Ehlebracht Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ehlebracht Bundle

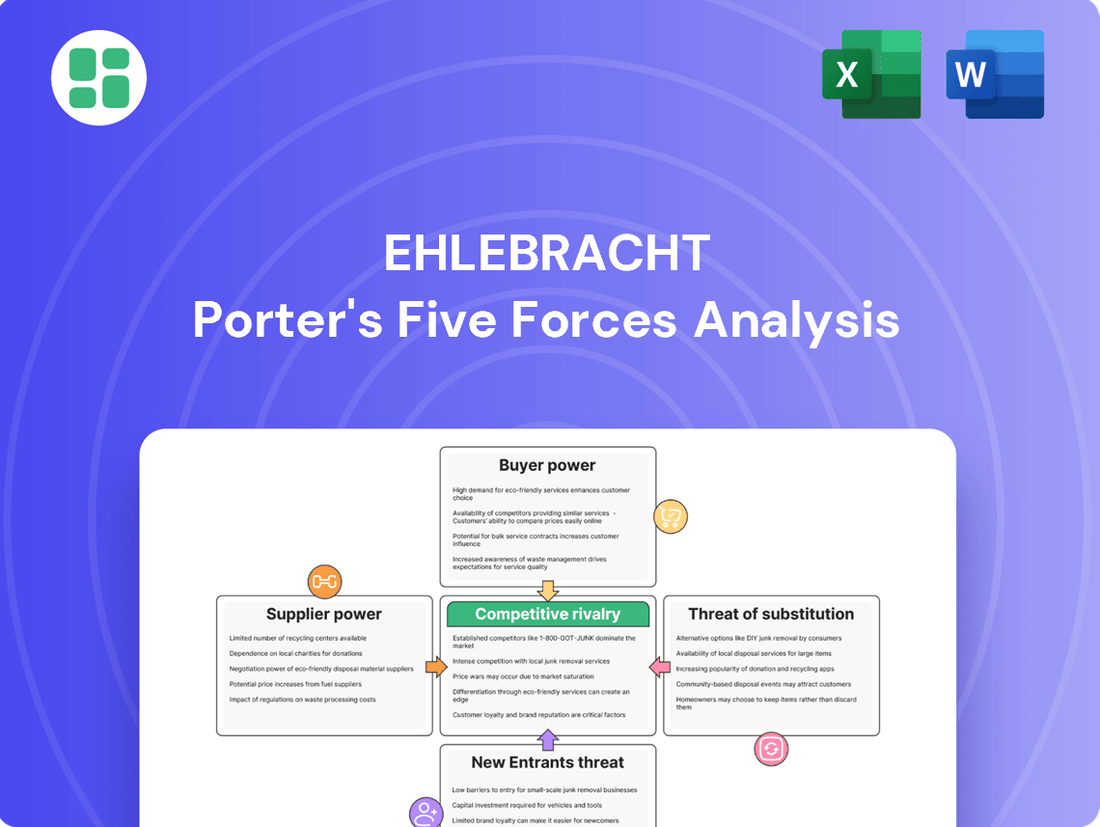

Ehlebracht's Porter's Five Forces Analysis reveals the intricate web of competitive forces shaping its market landscape. Understanding the power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry is crucial for strategic positioning. This brief overview only scratches the surface of the deep-dive insights available.

Unlock the full Porter's Five Forces Analysis to explore Ehlebracht’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Ehlebracht's reliance on specialized components such as print heads, laser modules, and unique ink formulations places significant power in the hands of its suppliers. When these suppliers are few in number and possess highly differentiated or patented technologies, their leverage increases substantially, directly impacting Ehlebracht's input costs.

The industrial inkjet printer market, a key sector for Ehlebracht, is experiencing rapid technological evolution, particularly in printhead capabilities and ink composition. This dynamic suggests that suppliers at the forefront of these innovations, offering proprietary solutions, are likely to command considerable bargaining power, potentially driving up the price of essential materials for Ehlebracht.

Switching suppliers for critical hardware or proprietary consumables presents substantial challenges for Ehlebracht. The potential costs associated with redesigning integrated systems, re-tooling production lines, rigorous testing, and retraining personnel can be considerable, directly impacting operational efficiency and budget.

These high switching costs effectively bolster the bargaining power of Ehlebracht's current suppliers. The significant disruption and financial outlay required to transition to a new vendor make Ehlebracht more reliant on existing relationships, granting suppliers leverage in price negotiations and contract terms.

The deep integration of marking systems within Ehlebracht's complex manufacturing processes means that even seemingly minor alterations to components can trigger cascading effects. This intricate interdependence amplifies the impact of supplier changes, further solidifying the supplier's advantageous position.

The ease with which Ehlebracht can find alternative sources for its inputs significantly shapes supplier power. If the company relies on readily available, generic items like standard paper stock or common office supplies, suppliers have less leverage. For instance, in 2024, the market for basic office consumables remained highly competitive, with numerous suppliers offering similar products, keeping prices in check for buyers like Ehlebracht.

Conversely, when Ehlebracht requires specialized components, such as custom-formulated adhesives or unique microchip designs, the availability of substitutes diminishes. This scarcity strengthens the bargaining position of those few suppliers capable of meeting these specific needs. In sectors demanding high-purity chemicals or advanced materials, supplier power can be substantial, as demonstrated by the limited number of certified producers in the semiconductor supply chain, which often leads to longer lead times and higher costs for manufacturers in 2024.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward is a significant consideration for Ehlebracht. If suppliers, particularly those providing specialized components or technologies, were to develop their own marking and coding systems, they would directly enter Ehlebracht's market. This scenario is more probable for large chemical companies with advanced R&D, especially if the market for integrated marking solutions proves exceptionally lucrative.

This potential for forward integration is amplified when suppliers possess robust research and development capabilities and established market access. For instance, a major ink manufacturer with a strong distribution network could potentially leverage its expertise to offer end-to-end marking solutions, bypassing intermediaries like Ehlebracht.

Consider the broader industry trends in 2024. The global market for industrial marking and coding solutions was projected to reach approximately $4.5 billion, indicating substantial growth potential. This attractiveness could incentivize suppliers to explore direct market entry.

- Supplier Forward Integration: Suppliers may develop their own marking and coding systems, directly competing with Ehlebracht.

- Attractiveness of Market: This threat is more likely if the market for finished marking systems is highly profitable.

- Key Supplier Capabilities: Strong R&D and established market access empower suppliers to integrate forward.

- Industry Growth: The global industrial marking and coding market's growth, estimated around $4.5 billion in 2024, makes direct market entry more appealing for suppliers.

Importance of Ehlebracht to Suppliers

Ehlebracht's significance to its suppliers directly impacts their bargaining power. If Ehlebracht constitutes a substantial portion of a supplier's overall revenue, that supplier has less leverage. They are more inclined to offer favorable pricing and terms to retain Ehlebracht as a key client, thereby reducing their bargaining power.

Conversely, if Ehlebracht is a minor customer for a large, dominant supplier, the supplier's bargaining power remains considerable. In such scenarios, the supplier is less dependent on Ehlebracht's business and can dictate terms more assertively, potentially leading to higher costs or less flexibility for Ehlebracht.

This dynamic is crucial for Ehlebracht's cost management and supply chain resilience. For instance, if a key component supplier, like one providing specialized electronic parts, reported that Ehlebracht accounted for over 25% of its sales in 2024, that supplier would likely be more accommodating. However, if Ehlebracht represents less than 1% of a major raw material provider's global sales, the supplier's position is significantly stronger.

- Supplier Dependence: A supplier relying heavily on Ehlebracht for revenue has reduced bargaining power.

- Customer Concentration: If Ehlebracht is a small customer for a large supplier, the supplier's power is high.

- Pricing Influence: Supplier dependence directly affects Ehlebracht's ability to negotiate favorable pricing.

- Supply Chain Flexibility: The balance of power influences how adaptable suppliers are to Ehlebracht's changing needs.

The bargaining power of suppliers significantly influences Ehlebracht's operational costs and strategic flexibility. Suppliers of specialized components, such as print heads and unique ink formulations, hold considerable sway due to the proprietary nature of their offerings and the high costs associated with switching vendors. This is particularly evident in the rapidly evolving industrial inkjet printer market, where innovation drives supplier leverage.

The limited availability of substitutes for specialized inputs, coupled with the potential for suppliers to integrate forward into Ehlebracht's market, further amplifies their power. For instance, the global industrial marking and coding market's projected $4.5 billion size in 2024 makes direct market entry attractive for capable suppliers. Conversely, Ehlebracht's significance as a customer can mitigate this power; a supplier heavily reliant on Ehlebracht's business will have less leverage.

| Factor | Impact on Ehlebracht | 2024 Data/Trend Example |

|---|---|---|

| Supplier Specialization | High power for suppliers of unique components | Proprietary printhead technology |

| Switching Costs | Increases supplier leverage due to integration complexity | Costs of re-tooling and system redesign |

| Availability of Substitutes | Low availability of specialized inputs grants power | Limited sources for advanced microchip designs |

| Supplier Forward Integration Threat | Suppliers may become direct competitors | Attractive market growth incentivizes direct entry |

| Customer Dependence | Supplier power decreases if Ehlebracht is a major client | Ehlebracht representing >25% of a supplier's sales |

What is included in the product

This analysis meticulously dissects the competitive forces impacting Ehlebracht, revealing the intensity of rivalry, buyer and supplier power, and the threat of new entrants and substitutes.

Effortlessly identify and address competitive pressures with a visual representation of all five forces, making strategic adjustments intuitive.

Customers Bargaining Power

Ehlebracht serves a diverse customer base spanning food & beverage, pharmaceutical, automotive, and electronics sectors. Customers with substantial purchase volumes, particularly large industrial clients, wield significant bargaining power due to their scale and the impact of their orders on Ehlebracht's revenue. For instance, a major automotive manufacturer placing a large order for coding and marking systems can negotiate more favorable terms than a smaller client.

Customers investing in Ehlebracht’s integrated marking and coding solutions encounter significant switching costs. These costs encompass not only the expense of replacing installed systems but also the investment in retraining personnel and the potential for costly production interruptions during a transition. This lock-in effect grants Ehlebracht considerable leverage in its dealings with existing clientele.

Ehlebracht's capacity to deliver highly specialized, reliable, and integrated solutions for product identification, traceability, and anti-counterfeiting significantly curtails customer bargaining power. These offerings provide distinct advantages, such as improved accuracy, faster processing, or adherence to stringent regulatory requirements, thereby preventing Ehlebracht's products from being viewed as mere commodities.

The increasing global emphasis on product traceability and robust anti-counterfeiting strategies underscores the substantial value customers place on these differentiated solutions. For instance, the global track and trace solutions market was projected to reach $7.8 billion in 2024, indicating a strong demand for such specialized services.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while present, is generally limited for suppliers of marking and coding solutions. Large industrial clients might consider bringing basic labeling in-house, especially for simple tasks.

However, the sophisticated nature of advanced technologies like inkjet, laser etching, and anti-counterfeiting solutions presents significant barriers. These require specialized technical expertise and substantial capital investment, making full backward integration impractical for most customers.

- Limited In-House Capability: Many customers lack the specialized technical knowledge for advanced marking and coding.

- High Capital Costs: Investing in high-end marking equipment and maintenance is often cost-prohibitive.

- Focus on Core Competencies: Customers typically prefer to concentrate on their primary business operations rather than developing niche technical solutions.

Customer Price Sensitivity

Customer price sensitivity for marking and coding solutions is directly tied to how crucial these systems are for a company's final product cost and its overall market approach. For instance, in the food and beverage sector, where margins can be tight, even a 1% increase in the cost of coding equipment or consumables could significantly impact profitability, especially for high-volume producers. This heightened awareness of smaller expenses becomes a driver for seeking competitive pricing.

While marking and coding are essential for regulatory compliance and supply chain visibility, their direct cost contribution to a finished product might be relatively minor. However, this perception can shift dramatically in intensely competitive markets. For example, a study in the automotive parts industry in 2024 indicated that companies actively sought cost reductions in every operational area, finding that even savings of 0.5% on ancillary services like coding could be reinvested into R&D or marketing, thus increasing their price sensitivity.

- Impact on Margins: In industries with thin profit margins, such as discount retail or basic manufacturing, customers are more likely to scrutinize the cost of marking and coding solutions, as even small price increases can disproportionately affect their bottom line.

- Competitive Landscape: In markets where competitors offer similar products with little differentiation, price becomes a primary decision-making factor. Businesses in such environments will actively seek out suppliers who can offer cost-effective marking and coding solutions.

- Cost vs. Value: Customers weigh the cost of marking and coding against its perceived value. If the solutions are seen as a commodity, price sensitivity will be high. If they offer unique benefits like enhanced brand protection or advanced data integration, customers may be less sensitive to price.

- Total Cost of Ownership: Beyond the initial purchase price, customers consider the total cost of ownership, including consumables, maintenance, and potential downtime. A provider offering a lower upfront cost but higher long-term expenses might face resistance from price-sensitive buyers.

Customers' bargaining power is influenced by their volume purchases and the availability of alternatives. For Ehlebracht, large clients in sectors like automotive can negotiate better terms due to their significant order sizes. The threat of backward integration is generally low, as the specialized nature of advanced marking and coding technologies requires substantial expertise and investment, making it impractical for most customers to replicate in-house.

Price sensitivity is a key factor, especially in industries with tight margins, where even minor cost increases for coding solutions can impact profitability. In highly competitive markets, price often becomes a deciding factor when product differentiation is minimal. Customers also consider the total cost of ownership, including maintenance and consumables, when evaluating suppliers.

| Factor | Impact on Ehlebracht | Customer Behavior |

|---|---|---|

| Purchase Volume | High volume buyers have greater leverage. | Negotiate for lower prices or better terms. |

| Switching Costs | High switching costs reduce customer power. | Less likely to switch due to integration and training expenses. |

| Product Differentiation | Unique solutions limit customer power. | Less price-sensitive for specialized, high-value offerings. |

| Price Sensitivity | Higher in low-margin, competitive industries. | Actively seek cost-effective solutions. |

Preview Before You Purchase

Ehlebracht Porter's Five Forces Analysis

This preview displays the complete Ehlebracht Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive instantly upon purchase, ensuring no surprises or missing sections. You can confidently proceed with your purchase knowing you'll gain immediate access to this comprehensive strategic tool.

Rivalry Among Competitors

The industrial marking, coding, and labeling sector is teeming with a diverse array of competitors. This market includes giants like LEIBINGER, Videojet, Markem-Imaje, and Domino Printing Sciences, alongside many smaller, specialized firms. This broad spectrum of companies, offering everything from continuous inkjet to laser coding, creates a fragmented yet intensely competitive environment.

The industrial coding and marking systems market is expanding robustly. It's expected to hit USD 9.53 billion by 2030, up from USD 6.66 billion in 2024, with a compound annual growth rate of 6.15%. This growth is fueled by increased industrialization, tighter regulations, and a greater need for product traceability.

A rapidly growing market often tempers competitive rivalry. When the pie is getting bigger, companies can achieve growth by capturing new demand rather than by aggressively stealing market share from rivals. This can lead to a less cutthroat environment, at least in the short to medium term.

Competitors in the identification and traceability market are heavily investing in technological advancements. This includes developing AI-driven systems for enhanced data analysis and implementing eco-friendly solutions to meet growing sustainability demands. Companies are also focusing on improving the speed and precision of their identification processes, alongside robust integration capabilities with existing supply chain systems.

Ehlebracht distinguishes itself by offering comprehensive solutions that address identification, traceability, and anti-counterfeiting needs. This integrated approach aims to provide a more holistic value proposition compared to competitors who might offer more specialized services. For instance, a company might focus solely on RFID tagging, while Ehlebracht provides a broader suite of services.

The market saw significant investment in R&D for traceability solutions in 2024, with global spending projected to reach over $15 billion. This focus on innovation, particularly in areas like blockchain for supply chain transparency, highlights the competitive drive for differentiation. However, a key risk is product commoditization, where if these technological advancements lead to highly similar offerings across the board, the market could shift towards intense price-based competition, impacting profit margins for all players.

Exit Barriers for Competitors

High exit barriers are a significant factor in competitive rivalry. When it's difficult or costly for companies to leave an industry, even those performing poorly may remain, continuing to compete and potentially driving down prices. This can manifest through specialized assets that have little value elsewhere, substantial long-term contracts that must be fulfilled, or significant capital investments in manufacturing facilities that are hard to recoup.

In industries requiring continuous research and development, coupled with specialized equipment, exit barriers are often moderately high. This situation can foster persistent overcapacity within the market. Such an environment frequently leads to intense price wars as companies fight to maintain market share, even when profitability is low.

- Specialized Assets: Companies with unique machinery or patented technology may find it difficult to sell these assets at a reasonable price if they decide to exit.

- Long-Term Contracts: Existing commitments with suppliers or customers can obligate a company to continue operations for a set period, even if the business is no longer profitable.

- High Capital Investment: Significant upfront investments in manufacturing plants, distribution networks, or R&D facilities create a substantial financial hurdle for exiting competitors.

- Industry Trends: For example, the semiconductor industry in 2024 continues to see massive capital expenditures on advanced fabrication plants, estimated to be tens of billions of dollars per facility, making exit extremely costly.

Intensity of Competition on Price vs. Innovation

Competitive rivalry in the industrial marking sector is a dynamic interplay between price sensitivity and the relentless pursuit of innovation. While cost remains a significant factor for many customers, the market is increasingly swayed by advanced functionalities. For instance, the demand for enhanced anti-counterfeiting measures and seamless integration with Industry 4.0 technologies is pushing companies to invest heavily in R&D.

This push for innovation is evident in the development of next-generation marking solutions. Companies are actively launching products like environmentally friendly green marking lasers and AI-powered smart marking systems designed for greater efficiency and data analytics. For example, in 2024, several key players in the industrial marking market reported R&D expenditures exceeding 10% of their revenue, a clear indicator of the focus on technological advancement to gain a competitive edge.

- Price Sensitivity: Customers consistently seek cost-effective marking solutions, creating pressure on profit margins.

- Demand for Innovation: Growing requirements for features such as anti-counterfeiting, high-speed printing, and Industry 4.0 integration drive innovation.

- New Product Development: Focus on green marking lasers and AI-driven smart marking systems highlights the industry's innovative direction.

- R&D Investment: In 2024, leading companies allocated over 10% of revenue to R&D, underscoring the importance of technological advancement.

The industrial marking and coding sector is highly competitive, featuring numerous players from global giants to niche specialists. This fragmentation intensifies rivalry, as companies vie for market share through innovation and pricing strategies. The market's growth, projected to reach USD 9.53 billion by 2030, offers opportunities but also fuels aggressive competition as firms seek to capture expanding demand.

Companies are heavily investing in R&D, with a focus on AI, eco-friendly solutions, and enhanced traceability. This technological race aims to differentiate offerings and command premium pricing. However, the risk of product commoditization looms, potentially leading to price wars if innovations become too similar across the board.

High exit barriers, such as specialized assets and significant capital investments, keep even struggling companies in the market. This persistence can lead to overcapacity and sustained price competition, impacting overall industry profitability. For example, the semiconductor industry's massive capital expenditures, often in the tens of billions per facility, illustrate the costly nature of exiting such specialized sectors.

| Factor | Description | Impact on Rivalry | 2024 Data/Example |

| Number of Competitors | Fragmented market with many global and specialized players. | Intensifies rivalry, pressure on pricing. | LEIBINGER, Videojet, Markem-Imaje, Domino Printing Sciences are key players. |

| Market Growth | Robust growth expected, USD 9.53 billion by 2030 (from USD 6.66 billion in 2024). | Can temper rivalry by allowing growth through new demand. | CAGR of 6.15% fuels investment and competition for share. |

| Innovation & R&D | Heavy investment in AI, eco-friendly, and traceability solutions. | Drives differentiation, potential for price premiums. | R&D spending exceeding 10% of revenue by leading companies in 2024. |

| Exit Barriers | High due to specialized assets and capital investment. | Keeps players in the market, potentially leading to overcapacity and price wars. | Semiconductor fabrication plants costing tens of billions illustrate high capital commitment. |

SSubstitutes Threaten

While Ehlebracht focuses on marking, coding, and labeling, alternative identification methods pose a significant threat. These could include technologies like embedded RFID chips for product tracking, blockchain for enhanced traceability, or even biological markers, bypassing traditional visual codes entirely.

The increasing adoption of these advanced solutions is evident in market projections. For instance, the global anti-counterfeiting packaging market, which encompasses RFID and holographic technologies, is expected to experience robust growth, signaling a clear shift towards diverse and sophisticated identification strategies beyond conventional labeling.

Advances in manufacturing processes, such as additive manufacturing (3D printing) and integrated sensor technology, could significantly reduce the reliance on traditional external marking and labeling services. For instance, smart components with embedded digital identifiers could streamline supply chain tracking, potentially diminishing the demand for visible serial numbers or batch codes applied post-production. The global 3D printing market was valued at approximately $19.8 billion in 2023 and is projected to grow substantially, indicating a trend towards more integrated manufacturing identification methods.

Non-technological approaches like robust supply chain agreements and stringent legal frameworks can offer alternative methods for traceability and anti-counterfeiting, potentially diminishing the perceived necessity for Ehlebracht's advanced marking technologies. These measures, while not direct product substitutes, can achieve similar outcomes by deterring counterfeiters. For example, in 2023, the OECD reported that customs authorities seized over 120 million counterfeit goods, highlighting the impact of regulatory and enforcement efforts.

Cost-Benefit of Substitutes

The threat of substitutes for Ehlebracht's solutions hinges on their cost-effectiveness and how well they match the functionality Ehlebracht offers. If other methods can provide similar benefits, like tracking products or preventing fakes, but at a much lower price or with less hassle to set up, customers might be tempted to switch.

For example, the upfront investment required for automated tracking systems can be a barrier. This makes simpler, less expensive substitutes seem more appealing to potential buyers. In 2024, many businesses are still evaluating the ROI of advanced traceability solutions, with some opting for phased implementations or hybrid approaches to manage initial capital outlay.

- Cost-Effectiveness: Substitutes that offer comparable traceability and anti-counterfeiting features at a lower total cost of ownership pose a significant threat.

- Functional Equivalence: Alternatives that provide similar levels of security, data integrity, and ease of use will draw customers away from Ehlebracht's offerings.

- Implementation Ease: Solutions requiring less complex integration or training, even if slightly less sophisticated, can be favored if they reduce adoption friction.

- Market Trends: The increasing demand for supply chain transparency in 2024 means that while advanced solutions are sought, accessible and affordable alternatives are also gaining traction, particularly among SMEs.

Customer Acceptance of Substitutes

Customer acceptance of substitutes can be a significant hurdle, often progressing slowly. This is frequently due to established operational workflows, the need for regulatory compliance, and the inherent reliability customers have come to expect from existing marking systems. For instance, in highly regulated sectors like pharmaceuticals and food & beverage, coding and marking practices are deeply embedded due to stringent safety and traceability requirements. This makes a complete shift to entirely new, unproven substitutes a challenging proposition, often requiring extensive validation and pilot programs.

The reluctance to adopt substitutes is amplified when the perceived benefits do not outweigh the costs and risks associated with change. Industries that rely on established marking technologies, such as thermal inkjet or laser marking, have invested heavily in these systems and the associated training and maintenance. The threat of substitutes is therefore moderated by the switching costs and the learning curve involved in implementing new solutions. For example, a study by Smithers in 2024 indicated that over 70% of manufacturers in the packaging sector cited integration challenges as a primary barrier to adopting novel marking technologies.

- Established Workflows: Many businesses have deeply integrated marking systems into their production lines, making disruption costly.

- Regulatory Compliance: Industries like pharmaceuticals and food require rigorous validation for any changes to marking, slowing adoption.

- Reliability of Existing Systems: Proven marking technologies often offer a perceived level of reliability that new substitutes must demonstrably surpass.

- Switching Costs: The financial investment in new hardware, software, and employee training can be substantial, deterring quick adoption.

The threat of substitutes for Ehlebracht's marking and coding solutions arises from alternative technologies and methods that can achieve similar outcomes like product traceability or anti-counterfeiting. These substitutes can range from advanced tech like RFID and blockchain to simpler, non-technological approaches such as robust legal frameworks and supply chain agreements.

The appeal of these substitutes often lies in their cost-effectiveness and ease of implementation compared to Ehlebracht's offerings. For instance, the global anti-counterfeiting packaging market, which includes RFID, was projected for strong growth, indicating a move towards diverse identification strategies. In 2024, many businesses are still assessing the return on investment for advanced traceability, with some opting for phased or hybrid implementations to manage initial capital outlay.

Customer reluctance to adopt substitutes is a significant factor, often due to established workflows and regulatory compliance needs. For example, in the pharmaceutical sector, existing marking practices are deeply ingrained due to safety requirements, making a shift to new, unproven substitutes a slow process requiring extensive validation. A 2024 study highlighted that over 70% of manufacturers cited integration challenges as a primary barrier to adopting novel marking technologies.

| Substitute Type | Key Benefit | Market Trend/Data Point |

|---|---|---|

| RFID Chips | Enhanced tracking, reduced manual scanning | Global anti-counterfeiting packaging market growth |

| Blockchain | Increased traceability, data integrity | Growing adoption in supply chain management |

| 3D Printing (Additive Mfg.) | Integrated digital identifiers | Global 3D printing market valued at ~$19.8 billion in 2023 |

| Legal Frameworks/Agreements | Deters counterfeiting through enforcement | OECD seized over 120 million counterfeit goods in 2023 |

Entrants Threaten

Entering the industrial marking, coding, and labeling sector demands significant upfront investment. Companies need capital for research and development, building manufacturing plants for hardware like printers and lasers, and creating sophisticated software. For instance, establishing a new production line for advanced inkjet printers can easily run into millions of dollars, not including the ongoing costs of developing new marking technologies.

Beyond manufacturing, setting up a comprehensive sales and service infrastructure is crucial and capital-intensive. This involves building a skilled workforce, creating distribution channels, and maintaining spare parts inventory. The need for specialized machinery and the sheer scale of operations required to compete effectively means that newcomers face substantial financial hurdles, making it difficult to enter the market without considerable backing.

Existing players in the printing and marking industry, like Ehlebracht, often hold significant intellectual property. This includes patents covering unique printhead designs and specialized ink formulations, creating a substantial hurdle for newcomers. For instance, advancements in laser marking technology require substantial R&D investment, making it challenging for new entrants to replicate these innovations without considerable capital outlay or licensing agreements.

Established relationships with industrial customers form a significant barrier for new entrants. These long-standing connections foster trust and reliability, making it difficult for newcomers to penetrate the market.

High switching costs associated with changing marking systems further solidify this barrier. Companies have invested in specific technologies and processes, and the expense and disruption of transitioning to a new system are substantial deterrents. For example, in 2024, the average cost for a manufacturing plant to retool its entire marking and coding infrastructure could range from tens of thousands to over a million dollars, depending on scale and complexity.

Customers inherently prefer proven, reliable solutions that are seamlessly integrated into their existing production lines. This preference means new entrants must offer exceptionally compelling advantages, such as a significant cost reduction, superior performance, or truly unique features, to even consider overcoming the established customer loyalty and the inherent switching costs.

Access to Distribution Channels

Gaining access to established distribution channels presents a significant hurdle for potential new entrants in the industrial sector. Building out effective sales and service networks across various global industries is not only complex but also requires substantial time and capital investment. As a company with a long-standing presence, Ehlebracht likely benefits from pre-existing, robust distribution relationships that new competitors would find difficult to replicate.

Newcomers would need to invest heavily in developing their own direct sales forces, forging strategic partnerships, or undertaking costly acquisitions to secure market access. The sheer scale of the industrial distribution market, which was valued at over $1.3 trillion globally in 2023 and is projected to grow, underscores the magnitude of this challenge.

- Established Relationships: Existing players like Ehlebracht often possess long-standing contracts and loyalties with distributors, making it hard for new entrants to secure shelf space or sales representation.

- High Setup Costs: Creating a parallel distribution infrastructure, including warehouses, logistics, and sales teams, can cost millions, deterring many potential new market participants.

- Brand Recognition: Distributors are more likely to carry products from known brands, meaning new entrants must overcome a significant brand awareness gap to gain traction.

Regulatory Hurdles and Compliance Knowledge

The industrial marking market, particularly within the pharmaceutical and food & beverage sectors, is heavily regulated. Companies entering this space must grapple with intricate rules concerning traceability, serialization, and the precise display of product information. For instance, the U.S. Drug Supply Chain Security Act (DSCSA) mandates specific serialization requirements for prescription drugs, demanding significant investment in compliant marking technologies and processes.

New entrants face a substantial barrier due to the need for deep expertise in these complex compliance standards. Understanding and implementing solutions that meet these stringent regulations requires considerable investment in specialized knowledge, software, and hardware. Failure to comply can result in severe penalties, making this a critical hurdle for potential competitors.

- Regulatory Complexity: Pharmaceutical and food industries demand adherence to strict traceability and serialization laws.

- Compliance Expertise: New entrants need specialized knowledge to navigate these intricate regulatory landscapes.

- Investment Requirements: Meeting compliance standards necessitates significant financial outlay for technology and process integration.

- Market Entry Barrier: The high cost and complexity of regulatory adherence deter many potential new players.

The threat of new entrants in the industrial marking sector is moderate, largely due to high capital requirements and established brand loyalty. Significant upfront investment is needed for research, manufacturing, and sales infrastructure, with new production lines costing millions. For example, developing advanced inkjet printers requires substantial capital.

Furthermore, intellectual property, such as patents on printhead designs, and the need for specialized expertise in complex regulatory environments like pharmaceutical serialization, create considerable barriers. Switching costs for customers, often in the tens of thousands to over a million dollars in 2024, also solidify existing market positions.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High investment for R&D, manufacturing, and sales infrastructure. | Significant financial hurdle, requiring substantial backing. |

| Intellectual Property | Patents on unique technologies and formulations. | Difficult for newcomers to replicate innovations without licensing or extensive R&D. |

| Switching Costs | Customer investment in existing marking systems and processes. | Deters customers from adopting new, unproven solutions. |

| Regulatory Compliance | Adherence to strict industry standards (e.g., pharmaceutical serialization). | Requires specialized knowledge and investment, with severe penalties for non-compliance. |

Porter's Five Forces Analysis Data Sources

Our Ehlebracht Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial statements, investor relations materials, and industry-specific market research reports to capture the full competitive landscape.