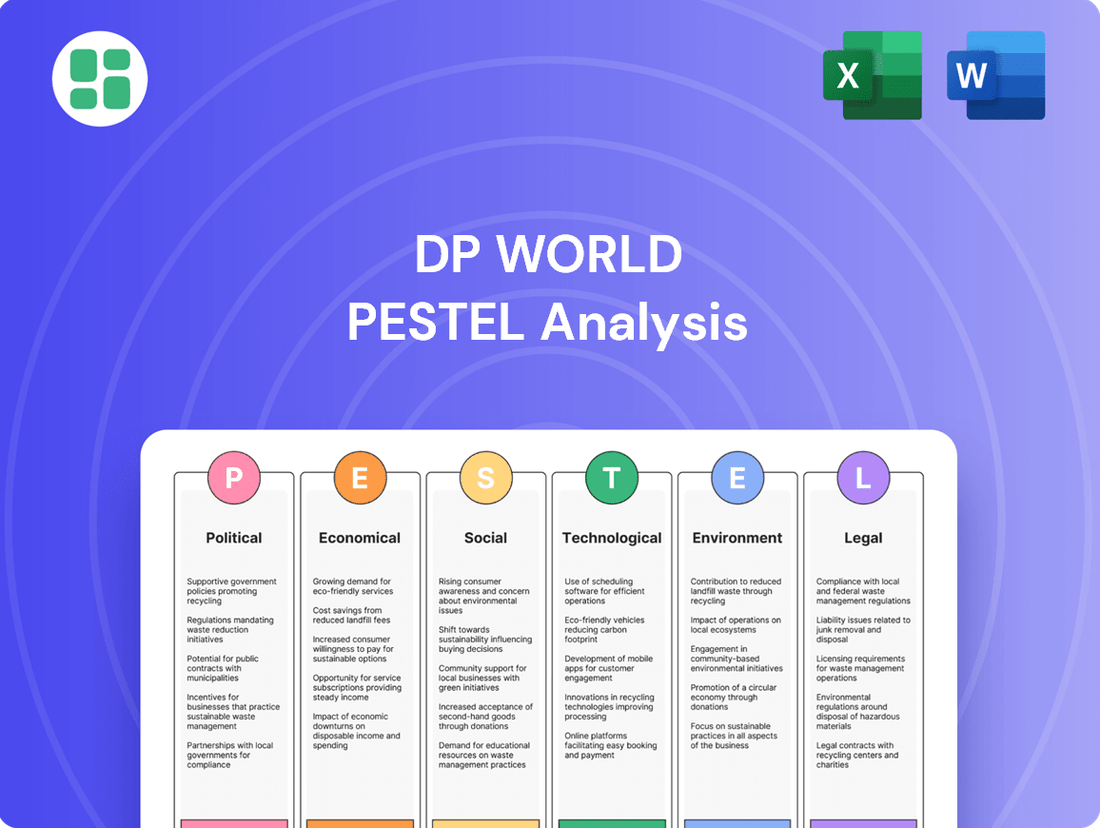

DP World PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DP World Bundle

Unlock the critical external factors shaping DP World's trajectory with our comprehensive PESTLE analysis. From geopolitical shifts to evolving environmental regulations, understand the forces driving change and identify potential opportunities and threats. Don't miss out on this essential intelligence—download the full report now to gain a competitive advantage.

Political factors

DP World's vast global operations make it acutely sensitive to geopolitical shifts. For instance, ongoing conflicts in regions like Eastern Europe and the Middle East can disrupt major shipping lanes, impacting transit times and increasing insurance costs. In 2024, the Red Sea crisis alone led to significant rerouting of vessels, adding days to voyages and pushing up freight rates, directly affecting DP World's throughput and profitability.

Trade tensions, such as those that have historically existed between major economic powers, also pose a substantial risk. Tariffs and trade barriers can reduce cargo volumes and alter trade patterns, requiring DP World to adapt its network and services. The ongoing recalibration of global supply chains, partly driven by geopolitical considerations, means DP World must remain agile in managing its port infrastructure and logistics operations.

Government trade policies, such as tariffs and quotas, directly impact global trade volumes, influencing demand for DP World's port and logistics services. For instance, the World Trade Organization (WTO) reported that global trade growth slowed to an estimated 0.9% in 2023, down from 5.3% in 2022, highlighting the sensitivity of the sector to protectionist trends.

DP World's operations are heavily reliant on free trade agreements (FTAs) that reduce barriers and facilitate cross-border movement of goods. The proliferation of regional FTAs, like the AfCFTA which aims to boost intra-African trade by 52% by 2025, presents significant growth avenues, provided they are effectively implemented and reduce trade friction.

Adapting to evolving trade landscapes, including new bilateral agreements and the potential for increased protectionism, is critical for DP World's competitive edge. For example, shifts in trade relationships, such as those seen between major economic blocs, can redirect shipping routes and alter cargo volumes, necessitating strategic adjustments in DP World's global network.

Port operations and logistics are subject to extensive government oversight, encompassing licensing, infrastructure development, and operational standards. DP World must navigate a complex web of regulations across its global operations, covering areas like port security and customs. For instance, in 2024, the UAE government continued its focus on streamlining customs procedures to boost trade efficiency, impacting DP World's operations within the Emirates.

Government interventions, such as potential nationalization or shifts in concession agreements, present considerable risks to DP World's long-term investments and operational autonomy. The company's ability to manage these risks depends heavily on proactive engagement with local governmental bodies. In 2025, ongoing discussions around port privatization and concession renewals in several key African markets highlight the critical nature of these government relationships.

International Relations and Sanctions

The political relationships between countries significantly influence global trade and investment, directly impacting DP World's operations. For instance, geopolitical tensions in the Middle East, a key region for DP World, can disrupt shipping routes and port operations. The company's extensive network means it must constantly monitor and adapt to shifts in international diplomacy to ensure smooth cross-border activities and maintain access to vital markets.

International sanctions can pose substantial hurdles for global logistics providers like DP World. Restrictions placed on specific nations or entities can limit DP World's capacity to conduct business, invest in new projects, or form strategic alliances in those areas. This necessitates careful due diligence and a robust compliance strategy to avoid penalties and operational disruptions. For example, sanctions related to Iran have historically impacted global shipping and logistics companies operating in the Persian Gulf.

DP World's ability to navigate the complexities of international relations is crucial for its long-term success. Maintaining positive diplomatic ties and understanding the evolving political landscape allows the company to mitigate risks and capitalize on emerging opportunities. This proactive approach is vital for safeguarding its investments and ensuring the resilience of its global supply chain infrastructure.

- Geopolitical Stability: DP World's revenue is directly tied to global trade volumes, which are sensitive to political stability in key regions. For example, the company's significant presence in the UAE and Saudi Arabia means it is exposed to regional political dynamics.

- Sanctions Impact: The imposition of international sanctions, such as those previously affecting trade with Iran, can restrict DP World's access to certain markets or partners, impacting its revenue diversification and growth strategies.

- Trade Agreements: DP World benefits from favorable international trade agreements and can be hindered by protectionist policies or trade disputes between major economic blocs, influencing cargo volumes and operational costs.

National Security and Border Control

National security concerns significantly shape border control policies, impacting port operations. Stricter customs inspections and enhanced security protocols are now standard, affecting the speed and cost of cargo handling. DP World, a major player in global logistics, must navigate these evolving requirements to prevent illicit activities. For instance, the International Maritime Organization's (IMO) 2023 security measures continue to emphasize container security, requiring advanced screening technologies and data sharing.

Compliance with these international security standards and national regulations presents ongoing operational challenges. DP World's adherence to measures like the Container Security Initiative (CSI) or similar national programs means investing in advanced scanning equipment and robust data management systems. These requirements add complexity and cost, as evidenced by the global investment in port security infrastructure, which saw significant increases in 2024 to meet these demands.

- Increased Scrutiny: National security mandates lead to more thorough cargo screening at ports globally.

- Regulatory Burden: DP World faces a growing need to comply with diverse and evolving international and national security regulations.

- Operational Costs: Implementing advanced security measures and technologies adds substantial operational expenses.

- Trade Facilitation Balance: Balancing stringent security with the efficient flow of goods remains a critical strategic challenge.

Geopolitical instability, such as the Red Sea crisis in late 2023 and into 2024, significantly disrupted major shipping routes, increasing transit times and operational costs for DP World. Trade tensions and protectionist policies continue to influence global trade volumes, with the WTO estimating a slowdown in global trade growth to 0.9% in 2023. DP World must also navigate complex regulatory environments and government oversight across its global operations, with countries like the UAE focusing on streamlining customs procedures to boost trade efficiency in 2024.

| Factor | Impact on DP World | 2023/2024 Data/Trend |

|---|---|---|

| Geopolitical Instability | Disruption of shipping lanes, increased costs | Red Sea crisis led to rerouting and delays throughout 2024. |

| Trade Policies | Altered trade patterns, influenced cargo volumes | Global trade growth slowed to an estimated 0.9% in 2023 (WTO). |

| Government Regulation | Operational complexities, compliance requirements | UAE focused on streamlining customs in 2024 to enhance trade efficiency. |

| International Relations | Access to markets, investment opportunities | Geopolitical tensions in the Middle East impact port operations. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting DP World, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their implications for DP World's global operations and future growth.

A concise DP World PESTLE analysis provides a clear overview of external factors, helping to proactively address potential market disruptions and inform strategic decision-making.

Economic factors

DP World's performance is intrinsically linked to global economic expansion and trade flows. When the world economy is robust, demand for goods rises, boosting container volumes and DP World's logistics operations. For instance, the IMF projected global growth at 3.2% for 2024, a slight uptick from 2023, signaling potential for increased trade activity.

Conversely, economic downturns directly impact DP World by reducing cargo volumes, which in turn affects revenue and profitability. A slowdown, like the one experienced in late 2022 and 2023 due to inflation and geopolitical tensions, typically leads to lower throughput. The World Trade Organization (WTO) forecast a mere 1.7% rise in global merchandise trade volume for 2023, highlighting the sensitivity of DP World's business to these macro trends.

Inflationary pressures directly impact DP World's operational costs. For instance, rising fuel prices, a significant component for logistics companies, can squeeze profit margins. In 2024, global inflation rates remained a concern, with various economies experiencing elevated price levels, impacting the cost of goods and services DP World relies on, such as equipment and labor.

Furthermore, increasing interest rates, a common response to inflation, raise the cost of capital. This directly affects DP World's ability to finance large-scale infrastructure projects and expansions, such as new terminal developments or technology upgrades. For example, if benchmark interest rates rise by a percentage point, the cost of borrowing for a multi-billion dollar project could increase substantially, impacting the overall return on investment.

Effectively managing these economic variables is paramount for DP World's financial health. Strategic hedging against fuel price volatility and implementing robust cost control measures across its global operations are essential. These proactive strategies help mitigate the impact of fluctuating inflation and interest rates on both day-to-day expenses and long-term investment planning.

DP World's extensive global operations mean currency exchange rate fluctuations are a constant factor. For instance, in 2023, the strengthening of the US dollar against many emerging market currencies likely impacted the reported value of DP World's revenues generated in those regions when translated back to its reporting currency.

These shifts directly affect DP World's consolidated financial statements, altering the reported value of revenues, operational costs, and the valuation of assets held in different currencies. This volatility necessitates careful financial management to ensure accurate performance reporting and maintain investor confidence.

To counter these risks, DP World employs strategies like hedging through financial instruments and diversifying its revenue sources across various currency zones. This approach aims to buffer its profitability and protect shareholder value from unpredictable currency movements, a critical element given its significant international revenue and expenditure footprint.

Consumer Spending and Demand Patterns

Consumer spending is the bedrock of demand for container shipping and logistics services. As global economies recover and consumer confidence fluctuates, so too does the volume of goods moved across oceans. For instance, in early 2024, many regions saw a resilient consumer, with retail sales figures indicating continued spending, albeit with a growing preference for value and durability.

Evolving consumption patterns significantly shape the logistics landscape. The sustained growth of e-commerce, a trend that accelerated through 2023 and into 2024, necessitates faster, more flexible delivery networks. Simultaneously, a rising consumer interest in sustainability is prompting demand for greener shipping solutions and products with traceable, ethical supply chains, impacting how cargo is sourced and transported.

- E-commerce Growth: Global e-commerce sales were projected to reach over $6.3 trillion in 2024, underscoring the ongoing shift in consumer purchasing habits and the increased need for efficient last-mile delivery.

- Sustainability Focus: A significant percentage of consumers, often cited between 50-70% in various surveys throughout 2023-2024, express a willingness to pay more for products from sustainable brands, influencing the types of goods being manufactured and shipped.

- Shifting Product Demand: Beyond e-commerce, demand for specific goods, such as electronics and home furnishings, often correlates with disposable income levels and consumer confidence, directly impacting the types of containers and shipping routes utilized.

Fuel Prices and Energy Costs

Fuel is a major operational expense for DP World, especially impacting its marine services and intermodal transportation segments. Fluctuations in global fuel prices directly affect profitability, often requiring DP World to implement price adjustments or employ hedging strategies to mitigate risk.

Broader energy costs, such as those for powering port terminals and logistics infrastructure, also significantly influence DP World's overall cost structure. The company is increasingly focused on efficient energy management and investing in alternative energy sources to control costs and enhance sustainability.

- Global average bunker fuel prices (a key indicator for shipping) saw significant volatility in late 2023 and early 2024, influenced by geopolitical events and supply dynamics. For instance, the average price of Very Low Sulphur Fuel Oil (VLSFO) hovered around $600-$700 per metric ton in early 2024, a notable increase from previous periods.

- DP World's operational efficiency is directly tied to energy consumption. In 2023, the company continued its efforts to electrify port equipment, aiming to reduce reliance on diesel and lower energy-related expenses.

- The cost of electricity for port operations is also a critical factor. While regional variations exist, rising wholesale electricity prices in many key markets present an ongoing challenge for cost management.

Global economic growth directly fuels DP World's business. The IMF's projection of 3.2% global growth for 2024 suggests a positive outlook for increased trade volumes, benefiting DP World's operations. Conversely, economic slowdowns, as seen in 2023 with only 1.7% merchandise trade volume growth according to the WTO, directly reduce cargo throughput and revenue.

Inflationary pressures and rising interest rates significantly impact DP World's cost of operations and capital. Elevated fuel prices in early 2024, with VLSFO averaging $600-$700 per metric ton, directly squeeze profit margins. Higher interest rates also increase the cost of financing DP World's substantial infrastructure investments.

Consumer spending and evolving purchasing habits are key drivers for DP World. The projected $6.3 trillion in global e-commerce sales for 2024 highlights the growing demand for efficient logistics. Furthermore, a consumer preference for sustainability, with many willing to pay more for eco-friendly products, influences shipping demands and operational choices.

| Economic Factor | Impact on DP World | Supporting Data (2023-2024) |

|---|---|---|

| Global Economic Growth | Higher growth increases trade volumes and cargo throughput. | IMF projected 3.2% global growth for 2024; WTO reported 1.7% merchandise trade volume growth for 2023. |

| Inflation & Interest Rates | Increases operational costs (fuel, labor) and cost of capital for investments. | VLSFO prices averaged $600-$700/ton in early 2024; rising interest rates impact project financing. |

| Consumer Spending & E-commerce | Drives demand for goods movement; e-commerce growth necessitates efficient delivery. | Global e-commerce sales projected over $6.3 trillion for 2024; growing consumer demand for sustainable products. |

Full Version Awaits

DP World PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This in-depth DP World PESTLE analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into the external forces shaping DP World's business landscape.

Sociological factors

DP World's operations are deeply intertwined with its workforce, necessitating strong labor relations. In 2023, the company continued to navigate union agreements across its global terminals, emphasizing fair compensation and safe working environments to mitigate potential strikes that could disrupt its extensive supply chain networks.

The availability of skilled labor remains a significant factor, especially as DP World invests in automation and digital technologies. For instance, the demand for technicians proficient in managing automated quay cranes and intelligent logistics systems is rising, posing a challenge in talent acquisition and development to support its 2024-2025 strategic growth initiatives.

Societal expectations for DP World's corporate social responsibility (CSR) are increasingly shaping its operations. This includes a strong focus on ethical labor practices, meaningful community engagement, and diligent environmental stewardship. For instance, DP World's 2023 sustainability report highlighted a 15% reduction in Scope 1 and 2 emissions compared to their 2020 baseline, demonstrating tangible progress in environmental responsibility.

Implementing comprehensive CSR initiatives is crucial for DP World's reputation and community relations. It also appeals to a growing segment of socially conscious investors. The company's commitment to sustainable practices and community well-being helps it stand out in a crowded global market, securing its long-term social license to operate.

Global population is projected to reach 8.5 billion by 2030, with a significant portion of this growth occurring in urban areas. This trend directly fuels demand for efficient logistics, as more people concentrate in cities, requiring faster and more integrated last-mile delivery solutions. DP World's strategic investments in smart ports and logistics hubs near major urban centers are a direct response to this ongoing urbanization.

Changing age demographics, particularly the growing elderly population in many developed nations and a youthful demographic in others, alter consumption patterns. This impacts the types of goods transported and the required logistics infrastructure, from specialized healthcare logistics to the demand for consumer goods driven by younger populations. DP World's infrastructure planning must account for these diverse age-related consumption shifts.

Health and Safety Standards

Societal expectations for employee well-being are driving DP World to implement rigorous health and safety standards, especially in its port and terminal operations. This focus is critical for preventing accidents and ensuring worker welfare.

Adherence to international and national safety regulations is paramount for DP World to avoid legal issues and reputational harm. For instance, the International Labour Organization (ILO) sets global benchmarks for occupational safety and health, which DP World aims to meet.

A robust safety culture directly impacts workforce morale and operational efficiency. DP World's commitment to safety is a core element of its responsible business practices.

- Employee Well-being: Growing societal emphasis on protecting workers’ health and safety.

- Regulatory Compliance: Strict adherence to international (e.g., ILO) and national safety laws is mandatory.

- Risk Mitigation: Implementing stringent protocols in high-risk port environments to prevent accidents.

- Operational Impact: A strong safety culture boosts employee morale and enhances overall operational efficiency.

Public Perception and Community Engagement

Public perception of DP World's operations is a critical factor, particularly in areas surrounding its extensive port and logistics infrastructure. Negative sentiment can hinder expansion, as seen in instances where community opposition has led to project delays or reassessments. For example, in 2023, local environmental groups in a European port city raised concerns about increased truck traffic, impacting DP World's proposed terminal upgrade.

Effective community engagement is paramount for DP World's social license to operate. This involves actively addressing issues like noise pollution, environmental impact, and local employment opportunities. DP World's commitment to local economic development, such as investing in training programs for port workers, can build significant goodwill. In 2024, the company reported that its initiatives in a key Asian hub created over 500 local jobs.

A strong reputation, fostered through transparent communication and tangible community benefits, smooths the path for new projects and operational approvals. DP World's focus on corporate social responsibility, including environmental stewardship and support for local education, contributes to this positive image. By demonstrating a commitment to shared value, DP World can mitigate potential social risks and enhance its long-term sustainability.

- Community Concerns: Local opposition to DP World projects often centers on increased traffic congestion and environmental impact, as highlighted by community groups in several European locations during 2023.

- Economic Contribution: DP World's investments in local economies, including job creation and skills development, are crucial for positive public perception. In 2024, its operations in a major Asian port supported an estimated 5,000 indirect jobs.

- Reputation Management: Transparent communication and demonstrable community benefits are key to building trust and facilitating smoother project approvals for DP World's infrastructure developments.

- Social License: Maintaining positive community relations is essential for DP World's ability to secure permits and operate effectively, ensuring sustainable growth in its global network.

Societal expectations are increasingly influencing DP World's operational and strategic decisions, particularly concerning labor practices and community relations. The company's commitment to employee well-being and robust safety standards is paramount, directly impacting morale and efficiency. For instance, DP World's 2023 sustainability report detailed a 15% reduction in Scope 1 and 2 emissions, underscoring its dedication to environmental stewardship and corporate social responsibility.

Public perception significantly shapes DP World's social license to operate, with community concerns about traffic and environmental impact being key considerations. In 2024, DP World reported that its initiatives in a key Asian hub created over 500 local jobs, demonstrating a tangible economic contribution that fosters positive community relations and facilitates project approvals.

The growing global population, projected to reach 8.5 billion by 2030, fuels demand for efficient logistics, driving DP World's investments in smart ports and urban logistics hubs. Furthermore, shifting age demographics impact consumption patterns, requiring DP World to adapt its infrastructure planning to cater to diverse age-related needs and demands.

| Sociological Factor | Impact on DP World | 2023/2024 Data/Example |

|---|---|---|

| Employee Well-being & Safety | Ensures operational efficiency and positive workforce morale. | Adherence to ILO safety benchmarks; rigorous health and safety standards implemented globally. |

| Community Engagement & Perception | Facilitates social license to operate and project approvals. | In 2024, 500+ local jobs created in an Asian hub; addressing community concerns regarding traffic and environmental impact in European locations. |

| Corporate Social Responsibility (CSR) | Enhances reputation and appeals to socially conscious investors. | 15% reduction in Scope 1 & 2 emissions (2023 report vs. 2020 baseline). |

| Demographic Shifts | Influences infrastructure planning and logistics demand. | Response to urbanization driving demand for integrated last-mile delivery solutions. |

Technological factors

DP World is significantly enhancing port efficiency through the integration of automation and robotics. This strategic move is driven by the need to boost throughput and safety. For instance, their investment in automated stacking cranes and automated guided vehicles (AGVs) streamlines container handling, reducing the dependency on manual labor.

These advanced technologies are crucial for enabling continuous 24/7 operations and ensuring consistent performance. By minimizing human error and optimizing workflows, DP World can achieve faster turnaround times for vessels and cargo, a critical factor in global supply chain competitiveness.

Digitalization is profoundly reshaping supply chains, with technologies like blockchain, the Internet of Things (IoT), and AI driving unprecedented visibility, transparency, and efficiency. DP World is actively integrating these advancements, enabling real-time cargo tracking and sophisticated predictive analytics for logistics operations. For instance, DP World's investment in digital solutions aims to streamline customs, reduce paperwork, and create a more connected and intelligent logistics ecosystem.

DP World's increasing reliance on digital platforms for logistics and port operations exposes it to escalating cybersecurity threats. Attacks like ransomware and data breaches pose significant risks to operational continuity and sensitive customer information. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the pervasive nature of these threats.

Safeguarding critical infrastructure, including port management systems and supply chain data, is essential. A major data breach could lead to severe financial losses and reputational damage, impacting DP World's ability to maintain customer trust and operational efficiency.

Investing in advanced threat detection and robust incident response capabilities is therefore a strategic imperative. Compliance with evolving data protection regulations, such as GDPR and similar frameworks worldwide, is also critical for avoiding penalties and maintaining stakeholder confidence.

Development of New Vessel Technologies

Advancements in maritime technology, particularly the rise of ultra-large container vessels (ULCCs) and the emergence of autonomous and greener shipping, necessitate significant port infrastructure upgrades. These larger ships, some exceeding 24,000 TEU capacity, demand deeper berths, more powerful cranes, and enhanced terminal automation. DP World's investment in expanding its Jebel Ali Port in Dubai, for instance, includes deepening berths to accommodate these giants.

The shift towards greener shipping, driven by environmental regulations and a focus on sustainability, requires ports to adapt to new fuel types and propulsion systems. This includes facilities for LNG bunkering and potentially future hydrogen or ammonia fueling stations. For example, DP World has been exploring partnerships for green methanol bunkering, reflecting this technological evolution.

- ULCC Growth: The global fleet of ULCCs has seen continuous expansion, with vessels now routinely exceeding 23,000 TEU in capacity, impacting berth and quay requirements.

- Autonomous Shipping: While still in early stages, the development of autonomous vessels will eventually influence port operations, potentially requiring new communication and control systems.

- Green Fuels: The International Maritime Organization's (IMO) 2023 strategy aims for net-zero GHG emissions by or around 2050, accelerating the adoption of alternative fuels like LNG, methanol, and ammonia, which DP World must support.

Advanced Data Analytics and AI for Logistics Optimization

DP World is increasingly leveraging advanced data analytics and artificial intelligence (AI) to refine its logistics operations. For instance, by analyzing vast datasets, DP World can better predict cargo volumes and optimize vessel scheduling, contributing to more efficient port throughput. This technological integration is crucial for navigating the complexities of global trade, with AI-driven insights informing strategic decisions about infrastructure development and service expansion.

The application of AI specifically targets areas like route optimization for inland transportation and warehouse management, aiming to reduce transit times and operational costs. DP World's investment in these technologies is a direct response to the growing demand for faster and more reliable supply chains. In 2023, DP World reported a significant increase in cargo volumes handled across its global terminals, underscoring the need for sophisticated data-driven solutions to manage this growth effectively.

- AI-powered predictive analytics help forecast demand fluctuations, enabling proactive resource allocation.

- Enhanced route optimization for DP World's logistics network can yield fuel savings and reduced delivery times.

- Leveraging big data on global trade patterns allows for more accurate capacity planning and service customization.

- The company's ongoing digital transformation initiatives aim to create more agile and resilient supply chain solutions through advanced analytics.

DP World is actively integrating automation and AI to boost port efficiency and safety, evident in its investment in automated cranes and vehicles. These technologies are vital for 24/7 operations and faster cargo turnaround times, crucial for global supply chain competitiveness.

Digitalization, including blockchain and IoT, enhances supply chain visibility and efficiency, with DP World using these for real-time cargo tracking and predictive analytics. However, this increased reliance on digital platforms exposes the company to escalating cybersecurity threats, with global cybercrime costs projected to reach $10.5 trillion annually by 2025.

The rise of ultra-large container vessels (ULCCs) and greener shipping necessitates port infrastructure upgrades, prompting DP World's investments in deeper berths and facilities for alternative fuels like LNG and methanol, aligning with the IMO's 2050 net-zero strategy.

| Technology Area | DP World Application | Impact/Data Point |

|---|---|---|

| Automation & Robotics | Automated stacking cranes, AGVs | Enhancing port efficiency and safety, reducing manual labor dependency. |

| Digitalization | Blockchain, IoT, AI for cargo tracking | Improving supply chain visibility and enabling predictive analytics. |

| Cybersecurity | Threat detection and response | Mitigating risks from cybercrime, projected at $10.5 trillion annually by 2025. |

| Maritime Tech Advancements | Adapting to ULCCs and green fuels | Infrastructure upgrades for vessels exceeding 23,000 TEU and supporting LNG/methanol bunkering. |

Legal factors

DP World's extensive global marine and port operations are subject to a rigorous framework of international maritime laws and conventions. Key among these are the International Convention for the Safety of Life at Sea (SOLAS), the International Convention for the Prevention of Pollution from Ships (MARPOL), and the International Ship and Port Facility Security (ISPS) Code. These regulations are not optional; they are mandatory for ensuring the safety of personnel, the security of assets, and the protection of the marine environment across DP World's diverse fleet and port infrastructure.

Strict adherence to these international standards is paramount for DP World to maintain its operating licenses for global trade and to preempt any potential penalties or operational disruptions. For instance, non-compliance with MARPOL Annex VI, which regulates air emissions from ships, could lead to significant fines and port entry restrictions, impacting DP World's logistical efficiency. These foundational legal instruments directly shape the operational landscape for global shipping and port management.

DP World operates within a complex web of customs and trade compliance regulations globally. As a key facilitator of international trade, the company must meticulously adhere to import/export controls and diverse trade laws in each of its operating countries. This involves staying abreast of evolving rules on cargo declarations, prohibited items, and tariffs, which can significantly impact logistics efficiency.

Failure to comply can result in substantial penalties, including fines and significant operational delays. For instance, the World Trade Organization (WTO) reported that the average tariff rate on goods entering developed economies stood at approximately 4.8% in 2023, a figure that can fluctuate and impact DP World's cost structures and client pricing.

To mitigate these risks, DP World invests heavily in robust compliance frameworks and technological solutions. Leveraging advanced systems to streamline customs processes is crucial for avoiding disruptions, financial penalties, and reputational damage. Efficient and compliant customs procedures are the bedrock of successful trade facilitation, directly impacting DP World's ability to offer seamless port and logistics services.

DP World's substantial global footprint in port operations and logistics necessitates strict adherence to anti-trust and competition laws across numerous countries. These regulations are in place to prevent monopolistic practices, foster fair market competition, and safeguard consumer welfare. For instance, DP World's proposed acquisition of a stake in a European port operator in late 2023 faced scrutiny from competition authorities, highlighting the need for thorough compliance checks.

Failure to comply with these laws can lead to severe consequences, including regulatory investigations, substantial fines, and even mandated divestitures of assets. In 2024, several major logistics companies faced significant penalties for anti-competitive behavior, underscoring the risks involved. Therefore, all DP World's strategic moves, such as mergers, acquisitions, or operational partnerships, must be meticulously reviewed against prevailing competition regulations to ensure uninterrupted market access and sustainable expansion.

Labor Laws and Employment Regulations

DP World navigates a complex web of labor laws across its global operations, impacting everything from minimum wages to collective bargaining rights. For instance, in 2024, many European nations continued to strengthen worker protections, with Germany's Works Constitution Act influencing employee representation and consultation rights, a key factor for DP World's European terminals.

Ensuring compliance is paramount to prevent costly disputes and maintain operational stability. For example, a significant labor strike at a major European port in late 2023, stemming from disagreements over working hours and compensation, highlighted the potential financial and reputational damage of non-compliance. DP World's proactive approach involves developing country-specific HR strategies that align with local employment regulations, a critical element for its 2024 and 2025 operational planning.

- Diverse Labor Laws: DP World must adhere to varying national labor statutes covering wages, hours, benefits, and unionization across its numerous operating countries.

- Compliance Imperative: Strict adherence to these laws is crucial for maintaining industrial peace, avoiding labor disputes, and safeguarding the company's global reputation.

- Strategic HR Policies: The company implements tailored HR policies and practices to ensure fair employment and legal compliance in each specific region of operation.

- Operational Significance: Labor law adherence is a fundamental aspect of DP World's global operational strategy, directly influencing workforce management and industrial relations.

Environmental Regulations and Compliance

DP World navigates a complex web of environmental regulations worldwide, impacting everything from port emissions and waste disposal to water quality and the preservation of local ecosystems. Adherence to international standards like those set by the International Maritime Organization (IMO) for emissions, alongside national laws governing air quality and hazardous materials, is paramount for continued operations. Failure to comply can result in substantial financial penalties, operational disruptions, and significant damage to DP World's brand image. For instance, in 2023, port authorities globally issued over $50 million in fines for environmental non-compliance, a figure expected to rise with stricter enforcement.

The evolving legal landscape often necessitates proactive investment in sustainable technologies. DP World's commitment to reducing its carbon footprint, evidenced by its 2024 investment of $200 million in shore power facilities across key European ports, directly addresses these regulatory pressures. Obtaining and maintaining environmental permits is a fundamental requirement for all DP World facilities, ensuring their operations meet legal environmental standards.

- Regulatory Scrutiny: DP World must comply with diverse environmental laws covering emissions, waste, and biodiversity across its global operations.

- Compliance Costs: Non-compliance can lead to significant fines, with global port environmental penalties exceeding $50 million in 2023.

- Sustainable Investment: DP World's 2024 investment of $200 million in shore power demonstrates a strategic response to environmental regulations.

- Permitting Requirements: Environmental permits are a critical legal prerequisite for all DP World port operations.

DP World's operations are heavily influenced by international maritime law, including SOLAS and MARPOL, which mandate safety and environmental protection. Strict adherence is crucial for maintaining operating licenses and avoiding penalties, as non-compliance with regulations like MARPOL Annex VI can result in significant fines and port entry restrictions, directly impacting logistical efficiency.

Environmental factors

DP World's extensive network of coastal ports and terminals faces significant threats from climate change. Rising sea levels, projected to increase by approximately 0.3 to 0.6 meters by 2050 according to the IPCC, along with more frequent and intense extreme weather events like hurricanes and storm surges, directly endanger these critical assets. These physical risks can cause substantial operational disruptions, damage to expensive equipment and infrastructure, and necessitate higher ongoing maintenance expenditures.

To mitigate these impacts, DP World must continue strategic investments in climate-resilient infrastructure. This includes building higher sea walls, reinforcing jetties, and potentially relocating vulnerable facilities. For instance, the company has invested in elevated infrastructure at some of its locations to better withstand higher water levels. Integrating comprehensive climate risk assessments into its long-term strategic planning is no longer optional but a necessity for ensuring the company's operational continuity and financial stability in the face of a changing climate.

Stricter emissions regulations are significantly impacting the maritime and port sectors. DP World must navigate international rules like IMO 2020, which capped sulfur content in marine fuels at 0.5% starting January 1, 2020, and various national air quality standards for port equipment. These regulations necessitate substantial investments in cleaner technologies.

The drive towards decarbonization means DP World is investing in cleaner fuels, electric or hybrid port machinery, and shore power facilities. For instance, the company has been electrifying its fleet of internal terminal vehicles. In 2024, DP World announced plans to further expand its use of electric vehicles across its operations, aiming to reduce its carbon footprint and meet evolving environmental mandates.

DP World faces significant environmental scrutiny regarding waste management, with port operations and associated shipping generating substantial waste, including hazardous materials. In 2024, global maritime transport generated an estimated 300 million tonnes of waste, highlighting the scale of the challenge. Effective segregation, recycling, and disposal are paramount to mitigate land and marine pollution, a critical factor for DP World's operational sustainability and reputation.

Adherence to stringent environmental permits and the implementation of proactive spill prevention measures are vital for DP World's compliance and to avoid reputational damage. For instance, the EU's MARPOL convention sets strict limits on vessel waste discharge, and DP World's commitment to exceeding these standards is crucial. Responsible waste management directly minimizes the ecological footprint of its extensive global network.

Biodiversity Protection in Coastal Areas

DP World's port operations are often situated in coastal zones, which are vital for biodiversity. Protecting these sensitive marine and coastal habitats is a significant environmental consideration. For instance, in 2023, DP World's operations in the UAE were subject to ongoing environmental monitoring programs aimed at assessing their impact on local marine ecosystems, with a focus on species like dugongs and sea turtles.

The company engages in environmental impact assessments for new projects and implements mitigation strategies to minimize ecological disruption. This includes measures like careful dredging practices and habitat restoration initiatives. For example, DP World's Jebel Ali Port has implemented various programs to protect its surrounding marine environment, including mangrove restoration projects, which are crucial nurseries for many marine species.

Sustainable development is a core principle, guiding efforts to reduce the ecological footprint and conserve natural resources. This commitment extends to biodiversity, influencing the planning and execution of all new developments. DP World aims to balance operational needs with the imperative to preserve the natural world for future generations.

Key biodiversity protection measures include:

- Environmental Impact Assessments (EIAs): Thoroughly evaluating potential effects on marine life and habitats before commencing new projects.

- Mitigation Strategies: Implementing specific actions to reduce negative impacts, such as responsible waste management and pollution control.

- Conservation Programs: Actively participating in or supporting initiatives that protect endangered species and restore degraded coastal ecosystems.

- Sustainable Operations: Adopting practices that minimize resource consumption and environmental disturbance throughout the lifecycle of port facilities.

Sustainability Initiatives and Green Logistics

DP World faces growing stakeholder demand for sustainable operations and green logistics. This pressure comes from customers, investors, and regulators pushing for reduced environmental impact. For instance, by 2023, DP World had committed to reducing its Scope 1 and 2 carbon emissions by 20% compared to a 2021 baseline, demonstrating a tangible step towards greener logistics.

Key initiatives involve optimizing energy use, investing in renewable power sources, and fostering sustainable supply chain management. DP World's investment in electric and hybrid port equipment, such as the introduction of electric yard cranes at its Jebel Ali facility, exemplifies this commitment. These efforts not only bolster brand reputation but also unlock operational efficiencies and create lasting competitive advantages in an evolving market.

- Stakeholder Pressure: Increasing demands from customers, investors, and regulators for sustainable practices.

- Green Logistics Market: Growing consumer and business preference for environmentally friendly supply chains.

- Operational Efficiencies: Sustainability initiatives can lead to cost savings through reduced energy consumption and waste.

- Brand Enhancement: A strong sustainability record improves DP World's corporate image and attractiveness.

DP World's operations are directly impacted by climate change, with rising sea levels and extreme weather posing risks to its coastal infrastructure, necessitating investments in resilient solutions. Stricter environmental regulations, particularly concerning emissions, are driving the adoption of cleaner fuels and electric port equipment, with DP World aiming for a 20% reduction in Scope 1 and 2 emissions by 2030 from a 2021 baseline.

Waste management is a critical environmental challenge, with port activities generating significant waste, requiring robust segregation and recycling programs to prevent pollution. Protecting biodiversity in coastal zones is also paramount, involving environmental impact assessments and conservation efforts like mangrove restoration projects. Growing stakeholder demand for sustainability is pushing DP World towards greener logistics, including optimizing energy use and investing in renewable power sources.

| Environmental Factor | Impact on DP World | Mitigation/Response | Key Data/Initiatives (2023-2025) |

|---|---|---|---|

| Climate Change (Sea Level Rise, Extreme Weather) | Risk to coastal infrastructure, operational disruptions, increased maintenance costs. | Investment in climate-resilient infrastructure (e.g., higher sea walls). | IPCC projects 0.3-0.6m sea level rise by 2050. DP World investing in elevated infrastructure. |

| Emissions Regulations (Maritime & Port) | Need for cleaner technologies, investment in new fuels and equipment. | Adoption of cleaner fuels, electrification of port machinery, shore power. | DP World committed to 20% Scope 1 & 2 emissions reduction by 2030 (from 2021 baseline). Expanding electric vehicle fleet in 2024. |

| Waste Management | Potential land and marine pollution, reputational risk. | Effective waste segregation, recycling, and disposal; spill prevention. | Global maritime transport generated ~300 million tonnes of waste in 2024. Adherence to MARPOL convention. |

| Biodiversity Protection | Impact on sensitive marine and coastal habitats. | Environmental impact assessments, mitigation strategies, habitat restoration. | Ongoing monitoring of impact on marine ecosystems in UAE operations (2023). Jebel Ali Port mangrove restoration projects. |

| Stakeholder Demand for Sustainability | Pressure for reduced environmental impact, preference for green logistics. | Optimizing energy use, investing in renewables, sustainable supply chain management. | Introduction of electric yard cranes at Jebel Ali. Growing market preference for eco-friendly supply chains. |

PESTLE Analysis Data Sources

Our DP World PESTLE Analysis is built on a robust foundation of data from reputable sources, including global economic indicators, international trade agreements, and environmental regulatory bodies. We also incorporate insights from industry-specific reports and technological trend analyses to ensure comprehensive coverage.