Edelweiss Financial Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edelweiss Financial Services Bundle

Gain a critical advantage with our comprehensive PESTLE analysis of Edelweiss Financial Services. Understand the intricate interplay of political, economic, social, technological, legal, and environmental factors that are shaping its operational landscape. This expertly crafted analysis provides the deep insights you need to anticipate market shifts and refine your strategic approach. Download the full version now for actionable intelligence that empowers smarter decision-making.

Political factors

The Indian government's ongoing commitment to financial inclusion, exemplified by programs such as the Pradhan Mantri Jan Dhan Yojana (PMJDY) and the Unified Payments Interface (UPI), significantly benefits diversified financial services companies like Edelweiss. These initiatives broaden access to financial products and services, potentially expanding Edelweiss's customer base. For instance, UPI transactions in India reached a staggering 13.42 billion in the first quarter of 2024, indicating a massive shift towards digital payments and financial engagement.

Reforms within the financial sector are also crucial. The Union Budget 2024-25, with its focus on next-generation reforms, is poised to further influence the operational environment for financial institutions. These policy shifts can create new opportunities or necessitate strategic adjustments for firms like Edelweiss to remain competitive and compliant in an evolving market.

The Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) are key regulators for the financial services industry. Their oversight is critical for maintaining market integrity and investor confidence. For instance, the RBI's temporary restrictions on certain Edelweiss entities in May 2024, which were subsequently lifted in December 2024, underscore the dynamic nature of regulatory intervention aimed at ensuring compliance and preventing practices such as evergreening of stressed loans.

The Department of Financial Services (DFS) is actively pushing forward with reforms like the EASE (Enhanced Access and Service Excellence) agenda. This program aims to improve the efficiency and customer service of public sector banks, which indirectly impacts the broader financial ecosystem by setting benchmarks for operational excellence and digital adoption.

These reforms, particularly those targeting risk assessment and Non-Performing Asset (NPA) management, directly shape the regulatory landscape and compliance burdens for institutions such as Edelweiss. For instance, the EASE 4.0 reforms, launched in 2021, emphasized digital customer service, responsible lending, and credit governance, areas crucial for financial service providers.

The continued focus on digital transformation within the EASE framework encourages financial entities to invest in technology for better customer engagement and streamlined operations. This push for modernization means institutions need to adapt their strategies to meet evolving customer expectations and regulatory requirements, potentially leading to increased operational costs but also new avenues for growth.

Global Geopolitical Landscape

Global economic shifts and evolving political landscapes, particularly potential shifts in U.S. trade policies and the imposition of tariffs, can significantly influence capital flows and investment sentiment towards emerging markets like India. For Edelweiss Financial Services, with its significant presence in investment banking and capital markets, staying attuned to these international dynamics is crucial for navigating potential market volatility and identifying opportunities. For instance, a more protectionist stance from major economies could lead to reduced foreign direct investment in India, impacting the deal pipeline and asset management performance.

Edelweiss must closely monitor how changes in global trade agreements and geopolitical tensions might affect India's export competitiveness and overall economic growth trajectory. For example, ongoing trade disputes in 2024 between major economic blocs could create ripple effects, potentially impacting commodity prices and supply chains, which in turn influence corporate earnings and investor confidence in sectors where Edelweiss operates. The company's strategic planning needs to incorporate scenarios reflecting these potential international policy shifts.

- Monitoring U.S. Trade Policy: Changes in U.S. tariffs or trade agreements directly impact India's export-oriented sectors, influencing investment decisions in areas like IT and manufacturing, which are key for Edelweiss's capital markets business.

- Geopolitical Risk Assessment: Increased global instability can lead to a flight to safety, potentially diverting foreign institutional investment away from emerging markets like India, affecting Edelweiss's asset under management and advisory services.

- Impact on Capital Flows: Shifts in global monetary policy, such as interest rate hikes in developed economies, can lead to capital outflows from emerging markets, posing challenges for Edelweiss's wealth management and investment banking divisions.

- Emerging Market Sentiment: The overall perception of emerging markets, often influenced by major political events or economic policy changes in large economies, directly affects investor appetite for Indian equities and debt, a core area for Edelweiss.

Government Support for Digital India

The Indian government's unwavering commitment to Digital India, particularly its emphasis on Digital Public Infrastructure (DPI), creates a fertile ground for financial technology companies like Edelweiss. Initiatives such as Aadhaar for identity verification and the Unified Payments Interface (UPI) have revolutionized digital transactions, making them more accessible and efficient for a wider population.

This digital push directly benefits Edelweiss Financial Services by enabling them to leverage these platforms for innovative, technology-driven solutions. The government's vision aligns perfectly with Edelweiss's strategy to expand its reach and serve a broader customer base through digital channels.

- Digital India's Impact: In FY24, UPI processed over 26.4 billion transactions, valued at ₹39.5 trillion, demonstrating the massive adoption of digital payments.

- Government Investment: The Indian government has allocated significant funds towards developing digital infrastructure, aiming to further boost digital literacy and access.

- Financial Inclusion: DPIs have been instrumental in increasing financial inclusion, with over 500 million Jan Dhan accounts active, many linked to Aadhaar.

- Edelweiss Alignment: Edelweiss's investment in digital platforms and customer onboarding processes directly capitalizes on this government-supported digital ecosystem.

Government policies promoting financial inclusion, such as the Pradhan Mantri Jan Dhan Yojana and the Unified Payments Interface (UPI), are expanding the customer base for financial services like Edelweiss. The Union Budget 2024-25's focus on next-generation reforms signals a dynamic regulatory environment, requiring adaptation from financial institutions.

Regulatory bodies like the RBI and SEBI play a critical role in maintaining market integrity, with their interventions, such as the temporary restrictions on certain Edelweiss entities in May 2024, highlighting the importance of compliance. The EASE agenda, particularly EASE 4.0, drives digital transformation and improved operational efficiency across the financial sector.

Global political shifts and trade policies, including potential U.S. tariffs, can impact capital flows into emerging markets like India, affecting Edelweiss's investment banking and capital markets divisions. Monitoring these international dynamics is crucial for navigating market volatility and identifying opportunities for growth.

What is included in the product

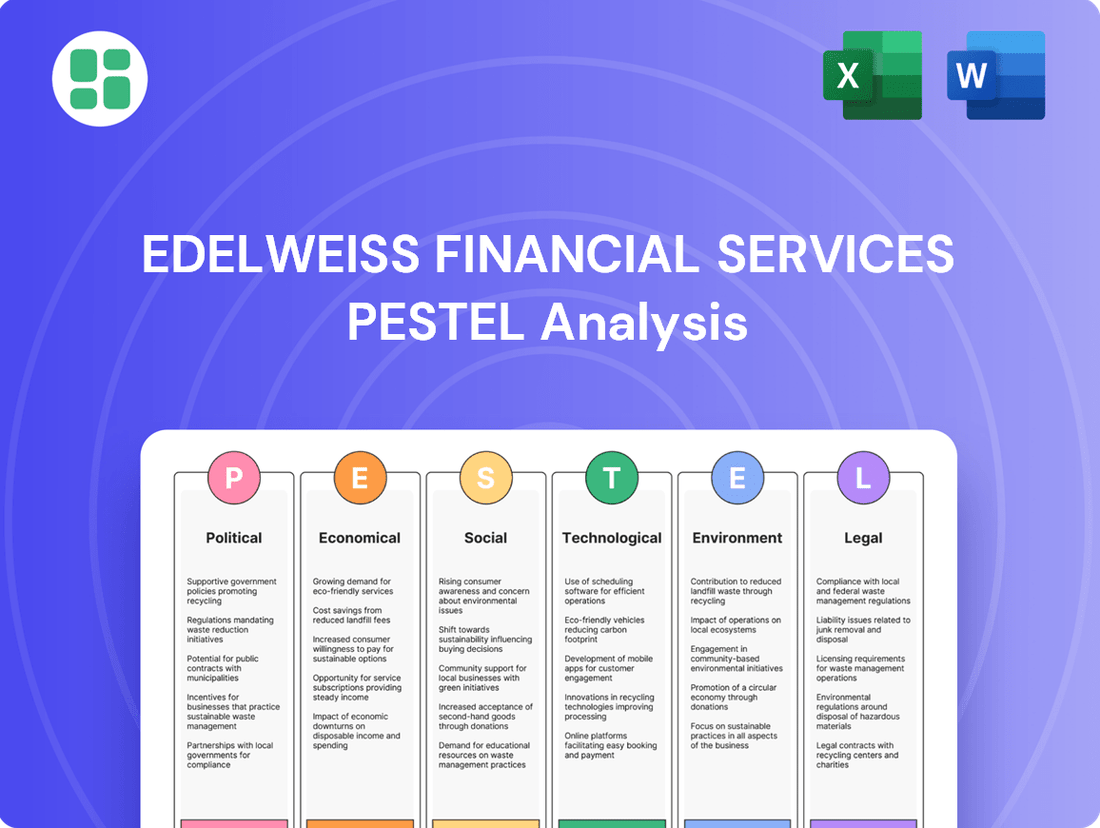

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Edelweiss Financial Services, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, highlighting potential threats and opportunities within the company's operating landscape.

A PESTLE analysis for Edelweiss Financial Services offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during strategic discussions and decision-making.

Economic factors

India's economic trajectory remains strong, with projections indicating it will continue to be a leading growth engine among major economies. For the fiscal year 2025-26, real GDP growth is anticipated to fall within the 6.3% to 6.8% range. This sustained expansion is a significant positive for financial services firms like Edelweiss.

This robust economic expansion directly translates into increased demand across Edelweiss's key business areas. Higher GDP growth typically fuels greater needs for credit facilities, drives investment activity in capital markets, and elevates the demand for expert financial advisory services, all of which are central to Edelweiss's operations and revenue generation.

India's inflation rate has shown a downward trend, with the Consumer Price Index (CPI) easing to 4.83% in April 2024, down from 4.85% in March 2024. This moderation in inflation is paving the way for potential interest rate cuts by the Reserve Bank of India (RBI).

Lower borrowing costs resulting from potential rate cuts are expected to stimulate demand for loans and investments, benefiting financial institutions like Edelweiss. This environment is likely to improve sentiment for both consumers and businesses, encouraging spending and capital expenditure, which directly influences Edelweiss's lending and investment performance.

Indian capital markets are poised for a rebound in the latter half of 2025, with projections indicating a strong earnings recovery fueled by favorable economic tailwinds.

For Edelweiss Financial Services, a robust and resilient capital market performance is fundamental, directly impacting the success of its capital markets and wealth management divisions.

The Nifty 50 index, a key benchmark, has shown considerable volatility but is anticipated to benefit from anticipated GDP growth of around 6.5-7.0% in FY26, supporting market sentiment.

Edelweiss's ability to navigate market fluctuations and capitalize on growth opportunities will be significantly influenced by these broader capital market dynamics.

Credit Demand and Lending Environment

Despite potential regulatory tightening on unsecured loans, the underlying demand for credit in India continues to be robust. Key sectors like Micro, Small, and Medium Enterprises (MSMEs) and affordable housing are showing sustained growth in credit needs. For instance, MSME credit demand is projected to grow significantly, with estimates suggesting a potential market size of over $600 billion by 2025.

Edelweiss Financial Services is well-positioned to leverage this strong credit demand, particularly within its credit business segments. The company's ability to efficiently distribute credit products will be crucial in capitalizing on these opportunities, especially in areas like MSME financing and the burgeoning affordable housing market.

The lending environment, while influenced by regulatory considerations, remains favorable for institutions that can navigate these dynamics. Edelweiss's strategic focus on specific growth segments and efficient distribution channels can help it capture market share.

- MSME Credit Growth: India's MSME credit market is expected to expand substantially, potentially reaching over $600 billion by 2025, indicating strong underlying demand.

- Affordable Housing Demand: The affordable housing segment continues to exhibit high credit demand, driven by government initiatives and rising aspirations.

- Regulatory Impact: While regulatory actions may moderate growth in unsecured lending, the overall credit appetite remains healthy across key economic sectors.

- Edelweiss's Opportunity: Efficient distribution networks and a focused approach on high-demand segments like MSMEs and affordable housing present significant opportunities for Edelweiss's credit business.

Foreign Direct Investment (FDI) Inflows

India's attractiveness to foreign investors has surged, with Foreign Direct Investment (FDI) inflows reaching a record $87.04 billion in the fiscal year 2023-24, a notable increase from the previous year. This robust inflow underscores strong global confidence in India's economic trajectory and its potential for growth. For Edelweiss Financial Services, this heightened investor interest translates into a more dynamic market, offering expanded opportunities for capital raising, mergers and acquisitions advisory, and wealth management services.

The surge in FDI is a positive indicator for the broader financial sector, suggesting increased liquidity and a greater appetite for investment across various asset classes. This environment is conducive to Edelweiss's business model, which spans investment banking, asset management, and retail broking. Specifically, the influx of foreign capital can fuel domestic companies, leading to greater demand for financial advisory and underwriting services. For instance, the automotive sector alone saw significant FDI in 2023, creating ripple effects for financial intermediaries involved in corporate finance and lending.

- FDI Inflows: India recorded $87.04 billion in FDI inflows in FY24.

- Investor Confidence: This signifies strong global belief in India's economic prospects.

- Market Growth: Increased foreign capital stimulates economic activity and capital markets.

- Edelweiss Opportunities: FDI creates avenues for capital raising, M&A advisory, and wealth management.

India's economic growth remains a key strength, with real GDP projected between 6.3% and 6.8% for FY2025-26. This expansion fuels demand across financial services, from credit to capital markets and advisory. Inflation easing to 4.83% in April 2024 could lead to interest rate cuts, further stimulating lending and investment.

Capital markets are expected to rebound in late 2025, supported by economic tailwinds and a projected GDP growth of 6.5-7.0% in FY26, benefiting Edelweiss's capital markets and wealth management divisions. Despite regulatory shifts, credit demand, particularly in MSME and affordable housing sectors, remains robust, with the MSME credit market potentially exceeding $600 billion by 2025.

Foreign Direct Investment (FDI) hit a record $87.04 billion in FY24, signaling strong global confidence and boosting liquidity. This influx creates opportunities for Edelweiss in capital raising, M&A advisory, and wealth management, positively impacting its diverse business segments.

| Economic Indicator | Value/Projection | Impact on Edelweiss |

|---|---|---|

| Real GDP Growth (FY2025-26) | 6.3% - 6.8% | Increased demand for credit, investments, and advisory services. |

| CPI Inflation (April 2024) | 4.83% | Potential for interest rate cuts, stimulating lending and investment. |

| MSME Credit Market Size (by 2025) | > $600 billion | Significant opportunity for Edelweiss's credit business. |

| FDI Inflows (FY2023-24) | $87.04 billion | Enhanced market liquidity, opportunities in capital raising and M&A. |

Full Version Awaits

Edelweiss Financial Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Edelweiss Financial Services delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping Edelweiss's strategic landscape.

Sociological factors

India's drive towards financial inclusion is a significant sociological shift, directly benefiting financial service providers like Edelweiss. By the end of 2023, over 90% of Indian adults had at least one bank account, a testament to initiatives like the Pradhan Mantri Jan Dhan Yojana. This expanding base of banked individuals, coupled with the rapid adoption of digital payment systems, creates a larger and more accessible client pool for Edelweiss's diverse offerings.

The surge in digital adoption, particularly with smartphone penetration reaching over 90% in urban India by late 2024, is fundamentally reshaping financial service consumption. Platforms like Unified Payments Interface (UPI) have become ubiquitous, facilitating millions of daily transactions and demonstrating a clear shift towards digital financial interactions.

Edelweiss Financial Services can capitalize on this by prioritizing digital-first offerings, catering to an increasingly tech-savvy customer base comfortable with online onboarding, trading, and advisory services. This focus aligns with the growing expectation for seamless, accessible digital financial tools.

Consumers are increasingly demanding personalized, convenient, and tech-forward financial services. This includes a growing interest in embedded finance options and AI-powered advisory tools, reflecting a shift towards digital-first interactions across all sectors, including wealth and asset management.

Edelweiss Financial Services must adapt its product suite and service delivery to cater to these evolving consumer expectations. For instance, in wealth management, clients now expect seamless digital onboarding and customized investment portfolios, a trend that gained significant traction in 2024, with reports indicating a 25% year-over-year increase in digital channel adoption for investment services.

The demand for AI-driven financial advice is also on the rise, with many consumers seeking automated, data-driven insights for credit and investment decisions. This preference for efficiency and accessibility means Edelweiss needs to invest in and refine its digital platforms to remain competitive and meet the evolving needs of its client base.

Demographic Dividend and Urbanization

India's demographic dividend, characterized by a young and increasingly tech-savvy population, is a significant driver for financial services. As of 2024, India's median age hovers around 28 years, indicating a vast pool of potential consumers for financial products and services. This youthful demographic is more inclined towards digital platforms and innovative financial solutions, creating a fertile ground for companies like Edelweiss to expand their offerings in areas such as wealth management, digital lending, and insurance.

The ongoing urbanization trend further amplifies this potential. By 2024, over 35% of India's population resides in urban areas, and this figure is projected to climb. Urban centers typically exhibit higher disposable incomes and greater awareness of financial planning needs. This concentration of population in cities fuels demand for a broader spectrum of financial services, including sophisticated investment products, retail banking, and insurance tailored to urban lifestyles and aspirations.

This demographic and urbanization confluence directly translates into increased demand for diverse financial services. Edelweiss Financial Services, for instance, can capitalize on this by offering:

- Tailored investment solutions: catering to the risk appetite and financial goals of a young, growing workforce.

- Digital-first banking and lending: leveraging the tech-savviness of the younger generation.

- Comprehensive insurance products: addressing the evolving needs of urban dwellers, from health to property.

- Financial literacy programs: empowering a large segment of the population to engage more effectively with financial markets.

Focus on Financial Well-being and Advisory

Sociological shifts are significantly impacting the financial services sector, with a notable increase in the demand for enhanced financial well-being and expert advisory. As individuals become more financially literate and their disposable incomes rise, they are actively seeking guidance to manage their wealth effectively. This trend presents a prime opportunity for companies like Edelweiss Financial Services.

Edelweiss's wealth and asset management divisions are strategically positioned to capitalize on this growing need for informed financial planning. For instance, in 2023, India's mutual fund industry saw an inflow of INR 1.74 lakh crore, indicating a strong retail participation and a growing reliance on professional management. This surge underscores the societal shift towards seeking expert advice for investment decisions.

The emphasis on financial well-being is not just about investment growth, but also about long-term security and planning. This is reflected in the increasing popularity of financial advisory services across various demographics. Edelweiss can leverage this by offering tailored solutions that address diverse financial goals, from retirement planning to wealth preservation.

- Growing Demand for Financial Literacy: A recent survey indicated that over 60% of Indian millennials are actively seeking financial education, highlighting a societal push towards better financial management.

- Increased Disposable Income: With rising economic prosperity, more households have surplus funds available for investment and wealth creation, fueling the demand for advisory services.

- Preference for Professional Guidance: The complexity of financial markets and products leads a significant portion of the population, especially younger generations, to prefer consulting financial advisors for informed decision-making.

- Focus on Long-Term Financial Security: Societal trends show a heightened awareness regarding retirement planning and legacy building, driving the need for comprehensive financial advisory services.

India's young and growing population, with a median age around 28 in 2024, represents a significant demographic advantage for financial services. This tech-savvy youth is driving demand for digital-first financial products and personalized investment solutions, creating substantial opportunities for companies like Edelweiss.

Urbanization continues to concentrate wealth and financial needs, with over 35% of India's population residing in cities by 2024. These urban centers foster higher disposable incomes and a greater awareness of financial planning, increasing the need for sophisticated financial services and advisory.

The increasing demand for financial literacy and professional guidance is a key sociological trend, with over 60% of Indian millennials actively seeking financial education. This societal shift towards informed decision-making fuels growth in wealth management and advisory services, areas where Edelweiss is well-positioned.

| Sociological Factor | Description | Implication for Edelweiss | Supporting Data (2023-2025) |

|---|---|---|---|

| Demographic Dividend | Large, young, and increasingly tech-savvy population. | Drives adoption of digital financial services and demand for innovative products. | India's median age ~28 (2024); Over 90% smartphone penetration in urban areas (late 2024). |

| Urbanization | Growing concentration of population in urban centers. | Increases demand for sophisticated financial planning and wealth management services. | Over 35% of India's population urbanized (2024), with continued growth. |

| Financial Literacy & Advisory Demand | Rising interest in financial education and professional guidance. | Boosts wealth and asset management divisions; opportunity for advisory services. | 60%+ millennials seeking financial education; INR 1.74 lakh crore inflow into Indian mutual funds (2023). |

Technological factors

The Indian financial services landscape is rapidly digitizing, with embedded finance, AI personalization, and cloud solutions becoming standard. Edelweiss Financial Services needs to actively embrace these shifts to stay ahead. For instance, the adoption of AI in customer service and risk assessment is projected to grow significantly, with reports suggesting a potential market size of over $15 billion for AI in Indian BFSI by 2026.

Artificial Intelligence (AI) and Machine Learning (ML) are becoming indispensable in the financial sector. For Edelweiss Financial Services, these technologies are key to offering hyper-personalized financial products, streamlining loan approvals with predictive accuracy, and automating savings plans. For instance, in 2024, the adoption of AI in financial services saw a significant uptick, with many institutions reporting improved customer satisfaction scores due to personalized recommendations.

Furthermore, AI and ML are instrumental in bolstering operational efficiency and fortifying risk management. By leveraging these advanced analytics, Edelweiss can enhance fraud detection capabilities, a critical aspect in financial services. Reports from 2025 indicate that companies utilizing AI for fraud detection experienced a reduction in fraudulent transactions by up to 20%, directly impacting profitability and customer trust.

The escalating volume of digital transactions in the financial sector amplifies cybersecurity risks. For institutions like Edelweiss, safeguarding sensitive customer data is paramount to maintaining trust and operational integrity. This necessitates significant investment in advanced security protocols.

Financial firms are increasingly adopting sophisticated measures such as biometric authentication, AI-powered fraud detection systems, and multi-layered encryption to combat evolving cyber threats. These technologies are crucial for protecting against data breaches and ensuring compliance with stringent data protection regulations, which are becoming more rigorous globally.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are increasingly being explored by financial services firms like Edelweiss for operational enhancements. These technologies offer potential for more secure and efficient processes, particularly in areas like customer onboarding and transaction settlements. For instance, integrated Know Your Customer (KYC) processes leveraging blockchain could streamline compliance and reduce duplication of effort across the industry.

The adoption of DLT is still in its developmental stages, but its promise for the future of financial services is significant. Edelweiss could benefit from improved data integrity and faster transaction speeds, potentially reducing costs and increasing customer satisfaction. Early 2024 saw continued investment and pilot programs in this space, with projections suggesting broader integration in the coming years.

- Blockchain for integrated KYC: Reduces onboarding time and enhances data security.

- DLT in trade finance: Streamlines processes like letters of credit, improving efficiency and transparency.

- Enhanced security: Cryptographic principles inherent in blockchain offer robust data protection.

- Potential cost savings: Automation and reduced intermediaries can lead to lower operational expenses.

Cloud Computing and API-based Ecosystems

Cloud-native platforms are transforming how financial services operate, allowing for significant cost savings and flexible infrastructure scaling. This means companies like Edelweiss can adjust their IT resources up or down based on demand, a crucial advantage in the dynamic financial market. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2025, underscoring its widespread adoption and economic impact.

API-based ecosystems are fostering an era of open banking, where financial institutions can easily connect with third-party providers and fintech innovators. This facilitates the seamless integration of new services, enhancing customer experience and operational efficiency. Edelweiss can leverage these APIs to offer more integrated financial solutions and collaborate with a wider network of partners.

By embracing these technological advancements, Edelweiss can significantly boost its agility. This includes faster product development cycles and improved responsiveness to market changes. The ability to partner effectively with fintechs, for example, allows Edelweiss to tap into specialized innovations and reach new customer segments more rapidly, strengthening its competitive position in the evolving financial landscape.

Technological advancements are reshaping the financial services sector, with AI and ML driving personalization and efficiency. By 2025, AI in India's BFSI sector is expected to reach a market size exceeding $15 billion, highlighting its transformative potential. These technologies enable hyper-personalized products, faster loan approvals, and robust risk management, as seen by a 20% reduction in fraudulent transactions reported by AI-utilizing firms in early 2025.

Legal factors

The Digital Personal Data Protection Act (DPDPA), 2023, with its rules expected in 2025, introduces stringent data protection measures for companies like Edelweiss Financial Services. This legislation mandates clear consent mechanisms for data processing and outlines specific obligations regarding data collection, storage, and the rights of data principals, impacting how Edelweiss manages customer information.

Edelweiss must adapt its data handling practices to align with the DPDPA's requirements, which include provisions for data breach notifications and cross-border data transfer restrictions. Non-compliance could lead to significant penalties, underscoring the need for robust data governance frameworks and a thorough understanding of the Act's implications for financial services operations.

Edelweiss Financial Services operates under the watchful eyes of the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), facing strict rules for everything from how they lend money to how they handle asset reconstruction and operate in capital markets. This regulatory environment is crucial for maintaining trust and stability within the financial sector.

The RBI's recent focus on preventing the 'evergreening' of loans, a practice where troubled loans are disguised as new ones to avoid recognition, underscores the critical need for companies like Edelweiss to meticulously follow all regulatory directives. Adherence to these guidelines is paramount for operational integrity and avoiding potential penalties.

Edelweiss Financial Services operates under stringent Anti-Money Laundering (AML) and Know Your Client (KYC) norms, primarily driven by the Prevention of Money Laundering Act (PMLA) and SEBI's KYC regulations. These legal frameworks mandate robust customer due diligence and transaction monitoring to curb financial crimes.

Compliance with these regulations is critical for Edelweiss to maintain its operational license and reputation. For instance, in 2023, Indian financial institutions reported a significant increase in suspicious transaction reports (STRs) filed with the Financial Intelligence Unit-India (FIU-IND), highlighting the heightened regulatory scrutiny and the importance of effective AML/KYC systems.

Corporate Governance Standards

Adherence to robust corporate governance standards is paramount for financial institutions like Edelweiss, directly impacting investor trust and regulatory standing. In 2023, the Securities and Exchange Board of India (SEBI) continued to emphasize stricter governance norms for listed entities, including enhanced disclosure requirements and independent director oversight. Edelweiss’s proactive approach to these evolving standards, especially following past regulatory scrutiny, is critical for its long-term sustainability and market reputation.

Edelweiss's commitment to transparency and ethical conduct is a cornerstone of its operational strategy. For instance, in its FY24 annual report, the company detailed its board composition, audit committee activities, and risk management frameworks, aligning with SEBI's Corporate Governance Code. Maintaining these high standards is not just about compliance; it’s about building a resilient business model that can navigate the dynamic financial landscape.

- Enhanced Board Independence: Edelweiss aims to ensure a majority of independent directors on its board, fostering objective decision-making.

- Robust Risk Management: Implementing stringent internal controls and risk mitigation strategies is key to preventing operational failures and regulatory breaches.

- Shareholder Rights Protection: Upholding the rights of all shareholders through transparent communication and fair treatment is a core governance principle.

New Financial Sector Legislation

The Indian government's emphasis on 'Next Generation Reforms' signals a proactive approach to modernizing financial markets. This includes potential new legislation, such as the introduction of the Variable Capital Company (VCC) structure, designed to attract international investment funds and enhance regulatory clarity. Edelweiss Financial Services will need to adapt to these evolving legal frameworks, which could impact its operational strategies and product offerings in areas like alternative investment funds and asset management.

These legislative shifts are crucial for the financial sector's growth and competitiveness. For instance, the Securities and Exchange Board of India (SEBI) has been actively working on streamlining regulations for Alternative Investment Funds (AIFs) and introducing measures to boost investor confidence. Edelweiss, as a diversified financial services provider, must stay abreast of these changes, ensuring compliance and leveraging opportunities presented by a more robust and transparent legal environment.

Key legislative developments to monitor include:

- Variable Capital Company (VCC) Structure: Potential introduction to offer a more flexible and tax-efficient vehicle for investment managers.

- Digital Assets Regulation: Evolving guidelines for cryptocurrencies and other digital assets could create new compliance requirements and business avenues.

- Insolvency and Bankruptcy Code Amendments: Ongoing refinements to the IBC could affect the company's debt recovery and restructuring operations.

Edelweiss Financial Services operates within a dynamic legal landscape shaped by regulators like the RBI and SEBI, necessitating strict adherence to evolving norms. The Digital Personal Data Protection Act (DPDPA), 2023, with rules anticipated in 2025, imposes significant data protection obligations, requiring robust consent management and data breach notification protocols.

Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, driven by the PMLA and SEBI guidelines, is critical for maintaining operational licenses and reputation, as evidenced by the increasing Suspicious Transaction Reports filed in 2023.

The company must also navigate potential legislative reforms, such as the introduction of the Variable Capital Company (VCC) structure, aimed at attracting foreign investment and streamlining regulations for Alternative Investment Funds (AIFs), as emphasized by SEBI's ongoing efforts to enhance market transparency and investor confidence.

| Legal Factor | Impact on Edelweiss | Key Regulations/Acts | Relevant Data/Trends |

|---|---|---|---|

| Data Protection | Mandates stringent data handling, consent, and breach notification. | Digital Personal Data Protection Act (DPDPA), 2023 | Rules expected in 2025; impacts customer data management. |

| Regulatory Oversight | Governs lending, capital markets, and asset reconstruction. | RBI Act, SEBI Act | Focus on preventing loan evergreening. |

| AML/KYC Compliance | Requires robust customer due diligence and transaction monitoring. | Prevention of Money Laundering Act (PMLA), SEBI KYC Regulations | Increased Suspicious Transaction Reports (STRs) filed in 2023. |

| Corporate Governance | Ensures transparency, independent oversight, and shareholder rights. | SEBI Corporate Governance Code | Emphasis on board independence and enhanced disclosures in FY24. |

| Market Reforms | Introduces new structures and streamlines existing ones. | Potential VCC structure, AIF regulations | SEBI streamlining AIF rules to boost investor confidence. |

Environmental factors

Environmental, Social, and Governance (ESG) investing is rapidly becoming a major trend in India. This is driven by growing interest from both individual investors and large institutions. For Edelweiss Financial Services, this presents a clear opportunity to create and market investment products specifically designed around ESG principles.

The Reserve Bank of India (RBI) has been actively encouraging banks to pinpoint sectors within their loan portfolios that are particularly vulnerable to climate change impacts. This directive aims to foster a more resilient financial system by promoting awareness and proactive risk management.

Complementing this, the Securities and Exchange Board of India (SEBI) has made Business Responsibility and Sustainability Reporting (BRSR) mandatory for the top 1000 listed companies. This move is designed to enhance transparency and accountability regarding environmental, social, and governance (ESG) performance.

These regulatory initiatives are creating a significant impetus for financial institutions like Edelweiss Financial Services to embed ESG considerations deeply into their core operations and strategic decision-making processes, driving a shift towards more sustainable finance practices.

Edelweiss Financial Services, like many global financial institutions, faces growing pressure to integrate climate change risk into its operations. This involves evaluating how physical risks, such as extreme weather events impacting borrower collateral, and transition risks, like policy changes affecting carbon-intensive industries, could affect its investment and lending portfolios.

By 2024, over 90% of S&P 500 companies were reporting on climate-related risks, a trend Edelweiss is likely mirroring. The company may need to conduct detailed assessments on sectors it supports, such as real estate or manufacturing, to understand their vulnerability to climate impacts and regulatory shifts, potentially influencing future lending criteria and investment strategies.

Sustainable Product Opportunities

The financial sector is witnessing a significant surge in demand for sustainable products, with green bonds and climate-resilient investments leading the charge. For Edelweiss Financial Services, this presents a substantial opportunity to broaden its product portfolio and cater to an increasingly environmentally aware clientele. By expanding into these burgeoning markets, Edelweiss can tap into a growing pool of capital seeking ethical and impactful investments.

Global trends underscore the importance of sustainability in finance. For instance, the global green bond market reached an estimated $1.3 trillion in issuance by the end of 2024, a substantial increase from previous years. Edelweiss can leverage this momentum by developing and promoting financial instruments that directly support environmental initiatives and climate adaptation projects, thereby attracting investors focused on long-term value creation and positive societal impact.

- Growing Demand: The market for sustainable finance products is expanding rapidly, driven by investor preference and regulatory tailwinds.

- Product Expansion: Edelweiss can introduce or enhance offerings like green bonds, sustainability-linked loans, and ESG-focused mutual funds.

- Client Attraction: Aligning with global sustainability trends will attract environmentally conscious individual and institutional investors.

- Market Size: The global sustainable finance market is projected to exceed $50 trillion by 2025, presenting a vast opportunity for financial institutions.

Corporate Sustainability and Reporting

Edelweiss's own operational sustainability is becoming a key focus. The company's environmental footprint and reporting practices will face increasing scrutiny from stakeholders. For instance, in 2023, many Indian financial institutions, including those similar to Edelweiss, reported a rise in their Scope 1 and Scope 2 emissions, highlighting the need for robust reduction strategies.

Integrating principles from the Sustainable Development Goals (SDGs) and adopting transparent Environmental, Social, and Governance (ESG) reporting can significantly bolster Edelweiss's reputation. This commitment can foster greater stakeholder trust and potentially attract more environmentally conscious investors.

Key areas for Edelweiss's environmental focus include:

- Energy Consumption: Reducing reliance on fossil fuels in office spaces and data centers.

- Waste Management: Implementing comprehensive recycling and waste reduction programs.

- Supply Chain: Encouraging sustainable practices among its vendors and partners.

- Digital Transformation: Leveraging technology to reduce paper usage and travel-related emissions.

Environmental regulations and the growing emphasis on ESG factors are reshaping the financial landscape. Edelweiss must navigate these evolving standards, particularly concerning climate risk assessment and sustainable reporting, to maintain compliance and capitalize on emerging opportunities.

The push for green finance is undeniable, with global sustainable investment assets projected to reach $50 trillion by 2025. Edelweiss can leverage this trend by offering innovative ESG-aligned products, attracting a wider investor base keen on environmentally responsible investments.

Edelweiss's own operational footprint is under increasing scrutiny, with a focus on reducing energy consumption and waste. By adopting sustainable practices and transparent ESG reporting, the company can enhance its reputation and stakeholder trust, aligning with global sustainability goals.

| Factor | Impact on Edelweiss | Opportunity/Challenge |

|---|---|---|

| Climate Change Risk | Potential impact on loan portfolios and asset valuations due to physical and transition risks. | Develop climate-resilient investment strategies and risk management frameworks. |

| ESG Investing Trend | Growing investor demand for sustainable financial products. | Expand product offerings like green bonds and ESG-focused funds; attract environmentally conscious investors. |

| Regulatory Mandates (RBI/SEBI) | Requirement for climate risk assessment and mandatory Business Responsibility and Sustainability Reporting (BRSR). | Ensure compliance, enhance transparency, and integrate ESG into core business strategy. |

| Operational Sustainability | Need to reduce environmental footprint (energy, waste). | Improve brand image, attract ESG-focused talent, and potentially reduce operational costs. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Edelweiss Financial Services is built on comprehensive data from official regulatory bodies, financial market reports, and economic forecasting agencies. We incorporate insights from government publications, industry-specific research, and reputable news sources to capture the dynamic macro-environmental landscape.