DoubleVerify Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DoubleVerify Bundle

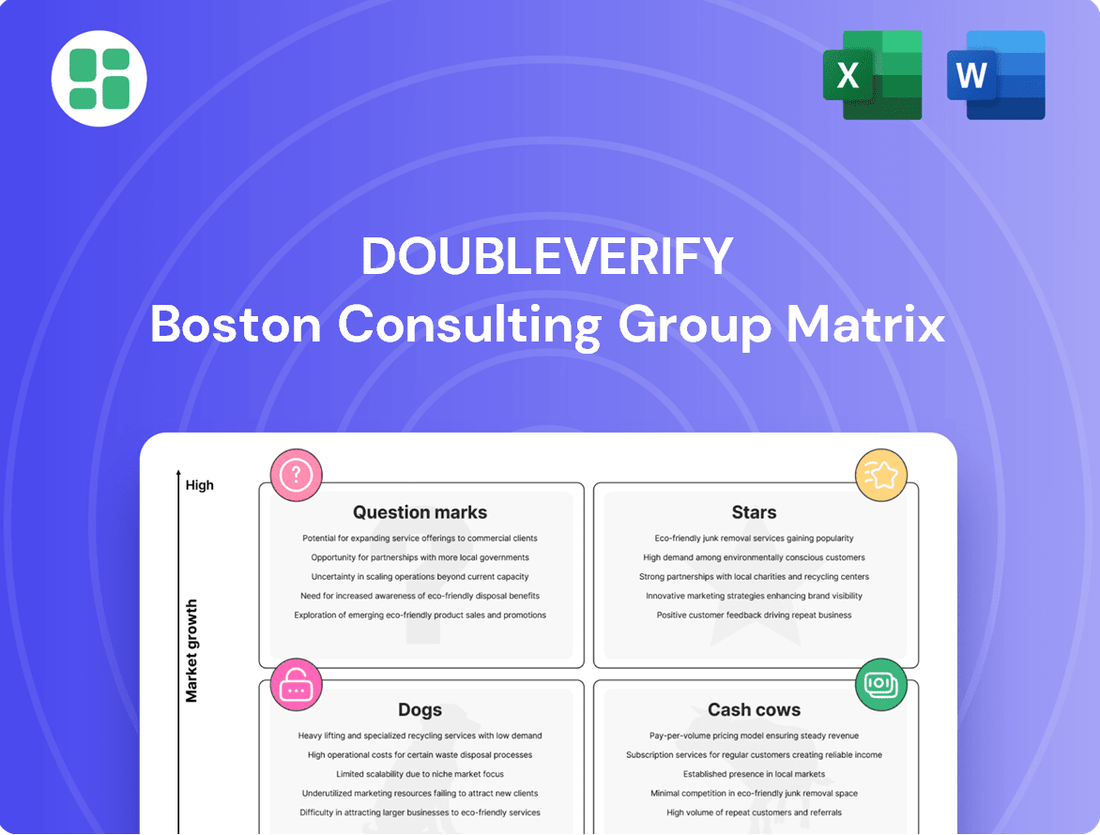

Curious about DoubleVerify's strategic positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. To truly unlock actionable insights and a clear path forward, purchase the full BCG Matrix report.

Don't settle for a partial view of DoubleVerify's product portfolio. The complete BCG Matrix provides detailed quadrant analysis, data-driven recommendations, and a strategic roadmap to optimize your investments and product decisions. Get the full picture today.

Stars

DoubleVerify's CTV measurement solutions are a shining Star in their portfolio. The company saw a remarkable 66% surge in Media Transactions Measured (MTM) for CTV in 2024, followed by another 43% jump in Q1 2025. This growth reflects the booming CTV market and advertisers' increasing commitment to the channel.

Advertisers are clearly recognizing the power of CTV. In the past year, 54% of them increased their CTV spend, and a substantial 66% of those not yet investing in CTV plan to do so within the next twelve months. This widespread adoption underscores the massive market demand DoubleVerify's solutions are poised to capture.

DoubleVerify is strategically investing in its CTV offerings to tackle critical industry challenges. They are developing advanced solutions to combat transparency issues, ad fraud, and measurement inconsistencies, which are major concerns for advertisers navigating the complex CTV landscape. This focus on innovation is key to unlocking the full potential of streaming advertising for both brand building and performance outcomes.

DoubleVerify's AI-powered solutions, like Scibids AI and DV Authentic Attention, are showing significant promise. Scibids, a recent acquisition, has already been adopted by over 200 clients, highlighting its strong market fit and revenue potential, with projections suggesting it could reach $100 million by 2028.

DV Authentic Attention is also gaining traction by offering detailed engagement metrics, catering to the growing advertiser demand for performance-focused measurement beyond simple viewability. This expansion into new channels, such as Snapchat, underscores the increasing need for advanced insights in the digital advertising space.

DoubleVerify's solutions for Retail Media Networks (RMNs) are a significant growth driver. Supply-side revenue for these networks surged by 25% in 2024 and is projected to climb another 35% in Q1 2025, reflecting the booming retail media landscape.

Advertisers are flocking to RMNs, drawn by their valuable first-party data and the unique ability to connect with shoppers at the crucial point of purchase, especially as third-party cookies become less prevalent. This trend is further validated by DoubleVerify's findings that 91% of those investing in RMN inventory already partner with an ad verification provider, signaling a strong demand for quality assurance.

DoubleVerify's measurement tags are integrated across an impressive 124 retail media sites, demonstrating a substantial footprint and growing market share in this dynamic sector. Although some owned and operated RMN inventory presents viewability hurdles, the overall market expansion and DV's established position mark this as a pivotal area for continued growth.

Social Media Measurement & Activation

DoubleVerify's Social Media Measurement & Activation is a clear Star in its portfolio. In 2024, social measurement revenue saw a substantial 27% jump, highlighting strong market demand. The company is also making strides in social activation, particularly on platforms like Meta, where new content-level pre-bid avoidance solutions saw 20 customer activations in just two months. This rapid uptake underscores the critical need for brand safety and suitability within social media advertising.

Despite a slight dip in Q1 2025 social measurement revenue due to isolated customer challenges, the overarching trajectory for this segment remains robust. DoubleVerify is actively enhancing its AI-driven brand safety and suitability tools for platforms such as TikTok, introducing new categories to better serve advertiser requirements. This strategic push to integrate performance data and AI optimization with social platforms is poised to drive continued market share expansion.

- Social Measurement Revenue Growth: Increased by 27% in 2024.

- Meta Pre-Bid Avoidance: 20 customers activated within two months of launch.

- AI Expansion: Focus on AI-powered brand safety and suitability for platforms like TikTok.

- Strategic Integration: Combining performance data and AI optimization for social platforms.

Generative AI Website Avoidance & Detection

DoubleVerify's December 2024 launch of its Generative AI (GenAI) Website Avoidance & Detection solution is a pivotal new Star. This innovation directly tackles the growing concern of AI-generated content impacting media quality, a worry shared by 54% of marketers. DV's proactive stance in identifying low-quality, AI-driven sites positions them as a leader in this emerging space.

The solution offers advertisers crucial brand safety tools, enabling both post-bid monitoring and pre-bid avoidance through major DSPs. This capability is vital as the digital landscape grapples with the proliferation of AI-generated content. DV's proprietary technology, a blend of AI and human oversight, ensures accurate identification and categorization of problematic sites.

This strategic move by DoubleVerify addresses a critical market gap, anticipating the challenges posed by evolving AI content. By offering robust detection and avoidance mechanisms, DV is setting a new standard for digital media quality, aiming to capture significant market share in the high-growth AI content segment.

- Market Need: 54% of marketers believe GenAI negatively impacts media quality.

- Solution: Post-bid monitoring and pre-bid avoidance across leading DSPs.

- Technology: Proprietary detection combining AI analysis with human expertise.

- Market Position: Leading edge in a nascent but high-growth segment of AI content quality.

DoubleVerify's CTV measurement solutions are a clear Star, with Media Transactions Measured (MTM) for CTV surging by 66% in 2024 and another 43% in Q1 2025. This growth aligns with 54% of advertisers increasing their CTV spend, and 66% of non-investors planning to enter the market. The company's investment in advanced solutions to combat transparency and fraud in this booming sector is critical.

The Generative AI (GenAI) Website Avoidance & Detection solution is another emerging Star, addressing the 54% of marketers concerned about AI-generated content's impact on media quality. This solution provides crucial brand safety through post-bid monitoring and pre-bid avoidance across major DSPs, leveraging a proprietary blend of AI and human oversight.

DoubleVerify's Social Media Measurement & Activation is also a strong Star, evidenced by a 27% increase in social measurement revenue in 2024. The rapid adoption of new content-level pre-bid avoidance solutions on Meta, with 20 customer activations in two months, highlights the demand for brand safety. Enhancements for platforms like TikTok are further solidifying its position.

Retail Media Networks (RMNs) represent a significant growth area, with supply-side revenue up 25% in 2024 and projected to rise another 35% in Q1 2025. This is driven by advertisers leveraging RMNs for first-party data and point-of-purchase connections, with 91% of RMN investors already using ad verification providers.

| Segment | 2024 Growth | Q1 2025 Projection | Key Driver | Market Adoption |

| CTV Measurement | 66% MTM increase | 43% MTM increase | Advertiser demand for transparency | 54% increased spend; 66% plan to invest |

| GenAI Website Avoidance | New Launch (Dec 2024) | N/A | Addressing AI content quality concerns | 54% marketer concern |

| Social Measurement & Activation | 27% revenue increase | N/A | Demand for brand safety | 20 Meta activations in 2 months |

| Retail Media Networks (RMNs) | 25% supply revenue increase | 35% supply revenue increase | First-party data and purchase proximity | 91% of RMN investors use verification |

What is included in the product

The DoubleVerify BCG Matrix analyzes its product portfolio across Stars, Cash Cows, Question Marks, and Dogs, offering strategic guidance.

A clear, visual DoubleVerify BCG Matrix instantly clarifies which ad verification solutions are stars, cash cows, question marks, or dogs, alleviating the pain of strategic uncertainty.

Cash Cows

DoubleVerify's core ad verification services, including fraud prevention, viewability measurement, and brand safety, are its foundational cash cows. These are mature, widely adopted solutions that are essential for nearly all digital advertisers, providing consistent and high-margin revenue.

DV is accredited by the Media Rating Council (MRC) for detecting and blocking fraud across various environments, solidifying its market leadership in this established segment. While the market for these core services is mature, the ongoing prevalence of ad fraud and brand suitability concerns ensures sustained demand, allowing DV to generate significant cash flow from these offerings.

The company's strong financial performance, with a gross profit margin of 82% in 2023, further underscores the profitability and stability of these core verification services. This high margin indicates efficient operations and strong pricing power in a critical market segment.

DoubleVerify's Open Web Measurement, encompassing display and video advertising, functions as a robust Cash Cow. This segment, a cornerstone of their business, generates predictable revenue from established digital advertising.

The sheer volume of transactions on the open web guarantees consistent cash flow, even if growth rates are more moderate than newer ad formats. DoubleVerify's impressive gross revenue retention, consistently above 95% with existing clients, underscores the loyalty and recurring nature of these core measurement services.

Authentic Brand Suitability (ABS) is a powerhouse for DoubleVerify, firmly positioned as a Cash Cow. This crucial solution, ensuring ads run in brand-aligned environments, generated a significant 54% of DoubleVerify's activation revenue in Q1 2025. Its widespread acceptance is evident, with nearly 70% of their top 500 customers utilizing it during the same period.

ABS represents a mature but vital segment of digital advertising, and its continued adoption underscores its value. Despite already widespread use, ABS experienced a healthy 16% year-over-year growth in Q1 2025. This consistent demand, driven by advertisers' ongoing focus on brand safety, solidifies ABS as a reliable and profitable revenue stream for DoubleVerify.

International Measurement Revenue (Mature Markets)

DoubleVerify's international measurement revenue from mature markets functions as a Cash Cow, generating consistent and diversified income streams. Despite a slight slowdown in overall international revenue growth in Q1 2025, attributed to isolated customer challenges, the company's established footprint in key regions remains robust.

Established markets like EMEA and APAC demonstrated significant growth in 2024, with EMEA experiencing a 25% increase and APAC seeing an 18% rise. These figures underscore the mature nature of these digital advertising landscapes, where the demand for ad verification services is well-established and integrated into standard media purchasing practices.

DoubleVerify's strategic focus on deepening its engagement within these existing international markets further solidifies the cash-generating capacity of these operations. This geographical diversification is a key contributor to the company's overall financial stability and profitability.

- Mature Markets as Cash Cows: DoubleVerify's international measurement revenue from established regions provides a stable and diversified income source.

- Regional Growth in 2024: EMEA saw 25% growth and APAC experienced 18% growth, highlighting the strength of mature digital advertising markets.

- Embedded Demand: The need for ad verification is deeply ingrained in media buying processes within these established international markets.

- Strategic Focus: Deepening presence in existing international markets reinforces the cash-generating nature of these operations.

Supply-Side Business

DoubleVerify's supply-side business is a strong Cash Cow. This segment, which supports platforms and publishers, experienced a significant 25% growth in 2024 and continued its upward trajectory with 35% growth in Q1 2025.

This growth is driven by publishers and platforms using DV's verification and measurement tools. These services are essential for ensuring ad quality and attracting advertiser investment on the sell-side of the digital advertising market.

- Strong Revenue Generation: The supply-side business generates consistent revenue from publishers and platforms that leverage DoubleVerify's verification and measurement solutions.

- Robust Growth: This segment saw 25% growth in 2024 and an impressive 35% growth in Q1 2025, highlighting its expanding market presence.

- Value Proposition: DoubleVerify offers a clear value proposition to the sell-side of the ad ecosystem by ensuring media quality and transparency.

- Market Demand: Increasing demand from retail media platforms and the broader need for third-party verification contribute to the stable and growing revenue stream for DV's supply-side offerings.

DoubleVerify's core ad verification services, including fraud prevention and brand safety, are its foundational cash cows. These mature, widely adopted solutions provide consistent, high-margin revenue, evidenced by a gross profit margin of 82% in 2023.

The company's Open Web Measurement and Authentic Brand Suitability (ABS) also function as robust cash cows. ABS alone generated 54% of activation revenue in Q1 2025, with nearly 70% of top customers using it, demonstrating strong market penetration and recurring value.

International measurement revenue from mature markets, bolstered by 25% growth in EMEA and 18% in APAC during 2024, represents another key cash cow. Similarly, the supply-side business, experiencing 35% growth in Q1 2025, is a significant cash generator.

| Service Segment | BCG Category | Key Performance Indicator | 2023/2024/Q1 2025 Data | Description |

| Core Ad Verification | Cash Cow | Gross Profit Margin | 82% (2023) | Mature, essential services with high profitability. |

| Open Web Measurement | Cash Cow | Gross Revenue Retention | >95% | Consistent cash flow from established digital advertising. |

| Authentic Brand Suitability (ABS) | Cash Cow | Activation Revenue Share | 54% (Q1 2025) | High adoption and growth in a vital segment. |

| International Measurement (Mature Markets) | Cash Cow | EMEA Growth | 25% (2024) | Stable, diversified income from established regions. |

| Supply-Side Business | Cash Cow | Q1 2025 Growth | 35% | Growing revenue from publishers and platforms. |

Delivered as Shown

DoubleVerify BCG Matrix

The DoubleVerify BCG Matrix you see here is the complete, unwatermarked document you will receive immediately after purchase. This preview accurately represents the final, professionally formatted report, ready for your strategic analysis and decision-making. You can confidently download this exact file to gain insights into your digital advertising performance without any hidden surprises or additional steps.

Dogs

Legacy or Undifferentiated Niche Solutions within DoubleVerify's portfolio could represent older, less differentiated, or highly specialized niche offerings. These might be products that haven't received significant updates or haven't gained substantial market traction. For example, verification for very specific, outdated ad formats that are no longer widely adopted could fall into this category.

These types of solutions would likely exhibit both low market share and operate within segments characterized by minimal growth potential. Consequently, they would probably contribute little to overall revenue while demanding a disproportionate amount of resources for their upkeep, yielding a poor return on investment. Without explicit public disclosures from DoubleVerify, these are inferred as areas where the company might strategically decrease investment or even consider divesting.

Certain international segments within DoubleVerify may be considered Dogs. While the company's overall international presence is strong, specific smaller markets or regions where DoubleVerify has not achieved substantial market penetration or faces significant local competition could fall into this category. These areas often exhibit low growth prospects and a low relative market share.

For instance, a reported 8% decrease in international measurement revenue in Q1 2025, attributed in part to a major client temporarily reducing spend, highlights potential vulnerabilities in particular international markets or with certain client relationships. Such underperforming segments might consume valuable resources without generating commensurate returns, presenting a strategic challenge.

Services heavily reliant on declining ad formats would be classified as Dogs in the DoubleVerify BCG Matrix. These are typically solutions tied to digital ad units or channels experiencing a significant drop in advertiser spend or user engagement.

For instance, if DoubleVerify offered robust verification for banner ads that have seen a substantial decrease in investment, with programmatic spend on traditional display units declining year-over-year, these specific services would fit the Dog category. As of 2024, while the digital ad market overall is robust, niche formats are indeed seeing reduced investment as advertisers shift towards video and social media placements.

Non-Strategic Acquisitions with Limited Integration

Non-strategic acquisitions with limited integration, often referred to as Dogs in the BCG Matrix, represent areas where DoubleVerify might be investing resources without seeing commensurate returns. These could be smaller companies acquired for tangential benefits that never fully meshed with DoubleVerify's primary digital verification and performance solutions.

Such an acquisition might have been intended to broaden the company's reach or add a niche capability, but if the integration proved difficult or the market didn't embrace the combined offering, it could languish. For instance, if a past acquisition focused on a nascent ad verification technology that didn't gain traction, it would fit this category. These situations can drain management attention and R&D budgets.

- Resource Drain: Acquisitions that fail to integrate effectively can consume valuable resources, including financial capital and human expertise, without contributing to overall growth.

- Limited Market Adoption: If the acquired entity's products or services do not gain significant market acceptance or adoption post-acquisition, they represent a poor investment.

- Synergy Misses: The expected synergies, whether cost savings or revenue enhancements, are not realized, leaving the acquisition as a standalone underperforming asset.

- Strategic Drift: These "Dogs" can distract from core business objectives, diverting focus from more promising opportunities within DoubleVerify's main product lines.

Certain Aspects of 'Measurement' Revenue with Slow Growth

Within DoubleVerify's 'Measurement' revenue, while the overall segment functions as a Cash Cow, certain sub-segments are exhibiting notably slow growth. For instance, Q1 2025 measurement revenue saw an 8% increase, lagging behind the 20% growth in activation revenue. This disparity highlights potential areas of concern.

Specifically, social measurement revenue experienced a minimal 1% increase in Q1 2025. This sluggish performance, especially when contrasted with other segments, suggests that these slower-growing measurement components, particularly if they are lower-priced relative to activation, might be merely breaking even or consuming resources without substantial future growth potential.

- Overall 'Measurement' Revenue: Functions as a Cash Cow for DoubleVerify.

- Q1 2025 Measurement Revenue Growth: Recorded at 8%, indicating a slower pace compared to activation revenue.

- Q1 2025 Activation Revenue Growth: Reached 20%, demonstrating a significantly higher growth rate.

- Social Measurement Revenue Growth (Q1 2025): Showed a modest 1% increase, signaling potential weakness in this specific area.

Dogs within DoubleVerify's portfolio represent offerings with low market share and low growth potential. These are often legacy products or services tied to declining ad formats, such as older banner ad verification, which advertisers are investing less in. As of 2024, the shift towards video and social media has reduced investment in some traditional formats.

Specific international markets where DoubleVerify has not achieved significant penetration or faces strong local competition could also be classified as Dogs. For example, a reported 8% decrease in international measurement revenue in Q1 2025, partly due to a major client's reduced spend, highlights potential underperformance in certain regions.

Social measurement revenue, which saw only a 1% increase in Q1 2025, also exhibits characteristics of a Dog segment within the broader Measurement category. This sluggish growth, contrasted with a 20% rise in activation revenue during the same period, suggests these areas may consume resources without generating substantial future returns.

Non-strategic acquisitions that haven't integrated well or whose technologies haven't gained market traction also fall into the Dog category. These can drain management attention and R&D budgets, offering little in return.

| Category | Market Share | Market Growth | DoubleVerify Example |

| Dogs | Low | Low | Verification for declining ad formats (e.g., older banner ads) |

| Dogs | Low | Low | Underperforming international segments with low penetration |

| Dogs | Low | Low | Social measurement revenue (Q1 2025 growth: 1%) |

| Dogs | Low | Low | Non-strategic acquisitions with poor integration |

Question Marks

DoubleVerify's acquisition of Rockerbox in March 2025 for $82.6 million places it squarely in the Question Mark quadrant of the BCG Matrix. Rockerbox, a leader in performance attribution and marketing measurement, operates in a high-growth sector crucial for demonstrating ad effectiveness and return on investment.

While Rockerbox offers substantial growth potential, its current market share within DoubleVerify's broader offerings is still developing. The company is in the initial phases of integrating Rockerbox and driving its adoption among its existing client base, a process that requires significant strategic investment.

The key challenge for DoubleVerify is to effectively invest in and integrate Rockerbox's advanced capabilities. The goal is to capture a significant market share in the competitive performance measurement space, transforming Rockerbox from a Question Mark into a future Star performer.

DoubleVerify's innovation pipeline extends beyond GenAI Website Avoidance. The company is actively developing new AI-powered verification and optimization solutions targeting emerging high-growth areas in digital advertising, such as sophisticated invalid traffic detection and advanced brand safety for emerging content formats.

These nascent solutions, while leveraging DoubleVerify's Universal Content Intelligence AI, are in early adoption phases with currently low market share as they aim for broader market penetration. Significant investment in scaling these offerings is crucial to demonstrate their value and convert them into future Stars.

DoubleVerify's strategic expansion into new, untapped digital channels signifies a deliberate move into less-saturated markets where their current market share is minimal. This includes exploring emerging platforms and niche advertising environments where their verification services are still gaining traction.

This multi-vector growth strategy is a key component of DoubleVerify's approach, demonstrating a commitment to identifying and capitalizing on future growth opportunities. These ventures, while holding significant potential, are characterized by low current market penetration and necessitate substantial investment to achieve scale and establish a dominant position.

Deepening Penetration in Specific International Emerging Markets

DoubleVerify's strategy in specific international emerging markets, characterized by rapid digital ad spend growth but limited DV presence, positions them as Question Marks in the BCG Matrix. These markets, such as Southeast Asia and parts of Latin America, represent significant future potential but demand considerable investment for localization and market education. For instance, digital ad spending in Southeast Asia was projected to reach over $20 billion in 2024, a substantial increase from previous years, highlighting the opportunity.

The company’s approach involves adapting its verification and measurement solutions to local nuances, a classic Question Mark tactic. This requires building new partnerships and educating local advertisers and publishers on the value of digital ad quality. While the long-term payoff could be substantial, transforming these markets into Stars, the immediate financial outlay means they are currently cash consumers with uncertain outcomes.

- Emerging Market Focus: Targeting regions with high digital ad growth but low DV penetration.

- Investment Required: Significant capital for localization, partnerships, and market education.

- Strategic Goal: Convert these Question Marks into future Stars through successful market penetration.

- Current Status: Cash consumers with high growth potential but uncertain returns.

Advanced Attention Metrics beyond Core Authentic Attention

While DV Authentic Attention is a foundational offering, DoubleVerify is actively exploring advanced and experimental attention metrics. These are currently in early development or pilot phases, reflecting the industry's move towards more granular attention measurement, a market poised for significant growth. However, widespread adoption of these highly novel approaches is still nascent.

DoubleVerify's investment in content-level scoring aims to enhance brand suitability, a crucial element for advertisers. Furthermore, their work connecting measurement with outcomes, notably through Scibids AI, signals a future where attention is directly linked to tangible results. These forward-looking initiatives represent a significant R&D investment and will necessitate substantial market education to achieve widespread adoption and establish leadership.

- Content-Level Scoring: DoubleVerify is developing metrics that assess attention at the individual content piece level, moving beyond general placement.

- Outcome-Based Attention: Integrating Scibids AI allows for the measurement of attention's impact on specific business objectives, creating a more direct link to ROI.

- Emerging Methodologies: The company is exploring new ways to quantify attention, potentially incorporating biometric data or more sophisticated engagement signals.

- Market Education Focus: Significant effort will be required to educate the market on the value and application of these advanced attention metrics.

DoubleVerify's strategic investments in emerging technologies and markets position several of its initiatives as Question Marks on the BCG Matrix. These are areas with high growth potential but currently low market share, requiring significant investment to capture market leadership.

The acquisition of Rockerbox for $82.6 million in March 2025 exemplifies this, aiming to establish a strong foothold in performance attribution. Similarly, nascent AI-powered verification solutions and expansion into untapped digital channels are being nurtured with substantial capital outlay.

The company's focus on international emerging markets, such as Southeast Asia where digital ad spend is projected to exceed $20 billion in 2024, also falls into this category. These ventures are cash consumers with the potential to become future Stars, contingent on successful market penetration and adoption.

| Initiative | Market Growth Potential | Current Market Share | Investment Status | BCG Quadrant |

| Rockerbox Acquisition | High | Developing | Significant Investment | Question Mark |

| AI Verification Solutions | High | Low | High Investment | Question Mark |

| Emerging Digital Channels | High | Minimal | Substantial Investment | Question Mark |

| Emerging Markets (e.g., SEA) | Very High (>$20B in 2024) | Low DV Presence | High Investment for Localization | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial statements, industry growth rates, and competitor performance metrics, to accurately position business units.