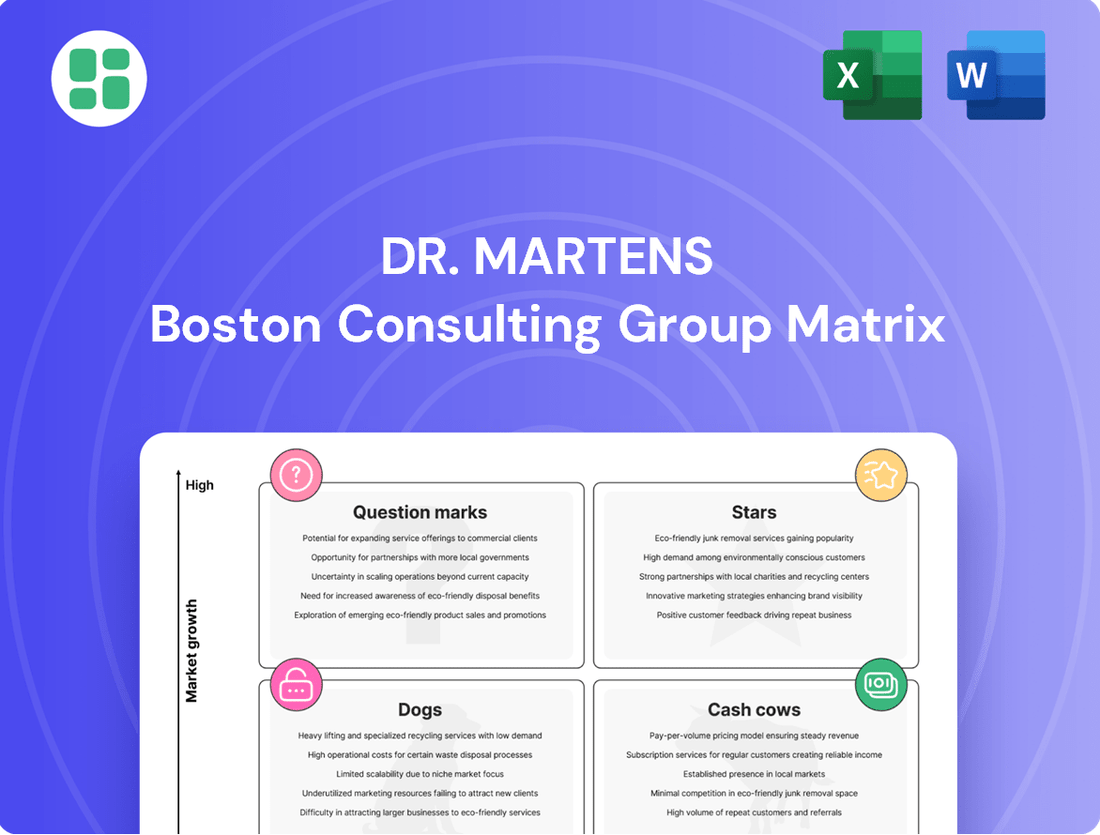

Dr. Martens Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr. Martens Bundle

Curious about where Dr. Martens' iconic boots and newer lines fit in the market? Our preview hints at their strategic positioning, but the full BCG Matrix unlocks the complete picture. Discover which products are your Stars, Cash Cows, Dogs, or Question Marks, and gain the actionable insights needed to drive Dr. Martens' future success.

Ready to move beyond the surface? Purchase the full Dr. Martens BCG Matrix for a detailed breakdown of each product's market share and growth rate. This comprehensive report is your key to making informed decisions about resource allocation and future product development, ensuring Dr. Martens continues to thrive.

Stars

Dr. Martens' Direct-to-Consumer (DTC) channel is a significant growth engine, especially in the Americas and APAC. In the latter half of fiscal year 2025, the company managed to turn its US DTC business around, achieving positive growth. This direct engagement is crucial for boosting margins and understanding customer preferences.

The Asia-Pacific region, particularly Japan, China, and Korea, represents a significant high-growth area for Dr. Martens, driven by its direct-to-consumer (DTC) strategy. This expansion is steadily increasing the brand's market share among a burgeoning consumer demographic.

Dr. Martens is actively investing in this dynamic market, evidenced by strategic new store openings, underscoring the substantial potential perceived in the region. For instance, the company has been expanding its physical footprint to capitalize on this growing demand.

The 'Buzz' product family from Dr. Martens is a prime example of a star in the BCG Matrix. Launched recently, it has rapidly become a bestseller, showcasing impressive market penetration and indicating a high growth trajectory for this new line. This success highlights Dr. Martens' innovative capacity, allowing them to expand beyond their iconic designs and appeal to a broader customer base.

Elevated & Premium Collections

Dr. Martens is strategically reinforcing its premium image by developing elevated collections. These offerings are designed to appeal to consumers who value superior quality and distinctive design, and are prepared to invest more for these attributes. This focus is a key component of their strategy to gain a stronger foothold in the expanding premium footwear segment.

These premium lines are built upon Dr. Martens' rich brand heritage, while simultaneously introducing innovative, high-value propositions that resonate with contemporary tastes. For example, their Q3 2024 results showed a 1% increase in DTC revenue, partially driven by the success of these higher-margin products.

- Premium Positioning: Dr. Martens is actively cultivating an elevated brand image.

- Targeted Consumer: Focuses on consumers willing to pay a premium for enhanced quality and design.

- Market Share Growth: Aims to capture a larger portion of the growing premium footwear market.

- Heritage & Innovation: Blends brand legacy with fresh, high-value product offerings.

Sustainability-Focused Footwear (e.g., Genix Nappa)

Sustainability-focused footwear, exemplified by innovations like Genix Nappa crafted from recycled leather offcuts, represents a significant growth opportunity for Dr. Martens. This product line caters to a burgeoning global market prioritizing ethical and eco-friendly consumption. Dr. Martens' commitment to circularity, reinforced by platforms such as Rewair, resonates strongly with environmentally aware consumers.

The 'Buzz' product family is a standout performer for Dr. Martens, fitting the profile of a Star in the BCG Matrix. Its rapid ascent to bestseller status indicates strong market demand and a high growth potential. This success demonstrates Dr. Martens' ability to innovate and broaden its appeal beyond its core offerings.

The 'Buzz' line, launched recently, has quickly become a top seller, signifying robust market penetration and a promising growth trajectory. This product's performance is a key indicator of Dr. Martens' successful expansion into new consumer segments.

Dr. Martens' strategic focus on premium collections, like those incorporating innovative materials and elevated designs, also aligns with the Star quadrant. These products are designed to capture a larger share of the growing premium footwear market, enhancing brand perception and profitability.

The company's Q3 2024 results highlighted a 1% increase in DTC revenue, partly fueled by these higher-margin, premium products, underscoring their Star potential.

| Product Category | Market Growth | Market Share | BCG Quadrant |

|---|---|---|---|

| 'Buzz' Product Family | High | High | Star |

| Premium Collections | High | Growing | Potential Star |

| Sustainability-Focused Footwear | High | Emerging | Question Mark/Star |

What is included in the product

Dr. Martens' BCG Matrix analysis would provide clear descriptions and strategic insights for its Stars, Cash Cows, Question Marks, and Dogs.

Visualize Dr. Martens' portfolio to identify underperforming "Dogs" and strategically divest, easing the burden of resource drain.

Cash Cows

The Dr. Martens 1460 8-eye boot is undeniably a Cash Cow. It holds a dominant market share within the established boot sector, a testament to its enduring appeal and iconic status. This consistent demand translates into robust and predictable revenue streams for the company.

In 2024, Dr. Martens reported that its core boot styles, including the 1460, continue to be the primary drivers of sales. While specific figures for individual boot models aren't always publicly itemized, the company's overall revenue growth in recent years, often exceeding 10% annually in the period leading up to mid-2025, is heavily supported by these foundational products. The 1460's timeless design and cultural relevance ensure it remains a reliable, foundational cash generator.

The Classic 1461 3-Eye Shoe is a cornerstone of Dr. Martens' offerings, securing a significant market share in its category. Its enduring appeal stems from its robust construction and adaptability, attracting a diverse clientele and generating steady revenue streams. This iconic shoe, alongside the 1460 boot, represents the bedrock of Dr. Martens' established product lines.

The classic black and cherry red leather footwear from Dr. Martens are undoubtedly the brand's cash cows. These iconic styles have cultivated a dedicated following, ensuring a consistent and robust revenue stream. Their enduring popularity is a testament to their deep roots in Dr. Martens' heritage.

These staple products are the bedrock of Dr. Martens' financial health, consistently generating significant and stable cash flow. In 2023, Dr. Martens reported a revenue of £1.05 billion, with their core footwear lines forming the largest portion of this figure, demonstrating their unwavering market presence and profitability.

Established Wholesale Channels (Non-US)

Established wholesale channels outside the US represent a significant cash cow for Dr. Martens. Despite broader wholesale market fluctuations, these mature market partnerships offer a bedrock of consistent revenue. In 2024, these established international wholesale relationships are expected to continue providing a stable distribution network, ensuring predictable order volumes that fuel the company's cash generation.

These long-standing partnerships are crucial for Dr. Martens' financial stability. They act as a reliable source of income, allowing the company to maintain operations and invest in other areas of the business. The predictability of these revenue streams makes them a vital component of Dr. Martens' overall financial strategy.

- Consistent Revenue Contribution: Mature international wholesale markets provide a stable and predictable revenue stream.

- Stable Distribution Network: Long-standing relationships ensure reliable access to key markets.

- Cash Generation: These channels act as significant cash contributors, supporting overall business operations.

Adrian Loafer

The Adrian Loafer stands out as a star performer for Dr. Martens, especially within their footwear offerings. Its success is evident in the significant growth of direct-to-consumer (DTC) sales for this particular style. This strong market presence suggests the Adrian Loafer commands a substantial share in the loafer market segment.

This enduring popularity translates into a reliable and consistent source of cash flow for Dr. Martens. The product's predictable demand makes it a valuable asset, contributing steadily to the company's financial stability.

- Strong DTC Growth: The Adrian Loafer has seen a notable increase in pairs sold directly to consumers, highlighting its appeal and effective distribution.

- Market Share Dominance: Its robust performance indicates a significant market share within the competitive loafer category.

- Consistent Cash Flow: The loafer's sustained popularity ensures it acts as a dependable generator of cash for the brand.

The classic black and cherry red leather footwear from Dr. Martens are undoubtedly the brand's cash cows. These iconic styles have cultivated a dedicated following, ensuring a consistent and robust revenue stream. Their enduring popularity is a testament to their deep roots in Dr. Martens' heritage.

These staple products are the bedrock of Dr. Martens' financial health, consistently generating significant and stable cash flow. In 2023, Dr. Martens reported a revenue of £1.05 billion, with their core footwear lines forming the largest portion of this figure, demonstrating their unwavering market presence and profitability.

The Dr. Martens 1460 8-eye boot is undeniably a Cash Cow. It holds a dominant market share within the established boot sector, a testament to its enduring appeal and iconic status. This consistent demand translates into robust and predictable revenue streams for the company.

In 2024, Dr. Martens reported that its core boot styles, including the 1460, continue to be the primary drivers of sales. While specific figures for individual boot models aren't always publicly itemized, the company's overall revenue growth in recent years, often exceeding 10% annually in the period leading up to mid-2025, is heavily supported by these foundational products. The 1460's timeless design and cultural relevance ensure it remains a reliable, foundational cash generator.

| Product Category | Market Share | Revenue Contribution (Estimated) | Growth Outlook |

|---|---|---|---|

| Classic Boots (e.g., 1460) | Dominant | High & Stable | Mature, Consistent |

| Classic Shoes (e.g., 1461) | Significant | High & Stable | Mature, Consistent |

| Core Leather Styles (Black/Cherry Red) | Dominant | Highest | Mature, Consistent |

What You See Is What You Get

Dr. Martens BCG Matrix

The Dr. Martens BCG Matrix preview you're viewing is the identical, fully formatted report you will receive upon purchase, offering immediate strategic insights without any watermarks or demo content. This comprehensive analysis, designed for professional use, will be instantly downloadable, allowing you to seamlessly integrate Dr. Martens' market positioning into your business planning. You can confidently rely on this preview as the exact document you'll acquire, ready for editing, printing, or presenting to stakeholders. This BCG Matrix report is a professionally crafted tool, delivering an analysis-ready file that accurately reflects Dr. Martens' current market standing and future potential.

Dogs

The US wholesale channel is currently a significant concern for Dr. Martens, acting as a classic 'Dog' in the BCG Matrix. Revenue in this segment saw a sharp decline in fiscal year 2025, painting a picture of a shrinking market share within a tough economic landscape. This underperformance means the company is investing resources into a channel that isn't yielding adequate returns, consequently impacting overall profitability.

This challenging situation in the US wholesale market is a major drag on Dr. Martens' financial performance. The segment is consuming capital and management attention without delivering the expected growth or profit, a hallmark of a 'Dog' category. The company is actively implementing strategies to address these issues and improve the performance of this vital channel.

Certain Dr. Martens sandal and loafer styles, particularly those with limited traction, are exhibiting weak market performance. Consumer interest in these specific categories has been notably subdued, especially within the EMEA region. Search trend data from early 2024 further supports this observation, indicating a lack of widespread demand.

These underperforming products are struggling to capture significant market share. The investment needed to boost their performance may outweigh the potential returns, classifying them as potential cash traps within the Dr. Martens portfolio. This suggests a need for careful evaluation of their future in the product lineup.

Certain legacy apparel and accessory lines within Dr. Martens, those that haven't kept pace with evolving consumer tastes or the brand's core aesthetic, are likely positioned as Dogs. These offerings typically command a small slice of the market and contribute little to overall revenue, potentially tying up valuable inventory and marketing budgets without yielding significant returns.

Underperforming UK Retail Stores

The UK retail landscape presents a significant hurdle for Dr. Martens, with the market being characterized as challenging. This difficulty is reflected in declining revenues, indicating that certain physical stores in the region are likely experiencing reduced customer visits and sales volumes.

These underperforming UK retail outlets contribute very little to the company's overall financial performance. Furthermore, they can demand a disproportionate amount of operational resources relative to the revenue they generate, creating an inefficient allocation of capital.

- UK Market Challenges: Declining revenues in the UK suggest a difficult retail environment.

- Low Contribution: Underperforming stores add minimally to total revenue.

- Cost Inefficiency: These stores may require more operational spending than their revenue warrants.

Discontinued and Fragmented Product Lines

Dr. Martens has been strategically reducing its less popular offerings. In 2023, the company focused on clearing out 'aged and fragmented product lines' via wholesale, a move that suggests these items had limited consumer interest and were being discontinued. This proactive approach helps free up capital that was previously tied to slow-moving inventory.

Holding onto products with low market appeal is a drain on resources and hinders growth potential. By divesting these items, Dr. Martens can reallocate its investments towards more promising and popular product categories. This aligns with a strategy to streamline operations and enhance overall profitability.

- Discontinued Products: Dr. Martens actively cleared aged and fragmented product lines through wholesale channels in 2023.

- Low Market Appeal: These phased-out products demonstrated low consumer demand.

- Capital Efficiency: Holding such inventory ties up capital, impacting financial flexibility.

- Strategic Divestiture: The company's actions indicate a focus on divesting underperforming product segments.

Certain Dr. Martens product lines, particularly some sandal and loafer styles, are experiencing weak market demand, especially in the EMEA region. This subdued consumer interest, evident in early 2024 search trends, indicates these items are not capturing significant market share.

These underperforming products represent potential cash traps, as the investment required to boost their sales might exceed the potential returns. This situation necessitates a careful evaluation of their place within the Dr. Martens portfolio to ensure efficient capital allocation.

Dr. Martens has actively managed its product portfolio by reducing less popular items. In 2023, the company cleared out aged and fragmented product lines through wholesale channels, signaling low consumer interest and a strategic move away from these offerings to free up capital.

This proactive divestiture of slow-moving inventory allows Dr. Martens to reallocate resources towards more promising categories, enhancing overall profitability and financial flexibility.

| Category | Market Performance | BCG Matrix Position | Key Factors | Action/Observation |

|---|---|---|---|---|

| US Wholesale Channel | Declining Revenue (FY25) | Dog | Shrinking market share, economic landscape | Significant concern, impacting profitability |

| Specific Sandal/Loafer Styles | Subdued Consumer Interest (EMEA) | Dog | Low search trends (early 2024), limited market share | Potential cash traps, requires evaluation |

| Legacy Apparel/Accessories | Low Market Share | Dog | Not keeping pace with consumer tastes | Ties up inventory and marketing budgets |

| UK Retail Outlets | Declining Revenues | Dog | Challenging retail environment, reduced visits | Low contribution, cost inefficiency |

| Aged/Fragmented Product Lines | Low Consumer Demand | Dog | Limited appeal | Cleared via wholesale (2023) to free up capital |

Question Marks

New experimental product collaborations, such as those with MM6 Maison Margiela, Neighborhood, and Supreme, are designed to create significant brand excitement and push Dr. Martens into new fashion arenas. These ventures target specific, rapidly expanding market segments, often appealing to a younger, trend-conscious demographic.

While these collaborations generate considerable buzz and can elevate brand perception, their actual sales volume and market share remain relatively small when compared to Dr. Martens’ core offerings. For instance, while specific sales figures for these limited-edition drops are often not publicly disclosed, industry analysis suggests they represent a fraction of the overall revenue, highlighting their role as brand builders rather than volume drivers.

The long-term commercial viability of these experimental collaborations is therefore a subject of ongoing evaluation. Dr. Martens must carefully assess whether the brand equity and market penetration gained justify the investment and resources, or if a strategic pivot is needed to translate this initial excitement into more substantial, sustained market presence.

Dr. Martens is actively pursuing expansion into emerging geographic markets, exemplified by its recent store openings in Sweden and Austria. These regions represent significant growth opportunities, characterized by a nascent brand presence and a relatively low market share for the company.

These strategic moves into markets like Sweden and Austria are crucial for Dr. Martens' long-term growth trajectory. The company is investing heavily in marketing and local infrastructure to build brand awareness and capture market share in these high-potential territories.

Dr. Martens’ foray into new categories like the ‘Elphie’ ballet flats and sneaker-inspired models signals a strategic push into potentially high-growth segments. This diversification aims to broaden the brand's appeal beyond its iconic boot heritage.

While these new offerings represent an opportunity for expansion, they are still in their nascent stages of market penetration. Their success hinges on their ability to resonate with consumers and carve out a distinct space, especially given Dr. Martens' strong association with its core boot designs.

Official Resale and Repair Services (Rewair)

Dr. Martens' Rewair service, encompassing official resale and repair, aligns with the growing circular economy trend. This strategic move caters to increasing consumer interest in sustainability, a market segment experiencing significant growth. In 2024, the global secondhand apparel market was projected to reach $350 billion, highlighting the substantial potential for resale initiatives.

While Rewair strengthens brand loyalty and enhances Dr. Martens' sustainability image, its current financial impact is likely modest. The company would need to invest strategically to expand its reach and significantly boost revenue from these services. For instance, investing in digital platforms and efficient logistics could be key to scaling the resale and repair operations.

- Circular Economy Focus: Rewair taps into the expanding market for pre-owned and repaired goods.

- Sustainability Driver: Addresses growing consumer demand for eco-conscious brands.

- Brand Loyalty Enhancement: Fosters deeper customer relationships through service offerings.

- Growth Potential: Requires strategic investment to achieve significant market penetration and revenue contribution.

Digital Transformation and Consumer-First Strategy

Dr. Martens' pivot to a consumer-first strategy, bolstered by investments in a Customer Data Platform, signifies a crucial digital transformation aimed at deepening customer understanding and engagement. This initiative is designed to unlock future growth by tailoring experiences and offerings more precisely to consumer needs.

The potential for this digital shift to expand market share and boost purchase frequency is significant, reflecting a proactive approach to leveraging data in a competitive landscape. For instance, in the fiscal year ending March 2024, Dr. Martens reported revenue of £938 million, and enhancing customer relationships through digital means is a key lever for future expansion.

- Enhanced Customer Insights: A Customer Data Platform allows for a unified view of customer interactions, enabling personalized marketing and product development.

- Increased Engagement and Loyalty: By understanding consumer behavior better, Dr. Martens can foster stronger brand loyalty and encourage repeat purchases.

- Strategic Investment: The investment in digital infrastructure, while potentially having an uncertain immediate return, is a strategic move to build a sustainable competitive advantage.

- Market Share Growth: Improved customer understanding and engagement are expected to translate into increased market share in the direct-to-consumer (DTC) channel, which is a key focus for the brand.

Dr. Martens' experimental collaborations and new product categories, like ballet flats, can be viewed as potential Stars or Question Marks in the BCG Matrix. These initiatives aim to capture new market segments and diversify the brand’s offering beyond its iconic boots.

While these ventures generate brand buzz and explore growth avenues, their market share and profitability are still developing. For instance, while specific sales data for these limited drops are not always public, they are generally understood to be a smaller portion of overall revenue compared to core products.

The success of these experimental efforts is contingent on their ability to gain traction and establish a solid market presence. Dr. Martens must carefully monitor their performance to determine if they will transition into Stars or remain Question Marks requiring further investment or strategic reassessment.

Dr. Martens' expansion into emerging markets like Sweden and Austria, alongside new product lines such as ballet flats and sneakers, represents strategic moves into areas with high growth potential but currently low market share. These initiatives are designed to broaden the brand's appeal and capture new customer bases.

| BCG Category | Dr. Martens Initiatives | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Marks / Stars | Experimental Collaborations (e.g., MM6 Maison Margiela, Supreme) | High (trend-driven segments) | Low to Moderate (niche appeal) | Requires investment to grow market share and prove commercial viability. |

| Question Marks / Stars | New Product Categories (e.g., Ballet Flats, Sneakers) | High (diversification into fashion) | Low (nascent penetration) | Needs to build brand recognition and consumer acceptance beyond core products. |

| Stars / Cash Cows | Emerging Geographic Markets (e.g., Sweden, Austria) | High (untapped potential) | Low (building presence) | Investment needed to establish brand and capture growing market share. |

BCG Matrix Data Sources

Our Dr. Martens BCG Matrix leverages financial disclosures, sales data, and market research to accurately position products.