DP World Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DP World Bundle

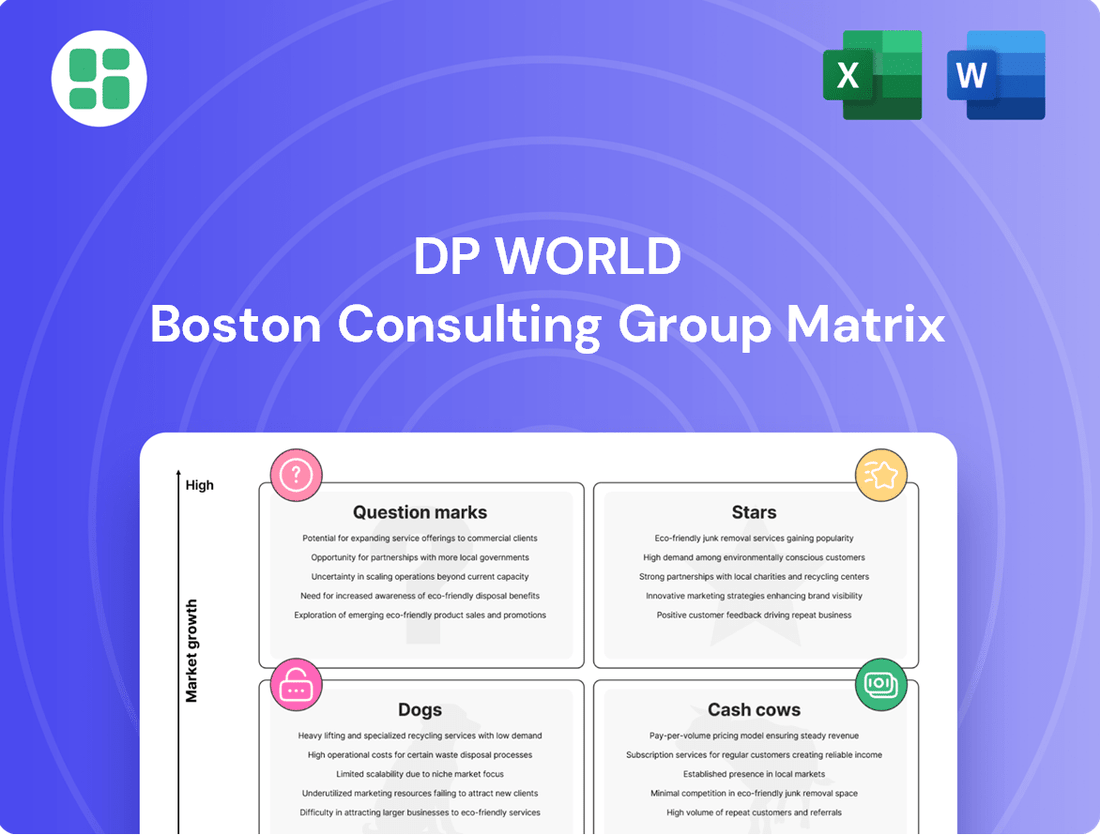

Uncover the strategic positioning of DP World's diverse portfolio with our insightful BCG Matrix preview. See how their ventures stack up as potential Stars, stable Cash Cows, underperforming Dogs, or promising Question Marks.

This glimpse into DP World's market dynamics is just the beginning. Purchase the full BCG Matrix report to unlock detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing their investments and product strategies.

Stars

Integrated Logistics Solutions represent a significant growth area for DP World, moving beyond pure port operations. By offering services like freight forwarding, warehousing, and intermodal transport, DP World is tapping into high-growth segments of the global trade market. This strategic expansion aims to create more seamless supply chains for cargo owners.

DP World's investment in these integrated logistics solutions is crucial for its future. In 2023, the global logistics market was valued at approximately $9.5 trillion, with significant growth projected. DP World's move into this space, including acquisitions and organic development of its logistics capabilities, positions it to capture a larger share of this expanding market, driving revenue synergies and strengthening customer relationships.

DP World is strategically investing in high-growth markets, channeling significant capital into new port and terminal development across India, Africa, and South America. This focus targets regions with projected substantial trade volume increases. For instance, in 2024, DP World continued its expansion in India with projects like Tuna Tekra, while also bolstering its presence in Africa through initiatives such as the Banana Port in the Democratic Republic of Congo and Ndayane Port in Senegal. These moves underscore a commitment to capturing future growth in emerging economies.

DP World is aggressively pursuing digital transformation, pouring significant resources into AI, automation, and advanced platforms. This strategic push aims to boost efficiency and transparency across its global port operations. For instance, in 2024, the company continued its significant investments in smart logistics, including the electrification of Jebel Ali Port, a move designed to reduce emissions and operational costs.

These technological integrations are not just about internal improvements; they are about creating market-leading solutions. The development of advanced car markets, leveraging technology for streamlined processing and logistics, exemplifies DP World's commitment to innovative, smart logistics. This focus is crucial as the global demand for efficient, technology-driven supply chains continues to grow, positioning DP World favorably in the evolving logistics landscape.

London Gateway Expansion

The London Gateway expansion, a US$1 billion investment by DP World, is designed to transform it into Britain's largest container port by 2030. This strategic development, adding two new shipping berths and a second rail terminal, is a prime example of a Question Mark in the BCG Matrix. Its location in a major developed market with substantial trade volume and high strategic value suggests significant potential for growth, attracting increased container traffic and solidifying its position as a high-growth asset within DP World's global operations.

- Projected completion: By the end of the decade.

- Investment: US$1 billion.

- Key additions: Two new shipping berths and a second rail terminal.

- Strategic positioning: Aiming to become Britain's biggest container port.

Automotive Logistics Hubs

DP World's strategic expansion into automotive logistics, marked by the development of a 20 million square foot advanced car market in Dubai and significant growth in automotive handling at Jebel Ali Port, highlights its commitment to this high-growth sector.

This initiative aims to position Dubai as a premier global automotive trade hub, capitalizing on the increasing demand for specialized logistics services. In 2023, Jebel Ali Port handled over 1.5 million vehicles, a 15% increase year-on-year, underscoring the robust growth in this segment.

- Automotive Handling Growth: Jebel Ali Port saw a 15% year-on-year increase in vehicle handling in 2023, processing over 1.5 million units.

- Dubai's Car Market Ambitions: Plans include a 20 million square foot advanced car market, set to become a global hub for automotive trade and services.

- Strategic Focus: DP World is investing heavily in specialized infrastructure to meet the evolving needs of the automotive supply chain.

DP World's integrated logistics solutions, including freight forwarding and warehousing, represent a significant growth area, aiming to create seamless supply chains. The global logistics market was valued at approximately $9.5 trillion in 2023, and DP World's expansion into this space positions it to capture a larger share of this expanding market.

DP World's strategic investments in high-growth markets, such as India and Africa, are crucial. For instance, in 2024, the company continued its expansion in India with projects like Tuna Tekra, and in Africa, it bolstered its presence with initiatives like the Banana Port in the Democratic Republic of Congo.

The company's aggressive pursuit of digital transformation, with significant resources poured into AI and automation, aims to boost efficiency. In 2024, DP World continued its substantial investments in smart logistics, including the electrification of Jebel Ali Port.

DP World's expansion into automotive logistics, including a 20 million square foot advanced car market in Dubai, highlights its commitment to this sector. Jebel Ali Port handled over 1.5 million vehicles in 2023, a 15% increase year-on-year.

| DP World Business Segments | Market Growth Potential | DP World's Strategic Position |

| Integrated Logistics Solutions | High (Global market ~$9.5T in 2023) | Expanding rapidly through acquisitions and organic development. |

| Emerging Market Port Development | High (Focus on India, Africa, South America) | Significant capital investment in new terminals and expansions. |

| Digital Transformation & Smart Logistics | High (Efficiency and transparency drivers) | Aggressive investment in AI, automation, and electrification. |

| Automotive Logistics | High (Dubai hub development, Jebel Ali growth) | Increasing vehicle handling, targeting specialized logistics needs. |

What is included in the product

This DP World BCG Matrix overview provides clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs within their portfolio.

A clear DP World BCG Matrix visualizes business unit performance, relieving the pain of strategic ambiguity.

Cash Cows

Jebel Ali Port and its adjacent Free Zone (JAFZA) are DP World's prime cash cows. These are mature, highly profitable assets that consistently churn out significant revenue and cash flow for the company.

JAFZA’s performance in 2024 was particularly strong, with trade volumes reaching a record $190 billion. This figure underscores JAFZA's dominant market position and its ability to maintain high, stable profit margins in a well-established market.

DP World's established global port terminal network, excluding newer ventures, functions as a significant cash cow. These mature, high-performing terminals in crucial trade locations boast substantial market share, generating consistent and reliable cash flows. For instance, in 2023, DP World reported a 12.5% increase in revenue to $12.4 billion, largely driven by its existing terminal operations.

DP World's marine services, encompassing pilotage, tugging, and bunkering, are fundamental to its extensive port operations. These services operate within a mature market, characterized by stable, established demand that underpins DP World's global network.

The company holds a significant market share in these essential services, largely due to its vast infrastructure and considerable operational scale. This strong position allows DP World to generate consistent and reliable revenue streams from its marine services segment.

While these operations exhibit low growth potential, they require relatively minimal investment for continued operation, positioning them as classic cash cows within DP World's business portfolio. For instance, DP World's 2023 revenue reached $11.6 billion, with its terminals segment, heavily reliant on these marine services, contributing significantly to this figure.

Well-Established Warehousing and Distribution Centers

DP World's established warehousing and distribution centers, especially those linked to its key ports, function as cash cows within the BCG matrix. These operations leverage steady demand from a loyal customer base, generating substantial cash flow without requiring significant investment for growth. The focus here is on optimizing existing infrastructure and processes to maintain profitability.

These mature assets are crucial for DP World's consistent revenue generation. For instance, in 2024, DP World reported a 10% increase in revenue from its logistics and services segment, largely driven by its warehousing and distribution network. This segment typically has high utilization rates, reflecting the ongoing need for efficient supply chain solutions.

- Mature Operations: DP World's warehousing facilities in established trade routes are highly efficient, benefiting from long-term contracts and economies of scale.

- Consistent Cash Flow: These centers generate predictable and substantial cash flow, supporting investments in other business units.

- Operational Focus: The strategy for these assets centers on enhancing operational efficiency rather than aggressive market expansion, ensuring high margins.

- Contribution to DP World: In 2023, DP World's logistics segment, which includes these warehouses, contributed over $2 billion in revenue, highlighting their importance as cash cows.

Conventional Container Handling Operations

DP World's conventional container handling operations are the bedrock of its revenue, consistently generating substantial cash flow. Despite moderate growth in the global container market, DP World's significant market share and operational excellence in these mature segments translate into robust profitability.

These operations are characterized by high volumes and established infrastructure, making them reliable cash generators. For instance, in 2023, DP World handled a record 89.4 million TEU (twenty-foot equivalent units) across its global portfolio, showcasing the sheer scale and maturity of these core businesses.

- Dominant Revenue Source: Conventional container handling remains DP World's primary revenue driver.

- High Market Share: DP World commands a leading position in many of the ports it operates.

- Operational Efficiency: Streamlined processes and advanced technology contribute to strong profitability.

- Consistent Cash Generation: These mature operations provide a stable and predictable cash flow stream.

DP World's established global port terminal network, excluding newer ventures, functions as a significant cash cow. These mature, high-performing terminals in crucial trade locations boast substantial market share, generating consistent and reliable cash flows. For instance, in 2023, DP World reported a 12.5% increase in revenue to $12.4 billion, largely driven by its existing terminal operations.

DP World's conventional container handling operations are the bedrock of its revenue, consistently generating substantial cash flow. Despite moderate growth in the global container market, DP World's significant market share and operational excellence in these mature segments translate into robust profitability. In 2023, DP World handled a record 89.4 million TEU across its global portfolio.

Jebel Ali Port and its adjacent Free Zone (JAFZA) are DP World's prime cash cows, mature, highly profitable assets that consistently churn out significant revenue and cash flow. JAFZA’s performance in 2024 was particularly strong, with trade volumes reaching a record $190 billion, underscoring its dominant market position and stable profit margins.

| Business Unit | BCG Category | 2023 Revenue (Approx.) | Key Characteristic |

|---|---|---|---|

| Global Port Terminals (Established) | Cash Cow | $12.4 Billion (Total DP World Revenue) | Mature, high market share, stable cash flow |

| Conventional Container Handling | Cash Cow | Significant contributor to total revenue | High volume, operational efficiency, consistent cash generation |

| Jebel Ali Port & JAFZA | Cash Cow | $190 Billion (JAFZA Trade Volume 2024) | Prime asset, high profitability, dominant market position |

What You See Is What You Get

DP World BCG Matrix

The DP World BCG Matrix preview you are currently viewing is the identical, fully polished document you will receive immediately after your purchase. This means you can confidently assess the depth of analysis and strategic insights without any watermarks or placeholder content. Upon completion of your purchase, this comprehensive report will be directly accessible, ready for immediate implementation in your strategic planning or client presentations.

Dogs

Underperforming niche cargo services within DP World's extensive operations can be categorized as Dogs in the BCG Matrix. These might include highly specialized services with limited global demand or those facing fierce, localized competition, potentially hindering significant growth. For instance, if a particular niche service, like specialized refrigerated transport for a very specific commodity, only served a handful of routes and saw its demand stagnate or decline due to shifting trade patterns, it would fit this profile. Such services often generate just enough revenue to cover their operating costs, offering minimal profit and representing a drain on capital that could be better invested elsewhere.

Older, less strategic small terminals often find themselves in the Dog quadrant of the DP World BCG Matrix. These facilities, perhaps located in regions experiencing minimal trade growth or a decrease in their overall importance, typically struggle with low market share. For instance, a small, aging terminal in a port that saw only a 1.5% increase in container throughput in 2024, compared to a global average of 3.2%, would likely fit this description.

These assets frequently demand significant investment in maintenance and operations, yet their revenue generation capabilities are limited. This cost-to-revenue imbalance makes them candidates for divestiture or restructuring. DP World's strategy often involves assessing whether such terminals can be revitalized or if exiting the market is the more financially prudent decision to reallocate capital to more promising ventures.

Legacy IT systems or non-integrated digital tools at DP World could be classified as Dogs within the BCG Matrix. These systems, often costly to maintain and offering minimal competitive advantage, represent a drain on resources in a rapidly digitizing logistics sector. For instance, in 2024, many companies across industries found themselves burdened by legacy systems that accounted for a significant portion of their IT budget, diverting funds that could have been invested in innovation.

These outdated platforms may struggle to keep pace with the demands of modern, interconnected supply chains, leading to inefficiencies and a lack of real-time data visibility. The upkeep costs for such systems can be substantial, with some estimates suggesting that maintaining legacy IT can cost up to 80% of an IT department's budget, leaving little room for growth or adaptation.

Low-Volume Conventional Breakbulk Operations in Declining Markets

Low-volume conventional breakbulk operations in declining markets, such as those historically handling coal or certain manufactured goods in regions with reduced industrial output, could be considered Dogs within the DP World BCG Matrix.

These operations often face challenges due to the widespread adoption of containerization, which offers greater efficiency and cost-effectiveness for many types of cargo. For instance, while global container throughput reached an estimated 900 million TEUs in 2023, the share of breakbulk cargo has diminished significantly in many established trade lanes.

Such segments might exhibit:

- Declining cargo volumes: Specific ports or terminals might see their conventional breakbulk tonnage decrease year-on-year, potentially falling below economically viable thresholds. For example, a port that once handled millions of tons of steel annually might now see that figure in the hundreds of thousands due to shifts in global manufacturing and trade patterns.

- Low profit margins: The specialized handling requirements for breakbulk cargo, coupled with lower volumes, can lead to slim operating margins, making reinvestment unattractive.

- Limited growth potential: In markets where containerization dominates or industrial activity is contracting, the outlook for substantial growth in conventional breakbulk is often bleak.

Peripheral Regional Logistics Ventures with Limited Scale

Peripheral regional logistics ventures with limited scale, often categorized as Dogs in the DP World BCG Matrix, represent smaller acquisitions or nascent operations. These entities typically operate in low-growth local markets and have struggled to capture substantial market share. For instance, DP World's 2023 annual report indicated a focus on integrating acquired smaller logistics players, some of which may fall into this category if they haven't yet demonstrated significant growth or profitability. These ventures can drain resources without yielding proportional returns, potentially hindering DP World's overall financial performance and strategic focus.

These operations might consume resources without contributing meaningfully to the company's overall profitability or strategic objectives. For example, a small, regional warehousing operation acquired in a mature market might require ongoing investment in technology and personnel but generate only modest revenue. In 2024, DP World continued its strategy of selective acquisitions, and while many are designed for growth, some smaller, peripheral ventures may still be in the "Dog" quadrant, undergoing restructuring or awaiting a strategic decision on their future. Such units often have limited scalability and face intense competition from larger, more established players.

- Low Market Share: These ventures typically hold a small percentage of their respective regional logistics markets, often below 5% in their specific niches.

- Slow Market Growth: The markets in which these peripheral ventures operate are characterized by low annual growth rates, typically in the low single digits (e.g., 1-3% annually).

- Resource Drain: Despite their limited contribution, these operations can still require capital expenditure for maintenance and operational costs, impacting overall resource allocation.

- Strategic Re-evaluation: DP World likely reviews these smaller units periodically to determine if divestment, restructuring, or continued minimal investment is the most prudent course of action.

DP World's "Dogs" in the BCG Matrix represent business units with low market share in slow-growing industries. These often include underperforming niche cargo services, older or less strategic terminals, and legacy IT systems. For example, a small, aging terminal seeing only 1.5% throughput growth in 2024, compared to a global average of 3.2%, would fit this category. These segments typically consume resources without generating significant returns, often requiring substantial maintenance while offering minimal profit.

| DP World BCG Matrix: Dogs Examples | Market Share | Market Growth | Profitability | Strategic Implication |

|---|---|---|---|---|

| Underperforming Niche Cargo Services | Low | Slow/Declining | Low/Negative | Divest or Restructure |

| Older, Less Strategic Terminals | Low | Slow | Low | Divest or Modernize |

| Legacy IT Systems | N/A (Internal) | N/A (Internal) | Low (High Maintenance Cost) | Upgrade or Replace |

| Low-Volume Breakbulk in Declining Markets | Low | Declining | Low | Exit or Reduce Investment |

Question Marks

DP World's ventures into early-stage technologies like hyperloop integration or advanced automation pilots fall into the question mark category. These initiatives demand substantial capital outlay and currently hold minimal market share, but they offer significant growth prospects should they achieve scalability and commercial success. For instance, DP World's investment in the $100 million Virgin Hyperloop One in 2021, though facing future uncertainties, exemplifies this strategic positioning.

DP World's new market entries into volatile developing regions represent classic Stars or Question Marks, depending on their current market share and growth trajectory. For instance, recent investments in emerging African ports, like those in Senegal or Mozambique, fit this profile. These regions often exhibit high GDP growth potential, with some projecting over 5% annually in the coming years, but also carry significant geopolitical and economic risks.

These ventures require substantial capital for infrastructure development, mirroring the high investment needs of Stars. However, their nascent market share and uncertain regulatory environments place them firmly in the Question Mark category. DP World's strategy here likely involves aggressive market penetration, potentially through strategic partnerships and substantial upfront investment, aiming to capture market share before competitors emerge.

DP World's foray into specialized green logistics, including blue carbon ecosystem restoration and niche sustainable financing, positions these ventures in emerging, high-potential environmental markets. These initiatives, while promising, currently represent a small fraction of DP World's overall market presence, demanding substantial capital for development and commercial scaling.

Expansion of Freight Forwarding in New, Competitive Geographies

The expansion of freight forwarding offices into new, highly competitive geographies where DP World has a nascent presence and is building market share, particularly where established players dominate, can be considered a Question Mark in the BCG Matrix.

These new operations require substantial investment to capture market share and prove profitability, even as the overall freight forwarding market is growing. For instance, DP World's strategic investments in emerging markets are designed to build long-term capacity, though initial returns may be modest. The global freight forwarding market was valued at approximately $250 billion in 2023 and is projected to grow, but entering saturated markets demands aggressive strategies.

- High Investment Needs: Significant capital is allocated to establishing infrastructure and marketing in these competitive new territories.

- Nascent Market Share: DP World is in the early stages of building its presence and customer base against entrenched competitors.

- Potential for Growth: Despite the challenges, these markets offer substantial long-term growth opportunities if market share can be effectively captured.

- Profitability Uncertainty: The path to profitability is less certain compared to established markets, requiring careful monitoring and strategic adjustments.

Niche Cold Chain Logistics in Underserved Markets

Developing niche cold chain logistics in underserved markets, where infrastructure is nascent but demand for temperature-controlled goods is poised for rapid growth, fits the 'Question Mark' category in the DP World BCG Matrix. These ventures demand substantial initial capital for specialized facilities and advanced technology. For example, the global cold chain market was valued at approximately $173.7 billion in 2023 and is projected to reach $347.7 billion by 2028, with emerging markets driving a significant portion of this expansion.

- High Investment Needs: Building new refrigerated warehouses and investing in specialized transport fleets requires significant capital outlay.

- Market Development: Establishing market share in these new territories involves overcoming logistical hurdles and building customer trust.

- Growth Potential: The projected surge in demand for pharmaceuticals, fresh produce, and other temperature-sensitive goods in these regions offers substantial long-term upside.

- Risk Factor: The underdeveloped infrastructure and potential regulatory uncertainties present inherent risks that need careful management.

DP World's ventures into early-stage technologies, new market entries in developing regions, specialized green logistics, and niche cold chain logistics all represent Question Marks in the BCG Matrix. These initiatives require significant capital investment and currently hold small market shares but possess high growth potential if successful.

For example, DP World's investment in Virgin Hyperloop One, valued at $100 million in 2021, exemplifies this category, as does its expansion into emerging African ports with projected GDP growth exceeding 5% annually. The global cold chain market, valued at approximately $173.7 billion in 2023, shows the potential for these niche ventures.

These Question Marks are characterized by high investment needs, nascent market share, and profitability uncertainty, necessitating aggressive strategies and careful monitoring to capture future growth opportunities.

| Venture Area | BCG Category | Key Characteristics | Market Context/Data |

|---|---|---|---|

| Early-stage Technologies (e.g., Hyperloop) | Question Mark | High Investment, Low Market Share, High Growth Potential | Virgin Hyperloop One investment: $100 million (2021) |

| New Market Entries (Developing Regions) | Question Mark | High Investment, Low Market Share, High Growth Potential, High Risk | Emerging African Ports: Projected GDP growth >5% annually |

| Specialized Green Logistics | Question Mark | High Investment, Low Market Share, High Growth Potential | Emerging environmental markets |

| Niche Cold Chain Logistics | Question Mark | High Investment, Low Market Share, High Growth Potential | Global Cold Chain Market: $173.7 billion (2023), projected $347.7 billion by 2028 |

BCG Matrix Data Sources

Our DP World BCG Matrix is built on a foundation of comprehensive data, integrating publicly available financial statements, global trade statistics, and port performance reports to ensure accurate strategic insights.