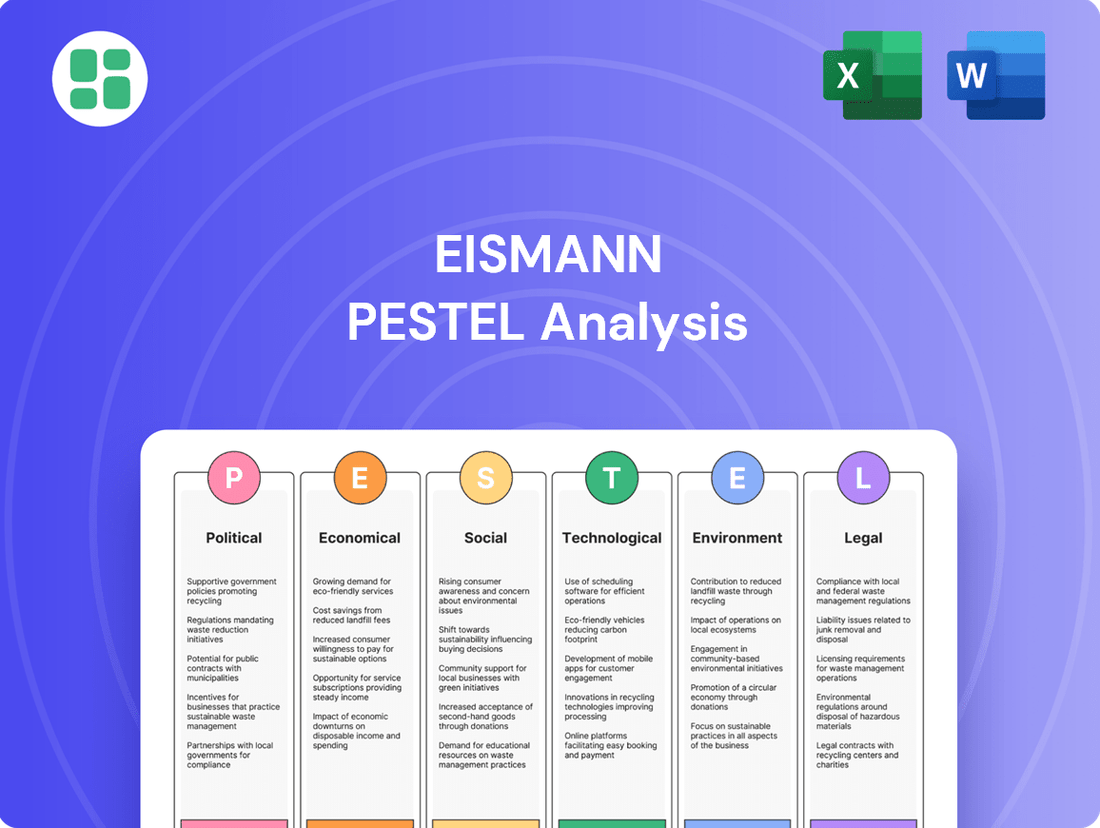

eismann PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

eismann Bundle

Navigate the complex external forces shaping eismann's future with our comprehensive PESTEL Analysis. Understand the political, economic, social, technological, environmental, and legal factors that present both opportunities and challenges. Equip yourself with actionable intelligence to make informed strategic decisions and gain a competitive advantage. Download the full analysis now and unlock critical insights.

Political factors

Evolving EU and German food safety regulations, including novel food rules and stricter food contact material laws, present a significant political factor for Eismann. For instance, the European Food Safety Authority (EFSA) continuously updates its guidelines; in 2024, ongoing discussions around the re-evaluation of certain food additives and the implementation of enhanced traceability requirements for imported goods will directly influence Eismann's sourcing and product formulation strategies.

Germany's labor laws regarding the classification of independent contractors are particularly relevant for Eismann. A key consideration is the risk of misclassification, which could result in substantial penalties. For instance, in 2023, German courts continued to scrutinize contractor relationships, emphasizing the need for genuine independence to avoid social security contributions and back payments.

The German Federal Labor Court has consistently upheld strict criteria for distinguishing between employees and independent contractors. If Eismann's sales representatives are deemed employees, the company would face additional costs related to social security contributions, paid leave, and other employee benefits, impacting its profitability. This legal landscape directly affects Eismann's business model, which relies on a flexible, independent sales force.

Eismann, as a German direct seller, navigates a complex international trade landscape. Potential shifts in EU trade policies or new tariffs on goods imported from outside the bloc could directly impact the cost of raw materials or specific frozen food items if Eismann sources them globally. For instance, a hypothetical 5% tariff on imported berries from outside the EU could add significant costs to Eismann's product lines relying on these ingredients.

Consumer Protection and Distance Selling Laws

Eismann's direct-to-consumer business model is significantly shaped by evolving consumer protection laws, particularly those pertaining to distance selling and the quality of food products. Staying compliant with these regulations is crucial for maintaining customer trust and avoiding costly legal challenges. For instance, in 2024, the European Union continued to strengthen consumer rights, with a focus on transparency in online food sales and clearer information on product origins and ingredients.

Adherence to these legal frameworks directly impacts Eismann's operational strategy, ensuring that customer satisfaction is prioritized and that potential disputes over delivery or product quality are minimized. As of early 2025, regulatory bodies are increasingly scrutinizing online food retailers for adherence to stringent hygiene and labeling standards, a trend Eismann must actively monitor.

- Evolving Legislation: Ongoing updates to EU consumer protection laws in 2024 and anticipated changes in 2025 place a greater emphasis on digital sales channels and food safety information.

- Consumer Confidence: Strict compliance with distance selling and food quality laws builds and maintains consumer trust, a vital asset for Eismann's reputation.

- Risk Mitigation: Proactive adherence to these regulations helps Eismann avoid potential fines, lawsuits, and reputational damage stemming from consumer complaints or legal challenges.

Government Initiatives for Sustainability

Government initiatives are increasingly pushing for sustainability across industries, and Eismann is no exception. For instance, the EU Green Deal and its associated Farm to Fork Strategy are driving significant changes in how food is produced, processed, and distributed. These policies encourage a move towards more energy-efficient refrigeration systems and the adoption of recyclable packaging materials, directly impacting Eismann's operational choices and supply chain management.

Eismann must navigate these evolving environmental directives to remain competitive and compliant. The company can potentially leverage these government-backed goals to its advantage by investing in greener technologies and more sustainable packaging solutions. Aligning with these policies not only ensures regulatory adherence but also opens avenues for innovation and potential cost savings through improved resource efficiency.

Key areas of focus for Eismann in response to these political factors include:

- Energy Efficiency: Investing in and upgrading refrigeration fleets and storage facilities to meet stricter energy consumption standards, aligning with goals like those outlined in the EU's energy performance of buildings directive which aims for climate-neutral buildings by 2050.

- Sustainable Packaging: Transitioning to recyclable, biodegradable, or reusable packaging materials to comply with directives aimed at reducing plastic waste and promoting a circular economy, such as the EU's Packaging and Packaging Waste Regulation.

- Supply Chain Transparency: Enhancing traceability and sustainability reporting throughout the supply chain to meet growing consumer and regulatory demands for ethically sourced and environmentally friendly products.

- Carbon Footprint Reduction: Implementing strategies to reduce greenhouse gas emissions across all operations, from logistics to warehousing, in line with national and international climate targets.

Political factors significantly influence Eismann's operations, particularly concerning EU and German food safety regulations, which are continually updated. For instance, in 2024, the European Food Safety Authority (EFSA) focused on re-evaluating food additives and enhancing traceability for imported goods, directly impacting Eismann's product sourcing and formulation.

Germany's labor laws, especially regarding the classification of independent contractors, pose a notable political risk. The German Federal Labor Court's strict criteria mean misclassification can lead to substantial penalties, affecting Eismann's business model which relies on a flexible sales force. As of 2023, courts continued to scrutinize these relationships closely.

Eismann must also navigate international trade policies and potential new tariffs on imported goods, which could increase raw material costs. For example, a hypothetical 5% tariff on non-EU berries could impact product pricing. Furthermore, evolving consumer protection laws, especially for distance selling and food quality, require strict adherence to maintain trust and avoid legal issues, with a continued focus on transparency in online food sales as of early 2025.

Government initiatives promoting sustainability, such as the EU Green Deal, are pushing for energy-efficient operations and recyclable packaging. Eismann can leverage these by investing in greener technologies, aligning with policies that encourage reduced plastic waste and improved resource efficiency, potentially leading to cost savings and innovation.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting eismann, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The eismann PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain of navigating complex market dynamics by offering clarity on potential opportunities and threats.

Economic factors

Germany's inflation rate, particularly in food prices, has been a significant concern. For instance, in early 2024, food inflation remained elevated, impacting household budgets and potentially reducing discretionary spending. This trend directly affects Eismann's sales volume for premium frozen foods, as consumers may prioritize essential goods over non-essential or higher-priced items.

Eismann's pricing strategy must carefully consider the prevailing economic climate and the resulting impact on household disposable income. As inflation erodes purchasing power, consumers become more price-sensitive. This necessitates a strategic approach to pricing and product offerings to maintain sales volume and market share amidst these economic pressures.

Eismann's direct-to-consumer model is particularly sensitive to fuel price volatility. Given their reliance on a delivery fleet, any significant uptick in diesel or gasoline prices directly translates to higher operational expenses and can squeeze profit margins. For instance, in early 2024, global oil prices saw fluctuations, with Brent crude averaging around $80 per barrel, impacting transportation costs across industries.

Beyond just fuel, broader energy and raw material costs are a substantial part of Eismann's business. The production of frozen foods, from sourcing ingredients to maintaining cold chain logistics, is energy-intensive. Increases in natural gas prices, which are crucial for food processing, and the cost of packaging materials, can significantly elevate their cost of goods sold, directly affecting profitability.

The German frozen food market is intensely competitive, with supermarkets and discounters like Aldi and Lidl offering aggressive pricing. Eismann faces direct challenges from these established players, as well as the rapidly expanding online food delivery services that cater to consumer demand for convenience and speed.

In 2024, the German grocery market saw discounters continue to gain market share, putting pressure on traditional retailers and direct-to-consumer models like Eismann. Consumers increasingly value the ease of ordering prepared meals online, a trend that intensified post-pandemic, forcing Eismann to innovate its service and product offerings to remain competitive.

Economic Growth and Consumer Confidence

Germany's economic growth trajectory is a critical determinant for Eismann, as it directly impacts consumer confidence and spending power. A robust economy typically fosters higher consumer confidence, encouraging discretionary spending on products like Eismann's convenient frozen meals. Conversely, economic headwinds can lead to more cautious consumer behavior.

Consumer confidence in Germany showed a slight recovery in early 2024, but remained below historical averages. For instance, the GfK Consumer Sentiment Index for Germany indicated a modest increase in March 2024, reaching -29.7 points, up from -30.6 in February. This suggests that while sentiment is improving, consumers are still hesitant to spend freely.

The impact on Eismann is clear: a less optimistic economic outlook and lingering inflation concerns could prompt consumers to reduce spending on premium convenience foods.

- Economic Growth Outlook: Germany's GDP growth forecast for 2024 is projected to be around 0.2% to 0.3%, indicating a period of sluggish expansion.

- Consumer Confidence: The GfK Consumer Sentiment Index, while showing slight improvement, remained in deeply negative territory in early 2024, signaling ongoing consumer caution.

- Spending Habits: Consumers are likely to prioritize essential spending and may reduce outlays on non-essential or convenience-oriented food items if economic uncertainty persists.

- Inflationary Pressures: Persistent inflation, even if moderating, erodes purchasing power, making consumers more price-sensitive and potentially impacting demand for Eismann's offerings.

Employment and Wage Levels

Changes in employment rates and average wage levels in Germany directly impact Eismann's operational landscape. A robust job market, characterized by low unemployment and rising wages, typically translates to increased consumer disposable income. This can lead to higher spending on Eismann's convenient, high-quality frozen food products. For instance, Germany's unemployment rate was around 5.9% in early 2024, and nominal wage growth has shown positive trends, supporting consumer purchasing power.

Furthermore, the availability of labor and wage expectations are critical for Eismann's recruitment and retention of its independent sales representatives. A tight labor market might necessitate higher commission structures or incentives to attract and keep sales personnel. Conversely, a more abundant labor pool could ease these pressures. The ability to attract and retain skilled and motivated representatives is crucial for maintaining sales volume and customer reach.

- Germany's unemployment rate hovered near 5.9% in early 2024, indicating a relatively stable labor market.

- Nominal wage growth in Germany has been positive in recent periods, bolstering consumer spending potential.

- A strong employment environment generally supports demand for convenience-oriented food services like Eismann's.

- Wage levels directly influence Eismann's cost of sales representation and its ability to attract talent.

Germany's economic outlook for 2024 indicates sluggish growth, with GDP forecasts around 0.2% to 0.3%. This subdued economic environment, coupled with persistent inflation, continues to dampen consumer confidence, as seen in the GfK Consumer Sentiment Index remaining in negative territory in early 2024. Consequently, consumers are likely to prioritize essential spending, potentially reducing demand for premium convenience foods like Eismann's offerings, impacting sales volume.

| Economic Factor | 2024 Projection/Data | Impact on Eismann |

|---|---|---|

| GDP Growth | 0.2% - 0.3% | Limits consumer spending power and confidence. |

| Consumer Confidence (GfK Index) | -29.7 (March 2024) | Indicates consumer caution, favoring essential spending. |

| Inflation (Food Prices) | Elevated in early 2024 | Reduces disposable income, increases price sensitivity. |

| Unemployment Rate | ~5.9% (early 2024) | Supports consumer spending potential, but wage growth is key. |

| Fuel Prices (Brent Crude) | ~$80/barrel (early 2024 average) | Increases delivery costs, impacting operational margins. |

What You See Is What You Get

eismann PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Eismann PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this valuable strategic tool to inform your business decisions.

Sociological factors

Germany's demographic shift towards an older population is a significant factor influencing consumer behavior. By the end of 2023, the share of people aged 65 and over in Germany reached approximately 22.8% of the total population, a figure projected to grow. This demographic trend directly translates into an increased demand for convenient services, particularly home delivery and pre-prepared meals, as individuals may have reduced mobility or simply prefer the ease of ready-to-eat options.

Eismann's established direct-to-consumer (DTC) business model, which focuses on delivering frozen food directly to households, is inherently aligned with these evolving consumer needs. This strategic positioning allows Eismann to effectively tap into the growing market segment of seniors seeking convenience and accessibility in their food procurement, a trend that is expected to continue its upward trajectory through 2025.

Consumers are increasingly prioritizing health and wellness, driving demand for nutritious and ethically sourced food options. This includes a significant rise in interest for organic, plant-based, and clean-label products, reflecting a growing awareness of the connection between diet and overall well-being. For instance, the global plant-based food market was projected to reach over $74 billion by 2030, showcasing a substantial shift in consumer preferences.

Eismann's strategic expansion into organic and vegan product lines directly addresses these evolving consumer values. This move demonstrates a proactive approach to capitalize on the burgeoning market for healthier and more sustainable food choices, aligning their offerings with the health-conscious demographic that is actively seeking alternatives to traditional products.

Busy lifestyles and increasing urbanization are significantly boosting the demand for convenient, time-saving meal solutions. Consumers are actively seeking ready-to-eat or easy-to-prepare meals that fit into their packed schedules, a trend that Eismann's direct-to-consumer model is well-positioned to capitalize on.

The sustained shift towards at-home consumption, a pattern amplified by recent global events, continues to favor businesses like Eismann that specialize in home delivery. This enduring preference for dining in provides a robust foundation for Eismann's ready meal and ingredient delivery services, as evidenced by the continued growth in online grocery sales, which reached over $150 billion in the US alone in 2024.

Shift Towards Personalized Services and Customer Relationships

Consumers increasingly desire personalized experiences and value strong relationships with brands. This sociological shift means that companies focusing on direct interaction and tailored service are likely to resonate more deeply. Eismann’s direct selling model is well-positioned here, as its sales drivers act as personal consultants, fostering trust and understanding.

The emphasis on building customer relationships is a key differentiator in today's market. For instance, a 2024 survey indicated that over 60% of consumers are more likely to remain loyal to brands that offer personalized experiences. Eismann’s approach, where sales drivers know their customers’ preferences, directly taps into this preference for a more intimate and responsive service.

- Personalized Consultations: Eismann's sales drivers provide tailored advice, aligning with the consumer trend for bespoke services.

- Relationship Building: The direct selling model inherently fosters stronger, more personal connections between the company and its customers.

- Customer Loyalty: Studies in 2024 and early 2025 show a direct correlation between personalized service and increased customer retention rates.

- Tailored Experiences: Consumers are actively seeking out brands that understand and cater to their individual needs and preferences.

Sustainability Consciousness in Consumer Choices

Consumers are increasingly prioritizing environmental impact in their purchasing decisions, with a growing preference for eco-friendly products and sustainable business practices. This trend is particularly evident in the food sector, where transparency regarding sourcing and production methods is highly valued.

Eismann's established reputation for quality aligns well with this consumer shift. By further emphasizing and potentially adopting sustainable packaging solutions and optimizing delivery routes for reduced emissions, Eismann can significantly enhance its brand appeal. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay a premium for products with demonstrable sustainability credentials.

This focus on sustainability can directly translate into improved customer loyalty and attract new market segments. Eismann could leverage this by highlighting:

- Reduced carbon footprint in delivery logistics.

- Use of recyclable or compostable packaging materials.

- Ethical sourcing of ingredients and commitment to fair labor practices.

The aging German population, with over 22.8% aged 65+ by late 2023, drives demand for convenient food solutions like home delivery, a need Eismann's DTC model effectively meets. Simultaneously, a growing health consciousness fuels interest in organic and plant-based options, with the global plant-based market projected to exceed $74 billion by 2030, a trend Eismann is addressing with its expanded product lines.

Technological factors

Advancements in logistics and route optimization software are critical for Eismann's operational efficiency and cost management in its home delivery model. These technologies directly impact delivery times, fuel consumption, and driver productivity, key factors in maintaining profitability.

By integrating sophisticated algorithms, Eismann can dynamically adjust delivery routes in real-time, responding to traffic conditions and order volumes. This capability is essential for meeting customer expectations for timely deliveries. For instance, companies utilizing advanced route optimization have reported reductions in mileage by as much as 15-20% and significant improvements in on-time delivery rates, a benchmark Eismann aims to achieve.

The enhanced flexibility offered by these systems allows Eismann to offer more precise delivery windows and improve the overall customer experience, a key differentiator in the competitive frozen food delivery market. A smoother, more predictable delivery process can lead to higher customer satisfaction and retention rates, directly contributing to revenue growth.

The increasing penetration of online retail is a major technological factor for Eismann. In 2024, global e-commerce sales were projected to reach over $6.3 trillion, highlighting a significant shift in consumer purchasing habits. This trend necessitates Eismann's investment in robust digital platforms to capture a wider market share.

The rise of user-friendly mobile applications for food ordering presents another crucial technological avenue. By Q4 2024, mobile commerce accounted for nearly 60% of all e-commerce transactions in many developed markets. Enhancing Eismann's mobile app capabilities will directly translate to improved customer convenience and increased order volumes.

New freezing technologies like Individual Quick Freezing (IQF) and cryogenic freezing are revolutionizing food preservation. IQF, for instance, freezes products individually and rapidly, preserving texture and nutritional integrity far better than older blast freezing methods. This is crucial for a company like Eismann, which relies on delivering high-quality frozen goods.

Cryogenic freezing, using liquid nitrogen or carbon dioxide, offers even faster freezing times, resulting in smaller ice crystals and minimal damage to cell structures. This translates to superior product quality, especially for delicate items like berries or seafood. Eismann can capitalize on these advancements to enhance its product offerings and appeal to consumers increasingly focused on health and quality.

The global frozen food market is projected to reach $404.3 billion by 2027, growing at a CAGR of 4.5% from 2021, indicating a strong consumer demand for convenient, high-quality frozen products. Innovations in cold chain technology, including advanced freezing methods and improved insulation for transport and storage, are key drivers of this growth, allowing companies like Eismann to maintain product integrity from production to consumer.

Data Analytics and Customer Relationship Management (CRM)

Eismann leverages data analytics and CRM systems to deeply understand its customer base. By analyzing purchasing patterns and preferences, the company can tailor product recommendations and promotions, leading to more effective marketing campaigns. This data-driven approach allows for precise demand forecasting, optimizing inventory and reducing waste.

The integration of AI into CRM is a significant technological factor for Eismann. AI-powered personalization enables the company to offer highly targeted promotions and content, enhancing customer satisfaction and loyalty. For instance, in 2024, the online food delivery sector saw a significant increase in AI adoption for personalized customer experiences, with many platforms reporting improved conversion rates.

- Customer Behavior Analysis: Eismann uses data analytics to dissect consumer purchasing habits and preferences, informing product development and marketing strategies.

- Personalized Offers: CRM systems, enhanced by AI, allow for the creation of individualized promotions and recommendations, boosting customer engagement.

- Demand Prediction: Advanced analytics help Eismann anticipate customer demand more accurately, leading to better inventory management and operational efficiency.

- AI in Food Delivery: The food delivery market, in general, is increasingly adopting AI for personalized marketing, with early adopters seeing a notable uplift in customer retention rates by up to 15% in 2024.

Digital Marketing and Social Selling

Eismann's success hinges on its ability to effectively leverage digital marketing and social selling. These channels are crucial for attracting new customers and building a strong sales force. In 2024, the German e-commerce market saw significant growth, with online sales reaching an estimated €90 billion, underscoring the importance of a robust digital presence for companies like Eismann.

Personalized e-commerce experiences and direct engagement through social selling are increasingly shaping the German direct sales landscape. This approach allows Eismann to foster deeper connections with its customer base, driving loyalty and repeat business. By 2025, it's projected that social commerce sales in Germany will continue to climb, indicating a strong consumer preference for interactive and personalized online shopping journeys.

The strategic use of digital platforms enables Eismann to efficiently recruit new sales representatives, expanding its reach and operational capacity. Simultaneously, these digital tools are instrumental in nurturing customer relationships and fostering brand advocacy. For instance, targeted social media campaigns can significantly boost brand awareness and customer engagement, a trend that is expected to intensify in the coming years.

- Digital Reach: Eismann can tap into Germany's growing online population, which is projected to exceed 75 million users by 2025, to expand its customer base.

- Social Selling Impact: The German social commerce market is anticipated to grow by over 15% annually through 2025, presenting a substantial opportunity for Eismann's sales representatives.

- Recruitment Advantage: Digital channels offer a cost-effective and efficient way for Eismann to reach potential sales representatives, with online job boards and social media platforms playing a key role.

- Customer Loyalty: Personalized e-commerce and direct engagement via social media are vital for retaining customers, as studies show that personalized experiences increase customer retention rates by up to 20%.

Technological advancements are reshaping Eismann's operational landscape, particularly in logistics and customer engagement. The company benefits from sophisticated route optimization software, which in 2024, helped companies reduce mileage by up to 20% and improve delivery times. Furthermore, the increasing reliance on mobile commerce, accounting for nearly 60% of e-commerce transactions by late 2024, necessitates a strong mobile app presence for Eismann.

Innovations in freezing technologies, such as Individual Quick Freezing (IQF), are crucial for maintaining the quality of Eismann's frozen products. The global frozen food market's projected growth to $404.3 billion by 2027, driven by these advancements, highlights the opportunities for Eismann. Data analytics and AI integration in CRM systems are also key, enabling personalized customer experiences and accurate demand forecasting, with early AI adopters in food delivery seeing up to a 15% increase in customer retention in 2024.

Eismann's digital marketing and social selling strategies are vital for growth, especially in the German market where online sales reached an estimated €90 billion in 2024. The projected 15% annual growth in German social commerce through 2025 offers significant potential for Eismann's sales representatives. Leveraging digital channels also aids in efficient recruitment and customer loyalty, as personalized experiences can boost retention by up to 20%.

Legal factors

Eismann must adhere to stringent EU and German food labeling regulations, which mandate detailed nutritional information and clear allergen declarations on all products. For instance, the EU's Food Information to Consumers (FIC) Regulation (EU) No 1169/2011 dictates these requirements, impacting Eismann's product packaging and online descriptions to ensure consumer safety and transparency.

Staying ahead of evolving regulations, such as those concerning novel foods or updated allergen listing requirements, is critical for Eismann's compliance. Failure to adapt to changes, like the recent EU guidance on the labeling of allergenic ingredients in pre-packed foods, could lead to penalties and damage brand reputation.

Eismann's direct-to-consumer model thrives on customer data, making compliance with regulations like GDPR paramount. In 2024, data breaches cost companies an average of $4.45 million globally, highlighting the financial risks of non-compliance. Protecting personal information is not just a legal obligation but a cornerstone of building and maintaining customer trust, which is vital for Eismann's ongoing success.

German labor laws maintain a strict distinction between employees and independent contractors, with significant penalties for misclassification. Eismann must meticulously ensure its agreements and operational practices with sales representatives align with these stringent regulations to prevent substantial legal and financial repercussions.

Failure to comply could result in back payments of social security contributions, taxes, and potential fines. For instance, in 2023, German labor courts continued to scrutinize contractor relationships, with several high-profile cases highlighting the risks of incorrect classification, impacting companies across various sectors.

Consumer Rights in Distance Selling and Product Returns

In the European Union, the Consumer Rights Directive (2011/83/EU) significantly shapes distance selling, including for food. For Eismann, this means consumers generally have a 14-day cooling-off period to cancel orders placed online or by phone, though exceptions exist for perishable goods like fresh food. This requires clear communication about return policies and potential limitations, especially concerning the condition of returned items.

Navigating these regulations is crucial for Eismann to avoid penalties and maintain customer trust. For instance, in 2024, the European Commission continued to emphasize enforcement of consumer protection laws, with fines for non-compliance potentially reaching up to 4% of annual turnover in member states. Eismann must ensure its terms and conditions clearly outline consumer rights regarding cancellations and returns for its frozen food products, balancing consumer protection with the practicalities of food logistics.

- Right to Cancel: Consumers typically have 14 days from receiving goods to cancel a distance contract.

- Perishable Goods Exception: For food and other perishable items, the right to cancel may be restricted if the goods are likely to deteriorate or expire rapidly.

- Information Requirements: Sellers must provide clear information about cancellation rights, return procedures, and any exceptions.

- Compliance Costs: Businesses like Eismann incur costs in adapting systems and training staff to meet these legal obligations.

Packaging and Packaging Waste Regulations

New European Union regulations, particularly the Packaging and Packaging Waste Regulation (PPWR) which began its phased implementation from 2024, are setting stringent mandates for minimum recyclability thresholds and ambitious targets for overall packaging waste reduction. Eismann, like all businesses operating within the EU, must proactively adapt its packaging strategies to align with these evolving environmental legal requirements.

These regulations aim to foster a more circular economy by increasing the reuse and recyclability of packaging materials. For instance, the PPWR introduces specific design-for-recycling requirements and aims to harmonize packaging waste management across member states, potentially impacting Eismann's supply chain and material sourcing decisions.

- EU PPWR Implementation: Phased rollout from 2024, impacting packaging design and waste management.

- Recyclability Targets: Mandated minimum recyclability rates for various packaging types.

- Waste Reduction Goals: Ambitious objectives to decrease the overall volume of packaging waste generated.

- Eismann's Adaptation: Necessity to revise packaging materials and processes to comply with new legal standards.

Eismann must navigate a complex web of consumer protection laws across its operating markets, particularly concerning online sales and product safety. In 2024, the EU continued to strengthen consumer rights, with potential fines for non-compliance reaching up to 4% of annual turnover. This necessitates clear communication on return policies, especially for perishable goods, and robust data privacy measures under GDPR, where breaches in 2024 averaged $4.45 million globally.

Environmental factors

Growing environmental awareness and upcoming EU regulations are significantly boosting the demand for sustainable and recyclable packaging within the frozen food sector. Eismann is feeling the pressure to cut down on plastic waste and transition to more eco-friendly packaging materials.

Eismann's large delivery fleet has a notable environmental impact due to emissions and fuel consumption. For instance, in 2023, the average CO2 emissions for delivery vehicles in Germany were around 130 g/km, a figure Eismann aims to reduce.

Increasing regulatory pressure and consumer demand for sustainability are pushing companies like Eismann to invest in greener logistics. This could involve adopting electric vehicles, with the German government setting a target of 15 million electric cars by 2030, or implementing advanced route optimization software to minimize mileage and fuel usage.

Furthermore, Eismann might explore carbon offsetting programs to mitigate the environmental cost of its operations. The voluntary carbon market saw significant growth in 2024, indicating a trend towards businesses actively compensating for their unavoidable emissions.

The frozen food industry, including companies like Eismann, plays a significant role in combating food waste by offering products with extended shelf lives. This inherent characteristic means less spoilage compared to fresh alternatives. For instance, in 2024, the EU reported that around 131 million tonnes of food were wasted annually, with households being major contributors, highlighting the need for solutions that prolong food usability.

Eismann can leverage its frozen product offerings to educate consumers on waste reduction. By emphasizing the long-term storage capabilities of frozen goods, the company can position itself as a partner in sustainable consumption. Implementing robust waste minimization practices across Eismann's entire supply chain, from sourcing to delivery, further reinforces this commitment and appeals to environmentally conscious consumers who are increasingly seeking such benefits.

Ethical Sourcing and Supply Chain Transparency

Consumers are increasingly scrutinizing where their food comes from, pushing companies like Eismann to prioritize ethical sourcing. This trend significantly influences ingredient procurement, especially for core products like meat, fish, and vegetables.

Eismann's brand reputation is directly tied to its ability to demonstrate responsible practices throughout its supply chain. A failure to ensure ethical treatment of animals or sustainable farming methods can lead to significant backlash. For instance, a 2024 survey indicated that 72% of European consumers are willing to pay a premium for food products with verified ethical sourcing claims.

- Growing Consumer Demand: Reports from 2024 show a significant uplift in consumer preference for ethically produced food.

- Supply Chain Scrutiny: Transparency in sourcing, particularly for animal products, is becoming a non-negotiable for many shoppers.

- Brand Reputation Impact: Negative publicity surrounding unethical sourcing practices can rapidly damage brand trust and sales.

- Supplier Accountability: Eismann faces pressure to ensure its suppliers adhere to stringent ethical and environmental standards.

Climate Change Impact on Raw Material Supply

Climate change poses a significant threat to Eismann's raw material supply, particularly for its frozen food products. Fluctuations in weather patterns directly impact agricultural yields, affecting the availability and quality of ingredients like fruits, vegetables, and grains. For instance, extreme weather events, such as prolonged droughts or unseasonal frosts, can decimate crop harvests, leading to shortages and price volatility for key inputs in 2024 and projected into 2025.

Eismann could encounter substantial challenges in maintaining supply chain stability and predictable pricing. Disruptions in major agricultural regions due to climate change can create ripple effects throughout the supply network. Consider the impact on potato yields, a staple for many frozen food items; a 2024 report indicated that certain European growing seasons experienced a 15% reduction in yield due to heatwaves, directly affecting the cost of frozen fries.

- Agricultural Yield Volatility: Climate change-induced weather extremes can cause unpredictable swings in crop output, impacting the consistent availability of Eismann's primary ingredients.

- Supply Chain Disruptions: Extreme weather events in key sourcing regions can lead to transportation delays and increased logistical costs, affecting the timely delivery of raw materials.

- Price Instability: Reduced supply and increased production costs due to climate impacts will likely translate to higher raw material prices for Eismann, potentially affecting profit margins and consumer pricing.

- Resource Scarcity: Long-term climate shifts may lead to the scarcity of certain raw materials, forcing Eismann to seek alternative, potentially more expensive or less suitable, ingredients.

Environmental regulations are increasingly shaping the frozen food industry, pushing companies like Eismann towards sustainable packaging solutions. The push for reduced plastic waste is a significant driver, with many European countries implementing stricter rules on single-use plastics. Eismann's fleet operations are also under scrutiny, with a focus on lowering CO2 emissions, a critical factor given the average CO2 emissions for delivery vehicles in Germany were around 130 g/km in 2023. The company is exploring greener logistics, including electric vehicles, aligning with Germany's goal of 15 million electric cars by 2030, and considering carbon offsetting programs, a market that saw substantial growth in 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis draws on a comprehensive blend of data from reputable sources, including government publications, international organizations, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and societal trends to provide a robust overview.