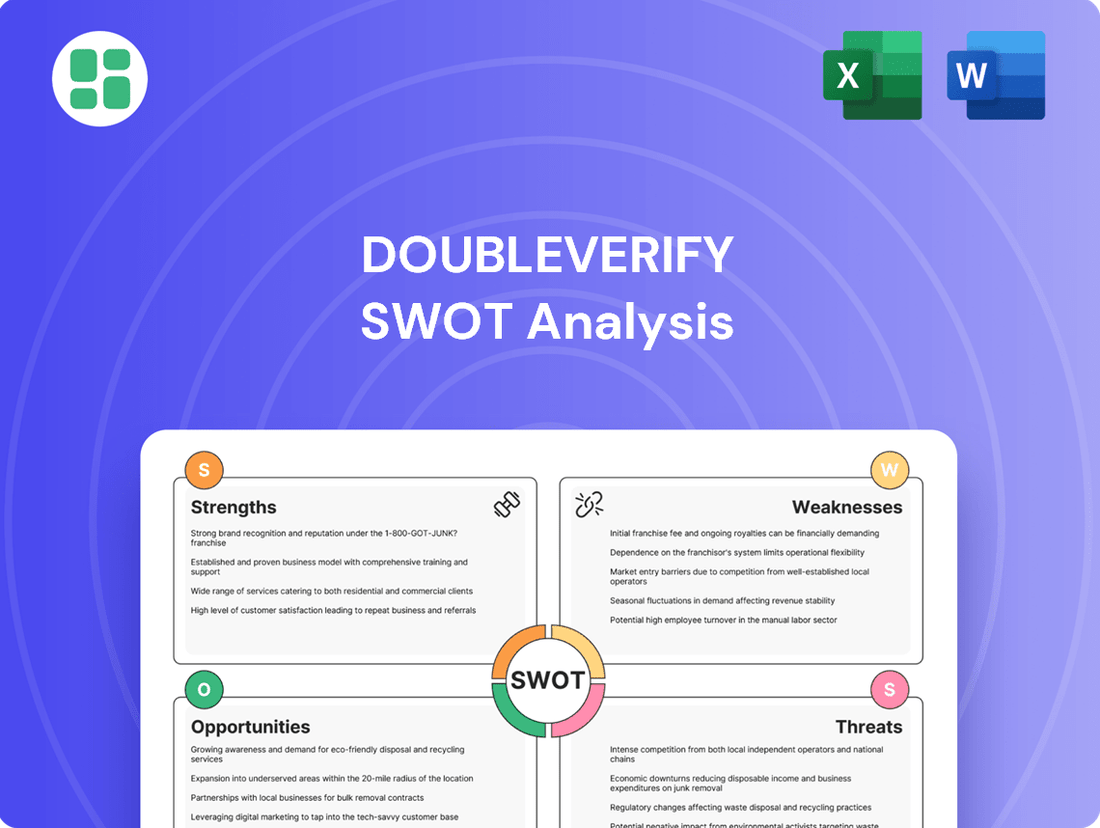

DoubleVerify SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DoubleVerify Bundle

DoubleVerify's market position is bolstered by its strong brand reputation and innovative technology, but it also faces challenges from evolving digital advertising landscapes and competitive pressures. Understanding these dynamics is crucial for navigating the industry.

Want the full story behind DoubleVerify’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DoubleVerify stands as a dominant force in digital media measurement, providing advertisers with a robust suite of tools for ad verification, fraud prevention, and ensuring ads are seen by real people. Their broad portfolio covers critical aspects like viewability and brand safety, empowering advertisers to maximize the impact of their digital campaigns across diverse channels.

This market leadership is solidified by DoubleVerify's extensive partnerships, including significant collaborations with major advertising platforms and a vast network of advertisers. For instance, as of early 2024, DoubleVerify reported protecting billions of ad impressions daily, demonstrating the scale of their operations and the trust placed in their verification services by leading industry players.

DoubleVerify's strength lies in its sophisticated, proprietary technology, particularly its AI-driven optimization tools such as Scibids AI. These capabilities are crucial for boosting campaign performance and efficiency in the digital advertising space.

The company's advanced technology automates and refines programmatic buying, giving it a significant edge in the dynamic digital advertising market. This technological prowess is a key differentiator.

DoubleVerify demonstrates a strong commitment to innovation through continuous investment in research and development. Notably, over 40% of its headcount growth in 2024 was directed towards R&D, underscoring its focus on staying ahead technologically.

DoubleVerify has showcased impressive financial strength. In the first quarter of 2025, the company reported substantial revenue growth, building on a strong performance throughout 2024. This upward trend is largely fueled by increasing client adoption of its essential verification and activation tools.

Customer loyalty is a key indicator of DoubleVerify's value proposition, evidenced by a gross revenue retention rate consistently above 95%. This high retention signifies that advertisers find its services indispensable, leading to recurring business and a stable revenue base. The company's healthy adjusted EBITDA margins further underscore its efficient operations and profitability.

Strategic Partnerships and Platform Integrations

DoubleVerify's strategic partnerships are a significant strength, notably its deep integrations with major social media platforms. These include Meta (Facebook and Instagram) and TikTok, alongside Google's Search Partner Network. These collaborations are crucial for providing advertisers with essential pre-bid and post-bid verification services across critical digital advertising environments.

These alliances extend DoubleVerify's market reach and enhance its value proposition by embedding its verification technology directly into key advertising ecosystems. Furthermore, the company's integration with commerce media networks diversifies its operational footprint and solidifies its position as a comprehensive verification provider.

- Meta Partnership: Ensures verification solutions are available across Facebook and Instagram's vast advertising inventory.

- TikTok Integration: Provides advertisers with brand safety and suitability tools on the rapidly growing platform.

- Google Search Partner Network: Extends verification capabilities to a wider range of search advertising placements.

- Commerce Media Networks: Broadens the scope of verification to include retail media platforms, a growing segment of digital advertising.

Growing Demand for Ad Quality and Transparency

The digital advertising landscape is under intense examination concerning brand safety, ad fraud, and viewability, directly fueling the demand for independent verification services such as those offered by DoubleVerify. Advertisers are increasingly turning to DV's objective data and analytics to refine their media spending and enhance return on investment, solidifying its role in fostering trust and accountability within the digital ecosystem.

Industry reports for 2024 emphasize that ad quality is becoming the bedrock of effective digital media performance. This trend is evident as major brands continue to prioritize verification, with DoubleVerify reporting a significant increase in advertiser adoption of its advanced measurement solutions throughout 2024.

Key growth drivers include:

- Heightened advertiser focus on ROI: Brands are demanding greater assurance that their ad spend is reaching genuine audiences and is not being wasted on fraudulent impressions.

- Regulatory pressures: Increasing calls for transparency and accountability in digital advertising are pushing platforms and advertisers towards third-party verification.

- Brand safety imperatives: Advertisers are more vigilant than ever about ensuring their ads appear in brand-safe environments, a core offering of DoubleVerify's services.

DoubleVerify's core strengths lie in its robust technology and market position. Its proprietary AI-driven tools, like Scibids AI, significantly enhance campaign performance. The company's commitment to innovation is evident, with over 40% of its 2024 headcount growth dedicated to R&D, ensuring it stays at the technological forefront.

Financial performance is another key strength, with substantial revenue growth reported in Q1 2025, driven by increasing client adoption of its verification and activation tools. This is complemented by a gross revenue retention rate consistently above 95%, indicating strong customer loyalty and a stable revenue base. Healthy adjusted EBITDA margins further highlight operational efficiency and profitability.

Strategic partnerships, particularly deep integrations with major platforms like Meta and TikTok, along with the Google Search Partner Network and commerce media networks, significantly expand DoubleVerify's market reach and value proposition. These alliances embed its verification technology within critical advertising ecosystems, solidifying its comprehensive offering.

The increasing demand for independent verification services, fueled by advertiser focus on ROI, regulatory pressures for transparency, and brand safety imperatives, directly benefits DoubleVerify. As of 2024, industry reports confirm that ad quality is paramount, with major brands prioritizing verification, leading to increased adoption of DoubleVerify's advanced measurement solutions.

What is included in the product

Analyzes DoubleVerify’s competitive position through key internal and external factors, highlighting its strengths in ad verification technology and market leadership, while also considering potential weaknesses and threats from evolving privacy regulations and competition.

Offers a clear, actionable framework to identify and address digital advertising quality challenges.

Weaknesses

DoubleVerify's business model is heavily reliant on the digital advertising market, which means its revenue is directly impacted by how much companies choose to spend on advertising. When the economy faces uncertainty, or when businesses decide to tighten their belts, advertising budgets are often among the first to be reduced. This creates a significant vulnerability for DoubleVerify.

The company itself has acknowledged this challenge. In late 2024 and into early 2025, DoubleVerify saw a noticeable slowdown in its growth rate. This was partly due to some of its larger clients scaling back their spending. The impact was significant enough that one key client’s reduced investment meant they were no longer included in the company's financial projections for 2025.

This close connection between DoubleVerify's performance and the ebb and flow of advertising expenditures introduces a considerable amount of volatility into its financial outlook. Such dependencies can create headwinds, making it harder for the company to predict its revenue and growth trajectory consistently.

The ad verification space is incredibly crowded. DoubleVerify faces stiff competition from established names like Integral Ad Science (IAS) and Comscore, alongside a growing number of newer entrants. This intense rivalry means DoubleVerify must constantly innovate and maintain competitive pricing to keep its clients and prevent rivals from chipping away at its market share.

DoubleVerify's ability to measure ad effectiveness can be hampered on closed platforms like Meta and Amazon. These companies maintain their own ad ecosystems, making it more difficult and potentially more expensive for DoubleVerify to implement its technology. This presents a challenge, as a substantial amount of digital advertising occurs within these controlled environments.

This limitation could impact DoubleVerify's revenue and future growth, especially as competitors may be better equipped to utilize artificial intelligence within these proprietary ad systems. The reliance on these closed platforms for a significant portion of ad spend means DoubleVerify needs to find ways to navigate these restrictions effectively to maintain its competitive edge.

Slower Growth in Certain Revenue Segments

While DoubleVerify's overall revenue growth is robust, certain revenue streams are experiencing a slowdown. For example, the social measurement segment's growth has moderated, and international measurement revenue saw a decline of 8% in the first quarter of 2025. This performance suggests potential challenges in specific product adoption or market penetration strategies across different geographical regions or service offerings.

These uneven growth patterns highlight areas where DoubleVerify may need to re-evaluate its market approach or product development. The decrease in international measurement revenue, in particular, points to potential headwinds in expanding its global footprint or competing effectively in those markets.

- Slowing Social Measurement Growth: The social measurement segment, a key area for digital advertising verification, has shown a deceleration in its growth trajectory.

- International Revenue Decline: A notable weakness is the 8% decrease in international measurement revenue recorded in Q1 2025, indicating potential challenges in overseas markets.

- Uneven Product Adoption: The varied performance across different revenue segments suggests that product adoption and market penetration are not uniform, requiring targeted strategies.

Past Issues with Data Accuracy and Client Trust

DoubleVerify experienced a notable challenge in early 2024 when its brand safety scoring tool for X (formerly Twitter) advertisers was found to be providing inaccurate data for an extended period of nearly five months. This data discrepancy directly impacted advertiser confidence, leading to a significant downturn in the company's stock price and subsequent class-action lawsuits. The incident cast a shadow over the reliability of DoubleVerify's data and eroded trust among its clientele.

The fallout from the X data inaccuracy was substantial. Advertisers who relied on DoubleVerify's metrics for campaign placement and brand protection may have made suboptimal decisions, potentially leading to wasted ad spend or brand exposure in unsuitable environments. This directly affected DoubleVerify's reputation as a trusted verification partner.

- Data Accuracy Issues: Incorrect brand safety scores for X advertisers were reported for approximately five months in 2024.

- Financial Impact: The data error contributed to a sharp drop in DoubleVerify's stock price.

- Legal Repercussions: The situation led to the filing of class-action lawsuits against the company.

- Client Trust Erosion: The incident raised significant concerns about the reliability of DoubleVerify's data and its impact on client relationships.

DoubleVerify's reliance on the broader digital advertising market makes it susceptible to economic downturns, as evidenced by a slowdown in growth observed in late 2024 and early 2025, partly due to reduced spending by key clients. Intense competition from players like Integral Ad Science and Comscore necessitates continuous innovation and competitive pricing to retain market share.

Limitations in verifying ad effectiveness on closed platforms such as Meta and Amazon present a significant hurdle, as these environments house a substantial portion of digital ad spend. Furthermore, specific revenue streams, like international measurement, experienced a decline of 8% in Q1 2025, indicating potential challenges in global market penetration and adoption.

A critical weakness emerged in 2024 when inaccurate brand safety scores for X advertisers, persisting for nearly five months, led to a significant stock price drop and class-action lawsuits, severely impacting client trust and the company's reputation for data reliability.

What You See Is What You Get

DoubleVerify SWOT Analysis

The preview you see is the same document the customer will receive after purchasing, ensuring transparency and quality. This detailed SWOT analysis for DoubleVerify is professionally structured and ready for immediate use upon purchase. You're viewing a live preview of the actual SWOT analysis file; the complete version becomes available after checkout.

Opportunities

DoubleVerify has a prime opportunity to capitalize on the booming Connected TV (CTV) and Retail Media Networks. These channels are experiencing rapid growth, with CTV measurement volumes seeing a significant uptick through 2024 and into Q1 2025 as advertisers seek solutions for viewability and fraud.

Retail Media Networks, in particular, present a valuable avenue due to their specialized, high-quality inventory. This expansion allows DoubleVerify to offer its robust verification solutions to a wider, more engaged audience across these emerging digital frontiers.

The growing integration of AI in advertising offers a significant chance for DoubleVerify to boost its services. For instance, DV Scibids uses AI to refine ad spending and boost campaign success, a key advantage in the evolving digital landscape.

AI's ability to combat emerging fraud tactics and enable more accurate audience targeting and performance measurement is crucial. In 2024, advertisers are increasingly seeking AI-driven solutions to ensure their ad spend delivers tangible business outcomes, making DoubleVerify's AI capabilities highly relevant.

DoubleVerify has a significant opportunity to grow its presence in international markets, building on its successes in regions like EMEA and APAC during 2024. This global expansion allows the company to reach new advertisers and capture a larger share of the digital advertising market beyond its established territories.

By tailoring its verification and measurement solutions to the specific needs of different countries, DoubleVerify can further penetrate emerging markets and solidify its position as a global leader. The company's strategic focus on international market share growth underscores the importance of this ongoing expansion effort.

Increased Demand for Attention-Based Measurement

The advertising industry is increasingly shifting its focus to attention as a key performance indicator, moving beyond simple viewability metrics. Media buyers are actively seeking ways to incorporate attention-based measurement into their campaign planning and execution. This trend presents a significant opportunity for companies like DoubleVerify that offer advanced solutions in this area.

DoubleVerify’s Authentic Attention product is well-positioned to benefit from this growing demand. By providing deeper insights into how audiences actually engage with ads, rather than just whether they were seen, DoubleVerify can help clients optimize their campaigns for greater effectiveness. This granular data allows advertisers to understand true ad impact.

Consider these points regarding the opportunity:

- Growing Industry Adoption: Reports indicate a substantial increase in media buyers planning to integrate attention metrics into their strategies for 2024 and beyond. For instance, some industry surveys suggest over 70% of media buyers are considering or actively using attention metrics.

- Enhanced Campaign Performance: DoubleVerify's Authentic Attention offers a more nuanced understanding of ad engagement, which can lead to improved campaign ROI by ensuring ads are not only seen but also actively processed by consumers.

- Competitive Differentiation: As attention measurement becomes more mainstream, DoubleVerify’s established and sophisticated offerings provide a competitive edge, attracting clients looking for advanced verification and optimization tools.

Strategic Acquisitions and New Product Development

DoubleVerify can strategically expand its offerings through targeted acquisitions. For instance, the acquisition of Rockerbox in late 2023 bolstered its capabilities in outcomes measurement, a critical area for advertisers. Similarly, integrating Scibids' AI-driven optimization technology further enhances DoubleVerify's ability to deliver measurable performance improvements for clients.

Furthermore, the company's commitment to new product development is a key growth driver. Innovations like Authentic AdVantage and Performance AdVantage are designed to increase platform adoption by providing advertisers with more comprehensive, performance-focused solutions. This strategic shift aims to capture a larger share of the growing performance marketing spend, which is projected to reach $300 billion globally by 2025.

- Acquisition Synergies: Rockerbox acquisition enhances outcomes measurement, while Scibids integration boosts AI-powered optimization.

- Product Innovation: Authentic AdVantage and Performance AdVantage drive adoption and monetization.

- Market Focus: Shift towards a comprehensive, performance-oriented offering aligns with market demand.

- Market Growth: Capitalizes on the expanding global performance marketing sector.

DoubleVerify is well-positioned to leverage the rapid growth in Connected TV (CTV) and Retail Media Networks, with CTV measurement volumes showing a significant increase through early 2025. By extending its verification solutions to these burgeoning channels, DoubleVerify can capture a larger share of advertiser spend. The company's AI capabilities, exemplified by DV Scibids, offer a distinct advantage in combating sophisticated fraud and enhancing campaign performance, a critical need for advertisers in 2024 as they seek demonstrable ROI.

The global advertising market's increasing focus on attention metrics presents a substantial opportunity for DoubleVerify's Authentic Attention product. As media buyers increasingly prioritize engagement over mere viewability, DoubleVerify's advanced measurement tools can provide crucial insights, driving better campaign outcomes and offering a competitive edge. This strategic alignment with industry trends, coupled with targeted acquisitions like Rockerbox and ongoing product innovation, positions DoubleVerify for continued growth in the performance marketing sector, which is projected to exceed $300 billion globally by 2025.

Threats

The intensifying global data privacy regulations, such as GDPR, CCPA, and the Digital Markets Act (DMA), alongside emerging state-level laws in the US, present a substantial challenge for the ad tech sector, including DoubleVerify. These evolving rules impose tighter controls on how data is gathered, the necessity of explicit user consent, and the methods of tracking online behavior.

The planned deprecation of third-party cookies, a cornerstone of digital advertising, further compounds this threat. This shift could diminish the volume and quality of data available for crucial ad verification and performance measurement services that DoubleVerify provides, potentially impacting its core offerings and revenue streams.

Global economic uncertainties and the specter of downturns pose a significant threat, potentially curbing brand advertising budgets. This directly impacts DoubleVerify's revenue streams as companies tighten their belts.

The company's Q4 2024 performance and its outlook for 2025 illustrate this vulnerability. Specifically, reduced spending from some major clients and a weaker-than-expected rebound in post-election ad sales underscore the sensitivity of DoubleVerify's business to broader economic headwinds.

The increasing sophistication of AI is a significant threat, enabling more advanced ad fraud and invalid traffic (IVT). DoubleVerify's 2025 report highlighted a notable rise in bot fraud, with some instances leveraging legitimate AI tools. This evolving landscape creates a constant challenge, demanding ongoing investment in cutting-edge detection technologies to stay ahead of these evolving fraudulent activities.

Platform Policy Changes and Walled Garden Dynamics

Major advertising platforms, like Meta and Google, frequently update their policies and technologies. These changes can restrict access for third-party verification services or modify how ad measurement operates within their controlled environments, often referred to as 'walled gardens.'

For DoubleVerify, this presents a significant threat. The company must constantly adapt its verification solutions to comply with new platform rules or risk diminished effectiveness and reduced market access on crucial advertising channels. For instance, changes to cookie policies or data privacy regulations on these platforms can directly impact the granularity and accuracy of ad verification data available to DoubleVerify.

- Platform policy shifts: For example, Google's Privacy Sandbox initiative aims to replace third-party cookies, potentially altering measurement methodologies.

- Walled garden restrictions: Increased data access controls by major platforms can limit the scope of independent verification.

- Adaptation costs: Rapid technological changes necessitate continuous investment in R&D to maintain competitive verification capabilities.

Intensifying Competition and Potential for Disruption

The ad verification landscape is fiercely competitive, with established players like Integral Ad Science (IAS) continuously enhancing their offerings. DoubleVerify faces the ongoing challenge of staying ahead of rivals who are also investing heavily in innovation to capture market share.

Emerging technologies and novel business models pose a significant threat, particularly those that can more effectively navigate the complexities of privacy-centric digital environments and closed advertising ecosystems. Such disruptions could erode DoubleVerify's current market leadership and impact its revenue streams.

For instance, the increasing prevalence of AI-driven ad fraud and sophisticated invalid traffic (IVT) techniques necessitate constant adaptation. In 2024, the estimated cost of digital ad fraud globally was projected to reach over $100 billion, a figure that underscores the escalating arms race in ad verification.

- Intensifying Competition: Rivals like IAS are actively developing new solutions.

- Disruptive Technologies: AI and privacy-first models present significant challenges.

- Market Share Erosion: Failure to adapt could lead to a decline in DoubleVerify's leadership position.

- Profitability Impact: New entrants or disruptive tech could compress margins.

The escalating complexity of global data privacy regulations, such as the Digital Markets Act (DMA) and various US state-level laws, along with the impending deprecation of third-party cookies, poses a significant challenge to DoubleVerify's core business model. These shifts could restrict data availability for ad verification and performance measurement, impacting its services. Furthermore, economic uncertainties, as evidenced by reduced client spending in late 2024, directly threaten revenue streams by potentially curbing advertising budgets.

The increasing sophistication of AI-driven ad fraud, with bot fraud noted in 2025 reports, necessitates continuous investment in advanced detection technologies to combat evolving threats, estimated to cost the industry over $100 billion globally in 2024. Major platforms like Google and Meta frequently update their policies, creating adaptation costs and potentially limiting third-party verification access. Intense competition from players like Integral Ad Science (IAS) also demands ongoing innovation to maintain market share and leadership.

| Threat Category | Specific Challenge | Impact on DoubleVerify | 2024/2025 Data Point |

|---|---|---|---|

| Regulatory & Privacy Changes | Stricter data collection rules, consent requirements | Reduced data for verification, potential compliance costs | Global privacy regulations increasing complexity |

| Technological Shifts | Third-party cookie deprecation | Diminished data volume/quality for core services | Ongoing transition away from third-party cookies |

| Economic Headwinds | Reduced brand advertising budgets | Direct impact on revenue streams | Q4 2024 saw reduced spending from major clients |

| Ad Fraud Evolution | AI-powered ad fraud and IVT | Need for continuous R&D in detection technology | Estimated global digital ad fraud cost over $100 billion in 2024 |

| Platform Ecosystems | Walled garden restrictions, policy updates | Risk of diminished effectiveness, reduced market access | Google's Privacy Sandbox initiative |

| Competitive Landscape | Rival innovation (e.g., IAS) | Pressure to maintain market leadership and innovation pace | IAS actively developing new solutions |

SWOT Analysis Data Sources

This DoubleVerify SWOT analysis is built upon a robust foundation of data, incorporating publicly available financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded and actionable assessment.