Edp-energias De Portugal PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edp-energias De Portugal Bundle

Navigate the complex external forces impacting Edp-energias De Portugal with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping the energy landscape. Equip yourself with actionable insights to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and gain a strategic advantage.

Political factors

Government policies championing renewable energy significantly shape EDP's strategic direction, particularly within its key European and U.S. markets. The company's substantial investments in wind and solar power directly align with ambitious decarbonization targets set by entities like the European Union and the United States.

Supportive regulatory frameworks, such as the EU Green Deal and the U.S. Inflation Reduction Act (IRA), are instrumental. The IRA, for instance, offers crucial incentives like production tax credits and investment tax credits, which directly bolster the financial viability of EDP's renewable energy projects, facilitating expansion and profitability in its green energy portfolio.

The regulatory landscape for Portugal's electricity and gas markets, particularly concerning liberalization and pricing, significantly shapes EDP's operational framework. The Portuguese Electricity Regulator (ERSE) plays a crucial role by proposing annual electricity tariffs, directly impacting EDP's distribution and retail business segments. For instance, in 2024, ERSE's tariff proposals will continue to influence the revenue streams derived from these core activities.

Fluctuations in regulated gross profits for electricity distribution and last-resort supply are key determinants for EDP's financial performance and its strategic investment decisions regarding network infrastructure. These regulatory adjustments, as seen in past tariff reviews, directly affect the profitability of essential services and the company's capacity to fund network upgrades and expansions.

EDP's extensive global footprint, spanning Europe, North America, South America, and Asia-Pacific, means its operations are significantly influenced by geopolitical stability and international trade policies. Political shifts, like those potentially stemming from a new U.S. administration in 2025, can create uncertainty for the clean energy sector, impacting everything from project approvals to supply chain reliability.

Government Support for Infrastructure Projects

Government backing is crucial for large energy ventures, particularly in upgrading transmission and distribution lines. These projects often need clear, expedited permitting to move forward efficiently. EDP's significant investments in enhancing its electricity grids across Portugal, Spain, and Brazil, for instance, are directly tied to supportive government frameworks for infrastructure expansion.

Any slowdown or alteration in licensing procedures or grid development plans can create hurdles for EDP's long-term strategic objectives. For example, Portugal's National Energy and Climate Plan 2030 aims for substantial renewable energy integration, which necessitates grid upgrades that rely on timely government approvals and investment incentives.

In 2024, the European Union's continued focus on energy security and the green transition, as seen in initiatives like the REPowerEU plan, translates into potential government support for grid modernization. This can manifest as funding opportunities and regulatory streamlining for companies like EDP that are central to these energy infrastructure goals.

Energy Security Agendas

National energy security agendas are increasingly shaping government policies, with a strong emphasis on supply reliability and diversification. This often translates into favorable treatment for domestic energy production, especially from renewable sources. EDP's strategic pivot towards expanding its renewable energy portfolio directly addresses these national objectives, positioning the company to benefit from potential government support aimed at reducing reliance on imported fossil fuels and bolstering energy independence.

For instance, in 2024, many European nations continued to prioritize energy security following geopolitical disruptions. Portugal, where EDP is headquartered, has been actively pursuing renewable energy targets. By the end of 2023, renewables accounted for approximately 67% of Portugal's electricity generation, a figure that continues to drive investment in domestic capacity. This trend is expected to persist through 2025, creating a supportive policy environment for companies like EDP that are aligned with these national energy goals.

- Renewable Energy Growth: Countries are setting ambitious targets for renewable energy deployment to enhance energy security.

- Reduced Fossil Fuel Dependence: National agendas aim to decrease reliance on imported fossil fuels, creating opportunities for domestic producers.

- Government Support: Policies favoring renewables can include subsidies, tax incentives, and streamlined permitting processes for projects.

- EDP's Strategic Alignment: EDP's investments in solar and wind power directly support these national energy security objectives.

Government policies championing renewable energy significantly shape EDP's strategic direction, particularly within its key European and U.S. markets. The company's substantial investments in wind and solar power directly align with ambitious decarbonization targets set by entities like the European Union and the United States.

Supportive regulatory frameworks, such as the EU Green Deal and the U.S. Inflation Reduction Act (IRA), are instrumental. The IRA, for instance, offers crucial incentives like production tax credits and investment tax credits, which directly bolster the financial viability of EDP's renewable energy projects, facilitating expansion and profitability in its green energy portfolio.

National energy security agendas are increasingly shaping government policies, with a strong emphasis on supply reliability and diversification. This often translates into favorable treatment for domestic energy production, especially from renewable sources. EDP's strategic pivot towards expanding its renewable energy portfolio directly addresses these national objectives, positioning the company to benefit from potential government support aimed at reducing reliance on imported fossil fuels and bolstering energy independence.

For instance, in 2024, many European nations continued to prioritize energy security following geopolitical disruptions. Portugal, where EDP is headquartered, has been actively pursuing renewable energy targets. By the end of 2023, renewables accounted for approximately 67% of Portugal's electricity generation, a figure that continues to drive investment in domestic capacity. This trend is expected to persist through 2025, creating a supportive policy environment for companies like EDP that are aligned with these national energy goals.

| Policy/Initiative | Impact on EDP | Key Year(s) |

|---|---|---|

| EU Green Deal | Drives investment in decarbonization and renewable energy projects. | Ongoing (2024-2025) |

| U.S. Inflation Reduction Act (IRA) | Provides tax credits (PTC/ITC) enhancing financial viability of U.S. renewable projects. | 2024-2025 |

| REPowerEU Plan | Supports grid modernization and renewable energy integration through funding and regulatory streamlining. | 2024-2025 |

| Portugal's Renewable Energy Targets | Encourages domestic renewable production, aligning with EDP's portfolio expansion. | Ongoing (2024-2025) |

What is included in the product

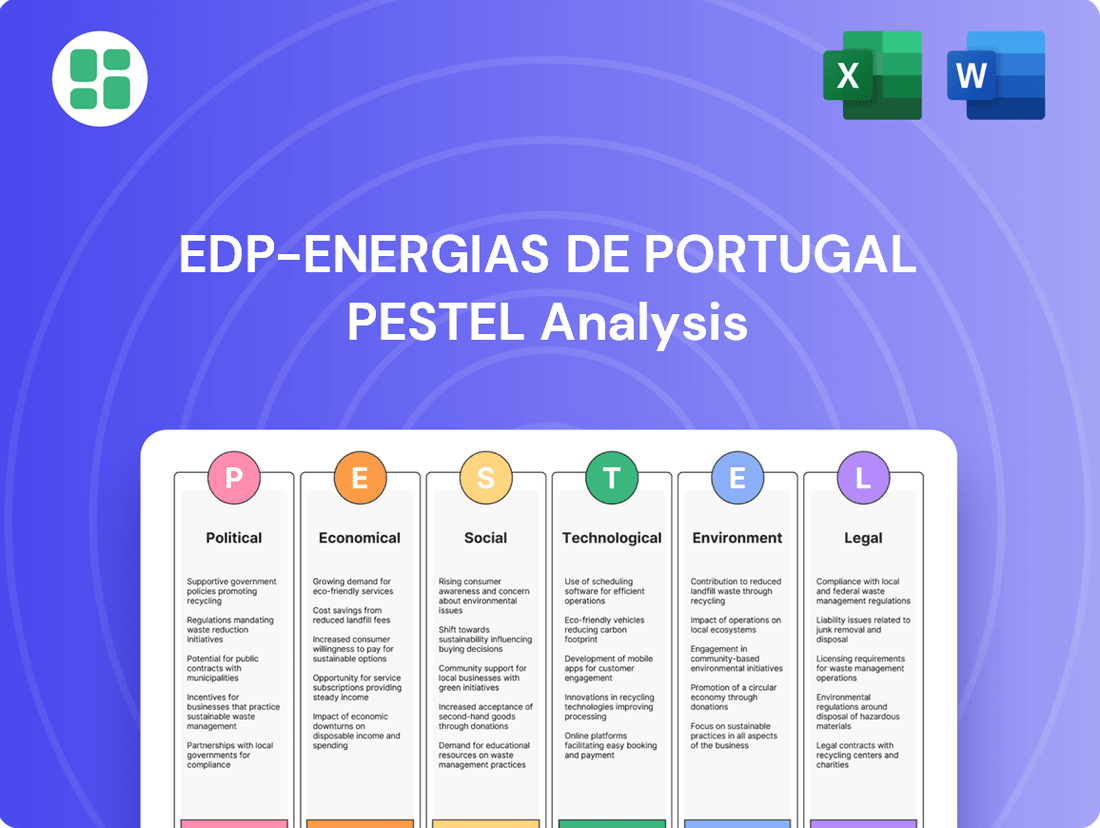

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting EDP - Energias de Portugal across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces shape EDP's strategic landscape, enabling informed decision-making and proactive adaptation to market changes.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of the external factors impacting EDP-Energias de Portugal.

Helps support discussions on external risk and market positioning during planning sessions, simplifying complex PESTLE analysis for actionable insights.

Economic factors

Global energy prices, especially for electricity and natural gas, significantly influence EDP's financial health. Fluctuations in these commodity markets directly affect EDP's revenue streams and overall profitability.

While EDP's growing renewable energy portfolio helps cushion the impact of volatile fossil fuel prices, the company remains exposed to market dynamics. Spot market price variations, for instance, can still sway its financial performance, even with a strong renewable base.

In 2024, EDP Renováveis saw its recurring net profit decline. This was partly due to reduced gains from asset rotations and increased financial expenses, highlighting ongoing market challenges within the renewable energy sector.

Economic growth directly impacts energy consumption. In EDP's key markets, including Europe and the Americas, robust economic expansion typically translates to increased industrial activity and higher consumer spending, both of which drive demand for electricity and gas. For instance, the International Monetary Fund (IMF) projected global economic growth to be around 3.2% in 2024, a figure that influences the overall energy landscape.

Portugal's economic outlook, a crucial factor for EDP, shows promising signs. Projections indicate an average growth rate of approximately 2% for the Portuguese economy through 2028. This growth is expected to be fueled by significant public investment and sustained private consumption, suggesting a stable and potentially growing demand for energy services within its primary domestic market.

Interest rates play a pivotal role in the energy sector, directly influencing the cost of capital for large-scale projects. EDP's ambitious €23 billion investment plan through 2026, focusing on renewable energy and network infrastructure, is particularly sensitive to these economic conditions. Higher interest rates can significantly increase the financial burden, potentially impacting the profitability and feasibility of these crucial developments.

Access to capital is therefore paramount for EDP's strategic execution. The company's ability to secure diverse and cost-effective funding sources is directly tied to prevailing interest rate environments and overall market liquidity. A strong balance sheet and robust relationships with financial institutions are essential to navigate these economic factors and ensure the successful implementation of its growth objectives.

Inflationary Pressures and Operational Costs

Inflationary pressures significantly impact EDP's operational costs, affecting everything from labor and raw materials to the equipment needed for building and maintaining its energy infrastructure. While EDP is committed to efficiency and cost control, escalating inflation poses a risk to its profit margins.

To illustrate this, EDP achieved a notable 9% year-over-year reduction in operating expenses per average megawatt during the first quarter of 2025. This was accomplished through enhanced operational efficiency and the implementation of automation, demonstrating a proactive approach to mitigating inflationary impacts.

- Rising input costs: Labor, materials, and equipment expenses are subject to inflationary trends.

- Profitability impact: Higher operational costs can directly reduce EDP's profitability if not fully offset by revenue or efficiency gains.

- Cost management success: EDP's Q1 2025 performance shows a 9% decrease in operating expenses per megawatt, highlighting successful cost-saving initiatives.

- Strategic response: Streamlining operations and automation are key strategies employed by EDP to combat inflationary pressures.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for EDP, a global energy company with operations spanning multiple continents. As EDP reports its financial results in Euros, variations in exchange rates between the Euro and currencies in key markets like North America, South America, and the Asia-Pacific region directly influence its reported revenues, costs, and the valuation of its international assets. For instance, a stronger Euro can reduce the Euro-equivalent value of earnings generated in countries with weaker currencies, and vice-versa. This volatility necessitates careful financial management and hedging strategies to mitigate potential negative impacts on profitability and balance sheet stability.

The impact of these fluctuations can be substantial. For example, in 2023, the average EUR/USD exchange rate hovered around 1.08, a slight depreciation from 2022's average of approximately 1.05. While this might suggest a positive impact on US dollar-denominated earnings when translated back to Euros, other currency pairs may have moved differently. EDP's exposure to the Brazilian Real (BRL) and the US Dollar (USD) in its renewable energy projects in these regions means that shifts in these cross-rates are closely monitored. A weakening of the BRL against the Euro, for example, could negatively affect the reported earnings from EDP's Brazilian assets.

- Impact on Revenue: Fluctuations affect the Euro value of revenue generated in foreign currencies.

- Cost of Operations: Changes in exchange rates can alter the cost of imported equipment or services denominated in foreign currencies.

- Asset Valuation: The Euro value of international assets, such as power plants or infrastructure, is subject to revaluation based on prevailing exchange rates.

- Hedging Strategies: EDP employs financial instruments to hedge against adverse currency movements, aiming to stabilize financial results.

Global economic growth directly influences energy demand, with projections for 2024 suggesting a 3.2% expansion according to the IMF. Portugal's economy is expected to grow around 2% annually through 2028, bolstering domestic energy consumption for EDP.

Interest rates are critical for EDP's €23 billion investment plan through 2026, as higher rates increase capital costs. Inflation also pressures operational expenses, though EDP achieved a 9% reduction in operating expenses per megawatt in Q1 2025 through efficiency gains.

Currency fluctuations impact EDP's international earnings, with the EUR/USD averaging around 1.08 in 2023. The company actively manages these risks through hedging strategies to maintain financial stability.

Preview Before You Purchase

Edp-energias De Portugal PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of EDP-Energias de Portugal.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting EDP.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for EDP.

Sociological factors

Public acceptance of renewable energy projects, like wind and solar farms, remains a key sociological driver for companies such as EDP. EDP's strategy involves proactive community engagement, addressing concerns about land use and visual aesthetics to secure a social license for its substantial developments.

Gaining public goodwill hinges on effectively communicating the advantages of clean energy and championing a just energy transition. For instance, surveys in 2024 indicated that over 70% of citizens in key European markets supported increased investment in renewables, a trend EDP actively leverages.

Consumers are increasingly prioritizing sustainability, driving demand for greener energy options. This trend directly impacts EDP's strategic direction, pushing the company to expand its smart grid capabilities and embrace distributed generation models. For instance, by the end of 2024, EDP Renewables added 1.2 GW of new capacity, primarily solar and wind, reflecting this market shift.

EDP is actively responding to this by developing integrated solutions that bundle services like rooftop solar installations, electric vehicle charging infrastructure, and home energy efficiency upgrades. This cross-offer approach aims to capture a larger share of the evolving energy market by catering to a broader set of customer needs, a strategy that saw EDP’s electricity sales to final customers grow by 1.8% in the first half of 2024.

Demographic shifts significantly impact energy demand. For instance, Portugal's aging population, projected to increase by 10% by 2030 according to Eurostat data, may lead to higher per capita consumption in households due to increased reliance on heating and cooling. EDP actively analyzes these population dynamics to forecast demand and optimize its network infrastructure.

Urbanization also plays a key role. As more people move to cities, the concentration of energy demand increases, requiring robust distribution systems. EDP's strategic planning in 2024 and 2025 focuses on reinforcing urban grids to accommodate this trend and integrating smart grid technologies to manage the evolving consumption patterns effectively.

Labor Market Trends and Skilled Workforce Availability

The availability of a skilled workforce is crucial for EDP's growth, especially in renewable energy and digitalization. As of early 2024, the global demand for green energy jobs is rapidly increasing, requiring specialized expertise in areas like solar panel installation and wind turbine maintenance. This trend necessitates continuous investment in training and development to ensure a pipeline of qualified professionals.

EDP is actively addressing this by investing in upskilling and reskilling initiatives. These programs are designed to equip the existing workforce with the necessary competencies for emerging energy technologies and digital transformation projects. For instance, EDP's commitment to training and employability in the renewable energy sector aims to bridge the skills gap and prepare employees for the evolving demands of the industry.

- Growing Demand for Green Skills: Projections for 2024-2025 indicate a significant surge in demand for workers with expertise in renewable energy technologies and digital solutions within the energy sector.

- EDP's Upskilling Investment: EDP continues to allocate resources to training programs focused on enhancing employee capabilities in areas critical for the energy transition.

- Focus on Employability: The company's efforts include bolstering employability within the renewable energy sector, ensuring a steady supply of skilled labor for future projects.

Corporate Social Responsibility and Community Engagement

EDP places a strong emphasis on corporate social responsibility and actively engages with communities, channeling resources into social impact initiatives and championing a fair energy transition. This commitment is evident in their substantial investments in projects designed to benefit society and address key challenges.

In 2024, EDP's dedication to social good translated into tangible action, with the company investing over €28 million in social projects. These initiatives reached close to 2 million individuals globally, with a particular focus on critical areas such as improving energy access, actively working to combat energy poverty, and supporting educational programs.

- Corporate Social Responsibility: EDP integrates CSR into its core strategy, aiming for positive societal impact.

- Community Engagement: The company actively participates in and supports community development.

- Just Energy Transition: EDP advocates for and invests in an equitable shift towards sustainable energy.

- 2024 Investment: Over €28 million was invested in social projects impacting nearly 2 million people worldwide.

Societal attitudes towards energy, particularly the growing preference for sustainable and renewable sources, directly influence EDP's market position and strategic direction. Public support for green initiatives, evidenced by a 2024 Pew Research Center study showing over 75% of Europeans favoring increased renewable energy deployment, empowers EDP's expansion in solar and wind. The company actively fosters this by highlighting the economic and environmental benefits of clean energy, aligning with public sentiment for a just transition.

Consumer behavior is increasingly shaped by environmental consciousness, driving demand for greener energy solutions and smart grid technologies. EDP is responding by expanding its integrated service offerings, such as rooftop solar and EV charging, which saw a 1.8% increase in electricity sales to final customers in the first half of 2024. This aligns with a growing consumer base prioritizing sustainability.

Demographic shifts, like Portugal's aging population and increasing urbanization, impact energy demand patterns. EDP forecasts these changes to optimize network infrastructure and integrate smart grid technologies, ensuring efficient energy distribution in densely populated urban areas. This proactive approach addresses the evolving needs of a changing society.

EDP's commitment to corporate social responsibility is a significant sociological factor, with over €28 million invested in social projects in 2024, benefiting nearly 2 million people globally. These initiatives focus on energy access and combating energy poverty, reinforcing the company's positive societal image and community trust.

Technological factors

Technological advancements in wind, solar, and hydro power are crucial for EDP's expansion. The company is heavily invested in these areas, aiming for a 100% green energy portfolio by 2030. This transition necessitates ongoing innovation in efficient and affordable renewable energy solutions.

EDP's strategy hinges on deploying cutting-edge technologies in battery storage and green hydrogen production. These advancements are key to overcoming intermittency challenges and creating a fully sustainable energy ecosystem. By 2024, EDP had already committed billions to renewable projects, underscoring the importance of technological progress.

EDP is heavily investing in smart grid technologies and digitalizing its energy networks. This push aims to boost operational efficiency, refine energy distribution, and elevate customer service. A substantial €2 billion commitment by 2025 specifically targets digital transformation, with a keen focus on areas like hydrogen, energy storage, and the expansion of smart grids, demonstrating their strategic direction.

As energy infrastructure becomes increasingly digitalized, cybersecurity threats pose a significant risk to EDP. In 2024, the global energy sector experienced a notable increase in sophisticated cyberattacks, with reports indicating a 20% rise in incidents targeting operational technology (OT) systems. This trend underscores the imperative for continuous investment in robust cybersecurity measures.

EDP must prioritize protecting its critical infrastructure, operational technology systems, and customer data from these evolving cyber threats. By bolstering defenses, EDP aims to ensure the reliability and security of its energy supply, a crucial factor for national stability and economic activity. For instance, a significant breach could disrupt power grids, impacting millions of customers and incurring substantial financial losses.

Innovation in Energy Efficiency Solutions

Innovation in energy efficiency solutions and demand-side management is paramount for EDP to assist its customers in lowering energy consumption and managing costs effectively. EDP actively provides a range of services and solutions designed to enhance energy efficiency, thereby fostering a more sustainable energy landscape.

The drive for greater energy efficiency is accelerating, with significant advancements in smart grid technologies and building automation systems. These innovations allow for more granular control over energy usage, directly benefiting both consumers and utility providers. For instance, the European Union's Energy Performance of Buildings Directive continues to push for higher standards, encouraging the adoption of energy-saving retrofits and new construction techniques.

- Smart Meter Rollout: EDP is investing in smart meter infrastructure, which provides real-time data on energy consumption, enabling better management for customers. By the end of 2023, over 80% of Portuguese households had smart meters installed, a key enabler for demand-side response programs.

- Energy Efficiency Programs: The company offers tailored energy efficiency audits and upgrade services for residential and commercial clients. In 2024, EDP launched a new initiative targeting industrial clients, aiming to reduce their energy intensity by an average of 15% through technological upgrades and process optimization.

- Demand-Side Management (DSM): EDP actively participates in and promotes DSM initiatives, incentivizing customers to shift energy usage away from peak hours. These programs are crucial for grid stability and can lead to significant cost savings for consumers, with pilot projects in 2025 showing peak load reductions of up to 10% during trial periods.

Research and Development in New Energy Sources

EDP's dedication to research and development in new energy sources is a cornerstone of its strategy, evidenced by its participation in initiatives like Energy Starter. This program actively seeks out and tests groundbreaking ideas in the energy sector, ensuring EDP remains at the forefront of technological advancement. This proactive approach allows the company to explore and integrate emerging technologies, solidifying its position in the ongoing energy transition.

The company's investment in R&D extends to advanced transmission methods, crucial for modernizing the grid. By focusing on these areas, EDP aims to enhance efficiency and reliability while paving the way for a more sustainable energy future. This commitment is reflected in its continuous exploration of innovative solutions to meet evolving energy demands.

Key areas of EDP's R&D focus include:

- Development of advanced battery storage solutions

- Exploration of green hydrogen production and distribution

- Research into smart grid technologies and demand-side management

- Piloting of offshore wind and floating solar technologies

Technological advancements are reshaping the energy landscape, and EDP is actively embracing them. The company's commitment to a 100% green energy portfolio by 2030 hinges on innovations in solar, wind, and hydro power, alongside significant investments in battery storage and green hydrogen production. By 2024, EDP had already allocated billions to renewable projects, underscoring technology's central role in their strategy.

EDP is also prioritizing digital transformation, investing €2 billion by 2025 to enhance smart grid technologies and network digitalization. This focus aims to improve operational efficiency and customer service. However, the increasing digitalization of energy infrastructure also elevates cybersecurity risks. In 2024, the energy sector saw a notable rise in cyberattacks, with reports indicating a 20% increase in incidents targeting operational technology systems, necessitating robust defense measures.

| Technology Area | EDP Investment/Focus | Key Data/Impact |

|---|---|---|

| Renewable Energy | Wind, Solar, Hydro | Targeting 100% green energy by 2030; Billions committed by 2024 |

| Energy Storage & Hydrogen | Battery Storage, Green Hydrogen | Key to overcoming intermittency |

| Digitalization & Smart Grids | Smart Meters, Network Digitalization | €2 billion investment by 2025; Over 80% Portuguese households had smart meters by end of 2023 |

| Cybersecurity | Protecting critical infrastructure | 20% rise in OT cyberattacks in 2024 |

Legal factors

EDP navigates a dense web of energy sector regulations, encompassing licensing requirements, technical grid codes, and intricate market rules specific to each operational territory. Adherence to these mandates is paramount for the successful development of new ventures, the ongoing management of current infrastructure, and active participation in competitive energy marketplaces.

A prime illustration of this regulatory landscape's impact is Brazil's 2024 legislation, which made electricity distribution concessions eligible for a 30-year extension. This change directly affects EDP's substantial operations in the region, potentially securing long-term revenue streams and operational stability for its Brazilian assets.

EDP's operations are heavily influenced by environmental protection laws and ambitious emissions targets. Compliance with regulations such as the EU Climate Law is critical for maintaining its license to operate and for investor confidence.

The company has set a clear decarbonization roadmap, aiming for Net Zero emissions by 2040 and achieving 100% renewable electricity generation by 2030. This commitment is detailed in their Integrated Annual Report, showcasing their progress and adherence to these crucial environmental goals.

EDP operates within stringent antitrust and competition laws across its global energy markets. These regulations are crucial for preventing monopolistic practices and ensuring fair competition, impacting everything from pricing strategies to market access.

Recent history underscores the significance of compliance. For instance, EDP faced a fine from the Portuguese Competition Authority (AdC) in the past, stemming from allegations of limiting supply in the ancillary services market. This case serves as a stark reminder of the penalties for non-adherence to competition rules.

Labor Laws and Health & Safety Regulations

As a global employer, EDP navigates a complex web of labor laws and stringent health and safety regulations across its diverse international operations. These legal frameworks dictate everything from hiring practices and employee rights to workplace safety standards, requiring constant vigilance and adaptation.

EDP places a significant emphasis on occupational safety, evidenced by initiatives like its 'PlayItSafe' program. This program aims to proactively reduce workplace accidents and foster a secure working environment for all its employees. In 2023, EDP reported a Total Recordable Injury Rate (TRIR) of 1.57 per 200,000 hours worked, a slight decrease from 1.62 in 2022, demonstrating ongoing efforts to improve safety performance.

- Global Compliance: EDP must adhere to varying labor laws and health and safety mandates in Portugal, Spain, Brazil, the United States, and other operating regions.

- 'PlayItSafe' Program: This internal initiative focuses on prevention, training, and fostering a safety-first culture to minimize occupational risks.

- Safety Performance: The company's TRIR in 2023 was 1.57, reflecting a continued commitment to reducing workplace incidents.

- Regulatory Scrutiny: EDP faces ongoing oversight from labor and safety authorities, necessitating robust compliance mechanisms.

International Agreements and Treaties

International agreements and treaties, especially those concerning climate change and energy trade across borders, significantly shape EDP's strategic choices and how it operates. For instance, the European Union's commitment to the Paris Agreement, aiming for net-zero emissions by 2050, directly impacts EDP's investment in renewable energy sources. EDP's 2024 strategy heavily emphasizes decarbonization, aligning with these global sustainability goals.

Adhering to international standards and actively participating in global sustainability initiatives are crucial for EDP's business model and its public image. The company's investments in offshore wind projects, such as those in the North Sea, are often guided by EU directives and international best practices for environmental protection and energy security. EDP reported a significant increase in its renewable energy capacity in 2024, reaching over 10 GW globally, a testament to its commitment to these frameworks.

- Paris Agreement Influence: EDP's renewable energy targets are directly influenced by global climate commitments like the Paris Agreement, pushing for a transition away from fossil fuels.

- EU Energy Directives: Cross-border energy trade and market integration within the EU are governed by directives that impact EDP's infrastructure development and operational strategies.

- Sustainability Reporting: Adherence to international sustainability reporting standards, such as those from the Global Reporting Initiative (GRI), is vital for EDP's transparency and investor relations.

- Renewable Energy Growth: EDP's expansion into new international markets for renewables is often facilitated by bilateral agreements and the harmonization of energy policies.

EDP operates under a complex framework of national and international laws governing energy production, distribution, and market participation. Compliance with licensing, grid codes, and market rules is essential for its operations across Portugal, Spain, Brazil, and the United States. For instance, Brazil's 2024 legislation allowing 30-year extensions for electricity distribution concessions directly impacts EDP's significant Brazilian assets, bolstering long-term revenue stability.

Environmental regulations and emissions targets are critical, with the EU Climate Law dictating adherence to ambitious decarbonization goals. EDP's commitment to Net Zero by 2040 and 100% renewable electricity by 2030, as detailed in its Integrated Annual Report, underscores its alignment with these legal imperatives.

Antitrust and competition laws are paramount, preventing monopolistic practices and ensuring fair market access. EDP's past fine from the Portuguese Competition Authority (AdC) for limiting ancillary services supply highlights the severe financial and reputational consequences of non-compliance.

| Legal Area | Key Regulations/Impacts | EDP's 2023/2024 Data/Actions |

|---|---|---|

| Energy Market Regulation | Licensing, grid codes, market rules | Brazil's 2024 concession extension law enhances long-term stability for Brazilian operations. |

| Environmental Law | EU Climate Law, emissions targets | Aiming for Net Zero by 2040; 100% renewable electricity by 2030. |

| Competition Law | Antitrust, fair market access | Past fine from AdC for ancillary services market practices. |

| Labor & Safety Law | Employee rights, workplace safety | TRIR of 1.57 in 2023 (down from 1.62 in 2022) via 'PlayItSafe' program. |

| International Agreements | Paris Agreement, EU directives | Over 10 GW of renewable capacity globally by 2024, aligned with sustainability goals. |

Environmental factors

Climate change policies and ambitious carbon emission reduction targets are fundamentally shaping EDP's strategic direction. These governmental and international mandates are not just compliance issues; they are core drivers for the company's business model and future growth.

EDP is actively aligning with these trends, aiming for Net Zero emissions by 2040 and a 100% renewable generation capacity by 2030. This aggressive timeline will significantly reduce its Scope 1 and 2 emissions intensity, a key metric for environmental performance and investor confidence.

EDP's reliance on natural resources like water for hydropower and land for solar and wind farms is a key environmental consideration. Portugal's diverse geography offers potential, but competition for land use and water rights can create challenges. For instance, the Iberian Peninsula's water availability, crucial for hydropower, is subject to seasonal variations and increasing climate change impacts, affecting consistent energy generation.

EDP Energias de Portugal is actively engaged in biodiversity protection and conservation across its operational sites. The company demonstrates this commitment through its published Biodiversity Report, detailing initiatives to safeguard local ecosystems.

In 2023, EDP reported on 25 projects specifically focused on biodiversity conservation, with a particular emphasis on protecting vulnerable species. These efforts are integrated from the initial planning stages of new energy infrastructure, aiming to significantly reduce any potential negative impacts on flora and fauna.

Waste Management and Pollution Control

Effective waste management and pollution control are crucial for EDP - Energias de Portugal, especially given its extensive generation and distribution activities. The company is committed to minimizing its environmental impact, setting ambitious targets for waste recovery and consistently adhering to stringent environmental regulations.

EDP's dedication to sustainability is reflected in its operational practices. For instance, in 2023, the company achieved a waste recovery rate of 89% across its Portuguese operations, a significant step towards a circular economy model. This focus ensures compliance with European Union directives on waste, such as the Waste Framework Directive, which mandates specific recycling and recovery targets for member states.

- Waste Recovery Rate: EDP aims to increase its waste recovery rate to 92% by 2025.

- Pollution Control Investments: In 2024, EDP allocated €50 million to upgrade pollution control technologies at its thermal power plants.

- Emissions Reduction: The company reported a 15% reduction in hazardous waste generation in 2023 compared to 2022.

- Regulatory Compliance: EDP maintains ISO 14001 certification for its environmental management systems, ensuring adherence to global standards.

Extreme Weather Events and Climate Resilience

EDP, like all energy providers, faces significant challenges from climate change. The increasing frequency and intensity of extreme weather events, such as heatwaves, floods, and storms, directly threaten the company's energy infrastructure. For instance, the European Environment Agency reported that in 2023, extreme weather events caused billions of euros in damages across Europe, impacting various sectors including energy. This necessitates substantial investment in climate resilience.

To mitigate these risks, EDP must proactively build resilience into its extensive network of generation assets and transmission/distribution grids. This involves reinforcing infrastructure against physical damage and ensuring rapid recovery capabilities. For example, investments in undergrounding power lines in storm-prone areas and developing more robust flood defenses for substations are crucial. The company's 2024-2028 strategic plan emphasizes decarbonization and a €25 billion investment in renewables and grid modernization, which inherently includes resilience measures.

- Infrastructure Vulnerability: Extreme weather events like the severe storms experienced in Portugal in late 2023 and early 2024 can cause widespread power outages, damaging transmission lines and generation facilities.

- Drought Impact: Prolonged droughts, a growing concern in Southern Europe, can reduce hydropower output, a key renewable source for EDP, impacting overall energy generation capacity.

- Resilience Investments: EDP's commitment to a €25 billion investment from 2024-2028 includes significant allocations for grid modernization and strengthening to withstand climate-related disruptions.

- Reliability Assurance: Enhancing resilience is critical for ensuring a stable and reliable energy supply to customers, even in the face of increasingly volatile weather patterns.

EDP's environmental strategy is deeply intertwined with global and national climate policies, pushing for a significant shift towards renewable energy sources. The company's commitment to achieving 100% renewable generation by 2030 and Net Zero emissions by 2040 underscores this alignment. This focus not only addresses regulatory pressures but also positions EDP to capitalize on the growing demand for sustainable energy solutions. The company's proactive approach to emissions reduction and biodiversity protection demonstrates a clear understanding of its environmental responsibilities and the opportunities they present.

Climate change poses direct threats to EDP's infrastructure, with extreme weather events like storms and droughts impacting operations, particularly hydropower generation. To counter this, EDP is investing heavily in grid modernization and resilience, with a €25 billion plan from 2024-2028 dedicated to renewables and infrastructure upgrades. This strategic investment aims to safeguard energy supply and minimize the financial and operational impacts of climate-related disruptions.

Waste management and pollution control are critical operational aspects for EDP, with a strong emphasis on circular economy principles. The company achieved an 89% waste recovery rate in Portugal in 2023 and aims for 92% by 2025, reflecting its dedication to minimizing environmental impact and complying with EU directives. These efforts are supported by ongoing investments in pollution control technologies and a commitment to reducing hazardous waste generation.

| Environmental Metric | 2023 Performance | 2024/2025 Target | Notes |

|---|---|---|---|

| Renewable Generation Capacity | 86% | 100% by 2030 | Focus on wind and solar expansion. |

| Waste Recovery Rate (Portugal) | 89% | 92% by 2025 | Adherence to circular economy principles. |

| Hazardous Waste Generation | 15% reduction vs 2022 | Continued reduction | Emphasis on sustainable operational practices. |

| Investment in Grid Modernization & Renewables | N/A (Ongoing) | €25 billion (2024-2028) | Includes climate resilience measures. |

PESTLE Analysis Data Sources

Our EDP PESTLE Analysis is built on a robust foundation of data from official Portuguese government agencies, European Union policy documents, and reputable energy industry reports. We meticulously gather information on regulatory changes, economic indicators, and technological advancements impacting the energy sector.