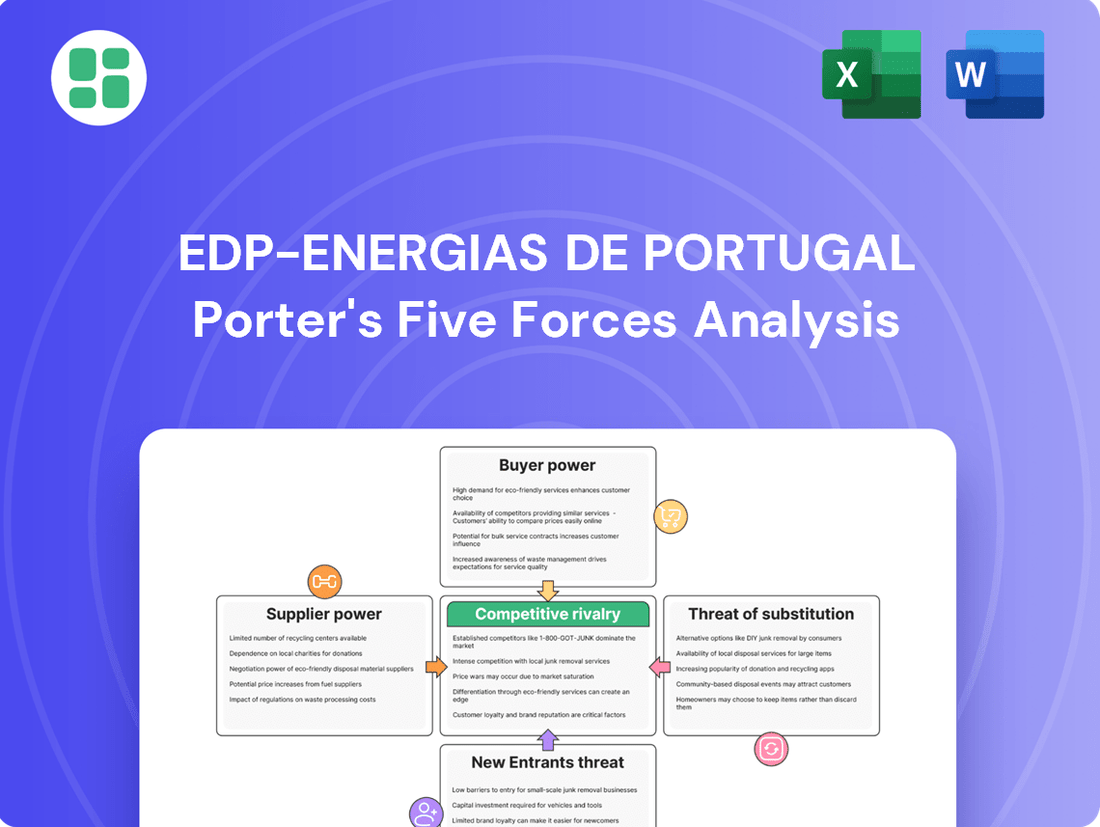

Edp-energias De Portugal Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edp-energias De Portugal Bundle

Edp-energias De Portugal operates within a dynamic energy sector, facing considerable pressure from intense rivalry and the looming threat of substitutes, particularly renewable energy sources. Understanding the nuances of buyer power and supplier leverage is crucial for navigating this complex landscape. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Edp-energias De Portugal’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of EDP's suppliers is significantly shaped by the concentration within the renewable energy equipment manufacturing sector. Key components for wind turbines and solar panels are often produced by a select group of global companies.

This limited supplier base for specialized equipment, like high-efficiency solar cells or advanced wind turbine nacelles, grants these manufacturers considerable leverage. For instance, in 2024, the top three wind turbine manufacturers globally accounted for over 50% of new installations, indicating a high degree of market concentration.

Consequently, suppliers can dictate pricing and delivery schedules for large-scale projects, potentially impacting EDP's project costs and timelines. This concentration means EDP has fewer alternatives when sourcing critical, high-value components, thereby strengthening supplier bargaining power.

Even with EDP's significant investments in renewables, its remaining thermal power plants still depend on commodity fuels such as natural gas and coal. The prices for these fuels are highly susceptible to global market forces, including shifts in supply and demand, geopolitical tensions, and the actions of major producing nations. This inherent reliance means EDP faces potential price volatility and disruptions in its fuel supply, which strengthens the bargaining power of its fuel suppliers.

Suppliers providing highly specialized technologies, such as advanced grid management systems and robust cybersecurity solutions, wield significant bargaining power over EDP. The unique nature of these offerings, coupled with the substantial costs and complexities involved in switching providers, creates a strong dependence. For instance, the demand for sophisticated IT infrastructure, critical for modern energy grids, means EDP faces limited alternatives when seeking these cutting-edge solutions.

Skilled Labor and Expertise

The availability of highly skilled labor, particularly engineers and technicians specializing in renewable energy and grid infrastructure, significantly impacts supplier power for EDP Energias de Portugal. A tight labor market for these specialized roles, as seen with projected shortages in the renewable energy sector, can drive up labor costs and reduce EDP's flexibility in managing projects and ongoing maintenance.

For instance, a report from the International Renewable Energy Agency (IRENA) in 2023 highlighted a growing global demand for skilled workers in solar and wind energy, suggesting potential challenges for companies like EDP in securing adequate talent at competitive rates. This scarcity directly translates to increased bargaining power for labor suppliers and specialized contracting firms.

- Shortage of Specialized Skills: Limited pools of engineers and technicians experienced in advanced grid management and renewable energy integration.

- Increased Labor Costs: Higher wages and benefits are demanded by skilled professionals in high-demand fields, impacting project budgets.

- Reduced Operational Flexibility: Difficulty in quickly staffing critical maintenance or new development projects due to labor constraints.

Financing and Capital Markets

While not traditional suppliers of goods, financial institutions and capital markets wield significant influence over EDP – Energias de Portugal. These entities provide the essential funding for EDP's extensive infrastructure development, from renewable energy plants to grid modernization. Their terms, including interest rates and loan covenants, directly affect EDP's cost of capital and ability to undertake new projects, effectively acting as a powerful supplier.

In 2024, the cost of capital for energy companies like EDP remained a critical factor, influenced by global interest rate trends and investor sentiment towards the energy sector, particularly renewables. For instance, if central banks maintain higher interest rates, the cost of borrowing for large-scale projects increases, directly impacting EDP's financial flexibility. This leverage held by capital providers means they can dictate terms that either facilitate or hinder EDP's strategic growth initiatives.

- Cost of Capital: Higher interest rates in 2024 increased the expense of debt financing for EDP's capital-intensive projects.

- Lending Terms: Covenants imposed by banks and bondholders can restrict EDP's operational and financial decisions.

- Access to Funding: The overall health and risk appetite of capital markets directly influence EDP's ability to secure necessary investment.

The bargaining power of EDP's suppliers is amplified by the concentration in specialized equipment manufacturing, particularly for renewable energy components. For example, in 2024, the top three global wind turbine manufacturers controlled over half of new installations, giving them significant leverage over their own suppliers.

EDP's reliance on commodity fuels like natural gas and coal for its thermal plants also exposes it to supplier power, as fuel prices are volatile and influenced by global supply, demand, and geopolitical events.

Furthermore, providers of advanced grid management and cybersecurity solutions hold considerable sway due to the unique nature of their offerings and the high switching costs involved, limiting EDP's alternatives.

The scarcity of skilled labor in renewable energy and grid infrastructure, highlighted by IRENA's 2023 report on global worker demand, increases the bargaining power of labor suppliers and specialized contractors.

Financial institutions also act as powerful suppliers, with their lending terms and the cost of capital directly impacting EDP's project financing and growth strategies, as evidenced by higher interest rates in 2024 influencing borrowing costs.

What is included in the product

This analysis dissects the competitive landscape for Edp-energias De Portugal, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and its strategic implications.

Effortlessly identify and address EDP's competitive pressures with a visual breakdown of each force, streamlining strategic planning.

Customers Bargaining Power

For a substantial segment of its retail customers, especially households and smaller businesses, EDP's pricing is governed by regulated markets. In these environments, tariffs are determined or significantly influenced by government agencies, which effectively caps the direct bargaining power of individual consumers. This regulatory oversight means prices are not subject to direct negotiation but are instead dictated by established frameworks.

Large industrial and commercial consumers hold significant sway over EDP due to their substantial energy needs. In 2024, these major clients, often equipped with advanced energy management systems, can negotiate for tailored contracts and more competitive pricing. Their ability to switch suppliers or even consider on-site generation, like solar or combined heat and power, further amplifies their bargaining power.

Customers are increasingly aware of climate change and are actively seeking out green energy options. This growing consciousness means they are more likely to switch to providers offering sustainable solutions, putting pressure on companies like EDP to demonstrate their environmental commitment. In 2023, for instance, renewable energy sources accounted for approximately 62% of electricity generation in Portugal, a significant increase that reflects this customer demand.

Development of Distributed Generation

The increasing adoption of distributed generation, like rooftop solar, is a significant factor in the bargaining power of EDP's customers. As more customers generate their own electricity, their dependence on traditional utility providers naturally decreases. This shift empowers them with a tangible alternative, directly impacting their negotiation leverage.

For instance, in 2024, the European Union saw continued growth in renewable energy installations, with solar PV capacity expanding. This trend means customers have more options for sourcing their power, reducing the necessity to solely rely on established utilities like EDP. The ability to self-generate or purchase from alternative providers strengthens their position.

- Reduced Reliance: Customers generating their own power are less dependent on EDP for electricity supply.

- Alternative Options: The rise of distributed generation provides viable alternatives to traditional energy purchasing.

- Enhanced Negotiation: This increased choice and self-sufficiency directly boosts customer bargaining power against utilities.

- Market Shift: By 2024, the distributed generation market continued its expansion, making these alternatives more accessible and impactful.

Energy Efficiency and Demand-Side Management

Customers are increasingly embracing energy efficiency, significantly impacting utilities like EDP. For instance, the adoption of smart thermostats and energy-efficient appliances directly curtails overall energy demand. This trend is amplified by participation in demand-side management programs, where consumers are incentivized to reduce usage during peak hours.

This shift in consumer behavior, fueled by both environmental consciousness and cost savings, grants customers greater bargaining power. As their reliance on utility-supplied power diminishes, their ability to negotiate terms or switch providers strengthens.

- Reduced Consumption: Widespread adoption of energy-efficient technologies lowers the volume of electricity customers require from EDP.

- Demand-Side Management: Active participation in programs that shift energy usage away from peak times further reduces reliance on traditional utility supply.

- Increased Leverage: Lower overall demand and greater control over consumption empower customers in their interactions with energy providers.

- Technological Advancements: Innovations in smart home technology and appliance efficiency continue to drive down individual energy footprints.

For many residential and small business customers, EDP's prices are set by regulated tariffs, limiting individual negotiation power. However, large industrial clients in 2024, with their significant consumption and ability to explore alternatives like on-site generation, wield considerable influence. This is further amplified by a growing customer demand for green energy, with renewable sources making up a substantial portion of Portugal's electricity mix, encouraging providers to offer sustainable options.

| Customer Segment | Bargaining Power Factors | 2024 Impact |

|---|---|---|

| Residential/Small Business | Regulated tariffs, Limited individual negotiation | Low direct bargaining power; prices set by regulators |

| Large Industrial/Commercial | High consumption volume, Potential for self-generation, Contract negotiation | Significant bargaining power; can negotiate tailored contracts and pricing |

| Environmentally Conscious | Demand for green energy, Willingness to switch providers | Increasing pressure on EDP to offer and highlight sustainable solutions |

| Distributed Generation Users | Rooftop solar, Reduced reliance on utility | Growing leverage due to viable alternatives to traditional supply |

Same Document Delivered

Edp-energias De Portugal Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for EDP-Energias de Portugal, providing an in-depth examination of industry competitiveness. The document you see here is the exact, fully formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

EDP faces fierce competition from established utility giants like Iberdrola, Enel, Engie, and RWE. This intense rivalry is particularly evident in the pursuit of renewable energy projects, where these players vie for market share and technological leadership. For instance, in 2023, the European renewable energy sector saw significant investment, with companies like Iberdrola and Enel making substantial commitments to offshore wind and solar development, directly challenging EDP's growth ambitions.

The global push for renewables has dramatically heated up competition in securing new wind and solar projects, especially through government-run auctions. EDP is up against a wide array of competitors, from established utilities and independent power producers to large investment funds, all vying for these contracts.

This intense bidding environment, a hallmark of 2024, has consequently pressured project profitability, as winning bids often reflect the lowest acceptable prices. For instance, in the United States, offshore wind lease auctions in 2024 saw record-breaking bids, demonstrating the fierce competition for seabed rights.

Ongoing market liberalization across Europe, for instance, has opened up EDP's traditional markets to a wider array of international energy providers. This means EDP now faces competition not just from domestic players, but also from companies like Iberdrola and Enel, which have expanded their reach significantly. The influx of these cross-border operators intensifies the pressure on pricing and service quality.

This increased competition necessitates greater operational efficiency and a more agile strategic approach for EDP. For example, as of early 2024, the European electricity market continues to see consolidation and new entrants, forcing established companies to constantly innovate and optimize their cost structures to remain competitive. EDP must adapt quickly to evolving customer demands and regulatory landscapes driven by these new market dynamics.

Technological Advancements and Innovation Race

The energy sector is experiencing a fierce competition driven by rapid technological progress in areas like renewable energy sources, sophisticated smart grids, and advanced energy storage systems. This innovation race compels energy providers, including EDP Energias de Portugal, to constantly invest in research and development to maintain a competitive edge.

Companies are vying to offer the most efficient, reliable, and integrated energy solutions. For instance, in 2024, global investment in clean energy R&D reached an estimated $200 billion, highlighting the significant resources dedicated to technological advancement.

- Focus on Efficiency: Companies are competing to improve the energy conversion efficiency of solar panels and wind turbines.

- Smart Grid Integration: The race is on to develop and implement smart grid technologies that enhance grid stability and optimize energy distribution.

- Energy Storage Solutions: Innovations in battery technology and other storage methods are crucial for managing the intermittency of renewables.

- Digitalization: Companies are investing in digital platforms for better customer engagement and operational management.

Impact of Government Policies and Subsidies

Government policies and subsidies play a crucial role in shaping the energy sector. For instance, in 2024, many European countries continued to offer significant incentives for renewable energy adoption, impacting the competitive positioning of utilities like EDP. These policies can create both opportunities and challenges, requiring companies to remain agile.

Regulatory frameworks, including those related to carbon emissions and grid access, directly influence operational costs and strategic investments. Changes in these frameworks can quickly alter a company's competitive advantage. EDP, like its peers, must continuously monitor and adapt to these evolving policy landscapes to maintain its market standing.

- Government support for renewables: In 2024, the EU's Renewable Energy Directive aimed to increase the share of renewables in the energy mix, potentially favoring companies heavily invested in green technologies.

- Carbon pricing mechanisms: The EU Emissions Trading System (ETS) continued to impact the cost of carbon-intensive energy generation, influencing investment decisions and operational strategies for companies like EDP.

- Subsidies for grid modernization: Investments in smart grids and energy storage received government backing in several key markets in 2024, creating opportunities for companies with advanced infrastructure capabilities.

EDP faces intense competition from a crowded field of global and regional energy players, particularly in the rapidly expanding renewable energy sector. This rivalry is characterized by aggressive bidding for projects, a race for technological innovation, and strategic maneuvers to capture market share, all amplified by evolving government policies and market liberalization across Europe.

The pursuit of renewable energy projects, especially through government auctions, has intensified competition significantly. EDP competes not only with established utilities but also with independent power producers and investment funds, all vying for contracts. This dynamic has led to pressure on project profitability, as winning bids often reflect the lowest acceptable prices, a trend clearly visible in 2024's record-breaking offshore wind lease auctions in the US.

Technological advancements in renewables, smart grids, and energy storage are fueling this competitive fire. Companies are investing heavily in R&D, with global clean energy R&D investment estimated at $200 billion in 2024, to enhance efficiency, integrate smart grid technologies, and develop advanced storage solutions. This necessitates continuous innovation and cost optimization for EDP to maintain its market position.

| Competitor | Key Focus Areas | 2024 Market Activity Example |

|---|---|---|

| Iberdrola | Renewables (Offshore Wind, Solar), Grid Modernization | Significant investments in offshore wind projects in the North Sea. |

| Enel | Renewables (Solar, Wind), Digitalization, Energy Storage | Expansion of renewable capacity in Latin America and Europe. |

| Engie | Renewables, Energy Services, Decarbonization Solutions | Focus on green hydrogen production and energy efficiency services. |

| RWE | Offshore Wind, Solar, Battery Storage | Acquisition of renewable energy portfolios to expand its global presence. |

SSubstitutes Threaten

The growing adoption of energy-efficient technologies and conservation practices by consumers and businesses acts as a substantial substitute for traditional utility-supplied energy. As buildings improve insulation and appliances become more efficient, the demand for grid electricity naturally declines. For instance, in 2023, the International Energy Agency reported that energy efficiency improvements saved the equivalent of the European Union's total energy consumption from Russia, highlighting its significant impact.

The growing adoption of distributed generation, especially rooftop solar, presents a significant threat to EDP. As more customers generate their own power, their need for electricity purchased from EDP diminishes, directly substituting for traditional supply. In 2023, solar PV installations in Portugal saw substantial growth, with residential sector contributions increasing, indicating a tangible shift towards self-consumption.

While electricity is EDP's core offering, alternative fuels and heating solutions present a significant threat of substitution. For instance, advancements in biomass, geothermal energy, and hydrogen technologies could directly compete with EDP's electricity for heating and industrial processes. In 2023, the global renewable energy market, including these alternatives, saw substantial growth, with investments reaching record highs, indicating a growing appetite for non-electric solutions.

Energy Storage Solutions and Microgrids

The increasing viability of energy storage solutions and microgrids presents a significant threat of substitution for traditional utility-provided electricity. As battery technology advances and costs decline, customers can increasingly generate, store, and manage their own power. This trend is amplified by the proliferation of microgrids, which offer localized energy independence.

These distributed energy resources (DERs) can directly compete with the services EDP currently offers. For instance, battery storage can smooth out intermittent renewable generation or provide backup power, reducing the need for grid-supplied electricity during peak demand periods. By 2024, global investment in energy storage systems is projected to reach tens of billions of dollars, indicating a strong market shift.

- Growing Battery Storage Deployment: The global energy storage market is expanding rapidly, with significant growth in battery installations. For example, the U.S. Energy Information Administration reported that utility-scale battery storage capacity in the United States more than doubled from 2021 to 2023, reaching over 10,000 megawatts.

- Rise of Microgrids: Microgrids are becoming more common, particularly in commercial and industrial sectors, offering enhanced resilience and potential cost savings by operating independently from the main grid.

- Reduced Grid Reliance: These technologies empower consumers to reduce their dependence on the traditional electricity grid, acting as a direct substitute for conventional power supply, especially during outages or high-price periods.

Behavioral Shifts Towards Lower Consumption

Societal shifts are increasingly influencing energy consumption patterns. For instance, the widespread adoption of remote work, which saw a significant surge in 2024, directly reduces the need for office building energy. This behavioral change, coupled with a growing environmental consciousness, acts as a subtle but potent substitute for traditional energy supply.

These evolving consumer behaviors can lead to a structural decrease in overall energy demand. In 2024, for example, reports indicated a plateau in residential electricity demand growth in several developed nations, partly attributed to increased energy efficiency measures and lifestyle adjustments. This reduced demand directly impacts the revenue streams of energy providers like EDP.

- Remote Work Impact: Increased adoption of remote and hybrid work models in 2024 has reduced the energy consumption of commercial buildings.

- Reduced Travel: A sustained trend towards less business and leisure travel in 2024 limits demand for transportation fuels and associated energy infrastructure.

- Environmental Awareness: Growing public concern over climate change in 2024 is driving adoption of energy-saving behaviors and alternative solutions.

- Efficiency Gains: Technological advancements and consumer adoption of energy-efficient appliances and practices continue to lower per-capita energy usage.

The threat of substitutes for EDP is significant, driven by advancements in distributed generation, energy efficiency, and alternative energy sources. The growing adoption of rooftop solar, coupled with increasing energy storage capabilities, allows consumers to generate and store their own power, directly reducing reliance on traditional grid supply. By 2024, global investment in energy storage systems was projected to reach tens of billions of dollars, underscoring this trend.

| Substitute Category | Description | Impact on EDP | 2023/2024 Data Point |

|---|---|---|---|

| Distributed Generation (e.g., Solar PV) | Customers generating their own electricity. | Reduced demand for grid electricity. | Residential solar PV installations in Portugal increased in 2023. |

| Energy Efficiency | Improved insulation, efficient appliances. | Lower overall energy consumption. | Energy efficiency savings in 2023 were equivalent to the EU's total energy consumption from Russia. |

| Alternative Fuels | Biomass, geothermal, hydrogen for heating/industry. | Competition for electricity in specific applications. | Global renewable energy market investments reached record highs in 2023. |

| Energy Storage & Microgrids | Batteries, localized power systems. | Increased energy independence, reduced grid reliance. | US utility-scale battery storage capacity more than doubled between 2021 and 2023. |

Entrants Threaten

The energy sector, especially in power generation, transmission, and distribution, demands massive upfront capital for infrastructure. For instance, building a new large-scale solar farm or upgrading a national grid requires billions. This substantial financial hurdle makes it incredibly difficult for new companies to enter and challenge established players like EDP, who have already made these significant investments.

New entrants in the energy sector, particularly for companies like EDP - Energias de Portugal, encounter a formidable landscape of extensive regulatory hurdles and licensing requirements. These are not minor inconveniences; they are fundamental barriers to entry that significantly deter potential competitors.

Navigating these stringent processes, which include obtaining specific energy generation and distribution licenses, adhering to environmental impact assessments, and complying with rigorous safety standards, demands substantial time, expertise, and capital. For instance, in 2024, the European Union continued to emphasize decarbonization goals, leading to evolving regulations around renewable energy integration and grid modernization, which new entrants must meticulously understand and implement.

These complex and often country-specific regulations act as a robust defense for established players like EDP, who have already invested heavily in compliance and possess the institutional knowledge to manage these requirements efficiently. The sheer administrative burden and the potential for lengthy delays in securing necessary permits create a significant deterrent, protecting market share for incumbents.

The energy sector, particularly for established players like EDP, requires a deep well of specialized knowledge in developing and operating complex assets such as power plants and intricate smart grids. This technical and operational expertise is not easily replicated by newcomers.

New entrants face significant hurdles in rapidly acquiring the necessary skilled workforce and establishing the extensive, interconnected transmission and distribution networks that incumbents have spent years building. For instance, in 2024, the global energy sector continued to see high demand for specialized engineers, with salary premiums reflecting this scarcity.

The sheer scale of investment and the regulatory complexities involved in building out new energy infrastructure further deter potential new entrants. The capital expenditure required for a new large-scale power generation facility alone can run into billions of euros, a barrier that is difficult for unestablished companies to overcome.

Economies of Scale and Scope

Established players like EDP benefit from substantial economies of scale across their operations, from energy generation to procurement and distribution. This allows them to spread fixed costs over a larger output, resulting in lower per-unit costs. For instance, in 2023, EDP's total installed capacity reached over 25 GW, enabling significant purchasing power for fuels and efficient management of its vast infrastructure.

Furthermore, EDP leverages economies of scope by providing a wide array of integrated energy services, spanning renewable energy, grid management, and energy efficiency solutions. This comprehensive offering creates a barrier for new entrants, as replicating such a diverse portfolio and achieving cost competitiveness across all segments is a considerable challenge. The company's 2023 financial reports indicated a strong presence in multiple energy markets, further solidifying its advantage.

- Economies of Scale: EDP's large operational footprint allows for reduced per-unit costs in generation and procurement.

- Economies of Scope: Offering integrated services across the energy value chain creates a competitive advantage.

- Cost Competitiveness: New entrants struggle to match the cost efficiencies achieved by established firms like EDP.

- Infrastructure Advantage: Significant investment in existing infrastructure provides a substantial barrier to entry.

Brand Recognition and Customer Loyalty

Incumbent utilities like EDP often boast deep-rooted customer relationships and strong brand recognition, especially in their retail operations. Newcomers face a significant hurdle in cultivating trust and attracting a substantial customer base without this established history and reputation.

For instance, in 2024, customer switching rates in many European liberalized energy markets remained relatively low, indicating the stickiness of existing provider relationships. New entrants must invest heavily in marketing and service to overcome this inertia.

- Brand Loyalty: Established utilities benefit from decades of service, fostering customer loyalty.

- Customer Acquisition Cost: New entrants face high costs to acquire customers from incumbents.

- Trust Factor: Long-standing presence builds trust, a difficult attribute for new players to replicate quickly.

The threat of new entrants for EDP – Energias de Portugal is significantly mitigated by immense capital requirements, stringent regulatory frameworks, and the need for specialized technical expertise. These factors create substantial barriers, making it exceedingly difficult for new companies to enter the market and compete effectively with established players who have already invested heavily in infrastructure and compliance.

Economies of scale and scope further solidify EDP's position, allowing for cost advantages in generation, procurement, and service offerings that newcomers cannot easily match. Additionally, established customer relationships and brand loyalty provide a protective layer, as new entrants face high acquisition costs and the challenge of building trust in a market where switching can be infrequent.

| Barrier to Entry | Impact on New Entrants | EDP's Advantage |

| Capital Requirements | Extremely High (billions for infrastructure) | Established infrastructure, significant investment capacity |

| Regulatory Hurdles | Complex licensing, environmental, and safety standards | Existing compliance, institutional knowledge |

| Technical Expertise | Need for skilled workforce and operational knowledge | Deep technical and operational experience |

| Economies of Scale/Scope | Difficulty matching cost efficiencies and integrated services | Lower per-unit costs, diverse service portfolio |

| Customer Relationships | High acquisition costs, need to build trust | Brand loyalty, established customer base |

Porter's Five Forces Analysis Data Sources

Our EDP-Energias de Portugal Porter's Five Forces analysis is built upon a foundation of verified data sources, including EDP's annual reports, regulatory filings from Portuguese and European energy authorities, and industry-specific market research reports.