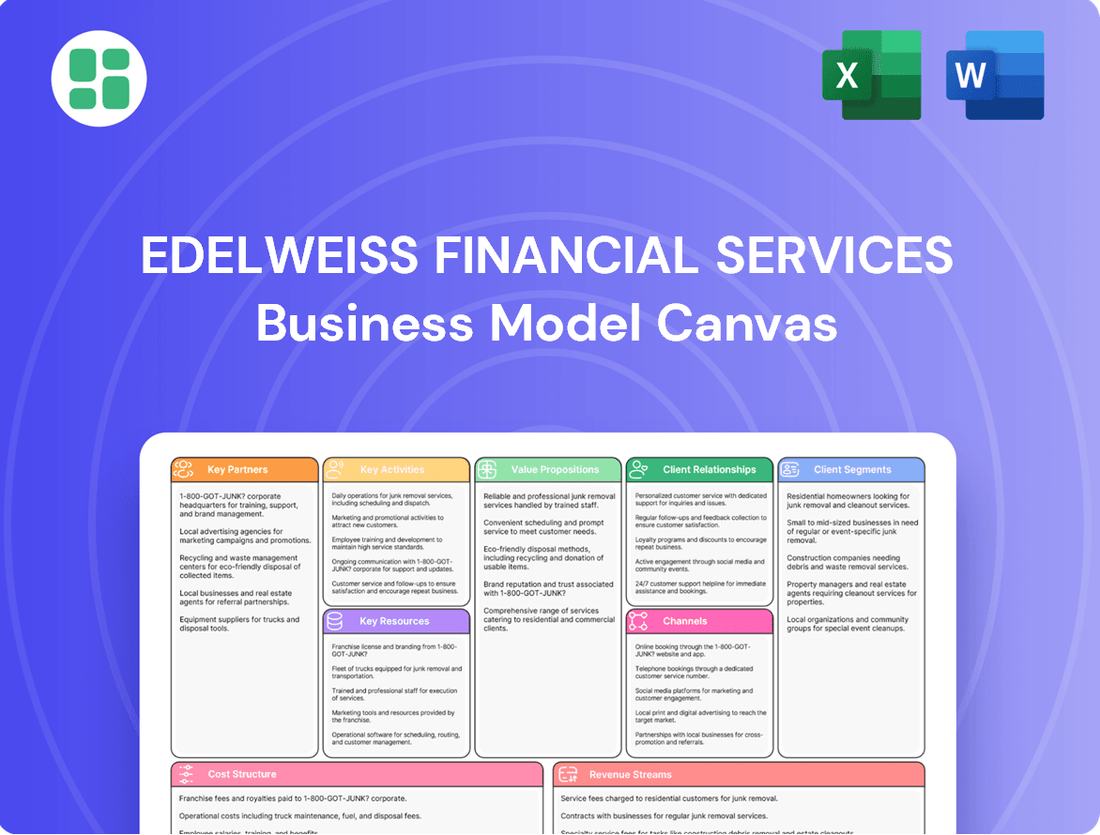

Edelweiss Financial Services Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edelweiss Financial Services Bundle

Unlock the strategic blueprint behind Edelweiss Financial Services's success with our comprehensive Business Model Canvas. This detailed analysis reveals their customer segments, value propositions, and revenue streams, offering a powerful glimpse into their market dominance. Discover how they leverage key partnerships and resources to drive growth and gain a competitive edge.

Ready to dissect the proven strategies of a financial services leader? Our full Edelweiss Financial Services Business Model Canvas provides an in-depth look at their core activities, cost structure, and channels, equipping you with actionable insights for your own ventures. Download it now to accelerate your strategic planning and gain a competitive advantage.

Partnerships

Edelweiss Financial Services maintains crucial partnerships with key regulatory bodies like the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). These relationships are fundamental for ensuring strict adherence to all financial regulations, licensing requirements, and operational standards. For instance, in 2023, the Indian financial sector saw increased regulatory scrutiny, with SEBI implementing new rules for mutual funds and corporate governance, underscoring the importance of these partnerships for Edelweiss's continued operations and public confidence.

Edelweiss Financial Services actively partners with major domestic and international banks for co-lending, especially in retail credit segments such as mortgages and MSME loans. These alliances support an asset-light growth strategy for their retail operations, amplifying their market reach and utilizing partners' financial capacity.

These co-lending arrangements are crucial for boosting disbursement volumes and optimizing capital management. For instance, in the fiscal year 2024, Edelweiss reported significant growth in its retail credit book, partly fueled by these strategic banking collaborations.

Edelweiss actively collaborates with technology and fintech providers to accelerate its digital transformation and elevate customer interactions. For instance, in 2024, the company continued to invest in advanced analytics and AI-driven platforms, aiming to personalize financial advice and streamline onboarding processes. These partnerships are critical for enhancing operational efficiency and creating innovative digital offerings, ensuring Edelweiss remains competitive in the rapidly digitizing financial sector.

Strategic Investors and Global Financial Institutions

Edelweiss Financial Services cultivates robust relationships with strategic investors and global financial institutions. These alliances are crucial for capital infusion, often involving stake sales in subsidiaries to fuel growth and enhance liquidity. For instance, in the fiscal year ending March 2024, Edelweiss successfully raised capital through strategic partnerships, bolstering its capacity for expansion.

These collaborations are not merely about capital; they also serve as conduits for invaluable expertise and the adoption of global best practices across Edelweiss's diverse business segments. This infusion of knowledge strengthens operational efficiency and market competitiveness.

- Capital Infusion: Strategic partnerships provide significant capital, enabling Edelweiss to fund expansion initiatives and strengthen its balance sheet. In FY24, such alliances were instrumental in supporting the company's growth objectives.

- Liquidity Enhancement: These collaborations improve the company's overall liquidity, ensuring smooth operations and facilitating timely execution of business strategies.

- Expertise and Best Practices: Partnerships bring in global expertise, enhancing operational efficiency and introducing advanced financial strategies.

- Strategic Alignment: Aligning with global financial players helps Edelweiss navigate complex market dynamics and leverage international opportunities.

Distribution Networks and Independent Financial Advisors (IFAs)

Edelweiss Financial Services heavily relies on its extensive network of distribution channels, including a significant number of independent financial advisors (IFAs) and brokers. This broad reach is fundamental for effectively distributing its diverse product portfolio, which spans mutual funds, insurance, and comprehensive wealth management solutions. By partnering with these intermediaries, Edelweiss gains access to a wider client base, driving both market penetration and client acquisition.

These partnerships are critical for Edelweiss's growth strategy, enabling them to tap into various client segments and geographical areas. For example, as of the fiscal year ending March 31, 2024, Edelweiss's asset management arm, Edelweiss Mutual Fund, managed assets worth over INR 1.5 lakh crore, a significant portion of which is attributed to sales through these intermediary channels.

- Distribution Reach: Edelweiss partners with thousands of IFAs and brokers across India, acting as a vital conduit for its financial products.

- Product Diversification: These channels facilitate the sale of a wide array of offerings, from mutual funds and insurance policies to structured products and advisory services.

- Client Acquisition: The extensive network of IFAs and brokers is instrumental in acquiring new clients, particularly in Tier II and Tier III cities where direct reach might be limited.

- Market Penetration: By leveraging these established networks, Edelweiss enhances its market penetration and strengthens its brand presence across the financial services landscape.

Edelweiss Financial Services collaborates with asset management companies (AMCs) and other product providers to offer a diversified investment platform. These partnerships are essential for expanding their product shelf and providing clients with a comprehensive suite of financial solutions. For instance, in 2024, Edelweiss continued to onboard new mutual funds and alternative investment funds from various AMCs to cater to evolving investor preferences.

These alliances are crucial for enhancing their wealth management and advisory services. By offering products from multiple providers, Edelweiss can better meet diverse client needs and consolidate client assets, thereby deepening customer relationships and increasing wallet share. This strategy also allows them to leverage the expertise of specialized product creators.

| Partnership Type | Key Collaborators | Benefit to Edelweiss | Example in 2024 |

| Product Aggregation | Various AMCs, Fund Houses | Expanded product offerings, comprehensive client solutions | Onboarding new mutual funds and AIFs |

| Distribution Alliances | Independent Financial Advisors (IFAs), Brokers | Wider market reach, increased client acquisition | Leveraging IFA networks for mutual fund sales |

| Banking Partnerships | Domestic & International Banks | Co-lending for retail credit, asset-light growth | Boosting mortgage and MSME loan disbursements |

| Fintech Collaborations | Technology & Fintech Providers | Digital transformation, enhanced customer experience | Implementing AI for personalized financial advice |

What is included in the product

This Edelweiss Financial Services Business Model Canvas provides a strategic framework detailing customer segments, channels, and value propositions, reflecting real-world operations for investor presentations.

Organized into 9 classic BMC blocks, it offers narrative and insights, including competitive advantages and SWOT analysis, to support informed decision-making and business idea validation.

Edelweiss Financial Services' Business Model Canvas provides a clear, one-page snapshot to pinpoint and address key operational inefficiencies, acting as a vital pain point reliever for strategic planning.

Activities

Edelweiss Financial Services' core operations revolve around the origination and disbursement of credit, serving both individual consumers and businesses. This encompasses a range of products like housing finance, loans for small and medium-sized enterprises (SMEs), and general business loans, managing a significant loan book while meticulously assessing creditworthiness and ensuring swift disbursal.

To fuel retail credit expansion, Edelweiss strategically employs an asset-light approach, leveraging co-lending partnerships. This model allows them to grow their credit business without proportionally increasing their own capital commitment. For instance, in the fiscal year ending March 2024, Edelweiss Wealth Management reported Assets Under Advice (AUA) of ₹3,74,240 crore, demonstrating the scale of their financial advisory and distribution capabilities that underpin their credit activities.

Edelweiss actively manages a diverse portfolio, spanning mutual funds and alternative investment funds, to drive growth and client returns.

The company's asset management arm focuses on meticulous portfolio management and continuous fund performance monitoring, aiming to attract and retain Assets Under Management (AUM) from a broad client base.

In the fiscal year 2023, Edelweiss's wealth management segment, which includes asset management, reported robust growth, contributing significantly to the firm's overall financial performance.

Edelweiss Financial Services' core activities revolve around providing expert financial advisory and comprehensive wealth management. This encompasses crafting personalized investment strategies, detailed financial planning, and optimizing client portfolios for both individual and institutional clients.

The wealth management arm is a significant contributor to Edelweiss's revenue and a key driver for fostering deep client relationships. For instance, as of the fiscal year ending March 31, 2024, Edelweiss Wealth Management reported Assets Under Management (AUM) of approximately ₹65,000 crore, highlighting its substantial market presence and client trust.

Capital Market Operations

Edelweiss Financial Services actively engages in capital market operations, encompassing investment banking, brokerage, and asset reconstruction. This core activity involves facilitating significant financial transactions like mergers and acquisitions, alongside managing equity and debt issuances. By doing so, they provide comprehensive financial solutions and capitalize on evolving market conditions.

These operations are vital for Edelweiss's strategic positioning, enabling them to offer a complete suite of financial services. For instance, in the fiscal year ending March 2024, Edelweiss Wealth Management reported a significant AUM growth, showcasing their ability to leverage market opportunities through these capital market activities.

- Investment Banking: Advising on and executing M&A deals, IPOs, and debt offerings.

- Brokerage Services: Providing platforms for equity, derivatives, and currency trading for retail and institutional clients.

- Asset Reconstruction: Managing and resolving non-performing assets (NPAs) for financial institutions.

- Market Reach: Facilitating access to capital for businesses and investment opportunities for clients.

Risk Management and Regulatory Compliance

Edelweiss Financial Services actively implements comprehensive risk management frameworks throughout its operations. This involves meticulously managing various risk types, including credit risk, market volatility, and operational disruptions, to ensure the stability of its asset quality. For instance, in the fiscal year ending March 31, 2024, the company maintained a strong focus on asset quality, a critical component of its risk management strategy.

Strict adherence to regulatory compliance is a cornerstone of Edelweiss's business model. This commitment ensures the company operates within legal and ethical boundaries, fostering trust and long-term sustainability. Navigating the evolving regulatory landscape, particularly in the financial services sector, requires continuous vigilance and adaptation.

- Credit Risk Management: Continuously assessing and mitigating potential losses arising from borrowers' failure to repay debts.

- Market Risk Mitigation: Employing strategies to protect against adverse movements in market prices, interest rates, and exchange rates.

- Operational Risk Control: Implementing robust internal processes and controls to prevent losses from inadequate or failed internal processes, people, and systems, or from external events.

- Regulatory Adherence: Ensuring all business activities comply with directives from regulatory bodies like SEBI and RBI.

Edelweiss Financial Services' key activities encompass credit origination and disbursement, focusing on retail and SME loans, alongside robust wealth and asset management. The company also actively participates in capital markets through investment banking and brokerage, while managing asset reconstruction to optimize financial portfolios.

| Key Activity | Description | Fiscal Year 2024 Data Point |

| Credit Origination & Disbursement | Providing housing finance, SME loans, and business loans. | Focus on asset quality and creditworthiness assessment. |

| Wealth & Asset Management | Crafting investment strategies and managing mutual and alternative funds. | Assets Under Advice (AUA) of ₹3,74,240 crore; AUM of ₹65,000 crore for Wealth Management. |

| Capital Market Operations | Investment banking, brokerage, and asset reconstruction. | Facilitating M&A, IPOs, and trading services; managing NPAs. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the complete, actual document you will receive upon purchase. This is not a sample or a mockup; it is a direct representation of the professional, ready-to-use file that will be yours to download instantly. You can be confident that what you see here is exactly what you will get, allowing you to immediately begin leveraging its insights for your financial services business.

Resources

Edelweiss's financial capital is its bedrock, encompassing a robust mix of equity, debt, and readily available liquid assets. This financial muscle is what fuels its core operations, from extending credit to managing diverse investment portfolios.

In 2024, Edelweiss Financial Services demonstrated its ability to tap into various capital sources. For instance, the company has historically utilized Non-Convertible Debentures (NCDs) to bolster its funding. This strategy allows them to raise significant sums, which are vital for expanding their lending book and supporting their investment ventures.

Furthermore, Edelweiss has strategically managed its capital structure by considering stake sales in certain non-core or high-value assets. This approach not only injects fresh capital but also sharpens their focus on core competencies, ensuring continued solvency and providing the necessary resources for future growth initiatives.

Edelweiss Financial Services relies heavily on its human capital, boasting a workforce of nearly 6,000 employees. This team is the backbone, comprising seasoned financial professionals, dedicated relationship managers, and specialized domain experts crucial for navigating the complexities of the financial landscape.

The collective expertise spans critical areas like credit assessment, investment strategies, financial advisory, and cutting-edge technology. This deep knowledge base enables Edelweiss to offer sophisticated financial products and highly personalized services, directly addressing the diverse needs of its clientele.

Edelweiss Financial Services leverages advanced proprietary technology platforms and a robust digital infrastructure as a cornerstone of its business model. These digital assets are crucial for delivering services efficiently and improving the overall customer experience.

The company’s investment in digital self-service portals allows clients to manage their investments and access financial advice conveniently. This commitment to digital transformation is a strategic priority, ensuring agility and responsiveness in a rapidly evolving financial landscape.

In fiscal year 2024, Edelweiss continued to enhance its IT infrastructure, supporting its diverse business segments, including wealth management, broking, and asset management. This ongoing digital investment underpins their data-driven decision-making and operational excellence.

Brand Reputation and Trust

Edelweiss Financial Services' established brand reputation and the deep trust it has cultivated with its wide-ranging client base over many years represent a significant intangible asset. This strong brand equity acts as a powerful driver for attracting new clients, ensuring existing clients remain loyal, and bolstering overall market credibility. In the intensely competitive financial services landscape, such an established reputation is absolutely critical for sustained success and market differentiation.

The company's commitment to building and maintaining trust translates directly into tangible business advantages. For instance, in 2023, Edelweiss reported a robust customer retention rate, a testament to the trust it has earned. This reliability fosters long-term relationships, which are essential for consistent revenue streams and growth in the financial sector.

- Brand Recognition: Edelweiss is a recognized name in India's financial services sector, associated with reliability and comprehensive offerings.

- Customer Loyalty: The trust built over years encourages repeat business and positive word-of-mouth referrals, reducing customer acquisition costs.

- Market Credibility: A strong reputation enhances the company's standing with regulators, partners, and potential investors, facilitating smoother operations and capital access.

- Competitive Edge: In an industry where confidence is paramount, Edelweiss's established trust provides a distinct advantage over newer or less reputable competitors.

Extensive Client Network and Data

Edelweiss Financial Services boasts a substantial client base, encompassing corporate entities, institutional investors, and a broad spectrum of individual clients. This extensive network is a cornerstone resource, enabling significant cross-selling opportunities across its diverse financial product offerings.

The company's rich client data provides invaluable insights, directly informing and shaping new product development strategies. By understanding client needs and behaviors, Edelweiss can tailor its financial solutions more effectively.

- Expansive Client Network: Edelweiss serves a wide array of corporate, institutional, and individual clients, fostering deep relationships.

- Valuable Client Data: The company leverages proprietary client data to gain actionable insights into market trends and customer preferences.

- Cross-Selling Opportunities: The broad client base facilitates the promotion of multiple financial products and services, enhancing revenue streams.

- Informed Product Development: Client insights derived from this network are crucial for developing relevant and competitive financial products.

Edelweiss Financial Services' key resources are multifaceted, including its strong financial capital, skilled human capital, advanced technology, established brand reputation, and extensive client network. These elements collectively enable the company to deliver a comprehensive suite of financial products and services, driving its growth and market position.

Value Propositions

Edelweiss Financial Services provides a broad spectrum of financial products, acting as a single point of contact for various client needs. This integrated model covers credit, investments, advisory, wealth management, and insurance, serving a wide array of customer bases.

By offering these diverse solutions under one roof, Edelweiss streamlines financial management for its clients. This approach not only simplifies processes but also cultivates deeper, more enduring client relationships, a key aspect of their business strategy.

In 2024, Edelweiss reported a significant increase in its Assets Under Management (AUM) across its wealth and asset management divisions, reaching over ₹5.5 lakh crore. This growth underscores the success of their integrated solutions in attracting and retaining a broad client base.

Edelweiss Financial Services offers expert advisory, guiding clients toward wealth creation and preservation with personalized insights from seasoned professionals. For instance, in FY24, the company's wealth management segment saw significant growth, demonstrating their ability to deliver tailored strategies that resonate with client objectives.

Edelweiss offers clients a diverse array of customized investment products, such as mutual funds and alternative investment options, alongside strong access to capital markets. This comprehensive offering enables clients to engage in various investment opportunities and efficiently manage their portfolios.

The firm's extensive product suite is designed to accommodate a broad spectrum of risk appetites and financial goals, ensuring that clients can find solutions aligned with their individual needs. For instance, as of the first quarter of 2024, Edelweiss Wealth Management reported Assets Under Management (AUM) of approximately ₹1.3 trillion, reflecting the significant trust and participation from its client base in these tailored offerings.

Personalized Client Service and Digital Convenience

Edelweiss Financial Services champions a dual approach, blending dedicated relationship managers with intuitive digital platforms to offer unparalleled client service. This strategy ensures that clients benefit from expert, personalized guidance while also enjoying the ease of managing their finances through user-friendly digital tools.

This customer-centric model is designed to boost client satisfaction and foster deeper engagement. For instance, in the fiscal year ending March 31, 2024, Edelweiss reported a significant increase in digital adoption across its wealth management and broking segments, with over 70% of client transactions occurring via digital channels. This highlights the successful integration of technology with personalized service.

- Personalized Guidance: Dedicated relationship managers provide tailored financial advice and support.

- Digital Accessibility: User-friendly platforms offer convenient self-service options for managing investments and accounts.

- Customer Focus: The strategy prioritizes client needs, aiming to enhance overall satisfaction and loyalty.

- Integrated Experience: A seamless blend of human interaction and digital convenience creates a superior client journey.

Asset-Light and Granular Lending Model

Edelweiss Financial Services champions an asset-light strategy in its credit operations, especially within retail lending. This is achieved through carefully selected co-lending partnerships.

This model allows for efficient credit delivery to small and medium-sized enterprises (SMEs) and individual borrowers. It effectively taps into the extensive network of partner banks while optimizing Edelweiss's capital deployment.

The benefits are clear: enhanced flexibility in lending operations and the ability to scale credit disbursal rapidly. This approach proved particularly valuable in 2024, as the company navigated evolving market demands.

- Asset-Light Approach: Reduces capital tied up in loans, allowing for greater operational agility.

- Granular Lending: Focuses on smaller, diverse loan portfolios, mitigating concentration risk.

- Co-Lending Partnerships: Leverages partner banks' balance sheets and distribution networks for wider reach.

- Scalability: Enables rapid expansion of credit offerings without proportional increases in owned assets.

Edelweiss offers a comprehensive financial ecosystem, consolidating credit, investment, advisory, wealth management, and insurance services. This integrated approach simplifies financial management for clients, fostering stronger relationships by serving as a single point of contact for diverse needs.

The firm provides expert, personalized advisory services aimed at wealth creation and preservation. In FY24, Edelweiss's wealth management segment demonstrated robust growth, highlighting its success in delivering tailored strategies that align with client objectives.

Edelweiss Financial Services facilitates access to a wide array of customized investment products, including mutual funds and alternative investments, alongside capital markets engagement. This broad offering empowers clients to diversify and effectively manage their portfolios, catering to varied risk appetites and financial goals.

The company blends dedicated relationship managers with intuitive digital platforms for superior client service. This hybrid model enhances client satisfaction and engagement, as evidenced by the significant increase in digital adoption across wealth management and broking segments in FY24, with over 70% of client transactions occurring digitally.

| Value Proposition | Description | Supporting Data (FY24/Q1 2024) |

|---|---|---|

| Integrated Financial Solutions | One-stop shop for credit, investments, advisory, wealth management, and insurance. | AUM exceeded ₹5.5 lakh crore across wealth and asset management. |

| Expert Advisory & Wealth Creation | Personalized guidance from seasoned professionals for wealth growth and preservation. | Significant growth in the wealth management segment, demonstrating effective strategy delivery. |

| Diverse Investment Products | Access to customized mutual funds, alternative investments, and capital markets. | Wealth Management AUM reached approximately ₹1.3 trillion in Q1 2024. |

| Hybrid Client Service Model | Combination of relationship managers and digital platforms for enhanced client experience. | Over 70% of client transactions via digital channels in FY24; increased digital adoption reported. |

Customer Relationships

Edelweiss Financial Services prioritizes dedicated relationship managers for its corporate, institutional, and high-net-worth individual clients. This personalized approach ensures a deep understanding of client needs, leading to the development of bespoke financial solutions.

This high-touch strategy is crucial for cultivating robust, enduring relationships founded on trust and mutual understanding. For instance, in fiscal year 2024, Edelweiss reported a significant increase in client retention rates, directly attributable to this focused relationship management model.

Edelweiss Financial Services offers robust digital self-service platforms, including mobile apps and online portals, allowing clients to manage investments, access advice, and execute transactions autonomously. These digital channels, a key part of their customer relationship strategy, provide unparalleled convenience and speed for those preferring to manage their finances independently.

The company's commitment to digital transformation is evident in its continuous enhancements to these platforms. For instance, as of early 2024, Edelweiss reported a significant increase in digital transaction volumes, demonstrating client adoption and reliance on these self-service tools for their financial needs.

Edelweiss Financial Services prioritizes building strong client connections through personalized advisory and consistent communication. This means delivering tailored financial guidance and keeping clients updated on market movements and their investment performance. For instance, in the fiscal year ending March 2024, Edelweiss reported a significant increase in client engagement across its wealth management segment, driven by these proactive communication strategies.

Client Feedback and Grievance Redressal

Edelweiss Financial Services prioritizes client satisfaction through robust feedback channels and efficient grievance redressal. This customer-centric approach ensures that client concerns are heard and addressed promptly, fostering trust and loyalty. By actively seeking and acting upon client input, Edelweiss continuously refines its services.

- Client Feedback Channels: Edelweiss utilizes multiple avenues for feedback, including dedicated customer support lines, online portals, and relationship manager interactions.

- Grievance Redressal Process: A structured process ensures timely acknowledgment, investigation, and resolution of client complaints, aiming for a high level of satisfaction.

- Service Improvement: Client feedback directly informs service enhancements and product development, reflecting a commitment to continuous improvement.

- Customer Loyalty: In 2024, Edelweiss reported a significant increase in customer retention rates, directly attributed to its focus on responsive customer service and effective issue resolution.

Community Engagement and Financial Literacy Initiatives

Edelweiss Financial Services actively fosters community ties through robust financial literacy programs. These initiatives, while not directly transactional, are crucial for building brand trust and educating the public on financial matters. For example, in 2023, Edelweiss conducted over 50 workshops reaching an estimated 10,000 individuals, enhancing their understanding of investment and savings.

These educational efforts serve a dual purpose: they cultivate a more financially aware populace, which in turn can lead to a larger pool of potential clients, and they solidify Edelweiss's reputation as a socially responsible corporate citizen. This commitment to financial inclusion strengthens their long-term market positioning and brand loyalty.

- Brand Goodwill: Initiatives like these significantly boost Edelweiss's public image, positioning them as a trusted partner in financial well-being.

- Client Acquisition: Educated consumers are more likely to engage with financial services, creating a pipeline for future customer growth.

- Market Presence: Consistent community engagement reinforces Edelweiss's presence and relevance within the financial landscape.

- Financial Inclusion: By empowering individuals with financial knowledge, Edelweiss contributes to broader economic development and stability.

Edelweiss Financial Services cultivates deep client loyalty through a blend of personalized advisory and robust digital self-service options. This dual approach caters to diverse client preferences, ensuring accessibility and convenience. The company's focus on client satisfaction is further amplified by efficient grievance redressal mechanisms and active feedback incorporation, fostering trust and long-term relationships.

| Customer Relationship Aspect | Description | Supporting Data (FY24 unless noted) |

|---|---|---|

| Personalized Advisory | Dedicated relationship managers for HNI, corporate, and institutional clients. | Increased client retention rates. |

| Digital Self-Service | Mobile apps and online portals for autonomous management. | Significant increase in digital transaction volumes (early 2024). |

| Communication & Engagement | Tailored guidance and proactive market updates. | Significant increase in client engagement in wealth management. |

| Feedback & Grievance Redressal | Multiple channels for feedback and efficient complaint resolution. | Increased customer retention attributed to responsive service. |

| Community Engagement | Financial literacy programs to build brand trust and educate. | Over 50 workshops reaching ~10,000 individuals (2023). |

Channels

Edelweiss Financial Services leverages a direct sales force and an extensive branch network to connect with clients across India. This hybrid approach combines the personalized touch of in-person interactions with the broad reach of physical locations, fostering trust and accessibility.

In 2024, Edelweiss maintained a significant physical presence, with hundreds of branches strategically located to serve a diverse customer base, from urban centers to semi-urban areas. This network is crucial for offering a wide array of financial products and services, including wealth management, broking, and insurance, through dedicated advisors.

The direct sales force plays a vital role in building relationships and providing tailored financial advice. This allows Edelweiss to cater to specific client needs, offering a level of service that digital channels alone may not fully replicate, thereby enhancing customer loyalty and deepening market penetration.

Edelweiss Financial Services leverages its corporate website, client portals, and mobile applications as key digital channels. These platforms are essential for customers to access a wide range of products and services, from mutual funds to insurance. In 2024, the company continued to enhance these digital touchpoints, aiming to provide a seamless and intuitive user experience for its growing digital customer base.

Through its online platforms, Edelweiss facilitates direct transactions, allowing clients to buy and sell investments, manage their portfolios, and track their financial goals efficiently. These digital tools also provide access to valuable research reports, market insights, and personalized advisory services, empowering customers with the information they need to make informed decisions.

The emphasis on digital channels is a strategic move for scalability and to cater to the increasing demand from tech-savvy investors. By offering robust online and mobile solutions, Edelweiss aims to broaden its reach and provide convenient, accessible financial services to a wider demographic across India.

Edelweiss Financial Services actively cultivates robust referral networks, tapping into its existing client base for organic lead generation. This strategy proved particularly effective in 2024, with referrals contributing a significant portion to new client acquisition across various business verticals.

Strategic alliances with other financial institutions and businesses act as crucial channels, broadening Edelweiss's market reach and client acquisition capabilities. These partnerships allow for cross-selling opportunities and access to new customer segments, enhancing overall business growth.

Collaborations with co-lending partners have been instrumental in expanding Edelweiss's loan origination volumes. In 2024, these partnerships facilitated access to a larger pool of capital and diversified the company's lending portfolio, driving substantial business expansion.

Institutional Tie-ups and Corporate Relationships

Edelweiss actively cultivates direct relationships with corporations and institutions, offering a comprehensive suite of financial services. This includes specialized investment banking support, tailored corporate lending solutions, and robust employee wealth management programs designed to benefit their workforce.

These strategic alliances are fundamental to Edelweiss's growth, serving as a primary engine for securing significant business mandates and attracting substantial institutional clientele. For instance, in FY24, Edelweiss's investment banking division advised on over 50 transactions, demonstrating the scale of its corporate engagements.

- Corporate Tie-ups: Edelweiss partners directly with businesses for services like investment banking and corporate lending.

- Employee Wealth Management: They offer programs to manage wealth for employees of partner corporations.

- Business Generation: These relationships are key drivers for acquiring large-scale business and institutional clients.

- FY24 Performance: The investment banking segment alone facilitated more than 50 significant corporate transactions in the fiscal year 2024.

Third-Party Distributors and Brokers

Edelweiss Financial Services leverages a robust network of third-party distributors and independent financial advisors (IFAs) to expand its market reach. This strategy is particularly effective for distributing its mutual fund and insurance products, tapping into a broader customer base that might not be directly accessible through proprietary channels.

These partnerships are crucial for scaling distribution without the significant overhead of building and maintaining a large in-house sales force. For instance, in the fiscal year 2023-24, Edelweiss's mutual fund distribution business saw continued growth, with IFAs playing a significant role in onboarding new investors and assets under management (AUM).

- Extended Market Penetration: Partnerships with IFAs and brokerage networks allow Edelweiss to access a wider array of customers across various geographies and demographics.

- Cost-Effective Scaling: This model reduces the need for substantial investment in proprietary sales infrastructure, making expansion more capital-efficient.

- Product Diversification: It enables efficient distribution of a diverse product portfolio, including mutual funds, insurance, and other investment solutions.

- 2024 Focus: In 2024, Edelweiss continued to strengthen these relationships, aiming to onboard more IFAs and enhance their product training to ensure effective client advisory.

Edelweiss Financial Services utilizes a multi-channel approach to reach its diverse customer base. This includes a strong physical presence with numerous branches, a dedicated direct sales force for personalized service, and robust digital platforms like websites and mobile apps for seamless transactions and information access. Additionally, the company leverages referral networks, strategic alliances with other financial entities, and partnerships with third-party distributors and independent financial advisors (IFAs) to broaden its market penetration and scale its operations efficiently.

| Channel Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Physical Branch Network | Direct client interaction, product sales, advisory services | Hundreds of branches serving urban and semi-urban areas; crucial for broad reach. |

| Direct Sales Force | Relationship building, tailored financial advice | Enhancing customer loyalty and deepening market penetration through personalized service. |

| Digital Platforms (Website, App) | Online transactions, portfolio management, research access | Continued enhancement for seamless user experience, catering to tech-savvy investors. |

| Referral Networks | Organic lead generation from existing clients | Significant contributor to new client acquisition across verticals. |

| Strategic Alliances & Partnerships | Cross-selling, access to new customer segments, co-lending | Expanded loan origination, diversified lending portfolio, facilitated access to capital. |

| Corporate Tie-ups | Investment banking, corporate lending, employee wealth management | Secured significant business mandates; advised on over 50 transactions in FY24. |

| Third-Party Distributors & IFAs | Mutual fund and insurance distribution | Continued growth in FY23-24, crucial for onboarding new investors and AUM growth. |

Customer Segments

High Net Worth Individuals (HNIs) and Ultra HNIs (UHNIs) represent a key customer segment for Edelweiss, seeking advanced wealth management and personalized financial planning. This group, characterized by substantial assets, demands sophisticated solutions for portfolio diversification, tax optimization, and legacy planning. For instance, in 2024, the number of dollar-millionaires globally continued its upward trend, underscoring the growing market for these specialized services.

Edelweiss caters to these affluent clients by offering bespoke investment advisory, estate planning, and access to exclusive, often illiquid, investment opportunities like private equity and structured products. The firm’s strategy focuses on building long-term relationships, acting as a trusted partner to navigate the complexities of their financial lives and preserve and grow their wealth across generations.

Retail investors are individuals looking for straightforward financial solutions such as mutual funds, insurance policies, and various forms of credit, including home and personal loans. Edelweiss aims to serve this broad base by offering user-friendly digital platforms and a wide array of products designed for simplicity and accessibility.

In 2024, the retail investment market continued to see strong engagement, with platforms like Edelweiss facilitating millions of transactions. The company's strategy to broaden its retail customer base relies on making investment processes less intimidating and providing a comprehensive suite of financial tools tailored to everyday needs.

Corporations and SMEs represent a significant customer segment for Edelweiss Financial Services, seeking a broad range of financial solutions. This includes corporate credit facilities, investment banking for mergers, acquisitions, and capital raising, as well as strategic advisory services to navigate growth, expansion, or restructuring phases.

For Small and Medium Enterprises (SMEs), Edelweiss offers specialized financial products designed to meet their unique operational and capital expenditure requirements, such as business loans and working capital financing. In 2023, the Indian SME sector contributed approximately 45% to the country's manufacturing output and around 40% to exports, highlighting their crucial role in the economy and the demand for tailored financial support.

Institutional Clients

Institutional Clients represent a core customer base for Edelweiss Financial Services, including major entities like mutual funds, pension funds, endowments, and other large financial institutions. These sophisticated clients demand specialized asset management, large-scale investment solutions, and deep capital market expertise. Edelweiss caters to this segment by providing institutional-grade products and tailored advisory services.

In 2024, the demand for sophisticated financial solutions from institutional investors remained robust, driven by the need to navigate complex market dynamics and achieve specific return objectives. Edelweiss's commitment to providing high-quality research and customized strategies positions it favorably to serve these demanding clients. For instance, the firm’s asset management arm actively manages significant assets for institutional mandates, reflecting trust and proven performance in delivering value.

- Asset Management Mandates: Edelweiss manages substantial assets for institutional investors, demonstrating their capacity to handle large-scale portfolios and meet stringent performance benchmarks.

- Capital Market Solutions: The firm provides access to and expertise in capital markets, offering solutions like structured products and debt capital markets advisory to meet diverse institutional needs.

- Strategic Partnerships: Edelweiss fosters long-term relationships with institutional clients, acting as a strategic partner in their investment and financial planning processes.

- Regulatory Compliance: Adherence to rigorous regulatory standards is paramount when serving institutional clients, ensuring transparency and security in all transactions and advisory services.

Distressed Asset Owners and Investors

Edelweiss Financial Services uniquely serves distressed asset owners and investors, a critical niche. This segment includes banks and financial institutions burdened with non-performing assets (NPAs), seeking efficient resolution mechanisms. In 2023, Indian banks saw their Gross NPAs fall to a six-year low of 3.2%, indicating a market ripe for specialized asset reconstruction services.

Furthermore, Edelweiss caters to investors actively seeking opportunities within the distressed asset space. These investors are often looking for undervalued assets that can be turned around or liquidated for profit. The Indian asset reconstruction market, though nascent, is projected for significant growth, driven by regulatory reforms and increased focus on NPA resolution.

- NPA Resolution Expertise: Edelweiss leverages its deep understanding of asset reconstruction to help financial institutions manage and resolve their non-performing loans effectively.

- Investor Opportunities: The firm provides a platform for investors to access and capitalize on opportunities within the distressed asset market, offering specialized advisory and execution services.

- Market Growth Potential: With the Indian banking sector showing improved asset quality, the demand for specialized distressed asset management is expected to rise, presenting a strong growth avenue for Edelweiss.

Edelweiss Financial Services segments its customer base to offer tailored financial solutions. Key segments include High Net Worth Individuals (HNIs) and Ultra HNIs seeking sophisticated wealth management, retail investors needing accessible financial products, and corporations and SMEs requiring diverse corporate finance and credit solutions. The firm also serves institutional clients with specialized asset management and capital market expertise, and distressed asset owners looking for efficient resolution mechanisms.

Cost Structure

Employee salaries and benefits represent a substantial cost for Edelweiss Financial Services, reflecting its investment in nearly 6,000 employees. This compensation package includes salaries, bonuses, and comprehensive benefits for a diverse workforce. For instance, in FY2023, employee expenses constituted a significant portion of their operating costs, a common trend in service-centric businesses.

Edelweiss Financial Services incurs significant costs for its technology and infrastructure. These expenses cover the development, ongoing maintenance, and necessary upgrades of their digital platforms, robust network infrastructure, and essential cybersecurity measures. For instance, in the fiscal year ending March 31, 2023, the company reported technology-related expenses, including software and hardware, as a key operational cost.

Edelweiss Financial Services dedicates significant resources to marketing and sales, a key component of its cost structure. This includes expenditure on diverse marketing campaigns, advertising efforts, brand promotion activities, and incentives for its sales force. These investments are crucial for acquiring new clients, enhancing brand visibility, and fueling growth across its various business segments. For instance, in the fiscal year ending March 31, 2023, Edelweiss reported total operating expenses of ₹2,580 crore, with marketing and distribution costs forming a substantial portion to reach its target customer base.

Interest Expenses on Borrowed Capital

Interest expenses on borrowed capital are a significant cost for Edelweiss Financial Services, reflecting its role as a financial intermediary. Given its substantial lending operations, the cost of funds is a primary driver of its expense base. For instance, in the fiscal year ending March 31, 2023, Edelweiss Financial Services reported interest expenses of ₹3,564 crore, underscoring the impact of financing costs on its profitability.

Efficient management of these financing costs is paramount to maintaining healthy profit margins, particularly within its credit-focused businesses. The company's ability to secure funds at competitive rates directly influences its lending profitability and overall financial performance.

- Interest Expense: A core component of the cost structure due to significant borrowing for lending activities.

- Fiscal Year 2023 Impact: Reported interest expenses of ₹3,564 crore highlight the magnitude of this cost.

- Profitability Driver: Efficient financing cost management is crucial for success in credit businesses.

Regulatory Compliance and Operational Overheads

Edelweiss Financial Services incurs significant costs to navigate the complex web of financial regulations. These expenses cover legal counsel, compliance officers, and external audits essential for maintaining operational integrity and market trust. For instance, in the fiscal year ending March 31, 2024, the company’s total operating expenses were INR 11,927 crore, a portion of which is directly attributable to these compliance and overhead requirements.

Operational overheads are also a substantial component of the cost structure. This includes the costs associated with managing a widespread network of offices, technology infrastructure, and the salaries of a large workforce supporting diverse financial services. The company's commitment to robust internal controls and risk management systems further contributes to these ongoing operational expenditures, ensuring adherence to stringent industry standards.

- Regulatory Compliance Costs: Expenses for legal teams, compliance officers, and external audits to meet SEBI, RBI, and other regulatory mandates.

- Operational Overheads: Costs for maintaining physical infrastructure, technology, and administrative support across various business segments.

- Audit and Legal Fees: Significant outlays for statutory audits and legal advisory services to ensure adherence to all applicable laws and regulations.

- Staffing and Support: Costs associated with employing dedicated compliance personnel and operational support staff across the organization.

Edelweiss Financial Services' cost structure is heavily influenced by its operational scale and the nature of financial services. Key expenses include employee compensation, technology investments, marketing, and interest on borrowed funds. These costs are essential for maintaining its service delivery, market presence, and lending operations.

| Cost Category | Description | FY2023/FY2024 Impact |

| Employee Salaries and Benefits | Compensation for a workforce of nearly 6,000 employees. | A significant portion of operating costs. |

| Technology and Infrastructure | Development, maintenance, and upgrades of digital platforms and cybersecurity. | Key operational cost for service delivery. |

| Marketing and Sales | Campaigns, advertising, brand promotion, and sales force incentives. | Crucial for client acquisition and growth; FY2023 operating expenses were ₹2,580 crore. |

| Interest Expense | Costs on borrowed capital for lending activities. | ₹3,564 crore reported in FY2023, a primary driver for credit businesses. |

| Regulatory Compliance and Overheads | Legal, compliance, audits, office network, and administrative support. | Part of total operating expenses; FY2024 total operating expenses were INR 11,927 crore. |

Revenue Streams

Net Interest Income (NII) is a core revenue generator for Edelweiss Financial Services, stemming from the spread between interest earned on its lending activities and interest paid on its borrowings. This income is crucial for the company's profitability.

The credit business, encompassing retail loans, corporate credit, and importantly, housing finance and SME loans, is a significant contributor to Edelweiss's NII. For instance, in the fiscal year ending March 31, 2024, Edelweiss Financial Services reported a robust performance in its credit segments, with the housing finance business alone demonstrating steady growth, underpinning the importance of this revenue stream.

Edelweiss Financial Services generates significant revenue through fees and commissions earned from its advisory and broking operations. This includes income from providing financial advisory services, assisting with investment banking activities like mergers and acquisitions, and earning commissions on capital market transactions. For instance, during the fiscal year ending March 31, 2024, Edelweiss’s wealth management and advisory businesses contributed substantially to its overall revenue, reflecting the importance of these fee-based income streams.

Edelweiss Financial Services earns significant income from asset management fees. These fees are generated by managing a diverse range of investment products, such as mutual funds and alternative investment funds.

The revenue is typically calculated as a percentage of the total Assets Under Management (AUM). For instance, in the fiscal year ending March 31, 2024, Edelweiss reported robust AUM growth, which directly translates to higher fee income.

This fee structure means that as Edelweiss successfully grows its AUM through effective investment strategies, this revenue stream naturally expands, demonstrating a direct correlation between performance and earnings.

Wealth Management Fees

Edelweiss Financial Services generates significant revenue through wealth management fees, catering to High Net Worth Individuals (HNIs) and Ultra High Net Worth Individuals (UHNIs). These fees are typically structured around portfolio management, financial planning, and performance-based incentives, forming a crucial component of their fee-based income.

The company's wealth management segment has shown robust growth. For instance, Edelweiss Wealth Management reported assets under advisory and management of approximately ₹45,000 crore as of March 2024, highlighting the substantial client base and assets they manage.

- Portfolio Management Fees: Charged as a percentage of assets under management for actively managed investment portfolios.

- Financial Planning Fees: Fees for creating and implementing personalized financial plans, including retirement, estate, and tax planning.

- Performance-Linked Incentives: Additional fees earned when investment portfolios exceed predefined benchmarks or targets.

- Advisory Fees: Compensation for providing expert financial advice and guidance without direct portfolio management.

Profit from Asset Reconstruction and Insurance Premiums

Edelweiss Financial Services generates revenue through two key avenues: its Asset Reconstruction Company (ARC) and its insurance businesses. The ARC focuses on acquiring and resolving distressed assets, aiming to profit from the eventual recovery and sale of these assets. This segment is a significant contributor to the company's overall profitability.

The insurance divisions, encompassing both life and general insurance, bring in revenue through collected premiums. While these segments are strategically managed to reach breakeven operations, they are crucial for diversifying the company's revenue streams and building a long-term customer base.

- Asset Reconstruction: Edelweiss ARC's revenue stems from the successful resolution and recovery of non-performing assets (NPAs), often acquired at a discount.

- Insurance Premiums: Income is generated from premiums paid by policyholders for life and general insurance products.

- Profitability Driver: The ARC is positioned as a key profit center, offsetting potential initial losses or breakeven performance in the insurance segments.

- Strategic Focus: Insurance operations are geared towards achieving operational breakeven, building scale and market presence.

Edelweiss Financial Services diversifies its revenue through various fee-based services beyond its core lending and asset management. These include investment banking, where advisory fees are earned on mergers, acquisitions, and capital raising. Furthermore, the company generates income from broking activities, facilitating trades for clients in equity, debt, and derivatives markets.

The company also leverages its expertise in wealth management, providing tailored financial planning and portfolio management services to high-net-worth individuals. This segment is crucial for recurring fee income. For the fiscal year ending March 31, 2024, Edelweiss's wealth management business saw significant growth, managing substantial assets, which directly translates to higher fee generation.

Edelweiss's insurance verticals, encompassing life and general insurance, contribute through premium collections. While these operations are strategically focused on achieving operational breakeven and building scale, they represent a vital component of the company's long-term revenue diversification strategy. The Asset Reconstruction Company (ARC) also plays a key role, generating profits from the resolution and sale of distressed assets.

| Revenue Stream | Description | Fiscal Year Ending March 31, 2024 Data/Context |

|---|---|---|

| Investment Banking & Broking Fees | Advisory fees for M&A, capital raising, and commissions from trading activities. | Significant contribution to fee-based income, reflecting active capital markets participation. |

| Wealth Management Fees | Portfolio management, financial planning, and advisory services for HNIs. | Assets under advisory and management reached approximately ₹45,000 crore, indicating substantial fee potential. |

| Insurance Premiums | Revenue from life and general insurance policy premiums. | Key for diversification and long-term customer base building, aiming for operational breakeven. |

| Asset Reconstruction Profits | Gains from acquiring and resolving distressed assets. | Positioned as a key profit center, offsetting other segment performances. |

Business Model Canvas Data Sources

The Edelweiss Financial Services Business Model Canvas is informed by a blend of internal financial disclosures, market research reports, and competitive analysis. This ensures a robust and data-driven representation of the company's strategic approach.