DoubleVerify Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DoubleVerify Bundle

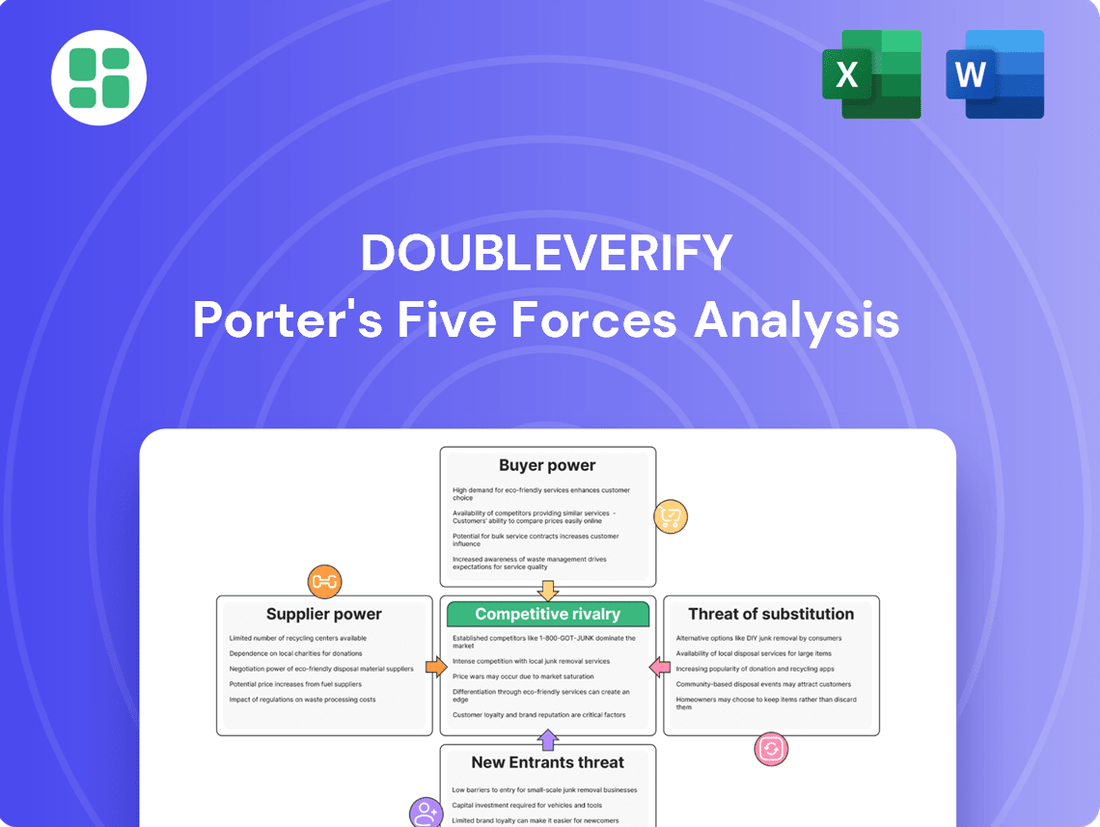

DoubleVerify operates in a dynamic digital advertising landscape, where the threat of new entrants is moderate, but the bargaining power of buyers, particularly large advertisers, can be significant. Understanding these forces is crucial for navigating the competitive intensity and potential for substitute solutions.

The complete report reveals the real forces shaping DoubleVerify’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DoubleVerify's reliance on a concentrated supplier base for critical services, such as cloud infrastructure and specialized data analytics, significantly influences its bargaining power. For instance, the dominance of major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud means DoubleVerify has limited alternatives for its core operational needs. These providers, controlling a substantial market share, can dictate terms and pricing due to the high switching costs and technical integration required for DoubleVerify to move to a different provider. This concentration grants these cloud giants considerable leverage.

DoubleVerify's switching costs from its current suppliers are a significant factor in assessing supplier bargaining power. If DoubleVerify needs to change its data providers or technology partners, it could face substantial expenses. These might include the cost of integrating new Application Programming Interfaces (APIs), which are the crucial links allowing different software systems to communicate. Migrating vast amounts of digital advertising data to a new platform also presents a considerable challenge and expense. Furthermore, retraining its employees on new systems and processes adds another layer of cost and disruption.

High switching costs would naturally empower DoubleVerify's suppliers, as the effort and expense involved in changing providers would make it more difficult for DoubleVerify to seek alternative solutions. Conversely, if the tools and data DoubleVerify uses are easily transferable and readily available from multiple vendors, its suppliers would have less leverage. The complexity of DoubleVerify's verification and measurement technology suggests that switching could indeed be costly, potentially giving suppliers more sway in negotiations.

DoubleVerify relies on a variety of data providers and technology partners for its ad verification services. The uniqueness of these offerings directly impacts supplier power. If a supplier provides highly specialized data sets or proprietary technology, like advanced fraud detection algorithms that are difficult for DoubleVerify to replicate or source elsewhere, that supplier gains significant leverage.

Threat of Forward Integration by Suppliers

The threat of forward integration by DoubleVerify's suppliers is a significant consideration within the bargaining power of suppliers. If a key data provider or technology vendor, for instance, were to launch its own ad verification services, it would directly compete with DoubleVerify. This move would leverage their existing infrastructure and data access, potentially offering advertisers a bundled solution that bypasses DoubleVerify altogether.

This scenario intensifies supplier power by allowing them to capture more of the value chain. For example, a major cloud service provider that also offers analytics could decide to enter the ad verification space, using its existing client relationships and technical capabilities. Such a development could pressure DoubleVerify's pricing and market share.

- Direct Competition: Suppliers entering the ad verification market directly challenge DoubleVerify's core business.

- Leveraging Existing Assets: Suppliers can utilize their established data, technology, and client bases to gain a competitive edge.

- Increased Supplier Power: Successful forward integration by suppliers would grant them greater control over the market and potentially reduce DoubleVerify's negotiation leverage.

Importance of DoubleVerify to Suppliers

The importance of DoubleVerify to its suppliers is a key factor in assessing supplier bargaining power. If DoubleVerify constitutes a substantial portion of a supplier's overall revenue, that supplier is likely to be more accommodating with pricing and terms to preserve the business relationship. This dynamic can significantly reduce the supplier's leverage.

For instance, consider a data analytics provider whose services are integral to DoubleVerify's platform. If DoubleVerify represents, say, 30% of that provider's annual sales, the provider has a strong incentive to maintain favorable terms rather than risk losing such a significant client. This reliance on DoubleVerify mitigates the supplier's ability to dictate terms or increase prices unilaterally.

- Dependency Analysis: Assessing the percentage of a supplier's revenue derived from DoubleVerify is crucial. A higher percentage indicates lower supplier bargaining power.

- Client Concentration: If DoubleVerify is a major client for a supplier, the supplier is less likely to exert significant bargaining power due to the risk of losing substantial business.

- Strategic Importance: For suppliers whose core business is intertwined with DoubleVerify's operations, the relationship is often more critical, further diminishing their bargaining leverage.

DoubleVerify's suppliers, particularly those providing essential cloud infrastructure and specialized data, hold significant bargaining power. This is amplified by the limited number of dominant players in these markets, such as major cloud providers, and the high costs associated with switching, including API integration and data migration. For example, in 2024, the top three cloud providers continued to dominate the market, making it challenging for DoubleVerify to diversify its infrastructure base without incurring substantial expenses.

The uniqueness of supplier offerings, like proprietary fraud detection algorithms, further strengthens their position. Suppliers also gain leverage through the threat of forward integration, where they might offer competing ad verification services. Conversely, DoubleVerify's bargaining power increases if it represents a substantial portion of a supplier's revenue, incentivizing suppliers to maintain favorable terms.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point (Illustrative for 2024) |

|---|---|---|

| Supplier Concentration | High | Dominance of AWS, Azure, GCP in cloud infrastructure limits alternatives. |

| Switching Costs | High | API integration, data migration, and retraining employees are costly. |

| Uniqueness of Offering | High | Proprietary fraud detection algorithms are difficult to replicate. |

| Threat of Forward Integration | High | Suppliers launching competing ad verification services. |

| Importance of DoubleVerify to Supplier | Low (for concentrated suppliers) / High (for DoubleVerify) | If DoubleVerify is a small client for a large supplier, supplier has more power. |

What is included in the product

This analysis unpacks the competitive forces impacting DoubleVerify, detailing supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the digital advertising verification market.

Instantly identify and quantify threats from competitors, new entrants, and substitutes, allowing for proactive strategy adjustments.

Gain clarity on buyer and supplier power dynamics to negotiate more favorable terms and mitigate risks.

Customers Bargaining Power

DoubleVerify's customer base exhibits a degree of concentration, meaning a few significant clients could wield considerable influence. If these major advertisers or holding companies account for a large percentage of DoubleVerify's revenue, they gain leverage to negotiate for reduced pricing or specialized service offerings.

For instance, while DoubleVerify reported robust growth in 2024, the company's filings also indicated that a small number of its largest customers contributed a material portion of its total revenue. This concentration means these key clients possess substantial bargaining power, potentially impacting DoubleVerify's profitability and service terms.

Advertisers face significant hurdles when considering a switch from DoubleVerify. Deep integration into existing ad tech stacks, which often involves complex API connections and data pipelines, makes a seamless transition to a new provider a time-consuming and potentially disruptive process. This technical entanglement significantly raises the cost and effort involved in changing vendors.

Furthermore, established workflows and reliance on DoubleVerify's proprietary data for crucial reporting, campaign optimization, and performance analysis create inertia. Advertisers have built their strategies and decision-making processes around this data. Moving away means not only finding a new provider but also potentially rebuilding reporting infrastructure and validating new data sets, which adds both financial and operational burdens.

Advertisers are increasingly price-sensitive for ad verification services, especially as digital ad spend grows. While they recognize the need to combat fraud and improve efficiency, they demand clear return on investment from these solutions. For instance, in 2024, advertisers are scrutinizing every dollar spent, seeking verification partners that offer demonstrable cost savings and improved campaign performance, making competitive pricing a significant factor in their purchasing decisions.

Availability of Substitute Solutions

The availability of substitute solutions significantly influences the bargaining power of DoubleVerify's customers. Advertisers have a range of alternative ad verification, brand safety, and media measurement providers they can turn to. This competitive landscape allows clients to shop around for the best features and pricing, putting pressure on DoubleVerify to remain competitive.

For instance, the market for ad verification and brand safety solutions is populated by several established players and emerging technologies. If advertisers perceive these alternatives as offering comparable or superior value, they are more likely to switch, thereby increasing their leverage in negotiations with DoubleVerify. This dynamic is further amplified by the potential for some advertisers, particularly larger ones, to develop certain in-house capabilities for media measurement or verification, reducing their reliance on third-party providers.

- Increased Competition: The presence of multiple ad verification and brand safety providers means customers can easily compare offerings and pricing, enhancing their bargaining power.

- In-house Capabilities: Larger advertisers may develop internal solutions for media measurement and verification, diminishing their dependence on external services like DoubleVerify.

- Technological Advancements: Rapid innovation in ad tech can lead to new, potentially lower-cost or more effective alternatives, further empowering customers.

- Market Dynamics: As of early 2024, the digital advertising ecosystem continues to evolve, with ongoing consolidation and new entrants in the verification space, all contributing to heightened customer choice and bargaining power.

Customer's Ability to Integrate Backward

The bargaining power of customers can be significantly influenced by their potential to integrate backward, meaning they could develop their own solutions. For a company like DoubleVerify, this presents a challenge. Large advertisers or major advertising agencies might consider building their own ad verification and measurement tools in-house.

This move would lessen their dependence on third-party providers. While creating such sophisticated systems is complex and resource-intensive, the allure of greater control over data and potential cost savings could drive this decision. For instance, a major holding company managing billions in ad spend might allocate resources to develop proprietary measurement technology, directly impacting the demand for services from companies like DoubleVerify.

- Backward Integration Threat: Large advertisers and agencies can develop in-house ad verification and measurement tools.

- Reduced Reliance: This capability directly reduces their need for external providers like DoubleVerify.

- Control and Cost Savings: The primary drivers for this integration are enhanced control and potential cost reductions.

- Industry Impact: A significant shift towards in-house solutions could reshape the competitive landscape for ad tech verification firms.

Customers, particularly large advertisers and agencies, possess considerable bargaining power due to the availability of alternative verification solutions and the potential for backward integration. This means they can often negotiate better terms or explore developing their own capabilities, pressuring DoubleVerify on pricing and service agreements.

The increasing price sensitivity among advertisers in 2024, coupled with a competitive market offering numerous alternatives, amplifies this customer leverage. Advertisers are actively seeking demonstrable ROI and cost efficiencies, making DoubleVerify’s value proposition crucial for retaining business.

The technical entanglement of DoubleVerify's services within client ad tech stacks creates switching costs, somewhat mitigating customer power, but this is often outweighed by the sheer number of competitive offerings and the ongoing drive for cost optimization in digital ad spend.

As of early 2024, the ad verification market is dynamic, with new entrants and evolving technologies constantly providing advertisers with more choices. This competitive environment directly translates to increased bargaining power for customers, forcing providers like DoubleVerify to remain agile and competitive in their offerings and pricing strategies.

Full Version Awaits

DoubleVerify Porter's Five Forces Analysis

This preview showcases the complete DoubleVerify Porter's Five Forces Analysis, offering a detailed examination of industry competition and profitability. The document you see here is precisely the same professionally formatted analysis you will receive instantly upon purchase, ensuring full transparency and immediate usability. You can confidently download and utilize this comprehensive report without any alterations or missing sections.

Rivalry Among Competitors

The digital media measurement and analytics landscape is characterized by a moderate to high level of competitive rivalry. Integral Ad Science (IAS) stands out as a significant competitor, with its revenue reaching $445 million in 2023, demonstrating substantial market presence. Moat, now part of Oracle, also represents a formidable player, leveraging Oracle's broader enterprise solutions.

Comscore, another established entity in the space, continues to compete, though its market position has evolved. Beyond these major players, a dynamic ecosystem of emerging companies constantly introduces innovative solutions, further intensifying competition and pushing for continuous improvement in measurement accuracy and data analytics capabilities.

The digital advertising market continues its robust expansion, with global ad spending projected to reach $745 billion in 2024. This growth, while substantial, fuels intense competition as numerous companies vie for a piece of the expanding pie.

Even in a growing industry, the sheer number of participants creates significant rivalry. Companies like DoubleVerify face pressure to differentiate themselves and capture market share amidst a crowded landscape of ad tech providers and verification specialists.

DoubleVerify differentiates itself through advanced technologies like its proprietary Connected TV (CTV) verification platform and sophisticated AI for fraud detection, offering advertisers assurance on ad quality. Competitors also invest heavily in innovation; for instance, IAS (Integral Ad Science) has focused on its "Quality Score" and attention metrics. This constant push for technological superiority and unique features like granular audience insights is key to maintaining a competitive edge in the digital verification market.

Switching Costs for Advertisers

Switching costs are a critical factor in how intensely competitors vie for customers. When it's difficult or expensive for advertisers to move from one ad verification service to another, it naturally lowers the pressure from rivals. This is because companies like DoubleVerify can build stronger, more protected relationships with their existing clients.

DoubleVerify works to make its platform so integrated and essential that switching becomes a significant undertaking for advertisers. This strategy helps to solidify its market position and reduce the direct impact of competitive rivalry. For instance, the process of onboarding a new verification system, retraining staff, and ensuring data integrity can involve substantial time and financial investment, making advertisers hesitant to switch providers.

- High Integration: Advertisers often integrate verification solutions deeply into their campaign management workflows, making a switch disruptive.

- Data Migration Challenges: Moving historical verification data and performance metrics to a new platform can be complex and costly.

- Training and Familiarity: Teams become accustomed to a specific interface and reporting structure, requiring time and resources to adapt to a new system.

- Potential for Disruption: A switch could temporarily impact campaign oversight and performance measurement, posing a risk to ongoing advertising efforts.

Exit Barriers for Competitors

Competitors in the digital advertising verification space may face significant hurdles in exiting the market, even if their profitability dwindles. High upfront investments in proprietary technology, data infrastructure, and skilled personnel create substantial fixed costs. For instance, developing and maintaining sophisticated verification algorithms requires ongoing R&D expenditure.

These specialized assets are often not easily transferable or repurposed, making divestment difficult. A company heavily invested in its unique verification technology might struggle to sell it off if it lacks broad market appeal. This lack of liquidity for specialized assets ties competitors to the market, regardless of current financial performance.

Furthermore, some competitors might be subsidiaries of larger media or technology conglomerates. In such cases, the strategic importance of maintaining a presence in the digital verification market, even at a loss, could outweigh immediate profitability concerns. This can be due to a desire to control the entire advertising ecosystem or to gather valuable data that benefits other parts of the parent company's business.

- High Capital Investments: Significant expenditure on technology development and data centers acts as a substantial barrier to exit.

- Specialized Assets: Proprietary verification algorithms and data sets are difficult to sell or redeploy, trapping capital.

- Strategic Importance: For larger parent companies, maintaining a position in the verification market may be crucial for broader strategic goals, even if the unit is not highly profitable.

The competitive rivalry within the digital media measurement and analytics sector is intense, driven by a growing market and a significant number of players. Companies like Integral Ad Science (IAS), which reported $445 million in revenue for 2023, and Moat, now part of Oracle, are major competitors. The digital advertising market's projected growth to $745 billion in 2024 further fuels this competition, as many firms vie for market share.

DoubleVerify differentiates itself through advanced technologies like its Connected TV (CTV) verification platform and AI-driven fraud detection, while competitors like IAS focus on metrics such as their "Quality Score." High switching costs, stemming from deep integration into advertiser workflows and data migration complexities, help DoubleVerify retain clients and mitigate competitive pressure.

The barriers to exit for companies in this space are considerable, due to high capital investments in proprietary technology and specialized assets that are difficult to redeploy. For some, strategic positioning within the broader digital advertising ecosystem, even without immediate profitability, can also deter market exit.

| Competitor | 2023 Revenue (Approx.) | Key Differentiators |

|---|---|---|

| Integral Ad Science (IAS) | $445 million | Quality Score, Attention Metrics |

| Moat (Oracle) | Undisclosed (Part of Oracle) | Integrated Enterprise Solutions |

| Comscore | Undisclosed | Established Market Presence |

SSubstitutes Threaten

Advertisers and large agencies may develop their own rudimentary ad verification tools to manage costs and data ownership. This DIY approach, while less comprehensive than third-party solutions, can address basic media quality checks. For instance, some brands might implement internal checks for brand safety or viewability metrics, particularly for high-volume campaigns.

The threat of substitutes from basic analytics tools offered by ad platforms like Google Ads and Meta Ads is a significant consideration. These platforms provide advertisers with built-in reporting on campaign performance, reach, and engagement, which can be sufficient for businesses with straightforward advertising objectives.

For instance, in 2024, the vast majority of digital ad spend is concentrated on these major platforms, indicating their widespread adoption and perceived utility. Advertisers prioritizing simplicity or operating with limited budgets might find these integrated tools adequate, thereby reducing their need for third-party verification solutions like DoubleVerify.

Advertisers could potentially revert to manual verification processes for ad quality and fraud detection. While less efficient than automated solutions, these manual methods represent a lower-cost substitute for some advertisers, particularly those with smaller budgets or less complex campaigns. For instance, manually reviewing a sample of ad placements or implementing basic, rule-based fraud flagging could be considered.

Alternative Measurement Methodologies

The rise of alternative measurement methodologies poses a significant threat. For instance, a growing emphasis on first-party data strategies allows advertisers to assess campaign effectiveness using their own customer insights, bypassing traditional third-party verification entirely. This shift is driven by increasing privacy concerns and regulatory changes, making these methods more attractive.

New privacy-centric targeting methods also offer alternatives. These approaches focus on aggregated or anonymized data, providing insights into audience behavior without compromising individual privacy. Companies are investing heavily in these technologies, as seen in the significant growth of privacy-preserving analytics platforms.

The threat is amplified by the potential for these new methods to offer a more cost-effective or granular view of ad performance.

- Focus on First-Party Data: Advertisers are increasingly leveraging their own customer data for campaign analysis, reducing reliance on external verification services.

- Privacy-Centric Targeting: New methods that prioritize user privacy offer alternative ways to measure ad impact without extensive data collection.

- Cost-Effectiveness: These emerging methodologies can potentially provide a more economical approach to understanding ad effectiveness compared to comprehensive verification suites.

Shift in Advertiser Priorities

Advertisers might shift their focus from deep verification to other campaign metrics if they perceive less value in comprehensive checks. However, the persistent and growing threat of ad fraud, which cost advertisers an estimated $61 billion globally in 2023 according to Statista, directly contradicts this notion. This escalating fraud landscape actually reinforces the critical need for robust verification services.

The perceived value of verification is intrinsically linked to the cost of inaction. As ad fraud continues to trend upwards, the financial and reputational damage it inflicts makes thorough verification a non-negotiable component of advertising spend. For instance, the Interactive Advertising Bureau (IAB) reported in 2024 that ad fraud remains a significant concern, impacting campaign effectiveness and ROI.

- Rising Ad Fraud Costs: Global ad fraud losses are projected to reach $87 billion by 2024, underscoring the financial imperative for verification.

- Shifting Advertiser Needs: While some advertisers may prioritize direct performance metrics, the increasing sophistication of fraud necessitates a counter-strategy.

- Verification as a Risk Mitigation Tool: Comprehensive verification services act as a crucial defense against fraudulent impressions and wasted ad spend, thereby increasing their perceived value.

- Data-Driven Decision Making: Advertisers increasingly rely on verifiable data to optimize campaigns, making robust verification essential for informed strategic choices.

Basic analytics tools from ad platforms like Google Ads and Meta Ads offer a substitute for more comprehensive verification. In 2024, these platforms handle the majority of digital ad spend, satisfying advertisers with simpler goals or tighter budgets who may not require third-party solutions.

Advertisers might also develop in-house capabilities for basic media quality checks, particularly for brand safety or viewability. Furthermore, a shift towards first-party data strategies and privacy-centric targeting methods offers alternative ways to assess campaign effectiveness, bypassing traditional verification entirely.

| Substitute Type | Description | Potential Impact on DoubleVerify |

| Platform Analytics | Built-in reporting on campaign performance, reach, and engagement. | Reduced demand from advertisers prioritizing simplicity or cost. |

| In-house Tools | Basic internal checks for brand safety, viewability. | Limited adoption for complex verification needs, but can address basic requirements. |

| First-Party Data | Using own customer insights to assess campaign effectiveness. | Significant threat due to privacy concerns and regulatory shifts. |

| Privacy-Centric Targeting | Aggregated or anonymized data for audience insights. | Growing adoption, offering alternative measurement without extensive data collection. |

Entrants Threaten

Developing a robust ad verification platform demands substantial capital, particularly for research and development. Companies like DoubleVerify invest heavily in advanced fraud detection algorithms, artificial intelligence, and machine learning capabilities to stay ahead of evolving threats. In 2023, DoubleVerify reported R&D expenses of $157.5 million, highlighting the ongoing commitment to innovation in this space.

Established players like DoubleVerify benefit significantly from strong brand loyalty among advertisers who trust their accreditation and verification services. This trust is built over time through consistent performance and a deep understanding of the complex digital advertising ecosystem.

Furthermore, network effects play a crucial role. As more advertisers and publishers integrate with DoubleVerify's solutions, the platform becomes more valuable to all participants, creating a powerful barrier for newcomers. For instance, in 2023, DoubleVerify reported a 20% increase in advertiser adoption of its Connected TV (CTV) solutions, highlighting the growing reliance on trusted verification services.

The ad verification industry, including companies like DoubleVerify, faces significant barriers to entry due to stringent regulatory requirements and the necessity of industry accreditations. Obtaining certifications, such as Media Rating Council (MRC) accreditation, is a complex and costly process that new entrants must navigate. For instance, MRC accreditation involves rigorous audits of a company's methodologies and data, ensuring accuracy and transparency in ad measurement and verification, which can take years and substantial investment to achieve.

Access to Data and Integration with Platforms

New entrants face a significant hurdle in acquiring the massive datasets of ad impression data that incumbents like DoubleVerify have cultivated over many years. This data is crucial for building effective ad verification and measurement solutions. Without this historical data, new players struggle to train their algorithms and establish credibility in the market.

Seamless integration with the complex ecosystem of ad exchanges, Demand-Side Platforms (DSPs), Supply-Side Platforms (SSPs), and publishers presents another formidable barrier. Incumbents have established deep, long-standing relationships and technical integrations, making it difficult for newcomers to plug into this intricate network. For example, as of early 2024, the digital advertising supply chain involves hundreds of interconnected platforms, each with its own technical specifications and data protocols.

- Data Acquisition Costs: New entrants must invest heavily to acquire or generate comparable ad impression data, a process that is both time-consuming and expensive.

- Integration Complexity: The technical challenge of integrating with a fragmented landscape of over 500 major ad tech platforms requires substantial engineering resources and time.

- Incumbent Network Effects: Established players benefit from network effects, where their existing data and integrations make their services more valuable and harder to displace.

- Trust and Reputation: Building trust and a reputation for data accuracy and reliability takes years, a significant disadvantage for new entrants.

Proprietary Technology and Expertise

DoubleVerify's significant investment in proprietary technology, particularly its advanced algorithms powered by artificial intelligence and machine learning, creates a substantial barrier to entry. Developing comparable capabilities in areas like ad fraud detection, brand safety, and performance verification requires immense specialized expertise and considerable R&D expenditure. For instance, DoubleVerify's continuous innovation in identifying sophisticated invalid traffic (SIVT) patterns, often employing real-time analysis, is a testament to this technological moat.

The company's deep bench of data scientists and engineers, skilled in areas crucial for digital advertising integrity, further solidifies its position. This specialized expertise, honed over years of operation and data analysis, is not easily replicated by newcomers. Consider that in 2023, DoubleVerify reported its technology platform processed over 100 billion ad transactions daily, underscoring the scale and complexity of its operations and the data science required to manage it effectively.

- Proprietary AI and Machine Learning: DoubleVerify leverages advanced AI and ML for sophisticated ad fraud detection and brand safety solutions.

- Specialized Expertise: The company employs a team of data scientists and engineers with deep knowledge in digital advertising verification.

- High R&D Investment: Significant ongoing investment is required to develop and maintain these complex technological capabilities.

- Data Scale: Processing billions of ad transactions daily necessitates robust and unique technological infrastructure.

The threat of new entrants in the ad verification space is significantly mitigated by the immense capital required for research and development, as evidenced by DoubleVerify's $157.5 million R&D expenditure in 2023. Furthermore, the need for stringent industry accreditations, like MRC accreditation, presents a costly and time-consuming hurdle that deters newcomers. Established trust and brand loyalty, cultivated over years of consistent performance, also act as powerful barriers, making it difficult for new players to gain traction against incumbents like DoubleVerify.

New entrants face substantial challenges in acquiring the vast datasets of ad impression data that companies like DoubleVerify have accumulated, which are critical for training effective verification algorithms. The complexity of integrating with the hundreds of ad tech platforms in the digital advertising ecosystem, coupled with the network effects enjoyed by incumbents, further raises the barrier to entry. Building the necessary trust and reputation for data accuracy and reliability is a long-term endeavor, placing new entrants at a distinct disadvantage.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements (R&D) | Substantial investment needed for advanced algorithms, AI, and ML. | High; Example: DoubleVerify's $157.5M R&D in 2023. |

| Industry Accreditations | Complex and costly processes like MRC accreditation. | High; Requires significant time and financial resources. |

| Data Acquisition and Scale | Need for massive historical ad impression data. | High; Crucial for algorithm training and credibility. |

| Ecosystem Integration | Technical challenges integrating with numerous ad tech platforms. | High; Requires extensive engineering and established relationships. |

| Trust and Reputation | Building credibility takes years of consistent performance. | High; Incumbents benefit from established trust. |

Porter's Five Forces Analysis Data Sources

Our DoubleVerify Porter's Five Forces analysis is built upon a robust foundation of data, including proprietary DoubleVerify platform metrics, industry-wide advertising spend reports, and insights from key media partners. We also leverage independent third-party verification data and publicly available financial disclosures from advertising technology companies to provide a comprehensive view of the competitive landscape.