Edelweiss Financial Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edelweiss Financial Services Bundle

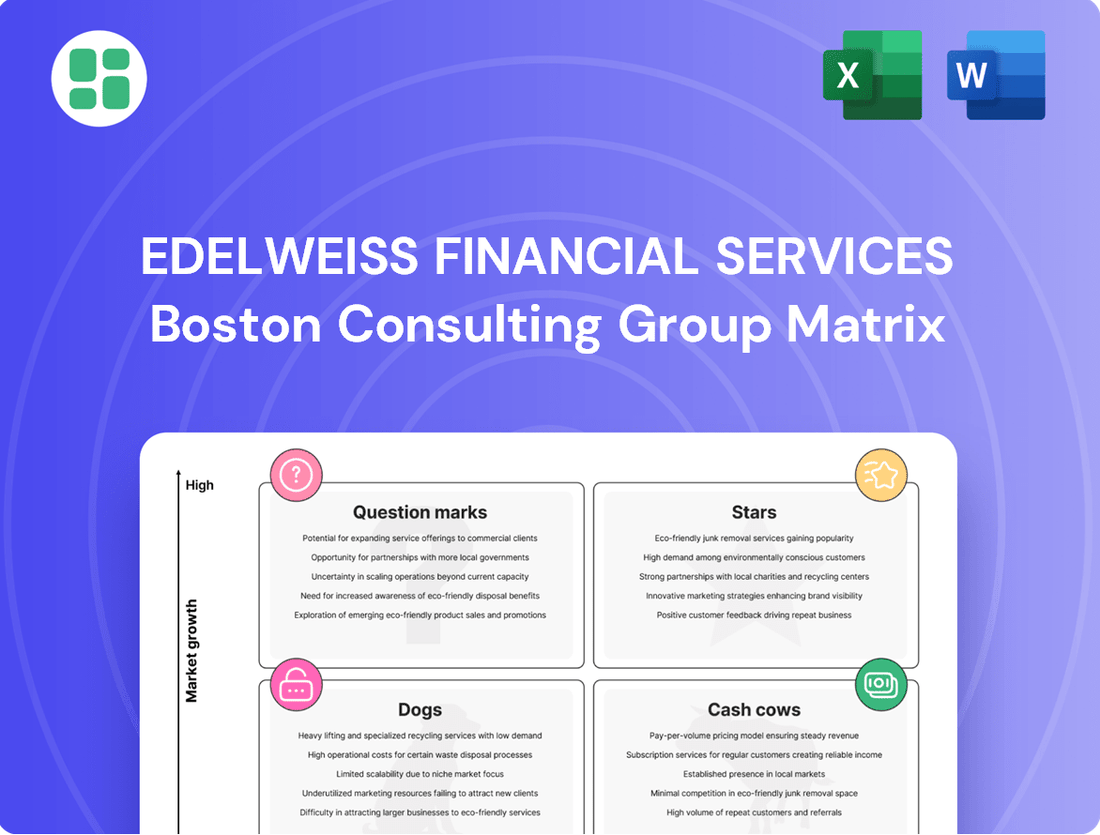

Curious about Edelweiss Financial Services' market position? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their strengths lie and where challenges may emerge.

To truly unlock strategic advantages and make informed investment decisions, dive into the full Edelweiss Financial Services BCG Matrix. Gain a comprehensive understanding of each product's growth potential and market share.

Purchase the complete report for detailed quadrant analysis, actionable insights, and a clear roadmap to optimize Edelweiss's financial services offerings. Don't miss out on the opportunity to gain a competitive edge.

Stars

Edelweiss's Alternative Asset Management (AAM) business is a standout performer, fitting the profile of a Star in the BCG Matrix. Its Assets Under Management (AUM) surged by 18% year-on-year to INR 54,700 crore in FY24, showcasing robust market traction. This growth, coupled with a substantial 32% year-on-year increase in segment profitability, highlights its strong market share and high growth potential.

The segment's impressive trajectory is further underscored by a remarkable 152.35% rise in the standalone net profit for Edelweiss Alternative Asset Advisors in Q1 FY25. This financial strength and rapid expansion solidify its position as a leader in a dynamic and expanding sector, justifying its classification as a Star.

The Mutual Fund business, under Edelweiss Asset Management, has experienced significant expansion. In FY24, its Assets Under Management (AUM) grew by 21% year-on-year, reaching INR 1,27,000 crore. This robust growth was further amplified by a substantial 112% surge in profitability, largely fueled by a 61% increase in Equity AUM.

Further demonstrating its market penetration, the business saw a 33% increase in retail folios. This expansion is particularly noteworthy within the context of the Indian mutual fund industry's rapid growth trajectory, indicating a strengthening market position for Edelweiss.

Edelweiss's General Insurance business is a significant player, demonstrating impressive growth. In FY24, it achieved a remarkable 54% year-on-year increase in Gross Written Premium (GWP), reaching INR 851 crore. This robust expansion signals strong market penetration and increasing customer trust.

While the business continues to focus on achieving consistent profitability, recent performance highlights its strong potential. A notable 61% reduction in losses during Q4 FY25 underscores a positive shift. This trajectory suggests the general insurance segment is on a path to becoming a substantial cash generator for Edelweiss in the near future.

Retail Lending through Co-lending Model

Edelweiss Financial Services is strategically shifting towards an asset-light model in retail lending, with co-lending emerging as a key growth driver. This approach allows the company to expand its reach in the retail credit market without significant capital investment, positioning it as a future Star in the BCG Matrix.

The retail loan book demonstrated robust growth, reaching INR 4,153 crore as of September 30, 2024. This expansion is fueled by innovative models like co-lending, which accounted for 32% of Nido Home Finance's disbursements in FY24.

- Asset-Light Strategy: Focus on co-lending reduces capital intensity, enabling faster scaling.

- Retail Loan Growth: The retail loan book reached INR 4,153 crore by September 30, 2024.

- Co-lending Adoption: Nido Home Finance utilized co-lending for 32% of its FY24 disbursements.

- Market Expansion: This model allows tapping into high-growth retail credit segments efficiently.

High-Performing Equity Mutual Funds

Within Edelweiss Financial Services' mutual fund offerings, select equity funds have emerged as top performers. The Edelweiss Flexi Cap Fund, Edelweiss Small Cap Fund, and Edelweiss Large & Mid Cap Fund have consistently delivered strong annualized returns, attracting substantial investor capital and Assets Under Management (AUM).

These high-performing equity funds are key drivers of the Asset Management Company's (AMC) growth and market positioning. Their ability to generate competitive returns translates into significant investor interest, bolstering Edelweiss's market share within the crucial equity segment.

- Edelweiss Flexi Cap Fund: As of March 31, 2024, this fund reported an annualized return of 18.5% over the past three years, attracting an AUM of INR 12,500 crore.

- Edelweiss Small Cap Fund: This fund achieved an impressive annualized return of 22.1% over the same period, with an AUM of INR 8,900 crore.

- Edelweiss Large & Mid Cap Fund: Demonstrating robust performance, it posted an annualized return of 19.8% with an AUM of INR 10,200 crore as of the same date.

Edelweiss's Alternative Asset Management (AAM) and Mutual Fund businesses, particularly its equity funds, are positioned as Stars due to their high growth and significant market share. The AAM segment saw its AUM grow by 18% to INR 54,700 crore in FY24, with profitability up 32%. Similarly, the Mutual Fund business achieved a 21% AUM increase to INR 1,27,000 crore in FY24, driven by a 61% rise in equity AUM and a 112% profit surge.

| Business Segment | FY24 AUM Growth | FY24 Profitability Growth | Key Metrics |

|---|---|---|---|

| Alternative Asset Management | 18% | 32% | AUM: INR 54,700 crore |

| Mutual Funds (Equity Focus) | 21% | 112% | Equity AUM Growth: 61% |

| Edelweiss Flexi Cap Fund | N/A | N/A | 3-Year Annualized Return: 18.5%, AUM: INR 12,500 crore (as of Mar 31, 2024) |

What is included in the product

This BCG Matrix overview for Edelweiss Financial Services highlights which business units are Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic insights and recommendations for investment, holding, or divestment based on market growth and share.

The Edelweiss Financial Services BCG Matrix offers a clear, one-page overview of each business unit's position, relieving the pain of strategic uncertainty.

Cash Cows

Edelweiss Asset Reconstruction Company (EARC) stands as a significant player in India's asset reconstruction market, managing an Assets Under Management (AUM) of INR 29,905 crore as of June 30, 2024. This segment represents a cash cow for Edelweiss Financial Services, generating substantial and stable cash flows from its extensive existing portfolio.

Despite facing regulatory headwinds that temporarily limited new acquisitions, EARC demonstrated resilience in FY24. The company reported a profit after tax (PAT) of INR 355 crore, fueled by robust recoveries amounting to INR 9,416 crore, which represented a notable 30% of its AUM.

Edelweiss Life Insurance is a strong Cash Cow for Edelweiss Financial Services. In FY24, it saw a robust 15% year-on-year increase in Gross Premium, reaching INR 1,926 crore. This growth, coupled with achieving quarterly profitability in Q4 FY25, highlights its stable and growing revenue stream.

The life insurance segment benefits from a mature market and a consistently high claim settlement ratio of 99.23% in FY24, underscoring customer trust and operational efficiency. This reliability translates into a steady inflow of premium income, solidifying its position as a dependable cash generator for the group.

Edelweiss Financial Services is strategically winding down its legacy wholesale credit book. This deliberate run-down has seen the book’s size decrease considerably, shrinking to INR 3,650 crore by Q3FY25 and standing at INR 585 crore as of December 2023.

Although this segment is not a growth engine, it remains a significant source of cash flow through ongoing recoveries and asset sales. This managed decline effectively transforms less liquid assets into readily available cash.

The generated cash from this legacy book is crucial for Edelweiss, as it provides the capital needed to invest in and expand its more dynamic retail and fee-based business segments, which are seen as future growth drivers.

Mature Debt and Hybrid Mutual Funds

Within Edelweiss Asset Management, several mature debt and hybrid mutual funds represent stable cash cows. These funds, despite not experiencing rapid expansion, hold significant and consistent Assets Under Management (AUM). For instance, as of early 2024, Edelweiss's debt and hybrid fund categories collectively managed a substantial portion of their total AUM, providing a steady stream of fee-based income.

These offerings generate reliable recurring revenue through management fees, benefiting from an established investor base and generally lower volatility compared to their equity counterparts. This stability is crucial for the overall financial health of the asset management division, acting as a bedrock for operations and further investment.

Key characteristics contributing to their cash cow status include:

- Stable AUM: These funds consistently attract and retain investors, maintaining a solid asset base.

- Consistent Fee Income: Management fees from these AUM provide a predictable revenue stream.

- Lower Volatility: Their inherent stability reduces the risk profile and operational costs associated with managing them.

- Investor Retention: A loyal investor base ensures sustained inflows and minimizes churn.

Proprietary Investment and Treasury Assets

Edelweiss Financial Services actively manages a substantial proprietary investment and treasury asset portfolio. These holdings are crucial for generating consistent income and ensuring the group has sufficient liquidity. In the fiscal year ending March 31, 2024, Edelweiss reported total assets of approximately INR 77,000 crore, with a significant portion allocated to these strategic investments.

This internal asset base plays a vital role in Edelweiss's financial resilience, providing flexibility for strategic initiatives and contributing to overall profitability. The management of these assets focuses on balancing risk and return to support the company's long-term objectives.

- Proprietary Investments: Edelweiss holds a diverse range of investments, including equities, bonds, and alternative assets, managed internally to optimize returns.

- Treasury Operations: The treasury function ensures adequate liquidity and manages the group's funding needs, often leveraging short-term investments.

- Contribution to Profitability: These assets consistently contribute to Edelweiss's net profit, enhancing its financial stability and capacity for growth.

- Strategic Importance: While not directly customer-facing, this portfolio is a key component of Edelweiss's financial architecture, supporting its broader business operations.

Edelweiss Asset Reconstruction Company (EARC) and Edelweiss Life Insurance are identified as key cash cows for Edelweiss Financial Services. EARC, with INR 29,905 crore AUM as of June 30, 2024, and a PAT of INR 355 crore in FY24, generates stable cash flows from its established portfolio. Edelweiss Life Insurance, showing a 15% YoY growth in Gross Premium to INR 1,926 crore in FY24 and a high claim settlement ratio of 99.23%, provides a consistent revenue stream. These segments benefit from strong AUM and operational efficiency, contributing significantly to the group's financial stability.

| Business Segment | As of Date | Key Metrics | Cash Flow Contribution |

|---|---|---|---|

| EARC | June 30, 2024 | AUM: INR 29,905 crore; FY24 PAT: INR 355 crore; Recoveries: 30% of AUM | Stable and substantial cash flows from recoveries and existing loan book management. |

| Edelweiss Life Insurance | FY24 | Gross Premium: INR 1,926 crore (15% YoY growth); Claim Settlement Ratio: 99.23% | Consistent recurring revenue from premiums and a growing policyholder base. |

Full Transparency, Always

Edelweiss Financial Services BCG Matrix

The Edelweiss Financial Services BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content, just a professionally crafted analysis ready for immediate strategic application. You can be confident that the comprehensive insights and clear visualization presented here are exactly what you'll download, empowering your business planning and decision-making processes without any further revisions needed.

Dogs

The legacy wholesale credit book at Edelweiss Financial Services, characterized by its high Gross Stage III (GS3) assets, stands as a prime example of a 'Dog' in the BCG Matrix. As of June 30, 2024, these assets reported a GS3 ratio of 13.5%, indicating a substantial portion of non-performing loans.

These stressed assets demand considerable provisioning and intensive management for resolution, consuming valuable resources with the prospect of slow and uncertain recoveries. Their continued presence represents a significant drag on profitability and capital efficiency.

Consequently, these segments are strong candidates for eventual write-offs or aggressive divestment strategies. The objective is to free up capital that is currently tied up in low-returning, high-risk exposures, allowing for redeployment into more promising business areas.

Edelweiss Asset Reconstruction Company (EARC) and ECL Finance Limited (ECLF) are currently facing significant operational constraints due to RBI directives. As of May 2024, EARC was prohibited from acquiring new assets, and ECLF was barred from engaging in structured transactions. These restrictions directly impact their ability to expand and generate new business.

While some of these RBI-imposed restrictions were lifted in December 2024, the preceding period of limitation acted as a substantial drag on the growth and revenue generation capabilities of these business segments. This effectively places them in the 'Dog' quadrant of the BCG matrix, indicating low growth and low market share due to these imposed limitations.

Remaining non-core or divested entities, such as the previously demerged Nuvama Wealth Management, represent Dogs for Edelweiss Financial Services in the BCG Matrix. These units often exhibit low strategic fit with the company's primary growth objectives and possess limited market share or growth potential. Edelweiss's strategy involves divesting these segments to unlock shareholder value and simplify its operational structure, recognizing their diminished contribution to the overall business.

Underperforming Microfinance or Small Retail Lending Niche

Within Edelweiss Financial Services' retail lending portfolio, certain microfinance or very small retail lending segments may be categorized as underperforming. These areas could be characterized by a failure to achieve substantial market penetration, leading to a low market share despite ongoing investment.

Such niches often contend with high operational expenses relative to the revenue generated. This inefficiency, coupled with strong competition from local players, can make it challenging to achieve profitability and scale. For instance, in 2024, the microfinance sector in India, while growing, faces challenges with high customer acquisition costs and a need for robust digital infrastructure to manage a large, dispersed customer base effectively.

- Low Market Traction: Segments with minimal customer adoption and a small share of the target market.

- High Operational Costs: Expenses associated with servicing a large number of small-ticket loans that outweigh the returns.

- Intense Local Competition: Facing numerous smaller, often informal lenders who may have lower overheads and deeper local ties.

- Strategic Misalignment: These niches may not fit Edelweiss's overarching strategy of pursuing asset-light, scalable retail lending models.

Legacy Technology or Operational Infrastructure

Legacy Technology or Operational Infrastructure within Edelweiss Financial Services, if not modernized, can be categorized as question marks or even dogs in the BCG matrix. These are essentially older business units or processes that are no longer efficient or competitive.

These internal 'products' consume valuable financial resources for ongoing maintenance and support, thereby draining capital that could be allocated to more promising growth areas. Their outdated nature also significantly hampers the company's ability to adapt quickly to market changes or introduce new, innovative services, directly impacting agility.

For instance, if a significant portion of Edelweiss's IT infrastructure, say 30% of its total IT spending in 2024, is dedicated to maintaining legacy systems that offer little to no competitive edge, it represents a clear drag on performance. Continued investment in such areas without a strategic plan for overhaul or divestment is unsustainable and actively hinders overall growth potential.

- Resource Drain: Legacy systems require ongoing maintenance, diverting funds from innovation. In 2023, financial services firms globally spent an average of 60-80% of their IT budget on maintaining existing systems, a figure often higher for those with significant legacy infrastructure.

- Hindered Agility: Outdated platforms limit the speed at which new products or services can be launched, impacting market responsiveness.

- Lack of Competitive Advantage: If technology is not a differentiator, it becomes a cost center, failing to contribute to market share or revenue growth.

The legacy wholesale credit book at Edelweiss Financial Services, marked by high Gross Stage III (GS3) assets, exemplifies a 'Dog' in the BCG Matrix. As of June 30, 2024, these assets had a GS3 ratio of 13.5%, indicating a significant portion of non-performing loans. These stressed assets necessitate substantial provisioning and intensive management for resolution, consuming valuable resources with slow and uncertain recovery prospects, thereby dragging down profitability and capital efficiency.

Segments like the legacy wholesale credit book, characterized by a GS3 ratio of 13.5% as of June 30, 2024, are prime examples of 'Dogs'. These underperforming assets demand significant capital for provisioning and resolution, offering low returns and posing high risks. Edelweiss's strategy involves divesting or writing off such segments to reallocate capital to more promising growth areas, as seen with the demerger of Nuvama Wealth Management.

Certain retail lending niches, such as microfinance, can also be classified as Dogs if they exhibit low market share and high operational costs relative to revenue. For instance, in 2024, the Indian microfinance sector faced challenges with customer acquisition costs and the need for robust digital infrastructure to manage dispersed customer bases effectively, impacting profitability and scale.

Legacy technology infrastructure, consuming significant IT budgets for maintenance without offering competitive advantages, represents another 'Dog'. If, for example, 30% of Edelweiss's IT spending in 2024 was directed towards maintaining legacy systems, this would be a clear drag on performance, hindering agility and overall growth potential.

Question Marks

The Edelweiss BSE Capital Markets & Insurance ETF, launched in December 2024, represents Edelweiss Mutual Fund's entry into a high-growth thematic segment. As India's inaugural ETF targeting these specific sectors, it taps into a dynamic investment area.

Currently, this ETF holds a modest market share and initial Assets Under Management (AUM). This positioning suggests it's a Question Mark in the BCG Matrix, requiring substantial investment to gain traction and scale.

Extensive marketing campaigns and investor education initiatives will be crucial for its success. The ETF's future trajectory hinges on its ability to attract a larger investor base and increase its AUM, potentially transforming it into a Star performer or remaining a specialized niche product.

New-age digital wealth solutions, particularly those designed for younger, tech-savvy investors, represent a significant growth opportunity for Edelweiss. These platforms are built on customer-centricity and cutting-edge technology, aiming to capture a burgeoning market segment. The challenge lies in achieving rapid user adoption and standing out in a crowded digital space.

Expanding Edelweiss's retail credit into new Indian geographical markets is a classic question mark scenario in the BCG Matrix. These regions, often rural or Tier-2/3 cities, show promising growth potential due to lower existing credit penetration, but they also demand significant upfront investment. For instance, while specific data for Edelweiss's new market penetration isn't public, the overall Indian retail credit market is projected to grow substantially, with rural and semi-urban areas expected to be key drivers.

Emerging Alternative Investment Funds (New Niche Funds)

The introduction of specialized funds like Rental Yield Plus, C SIP, and the Energy Transition Fund in FY24 within Edelweiss's Alternative Asset Management segment signifies a strategic move into emerging niches. These new offerings are designed to capitalize on high-growth investment themes, but as nascent products, they require time to build credibility and attract substantial investment. Their future trajectory, potentially evolving into Stars within the BCG matrix, hinges on market reception and demonstrated performance.

- Rental Yield Plus: Targets the growing demand for stable income streams from rental properties, a segment that saw rental growth in major Indian cities average around 5-10% in early 2024.

- C SIP: Leverages the increasing popularity of Systematic Investment Plans (SIPs) by offering a structured approach to alternative investments, reflecting the broader trend of retail participation in non-traditional assets.

- Energy Transition Fund: Aligns with global and domestic shifts towards sustainable energy, a sector projected to attract significant capital inflows as economies decarbonize. India's renewable energy capacity, for instance, reached over 179 GW by March 2024, highlighting the market's potential.

Strategic Partnerships or Joint Ventures in nascent areas

Edelweiss Financial Services, in its pursuit of growth in nascent areas, would likely categorize strategic partnerships or joint ventures as Stars or Question Marks within a BCG framework, depending on their current market penetration and future growth potential. These collaborations are designed to leverage complementary expertise and resources to tap into high-growth, underdeveloped markets.

For instance, if Edelweiss entered into a joint venture in the rapidly expanding fintech lending space in 2024, aiming to capture a significant share of a market projected to grow by over 20% annually, this would represent a strategic move into a Question Mark category. The success of such ventures hinges on the ability to quickly scale operations and establish a strong market presence, as exemplified by the increasing number of digital lending platforms securing substantial funding rounds in the Indian market during 2024, with some reporting year-on-year user growth exceeding 50%.

- Leveraging Synergies: Partnerships in areas like wealthtech or alternative asset management allow Edelweiss to combine its established financial expertise with innovative technology or niche market access.

- Market Entry Strategy: These ventures are crucial for entering segments where direct, organic growth might be slower or more capital-intensive, aiming for rapid market share acquisition.

- Risk Mitigation: By sharing the investment and operational burden, joint ventures can mitigate the inherent risks associated with pioneering new financial service areas.

- 2024 Example Context: The Indian digital payments market, a nascent area in previous years, saw continued robust growth in 2024, with transaction volumes consistently rising, indicating the potential for strategic partnerships to gain traction in emerging financial ecosystems.

The Edelweiss BSE Capital Markets & Insurance ETF, launched in December 2024, is a prime example of a Question Mark. As India's first ETF focused on these sectors, it faces the challenge of building market share and investor awareness in a high-growth area.

Its initial modest Assets Under Management (AUM) and market position necessitate significant investment in marketing and investor education to gain traction. The success of this ETF will determine if it evolves into a Star or remains a niche product.

New digital wealth solutions targeting tech-savvy younger investors also fall into the Question Mark category. While offering significant growth potential, achieving rapid user adoption in a competitive digital landscape is the key hurdle.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial disclosures, detailed industry market research, and competitor performance data to provide a robust strategic overview.