Edp-energias De Portugal Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edp-energias De Portugal Bundle

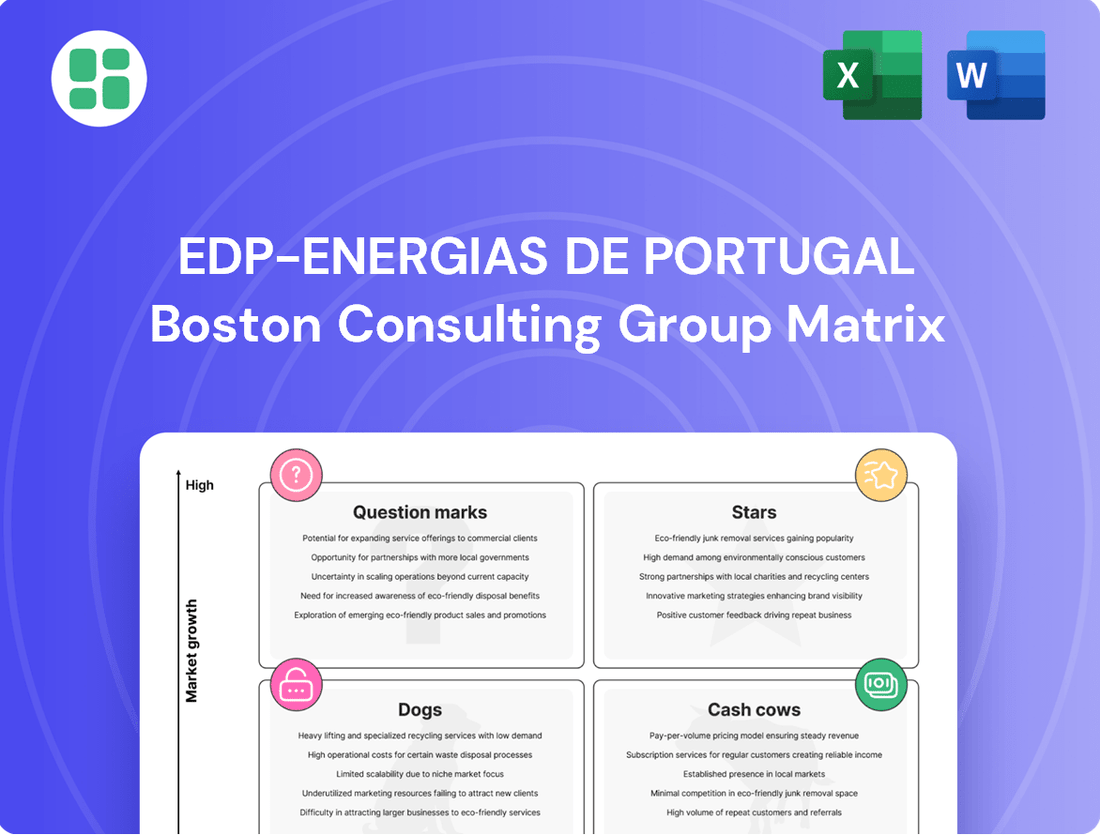

Curious about EDP-Energias de Portugal's strategic positioning? This glimpse into their BCG Matrix reveals the potential of their energy portfolio, hinting at areas of growth and stability.

Unlock the full picture and understand precisely which segments are driving cash flow and which require careful consideration for future investment. Purchase the complete BCG Matrix for a detailed breakdown and actionable insights to guide your own strategic decisions.

Stars

EDP's commitment to offshore wind, through its 50/50 Ocean Winds joint venture, is a significant growth engine. As of early 2024, the company boasts 2.3 GW of installed offshore wind capacity, with an additional 1.0 GW currently under construction. This expansion is fueled by robust global demand for renewable energy and substantial investments in large-scale infrastructure projects aimed at decarbonization.

EDP is making significant strides in utility-scale solar PV development across Europe and North America. In 2024 alone, the company achieved its highest annual capacity expansion, adding 4.0 GW to its portfolio, with solar projects being a primary driver of this impressive growth.

This expansion directly supports EDP's ambitious objective to increase its solar generation capacity tenfold by 2025, positioning it strongly within the rapidly growing solar market. Key development regions include Spain, Italy, and Germany in Europe, alongside substantial projects in North America.

Hybrid renewable energy projects, where EDP is a leader, combine wind and solar power on the same grid connections. This smart approach maximizes the use of existing infrastructure and boosts overall efficiency. For instance, projects like Rabosera in Spain showcase this innovation, contributing to a market that increasingly favors integrated renewable solutions.

This strategy not only enhances the value of EDP's assets but also speeds up the adoption of renewable energy sources. In 2023, EDP announced plans to invest €25 billion in renewables by 2026, with a significant portion likely allocated to these hybrid initiatives, reflecting their growing importance.

Distributed Solar Generation (e.g., Brazil)

EDP is heavily investing in distributed solar generation, with a particular focus on Brazil. The company aims to achieve approximately 500 MWp in this segment by 2026.

This strategic move targets both commercial and residential clients, capitalizing on the burgeoning demand for decentralized energy. It directly supports EDP's broader objective of transitioning to 100% green energy by 2030.

- Market Growth: The distributed solar market in Brazil is experiencing robust expansion, driven by favorable government policies and increasing consumer interest in renewable energy.

- Investment Focus: EDP's commitment extends to developing and operating solar projects for a diverse customer base, enhancing energy independence and reducing carbon footprints.

- Capacity Target: The 500 MWp goal by 2026 signifies a substantial commitment to scaling up operations in this high-potential segment.

- Green Transition: This initiative is a key pillar in EDP's ambitious plan to fully decarbonize its operations by the end of the decade.

Energy Storage Solutions (Batteries)

EDP's commitment to energy storage, particularly battery solutions, positions it strongly in a high-growth sector vital for renewable energy integration. These technologies are key to managing the intermittency of solar and wind power, ensuring grid stability. EDP's investment in a 16 MW storage facility, integrated with renewable assets in the United States, exemplifies this strategic focus.

The energy storage market is experiencing significant expansion. For instance, global battery energy storage system (BESS) deployments are projected to reach hundreds of gigawatts by the end of the decade, driven by the need for grid modernization and decarbonization efforts. EDP's participation in this burgeoning market is crucial for its long-term competitive advantage.

- EDP's Strategic Investment: Actively developing and deploying battery storage to support renewable energy integration and grid stability.

- Growth Potential: The energy storage sector is a rapidly expanding market essential for the future of clean energy.

- Key Projects: Including a 16 MW storage facility co-located with renewables in the US, demonstrating tangible progress.

- Market Significance: Battery storage is critical for enhancing grid flexibility and managing the variable output of renewable sources.

EDP's utility-scale solar PV projects are a clear star in its portfolio. In 2024, the company achieved its highest annual capacity expansion, adding 4.0 GW, with solar being the main driver. This rapid growth is crucial for EDP's goal of increasing solar generation capacity tenfold by 2025.

The offshore wind segment, through its Ocean Winds joint venture, also shines brightly. By early 2024, EDP had 2.3 GW installed offshore wind capacity, with an additional 1.0 GW under construction, supported by strong global demand for renewables.

Hybrid renewable energy projects, combining wind and solar, represent another strong area for EDP, maximizing infrastructure use and efficiency. This strategic approach enhances asset value and accelerates renewable energy adoption.

EDP's focus on distributed solar generation, particularly in Brazil, with a target of 500 MWp by 2026, is a promising growth area. This initiative supports the company's broader objective of transitioning to 100% green energy by 2030.

| Business Area | Status | Key Metric (2024/Early 2024) | Growth Driver | Strategic Importance |

|---|---|---|---|---|

| Utility-Scale Solar PV | Star | 4.0 GW capacity added in 2024 | High global demand, decarbonization investments | Tenfold increase target by 2025 |

| Offshore Wind | Star | 2.3 GW installed capacity | Global renewable energy demand | Significant growth engine |

| Hybrid Renewable Projects | Star | N/A (Strategy) | Infrastructure optimization | Enhances asset value, speeds adoption |

| Distributed Solar (Brazil) | Question Mark/Potential Star | 500 MWp target by 2026 | Favorable policies, consumer interest | 100% green energy goal by 2030 |

| Energy Storage | Question Mark | 16 MW facility deployed (US) | Grid stability, renewable integration | Vital for renewable energy future |

What is included in the product

EDP's BCG Matrix highlights its renewable energy Stars and mature electricity generation Cash Cows, while identifying potential Question Marks in new markets and Dogs in legacy fossil fuels.

The Edp-energias De Portugal BCG Matrix offers a clean, distraction-free view optimized for C-level presentation, simplifying complex strategic decisions.

Cash Cows

EDP's electricity distribution networks in Portugal, Spain, and Brazil function as robust cash cows. These are stable, regulated assets that consistently generate reliable cash flow, a hallmark of a cash cow in the BCG matrix.

In 2024, these vital networks collectively distributed approximately 90 terawatt-hours (TWh) of energy, spanning an impressive 389,000 kilometers. This extensive reach underscores EDP's dominant market share in these regions.

Further solidifying their cash cow status, over €930 million was allocated in 2024 for the expansion and modernization of these networks. This investment ensures continued operational efficiency and a predictable, stable revenue stream, even within markets exhibiting low growth.

EDP's established hydroelectric generation assets in Iberia are a cornerstone of its renewable energy strategy, contributing 25% to its global renewable portfolio as of September 2024. These mature assets are characterized by their stable, high-margin production, driven by favorable hydro conditions and consistent operational performance.

These hydroelectric facilities are key contributors to EDP's recurring EBITDA, underscoring their role as cash cows within the company's diverse energy generation mix. Their long-standing operational history and predictable output make them a reliable source of consistent cash flow, supporting the company's financial stability and investment capacity.

EDP's mature onshore wind farms in Europe and North America, many of which have been operational for over ten years, are prime examples of cash cows. These assets benefit from established market positions and long-term power purchase agreements (PPAs), ensuring stable and predictable revenue generation. For instance, in 2024, EDP Renewables reported a significant portion of its EBITDA coming from its mature wind portfolio in these regions, underscoring their consistent cash-generating capabilities despite potentially slower market growth for new installations.

Retail B2C Operations in Portugal

EDP's retail B2C operations in Portugal represent a classic cash cow within its business portfolio. The company serves over 3 million retail customers, a significant achievement given the increasingly competitive landscape. This established market presence translates into consistent revenue streams from electricity and gas provision.

- Customer Base: Over 3 million retail B2C clients in Portugal.

- Market Position: Incumbent in a mature, competitive market.

- Revenue Generation: Steady cash flow from electricity and gas supply.

- Strategic Value: Provides stable financial backing for other business units.

Conventional Flexible Generation Assets (Iberia)

EDP's conventional flexible generation assets, primarily combined-cycle gas turbines (CCGTs) in Iberia, are vital for maintaining grid stability. These assets are particularly important as Iberia increases its reliance on renewable energy sources, providing crucial ancillary services when renewable output fluctuates.

These CCGTs represent a significant source of reliable financial contributions for EDP, even as the company progresses towards its ambitious goal of being coal-free by 2025 and achieving 100% green energy by 2030. Their current operational performance underpins EDP's financial strength.

Key aspects of these conventional flexible generation assets include:

- Grid Stability: Essential for balancing the grid, especially with high renewable energy integration.

- Ancillary Services: Provide services like frequency regulation and voltage support, ensuring reliable power.

- Financial Contribution: Generate substantial and consistent revenue streams for EDP.

- Transitional Role: Support the energy transition while renewable capacity is scaled up.

EDP's electricity distribution networks in Portugal, Spain, and Brazil are strong cash cows, generating consistent cash flow from stable, regulated operations. These networks, covering 389,000 kilometers and distributing approximately 90 TWh of energy in 2024, demonstrate EDP's significant market presence.

Investments of over €930 million in 2024 for network expansion and modernization ensure continued efficiency and predictable revenue, even in low-growth markets. These mature assets provide a reliable financial base for the company.

EDP's mature onshore wind farms in Europe and North America also function as cash cows. Supported by long-term power purchase agreements, these assets, many operational for over a decade, contribute significantly to EBITDA, as seen in 2024 figures, ensuring stable income despite slower market growth for new installations.

| Asset Type | Key Characteristics | 2024 Data/Significance |

| Distribution Networks (Portugal, Spain, Brazil) | Stable, regulated, high volume | 389,000 km network, ~90 TWh distributed, >€930M invested in modernization |

| Hydroelectric Generation (Iberia) | Mature, high margin, consistent output | 25% of global renewable portfolio (Sept 2024), key contributor to recurring EBITDA |

| Onshore Wind Farms (Europe, North America) | Mature, long-term PPAs, stable revenue | Significant EBITDA contribution from mature portfolio in 2024 |

Delivered as Shown

Edp-energias De Portugal BCG Matrix

The preview you are seeing is the definitive Edp-energias De Portugal BCG Matrix report you will receive upon purchase. This means the analysis, formatting, and strategic insights are identical to the final, watermark-free document. You can trust that the comprehensive breakdown of EDP's business units will be immediately available for your strategic planning and decision-making. This is the exact, professionally crafted report you'll download, ready for immediate application.

Dogs

Decommissioned coal-fired power plants, like those EDP is transforming in Spain, fall into the Dogs category of the BCG Matrix. These assets are in a declining market as EDP phases out coal generation by 2025.

These former power plants, such as Aboño and Puente Nuevo, represent units with low market share in their original coal-fired capacity and no prospect for future growth in that form. Their transformation into green hubs signifies a strategic shift away from legacy, underperforming assets.

EDP has actively pursued asset rotation, divesting smaller, less strategic assets across markets like Spain, Poland, and Italy. For instance, in 2023, EDP completed the sale of its Polish renewable energy assets, which included several smaller solar and wind farms, generating approximately €100 million. These divestitures are crucial for freeing up capital.

EDP Renewables faced a substantial setback in 2024, with a reported loss heavily influenced by impairments on abandoned wind projects in Colombia. This situation clearly places these ventures in the 'dogs' category of the BCG Matrix.

These Colombian wind projects, having been exited by the company, represent a low market share in a struggling or unfavorable market. They consumed capital without generating the anticipated revenue or profits, a hallmark of 'dogs' that drain resources.

Older, Less Efficient Conventional Gas Assets

Older, less efficient conventional gas assets that don't fit EDP's green strategy and face high operating expenses in competitive markets can be classified as 'dogs.' These assets typically have a low market share and limited potential for future growth.

EDP's strategic shift towards renewable energy sources means these older gas plants are slated for decommissioning or repurposing. For instance, in 2024, the European Union's energy landscape continues to emphasize decarbonization, putting pressure on the profitability and longevity of such assets.

- Low Growth Prospects: These older gas plants face declining demand as cleaner energy alternatives become more prevalent.

- High Operational Costs: Inefficient technology leads to higher fuel consumption and maintenance expenses, eroding profitability.

- Strategic Misalignment: EDP's commitment to renewables makes continued investment in these conventional assets unlikely.

- Regulatory Pressure: Environmental regulations and carbon pricing mechanisms further disadvantage these older, less efficient facilities.

Small, Isolated Legacy Operations in Niche Markets

Small, isolated legacy operations within niche markets represent a category of assets that may not align with EDP's strategic direction towards large-scale renewables and regulated networks. These might include minor holdings or older infrastructure with limited growth prospects and low market share.

These operations often require disproportionate management attention or capital investment relative to their contribution to EDP's overall business, and their limited scale can hinder economies of scale. For instance, a small, legacy geothermal plant in a region with declining demand would fit this description.

- Low Market Share: These operations typically hold a negligible share in their respective niche markets.

- Limited Growth Potential: The underlying markets are often mature or declining, offering little opportunity for expansion.

- Non-Core Strategic Fit: They do not contribute significantly to EDP's core strategy of renewable energy generation or regulated utility services.

- Potential Divestment Candidates: Such assets are prime candidates for divestment or minimization to free up resources for more strategic investments.

EDP's 'Dogs' in the BCG Matrix encompass assets like decommissioned coal plants and underperforming older gas facilities. These are characterized by low market share in declining sectors, high operational costs, and a strategic misalignment with EDP's focus on renewables. Examples include the Aboño and Puente Nuevo coal plants undergoing transformation and older gas assets facing regulatory pressure due to decarbonization efforts.

EDP Renewables' ventures, such as the abandoned Colombian wind projects in 2024, also fall into this category, having consumed capital without delivering expected returns. These represent low market share in unfavorable markets, draining resources and highlighting the need for strategic divestment of non-core or legacy operations.

Smaller, isolated legacy operations, like a niche geothermal plant with declining demand, are also considered 'dogs'. They possess negligible market share and limited growth potential, often requiring disproportionate management attention without contributing significantly to EDP's core renewable strategy.

These 'dog' assets are prime candidates for divestment or minimization to free up capital for more strategic investments in EDP's renewable energy portfolio. For instance, the sale of Polish renewable assets in 2023 for approximately €100 million exemplifies this strategy of asset rotation.

Question Marks

EDP is actively investing in green hydrogen infrastructure and innovation, recognizing its potential to become a significant energy source, aiming for it to account for up to 25% of final energy consumption by 2050. This positions green hydrogen as a star in EDP's BCG matrix, representing a high-growth emerging technology where the company is focused on building market share.

The significant capital expenditure required for green hydrogen production, coupled with the current uncertainty surrounding immediate returns, highlights the investment-intensive nature of this venture. EDP's commitment signifies a strategic bet on a future energy paradigm, even with the present high investment needs and potentially longer payback periods.

EDP, recognizing the evolving energy landscape, is actively pursuing advanced energy storage technologies beyond traditional batteries. These innovative solutions, like liquid air energy storage (LAES), represent a potential high-growth area within the broader energy storage market.

While LAES and similar technologies are still in their early stages, with low current market penetration, their future potential is significant. EDP's investment in these nascent fields aligns with a strategy to capture future market share in a rapidly expanding sector. For instance, the global energy storage market is projected to reach hundreds of billions of dollars by the end of the decade, with advanced technologies expected to play a crucial role.

EDP views the Asia-Pacific, specifically Singapore, Japan, and Australia, as promising new market entries. These markets offer a favorable combination of low risk and robust currencies, making them attractive for expansion. In 2024, EDP is actively investing in these regions to establish a stronger foothold and capture market share, recognizing their significant future growth potential.

Digital Transformation & Innovation Projects (e.g., AutoPV)

EDP's significant investment of €2 billion in digital transformation, encompassing smart grids, automation, and novel renewable energy solutions like the AutoPV project for automated solar park construction, positions these initiatives within a high-growth technological sector. While the potential is substantial, their current market share and integration across EDP's broader operations are still in formative stages.

- High Growth Potential: The focus on advanced technologies like automated solar park construction indicates a strategic move into rapidly expanding markets.

- Developing Market Share: Despite significant investment, the widespread adoption and market penetration of these digital solutions within EDP are ongoing.

- Innovation Focus: Projects such as AutoPV represent EDP's commitment to innovation in renewable energy deployment.

- Strategic Investment: The €2 billion allocation underscores the importance EDP places on digital transformation for future growth and efficiency.

Community-Based Solar and Social Energy Transition Projects

EDP is actively participating in community-based solar and social energy transition projects, recognizing their significant growth potential within the social impact sector. A prime example is the 'Mulheres Mil' project in Brazil. This initiative focuses on installing solar energy systems in public schools, thereby broadening access to clean energy for these communities.

Beyond infrastructure, these projects also emphasize human capital development through professional training. While operating in a high-growth social impact area, EDP's current market share in the broader energy market for these specific community initiatives is relatively low. This presents an opportunity for expansion and increased influence in this socially conscious segment of the energy transition.

- Project Focus: Installation of solar energy systems in public schools and provision of professional training.

- Market Position: High growth in social impact area, but low market share in the overall energy market.

- Strategic Goal: Expand access to renewable energy and foster community development.

- Example Initiative: 'Mulheres Mil' project in Brazil.

Question marks in EDP's BCG matrix likely represent emerging technologies or markets where the company is investing but the long-term success and market share are still uncertain. These are areas with high growth potential but also high risk. EDP's exploration into advanced energy storage and new geographic markets, like Singapore and Australia, falls into this category. The significant capital required for ventures like green hydrogen production, coupled with current market uncertainties, also places them in this quadrant. These are strategic bets on the future of energy.

BCG Matrix Data Sources

This BCG Matrix for EDP is built on comprehensive financial statements, industry growth forecasts, and market share data from reputable sources. We also incorporate official company reports and expert analyses to ensure accurate strategic insights.