical to their success are more likely to push for lower prices. For instance, in 2023, the printing industry faced increased input costs, potentially making customers more sensitive to price hikes from providers like Elanders.

Buyer Power 5

Elanders' customers possess significant bargaining power, particularly due to the potential for backward integration. If customers perceive that bringing services like printing, logistics, or e-commerce fulfillment in-house would be more cost-effective or offer greater control, they can leverage this threat to negotiate better terms with Elanders.

This leverage is amplified when customers are large and have the financial and operational capacity to undertake these services themselves. For instance, a major retail client might explore establishing its own distribution network or printing facilities, thereby reducing its reliance on Elanders and increasing its negotiating stance.

The threat of backward integration directly impacts Elanders' pricing power and ability to maintain margins. Customers can use this as a strong point in discussions, pushing for lower prices or more favorable contract conditions. This is a constant consideration for Elanders in its client relationships.

- Customer Bargaining Power: High, driven by potential for backward integration.

- Threat of Self-Provisioning: Customers may bring services like printing and logistics in-house.

- Impact on Elanders: Increased negotiation leverage for customers, potentially pressuring pricing.

- Strategic Consideration: Elanders must manage client relationships to mitigate this power.

Elanders' customers hold considerable bargaining power, largely due to the fragmented nature of the printing and packaging industry and the availability of numerous alternative suppliers. This means clients can readily switch providers if terms aren't met, putting pressure on Elanders' pricing and margins. For example, in 2024, the ease of accessing digital printing solutions from various providers allows customers to compare offerings and negotiate more aggressively.

Customer concentration also plays a role; if a few large clients account for a significant portion of Elanders' revenue, their ability to negotiate favorable terms increases substantially. Furthermore, low switching costs for clients, especially those using standardized printing and packaging, amplify their power. The threat of backward integration, where clients consider bringing services in-house, serves as another potent negotiation tool.

| Factor Influencing Customer Bargaining Power | Description | Impact on Elanders |

|---|---|---|

| Availability of Alternatives | Numerous printing and packaging providers exist. | Increased negotiation leverage for customers, potential price pressure. |

| Customer Concentration | A few large clients represent a significant revenue share. | These clients have greater power to dictate terms. |

| Switching Costs | Low costs for clients to move to competitors. | Customers can easily switch, demanding better pricing/service. |

| Backward Integration Threat | Clients may bring services in-house. | Customers can leverage this to negotiate more favorable contracts. |

Preview the Actual Deliverable

Elanders Porter's Five Forces Analysis

This preview showcases the complete Elanders Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately upon purchase, ensuring no hidden surprises or placeholder content. You can trust that the detailed insights into threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry are all present and ready for your strategic planning.

Rivalry Among Competitors

Elanders operates in markets with a significant number of competitors, ranging from large global logistics players to specialized print and packaging firms, and increasingly, e-commerce fulfillment providers. The intensity of rivalry is further amplified by the presence of numerous similarly sized companies across these segments, all vying for market share.

The integrated supply chain, print, packaging, and e-commerce services industry is experiencing a moderate growth rate, which can lead to heightened competitive rivalry. As the market expands, companies are vying for a larger slice of the pie, rather than simply capitalizing on overall industry growth.

In 2024, while specific aggregate growth figures for this niche sector are still emerging, trends in e-commerce fulfillment and specialized printing services suggest a positive, albeit not explosive, trajectory. This environment means that established players and new entrants alike are keenly focused on differentiating their offerings and capturing market share, intensifying direct competition.

In Elanders' core markets, particularly in printing and packaging, product and service differentiation is often limited. Competitors frequently offer similar solutions, which intensifies price-based competition. This dynamic can put pressure on profit margins, especially for standard offerings.

For instance, in the European printing sector, Elanders faces numerous regional and local players. While Elanders aims to differentiate through specialized services and sustainability initiatives, many competitors compete primarily on cost. This was evident in 2023, where reports indicated a slight increase in price sensitivity among customers seeking cost efficiencies in their print procurement.

Competitive Rivalry 4

The printing and packaging industry, where Elanders operates, exhibits significant exit barriers. Companies often have substantial investments in specialized machinery, such as high-speed printing presses and finishing equipment, representing considerable fixed assets. These assets are not easily repurposed or sold, making it costly for firms to leave the market, especially during economic downturns. For instance, a typical offset printing press can cost hundreds of thousands to millions of dollars, and its resale value is often significantly depreciated.

Furthermore, many companies in this sector are locked into long-term supply contracts with clients, which can make exiting the business before the contract expires financially punitive. The need to maintain specialized technical expertise and workforce skills also contributes to the difficulty of exiting. These factors collectively mean that even struggling companies may continue to operate and compete aggressively, intensifying rivalry as they strive to cover their fixed costs and honor contractual obligations.

- High Fixed Assets: Investments in specialized printing and finishing machinery create substantial capital tied up in assets that are difficult to liquidate.

- Specialized Technology: The need for cutting-edge, often proprietary, printing technology requires significant upfront and ongoing investment.

- Long-Term Contracts: Commitments to clients through service agreements and supply contracts can impose penalties for early termination, hindering exit.

- Workforce Skills: The specialized nature of the labor force in printing and packaging means that retaining or redeploying skilled employees can be a challenge upon exiting.

Competitive Rivalry 5

Competitive rivalry within Elanders' operating segments is notably intense, driven by a constant push for innovation and enhanced service offerings. Companies actively invest in new technologies and process improvements to gain an edge.

The printing and packaging industry, a core area for Elanders, sees significant competition. For instance, in 2024, the global printing market was valued at approximately $850 billion, with a substantial portion of this driven by innovation in digital printing and sustainable packaging solutions. This necessitates continuous R&D spending from players like Elanders to remain competitive.

Elanders faces rivals who are also focusing on:

- Service Differentiation: Offering specialized printing techniques, advanced logistics, or integrated digital solutions.

- Efficiency Gains: Implementing automation and lean manufacturing principles to reduce costs and improve turnaround times.

- Technological Adoption: Investing in areas like AI-powered design tools, advanced finishing capabilities, and sustainable printing materials.

Competitive rivalry in Elanders' markets is robust, fueled by a fragmented landscape of global and specialized firms. The drive for market share is particularly acute in 2024, as companies across print, packaging, and e-commerce fulfillment sectors invest heavily in technological advancements and service diversification to stand out. This intense competition often leads to price-based strategies, especially for commoditized offerings, impacting profit margins.

The printing and packaging sector, a key focus for Elanders, is characterized by a high degree of competition due to significant exit barriers. Substantial investments in specialized machinery, such as advanced printing presses, and long-term client contracts make it difficult for firms to leave the market, even during economic slowdowns. This persistence of players, coupled with a moderate industry growth rate, intensifies the battle for customers and market positioning.

Elanders actively competes with firms that are differentiating through specialized printing techniques, advanced logistics, and the adoption of new technologies like AI in design. For instance, the global printing market was valued at approximately $850 billion in 2024, with innovation in digital printing and sustainable packaging being key drivers. This necessitates continuous investment in R&D to maintain a competitive edge.

| Competitor Focus Area | Elanders' Response | Market Trend (2024) |

|---|---|---|

| Service Differentiation | Specialized printing, advanced logistics, digital solutions | Increasing demand for integrated supply chain services |

| Efficiency Gains | Automation, lean manufacturing | Focus on cost reduction and faster turnaround times |

| Technological Adoption | AI-powered design, advanced finishing, sustainable materials | Growth in digital printing and eco-friendly packaging solutions |

SSubstitutes Threaten

The threat of substitutes for Elanders' traditional print services is significant, primarily driven by the rise of digital communication channels. Customers can easily opt for e-books, online publications, and direct digital marketing campaigns, which often offer lower costs and faster delivery. For instance, the global e-book market was valued at approximately USD 18.1 billion in 2023 and is projected to grow, indicating a strong customer preference for digital alternatives.

Elanders faces a growing threat from digital alternatives and evolving consumer demand for sustainability. Clients might shift from physical packaging to digital solutions for certain product information or delivery notifications, reducing the need for printed inserts. For instance, the rise of QR codes and augmented reality experiences in packaging could diminish the reliance on traditional printed materials.

Furthermore, the push towards reusable packaging models presents a significant substitution threat. As environmental concerns mount, businesses are exploring options like returnable containers and refillable systems, potentially decreasing the demand for single-use physical packaging Elanders provides. This trend is amplified by regulatory pressures and growing consumer preference for eco-friendly solutions, impacting the market for conventional packaging services.

Customers might consider bringing supply chain management in-house, especially with the rise of affordable ERP and logistics software. However, the significant investment in technology, skilled personnel, and the complexity of managing these operations often make outsourcing to specialists like Elanders more cost-effective and efficient.

In 2024, many businesses found that while software is accessible, the actual implementation, integration, and ongoing optimization of supply chain management systems require specialized expertise that is costly to develop internally. This reality reinforces the value proposition of outsourcing for many companies.

Threat of Substitution 4

The threat of substitutes for traditional e-commerce fulfillment services is growing as new models emerge. Direct manufacturer-to-consumer (M2C) shipping bypasses intermediaries, potentially reducing costs and delivery times for certain products. For instance, in 2024, many apparel brands have invested heavily in their direct-to-consumer capabilities, aiming to capture a larger share of the customer relationship and margin.

Localized pick-up points, often integrated with retail stores or dedicated locker systems, also present an alternative. These options cater to consumers seeking convenience and immediate access to their purchases without the need for home delivery. The growth in click-and-collect services, which saw a significant uptick in adoption during the pandemic, continues to be a strong substitute for traditional parcel delivery in 2024, particularly for smaller, frequently purchased items.

These alternatives offer different value propositions:

- Direct M2C Shipping: Offers potential cost savings and a more controlled brand experience.

- Localized Pick-up Points: Provide enhanced convenience and immediate availability for consumers.

- Emerging Technologies: Innovations in drone delivery and autonomous vehicles could further disrupt traditional logistics networks by 2025.

- Subscription Box Models: These services often handle their own fulfillment, reducing reliance on third-party providers for specific product categories.

Threat of Substitution 5

The threat of substitutes for Elanders' integrated solutions hinges on the price-performance trade-off offered by alternative services. If other providers can deliver comparable quality and functionality at a lower price point, or even superior benefits at a similar cost, their attractiveness increases significantly.

For instance, while Elanders offers comprehensive services in areas like print and packaging, standalone digital printing services or specialized packaging manufacturers might present a more cost-effective option for businesses with less complex needs. This is particularly relevant as digital transformation continues to lower barriers to entry for niche service providers.

- Price-Performance of Substitutes: Businesses continually assess if alternative solutions provide similar value for less money or better value for the same money.

- Digital Printing vs. Integrated Solutions: Standalone digital printing services may offer a lower cost for specific print jobs compared to Elanders' broader integrated offerings.

- Specialized Packaging: Niche packaging manufacturers can sometimes undercut integrated providers on price for specific packaging types, impacting Elanders' market share.

- Digitalization Impact: The ongoing digitalization of many industries makes it easier for specialized, lower-cost competitors to emerge and offer viable alternatives.

The threat of substitutes for Elanders' offerings, particularly in print and packaging, is substantial. Digital alternatives are increasingly prevalent, with the global e-book market alone reaching approximately USD 18.1 billion in 2023, demonstrating a clear shift in consumer preference. Furthermore, evolving sustainability demands are pushing businesses towards reusable packaging, potentially reducing the need for Elanders' single-use solutions.

E-commerce fulfillment also faces disruption from direct manufacturer-to-consumer (M2C) shipping, a trend actively pursued by many apparel brands in 2024 to control customer relationships and margins. Localized pick-up points and locker systems are also gaining traction as convenient alternatives to traditional home delivery for many consumers.

The core of this threat lies in the price-performance of substitutes. If alternative providers can match Elanders' quality and functionality at a lower cost, or offer superior benefits at a similar price, their appeal grows. This is especially true as digitalization lowers entry barriers for specialized, niche service providers.

| Service Area | Substitute | Key Advantage | 2023/2024 Data Point |

|---|---|---|---|

| Print Services | Digital Publications (e-books, online content) | Lower cost, faster delivery | Global e-book market valued at approx. USD 18.1 billion in 2023 |

| Packaging | Reusable/Returnable Packaging | Sustainability, reduced waste | Growing regulatory pressure and consumer demand for eco-friendly options |

| E-commerce Fulfillment | Direct-to-Consumer (M2C) Shipping | Potential cost savings, controlled brand experience | Many apparel brands invested heavily in D2C in 2024 |

| E-commerce Fulfillment | Localized Pick-up Points/Lockers | Consumer convenience, immediate access | Continued growth in click-and-collect services |

Entrants Threaten

The integrated supply chain, print, packaging, and e-commerce services markets demand substantial initial investment. Companies need significant capital for state-of-the-art printing presses, extensive warehouse facilities, and robust logistics networks. For instance, setting up a modern, high-volume printing operation can easily cost millions of dollars in equipment alone, plus ongoing investments in advanced IT infrastructure for seamless e-commerce integration.

These high capital requirements act as a formidable barrier to entry. New players must secure considerable funding to compete effectively with established firms that have already amortized their initial investments and built economies of scale. This financial hurdle significantly limits the number of potential new competitors.

The threat of new entrants for Elanders is moderate. Established players like Elanders benefit from significant economies of scale, particularly in high-volume print production and logistics. For instance, in 2024, Elanders' substantial operational capacity allows for lower per-unit costs, a hurdle for newcomers who would need considerable investment to achieve similar efficiencies and compete on price.

Elanders benefits from significant customer loyalty, especially with its integrated solutions, which makes it difficult for new companies to enter the market. These strong, established relationships mean clients are less likely to switch to a new provider, particularly given the potential disruption and costs involved in changing suppliers for complex, integrated services. This loyalty acts as a substantial barrier.

Threat of New Entrants 4

The threat of new entrants for Elanders is generally moderate, influenced by capital requirements and established industry standards. For instance, in the printing and packaging sector, significant upfront investment in specialized machinery and technology is necessary. Elanders operates in diverse markets, each with its own regulatory landscape. In Europe, adherence to environmental regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and specific waste management directives can be complex for new players. North America presents a patchwork of federal and state-level regulations concerning product safety and labeling, adding another layer of compliance. Asia, particularly in countries like China, has seen rapid industrial growth but also increasing regulatory scrutiny on environmental impact and labor practices.

New entrants must also navigate established industry standards and certifications that Elanders likely possesses, such as ISO certifications for quality management and environmental responsibility. These accreditations, while not always legally mandated, are often crucial for securing business with major clients. For example, in the automotive supply chain, stringent quality control and traceability standards are paramount. Elanders' long-standing relationships and proven track record in these demanding sectors create a barrier that newcomers must overcome through substantial investment in quality assurance and process development. In 2023, the global printing and packaging market was valued at approximately $1.1 trillion, indicating substantial revenue potential but also the scale of investment required to compete effectively.

Key barriers to entry that new companies face include:

- Capital Investment: High costs associated with acquiring advanced printing and packaging machinery, automation, and IT infrastructure.

- Regulatory Compliance: Navigating diverse and evolving environmental, safety, and product labeling regulations across Europe, Asia, and North America.

- Industry Standards and Certifications: Meeting established quality (e.g., ISO 9001), environmental (e.g., ISO 14001), and sector-specific certifications required by major clients.

- Economies of Scale: Elanders' existing scale allows for more efficient procurement of raw materials and optimized production processes, leading to cost advantages that new entrants struggle to match initially.

Threat of New Entrants 5

The threat of new entrants for Elanders is moderate, largely due to the capital-intensive nature of the printing and packaging industry, which requires significant upfront investment in machinery and technology.

Access to established distribution channels presents a substantial hurdle. New companies may struggle to secure reliable logistics networks or gain entry into existing supplier relationships that Elanders has cultivated over time. For instance, securing contracts with major retailers or e-commerce platforms often requires proven track records and established infrastructure, which newcomers lack.

Furthermore, specialized technology partnerships and proprietary software solutions that enhance efficiency and service offerings can be difficult for new entrants to replicate. Elanders' investments in areas like advanced digital printing technologies and integrated supply chain management software create a competitive advantage that raises the barrier to entry.

- Capital Investment: High initial costs for specialized printing and finishing equipment.

- Distribution Access: Difficulty in securing established logistics and retail partnerships.

- Supplier Relationships: Existing strong ties with key material suppliers can be hard to break into.

- Technological Expertise: Need for advanced, proprietary technology and skilled labor.

The threat of new entrants for Elanders is moderate. Significant capital investment in specialized printing and packaging machinery, along with advanced IT infrastructure, creates a substantial financial barrier. For example, in 2024, the cost of high-end digital printing presses alone can run into millions of dollars, a considerable hurdle for startups.

Established customer loyalty and long-standing supplier relationships further solidify Elanders' position, making it difficult for newcomers to gain market traction. Navigating complex regulatory landscapes and obtaining necessary industry certifications, such as ISO standards, also adds to the challenge. In 2023, the global printing and packaging market was valued at approximately $1.1 trillion, indicating substantial revenue potential but also highlighting the scale of investment required to compete effectively.

| Barrier Type | Description | Impact on New Entrants | Example for Elanders (2024) |

|---|---|---|---|

| Capital Investment | High costs for advanced machinery, automation, and IT. | Significant financial hurdle. | Millions required for state-of-the-art printing presses and logistics. |

| Customer Loyalty | Strong, established relationships with clients. | Makes switching suppliers difficult and costly. | Clients value integrated solutions and proven reliability. |

| Regulatory Compliance | Navigating diverse environmental and safety regulations. | Adds complexity and cost to market entry. | Adherence to REACH in Europe and various North American standards. |

| Economies of Scale | Lower per-unit costs due to high-volume production. | New entrants struggle to match price competitiveness. | Elanders' operational capacity provides cost advantages. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Elanders' annual reports, investor presentations, and publicly available financial statements. We also incorporate insights from reputable industry research firms and trade publications to provide a comprehensive view of the competitive landscape.