Dr. Martens Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr. Martens Bundle

Dr. Martens navigates a competitive landscape shaped by strong buyer loyalty and the persistent threat of new entrants in the footwear market. Understanding the nuances of supplier power and the availability of substitutes is crucial for their sustained success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Dr. Martens’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Dr. Martens' reliance on specialized, high-quality raw materials, particularly leather and the rubber for its iconic soles, grants considerable bargaining power to its suppliers. If only a limited number of suppliers can meet these stringent material specifications, their leverage naturally increases, especially when the cost and time involved in switching to alternative suppliers are substantial.

Dr. Martens' reliance on suppliers for specialized components, like their signature AirWair sole, grants these suppliers considerable leverage. The unique and durable nature of Dr. Martens' products necessitates suppliers capable of meeting stringent quality and material standards. This dependence can restrict Dr. Martens' options and potentially lead to increased costs.

Fluctuations in the cost of key raw materials like leather, a primary input for Dr. Martens footwear, significantly impact supplier power. For instance, global leather prices saw an average increase of 5-10% in early 2024 compared to the previous year, driven by demand and environmental regulations affecting tanneries. This directly translates to higher production costs for Dr. Martens if suppliers pass on these increases.

Rising labor costs in traditional manufacturing hubs, such as parts of Southeast Asia where Dr. Martens sources a portion of its production, also bolster supplier leverage. Wage inflation in Vietnam, a key production country, averaged around 6-7% in 2024. This makes it more expensive for Dr. Martens to secure manufacturing capacity, giving suppliers more room to negotiate terms.

Furthermore, geopolitical instability and trade disputes can disrupt global supply chains, creating scarcity and increasing shipping expenses. For example, increased freight costs in late 2023 and early 2024, sometimes doubling on certain routes due to regional conflicts, empower suppliers by making alternative sourcing more challenging and costly for Dr. Martens.

Supplier Power 4

The bargaining power of suppliers for Dr. Martens is a key factor in its profitability. If a few dominant suppliers control essential materials like specialized leather or unique sole components, they can significantly influence Dr. Martens' costs and production schedules. For instance, in 2024, the global leather market experienced price volatility, with some premium leather sources seeing increases of up to 10% due to supply chain disruptions and increased demand from competing luxury brands.

A concentrated supplier base means fewer alternatives for Dr. Martens, allowing these suppliers to potentially dictate terms and raise prices. Conversely, a diverse and fragmented supplier landscape would empower Dr. Martens by providing more negotiation leverage and the ability to switch suppliers if terms become unfavorable. This fragmentation is crucial for maintaining cost efficiency and ensuring a steady supply of high-quality inputs.

- Supplier Concentration: A few major suppliers for critical components like vulcanized rubber for soles or specific types of leather can exert considerable influence.

- Input Differentiation: If Dr. Martens relies on highly specialized or unique materials that are not easily sourced elsewhere, supplier power increases.

- Switching Costs: High costs associated with changing suppliers for specialized manufacturing processes or materials can lock Dr. Martens into existing relationships, strengthening supplier leverage.

- Market Conditions: In 2024, disruptions in global logistics and raw material availability have generally increased the bargaining power of suppliers across many industries, including footwear manufacturing.

Supplier Power 5

Dr. Martens' dedication to sustainability and ethical sourcing, as highlighted in its 2024 Annual Report, can significantly impact supplier power. Suppliers adhering to rigorous environmental and social criteria might be scarcer, thereby increasing their leverage over Dr. Martens. This commitment necessitates close collaboration with the supply chain to guarantee compliance and traceability, potentially fostering greater dependence on established, trusted suppliers.

The company's 2024 report indicates that a significant portion of its raw materials are sourced from suppliers with recognized ethical certifications. This focus means that suppliers who can meet these demanding standards are in a stronger negotiating position. For instance, suppliers of ethically sourced leather or recycled materials may command higher prices due to their specialized capabilities and the limited pool of qualifying partners.

- Ethical Sourcing: Dr. Martens' 2024 report emphasizes a growing percentage of materials sourced from certified ethical suppliers.

- Supplier Leverage: Suppliers meeting stringent environmental and social standards gain increased bargaining power.

- Traceability Demands: The need for supply chain transparency and traceability strengthens relationships with compliant suppliers.

- Partnership Reliance: Increased reliance on trusted, compliant partners can shift negotiation dynamics in favor of suppliers.

Dr. Martens' reliance on specialized materials, like premium leather and unique sole components, amplifies supplier bargaining power. In 2024, the global leather market saw price increases of 5-10% for certain grades, impacting Dr. Martens' costs. Suppliers meeting Dr. Martens' stringent quality and ethical sourcing standards, as noted in their 2024 report, are fewer, thus commanding greater leverage.

| Factor | Impact on Dr. Martens | 2024 Data/Trend |

|---|---|---|

| Material Specialization | Increased supplier leverage due to unique requirements. | Demand for premium leather continues, with some sourcing costs up 10%. |

| Supplier Concentration | Fewer alternatives empower dominant suppliers. | Limited number of suppliers for specific AirWair sole components. |

| Switching Costs | High costs deter changing suppliers, strengthening existing relationships. | Significant investment required to qualify new suppliers for specialized processes. |

| Ethical Sourcing Requirements | Scarcity of certified suppliers increases their negotiating power. | Growing percentage of materials from certified ethical suppliers, as per 2024 report. |

What is included in the product

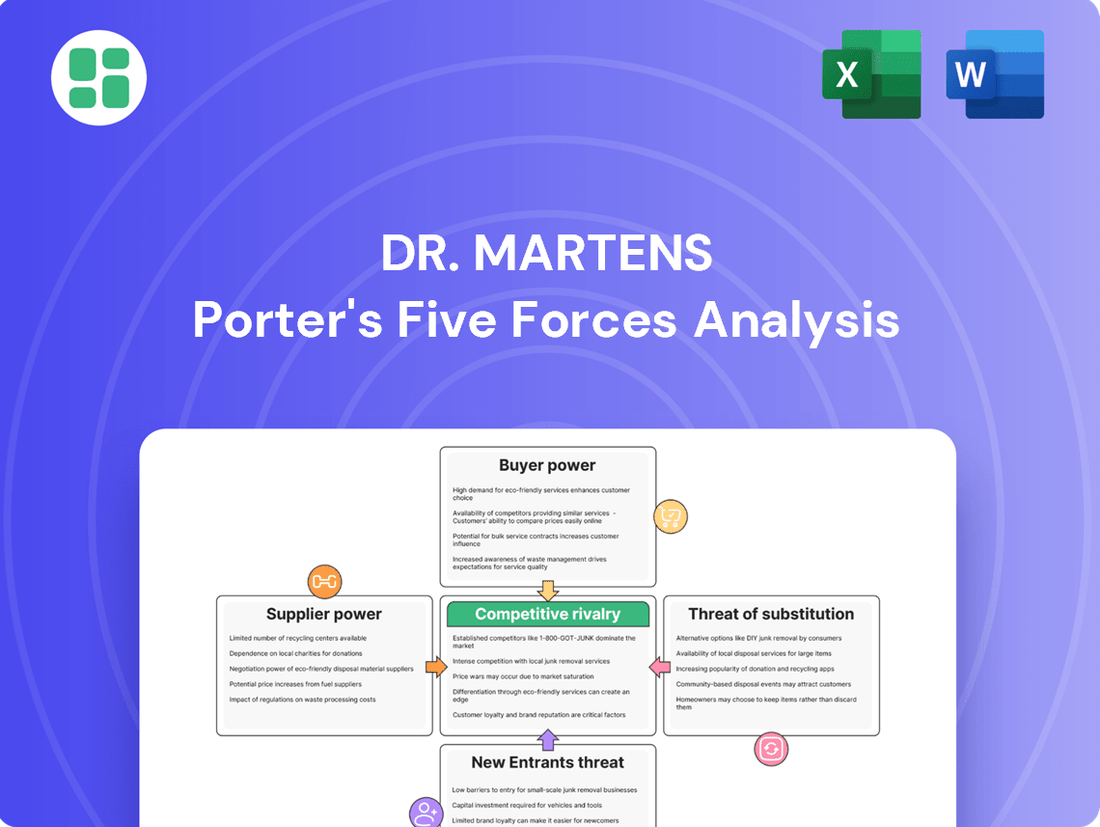

This Porter's Five Forces analysis for Dr. Martens examines the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on the iconic boot brand's market position.

Instantly assess competitive pressures with a dynamic Porter's Five Forces model, allowing for rapid identification of threats and opportunities in the Dr. Martens market.

Customers Bargaining Power

Despite Dr. Martens' strong brand recognition and loyal customer base, buyers hold moderate bargaining power. This is largely due to the wide availability of alternative footwear options in the market. In 2024, the global footwear market was valued at approximately $400 billion, with a significant portion comprised of boots and casual shoes, offering consumers ample choice.

Customers can easily switch to competing brands if Dr. Martens' pricing, product features, or overall value proposition doesn't align with their expectations. The sheer volume of competitors, from heritage boot makers to contemporary fashion brands, ensures that consumers have readily accessible substitutes, thereby limiting Dr. Martens' ability to dictate terms unilaterally.

The growing influence of e-commerce and digital transparency significantly amplifies customer bargaining power for brands like Dr. Martens. Consumers can readily compare prices, access extensive product reviews, and discover a wider array of competing brands online. This ease of access puts pressure on Dr. Martens to ensure competitive pricing and maintain a high standard of product quality to retain customer loyalty.

The digital marketplace empowers consumers with information, allowing them to make more informed purchasing decisions and seek out the best value. This trend is particularly relevant as online sales are a rapidly expanding segment of the global footwear market, with projections indicating they will account for 26% of all sales by 2027, underscoring the importance of an online strategy for Dr. Martens.

Buyer power significantly influences Dr. Martens, especially during economic headwinds. When the economy tightens, consumers become much more focused on price. This heightened sensitivity means they are more likely to shop around for deals or postpone purchases of items they consider less essential.

This dynamic was evident in 2024, with reports indicating weak consumer demand in key markets like the US. Such conditions directly impact Dr. Martens, forcing them to be more cautious about pricing strategies and potentially explore ways to control costs to remain competitive.

Buyer Power 4

The bargaining power of customers for Dr. Martens is a key consideration, particularly with wholesale relationships. While the company is expanding its direct-to-consumer (DTC) sales, wholesale partners remain a substantial revenue stream. These large buyers, often major department stores or footwear chains, leverage their significant order volumes to negotiate better pricing and terms, which can squeeze Dr. Martens' profit margins.

This dynamic is underscored by recent financial performance. In the fiscal year ending March 31, 2024 (FY24), Dr. Martens experienced a notable decline in wholesale revenue. This downturn highlights the sensitivity of the company's profitability to the demands of its key wholesale accounts.

- Wholesale Dependence: Despite DTC growth, wholesale remains a critical sales channel, exposing Dr. Martens to buyer leverage.

- Volume-Driven Negotiations: Large retail partners use their purchasing power to secure favorable terms, impacting Dr. Martens' profitability.

- FY24 Wholesale Decline: Wholesale revenue saw a significant drop in FY24, reflecting the pressures from powerful buyers.

- Margin Impact: The ability of major customers to negotiate terms directly affects Dr. Martens' gross margins and overall financial health.

Buyer Power 5

Dr. Martens faces significant buyer power, amplified by evolving fashion trends. Consumers increasingly prioritize comfort, versatility, and sustainability, directly impacting purchasing decisions. For instance, a 2024 report indicated that 60% of Gen Z consumers consider a brand's sustainability efforts before buying. This means Dr. Martens must continuously innovate its product offerings and marketing to align with these shifting preferences, or risk losing market share to competitors who do.

The growing demand for sustainable fashion presents a critical challenge. If Dr. Martens doesn't effectively integrate eco-friendly materials and ethical production practices, it could alienate a substantial and growing customer segment. For example, sales of sustainable apparel globally are projected to reach $150 billion by 2025, highlighting the market's potential. Failure to adapt to this trend empowers consumers to seek out alternatives, thereby increasing buyer power.

- Evolving Consumer Priorities: Comfort, versatility, and sustainability are key drivers in footwear choices.

- Sustainability as a Differentiator: Brands failing to address eco-conscious demands empower consumers to switch.

- Market Responsiveness: Dr. Martens' ability to adapt product lines and marketing to current trends directly influences its pricing power.

- Competitive Landscape: A wide array of alternative footwear brands means consumers have ample choices if Dr. Martens' offerings don't meet their needs.

Dr. Martens faces considerable customer bargaining power due to the vast array of alternative footwear options available. The global footwear market, valued at approximately $400 billion in 2024, offers consumers abundant choices, from heritage brands to contemporary fashion labels. This competitive landscape means customers can easily switch if Dr. Martens' pricing or value proposition doesn't meet their expectations, limiting the company's ability to dictate terms.

The digital age significantly enhances buyer power. Consumers can readily compare prices, read reviews, and discover competitors online, putting pressure on Dr. Martens to maintain competitive pricing and high quality. This is particularly relevant as online footwear sales are projected to reach 26% of the total market by 2027.

Economic downturns further amplify customer price sensitivity. In 2024, weak consumer demand in markets like the US forced companies like Dr. Martens to be more strategic with pricing and cost control.

Wholesale relationships also contribute to buyer power. Large retail partners leverage their order volumes to negotiate favorable terms, impacting Dr. Martens' profit margins. This was evident in fiscal year 2024, which saw a decline in wholesale revenue for the company.

| Factor | Impact on Dr. Martens | Supporting Data (2024/2025 Projections) |

| Availability of Substitutes | Moderate to High | Global Footwear Market Value: ~$400 Billion |

| Online Price Transparency | High | Projected Online Footwear Sales: 26% by 2027 |

| Economic Sensitivity | High | Reports of Weak Consumer Demand in Key Markets |

| Wholesale Negotiation Power | High | FY24 Wholesale Revenue Decline |

Full Version Awaits

Dr. Martens Porter's Five Forces Analysis

This preview displays the complete Dr. Martens Porter's Five Forces analysis, offering a thorough examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately upon purchase. This ensures you get a ready-to-use, in-depth analysis without any discrepancies or missing sections.

Rivalry Among Competitors

Dr. Martens operates in a fiercely competitive global footwear market. Rivalry comes from established heritage boot makers, trendy fashion brands, and even athletic companies pushing into the lifestyle space, all vying for consumer attention through unique designs and ongoing product development.

Competitive rivalry within the footwear industry remains intense, with brands like Timberland and Clarks often cited as direct competitors. These companies, similar to Dr. Martens, offer durable, stylish footwear, though they may differentiate through specific technologies or aesthetic nuances. For instance, Timberland's focus on rugged outdoor wear and Clarks' emphasis on comfort and classic styles present distinct value propositions that appeal to different consumer segments, yet they still vie for the same market share.

Dr. Martens enjoys a significant advantage due to its rich brand heritage and a dedicated following, which helps buffer against intense competition. This strong brand identity is a key differentiator in a crowded market.

Competitors are actively vying for market share by employing robust marketing campaigns, strategic collaborations, and by resonating with various subcultures. For instance, brands like Timberland and even fashion-forward sneaker companies often engage in similar tactics to capture younger demographics.

The ongoing challenge for Dr. Martens lies in consistently reinforcing and expanding its brand loyalty. This requires continuous engagement with its customer base and staying relevant to evolving consumer trends and cultural movements.

Competitive Rivalry 4

The footwear market's projected growth, estimated at a 4.3% CAGR from 2024 to 2030, suggests a generally expanding landscape. However, this overall growth can mask slower expansion in specific segments, intensifying competition for market share among established brands like Dr. Martens.

Dr. Martens has experienced revenue declines in certain geographical areas, which naturally amplifies the competitive pressures it faces. This means that even within a growing market, the brand must contend with rivals vying for a larger piece of the pie, especially in underperforming regions.

- Market Growth: Footwear market expected to grow at a 4.3% CAGR from 2024-2030.

- Segment Variation: Slower growth in certain footwear segments can lead to increased competition.

- Regional Challenges: Dr. Martens' revenue declines in specific regions heighten competitive rivalry.

Competitive Rivalry 5

Dr. Martens faces intense competition, exacerbated by high exit barriers. Significant investments in specialized manufacturing facilities and extensive, established distribution networks mean that even less profitable competitors may remain in the market. This can lead to persistent price wars or market oversupply, directly impacting Dr. Martens' profitability and its standing in the market.

These high barriers trap capital, forcing companies to continue operating even when margins are thin. For instance, in 2023, the global footwear market, including boots, was valued at approximately $260 billion, with a significant portion driven by established brands with substantial physical assets.

- High Capital Investment: Setting up and maintaining specialized boot manufacturing facilities requires substantial, often non-recoverable, capital.

- Established Distribution: Existing relationships with retailers and logistics networks are difficult and costly for new entrants to replicate.

- Brand Loyalty and Inertia: Consumers' preference for established brands can make it hard for new players to gain traction, forcing incumbents to compete on price.

- Impact on Profitability: Sustained competition can erode profit margins, as seen in periods of oversupply in the casual footwear sector, potentially affecting Dr. Martens' revenue growth targets.

The competitive rivalry for Dr. Martens is fierce, with numerous players in the global footwear market. Established heritage brands, fashion-forward labels, and even athletic companies all compete for consumer attention through design innovation and marketing. This intense competition is further amplified by high exit barriers, such as significant investments in manufacturing and distribution, which keep even less profitable competitors in the market.

| Key Competitor Type | Examples | Competitive Tactics |

| Heritage Boot Makers | Timberland, Clarks | Durability, specific technologies, classic styles |

| Fashion Brands | Various | Trendy designs, subculture resonance, collaborations |

| Athletic Companies | Nike, Adidas (in lifestyle) | Lifestyle integration, brand marketing |

SSubstitutes Threaten

The threat of substitutes for Dr. Martens is significant, primarily stemming from other durable, comfortable, and stylish footwear. While not direct boot competitors, high-quality sneakers, outdoor hiking boots, and versatile casual shoes offer longevity and comfort, attracting consumers seeking similar functional and aesthetic qualities. For instance, the global athletic footwear market, a key substitute category, was valued at approximately $100 billion in 2023 and is projected to grow steadily, indicating a robust alternative for consumers.

The threat of substitutes for Dr. Martens is amplified by shifting fashion trends. If the broader market moves towards lighter, more athletic, or minimalist footwear, consumers might bypass Dr. Martens' signature chunky boots. This requires the brand to remain adaptable to maintain its appeal.

For instance, the global athletic footwear market was valued at approximately $100 billion in 2023 and is projected to grow, indicating a strong consumer preference for comfort and performance-oriented shoes. This presents a significant alternative for consumers who might otherwise consider Dr. Martens.

The increasing consumer focus on sustainability and ethical sourcing poses a significant threat of substitution for Dr. Martens. Brands that champion eco-friendly materials, offer vegan alternatives, or operate on circular economy principles are increasingly appealing to environmentally aware shoppers. This trend could divert sales from Dr. Martens if their own sustainability initiatives are not seen as robust enough by these consumers.

Threat of Substitutes 4

The threat of substitutes for Dr. Martens is significant, particularly for price-sensitive consumers. In economic downturns, many shoppers look for more affordable footwear options. For instance, during periods of economic contraction, the demand for value-oriented apparel and footwear often rises, impacting premium brands.

Fast-fashion retailers and mass-market shoe brands offer products that can replicate Dr. Martens' iconic look at a fraction of the cost. While these alternatives generally do not match the durability or craftsmanship, their lower price point makes them a compelling choice for budget-conscious individuals. This segment of the market is crucial, as many consumers prioritize immediate affordability over long-term value.

Examples of these substitutes include:

- Mass-produced leather-look boots: Brands found in large department stores or online marketplaces offering similar chunky sole and lace-up designs.

- Fast-fashion footwear: Retailers that quickly produce trendy items, including boots inspired by Dr. Martens' aesthetic, often using synthetic materials.

- Second-hand Dr. Martens: While still Dr. Martens, the availability of pre-owned pairs at lower prices can act as a substitute for new purchases.

Threat of Substitutes 5

Technological advancements in footwear present a significant threat of substitutes for Dr. Martens. Innovations like smart shoes with integrated fitness tracking or advanced cushioning systems could offer enhanced functionality and comfort, potentially drawing consumers away from traditional boot styles. For instance, the global smart footwear market was valued at approximately USD 1.5 billion in 2023 and is projected to grow substantially, indicating a rising consumer interest in technologically integrated footwear.

Personalized fit solutions, enabled by 3D scanning and custom manufacturing, also pose a threat. If these become more accessible and affordable, they could offer a superior, tailored experience that traditional, mass-produced boots cannot match. This could force Dr. Martens to consider incorporating such technologies or risk losing market share to more adaptable competitors.

- Smart Footwear Market Growth: The global smart footwear market is expected to experience robust growth, reaching an estimated USD 4.5 billion by 2028, up from USD 1.5 billion in 2023.

- Consumer Demand for Comfort and Functionality: A significant portion of consumers, particularly younger demographics, are increasingly prioritizing comfort and advanced features in their footwear choices.

- Potential for Disruption: Emerging technologies in footwear manufacturing and materials could lead to the creation of entirely new product categories that directly compete with Dr. Martens' core offerings.

The threat of substitutes for Dr. Martens is substantial, with consumers often opting for more affordable, trend-driven, or technologically advanced footwear. The rise of fast-fashion brands offering similar aesthetics at lower price points, alongside the growing athletic footwear market valued at around $100 billion in 2023, presents compelling alternatives. Furthermore, advancements in smart footwear, a market projected to reach USD 4.5 billion by 2028, offer enhanced functionality that could lure consumers away from traditional boot styles.

| Substitute Category | Key Characteristics | Market Context (2023/2024 Data) |

|---|---|---|

| Athletic Footwear | Comfort, performance, casual style | Global market ~ $100 billion (2023), steady growth |

| Fast Fashion Footwear | Affordability, trend imitation | Significant portion of apparel market, rapid product cycles |

| Smart Footwear | Integrated technology, enhanced functionality | Market ~ $1.5 billion (2023), projected to reach $4.5 billion by 2028 |

Entrants Threaten

The threat of new entrants for a brand like Dr. Martens is generally considered moderate to high. Establishing a global footwear brand with a distinct heritage and manufacturing capabilities requires significant upfront capital. This includes investment in design, product development, and setting up or securing reliable manufacturing processes.

New players must also contend with the substantial costs associated with building brand recognition and a loyal customer base, which Dr. Martens has cultivated over decades. In 2023, Dr. Martens reported revenue of £1.00 billion, highlighting the scale of operation and marketing investment needed to compete effectively.

Furthermore, navigating complex global supply chains and distribution networks presents another considerable barrier. The need for substantial investment in these areas, alongside marketing and brand building, acts as a significant deterrent for many potential new entrants aiming for Dr. Martens' market position.

The threat of new entrants for Dr. Martens is relatively low, primarily due to the significant time and capital required to build comparable brand equity. It took Dr. Martens decades to cultivate its iconic status and global recognition, a feat not easily replicated by newcomers. For instance, in 2023, Dr. Martens reported revenue of £1.05 billion, underscoring the established market position that new brands would need to challenge.

Replicating the deep cultural resonance and widespread customer loyalty that Dr. Martens enjoys is a considerable hurdle for any new entrant. This brand loyalty allows Dr. Martens to command premium pricing and secure prime placement in distribution channels, advantages that are difficult for emerging brands to instantly achieve. Their strong brand perception, evident in their consistent sales figures, acts as a substantial barrier.

Establishing efficient and extensive distribution networks, encompassing wholesale partnerships, owned retail stores, and a robust e-commerce platform, presents a formidable hurdle for potential new entrants into the footwear market. Dr. Martens, for instance, has cultivated decades of experience in optimizing these channels, ensuring broad market reach and consistent brand presence. In 2023, Dr. Martens reported that its direct-to-consumer (DTC) business, which includes its own stores and e-commerce, accounted for 46% of its total revenue, highlighting the importance of these established channels.

Newcomers struggle to replicate the market access and visibility that established brands like Dr. Martens enjoy. Their long-standing relationships with retailers and sophisticated multi-channel strategies create significant barriers. For example, securing prime shelf space in department stores or obtaining favorable terms with online marketplaces requires established credibility and proven sales volume, which new entrants typically lack in their initial stages.

Threat of New Entrants 4

Dr. Martens benefits significantly from economies of scale across its operations. This includes bulk purchasing of raw materials like leather, efficient manufacturing processes, and widespread marketing campaigns, all contributing to lower per-unit costs. For instance, in 2023, Dr. Martens reported revenue of £1 billion, indicative of its substantial operational scale.

New entrants often struggle to match these cost advantages. Operating at a smaller scale means higher per-unit costs for sourcing and production, making it difficult to compete on price with established brands like Dr. Martens. This cost disadvantage is a significant barrier, as new companies must absorb these higher expenses or pass them on to consumers, potentially deterring market entry.

- Economies of Scale: Dr. Martens leverages scale in sourcing, manufacturing, and marketing to reduce per-unit costs.

- Cost Disadvantage for Newcomers: Smaller new entrants face higher production and operational costs, hindering price competitiveness.

- Brand Loyalty and Recognition: Dr. Martens' established brand image and customer loyalty further deter new entrants.

- Capital Requirements: Significant investment is needed for manufacturing facilities, supply chains, and marketing to effectively compete.

Threat of New Entrants 5

The threat of new entrants for Dr. Martens is somewhat limited by significant barriers, particularly intellectual property. Patents on their distinctive sole constructions and trademarks covering iconic elements like the yellow stitching and heel loop make direct imitation challenging and costly for newcomers.

New companies entering the boot market must invest heavily in developing their own unique designs and innovations to avoid infringing on Dr. Martens' protected intellectual property. This necessity for originality adds considerable complexity and expense to their market entry strategy, effectively raising the bar for potential competitors.

- Brand Loyalty: Dr. Martens benefits from strong brand loyalty, cultivated over decades, making it harder for new entrants to capture market share.

- Capital Requirements: Establishing manufacturing facilities, distribution networks, and marketing campaigns requires substantial capital investment, acting as a deterrent.

- Economies of Scale: Dr. Martens' established production volume allows for cost efficiencies that new, smaller competitors may struggle to match initially.

The threat of new entrants for Dr. Martens is generally considered moderate. While the brand enjoys significant loyalty and economies of scale, the capital required for manufacturing, global distribution, and marketing remains substantial. For instance, Dr. Martens invested £74.4 million in capital expenditure in the fiscal year ending March 2024, highlighting the investment needed to maintain its position.

New entrants would face challenges in replicating Dr. Martens' established brand equity and cultural resonance, which took decades to build. The company reported revenue of £1.05 billion for the fiscal year ending March 2024, demonstrating its significant market presence. Overcoming this brand loyalty requires considerable marketing investment and time.

Access to efficient supply chains and established distribution networks, including a robust direct-to-consumer (DTC) presence which accounted for 46% of revenue in FY24, presents another barrier. Newcomers must navigate these complexities and secure prime retail placements, often requiring significant upfront capital and established relationships.

| Factor | Dr. Martens' Position | Impact on New Entrants |

|---|---|---|

| Brand Equity & Loyalty | Very Strong (cultivated over decades) | High Barrier: Difficult to replicate cultural resonance and customer attachment. |

| Capital Requirements | High (e.g., £74.4m capex in FY24) | High Barrier: Significant investment needed for manufacturing, marketing, and distribution. |

| Economies of Scale | Significant (e.g., £1.05bn revenue in FY24) | Moderate Barrier: New entrants face higher per-unit costs initially. |

| Distribution Networks | Established and Extensive (including 46% DTC in FY24) | High Barrier: Securing market access and prime placement is challenging. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dr. Martens is built upon a foundation of publicly available financial reports, industry-specific market research from firms like Statista and IBISWorld, and recent news and analyst reports. This blend of data allows for a comprehensive understanding of competitive pressures within the footwear and fashion accessories market.