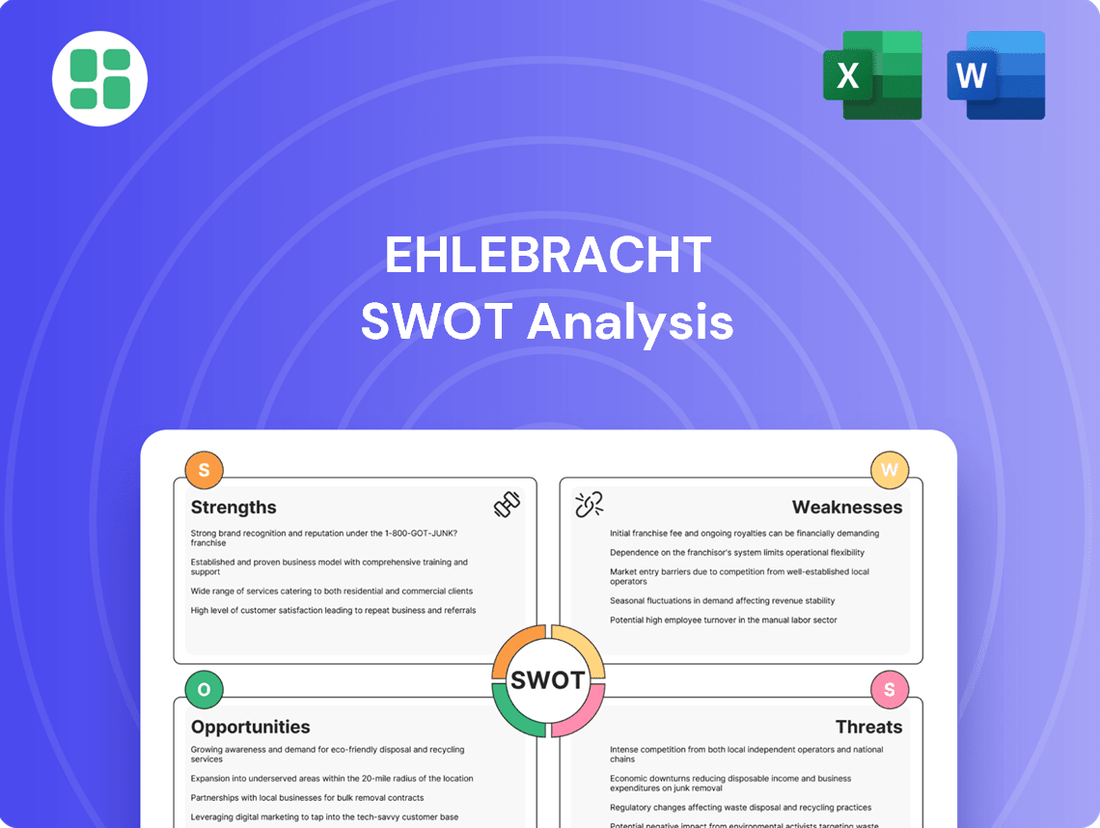

Ehlebracht SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ehlebracht Bundle

Curious about Ehlebracht's competitive edge and potential challenges? Our comprehensive SWOT analysis dives deep into their market standing, revealing key strengths, opportunities, weaknesses, and threats.

Want to understand the full strategic landscape Ehlebracht navigates? Purchase the complete SWOT analysis for actionable insights, expert commentary, and an editable format perfect for planning and presentations.

Strengths

Ehlebracht AG truly stands out as a comprehensive solution provider in the industrial marking, coding, and labeling sector. Their offering isn't just about printers; it's a complete ecosystem including specialized software and all the necessary consumables like inks and labels. This integrated approach simplifies things immensely for their clients.

By offering this all-in-one package, Ehlebracht AG is well-positioned to capture a significant share of the market. For instance, the global industrial printing market was valued at approximately USD 45 billion in 2023 and is projected to grow steadily. Ehlebracht's ability to supply both the hardware and the recurring consumable needs creates a strong foundation for sustained customer relationships and predictable revenue streams.

Ehlebracht's specialization in product identification, traceability, and anti-counterfeiting is a significant strength. This focus directly addresses growing industry needs driven by stringent regulations and complex global supply chains. For example, the pharmaceutical industry alone faces billions in losses annually due to counterfeit drugs, making robust traceability solutions essential.

Ehlebracht's dedication to optimizing production processes through advanced marking solutions is a significant strength. This focus directly translates into increased client efficiency and reduced operational downtime, a critical factor in today's manufacturing landscape. For example, in 2024, manufacturers across various sectors reported an average reduction in production line stoppages by up to 15% after implementing advanced marking and identification systems, directly impacting their bottom line.

Diverse Technology Offerings

Ehlebracht's diverse technology portfolio, encompassing inkjet printers, laser markers, and label applicators, allows them to address a broad spectrum of material compatibility, production line speeds, and specific application demands. This breadth of solutions enables the company to effectively serve a wider customer base, providing customized answers that align with unique industry needs and substrate characteristics.

This adaptability is a key differentiator in the competitive marking and coding landscape. For instance, in 2024, the industrial marking equipment market saw continued growth, with demand for versatile solutions increasing as manufacturers sought to optimize production lines. Ehlebracht's ability to offer multiple technologies positions them favorably to capture market share by meeting these varied requirements.

- Inkjet Printers: Versatile for various surfaces and high-speed lines.

- Laser Markers: Ideal for permanent, high-resolution marking on durable materials.

- Label Applicators: Efficient for pre-printed label application, enhancing brand visibility.

Ability to Serve Various Industries

Ehlebracht's industrial marking and coding solutions are applicable across a wide array of sectors, including the robust food and beverage, critical pharmaceuticals, and high-tech electronics and automotive industries. This broad market reach is a significant strength, as it mitigates the risk associated with economic downturns in any single sector. The ongoing and universal requirement for product identification guarantees a consistently substantial addressable market for these essential services.

The company's ability to cater to diverse industries translates into a more stable revenue stream, less susceptible to sector-specific volatility. For instance, the global industrial coding market was valued at approximately USD 5.5 billion in 2023 and is projected to grow, demonstrating the consistent demand across various manufacturing segments.

- Diverse Industry Application: Ehlebracht's solutions are relevant in food & beverage, pharmaceuticals, electronics, and automotive sectors.

- Reduced Sectoral Dependence: Diversification across industries minimizes exposure to the economic performance of any single market.

- Stable Revenue Potential: The universal need for product identification ensures consistent demand and revenue stability.

- Market Resilience: Serving multiple industries enhances the company's overall resilience against market fluctuations.

Ehlebracht AG's comprehensive offering, encompassing industrial marking, coding, and labeling hardware, software, and consumables, simplifies operations for clients. This integrated approach fosters strong customer relationships and predictable revenue, crucial in a market valued at approximately USD 45 billion in 2023 and projected for steady growth.

Their specialization in product identification, traceability, and anti-counterfeiting directly addresses critical industry needs, especially given that the pharmaceutical industry alone loses billions annually to counterfeit products, highlighting the demand for robust traceability solutions.

Ehlebracht's diverse technology portfolio, including inkjet printers, laser markers, and label applicators, ensures they can meet a wide range of customer requirements and material compatibilities, a significant advantage in the growing industrial marking equipment market of 2024.

The company's broad applicability across sectors like food and beverage, pharmaceuticals, electronics, and automotive provides market resilience, as the universal need for product identification ensures consistent demand, contributing to a stable revenue stream.

What is included in the product

Provides a strategic overview of Ehlebracht's internal strengths and weaknesses, alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

The significant upfront cost of advanced hardware, like industrial inkjet printers and laser markers, presents a notable weakness for Ehlebracht’s customers. For instance, a high-end industrial inkjet printer can range from $20,000 to over $100,000, a substantial barrier for many small to medium-sized enterprises (SMEs). This capital expenditure can deter potential clients with tighter budgets, limiting Ehlebracht's addressable market.

This high initial investment can also make Ehlebracht’s solutions less competitive compared to offerings from rivals who provide more accessible financing options or lower-cost alternatives. Businesses operating with lean capital may opt for less sophisticated but more affordable equipment, impacting Ehlebracht's market penetration.

Ehlebracht's reliance on consumables like inks and labels for recurring revenue, while beneficial, presents a significant weakness. This segment is intensely competitive, making it susceptible to price wars and eroding profit margins. For instance, in 2024, the global printing consumables market faced upward pressure on raw material costs for inks, impacting profitability for many players.

The company's profitability is directly tied to the cost of raw materials for these consumables, which can be volatile. Fluctuations in the price of pigments, solvents, or even the paper for labels can significantly impact Ehlebracht's bottom line. This vulnerability was highlighted in early 2025 when supply chain disruptions led to a temporary spike in key chemical precursor prices for ink production.

Maintaining a consistent and reliable supply chain for these essential consumables is paramount. Any disruption, whether due to geopolitical events or logistical challenges, could directly affect Ehlebracht's ability to meet customer demand and generate its recurring revenue. The industry experienced such challenges in late 2024 with port congestion affecting chemical imports.

Operating and maintaining Ehlebracht's complex industrial marking and coding systems demands specialized technical expertise, posing a significant hurdle for many clients in acquiring and retaining such skilled personnel. This dependency on specialized labor for installation, troubleshooting, and upkeep can escalate the overall cost of ownership for customers.

This reliance on skilled labor might diminish Ehlebracht's competitive edge, especially if simpler, more automated alternatives gain traction in the market. For instance, as of early 2025, the average cost for specialized industrial technicians in key manufacturing regions has seen an estimated increase of 8-12% compared to 2023, further amplifying this concern for potential clients.

Risk of Rapid Technological Obsolescence

The industrial marking and coding sector is rapidly evolving, driven by innovations like AI and advanced laser technologies. Ehlebracht must continually invest in research and development to prevent its hardware and software from becoming obsolete. For instance, the global industrial automation market, which heavily influences this sector, was projected to reach $320.9 billion in 2024, highlighting the pace of change and the need for adaptation.

Failure to keep pace with these technological shifts poses a significant risk. Companies that don't innovate risk losing market share to competitors offering more advanced solutions. This necessitates substantial and ongoing capital allocation towards R&D to maintain a competitive edge in a dynamic market.

- Technological Advancements: AI, machine learning, and new laser technologies are transforming the industry.

- Obsolescence Risk: Existing Ehlebracht solutions may quickly become outdated.

- R&D Investment: Continuous and significant investment is required to stay current.

- Competitive Landscape: Competitors are also investing heavily in new technologies.

Market Fragmentation and Intense Competition

The coding and marking sector is incredibly fragmented, featuring a multitude of global and local companies all vying for market share with comparable products. Ehlebracht faces stiff competition from both large, well-established corporations and smaller, specialized firms, which naturally drives down prices and squeezes profit margins. For instance, the global industrial coding and marking market was valued at approximately $5.2 billion in 2023 and is projected to grow, highlighting the crowded landscape Ehlebracht operates within.

This intense competition means Ehlebracht must constantly innovate to stand out and keep its customers loyal. Maintaining a strong market position isn't just about having good products; it's also about building robust relationships with clients. The pressure to differentiate is significant, as many competitors offer similar technological solutions, making customer service and unique value propositions crucial for success.

- Market Fragmentation: The coding and marking industry is characterized by a large number of players, both big and small, offering similar solutions.

- Intense Competition: Ehlebracht contends with major industry players and niche specialists, leading to aggressive pricing strategies and reduced profitability.

- Differentiation Challenge: Continuous innovation and strong customer relationship management are essential for Ehlebracht to distinguish its offerings and retain market share in this crowded environment.

Ehlebracht's reliance on consumables like inks and labels for recurring revenue creates a vulnerability. This market segment is highly competitive, leading to potential price wars and squeezed profit margins. For example, in 2024, rising raw material costs for inks put pressure on profitability across the industry.

The company's profitability is directly linked to the volatile costs of these raw materials. Fluctuations in pigment or solvent prices can significantly impact Ehlebracht's bottom line, as seen in early 2025 when supply chain issues caused temporary spikes in key chemical precursor prices.

Maintaining a consistent and reliable supply chain for these consumables is critical. Disruptions, whether geopolitical or logistical, can directly affect Ehlebracht's ability to meet demand and generate recurring revenue, a challenge faced by the industry in late 2024 due to port congestion affecting chemical imports.

The need for specialized technical expertise to operate and maintain Ehlebracht's complex systems presents a significant hurdle for many clients. This dependency on skilled labor for installation, troubleshooting, and upkeep can increase the overall cost of ownership, potentially diminishing Ehlebracht's competitive edge as simpler alternatives emerge.

The industrial marking and coding sector is rapidly evolving, with AI and advanced laser technologies driving innovation. Ehlebracht faces the risk of its hardware and software becoming obsolete if it doesn't invest sufficiently in R&D. The global industrial automation market, projected to reach $320.9 billion in 2024, underscores the pace of technological change and the necessity for adaptation.

The coding and marking sector is highly fragmented, with numerous global and local competitors offering comparable products. This intense competition, with the global market valued around $5.2 billion in 2023, drives down prices and compresses profit margins, requiring Ehlebracht to constantly innovate and focus on customer relationships to differentiate itself.

Full Version Awaits

Ehlebracht SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Ehlebracht SWOT analysis, ensuring transparency and quality. Once purchased, you'll gain access to the complete, detailed report.

Opportunities

Global regulatory bodies are intensifying demands for product traceability, especially within the pharmaceutical and food industries. This trend, accelerating through 2024 and into 2025, necessitates sophisticated coding and marking technologies to ensure compliance and prevent counterfeiting.

Ehlebracht is well-positioned to capitalize on this, as companies worldwide are actively seeking solutions to meet these stringent requirements, with non-compliance potentially leading to significant financial penalties and loss of market access.

The surge in e-commerce, projected to reach $11.1 trillion globally by 2025 according to Statista, coupled with intricate international supply chains, creates a significant demand for advanced product identification and tracking. This environment requires marking solutions that are not only fast but also adaptable to printing diverse information and guaranteeing product integrity from origin to consumer.

Ehlebracht is well-positioned to address this market need by offering high-speed, versatile marking technologies that support variable data printing and bolster brand protection strategies within these complex logistical networks. The company can leverage this opportunity to provide solutions that enhance supply chain visibility and combat counterfeiting.

Ehlebracht can capitalize on the Industry 4.0 trend by embedding its marking and coding solutions into smart factory architectures. This allows for seamless data flow, predictive maintenance insights for its equipment, and streamlined production processes, making its offerings more valuable to manufacturers embracing automation.

By aligning with Industry 4.0, Ehlebracht can develop more sophisticated, data-driven marking systems. For instance, integrating IoT sensors with its printers could provide real-time quality control data, a significant advantage as the global smart manufacturing market is projected to reach $763.7 billion by 2030, growing at a CAGR of 12.5% according to some analyses.

Rising Demand for Anti-Counterfeiting Solutions

The increasing global issue of product counterfeiting, impacting everything from high-end fashion to vital medicines, is a significant driver for advanced anti-counterfeiting technologies. This trend directly benefits companies like Ehlebracht that offer robust brand protection solutions.

Ehlebracht's proficiency in secure marking, featuring unique identifiers and tamper-proof seals, is perfectly aligned with this growing market demand. The company is well-positioned to capitalize on the increasing need for reliable product authentication.

- Market Growth: The global anti-counterfeit packaging market was valued at approximately $26.7 billion in 2023 and is anticipated to expand significantly, with projections suggesting a compound annual growth rate (CAGR) of around 6.5% through 2030.

- Industry Impact: Counterfeiting costs global businesses billions annually, creating a strong incentive for brands to invest in protective measures.

- Ehlebracht's Role: Ehlebracht's secure marking technologies, including specialized inks and track-and-trace capabilities, directly address these brand protection needs.

Trend Towards Sustainable and Eco-Friendly Solutions

The increasing global focus on environmental responsibility presents a significant opportunity for Ehlebracht. Consumer and industry demand for sustainable manufacturing, particularly in printing with eco-friendly solutions and recyclable materials, is on the rise. For instance, the global market for sustainable packaging, a key area for printing, was valued at approximately $277.4 billion in 2023 and is projected to reach $458.7 billion by 2030, growing at a CAGR of 7.5%.

Ehlebracht can leverage this trend by innovating with energy-efficient printing systems, developing biodegradable inks, and offering solutions that support circular economy principles. This strategic alignment with global environmental concerns and evolving regulatory landscapes, such as the EU's Green Deal, can serve as a powerful competitive differentiator. It also opens doors to new market segments actively seeking environmentally conscious partners.

- Growing Market Demand: The sustainable packaging market is projected to exceed $458 billion by 2030, indicating strong customer preference.

- Innovation Potential: Opportunities exist in developing energy-efficient printing, biodegradable inks, and circular economy solutions.

- Competitive Advantage: Adopting sustainable practices can differentiate Ehlebracht from competitors and attract environmentally aware clients.

- Regulatory Alignment: Meeting environmental regulations, like those in the EU, can prevent future compliance issues and enhance brand reputation.

Ehlebracht can capitalize on the increasing global demand for product traceability and regulatory compliance, particularly in sectors like pharmaceuticals and food. The company's advanced marking and coding solutions are essential for businesses needing to meet stringent track-and-trace requirements, which are becoming more critical through 2024 and 2025. This positions Ehlebracht to offer vital tools for brand protection and supply chain integrity.

The expansion of e-commerce and complex global supply chains presents a significant opportunity for Ehlebracht's high-speed, versatile marking technologies. These systems are crucial for printing variable data and ensuring product authenticity from production to the end consumer, a need amplified by the projected $11.1 trillion global e-commerce market by 2025. Ehlebracht's ability to enhance supply chain visibility and combat counterfeiting aligns perfectly with these market dynamics.

The pervasive issue of product counterfeiting, which costs global businesses billions annually, creates a robust market for Ehlebracht's secure marking and anti-counterfeiting solutions. With the global anti-counterfeit packaging market valued at approximately $26.7 billion in 2023 and expected to grow, Ehlebracht's specialized inks and track-and-trace capabilities are in high demand for brand protection.

Ehlebracht has a prime opportunity to align with the growing emphasis on environmental responsibility by offering sustainable printing solutions. As the sustainable packaging market is projected to reach $458.7 billion by 2030, the company can innovate with energy-efficient systems and biodegradable inks, differentiating itself and attracting environmentally conscious clients while adhering to regulations like the EU's Green Deal.

Threats

The industrial marking and coding sector is a crowded space, with established giants like Videojet and Markem-Imaje, alongside regional specialists, vying for market dominance. This fierce competition often sparks price wars, directly impacting profitability and making it difficult for companies like Ehlebracht to protect their existing market share.

To navigate this challenging landscape, Ehlebracht must prioritize continuous product innovation and cultivate strong points of differentiation. For instance, in 2023, the global marking and coding market was valued at approximately $6.5 billion, with growth projected to reach over $9 billion by 2028, underscoring the significant revenue potential but also the intensity of the competitive drive.

Global economic slowdowns pose a significant threat to Ehlebracht. For instance, the International Monetary Fund (IMF) projected a global growth slowdown to 2.9% in 2024, down from 3.5% in 2023, indicating a weaker demand environment for industrial capital goods. This contraction directly impacts Ehlebracht's reliance on manufacturing and industrial investment.

A downturn in key industrial sectors, such as automotive or electronics manufacturing, could lead to reduced capital expenditure on marking and coding equipment. For example, if major automotive manufacturers scale back production or delay new factory openings due to economic uncertainty, Ehlebracht's sales pipeline for new installations and upgrades would shrink considerably.

Ehlebracht's revenue is intrinsically linked to the health of the industrial sector. A contraction in manufacturing output, as seen in potential recessions, directly translates to fewer opportunities for Ehlebracht to secure new projects and sell its specialized equipment. This cyclical vulnerability is a critical external risk factor that needs careful management.

Competitors' rapid adoption of disruptive technologies, such as advanced AI-driven marketing platforms or next-generation printing solutions, could quickly erode Ehlebracht's market share. For example, a rival launching a 3D printing service with significantly lower material costs could pose a direct threat to traditional print providers.

The challenge lies in Ehlebracht's ability to match or exceed competitors' innovation cycles, particularly in areas like digital integration and sustainable material science. Failure to invest in and implement these advancements could lead to a competitive disadvantage, impacting revenue streams.

Supply Chain Disruptions for Components and Consumables

Ehlebracht's reliance on a consistent flow of components for its hardware and raw materials for consumables, such as inks and labels, presents a significant threat. Global events, from geopolitical tensions to natural disasters, can easily disrupt these supply chains. For instance, the ongoing semiconductor shortage, which began in late 2020 and continued through 2024, significantly impacted manufacturing across various sectors, leading to extended lead times and price hikes for essential electronic components. This vulnerability directly translates to increased operational costs and production delays for Ehlebracht.

These disruptions can severely hinder Ehlebracht's ability to meet customer demand, potentially damaging its reputation and market share. The International Monetary Fund (IMF) has repeatedly warned about the persistent risks to global supply chains in its 2024 reports, highlighting the potential for further volatility. This inability to fulfill orders promptly impacts profitability through lost sales and can erode customer loyalty.

- Component Shortages: Continued global shortages of key electronic components, exacerbated by geopolitical factors, could lead to significant production delays and increased sourcing costs for Ehlebracht's hardware.

- Raw Material Price Volatility: Fluctuations in the prices of raw materials for consumables, driven by energy costs and global demand, could squeeze profit margins if not effectively managed.

- Logistics Bottlenecks: Port congestion and increased shipping costs, as observed in late 2023 and early 2024, can delay deliveries of both incoming components and outgoing finished goods, impacting customer satisfaction.

Stricter Environmental Regulations on Inks and Consumables

While the push for sustainability is a significant opportunity, Ehlebracht must also navigate the potential threat of increasingly stringent environmental regulations concerning the chemical composition and disposal of industrial inks and labeling materials. These evolving standards, driven by global environmental concerns, could necessitate substantial investments in research and development to create compliant ink formulations and potentially alter manufacturing processes.

Failure to adapt proactively to these stricter regulations could lead to increased operational costs and complexities. For instance, the European Chemicals Agency (ECHA) continues to review and update regulations under REACH, impacting the use of certain chemicals in inks and coatings. Companies may face higher expenses for raw materials that meet new environmental criteria or for upgrading production lines to handle alternative, more eco-friendly consumables. By 2025, it's anticipated that regulatory bodies worldwide will further tighten restrictions on volatile organic compounds (VOCs) and other hazardous substances commonly found in traditional printing inks.

- Regulatory Compliance Costs: Increased R&D spending for new ink formulations and potential capital expenditure for manufacturing process modifications.

- Supply Chain Adjustments: Sourcing new, compliant raw materials might involve higher prices or limited availability, impacting cost of goods sold.

- Market Access Risks: Non-compliance with evolving environmental standards in key markets could restrict product sales and market penetration.

Intense competition in the marking and coding sector, with giants like Videojet and Markem-Imaje, leads to price wars, impacting Ehlebracht's profitability and market share. The global market, valued at approximately $6.5 billion in 2023 and projected to reach over $9 billion by 2028, highlights both opportunity and intense rivalry.

Global economic slowdowns, like the IMF's projected 2.9% growth for 2024, reduce demand for industrial capital goods, directly affecting Ehlebracht's reliance on manufacturing investment. Downturns in key sectors such as automotive or electronics manufacturing can shrink Ehlebracht's sales pipeline for new installations and upgrades.

Supply chain disruptions, exemplified by the ongoing semiconductor shortage impacting production through 2024, increase operational costs and production delays for Ehlebracht. Evolving environmental regulations, such as stricter limits on VOCs by 2025, necessitate R&D investment and potential manufacturing process changes, increasing compliance costs.

| Threat Category | Specific Risk | Impact on Ehlebracht | 2024/2025 Data/Projection |

|---|---|---|---|

| Competition | Price Wars | Reduced Profit Margins, Market Share Erosion | Global marking & coding market valued at ~$6.5B in 2023, growing to ~$9B by 2028. |

| Economic Factors | Global Slowdown | Decreased Demand for Capital Goods | IMF projected global growth of 2.9% in 2024. |

| Supply Chain | Component Shortages | Production Delays, Increased Costs | Semiconductor shortage continued impact through 2024. |

| Regulatory | Environmental Standards | R&D Costs, Manufacturing Adjustments | Stricter VOC limits anticipated by 2025. |

SWOT Analysis Data Sources

This Ehlebracht SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations, ensuring a thorough and accurate strategic assessment.