DP World Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DP World Bundle

DP World navigates a complex landscape shaped by intense rivalry, powerful buyers, and the constant threat of new entrants. Understanding these forces is crucial for any stakeholder in the global port and logistics sector.

The complete report reveals the real forces shaping DP World’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The global port and logistics sector, including companies like DP World, depends on a select group of manufacturers for highly specialized equipment. Think of things like the massive quay cranes that load and unload ships, or the automated guided vehicles (AGVs) that move containers around. This limited pool of suppliers means they can have considerable sway, particularly when it comes to advanced technologies that DP World is keen to adopt.

DP World's strategic push into areas like artificial intelligence and digitalization, as evidenced by its significant investments in technology, directly increases its reliance on these specialized equipment makers. For instance, the adoption of advanced automation and AI-driven systems in port operations, a key focus for DP World in 2024, means they are more dependent on suppliers who can deliver these sophisticated solutions.

Skilled labor, including port operators and logistics specialists, is a vital input for DP World's operations. The presence of strong labor unions in critical port regions can significantly amplify their bargaining leverage, impacting wages, benefits, and operational agreements. For instance, in 2023, DP World's workforce exceeded 115,000 individuals across numerous countries, highlighting the complexity of managing diverse labor relations and the potential for disruptions.

DP World's increasing reliance on advanced digital solutions, including AI and IoT for optimizing supply chain operations, directly boosts the bargaining power of technology and software providers. Companies offering specialized, integrated platforms, such as those for terminal operating systems or advanced analytics, can leverage DP World's growing dependence to negotiate favorable terms. For instance, the global market for supply chain management software was projected to reach over $30 billion by 2024, indicating the significant value and potential pricing power of these essential technology partners.

Land and Real Estate Owners

Land and real estate owners wield considerable bargaining power over DP World. This is primarily due to the immense land requirements for port terminals and logistics parks, which necessitate strategically positioned sites near key trade arteries and population hubs. The limited availability and escalating prices of such prime locations, combined with the intricate web of regulatory and environmental approvals, significantly bolster the leverage of property owners.

DP World's ongoing growth and development initiatives, including the recent expansion of its vehicle storage capacity at Jebel Ali Port, underscore its persistent demand for suitable land. For instance, in 2024, DP World's capital expenditure was reported to be around $1.5 billion, a portion of which is allocated to land acquisition and infrastructure development, highlighting the financial commitment tied to securing these essential assets.

- High Land Costs: Prime logistics land prices in major global port cities can range from several hundred to thousands of dollars per square meter, directly impacting DP World's expansion costs.

- Strategic Location Premium: Proximity to ports, major highways, and rail networks commands a significant premium, increasing the bargaining power of landowners in these critical areas.

- Regulatory Hurdles: Complex zoning laws, environmental impact assessments, and permitting processes can delay or even halt development, giving landowners more control over the terms of sale or lease.

- Limited Supply: The finite nature of developable land in desirable coastal and industrial zones creates a competitive environment for logistics operators like DP World, strengthening supplier (landowner) positions.

Energy and Fuel Suppliers

The bargaining power of energy and fuel suppliers is a significant factor for DP World, given the critical role of energy in port operations and its vast logistics network. Fluctuations in global energy prices directly impact operational expenditures, and the ongoing shift towards decarbonization introduces new dynamics with suppliers of both traditional fuels and renewable energy solutions.

DP World's strategic initiatives, as highlighted in its 2024 Sustainability Report, underscore its active engagement with this supplier segment. The company's commitment to reducing emissions and increasing the sourcing of renewable electricity demonstrates a proactive approach to managing energy costs and supply chain resilience. For instance, DP World aims to have 100% of its electricity sourced from renewable sources by 2030, a target that influences its negotiations with energy providers.

- High Dependence: Port operations, including crane movements, vehicle fleets, and terminal infrastructure, are heavily reliant on consistent and affordable energy.

- Price Volatility: Global oil and gas price swings, influenced by geopolitical events and market demand, directly affect DP World's fuel and energy procurement costs.

- Decarbonization Push: The increasing demand for sustainable energy solutions creates opportunities for renewable energy suppliers, potentially shifting negotiation leverage.

- Supplier Concentration: While the energy market is vast, specific fuel types or specialized renewable energy providers might represent concentrated supplier bases, enhancing their bargaining power.

The bargaining power of suppliers for DP World is notably high, especially for specialized port equipment and advanced technology solutions. Given the limited number of manufacturers capable of producing massive quay cranes and sophisticated automation systems, these suppliers can dictate terms. DP World's significant investments in technology, like AI-driven port operations, further solidify the leverage of these key technology providers, as seen in the projected over $30 billion global supply chain management software market by 2024.

Landowners also possess considerable bargaining power due to the critical need for strategically located port and logistics sites. The scarcity of prime real estate, coupled with complex regulatory approvals, strengthens their position. DP World's substantial capital expenditure, around $1.5 billion in 2024, includes land acquisition, illustrating the high costs and competitive landscape for securing these essential assets.

| Supplier Type | Factors Influencing Bargaining Power | Impact on DP World | 2024 Data/Trends |

|---|---|---|---|

| Specialized Equipment Manufacturers | Limited number of suppliers, high technological complexity | Higher equipment costs, potential delays in upgrades | DP World's tech investments increase reliance on these suppliers. |

| Technology & Software Providers | Proprietary solutions, integration needs | Negotiating power for AI, IoT, and terminal operating systems | Global SCM software market projected over $30 billion. |

| Land & Real Estate Owners | Scarcity of prime locations, regulatory hurdles | Increased land acquisition and lease costs | DP World's 2024 CAPEX includes land development. |

| Energy & Fuel Suppliers | Price volatility, decarbonization demands | Fluctuating operational costs, need for renewable energy sourcing | DP World aims for 100% renewable electricity by 2030. |

What is included in the product

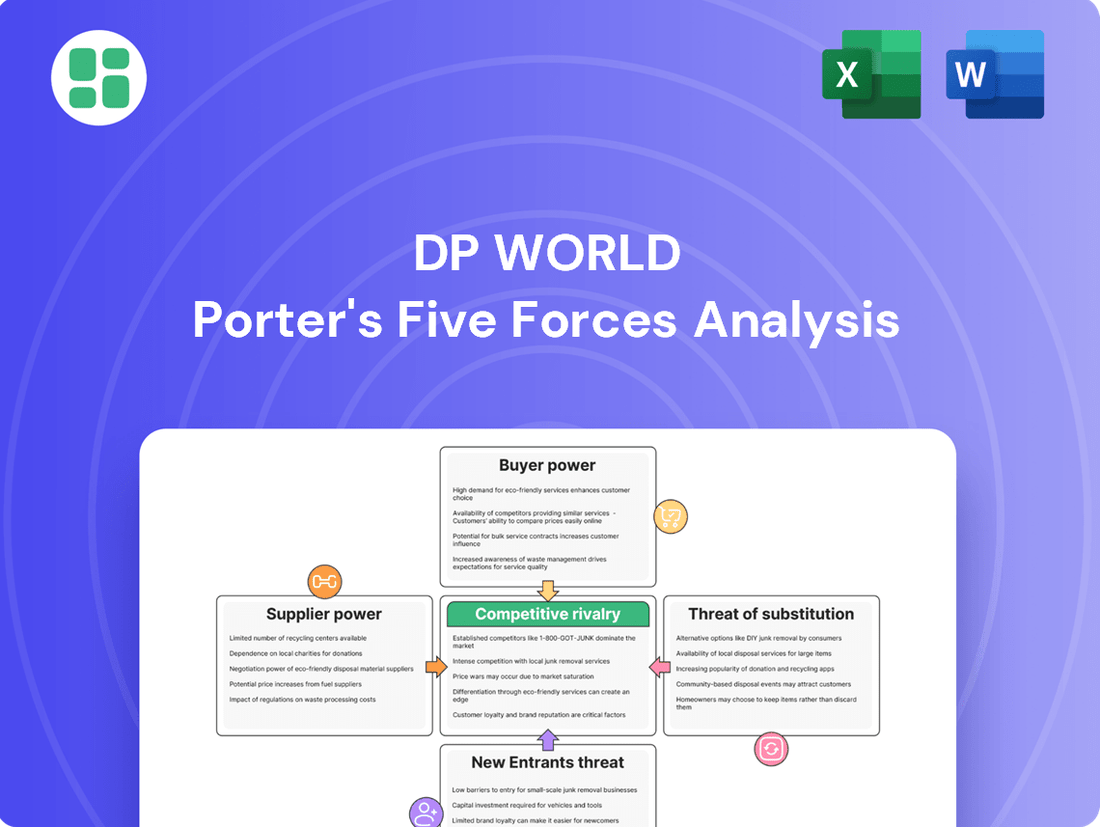

This analysis comprehensively evaluates the competitive landscape for DP World, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model, allowing for rapid assessment of market dynamics.

Customers Bargaining Power

DP World's primary customers are the major global shipping lines, a group that has become increasingly consolidated. Giants like MSC, Maersk, and CMA CGM handle enormous volumes of cargo, giving them substantial leverage. This concentration means these powerful entities can effectively negotiate pricing and service level agreements, as they possess the flexibility to divert their significant cargo flows to competing ports if their demands aren't met.

The bargaining power of these consolidated shipping lines is a critical factor for DP World. In 2024, DP World's operational focus on achieving a record 100 million TEU container capacity underscores its deep reliance on these large clients. Their ability to dictate terms can directly impact DP World's profitability and operational efficiency, making customer relationship management paramount.

Large Beneficial Cargo Owners (BCOs), including major manufacturers and retailers, wield significant bargaining power over DP World. These clients demand integrated, efficient, and cost-effective supply chain solutions, compelling DP World to deliver services that extend beyond traditional port operations. For instance, in 2024, global trade volumes continued to be influenced by these large players seeking optimized logistics, putting pressure on service providers like DP World to innovate and offer value-added services.

While significant customers can exert considerable bargaining power, the practicalities of switching port operators or comprehensive logistics partners often involve substantial costs. These costs stem from the deep integration of IT systems, existing contractual obligations, and the intricate web of supply chain connections that have been built. For instance, a major shipping line might face millions in costs to reconfigure its global scheduling and IT infrastructure if it were to switch providers.

DP World actively mitigates this customer power by focusing on service differentiation. By offering an extensive global network of ports and terminals, coupled with crucial value-added services such as advanced warehousing solutions and efficient intermodal transportation links, the company makes the prospect of switching significantly less appealing. This comprehensive offering, which goes beyond basic port services, locks customers into DP World's ecosystem, thereby reducing their inclination to seek alternatives.

Demand for Integrated and Resilient Solutions

Customers are increasingly seeking integrated and resilient supply chain solutions, a trend amplified by recent global disruptions. This demand for end-to-end visibility, advanced technology, and sustainability puts pressure on providers to offer comprehensive services. For DP World, meeting these evolving needs by leveraging its diversified global network and digital capabilities is key to managing customer bargaining power. For instance, DP World’s investment in smart logistics and automation aims to provide a seamless experience, reducing reliance on single points of failure and thus enhancing customer loyalty.

DP World's strategic focus on providing digitally integrated and resilient supply chain solutions directly addresses this growing customer demand. By offering end-to-end visibility and advanced technological integration, DP World strengthens its value proposition. This approach helps to mitigate customer power by creating a sticky customer base that benefits from DP World's comprehensive service offering. In 2023, DP World reported a 10.5% increase in revenue from its logistics and services segment, underscoring the market's appetite for these integrated solutions.

- Increased Demand for Resilience: Following supply chain disruptions in 2022 and 2023, businesses prioritized partners offering robust and adaptable logistics.

- Digital Integration Expectations: Customers now expect real-time tracking, data analytics, and seamless digital interfaces for managing their cargo flows.

- DP World's Response: Investments in technology, such as AI-powered route optimization and blockchain for supply chain transparency, directly cater to these demands.

- Mitigating Customer Power: By delivering superior, integrated solutions, DP World can command better pricing and reduce customer churn, thereby lessening their bargaining power.

Geographic Diversification of Customers

DP World's extensive global footprint, with operations on six continents, significantly reduces the bargaining power of individual customers. By serving diverse industries and geographies, the company avoids over-reliance on any single client or market segment. This broad customer base, evidenced by DP World's robust revenue growth in 2024, which saw strong performance across multiple regions, helps to stabilize demand and insulate the company from concentrated customer pressure.

- Global Reach: DP World operates in over 60 countries, reaching a vast and varied customer pool.

- Industry Diversity: Services cater to sectors ranging from logistics and shipping to manufacturing and retail, diffusing customer influence.

- Reduced Dependence: The company's ability to draw revenue from numerous sources limits the leverage any one customer can exert.

- 2024 Performance: Strong revenue growth in 2024 was supported by contributions from a wide geographical spread of operations, underscoring the benefits of diversification.

The bargaining power of DP World's customers is substantial, primarily due to the consolidation within the global shipping industry. Major shipping lines like MSC, Maersk, and CMA CGM command significant cargo volumes, enabling them to negotiate favorable pricing and service terms. Their ability to shift cargo to competing ports means DP World must remain competitive to retain these key clients, a dynamic that was evident in 2024 as DP World aimed to expand its capacity to meet demand from these large players.

Large Beneficial Cargo Owners (BCOs) also exert considerable influence, pushing DP World to offer integrated, efficient, and cost-effective supply chain solutions beyond basic port services. The increasing demand for resilience and digital integration, highlighted by DP World's 10.5% revenue growth in its logistics segment in 2023, means customers expect more, directly impacting DP World's service offerings and operational strategies.

While customers hold power, the high switching costs associated with reconfiguring IT systems and supply chain connections can mitigate this. DP World leverages its extensive global network and value-added services, such as advanced warehousing and intermodal transport, to create customer stickiness and reduce their inclination to switch providers. This strategy is crucial for maintaining profitability in an environment where customer leverage is high.

DP World's broad global presence across over 60 countries and diverse industries helps to diffuse customer influence. This wide customer base, which contributed to strong revenue growth in 2024, limits the leverage any single customer can exert, providing a degree of insulation against concentrated demands and ensuring more stable demand patterns.

| Customer Segment | Key Bargaining Factors | DP World's Mitigation Strategy | Impact on DP World |

|---|---|---|---|

| Global Shipping Lines (e.g., MSC, Maersk) | High cargo volumes, ability to switch ports | Service differentiation, competitive pricing, network integration | Direct impact on pricing and service level agreements |

| Large Beneficial Cargo Owners (BCOs) | Demand for integrated supply chain solutions, cost efficiency | Value-added services, digital integration, resilience focus | Pressure to innovate and expand service offerings |

| Overall Customer Base | Increasing demand for resilience and digital integration | Investment in technology (AI, blockchain), global network expansion | Need for continuous improvement and adaptation |

Preview the Actual Deliverable

DP World Porter's Five Forces Analysis

This preview showcases the complete DP World Porter's Five Forces analysis, offering an in-depth examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. This professionally formatted analysis is ready for your immediate use, providing actionable insights into DP World's industry dynamics.

Rivalry Among Competitors

The global port and logistics arena is intensely competitive, with DP World navigating a landscape populated by formidable players. Giants like PSA International, China Merchants Port Holdings, APM Terminals, and Hutchison Port Holdings are major rivals, alongside integrated logistics titans such as DHL and UPS. These companies actively pursue market share through significant investments, expanding their operational capacities, and embracing cutting-edge technology.

DP World consistently ranks among the leading global port operators, a testament to its strong market position. In 2023, DP World reported a 5.6% increase in total gross throughput to 89.9 million TEU (Twenty-foot Equivalent Units), demonstrating its ability to compete effectively in this dynamic sector.

The port and terminal operations sector is inherently capital-intensive, with significant investments required for infrastructure like berths, cranes, and land. These substantial fixed costs create a powerful incentive for companies like DP World to achieve high capacity utilization. For instance, in 2023, DP World handled a record 89.4 million TEU (twenty-foot equivalent units) across its global portfolio, a testament to their drive to maximize asset usage.

This pressure to fill capacity often translates into aggressive pricing competition as operators vie for cargo volumes. Companies must constantly seek efficiencies and innovative solutions to manage costs and remain competitive. DP World's strategic focus on operational excellence and its expansion into new markets are key strategies to navigate this intense rivalry and ensure sustained profitability.

The ports and terminal operations market is booming, with projections indicating it will hit USD 62.88 billion by 2029. This rapid expansion fuels intense competition as companies vie for market share.

However, this growth is coupled with significant industry consolidation. Mergers, acquisitions, and strategic alliances are becoming commonplace, reshaping the competitive landscape and increasing the stakes for all players.

DP World itself has actively participated in this consolidation trend, expanding its global footprint through strategic acquisitions and new concession agreements. This proactive approach highlights the dynamic nature of competitive rivalry within the sector.

Technological Advancements and Digitalization

Technological advancements are significantly reshaping the competitive landscape, with smart port initiatives, automation, and AI becoming crucial differentiators. DP World, for instance, is investing in its CARGOES suite, aiming to boost operational efficiency and visibility through digital platforms. This focus on innovation allows companies to offer superior services and gain a competitive edge.

The rapid adoption of these technologies is a key driver of competitive rivalry. For example, the global terminal operating systems market, which includes many of these digital solutions, was valued at approximately $1.5 billion in 2023 and is projected to grow substantially. Companies that lead in implementing AI for predictive maintenance or blockchain for supply chain transparency are likely to attract more business.

- Smart Port Initiatives: Integration of IoT, AI, and big data analytics to optimize port operations.

- Automation: Increased use of automated guided vehicles (AGVs) and automated stacking cranes to improve throughput and safety.

- Digital Platforms: Development of cloud-based solutions for cargo tracking, customs clearance, and customer engagement.

- Sustainability Tech: Adoption of technologies that reduce emissions and improve energy efficiency in port environments.

Geopolitical Factors and Trade Route Shifts

Geopolitical factors and trade route shifts are major drivers of competitive rivalry in the port and logistics sector. Trade wars and evolving global trade patterns directly impact demand for specific routes and the utilization of port infrastructure. For instance, in 2023, global trade volume saw a modest increase of around 0.9%, a slowdown from previous years, highlighting the sensitivity of the industry to these macro-economic and political forces.

DP World, like its competitors, must maintain agility to navigate these disruptions. Strategic investments in key growth markets, such as its expansion projects in India and the Middle East, are designed to capitalize on emerging trade flows and mitigate risks associated with shifts in established routes. The company’s focus on building resilient supply chains is a direct response to the increasing volatility caused by geopolitical tensions.

- Shifting Trade Dynamics: Geopolitical events, such as the ongoing restructuring of supply chains post-pandemic and regional conflicts, can lead to significant rerouting of cargo, impacting port volumes and competitive positioning.

- Trade Policy Impact: Tariffs and trade agreements directly influence trade volumes between nations, forcing port operators to adapt their capacity planning and investment strategies. For example, shifts in US-China trade policies have historically redirected shipping routes.

- DP World's Adaptability: DP World's strategy of diversifying its geographic footprint and investing in technologically advanced, efficient terminals allows it to better absorb the shocks of geopolitical instability and changing trade patterns, aiming to maintain market share across various regions.

Competitive rivalry is fierce in the global port and logistics sector, with DP World facing off against major players like PSA International and APM Terminals. These companies compete by investing heavily in infrastructure and technology, aiming to capture market share. DP World's 2023 throughput of 89.9 million TEU highlights its strong performance amidst this intense competition.

The industry's capital-intensive nature, requiring substantial investments in facilities, drives operators to maximize capacity utilization, leading to price competition. DP World's record handling of 89.4 million TEU in 2023 underscores this drive for efficiency.

Technological advancements, such as AI and automation, are key differentiators, with DP World investing in its CARGOES suite to enhance efficiency. The terminal operating systems market, valued at approximately $1.5 billion in 2023, reflects this technological race.

Geopolitical shifts and trade policy changes also significantly impact competition, forcing companies like DP World to adapt their strategies and diversify their global presence to navigate evolving trade flows.

SSubstitutes Threaten

While ocean freight is the dominant force in global trade, moving approximately 90% of all traded goods, other transportation methods can step in for specific needs. For high-value, urgent, or perishable items, air cargo presents a viable alternative. This is particularly relevant as global air cargo volumes saw a significant rebound in 2024, with many carriers reporting double-digit growth compared to 2023, indicating increased demand for faster transit times, albeit at a premium price.

DP World's strategic move to integrate air and land logistics into its port operations directly addresses this threat. By offering seamless multimodal solutions, they can capture business that might otherwise opt solely for air freight, thereby retaining a larger share of the supply chain and mitigating the direct substitution risk.

The growing trend of nearshoring and reshoring manufacturing presents a significant threat of substitutes for DP World. As companies increasingly look to bring production closer to their end markets, the reliance on long-haul ocean freight and large global port infrastructure may diminish. This shift could lead to a reduced demand for the extensive international logistics services that DP World specializes in, favoring more localized and regional supply chain solutions.

For instance, in 2024, several major automotive manufacturers announced plans to increase production in North America, aiming to mitigate supply chain disruptions experienced in previous years. This move, while potentially beneficial for regional economies, directly challenges the volume of containerized cargo typically handled by global port operators like DP World. While globalized production often remains cost-effective for many sectors, the increasing emphasis on supply chain resilience and reduced transit times due to nearshoring directly substitutes for the core services DP World provides.

The proliferation of direct-to-consumer (D2C) models and increasingly localized distribution networks presents a potential threat by shifting some volume away from large, centralized ports. This trend could fragment supply chains, with production and fulfillment occurring closer to the end consumer. For instance, the global D2C market was projected to reach over $1.2 trillion in 2024, indicating a significant shift in consumer purchasing habits.

However, the reliance on efficient inbound logistics for raw materials and international components remains a critical factor. Even D2C businesses often require robust global supply chains for their inputs, a segment where DP World’s expertise in managing complex international trade flows remains vital. DP World's extensive network of ports and logistics hubs is well-positioned to support these inbound requirements, mitigating the direct impact of localized fulfillment.

Customer In-house Logistics Capabilities

While some very large multinational corporations might consider building their own logistics capabilities, the significant capital outlay and specialized expertise needed for port operations make this a largely impractical substitute for most. For instance, establishing a global port infrastructure requires billions in investment, a barrier that few companies can overcome.

DP World's extensive network and operational efficiencies are difficult and costly for any single company to replicate independently. The sheer scale of global trade and the complexity of managing international supply chains mean that outsourcing to specialized providers like DP World remains the most economically viable option for the vast majority of businesses.

- High Capital Investment: Developing comparable in-house port facilities can cost billions, far exceeding the typical investment capacity of most corporations.

- Specialized Expertise: Managing complex global logistics and port operations requires a deep bench of specialized talent that is difficult and expensive to cultivate internally.

- Economies of Scale: DP World benefits from significant economies of scale across its global operations, offering cost advantages that are hard for individual companies to match.

Technological Alternatives for Supply Chain Management

The threat of substitutes for DP World's integrated logistics services is evolving with the rise of advanced supply chain management software and digital platforms. These solutions, often offered by technology firms rather than traditional logistics providers, aim to provide cargo owners with enhanced visibility and control over their shipments. For example, platforms leveraging AI and blockchain are emerging to streamline documentation and tracking, potentially reducing reliance on certain aspects of traditional freight forwarding and customs brokerage that DP World offers.

These digital alternatives can disintermediate some of the value chain by offering direct connections and automated processes. For instance, a shipper might use a digital platform to directly book capacity with carriers and manage customs clearance through integrated software, bypassing some of the manual coordination historically handled by logistics companies. This shift is driven by a demand for greater efficiency and transparency in global trade flows.

- Emerging Digital Platforms: Technology companies are developing sophisticated software solutions that offer end-to-end supply chain visibility and management, acting as potential substitutes for certain DP World services.

- Disintermediation Potential: These platforms can reduce the need for intermediaries by enabling direct interaction between cargo owners and service providers, impacting traditional logistics functions.

- DP World's Core Strength: Despite digital advancements, DP World's extensive physical infrastructure, including ports and terminals, along with its operational expertise, remains a critical differentiator and a barrier to complete substitution.

- Market Trends: The increasing adoption of digitalization in logistics, with global logistics technology spending projected to grow significantly, underscores the importance of adapting to these evolving substitute threats.

While air cargo offers speed for high-value goods, DP World's multimodal approach, integrating air and land logistics, captures business that might otherwise bypass its ports. The rise of nearshoring, exemplified by automotive manufacturers increasing North American production in 2024, reduces reliance on long-haul ocean freight, directly challenging DP World's core services by favoring localized supply chains.

The growing direct-to-consumer (D2C) market, projected to exceed $1.2 trillion in 2024, shifts volume away from large ports towards localized distribution. However, DP World's strength in managing inbound logistics for raw materials remains crucial for these D2C businesses, mitigating the direct substitution threat.

The threat of substitutes is also present in emerging digital platforms that offer enhanced supply chain visibility and management. These solutions can disintermediate traditional logistics functions, though DP World's extensive physical infrastructure and operational expertise provide a significant competitive advantage.

Entrants Threaten

The port and global logistics industry demands substantial capital, creating a significant barrier for newcomers. Building or acquiring a network on par with DP World's global presence, which recently announced a $2.5 billion investment package for 2025, requires immense financial resources.

Establishing and operating port terminals is a process fraught with significant regulatory hurdles and the necessity of securing long-term government concessions. These intricate legal and bureaucratic requirements act as substantial barriers to entry, as governments often award exclusive or limited operating rights, effectively restricting new competitors.

Economies of scale are a significant barrier for new entrants in the port and logistics sector. Established players like DP World leverage massive operational volumes to reduce per-unit costs in areas like cargo handling, warehousing, and fleet management. For instance, DP World's 2023 revenue reached $12.07 billion, reflecting its extensive global footprint and operational efficiency.

Network effects further solidify the position of incumbents. DP World's integrated global network of ports, logistics hubs, and digital platforms creates a powerful value proposition for customers, offering seamless end-to-end supply chain solutions. Replicating this extensive connectivity and the associated efficiencies would require immense capital investment and time, making it a formidable challenge for any new competitor.

Brand Reputation and Established Customer Relationships

Building a strong brand reputation for reliability and efficiency, as DP World has, is a formidable barrier. This takes decades to cultivate, making it challenging for newcomers to gain trust. For instance, DP World's consistent operational performance across its global network, which handled over 70 million TEUs in 2023, underscores this established credibility.

Established customer relationships with major shipping lines and cargo owners are crucial. These long-standing partnerships, built on years of dependable service and mutual trust, create significant loyalty. DP World's strategic alliances with carriers like Maersk and MSC, for example, demonstrate the depth of these entrenched relationships that new entrants would struggle to replicate.

- Brand Loyalty: DP World's reputation for operational excellence and global connectivity fosters strong customer loyalty, making it difficult for new entrants to attract and retain business.

- Customer Relationships: Decades of service have allowed DP World to build deep, trust-based relationships with key players in the shipping and logistics industry.

- Global Network: DP World's extensive network of ports and terminals in strategic trade locations provides a significant advantage that new competitors would find hard to match.

Technological Complexity and Specialized Expertise

The modern port and logistics industry is a high-tech arena, demanding significant investment in automation, artificial intelligence, and advanced terminal operating systems. DP World, for instance, has been a pioneer in adopting such technologies, as seen in its investments in automated quay cranes and yard cranes. This technological sophistication creates a substantial barrier to entry for potential new competitors.

Developing or acquiring the necessary expertise in these complex systems is a major hurdle. It requires not only capital but also access to specialized talent and a commitment to continuous innovation. For example, the integration of big data analytics for optimizing container flow and predictive maintenance necessitates skilled data scientists and engineers, a pool that is both competitive and costly to attract.

- High Capital Investment: Acquiring and implementing advanced port automation technologies requires billions of dollars.

- Specialized Workforce: The industry needs highly skilled engineers and technicians for operating and maintaining sophisticated systems.

- Intellectual Property & Know-How: Proprietary software and operational strategies are difficult for newcomers to replicate.

- Continuous R&D: Staying competitive means ongoing investment in research and development for new logistical solutions.

The threat of new entrants into the global port and logistics sector is generally low due to formidable barriers. DP World's substantial capital requirements, evidenced by its 2025 investment package of $2.5 billion, alongside complex regulatory landscapes and the need for long-term government concessions, deter many potential newcomers. Furthermore, the immense economies of scale enjoyed by established players like DP World, which reported $12.07 billion in revenue for 2023, and the powerful network effects created by its integrated global operations, make it exceedingly difficult for new entrants to compete effectively.

| Barrier Type | Description | DP World Relevance |

|---|---|---|

| Capital Intensity | High upfront investment for infrastructure and technology. | $2.5 billion investment package for 2025 highlights significant capital needs. |

| Regulatory Hurdles | Complex licensing, permits, and government concessions. | Securing long-term operating rights is a critical entry requirement. |

| Economies of Scale | Lower per-unit costs due to high operational volumes. | $12.07 billion revenue in 2023 reflects vast operational scale and efficiency. |

| Network Effects | Value increases with more connected ports and services. | Integrated global network offers seamless end-to-end solutions. |

Porter's Five Forces Analysis Data Sources

Our DP World Porter's Five Forces analysis is built upon a robust foundation of data, including DP World's annual reports, industry-specific market research from firms like Drewry and IHS Markit, and global trade statistics from organizations such as UNCTAD.