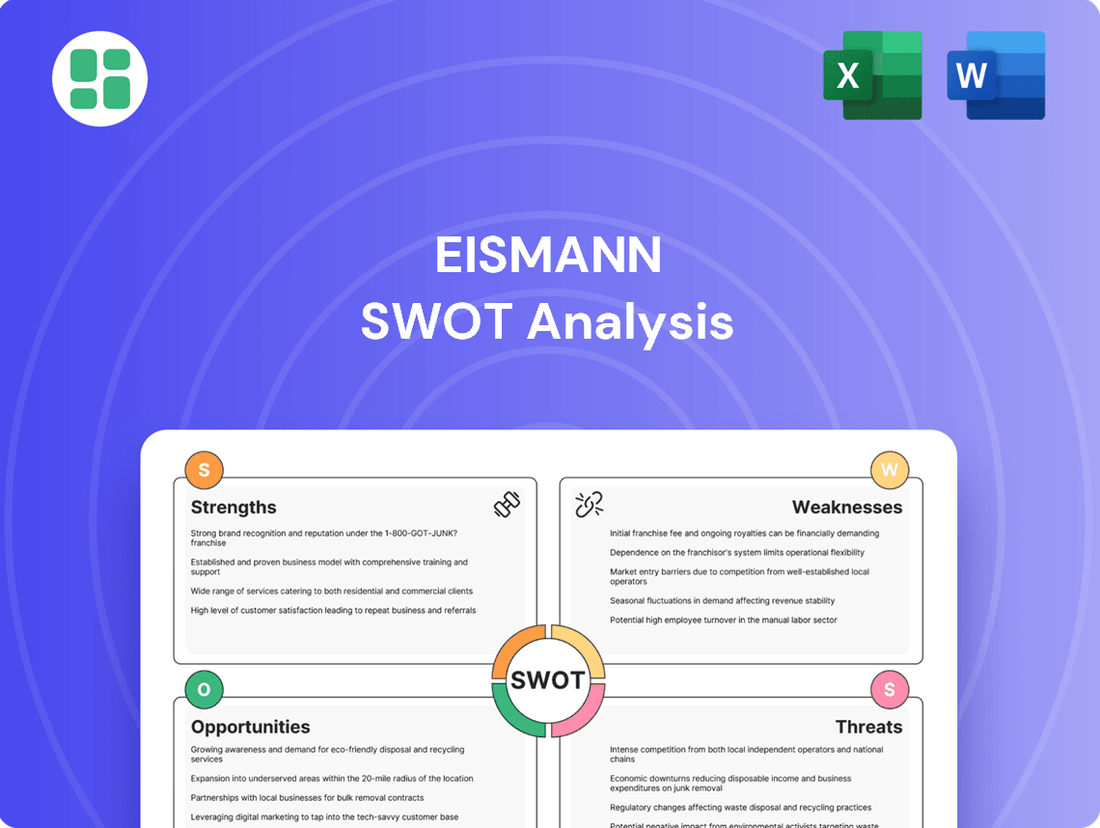

eismann SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

eismann Bundle

Eismann's strengths lie in its established brand and direct-to-consumer model, but understanding its weaknesses and the competitive landscape is crucial for future growth. Our full SWOT analysis dives deep into these areas, providing a comprehensive view of their market position.

Want the full story behind Eismann's opportunities and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Eismann has honed its direct-to-consumer sales approach over 40 years, building a loyal customer base of around 800,000 individuals who appreciate the tailored advice and doorstep convenience. This extensive experience translates into deep customer relationships and significant brand loyalty, setting it apart from competitors relying on traditional retail channels.

Eismann's strength lies in its extensive and high-quality frozen food selection, encompassing everything from ready meals and vegetables to meat, fish, and desserts. The company's dedication to using premium, natural ingredients is a cornerstone of its brand identity, resonating with consumers seeking healthier options. This focus on quality is a significant differentiator in the competitive frozen food market.

The company actively innovates, demonstrated by its recent expansion into BIO-products and vegan alternatives. This forward-thinking approach ensures Eismann stays relevant by catering to growing consumer preferences for organic and plant-based diets. For instance, in 2024, the demand for vegan frozen meals saw a notable increase, a segment Eismann is well-positioned to capitalize on.

Eismann demonstrated financial stability in 2024, achieving revenues of approximately €194 million. This performance highlights the company's ability to maintain its market position even amidst economic uncertainties.

Looking ahead to 2025, Eismann has outlined aggressive growth objectives. The company is strategically allocating resources towards expanding its sales force and implementing targeted customer acquisition initiatives to drive future revenue streams.

Strategic Expansion into Retail (LEH)

Eismann's strategic move into the retail food sector, branded as LEH, has proven to be a significant strength. This expansion saw a remarkable nearly 30% increase in turnover for this segment in 2024, demonstrating strong market acceptance.

The company has successfully placed its products in over 1,200 brick-and-mortar retail locations. These include prominent German supermarket chains such as Edeka and REWE, significantly broadening Eismann's market reach beyond its established direct-to-consumer model.

This diversification of sales channels not only increases revenue but also enhances brand visibility and accessibility for a wider customer base. The retail presence complements its traditional direct sales, creating a more robust and resilient business model.

- Retail Expansion (LEH): Achieved nearly 30% turnover growth in 2024.

- Extensive Retail Footprint: Products available in over 1,200 stationary retailers.

- Key Retail Partnerships: Presence in major chains like Edeka and REWE.

- Diversified Revenue Streams: Reduced reliance on direct sales by tapping into the retail market.

Innovation and Adaptability to Market Trends

Eismann's commitment to innovation is evident in its strategic collaborations, such as its partnership with celebrated culinary expert Johann Lafer. This collaboration fuels the development of novel product lines, ensuring Eismann remains at the forefront of taste and quality in the frozen food sector.

The company's successful pivot into organic and vegan product ranges showcases its keen understanding of evolving consumer preferences. This adaptability directly addresses the growing demand for healthier and more sustainable food options within the frozen food market, a trend that continued to accelerate through 2024 and into 2025.

- Product Development: Collaborations with experts like Johann Lafer drive innovation.

- Market Responsiveness: Expansion into organic and vegan lines meets current consumer demand.

- Trend Alignment: Eismann aligns its offerings with health and sustainability trends.

Eismann's direct-to-consumer model, refined over four decades, cultivates strong customer loyalty with approximately 800,000 individuals valuing its personalized service and convenience. This deep customer engagement, coupled with a broad, high-quality frozen food portfolio emphasizing premium, natural ingredients, provides a significant competitive edge.

The company's strategic expansion into retail, under the LEH brand, has been highly successful, achieving nearly 30% turnover growth in this segment during 2024. This move has broadened Eismann's market presence, with products now available in over 1,200 brick-and-mortar locations, including major German retailers like Edeka and REWE, diversifying revenue and increasing brand visibility.

Eismann demonstrates a commitment to innovation and market responsiveness through its development of BIO-products and vegan alternatives, aligning with growing consumer demand for healthier and sustainable options. Collaborations with culinary experts, such as Johann Lafer, further enhance its product development pipeline, ensuring continued relevance and quality.

| Strength Area | Key Metric/Fact | Year |

|---|---|---|

| Direct-to-Consumer Loyalty | ~800,000 loyal customers | Ongoing |

| Product Quality | Premium, natural ingredients | Ongoing |

| Retail Expansion (LEH) | Nearly 30% turnover growth | 2024 |

| Retail Footprint | Over 1,200 retail locations | Ongoing |

| Brand Partnerships | Collaboration with Johann Lafer | Ongoing |

| Product Innovation | Expansion into BIO & vegan ranges | Ongoing |

What is included in the product

Analyzes eismann’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

The eismann SWOT Analysis offers a clear, structured framework that simplifies complex strategic thinking, alleviating the pain of overwhelming data by providing actionable insights.

Weaknesses

Eismann's reliance on independent sales representatives presents a notable weakness. The company's success is intrinsically tied to its ability to consistently recruit, train, and retain a motivated sales force. This direct selling model requires ongoing investment in sales support and can be vulnerable to market fluctuations affecting independent contractor availability.

The challenge of attracting and keeping qualified sales representatives is amplified in a competitive labor market. Eismann must continually invest in its network to combat potential difficulties in onboarding new talent. For instance, in 2024, the direct selling industry faced increased scrutiny regarding worker classification, potentially impacting recruitment efforts for companies like Eismann.

Eismann's premium positioning, which includes personalized service and direct home delivery, often translates to higher prices compared to conventional frozen foods found in supermarkets. For instance, in 2024, with inflation impacting consumer spending, this premium pricing strategy might alienate budget-conscious shoppers looking for more economical options. This could be a significant hurdle, especially when competing against a vast array of supermarket brands offering similar product categories at lower price points.

While Eismann is venturing into retail, its primary direct-to-consumer approach, built on individual sales representatives, could naturally cap its market reach. This contrasts with the broad accessibility and intense marketing efforts of major supermarket chains and online grocery services, which currently hold substantial market share.

Logistical Complexities of Cold Chain Delivery

Operating a nationwide direct delivery service for frozen foods, like eismann, presents significant logistical hurdles. The core challenge lies in maintaining an unbroken cold chain from the point of origin to the customer's doorstep. This requires substantial investment in specialized, temperature-controlled vehicles and warehousing, which can be a considerable operational expense.

The complexity escalates with the need to ensure product integrity across vast distances. Fluctuations in fuel prices directly impact delivery costs, making it difficult to predict and manage expenses. For instance, in 2024, the average diesel price saw significant volatility, impacting transportation budgets across industries.

- High infrastructure investment: Specialized refrigerated trucks and cold storage facilities are essential, representing a significant capital outlay.

- Operational costs: Maintaining consistent low temperatures requires continuous energy consumption, adding to overheads.

- Fuel price sensitivity: Delivery costs are directly tied to volatile fuel markets, impacting profitability and pricing strategies.

- Route optimization challenges: Efficiently covering wide geographic areas while maintaining delivery windows for frozen goods is complex.

Adapting to Digital Native Consumer Behavior

The direct selling industry, including companies like Eismann, struggles to connect with younger consumers who are accustomed to online shopping and digital interactions. This demographic, often referred to as digital natives, expects seamless online experiences and personalized engagement, which can be a hurdle for traditional direct selling models.

Eismann must prioritize continuous improvement of its digital offerings. This includes investing in user-friendly websites, mobile applications, and social media strategies to meet the expectations of digitally savvy consumers. For instance, in 2024, the global e-commerce market was projected to reach over $6.3 trillion, highlighting the significant shift in consumer purchasing habits towards online channels.

- Digital Engagement Gap: Younger generations prefer online channels for research and purchasing, posing a challenge for direct sales models.

- Platform Enhancement: Eismann needs to invest in robust digital platforms to cater to online-first consumers.

- E-commerce Growth: The continued expansion of e-commerce globally underscores the need for strong online presence.

- Customer Experience: A superior digital user experience is crucial for attracting and retaining digitally native customers.

Eismann's reliance on independent sales representatives creates a vulnerability in its recruitment and retention efforts. The company's success is directly linked to its ability to maintain a motivated and skilled sales force, requiring continuous investment in training and support, which can be challenging in competitive labor markets.

The premium pricing strategy, while supporting personalized service and direct delivery, may alienate budget-conscious consumers, especially in economic climates where consumers prioritize value. This positions Eismann at a disadvantage against lower-priced supermarket alternatives.

The inherent limitations of a direct-to-consumer model can cap market reach compared to the broad accessibility of supermarket chains and online grocery platforms. Eismann's expansion into retail aims to address this, but its core model still faces competition from established mass-market channels.

Maintaining a consistent cold chain for frozen food delivery across vast distances is a significant logistical challenge, demanding substantial investment in specialized infrastructure and facing volatility in fuel prices, which directly impact operational costs and profitability.

The company faces a digital engagement gap with younger consumers who prefer online shopping, necessitating investment in robust digital platforms and online marketing to meet evolving consumer expectations in a market where global e-commerce continues its rapid expansion.

What You See Is What You Get

eismann SWOT Analysis

The file shown below is not a sample—it’s the real eismann SWOT analysis you'll download post-purchase, in full detail. This ensures you know exactly what you're getting. The comprehensive report is ready for your strategic planning needs.

Opportunities

The German frozen food market is a significant growth area, with projections indicating continued expansion. Consumers are increasingly seeking convenience and pre-prepared meals, a trend Eismann is well-positioned to capitalize on. The market's growth is further boosted by a notable rise in demand for plant-based and vegan frozen products, offering a clear avenue for Eismann to broaden its appeal and market share.

Eismann can capitalize on the growing trend of digital transformation by further investing in and optimizing its online ordering platforms and mobile applications. This focus on digital channels, coupled with enhanced digital marketing strategies, can dramatically expand Eismann's customer reach and improve overall convenience. For instance, in 2023, the global e-commerce market was valued at over $6.3 trillion, demonstrating the immense potential for businesses to grow their online presence.

Improving the digital user experience is paramount to attracting and retaining customers, particularly younger demographics who are digital natives. A seamless and intuitive online interface, from browsing to checkout, can differentiate Eismann from competitors. Research indicates that a positive user experience can lead to a 400% increase in conversion rates for online businesses.

Eismann can significantly broaden its appeal by introducing specialized product lines. Think about expanding into areas like gluten-free, organic, or even specific ethnic frozen meal options, which are seeing robust growth. For instance, the global gluten-free market was valued at approximately $7.3 billion in 2023 and is projected to reach over $13 billion by 2030, indicating a substantial opportunity.

This strategic product diversification allows Eismann to capture a larger share of these expanding niche markets. By aligning with evolving consumer demand for healthier and more specific dietary choices, the company can establish a stronger competitive advantage and attract new customer segments beyond its traditional base.

Targeting New Demographics and Market Segments

Eismann has a significant opportunity to broaden its customer base by focusing on demographics that highly value convenience and home delivery. This includes younger generations and busy professionals who are increasingly seeking time-saving meal solutions. Furthermore, the growing elderly population represents a key segment that can greatly benefit from Eismann's reliable home delivery services.

Strategic marketing and recruitment efforts tailored to these groups can unlock substantial customer acquisition. For instance, by highlighting the ease and quality of Eismann's offerings, the company can appeal to the time constraints of urban professionals. Simultaneously, emphasizing the health benefits and accessibility for seniors can tap into a loyal and expanding market.

- Younger Generations & Busy Professionals: Increased demand for convenient, ready-to-eat meals, driven by busy lifestyles and a preference for online ordering.

- Elderly Population: A growing demographic that benefits from reliable home delivery of nutritious meals, addressing mobility and convenience needs.

- Market Expansion Potential: Targeting these segments can lead to a significant increase in Eismann's overall customer acquisition and revenue growth.

- 2024/2025 Data Insight: The ready-to-eat meal market is projected to see continued growth, with convenience being a primary purchasing driver across various age groups.

Strategic Partnerships and Collaborations

Strategic partnerships offer significant growth avenues for eismann. By teaming up with complementary businesses, eismann can tap into new customer bases and reinforce its brand presence. For instance, offering freezer services to corporate clients for their employees presents a B2B opportunity that diversifies revenue streams beyond direct-to-consumer sales.

Collaborations with organizations like the German Minigolf Association, as seen in past initiatives, illustrate how eismann can reach niche markets and enhance brand visibility in non-traditional settings. These types of alliances are crucial for expanding market reach and acquiring new customers, especially in a competitive landscape.

These strategic alliances can translate into tangible business benefits. For example, a 2024 market analysis indicated that companies engaging in cross-promotional activities with non-competing brands saw an average increase of 15% in customer acquisition compared to those operating solely independently.

Future opportunities include:

- Expanding corporate freezer services: Targeting businesses of all sizes to offer convenient frozen food solutions for employee welfare programs.

- Collaborating with health and wellness influencers: Partnering with individuals who align with eismann's healthy eating message to reach a broader audience.

- Joint ventures with complementary food service providers: Exploring partnerships with companies offering fresh produce or meal preparation kits to create bundled offerings.

- Sponsoring local community events: Increasing brand awareness and fostering goodwill through participation in events relevant to eismann's target demographics.

Eismann can leverage the growing demand for convenient, high-quality frozen meals by expanding its product lines to include more specialized options. This includes catering to dietary needs such as gluten-free or organic, as well as exploring plant-based and vegan alternatives, which saw significant market growth in 2023. By diversifying its offerings, Eismann can attract new customer segments and increase its market share.

Further investment in digital platforms and user experience presents a substantial opportunity for Eismann to broaden its customer reach and enhance convenience. Optimizing online ordering and mobile applications, coupled with targeted digital marketing, can significantly boost customer acquisition, especially among younger, digitally-native demographics. A seamless online experience is crucial for conversion, with studies showing it can increase rates by up to 400%.

Targeting specific demographic groups, such as busy professionals and the growing elderly population, can drive significant customer acquisition and revenue growth. These segments highly value convenience and reliable home delivery, areas where Eismann excels. Strategic marketing tailored to their needs can unlock substantial market potential.

Strategic partnerships and collaborations offer avenues to tap into new customer bases and enhance brand visibility. By teaming up with complementary businesses or sponsoring local events, Eismann can reach niche markets and diversify its revenue streams, potentially increasing customer acquisition by an average of 15% through cross-promotional activities.

Threats

Eismann confronts fierce competition from established supermarkets and burgeoning online grocery platforms. These competitors often boast wider product assortments, more aggressive pricing strategies, and a growing emphasis on rapid delivery, directly challenging Eismann's traditional direct-to-consumer model.

Large retail conglomerates, already holding substantial market share in the frozen food sector, represent a persistent threat. For instance, in 2024, the global frozen food market was valued at over $330 billion, with major supermarket chains capturing a significant portion of this. This dominance makes it difficult for specialized players like Eismann to expand their market penetration.

A significant societal trend is the increasing consumer preference for fresh, unprocessed, and locally sourced foods. This shift could pose a challenge to the long-term demand for frozen products, including those offered by Eismann. For instance, a 2024 report indicated that 65% of consumers surveyed expressed a preference for fresh produce over frozen options when available.

To mitigate this threat, Eismann must consistently highlight the superior quality and 'fresher than fresh' attributes of its frozen meals. Emphasizing advanced freezing techniques that preserve nutrients and taste is crucial to counter the perception that frozen is inherently inferior to fresh.

Economic instability, particularly high inflation rates seen in countries like Germany where food prices have risen significantly, poses a direct threat. Consumers are likely to curb spending on non-essential items and trade down to more budget-friendly options.

This shift in consumer behavior could negatively impact Eismann's sales volume, especially considering its established premium market positioning. For instance, if inflation continues to hover around 3-4% in key European markets throughout 2024 and into 2025, the pressure on discretionary income will intensify.

Recruitment and Retention Challenges for Sales Force

The direct selling model, like Eismann's, hinges on its sales force, making recruitment and retention a critical vulnerability. In 2024, the direct selling industry faced increased competition for talent, with many sectors experiencing labor shortages. This environment makes it harder to attract new representatives and retain existing ones who might be drawn to other opportunities with potentially higher immediate financial rewards or different working conditions. A significant drop in the number of active sales representatives directly translates to fewer customer interactions and a reduced capacity for sales, potentially hindering Eismann's ability to meet its delivery quotas and expand its customer base.

Challenges in maintaining a robust sales force can directly impede Eismann's growth trajectory. For instance, if recruitment efforts in 2024 and early 2025 fall short of replacing departing representatives, the overall sales capacity shrinks. This can lead to missed revenue targets and a slower pace of market penetration. The reliance on independent contractors means Eismann must continuously invest in training and motivational programs to keep its sales force engaged and productive, a cost that can fluctuate based on market dynamics.

The effectiveness of Eismann's sales force is paramount to its core business. A decline in the number of independent sales representatives directly impacts the company's ability to reach its customers effectively. For example, if Eismann aims to serve a certain number of households per day, a reduction in its sales force means it cannot fulfill this operational goal. This could lead to a decrease in sales volume and, consequently, affect the company's overall revenue and profitability, especially if the decline is substantial, impacting growth targets for 2025.

Key concerns regarding the sales force include:

- Difficulty attracting new, high-quality sales representatives in a competitive labor market during 2024-2025.

- High attrition rates among existing sales representatives seeking more stable or lucrative opportunities.

- The direct impact of a shrinking sales force on Eismann's customer reach and sales volume.

Supply Chain Disruptions and Cost Increases

Eismann faces significant threats from ongoing global supply chain vulnerabilities. Rising energy costs, a persistent issue throughout 2024 and projected into 2025, directly impact Eismann's ability to maintain its critical cold chain and extensive transportation network. For instance, the International Energy Agency reported that global energy prices remained volatile in early 2025, with natural gas prices showing upward trends in key European markets where Eismann operates.

These escalating operational expenses, driven by logistical challenges and energy price hikes, could squeeze Eismann's profit margins. The company might be compelled to implement price adjustments for its frozen food products to offset these increased costs, potentially affecting consumer demand and its competitive standing.

- Rising Fuel Costs: European diesel prices, crucial for Eismann's fleet, saw an average increase of 8% in the first half of 2025 compared to the previous year.

- Cold Chain Logistics: Maintaining sub-zero temperatures requires substantial energy, with electricity prices in Germany, a key market, increasing by approximately 15% year-over-year in Q1 2025.

- Raw Material Sourcing: Geopolitical instability continues to create uncertainties in the availability and cost of key ingredients, impacting production expenses.

Eismann's direct sales model faces a significant threat from challenges in attracting and retaining its sales force. In 2024 and early 2025, the direct selling industry experienced intensified competition for talent, leading to higher attrition rates. A shrinking sales force directly impacts customer reach and sales volume, potentially hindering revenue targets and market expansion for 2025.

SWOT Analysis Data Sources

This Eismann SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market research, and expert industry analyses to provide a thorough and actionable overview.