Digital Turbine Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital Turbine Bundle

Digital Turbine's marketing prowess is built on a strategic foundation of Product, Price, Place, and Promotion. Understanding how they leverage these elements offers invaluable insights into their market dominance.

Dive deeper into the intricate details of Digital Turbine's product innovation, competitive pricing, expansive distribution networks, and impactful promotional campaigns. This comprehensive analysis reveals the 'how' and 'why' behind their success.

Save yourself hours of research and gain a competitive edge. Our ready-made, editable 4Ps Marketing Mix Analysis for Digital Turbine provides actionable strategies and real-world examples, perfect for business professionals and students alike.

Product

Digital Turbine's Mobile Growth Platform acts as the Product component in its 4P analysis, offering a streamlined solution for app discovery, user acquisition, and monetization. This platform bridges the gap between mobile operators, OEMs, app developers, and advertisers, simplifying a complex ecosystem.

In 2024, Digital Turbine's focus on this integrated platform is crucial. The company's acquisition of Adplexity in 2023 for $300 million significantly bolsters its data and analytics capabilities, directly enhancing the value proposition of its mobile growth offerings. This move allows for more sophisticated targeting and performance insights for advertisers and developers.

By connecting over 1 billion devices, Digital Turbine's platform aims to boost awareness, acquisition, and monetization for its partners. This broad reach is a key differentiator, enabling them to efficiently connect with a vast consumer base across various devices and channels, a critical factor in the competitive mobile advertising landscape of 2024-2025.

On Device Solutions (ODS) is a key part of Digital Turbine's strategy, using deep device integrations to get apps preloaded and recommended right on smartphones. This approach allows mobile operators and manufacturers to introduce users to useful apps and content, often during the initial setup or via curated sections like DT Games Hub.

This method enables seamless, direct app installations for consumers and effectively monetizes the available screen space on mobile devices. For instance, in Q4 2023, Digital Turbine reported that ODS contributed significantly to their revenue, highlighting the effectiveness of these on-device placements in driving app discovery and adoption.

The App Growth Platform (AGP) is Digital Turbine's core offering for app developers and advertisers, focusing on driving app installs and user engagement. It provides a suite of tools designed for targeted advertising and programmatic ad exchanges, enabling efficient user acquisition and monetization strategies. Key features like SDK bidding and the DT Exchange (DTX) are central to its value proposition.

AGP facilitates connections between brands, agencies, and consumers through advanced ad formats and data-driven targeting capabilities. This strategic focus aims to optimize campaign performance and deliver measurable results in the competitive app ecosystem. Digital Turbine reported that its AGP segment, encompassing products like Ignite and its exchange, contributed significantly to its revenue growth, with a notable increase in its programmatic exchange business in 2024.

Ignite Platform

Ignite, Digital Turbine's core technology, functions as the product in their 4Ps analysis. This proprietary platform is embedded directly into mobile devices, facilitating crucial functions such as app installations, user engagement, and monetization for Original Equipment Manufacturers (OEMs) and other partners. Its presence on over 100 million devices globally as of early 2024 underscores its widespread adoption and capability for rapid service deployment.

The platform's product strategy centers on continuous innovation, particularly through the integration of advanced AI and machine learning. This technological backbone allows Ignite to effectively leverage first-party data, enhancing its ability to deliver more precise app recommendations and targeted advertising. This optimization of user data is a key differentiator, driving value for both users and partners by improving the relevance and effectiveness of mobile experiences.

- Product Core: Ignite is Digital Turbine's proprietary, on-device technology platform.

- Key Functionality: Powers app installation, user engagement, and monetization for OEMs and partners.

- Market Reach: Deployed on over 100 million devices globally as of early 2024, enabling faster service launches.

- Technological Edge: Utilizes AI and machine learning to optimize first-party data for superior app recommendations and ad targeting.

Alternative App Distribution

Digital Turbine is strategically broadening its reach beyond the dominant Google Play store, venturing into alternative app distribution channels. This move is designed to unlock new revenue streams and provide enhanced value across the mobile ecosystem. For instance, the acquisition of ONE Store International, a prominent app store in South Korea, signifies a concrete step in this direction.

This expansion into alternative ecosystems is further bolstered by key partnerships. Collaborations with major players like TIM Brazil and Motorola demonstrate Digital Turbine's commitment to integrating its solutions into diverse mobile environments. These alliances are crucial for tapping into markets and user bases that may not be fully served by traditional app stores alone.

The company's strategy is well-timed, particularly with evolving regulatory landscapes such as the EU's Digital Markets Act (DMA). The DMA encourages greater competition and interoperability, creating opportunities for platforms like Digital Turbine to offer alternative distribution methods. This regulatory shift empowers Digital Turbine to capitalize on the demand for more open app marketplaces.

- Diversification: Digital Turbine is actively moving beyond Google Play to reach users through alternative app stores and pre-installed solutions.

- Strategic Acquisitions: The acquisition of ONE Store International in 2023 for approximately $20 million highlights their commitment to expanding into new distribution territories.

- Key Partnerships: Collaborations with mobile operators like TIM Brazil and device manufacturers such as Motorola are central to their alternative distribution strategy.

- Regulatory Tailwinds: The EU's Digital Markets Act is expected to further open up opportunities for alternative app distribution channels, benefiting Digital Turbine's market position.

Digital Turbine's product strategy centers on its integrated Mobile Growth Platform, powered by the Ignite technology. This platform facilitates seamless app discovery, acquisition, and monetization by embedding solutions directly onto mobile devices. By leveraging AI and first-party data, it offers enhanced app recommendations and targeted advertising, a critical advantage in the competitive 2024-2025 mobile landscape.

The company's acquisition of Adplexity for $300 million in 2023 significantly enhances its data analytics capabilities, allowing for more precise targeting and performance insights. This strategic move directly strengthens the value proposition of its product offerings, enabling partners to connect with over 1 billion devices more effectively.

Digital Turbine's expansion into alternative app distribution channels, such as its acquisition of ONE Store International for approximately $20 million, diversifies its product reach. This strategy is further supported by key partnerships with entities like TIM Brazil and Motorola, positioning the company to capitalize on evolving market dynamics and regulatory shifts like the EU's Digital Markets Act.

| Key Product Components | Functionality | Market Reach (Early 2024) | Strategic Enhancements |

| Ignite Platform | On-device app installation, engagement, monetization | Over 100 million devices globally | AI/ML for data optimization, precise recommendations |

| App Growth Platform (AGP) | Targeted advertising, programmatic ad exchange (DTX) | Driving app installs and user engagement | SDK bidding, enhanced campaign performance |

| On Device Solutions (ODS) | Preloading and recommending apps via device integration | Significant revenue contributor (Q4 2023) | Monetizing screen space, direct user acquisition |

| Alternative Distribution | Expanding beyond Google Play | ONE Store International (South Korea) | Partnerships with TIM Brazil, Motorola; regulatory tailwinds (DMA) |

What is included in the product

This analysis provides a comprehensive breakdown of Digital Turbine's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's designed for professionals seeking to understand Digital Turbine's marketing positioning, offering a structured, data-rich overview ideal for reports or strategic planning.

Provides a clear, actionable framework to address marketing challenges by dissecting Digital Turbine's Product, Price, Place, and Promotion strategies.

Simplifies complex marketing decisions by offering a structured approach to identify and overcome obstacles within Digital Turbine's 4Ps.

Place

Digital Turbine's core distribution strategy heavily relies on its relationships with major mobile operators and OEMs. These partnerships are crucial for embedding their mobile growth platform, including On Device Solutions, directly onto devices. This integration ensures app discovery and distribution happen seamlessly for consumers.

By collaborating with industry giants such as Motorola, Nokia, and Xiaomi, Digital Turbine gains access to a vast global user base. In 2024, the company continued to strengthen these ties, aiming to expand its reach across key markets and solidify its position as a primary channel for mobile app monetization and user acquisition.

Digital Turbine leverages direct-to-consumer device integrations, including preloads and dynamic installs, placing apps directly onto mobile devices during activation. This strategy ensures widespread visibility for recommended applications and content from the outset. For instance, in 2023, Digital Turbine's platform facilitated over 1 billion app installs, showcasing the scale of these integrations.

Digital Turbine's App Growth Platform leverages programmatic ad exchanges like the DT Exchange (DTX) to facilitate real-time bidding for ad inventory across its extensive mobile app network. This creates a dynamic marketplace where advertisers can efficiently acquire users by bidding on available ad space, while app developers gain a valuable channel to monetize their inventory.

The DTX consolidates diverse supply sources, significantly amplifying its reach and operational efficiency for advertisers. For instance, in Q1 2024, Digital Turbine reported a 20% year-over-year increase in its Advertising segment revenue, partly driven by the performance of its programmatic offerings, indicating strong advertiser demand and effective inventory monetization.

Strategic Partnerships & Acquisitions

Digital Turbine actively grows its market reach through strategic alliances and acquisitions, exemplified by its acquisition of ONE Store International. This move, alongside ongoing collaborations with mobile carriers and original equipment manufacturers (OEMs), allows entry into new territories and strengthens its standing in the alternative app market.

These strategic moves are key to diversifying revenue and mitigating risks associated with over-reliance on single markets. By integrating new platforms and expanding its global footprint, Digital Turbine aims to solidify its competitive advantage.

- Acquisition of ONE Store International: This integration is expected to significantly boost Digital Turbine's presence in the South Korean market and the broader Asian app ecosystem.

- Carrier and OEM Partnerships: Collaborations with major mobile carriers and device manufacturers are crucial for pre-installing Digital Turbine's solutions, driving user acquisition and revenue.

- Market Diversification: Such partnerships help reduce dependence on any single region or platform, creating a more resilient revenue model.

Global Presence & Offices

Digital Turbine's global footprint is a cornerstone of its marketing strategy, allowing it to serve a worldwide network of telecom operators, advertisers, and publishers. With its headquarters in North America, the company has strategically established offices across key international markets. This expansive network facilitates the management of complex global partnerships and ensures localized support for regional business needs.

The company's commitment to a global presence is evident in its operational infrastructure, designed to cater to diverse market demands and connect partners with a broad consumer base. As of early 2024, Digital Turbine operates in over 20 countries, underscoring its dedication to international market penetration and client service.

- Global Reach: Operates in over 20 countries, supporting a diverse international clientele.

- Strategic Offices: Headquarters in North America with offices worldwide to manage global operations.

- Market Access: Enables partners to access a vast consumer base across various device ecosystems.

- Localized Support: Facilitates effective management of international partnerships and regional market demands.

Digital Turbine's Place strategy centers on deep integration within the mobile ecosystem, primarily through partnerships with mobile operators and OEMs. This ensures their solutions are present on devices from the point of sale, offering direct access to consumers. Their global presence, operating in over 20 countries as of early 2024, allows for broad market penetration and localized support for a diverse client base.

The company's acquisition of ONE Store International further solidifies its market access, particularly in Asia, complementing its existing carrier and OEM collaborations. This multi-faceted approach to distribution, including direct-to-consumer integrations and strategic alliances, aims to maximize app visibility and monetization opportunities across various device ecosystems.

| Key Distribution Channels | Strategic Partnerships | Market Reach (as of early 2024) | Recent Expansion Example |

| Mobile Operators & OEMs | Motorola, Nokia, Xiaomi | Over 20 Countries | ONE Store International Acquisition |

| Direct-to-Consumer Integrations | Global Telecom Operators | North America (HQ), Worldwide Offices | Strengthened Asian Presence |

| Alternative App Stores | Device Preloads & Dynamic Installs | Vast Global User Base | Facilitating 1 Billion+ App Installs (2023) |

What You See Is What You Get

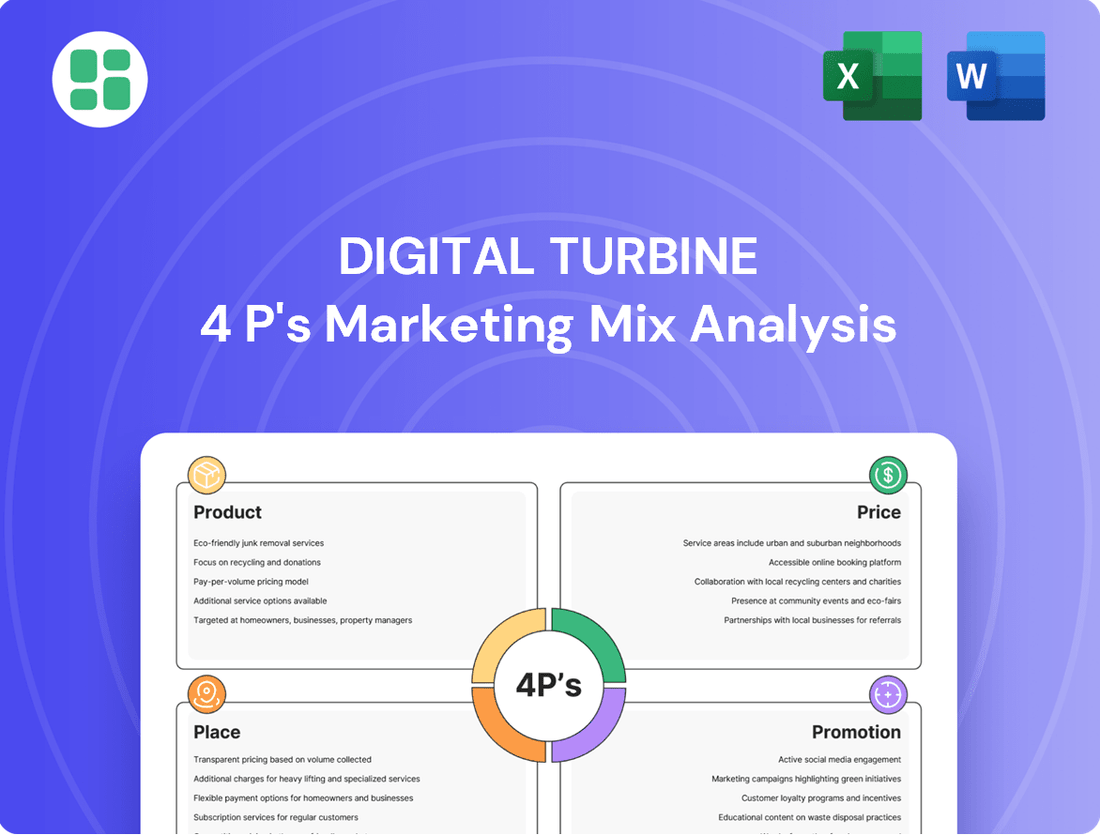

Digital Turbine 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Digital Turbine's 4P's Marketing Mix covers Product, Price, Place, and Promotion, offering a complete picture for your strategic planning.

Promotion

Digital Turbine's direct sales and business development are critical, focusing on building strong ties with mobile carriers, device manufacturers (OEMs), and major app companies. These teams actively pursue device-level partnerships and significant advertising deals, aiming for enduring collaborations that guarantee steady platform usage and revenue. For instance, in Q1 2024, Digital Turbine reported total revenue of $120.7 million, with a significant portion driven by these strategic partnerships and direct client engagements.

Digital Turbine's promotional strategy hinges on its mastery of first-party data combined with cutting-edge AI/ML. This potent combination fuels hyper-personalized app recommendations and precisely targeted ad campaigns, driving exceptional performance for advertisers.

By focusing on these advanced capabilities, Digital Turbine delivers superior conversion rates, a critical advantage in today's privacy-focused mobile advertising environment. This approach ensures maximum value for both advertisers seeking engaged users and consumers looking for relevant app experiences.

In 2024, Digital Turbine reported significant growth in its app install business, driven by these data-centric strategies. The company’s ability to connect advertisers with high-intent users through its intelligent platform continues to be a key differentiator.

Digital Turbine actively participates in key industry events and conferences, such as Mobile World Congress (MWC) and industry-specific forums, to highlight its advancements in mobile advertising and app distribution. These engagements allow them to demonstrate their expertise in areas like privacy-centric advertising solutions and alternative app monetization strategies, crucial in the evolving mobile landscape.

By contributing to publications and speaking at these events, Digital Turbine positions itself as a thought leader. This is particularly relevant given the increasing focus on data privacy and the shift away from traditional tracking methods, a trend that accelerated significantly through 2024 and is expected to continue shaping the industry in 2025.

This strategic presence not only builds brand awareness but also enhances credibility with potential partners and clients. For instance, in 2024, Digital Turbine reported significant growth in its partnerships, partly attributed to its visible role in shaping industry discussions around new advertising paradigms.

Investor Relations and Financial Communications

Digital Turbine prioritizes investor relations, clearly communicating its strategic vision and financial progress. This involves regular updates through earnings calls and investor presentations, aiming to foster confidence among stakeholders.

The company's proactive approach to financial communication is designed to attract and retain capital. For instance, in the first quarter of fiscal year 2025, Digital Turbine reported revenue of $140.5 million, demonstrating its ongoing operational performance.

- Strategic Communication: Digital Turbine details its growth strategies and market positioning.

- Financial Transparency: Regular reporting of financial results, such as Q1 FY25 revenue of $140.5 million, builds trust.

- Investor Engagement: Active participation in investor conferences and roadshows connects the company with potential investors.

- Capital Attraction: Clear communication of performance and future prospects aids in securing necessary funding for expansion.

Content Marketing and Case Studies

Digital Turbine leverages content marketing, featuring blog posts, detailed case studies, and insightful reports, to powerfully illustrate the value and performance of its mobile advertising platform. These materials frequently spotlight successful app discovery and monetization campaigns, providing concrete evidence of positive outcomes for app developers, brands, and mobile network operators.

This strategic content creation serves to demonstrate, with practical examples, precisely how Digital Turbine's solutions address key challenges and meet the specific needs of its diverse customer base. For instance, a case study might detail how a particular app achieved a 25% increase in user acquisition through Digital Turbine's intelligent campaign management in Q1 2024.

- Showcasing ROI: Case studies often quantify the return on investment achieved by clients, such as a 15% uplift in average revenue per user (ARPU) for mobile operators.

- Platform Efficacy: Content highlights how Digital Turbine's technology drives measurable results, like a 30% improvement in app install conversion rates for advertisers.

- Customer Success: Insights reports can aggregate data showing the collective success of partners, perhaps noting a 20% year-over-year growth in mobile ad spend managed through the platform.

Digital Turbine's promotion strategy is deeply embedded in showcasing its technological prowess and the tangible results it delivers. By leveraging first-party data and AI, they highlight superior conversion rates and hyper-personalized user experiences, which are crucial differentiators in the current privacy-conscious mobile advertising landscape. This focus on data-driven performance ensures value for both advertisers and consumers.

The company actively engages in industry events and thought leadership, positioning itself as an innovator in mobile advertising. This strategic visibility, coupled with transparent investor relations and detailed content marketing like case studies, builds brand awareness and credibility. For example, their Q1 FY25 revenue of $140.5 million underscores their operational success and ability to attract capital through clear communication of their growth strategies and market impact.

| Promotional Element | Description | Example Data/Impact |

|---|---|---|

| Data & AI Focus | Highlighting hyper-personalization and targeted campaigns driven by first-party data and AI/ML. | Drives superior conversion rates for advertisers. |

| Industry Presence | Participation in key events like MWC and thought leadership through publications. | Enhances credibility and brand awareness, contributing to partnership growth in 2024. |

| Content Marketing | Utilizing case studies, blog posts, and reports to demonstrate platform value and ROI. | Showcases client success, such as a 25% increase in user acquisition for an app in Q1 2024. |

| Investor Relations | Clear communication of strategy, financial progress, and performance. | Fosters stakeholder confidence, supporting capital attraction for expansion. |

Price

Digital Turbine frequently utilizes performance-based pricing, especially within its App Growth Platform. Advertisers are charged for tangible results like app installations or active user engagement, directly linking Digital Turbine's earnings to client success.

This approach significantly reduces financial risk for advertisers, as they primarily pay for demonstrated outcomes. For instance, in 2024, many mobile advertising platforms saw increased adoption of cost-per-install (CPI) and cost-per-action (CPA) models, reflecting this trend.

The focus is on delivering a clear return on investment (ROI) for marketing expenditures, a crucial factor for businesses navigating the competitive app marketplace. This strategy is particularly relevant given the projected global mobile ad spending of over $360 billion in 2024.

Digital Turbine's revenue share agreements with operators and OEMs are a cornerstone of its On Device Solutions. These partnerships involve sharing revenue generated from preloaded apps and on-device monetization strategies.

This collaborative pricing model directly incentivizes mobile carriers and original equipment manufacturers (OEMs) to deeply integrate Digital Turbine's platform into their devices. For instance, in 2023, Digital Turbine reported that its partners saw significant uplift in app engagement and revenue through these integrated solutions.

Digital Turbine likely employs value-based pricing for its key strategic partners, recognizing the substantial long-term value derived from deep device integrations and broad user access. This method prioritizes the overall economic benefit and strategic advantage delivered to partners, moving beyond simple transactional costs.

Pricing structures are often tailored to the specific scale of integration and the projected user base, ensuring alignment with the partner's anticipated return on investment. For instance, a partnership involving pre-installation across millions of devices would command a different pricing model than a more limited integration.

In 2024, Digital Turbine's focus on expanding its footprint within the mobile ecosystem, particularly through strategic carrier and OEM relationships, underscores this value-based approach. The company's ability to drive significant user engagement and monetization opportunities for partners directly informs the pricing of its solutions.

Tiered or Volume-Based Discounts

Digital Turbine likely employs tiered or volume-based discounts to incentivize larger clients. For instance, app developers or advertisers who consistently drive high volumes through Digital Turbine's programmatic exchange could see their per-unit costs decrease as their commitment grows. This strategy is designed to foster loyalty and encourage clients to maximize their use of the platform's comprehensive offerings.

This approach directly supports increased adoption and deeper integration with Digital Turbine's ecosystem. As clients scale their advertising efforts or leverage more of the platform's advanced features, they unlock progressively better pricing, making the service more cost-effective at higher usage levels. This creates a clear incentive for clients to invest more in the platform over time.

- Volume-Based Pricing: Encourages higher spend by offering lower rates for increased campaign volume.

- Tiered Discounts: Clients can achieve better per-unit costs as they reach specific usage thresholds.

- Incentivized Adoption: Drives deeper engagement with Digital Turbine's full suite of programmatic advertising solutions.

Monetization of First-Party Data

Digital Turbine's monetization of first-party data, while not a direct price point, underpins its service pricing. The company's ability to leverage unique device data for enhanced ad targeting and app distribution allows it to secure competitive rates for its offerings. This data advantage is a critical element in its value proposition, influencing its pricing power in the market.

The strategic use of first-party data directly impacts Digital Turbine's revenue generation. For instance, in 2023, the company reported significant growth in its digital media and advertising segment, partly driven by its data-centric approach. This allows them to offer more effective advertising solutions, justifying their pricing structure.

- Data-driven targeting enhances ad campaign performance, leading to higher client satisfaction and retention.

- Optimized app distribution through data insights increases user acquisition efficiency for developers.

- Competitive pricing is supported by the demonstrable ROI delivered through data-enhanced services.

- First-party data provides a distinct advantage over competitors relying on less granular information.

Digital Turbine leverages performance-based pricing, charging advertisers for tangible results like app installs. This model, prevalent in 2024 with CPI and CPA strategies, links their earnings directly to client success, making it a cost-effective approach given the projected $360 billion global mobile ad spend for the year.

Revenue share agreements with carriers and OEMs are key for their On Device Solutions, incentivizing deep integration. This value-based approach considers the long-term benefits and user access provided, with pricing adjusted for integration scale, as seen in their 2023 partner success stories.

Tiered and volume-based discounts encourage larger clients and deeper platform engagement. This strategy fosters loyalty by offering progressively better pricing as clients scale their campaigns or utilize more advanced features, directly supporting increased adoption of their programmatic advertising solutions.

The company's first-party data monetization enhances its service pricing by enabling superior ad targeting and app distribution. This data advantage, contributing to their 2023 digital media and advertising segment growth, allows for competitive rates due to demonstrable ROI.

4P's Marketing Mix Analysis Data Sources

Our Digital Turbine 4P's Marketing Mix Analysis is built upon a foundation of verified data, including official company disclosures, investor reports, and direct observation of their product and platform strategies. We meticulously gather information on their pricing structures, distribution partnerships, and promotional activities to ensure a comprehensive and accurate representation of their market approach.