Dr. Martens Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr. Martens Bundle

Unlock the core strategies behind Dr. Martens's iconic brand with our comprehensive Business Model Canvas. Discover how they connect with their rebellious customer base and maintain their heritage while innovating. This detailed breakdown is essential for anyone looking to understand enduring brand loyalty and market positioning.

Partnerships

Dr. Martens relies on a network of global suppliers and manufacturers to source raw materials like leather and produce its iconic footwear, maintaining high standards for quality and durability. This involves careful management of relationships with tanneries and other component providers.

A significant strategic shift has been Dr. Martens' increasing direct control over its supply chain. In the past five years, the company has boosted its direct sourcing of inputs to approximately 70%, a substantial rise from around 10%, thereby enhancing product consistency and quality.

Dr. Martens heavily relies on its wholesale and distributor partners to ensure its iconic footwear reaches customers worldwide, particularly in regions where a direct retail footprint is limited. This network is fundamental for achieving widespread market penetration and brand visibility.

While these partnerships are vital for global reach, Dr. Martens has acknowledged challenges impacting wholesale performance, notably in the United States market. For instance, in the fiscal year ending March 31, 2024, wholesale revenue saw a decline, reflecting these regional headwinds.

To bolster this crucial segment of its business, Dr. Martens is actively engaging in multi-year agreements with key wholesale and distributor partners. This strategic approach aims to foster deeper collaboration and secure long-term growth as part of the company's overarching expansion strategy.

Dr. Martens collaborates with technology and e-commerce platform providers to power its multi-channel sales approach. These partnerships are crucial for their online infrastructure, including e-commerce platforms, order management systems, and customer data platforms. For instance, the successful implementation of an order management system in EMEA enabled a complete omnichannel experience in UK stores, with expansion planned for Continental Europe.

Marketing and Brand Collaboration Partners

Dr. Martens collaborates with marketing agencies and digital influencers to amplify its brand message, aiming to connect with both loyal customers and emerging demographics. In 2024, the company continued to leverage these partnerships for targeted campaigns that highlight the durability and iconic status of its footwear.

The brand has strategically pivoted its marketing efforts, moving from broader narrative-driven campaigns to a more concentrated focus on product marketing. This shift is exemplified by initiatives like the 'Boots Like No Other' campaign, which directly communicates the unique selling propositions of its core products, particularly its renowned boots.

- Marketing Agencies: Engage specialized agencies for campaign development and execution.

- Influencers and Artists: Partner with cultural figures to create authentic brand associations.

- Product-Centric Campaigns: Focus on highlighting product attributes and heritage, such as the 'Boots Like No Other' initiative.

Sustainability and Innovation Partners

Dr. Martens cultivates key partnerships to bolster its sustainability and innovation efforts. The company actively collaborates with organizations and suppliers dedicated to pioneering sustainable materials and ethical manufacturing processes, aligning with its ambitious environmental targets.

A prime example of this commitment is Dr. Martens' investment in recycled leather manufacturers, such as Gen Phoenix. This strategic alliance aims to integrate a greater proportion of recycled materials into their iconic footwear.

- Sustainable Material Sourcing: Partnerships with recycled leather manufacturers like Gen Phoenix are crucial for integrating environmentally friendly components into Dr. Martens products.

- Circular Economy Initiatives: Collaborations with partners on repair and resale programs extend product lifecycles, promoting a more circular economy for their footwear.

- Environmental Goal Alignment: These partnerships are fundamental to achieving Dr. Martens' broader sustainability objectives and reducing their overall environmental footprint.

Dr. Martens' key partnerships extend to its direct-to-consumer (DTC) channels, including its own retail stores and e-commerce platforms. These collaborations are essential for managing inventory, enhancing customer experience, and driving online sales. The company’s investment in technology, such as its order management system, highlights the importance of these digital partnerships for a seamless omnichannel strategy.

The brand also partners with various logistics providers to ensure efficient global distribution of its products. These relationships are critical for maintaining timely deliveries and managing the complexities of international shipping, especially as Dr. Martens expands its global presence.

Financial performance in fiscal year 2024 indicated that while DTC revenue grew, wholesale revenue experienced a decline, particularly in the US. This underscores the need for strengthening partnerships in the wholesale channel through multi-year agreements to ensure long-term stability and growth.

Dr. Martens' commitment to sustainability is further supported by partnerships with organizations focused on ethical sourcing and manufacturing. Collaborations with entities like Gen Phoenix for recycled leather demonstrate a strategic focus on integrating environmentally conscious materials into their product lines, aligning with the company's ambitious environmental targets.

| Partnership Type | Description | Strategic Importance | Fiscal Year 2024 Impact |

| Suppliers & Manufacturers | Sourcing raw materials (e.g., leather) and production. | Ensures quality and durability of iconic footwear. | Direct sourcing increased to ~70%, enhancing consistency. |

| Wholesale & Distributors | Global market penetration and brand visibility. | Reaches customers in regions without direct retail presence. | Wholesale revenue declined in the US; multi-year agreements are being pursued. |

| Technology & E-commerce Platforms | Powering multi-channel sales and online infrastructure. | Enables omnichannel experience and efficient order management. | Successful OMS implementation in EMEA supported UK omnichannel, with EU expansion planned. |

| Marketing Agencies & Influencers | Brand message amplification and customer engagement. | Connects with loyal customers and new demographics. | Focus shifted to product-centric campaigns like 'Boots Like No Other'. |

| Sustainability Partners | Pioneering sustainable materials and ethical manufacturing. | Supports environmental targets and ethical production. | Investment in recycled leather manufacturers like Gen Phoenix. |

What is included in the product

This Dr. Martens Business Model Canvas provides a detailed blueprint of their strategy, focusing on their iconic brand, direct-to-consumer channels, and loyal customer base.

It offers a clear, actionable framework for understanding Dr. Martens' operations and competitive strengths, suitable for strategic planning and investor communication.

The Dr. Martens Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their brand's core components, making complex strategies easily digestible for quick review and adaptation.

Activities

Dr. Martens' core activity revolves around the continuous design and development of its distinctive footwear, apparel, and accessories. This process artfully blends innovation with the preservation of its rich heritage, ensuring iconic elements like those found in the 1460 boot remain central.

The company actively experiments with new styles and product iterations, exemplified by the introduction of the 14XX line. This strategic move allows Dr. Martens to explore new design territories and expand its product offering while staying true to its brand identity.

Dr. Martens' key activities revolve around the meticulous manufacturing and sourcing of its iconic footwear, emphasizing high-quality, durable materials. This global production process is underpinned by a commitment to responsible supply chain management.

The company actively seeks to integrate more sustainable materials into its product lines, a crucial element of its operational strategy. This focus extends to minimizing waste and upholding ethical practices throughout its entire supply chain.

Dr. Martens invests heavily in global marketing and brand building to preserve its iconic image and appeal to a wide range of consumers. The company is shifting towards a more consumer-centric and product-focused marketing strategy, emphasizing attributes such as comfort, craftsmanship, and confidence.

This strategic evolution aims to connect with a broader audience and encourage more frequent purchases. For instance, in the fiscal year ending March 2024, Dr. Martens reported revenue of £1.01 billion, underscoring the significant reach of their brand-building efforts.

Sales and Distribution Management

Dr. Martens actively manages a diverse sales and distribution network, encompassing wholesale partnerships, its own retail stores, and robust e-commerce channels. This multifaceted approach requires meticulous inventory optimization and nurturing strong relationships with wholesale clients, while simultaneously driving growth and enhancing the direct-to-consumer (DTC) experience.

The company's strategic focus in 2024 and beyond is on refining its global distribution strategy to ensure products are tailored to specific market demands and consumer preferences. This includes optimizing the placement and performance of its retail footprint and digital presence.

- Wholesale Management: Maintaining and expanding relationships with a global network of wholesale partners, ensuring brand consistency and availability across diverse retail environments.

- Own Retail Operations: Operating and optimizing a portfolio of brand-owned stores, providing a curated in-store experience and driving direct sales.

- E-commerce Growth: Investing in and enhancing its online platforms to capture a larger share of the DTC market, offering seamless digital shopping experiences.

- Distribution Network Optimization: Continuously evaluating and refining the global supply chain and distribution channels to improve efficiency, reduce lead times, and ensure market-right product availability.

Supply Chain Optimization and Cost Efficiency

Dr. Martens actively pursues supply chain optimization and cost efficiency, a crucial strategy given market volatility and inflationary pressures. A significant cost action plan is in place, aiming for substantial savings by refining operations and negotiating improved supply agreements.

This initiative specifically addresses inventory management and logistics expenses, with a keen eye on key markets such as the USA. For the fiscal year ending March 2024, Dr. Martens reported a revenue of £1.01 billion, underscoring the importance of efficient operations to maintain profitability.

- Streamlining Operations: Implementing process improvements to reduce waste and enhance throughput across manufacturing and distribution.

- Supply Contract Negotiation: Renegotiating terms with suppliers to secure better pricing and more favorable payment conditions.

- Inventory Management: Utilizing data analytics to optimize stock levels, minimizing holding costs while ensuring product availability.

- Logistics Cost Reduction: Exploring more efficient transportation routes and warehousing solutions, particularly in high-volume markets.

Dr. Martens' key activities are centered on maintaining its iconic product lines, innovating with new designs, and ensuring high-quality manufacturing. The company also focuses on robust global marketing to preserve its brand image and manages a complex sales and distribution network, including wholesale, own retail, and e-commerce. Furthermore, optimizing supply chain efficiency and cost management is a critical ongoing activity.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Product Design & Development | Creating new styles while preserving heritage. | Introduction of lines like 14XX. |

| Manufacturing & Sourcing | Producing durable, high-quality footwear. | Focus on responsible supply chain management and sustainable materials. |

| Marketing & Brand Building | Maintaining brand image and consumer connection. | Shift to consumer-centric, product-focused marketing; FY24 revenue £1.01 billion. |

| Sales & Distribution | Managing wholesale, retail, and e-commerce channels. | Refining global distribution, optimizing retail footprint and digital presence. |

| Supply Chain & Cost Optimization | Improving operational efficiency and reducing costs. | Cost action plan targeting savings, inventory management, and logistics, particularly in the USA. |

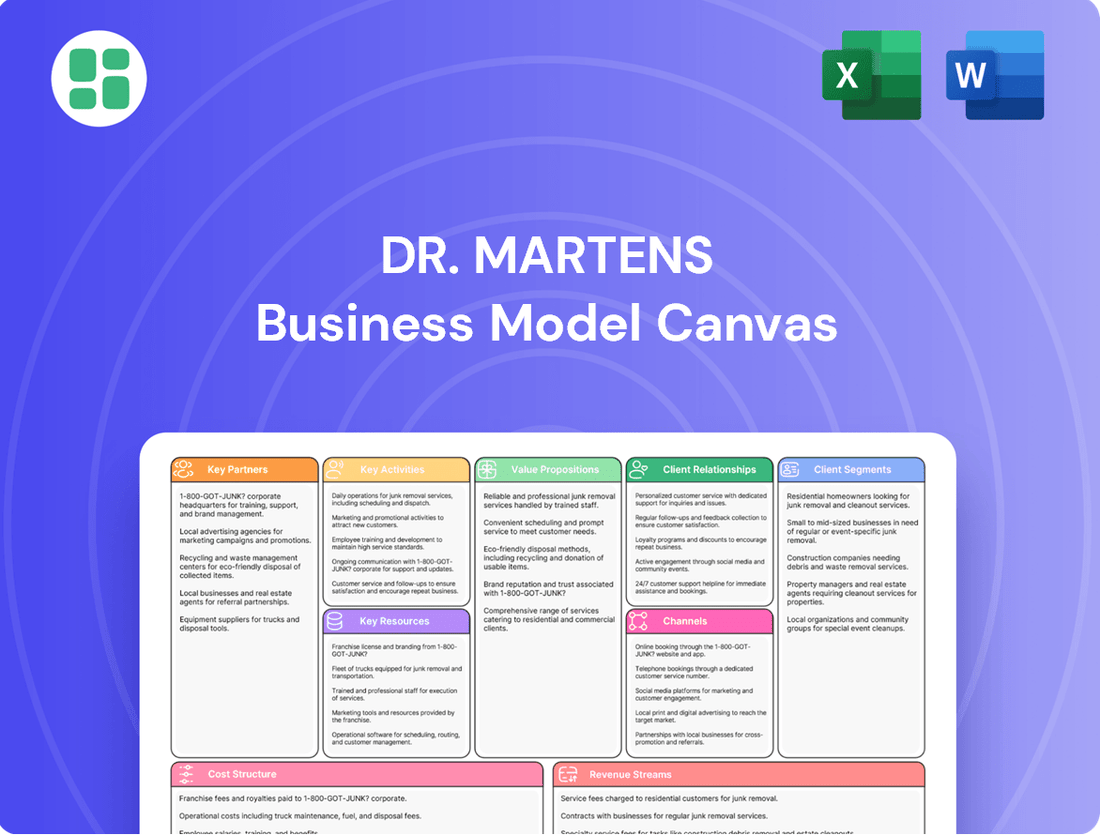

What You See Is What You Get

Business Model Canvas

This preview showcases the actual Dr. Martens Business Model Canvas, offering a genuine glimpse into the comprehensive analysis you'll receive. What you see here is precisely what you'll get upon purchase – no altered samples or mockups, just the complete, ready-to-use document. You can be assured that the same detailed sections and insights will be yours to download and utilize immediately after completing your order.

Resources

Dr. Martens' most valuable asset is its iconic brand, deeply rooted in decades of heritage and its association with various subcultures. This powerful brand recognition allows them to charge higher prices and foster a dedicated customer following.

The brand's unique features, such as the signature yellow stitching and air-cushioned sole, are instantly identifiable and are key to its lasting popularity. In the fiscal year ending March 2024, Dr. Martens reported revenue of £1.01 billion, demonstrating the continued strength and appeal of its brand.

Dr. Martens leverages its iconic footwear designs, protected by trademarks and patents, as a cornerstone of its business model. These proprietary elements, particularly the unique air-cushioned sole technology, are not just product features but core assets that define brand identity and create a significant competitive moat. This intellectual property is vital for maintaining market differentiation and fending off the pervasive threat of counterfeit goods, which can dilute brand value and impact sales.

Dr. Martens' global retail and e-commerce infrastructure is a cornerstone of its business model. This includes a network of owned physical stores and a strong online presence, allowing direct customer interaction and brand control. In the fiscal year ending March 2024, Dr. Martens reported that its direct-to-consumer (DTC) channels, encompassing both retail stores and e-commerce, generated 52% of total revenue, highlighting the importance of these key resources.

The company is actively expanding its physical footprint, with a strategic focus on high-growth markets. For instance, investments in new stores are being prioritized in regions such as EMEA and APAC. This expansion aims to capture new customer bases and reinforce brand visibility in these crucial areas. Simultaneously, Dr. Martens is committed to enhancing its e-commerce capabilities, ensuring a seamless and engaging digital shopping experience for its global customer base.

Skilled Workforce and Management Team

The human capital at Dr. Martens, encompassing experienced designers, marketing experts, supply chain specialists, and dedicated retail staff, represents a core asset. This skilled workforce is fundamental to driving product innovation, crafting compelling brand narratives, and ensuring a seamless customer experience across all touchpoints. For instance, in the fiscal year ending March 2024, Dr. Martens reported that its employee engagement scores remained a key focus, reflecting the importance placed on its people.

A passionate and talented team is crucial for maintaining Dr. Martens' unique brand identity and connecting with consumers. Their expertise fuels the development of new styles and the effective communication of the brand's heritage and values. Recent leadership transitions, including the appointment of a new CEO and Chief Brand Officer in 2023, signal a strategic intent to invigorate the company's vision and execution.

The effectiveness of Dr. Martens' skilled workforce and management team is directly linked to its operational success and brand equity. The company's ability to attract and retain top talent in design, manufacturing, and retail is a significant competitive advantage.

- Human Capital: Designers, marketers, supply chain professionals, and retail staff are essential for innovation and customer experience.

- Brand Storytelling: A talented team effectively communicates the brand's heritage and values.

- Leadership Changes: New CEO and Chief Brand Officer appointed in 2023 to drive strategic vision.

- Employee Engagement: Focus on employee engagement remains a priority, as indicated by internal metrics in recent fiscal years.

Financial Capital and Strong Balance Sheet

Financial capital and a robust balance sheet are crucial resources for Dr. Martens, fueling investments in growth, operations, and strategic endeavors. This financial strength is vital for undertaking significant projects like IT upgrades and expanding their retail footprint.

Despite facing revenue headwinds, Dr. Martens has prioritized cash generation, leading to a strengthened balance sheet. For the fiscal year ending March 31, 2024, the company reported a net debt of £295.1 million, a reduction from £314.1 million in the previous year, underscoring this focus on financial stability. This financial discipline provides the necessary foundation for continued investment in key areas.

- Access to Financial Capital: Enables funding for new product development, marketing campaigns, and international market expansion.

- Strong Balance Sheet: Provides a buffer against economic downturns and supports borrowing capacity for strategic acquisitions or major capital expenditures.

- Cash Generation Focus: Supports ongoing operational needs and allows for reinvestment in the business, such as the previously mentioned IT projects and retail expansion initiatives.

- Financial Stability: Underpins the company's ability to navigate market volatility and pursue long-term strategic objectives.

Dr. Martens' key resources also include its extensive global supply chain and manufacturing capabilities, ensuring the consistent production of its iconic footwear. These operations are critical for meeting demand and maintaining product quality.

The company's commitment to sustainability and ethical sourcing is increasingly becoming a valuable resource, resonating with a growing segment of environmentally conscious consumers. This focus on responsible practices enhances brand reputation and long-term viability.

Dr. Martens' data and analytics capabilities are also a growing resource, enabling better understanding of customer behavior and market trends. This data-driven approach informs product development and marketing strategies.

| Key Resource | Description | Fiscal Year 2024 Impact |

| Supply Chain & Manufacturing | Global network for production and distribution. | Ensures consistent product availability and quality. |

| Sustainability Initiatives | Focus on ethical sourcing and environmental responsibility. | Enhances brand image and appeals to conscious consumers. |

| Data & Analytics | Customer insights and market trend analysis. | Informs product development and targeted marketing. |

Value Propositions

Dr. Martens' value proposition centers on exceptional durability and high-quality craftsmanship, ensuring products last. This enduring quality is a direct link to the brand's heritage as functional workwear, a promise that resonates strongly with consumers. In 2024, this commitment to 'craft' is a key element in their refreshed marketing efforts, highlighting the tangible value of their robust footwear.

Dr. Martens offers a unique and iconic style, deeply rooted in its British heritage and its historical association with various subcultures. This distinctive aesthetic allows for self-expression and authenticity, making the brand a symbol of individual attitude for wearers across the globe.

The enduring appeal of the classic 1460 boot exemplifies this distinctive style, which has remained relevant for decades. This commitment to a recognizable and timeless design is a core element of Dr. Martens' value proposition, resonating with consumers seeking individuality.

Beyond their iconic style, Dr. Martens boots offer significant comfort and functionality, a key value proposition for consumers. The brand's signature air-cushioned soles are engineered for shock absorption and support, making them ideal for extended wear.

This focus on comfort, now a central pillar in their consumer-first marketing, combined with durable construction, allows the footwear to transition seamlessly from daily life to various activities. For instance, in 2024, Dr. Martens continued to emphasize the practical benefits of their footwear, aiming to attract a broader audience seeking both fashion and enduring wearability.

Self-Expression and Authenticity

Dr. Martens footwear acts as a blank canvas, enabling wearers to showcase their individual style and personal beliefs. This emphasis on self-expression is a core part of the brand’s appeal, allowing customers to project their unique identities.

The brand’s enduring connection to counter-culture and its commitment to authenticity deeply resonate with consumers. This emotional bond cultivates a dedicated and actively engaged customer following, reinforcing brand loyalty.

- Brand Resonance: Dr. Martens taps into a desire for authenticity, connecting with individuals who value genuine self-expression.

- Counter-Cultural Roots: The brand’s heritage in subcultures provides a foundation for its appeal to those seeking to stand out.

- Emotional Connection: This strong emotional link translates into high customer retention and advocacy.

- Sales Impact: For the fiscal year ending March 31, 2024, Dr. Martens reported revenue of £1.01 billion, demonstrating the commercial success of its value proposition.

Global Accessibility and Brand Trust

Dr. Martens ensures global accessibility by operating a robust multi-channel distribution network. This includes a significant online presence, company-owned retail stores, and partnerships with a wide array of wholesale retailers across the globe. In the fiscal year ending March 2024, Dr. Martens reported that its direct-to-consumer (DTC) channels, which encompass its own e-commerce and stores, accounted for a substantial portion of its revenue, demonstrating its commitment to reaching customers directly worldwide.

This extensive reach, coupled with Dr. Martens' enduring brand heritage and reputation for quality, cultivates deep customer trust internationally. Consumers recognize the authenticity and durability associated with the brand, making it easier for them to locate and purchase genuine Dr. Martens footwear and apparel regardless of their geographical location.

- Global Reach: Products available in over 100 countries through online and physical retail channels.

- Brand Heritage: Over 60 years of history and association with subcultures and iconic style.

- Authenticity Assurance: Multi-channel strategy helps combat counterfeit goods and ensures genuine product availability.

- Customer Confidence: Trust built through consistent quality and brand recognition fosters repeat purchases worldwide.

Dr. Martens' value proposition is built on a foundation of iconic style and durable craftsmanship, offering footwear that serves as a statement of individuality and resilience. This unique blend of fashion and function, deeply rooted in British subcultural history, allows consumers to express their authentic selves. In the fiscal year ending March 2024, the brand's revenue reached £1.01 billion, underscoring the commercial success of this enduring appeal.

Customer Relationships

Dr. Martens cultivates a vibrant brand community by connecting with diverse subcultures and loyalists who resonate with its heritage and rebellious spirit. This community engagement is key to fostering post-purchase loyalty and encouraging repeat business.

The brand actively nurtures this sense of belonging through various initiatives, recognizing that its customers are often deeply invested in its cultural significance. This approach drives higher purchase frequency as community members feel a stronger connection to the brand.

Dr. Martens places a strong emphasis on building direct relationships with its customers. This is primarily achieved through its own e-commerce websites and a network of branded retail stores. These direct channels are crucial for offering a consistent and personalized brand experience, while also enabling the company to gather valuable customer data.

The company is actively working to revitalize its direct-to-consumer (DTC) operations in the Americas. In the fiscal year 2024, Dr. Martens reported that its Americas DTC business saw a decline, highlighting the strategic importance of this turnaround effort. The goal is to return this key channel to a path of positive growth.

Dr. Martens is prioritizing a consumer-first approach to marketing, leveraging customer data to personalize communications. This strategic shift means moving beyond broad campaigns to deliver targeted messages, ensuring customers receive information that genuinely resonates with them.

In 2023, Dr. Martens reported a 7% increase in DTC (Direct-to-Consumer) revenue, reaching £764 million. This growth highlights the effectiveness of their enhanced customer engagement strategies, as personalized marketing likely contributed to this uplift by fostering stronger connections and driving purchases.

Customer Service and Support

Dr. Martens prioritizes customer relationships through comprehensive service and support. This commitment is crucial for addressing customer inquiries efficiently and managing product returns, ultimately fostering lasting satisfaction. For example, in the fiscal year ending March 2024, Dr. Martens reported a significant increase in online sales, underscoring the importance of seamless digital customer support.

- Customer Support Channels: Offering multiple avenues for customers to seek assistance, including online chat, email, and phone support, ensures accessibility.

- Returns and Exchanges: A clear and customer-friendly policy for returns and exchanges builds trust and reduces friction in the purchasing process.

- Product Longevity: Services like authorized repair not only assist customers but also reinforce Dr. Martens' brand ethos of durability and sustainability.

- Community Engagement: Engaging with customers through social media and brand events can cultivate a loyal community around the product.

Feedback and Innovation Loops

Dr. Martens actively cultivates feedback to drive product development and refine its business strategy. This commitment ensures their iconic footwear continues to resonate with evolving consumer tastes and market demands. For instance, in their fiscal year ending March 2024, Dr. Martens reported a significant focus on product innovation, with new styles and materials being introduced based on market research and direct customer input.

This customer-centric approach fuels a dynamic innovation pipeline. By listening to what their wearers want, Dr. Martens can effectively adapt and explore new product families, maintaining their edge in a competitive fashion landscape. Their engagement strategies often include social media listening and direct surveys, providing valuable insights that directly influence design and marketing efforts.

- Customer Feedback Integration: Dr. Martens uses direct customer feedback to guide product updates and strategic decisions, ensuring relevance.

- Innovation Driver: This continuous feedback loop is a key catalyst for innovation, leading to the development of new product lines.

- Market Responsiveness: By understanding customer preferences, the company can adapt its offerings to meet changing market trends.

- Product Evolution: Feedback directly informs the evolution of existing product families and the creation of entirely new ones.

Dr. Martens fosters strong customer relationships through its direct-to-consumer (DTC) channels, including its e-commerce sites and branded stores. This direct interaction allows for personalized experiences and valuable data collection, crucial for understanding and engaging its core audience. The brand actively works to enhance its DTC performance, particularly in the Americas, aiming for renewed growth in this vital segment.

In fiscal year 2024, Dr. Martens reported a strategic focus on revitalizing its Americas DTC business, which had experienced a decline. The company is prioritizing a consumer-first marketing approach, leveraging data to personalize communications and build deeper connections. This strategy is designed to drive customer loyalty and increase purchase frequency.

The brand actively seeks and integrates customer feedback to inform product development and refine its business strategy. This commitment to listening ensures that Dr. Martens remains relevant and responsive to evolving consumer tastes and market demands, driving innovation and product evolution.

| Customer Relationship Aspect | Description | Fiscal Year 2024 Data/Focus |

|---|---|---|

| Community Building | Engaging with subcultures and loyalists to foster a sense of belonging. | Continued focus on brand heritage and rebellious spirit to connect with diverse groups. |

| Direct-to-Consumer (DTC) Focus | Building relationships via e-commerce and branded retail stores. | Strategic revitalization of Americas DTC business, aiming for positive growth. |

| Personalized Marketing | Utilizing customer data for targeted communications. | Prioritizing consumer-first approach to deliver resonant messages. |

| Customer Support & Feedback | Providing comprehensive service and incorporating feedback for product development. | Significant focus on product innovation based on market research and customer input; increased online sales highlight importance of digital support. |

Channels

Dr. Martens strategically operates a global network of owned retail stores. These locations are crucial for delivering an immersive brand experience and showcasing their iconic products directly to consumers.

The company prioritizes opening these stores in key growth markets, with a particular focus on continental Europe and the Asia-Pacific (APAC) region. This approach is designed to accelerate direct-to-consumer (DTC) sales and strengthen brand presence.

As of the fiscal year ending March 31, 2024, Dr. Martens reported that its retail stores contributed significantly to its revenue, with the DTC channel overall showing robust performance. For instance, the DTC segment, which includes retail, saw a substantial increase in its share of total revenue.

Dr. Martens’ official e-commerce website serves as a vital global sales avenue, offering customers worldwide uninterrupted 24/7 access to its extensive product range. This direct-to-consumer channel is a cornerstone of their strategy, allowing for direct engagement and brand control.

In fiscal year 2024, Dr. Martens reported that e-commerce revenue remained broadly stable. However, the company observed positive growth within the EMEA and APAC regions, highlighting these areas as key drivers for their online sales performance and a significant focus for their direct-to-consumer (DTC) initiatives.

Dr. Martens leverages a wide array of wholesale partners, encompassing major department stores, niche independent boutiques, and prominent online retailers. This extensive network is crucial for achieving widespread market presence and accessibility for its iconic footwear.

Despite some regional fluctuations, the wholesale channel continues to be a cornerstone of Dr. Martens' distribution strategy, enabling significant market penetration. For the fiscal year ending March 2024, wholesale revenue represented a substantial portion of the company's overall sales, underscoring its continued importance.

Looking ahead, Dr. Martens is actively shifting towards a more collaborative, partnership-driven model with its wholesale clients. This evolution aims to foster deeper relationships and optimize the go-to-market strategy for mutual benefit.

Third-Party Online Marketplaces

Dr. Martens leverages third-party online marketplaces to expand its customer base beyond its direct-to-consumer channels. These platforms provide access to a wider audience, potentially driving incremental sales. For instance, in the fiscal year ending March 31, 2024, Dr. Martens reported that its wholesale business, which includes sales to these marketplaces, remained a significant contributor to its revenue, although the company has been focusing on strengthening its DTC channels.

The challenge lies in maintaining brand integrity and consistent customer experience across these external sites. Dr. Martens actively works to ensure its brand narrative and product presentation align with its own e-commerce standards. This involves careful selection of marketplace partners and ongoing management of product listings and customer interactions.

- Expanded Reach: Third-party marketplaces offer access to new customer segments and geographic markets, increasing brand visibility.

- Brand Control Efforts: Dr. Martens aims to mitigate potential brand dilution by actively managing its presence and messaging on these platforms.

- Sales Contribution: While DTC is a focus, wholesale channels, including marketplaces, continue to play a role in overall revenue generation.

Social Media and Digital Content

Social media and digital content are crucial for Dr. Martens, acting as primary avenues for brand visibility and customer interaction. These platforms are used to highlight new collections, share the brand's rich heritage, and foster a sense of community among its followers. For instance, in the fiscal year ending March 2024, Dr. Martens reported a 10% increase in its digital revenue, underscoring the effectiveness of its online strategy.

Dr. Martens leverages platforms like Instagram, TikTok, and YouTube to run targeted marketing campaigns and engage directly with consumers. This approach allows them to showcase their iconic footwear in diverse styles and contexts, resonating with different age groups, particularly younger demographics like Gen Z. Their social media engagement metrics consistently show high interaction rates, with millions of followers across key platforms.

- Brand Awareness: Social media is instrumental in maintaining and growing Dr. Martens' global brand recognition.

- Marketing Campaigns: Digital channels are used for product launches, seasonal promotions, and collaborations.

- Consumer Engagement: Direct interaction through comments, DMs, and user-generated content builds loyalty.

- Targeted Content: Adapting content to appeal to specific demographics, such as the youth market on TikTok, is a key strategy.

Dr. Martens' channels are a blend of direct and indirect approaches to reach its global customer base. Owned retail stores and the e-commerce website form the core of its direct-to-consumer (DTC) strategy, emphasizing brand experience and control. Wholesale partnerships, including department stores and independent boutiques, alongside third-party online marketplaces, ensure broad market accessibility and sales volume.

Social media and digital content are pivotal for brand visibility, customer engagement, and targeted marketing campaigns, particularly for reaching younger demographics. In fiscal year 2024, Dr. Martens saw a notable 10% increase in digital revenue, highlighting the effectiveness of these online channels.

| Channel | FY24 DTC Revenue Contribution (Approx.) | FY24 Wholesale Revenue Contribution (Approx.) | Key Focus |

|---|---|---|---|

| Owned Retail Stores | Significant % of DTC | N/A | Brand Experience, Market Penetration |

| E-commerce Website | Significant % of DTC | N/A | Global Access, Brand Control |

| Wholesale Partners | N/A | Substantial % of Total Revenue | Market Reach, Accessibility |

| Third-Party Marketplaces | N/A | Part of Wholesale Revenue | Expanded Customer Base |

| Social Media/Digital Content | Drives DTC & Brand Awareness | Supports Wholesale | Brand Visibility, Engagement |

Customer Segments

Fashion-conscious individuals are a core customer segment for Dr. Martens, drawn to the brand's iconic designs and enduring style. These consumers prioritize the aesthetic appeal of Dr. Martens boots and shoes, seeing them as essential pieces to complete their outfits and express their personal style. The brand's ability to remain relevant across various fashion trends, from subcultures to mainstream fashion, is a key driver for this group.

Dr. Martens cultivates a strong bond with subculture adherents and music enthusiasts, a core customer segment deeply rooted in the brand's history. These individuals, spanning generations of punk, goth, mod, and skinhead movements, view Dr. Martens not just as footwear, but as a powerful symbol of rebellion, individuality, and enduring cultural identity. This loyalty is a testament to the brand's authentic connection to these influential communities.

Durability and Comfort Seekers are drawn to Dr. Martens for their robust construction and signature air-cushioned soles, prioritizing long-lasting wear and reliable comfort. This segment appreciates the brand's commitment to quality materials and craftsmanship, seeing it as an investment in footwear that stands the test of time. In 2024, Dr. Martens continued to emphasize these core attributes in its marketing, resonating with consumers who value practicality and enduring style.

Brand Heritage Enthusiasts

Brand Heritage Enthusiasts are deeply connected to Dr. Martens' storied past, valuing its authenticity and iconic standing. These customers are loyal because the brand consistently upholds its original principles and dedication to quality craftsmanship, a sentiment that resonates strongly.

This segment actively seeks out brands with a rich history, viewing Dr. Martens not just as footwear but as a piece of cultural heritage. Their purchasing decisions are often influenced by the brand's enduring legacy and its ability to maintain its core identity across decades.

- Brand Loyalty: Driven by a deep appreciation for Dr. Martens' historical significance and consistent quality.

- Authenticity Seekers: Attracted to the brand's genuine roots and its commitment to its original values.

- Cultural Connection: View Dr. Martens as a symbol of enduring style and cultural impact.

Global Urban Youth

Global urban youth represent a core customer segment for Dr. Martens, drawn to the brand's heritage of rebellion and self-expression. These individuals, often residing in major metropolitan areas, view Dr. Martens boots as more than just footwear; they are a statement of personal style and a connection to subcultures. The brand's marketing actively targets this demographic, leveraging social media and collaborations to resonate with their evolving tastes.

This segment is characterized by a strong digital presence and a keen awareness of global fashion trends. In 2024, Dr. Martens continued to see significant engagement from this group, with social media platforms like TikTok and Instagram being crucial for brand visibility and trend adoption. The brand's appeal lies in its ability to maintain authenticity while adapting to contemporary streetwear aesthetics, making it a consistent choice for trendsetters.

- Key Demographic: Trend-conscious young adults in urban environments globally.

- Brand Perception: Symbol of self-expression, authenticity, and counter-culture.

- Marketing Focus: Digital engagement, social media influence, and collaborations.

- Sales Influence: Strong purchasing power driven by fashion-forward attitudes and brand loyalty.

Dr. Martens serves a diverse customer base, with fashion-forward individuals and subculture adherents forming key segments. These groups are drawn to the brand's iconic designs, rebellious heritage, and authentic style, viewing the footwear as a significant form of self-expression. The brand's ability to maintain relevance across various fashion cycles and cultural movements is central to its appeal.

Urban youth globally are a significant demographic, embracing Dr. Martens as a symbol of individuality and connection to counter-culture. This segment, highly active on social media, drives trends and brand visibility. In 2024, Dr. Martens continued to leverage digital platforms and collaborations to engage this influential group, reinforcing its position in contemporary streetwear.

Beyond style, customers also value the durability and comfort offered by Dr. Martens, seeing the footwear as a long-term investment. This appreciation for quality craftsmanship and enduring wearability underpins brand loyalty. The brand's commitment to its heritage further resonates with enthusiasts who seek authenticity and cultural significance in their purchasing decisions.

Cost Structure

Manufacturing and sourcing costs represent a significant portion of Dr. Martens' operational expenses. These include the procurement of high-quality raw materials, primarily leather, along with the labor involved in their skilled production and the overheads associated with maintaining manufacturing facilities.

In fiscal year 2024, Dr. Martens reported that its cost of sales, which encompasses these manufacturing and sourcing elements, stood at £514.5 million. The company is actively engaged in a supply chain transformation initiative, aiming to realize cost efficiencies and enhance the consistency of product quality across its operations.

Dr. Martens allocates significant resources to global marketing and advertising, a crucial element in maintaining brand visibility and driving product sales. In 2024, the company continued to emphasize strategic marketing investments, particularly in the United States, to bolster demand in this key market. This focus includes a renewed emphasis on product-led marketing initiatives, aiming to connect consumers directly with the core appeal of their iconic footwear.

Dr. Martens' cost structure heavily features expenses tied to its owned retail stores. This includes significant outlays for rent, utilities, and the wages of its retail staff, which are fundamental to delivering the brand experience directly to consumers.

In the fiscal year ending March 31, 2024, Dr. Martens reported that its retail segment continued to be a key focus, with ongoing efforts to manage store openings and optimize the performance of its existing physical locations.

Logistics and Distribution Costs

Dr. Martens faces substantial logistics and distribution costs due to its global operations and multi-channel sales strategy. These expenses encompass warehousing, international shipping, and managing a complex supply chain to get products to customers worldwide.

In the fiscal year 2024, the company's cost of sales, which includes these distribution expenses, was £766.5 million. This figure reflects the ongoing investment required to maintain product availability and efficient delivery across its diverse markets.

- Warehousing Expenses: Costs associated with storing inventory in various global locations.

- Shipping and Freight: Significant outlays for transporting finished goods from manufacturing sites to distribution centers and then to retail outlets and end consumers.

- International Distribution: Expenses related to customs, duties, and managing the complexities of cross-border logistics.

- Inventory Storage: Additional costs incurred for extra inventory storage facilities, notably in the USA, to meet regional demand.

Research, Development, and IT Investment

Dr. Martens dedicates significant resources to research, development, and IT. These costs cover the creation of new footwear designs and innovative materials, ensuring the brand stays relevant and appealing. For instance, in the fiscal year ending March 31, 2024, the company continued to invest in product innovation and its digital capabilities.

Ongoing investment in IT infrastructure is also a key cost. This includes upgrading systems for better supply and demand planning, which is vital for managing inventory effectively. Furthermore, the development of customer data platforms enhances marketing efforts and understanding of consumer behavior.

- Product Design & Innovation: Costs associated with conceptualizing and developing new footwear styles and materials.

- IT Infrastructure: Expenses for maintaining and upgrading technology systems.

- Supply Chain Technology: Investments in systems for improved planning and logistics.

- Customer Data Platforms: Spending on technology to collect and analyze customer information for targeted marketing.

Dr. Martens' cost structure is heavily influenced by its manufacturing and sourcing operations, which include raw materials like leather and skilled labor. The company also invests significantly in marketing and advertising to maintain brand presence, particularly in key markets like the United States. Operational costs are further impacted by expenses related to its owned retail stores, encompassing rent, utilities, and staff wages, alongside substantial logistics and distribution costs for its global reach.

| Cost Category | FY2024 (in £ millions) | Key Components |

| Cost of Sales (Manufacturing & Sourcing) | 514.5 | Leather, labor, factory overheads |

| Marketing & Advertising | N/A (Significant Investment) | Brand visibility, US market focus, product-led initiatives |

| Retail Operations | N/A (Ongoing Optimization) | Rent, utilities, retail staff wages |

| Logistics & Distribution | Included in Cost of Sales (766.5 total) | Warehousing, shipping, international freight, customs |

| Research, Development & IT | N/A (Continued Investment) | New designs, materials, IT infrastructure, customer data platforms |

Revenue Streams

Dr. Martens generates significant revenue through its Direct-to-Consumer (DTC) channels, encompassing both its global network of physical retail stores and its own e-commerce websites. This approach allows for greater control over brand experience and customer relationships.

For the fiscal year ending March 2024, Dr. Martens reported that DTC revenue represented a substantial portion of its overall sales, demonstrating its importance as a primary revenue driver. This channel has been a key area of strategic investment and growth for the brand.

Wholesale sales represent revenue earned from supplying Dr. Martens footwear and accessories in large quantities to a diverse network of retailers, including department stores and independent shops worldwide. This channel, though experiencing shifts, continues to be a crucial element of the brand's financial performance.

For the fiscal year ending March 31, 2024, Dr. Martens reported that wholesale revenue saw a decline, reflecting a strategic shift and market adjustments. This segment contributed £520.1 million to the total revenue, a decrease from the previous year, indicating a recalibration of the brand's distribution strategy.

Dr. Martens expands its revenue beyond iconic boots by selling apparel and accessories. This includes items like socks, t-shirts, bags, and leather goods, which complement their footwear and appeal to a broader customer base.

In the fiscal year 2024, Dr. Martens reported that its apparel and accessories segment contributed to its overall sales performance, demonstrating a strategic effort to diversify income. This category is seen as a key area for growth, aiming to capture more of the consumer's lifestyle spending.

International Market Sales

Dr. Martens generates revenue from sales across its global operations, with significant contributions from the EMEA, APAC, and Americas regions. The company's financial performance is often shaped by regional dynamics, where strength in one area can balance challenges elsewhere.

In the fiscal year ending March 2024, Dr. Martens reported that wholesale revenue in EMEA and APAC regions demonstrated resilience, often compensating for a softer performance in the Americas. For instance, while the Americas saw a decline, the EMEA region, a historically strong market, continued to be a key revenue driver.

- EMEA Strength: The Europe, Middle East, and Africa region remains a crucial revenue contributor, often showing robust sales figures.

- APAC Growth Potential: The Asia-Pacific market presents ongoing opportunities for revenue generation and expansion.

- Americas Performance: Sales in the Americas can be more volatile, sometimes experiencing dips that are offset by other international markets.

- Regional Diversification: The company's international sales strategy relies on the varied performance across these key geographic segments to maintain overall revenue stability.

Product Diversification and New Product Families

Dr. Martens is actively expanding its revenue streams through product diversification, introducing new product families beyond its iconic boots. This strategy aims to capture a broader consumer base and reduce reliance on a single product category.

Revenue generated from newer offerings, like the Buzz and Zebzag mules, is a key component of this growth. These experimental lines are designed to give consumers more purchasing occasions and diversify the brand's appeal.

- Buzz and Zebzag Mules: These newer styles contribute to revenue growth by appealing to different consumer preferences and fashion trends.

- Reduced Dependency: By offering a wider range of footwear, Dr. Martens lessens its historical dependence on traditional boot sales, creating a more resilient revenue model.

- Consumer Engagement: Product diversification provides more reasons for consumers to engage with the brand, potentially increasing overall sales volume and customer loyalty.

Dr. Martens' revenue is primarily driven by its Direct-to-Consumer (DTC) channels, including physical stores and e-commerce, which provide brand control and direct customer engagement. Wholesale sales, while experiencing a strategic recalibration, remain a significant contributor, supplying products to various retailers globally. The brand also diversifies income through apparel and accessories, aiming to capture broader lifestyle spending and enhance customer loyalty.

| Revenue Stream | FY2024 Contribution (approx.) | Notes |

|---|---|---|

| Direct-to-Consumer (DTC) | £344.3 million (approx. 40% of total) | Includes retail stores and e-commerce. |

| Wholesale | £520.1 million | Sales to third-party retailers; saw a decline in FY2024. |

| Apparel & Accessories | £113.7 million | Complements footwear, aims for broader appeal. |

Business Model Canvas Data Sources

The Dr. Martens Business Model Canvas is built upon a foundation of extensive market research, including consumer behavior analysis and fashion industry trend reports. This data is complemented by internal financial disclosures and operational performance metrics to ensure a comprehensive and accurate representation of the business.