Digital Turbine Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital Turbine Bundle

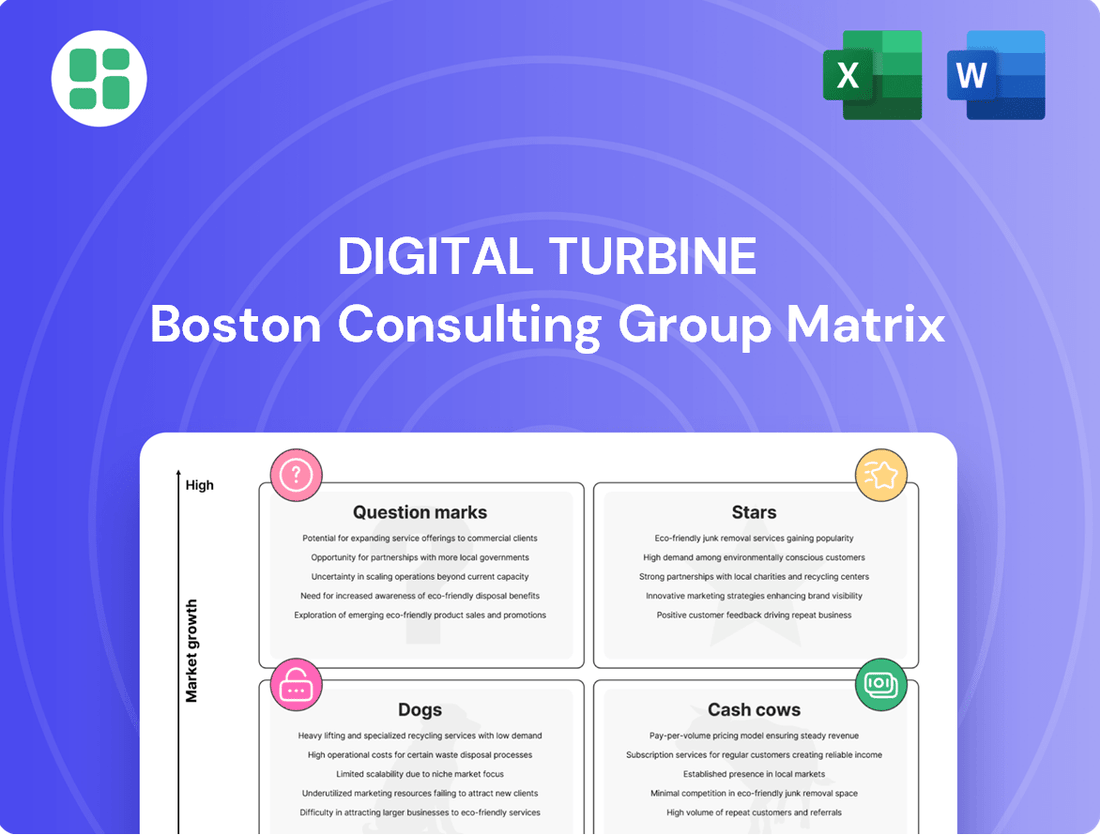

Curious about Digital Turbine's strategic positioning? This preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks within the dynamic mobile ecosystem. To truly unlock actionable insights and guide your investment decisions, dive into the full BCG Matrix report for a comprehensive quadrant breakdown and data-driven recommendations.

Stars

Digital Turbine's Ignite platform, a key component of its BCG Matrix positioning, is a powerhouse, currently active on over 100 million devices. Its increasing integration of AI and machine learning allows for sophisticated analysis of extensive data, directly improving ad targeting accuracy and boosting conversion rates. This strategic emphasis on first-party data is crucial, especially as privacy regulations tighten, positioning Ignite for significant growth in the privacy-focused mobile advertising landscape.

Digital Turbine's strategic expansion into alternative app store ecosystems is a key growth driver. The acquisition of ONE Store International in October 2024 for an undisclosed sum is a prime example of this initiative. This move is designed to foster a more dynamic app distribution environment, moving beyond the dominance of established players and catering to a rising consumer preference for varied app discovery methods.

Digital Turbine's On Device Solutions (ODS) segment, encompassing preloads and on-device recommendations, is experiencing robust international revenue per device (RPD) growth. This trend highlights a significant expansion of their market presence and the effectiveness of their strategies in regions outside the United States.

The increasing RPD in international markets points to substantial growth opportunities as mobile advertising continues its global expansion. For instance, in fiscal year 2024, Digital Turbine reported that its international revenue grew by 20%, with ODS being a key contributor to this expansion. This suggests a strong demand for their services in emerging and developed markets alike.

Strategic Partnerships (e.g., GroupM)

Securing global preferred partner status with major media buying agencies like GroupM is a significant growth driver for Digital Turbine. These strategic alliances are pivotal for accessing substantial media budgets and broadening Digital Turbine's influence across the advertising landscape.

These partnerships directly contribute to Digital Turbine's position in the BCG matrix, particularly in the 'Stars' quadrant, due to their high growth potential and market share. In 2024, Digital Turbine continued to deepen these relationships, aiming to leverage them for increased campaign volume and revenue.

- GroupM's Global Reach: GroupM, a WPP company, is one of the world's largest media investment groups, managing over $60 billion in ad spend annually as of recent reports.

- Increased Ad Spend Allocation: Preferred partner status often translates to a higher proportion of client ad spend being directed towards Digital Turbine's platforms.

- Ecosystem Expansion: Collaborations with agencies like GroupM facilitate integration with a wider array of advertisers and campaigns, solidifying Digital Turbine's role in the digital advertising ecosystem.

- Revenue Growth Potential: These partnerships are designed to unlock significant media dollars, directly fueling Digital Turbine's revenue growth trajectory.

In-App Advertising Monetization (Non-Gaming)

In-app advertising (IAA) outside of gaming is a bright spot, with revenues climbing. For instance, the global mobile ad spending reached an estimated $362 billion in 2024, and IAA is a significant contributor to this growth.

Digital Turbine's strategic push to bolster monetization tools for publishers and developers in this expanding non-gaming IAA space positions it for strong performance. This focus aligns with a market where advertisers are increasingly seeking engaged audiences within diverse app categories.

- Growing Non-Gaming IAA Market: The non-gaming in-app advertising sector is experiencing robust growth, driven by increased user engagement across various app types beyond gaming.

- Digital Turbine's Strategic Focus: The company is enhancing its monetization solutions specifically for publishers and developers operating within this lucrative non-gaming segment.

- Market Potential: With global mobile ad spending projected to continue its upward trajectory, Digital Turbine's specialization in non-gaming IAA could lead to significant revenue increases and market share gains.

Digital Turbine's "Stars" are characterized by high market share and high growth potential, driven by strategic initiatives like its Ignite platform and key partnerships. The company's focus on expanding into alternative app stores, exemplified by the October 2024 ONE Store International acquisition, positions it for continued growth in a diversifying mobile ecosystem. Furthermore, robust international revenue per device growth in its On Device Solutions segment, with international revenue up 20% in fiscal year 2024, directly contributes to its "Star" status.

The company's securing of global preferred partner status with major media buying agencies, such as GroupM, a WPP company managing over $60 billion in ad spend annually, is a significant growth driver. These alliances are crucial for accessing substantial media budgets and increasing campaign volumes, directly fueling revenue growth. The strong performance in non-gaming in-app advertising, a segment contributing significantly to the estimated $362 billion global mobile ad spending in 2024, further solidifies Digital Turbine's position as a "Star" by capitalizing on expanding market opportunities.

| Segment/Initiative | Market Share | Growth Potential | Key Drivers |

|---|---|---|---|

| Ignite Platform | High (100M+ devices) | High | AI/ML integration, first-party data focus |

| Alternative App Stores (ONE Store acquisition) | Growing | High | Diversification beyond major app stores |

| On Device Solutions (International) | Growing | High | Increasing international RPD, 20% international revenue growth FY24 |

| Partnerships (e.g., GroupM) | High (via partners) | High | Access to large ad budgets, increased campaign volume |

| Non-Gaming In-App Advertising | Growing | High | Monetization tools for publishers, strong market growth ($362B global mobile ad spend in 2024) |

What is included in the product

The Digital Turbine BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, or Dogs.

Digital Turbine's BCG Matrix provides a clear, actionable framework, alleviating the pain of strategic uncertainty by categorizing apps for focused investment decisions.

Cash Cows

Digital Turbine's Core On Device Solutions (ODS) in the U.S. market, encompassing preloads and app recommendations, stands as a cornerstone of their business. This segment boasts a high market share, indicating a strong established presence.

Despite headwinds in U.S. device sales and upgrade cycles, the ODS business continues to be a significant revenue generator for Digital Turbine. For instance, in fiscal year 2024, Digital Turbine reported total revenue of $1.3 billion, with a substantial portion attributable to its established U.S. ODS operations.

Digital Turbine's established relationships with major mobile carriers and OEMs are a significant asset, acting as a bedrock for its business. These deep-seated partnerships allow for seamless integration of Digital Turbine's software directly onto new devices, ensuring widespread reach and consistent user acquisition.

This dominance in device-level integrations translates into a reliable stream of revenue. In 2024, Digital Turbine continued to leverage these relationships, which are crucial for its app distribution and monetization strategies, contributing significantly to its cash flow generation. For instance, its partnerships with carriers like Verizon and T-Mobile in the US, and global OEMs, provide a predictable and substantial base for its operations.

SingleTap technology, a cornerstone of Digital Turbine's offering, represents a mature product with significant market penetration. Its ability to facilitate seamless app installations has cemented its position as a reliable revenue generator, demanding minimal ongoing marketing expenditure due to its established user base and proven efficacy.

In 2024, SingleTap continued to demonstrate robust performance, contributing a substantial portion to Digital Turbine's overall revenue. The technology's high conversion rates, often exceeding industry benchmarks, underscore its value proposition to app developers and advertisers alike, ensuring a steady and predictable income stream for the company.

Platform Infrastructure and Data Assets

Digital Turbine's platform infrastructure and extensive first-party data assets are undeniably cash cows. These have been meticulously built over years, creating a powerful moat. This robust foundation not only supports current operations efficiently but also ensures consistent cash generation with minimal additional investment.

The company's ability to leverage its accumulated data for targeted advertising and app distribution drives significant monetization. For instance, in Q1 2024, Digital Turbine reported a 21% year-over-year increase in revenue, largely attributed to the strength and efficiency of its existing platform and data monetization strategies.

- Platform Efficiency: Digital Turbine's infrastructure allows for streamlined ad delivery and app installation processes, reducing operational costs.

- Data Monetization: The first-party data enables highly effective audience segmentation, leading to premium pricing for advertising inventory.

- Sustained Cash Flow: These assets generate consistent revenue streams with low marginal costs, contributing significantly to free cash flow.

- Competitive Advantage: The depth and breadth of their data, combined with platform sophistication, create a significant barrier to entry for competitors.

Programmatic Advertising Solutions

Digital Turbine's programmatic advertising solutions, featuring DT DSP and DT Offer Wall, represent established revenue generators within its monetization framework. These offerings serve a wide array of advertisers and publishers, contributing to consistent income in the mature programmatic advertising sector. In 2023, Digital Turbine reported significant growth in its advertising segment, driven by these core solutions.

- Established Market Presence: DT DSP and DT Offer Wall have a solid footing in the programmatic advertising landscape.

- Broad Advertiser and Publisher Base: These solutions attract a diverse range of clients, ensuring steady demand.

- Stable Revenue Streams: The mature nature of the programmatic market provides predictable income for these offerings.

- Contribution to Monetization: They are key pillars in Digital Turbine's strategy to generate revenue from its mobile ecosystem.

Digital Turbine's Core On Device Solutions (ODS) in the U.S., including preloads and app recommendations, are its undisputed cash cows. This segment benefits from high market share and established relationships with major mobile carriers and OEMs, ensuring consistent revenue generation. For example, in fiscal year 2024, Digital Turbine reported total revenue of $1.3 billion, with a substantial portion stemming from these mature, high-performing operations.

SingleTap technology, a mature product with significant market penetration, also functions as a cash cow. Its proven efficacy in facilitating seamless app installations and high conversion rates, often exceeding industry benchmarks, generates a predictable and steady income stream with minimal additional marketing investment. In 2024, SingleTap continued to be a robust contributor to the company's overall revenue.

The company's platform infrastructure and extensive first-party data assets are also strong cash cows. These foundational elements, meticulously built over years, create a powerful competitive moat and ensure consistent cash generation with low marginal costs. In Q1 2024, Digital Turbine saw a 21% year-over-year revenue increase, largely driven by the efficient monetization of its existing platform and data.

Digital Turbine's programmatic advertising solutions, like DT DSP and DT Offer Wall, are established revenue generators within its monetization framework. These offerings serve a broad base of advertisers and publishers, contributing stable income from the mature programmatic advertising sector. Significant growth in the advertising segment was reported in 2023, bolstered by these core solutions.

| Segment | BCG Category | Description | Key Financial Indicator (FY24) | Strategic Importance |

| On Device Solutions (ODS) - US | Cash Cow | Preloads and app recommendations with high market share. | Significant portion of $1.3B total revenue. | Foundation of business, leverages carrier/OEM relationships. |

| SingleTap Technology | Cash Cow | Mature product for seamless app installations. | Robust performance, high conversion rates. | Predictable income stream, low marketing spend. |

| Platform & Data Assets | Cash Cow | Infrastructure and first-party data for targeted advertising. | Drove 21% YoY revenue increase in Q1 2024. | Competitive moat, consistent cash generation. |

| Programmatic Advertising (DT DSP, Offer Wall) | Cash Cow | Established solutions for advertisers and publishers. | Contributed to significant advertising segment growth in 2023. | Stable revenue from mature market. |

Preview = Final Product

Digital Turbine BCG Matrix

The Digital Turbine BCG Matrix you are previewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no hidden surprises – just a comprehensive strategic analysis ready for immediate application. You can confidently use this preview as a direct representation of the high-quality, actionable document that will be yours. Once purchased, this file is unlocked for your exclusive use, allowing you to integrate its insights directly into your business planning and decision-making processes.

Dogs

Legacy content media platforms, often featuring basic news, weather, or editorial content, can be classified as dogs within the Digital Turbine BCG matrix if they haven't been significantly updated or linked to high-growth areas. These components may struggle to gain traction or provide substantial unique value in today's saturated digital content market.

For instance, a platform primarily offering static news articles without interactive features or personalized content might see declining engagement. In 2023, the digital news publishing industry faced challenges with ad revenue growth slowing, with some segments experiencing a contraction as user attention shifts to more dynamic and interactive media experiences.

Certain regional operations within Digital Turbine might be classified as "dogs" if they consistently miss growth and profitability benchmarks. These underperforming segments, despite the company's broader success, could be draining valuable resources without generating adequate returns. For instance, if a specific European market partnership, which accounted for 3% of revenue in 2023, saw a 5% year-over-year decline in app install volume while investing heavily in local marketing, it would fit this category.

Digital Turbine's App Growth Platform (AGP), prior to its full AI integration, faced challenges in a dynamic ad tech market. Portions relying on older methodologies likely saw a decline in market share as competitors leveraged newer, AI-driven strategies. This resulted in lower efficiency and reduced competitiveness for these legacy components.

Non-Gaming Chinese Companies Revenue (U.S. Market)

Digital Turbine experienced a significant revenue drop from non-gaming Chinese companies in the U.S. market during fiscal year 2024. This downturn, attributed to distribution hurdles, positions this segment as a potential 'dog' within the BCG matrix.

The challenges faced by non-gaming Chinese companies in the U.S. market in fiscal year 2024 led to a considerable revenue decline for Digital Turbine. For instance, reports indicated a substantial percentage decrease in this specific revenue stream compared to previous periods.

- Revenue Decline: Fiscal year 2024 saw a marked decrease in revenue from non-gaming Chinese companies for Digital Turbine in the U.S.

- Distribution Challenges: The primary reason cited for this decline was difficulties in distribution within the U.S. market.

- BCG Matrix Implication: Persistent decline and unclear recovery prospects could classify this segment as a 'dog' due to low market growth and share.

- Financial Impact: Specific figures for FY2024 showed this segment contributing minimally to overall revenue, highlighting its underperformance.

Products Heavily Reliant on Declining Device Upgrade Cycles

Products heavily reliant on the U.S. device upgrade cycle, which has seen a slowdown, are likely candidates for the Dogs quadrant in the Digital Turbine BCG Matrix. This dependence means their growth is tied to a market segment facing challenges.

For instance, services or apps that thrive on users frequently purchasing new smartphones, perhaps due to compatibility or performance needs, would fall into this category. The current trend points to a more extended device ownership period, with some reports indicating an unsustainable eight-year upgrade cycle. This directly impacts the revenue streams of companies built on rapid hardware turnover.

- Extended Upgrade Cycles: The average smartphone replacement cycle in the U.S. extended to approximately 43 months in 2023, a significant increase from previous years.

- Market Saturation: High smartphone penetration rates in developed markets like the U.S. mean fewer new customers and a greater reliance on upgrades.

- Innovation Lag: Incremental hardware improvements in new device releases may not be compelling enough to drive frequent upgrades for the average consumer.

Segments within Digital Turbine's portfolio that exhibit low growth and a declining market share are categorized as Dogs. These are typically legacy products or services that are no longer competitive or relevant in the current market landscape. For example, older versions of their app pre-installation software that haven't been updated to incorporate new AI features or cater to evolving user preferences would fit this description.

Digital Turbine's fiscal year 2024 financial reports highlighted a significant revenue decrease from non-gaming Chinese companies in the U.S. market, largely due to distribution challenges. This underperforming segment, characterized by low market share and limited growth prospects, aligns with the 'dog' classification in the BCG matrix.

Furthermore, products heavily reliant on the U.S. device upgrade cycle, which has notably slowed, are also considered Dogs. With consumers holding onto devices longer, as evidenced by the average U.S. smartphone replacement cycle extending to approximately 43 months in 2023, these offerings face diminished demand.

| BCG Category | Digital Turbine Segment Example | Market Growth | Market Share | Rationale |

|---|---|---|---|---|

| Dogs | Legacy App Pre-installation Software (Non-AI enhanced) | Low | Declining | Outdated technology, losing to AI-driven competitors. |

| Dogs | Non-Gaming Chinese Companies (U.S. Market) | Low | Low | Distribution challenges in FY2024 led to significant revenue decline. |

| Dogs | Services tied to rapid device upgrades | Low | Declining | Extended U.S. smartphone replacement cycles (avg. 43 months in 2023) reduce demand. |

Question Marks

Digital Turbine's ventures into AI/ML-driven monetization features, particularly those leveraging first-party data and exploring new app distribution channels, are firmly positioned as question marks within its BCG matrix. These initiatives, while promising significant future growth, currently demand substantial capital outlay and have not yet solidified a commanding position in the competitive landscape. For instance, the company's continued investment in its proprietary AI platform, which aims to personalize app recommendations and ad targeting, reflects this question mark status.

Digital Turbine's potential expansion into alternative app stores on iOS, exemplified by their collaboration with ONE Store, presents a significant question mark. This move targets Apple's vast ecosystem, a high-growth opportunity, but the venture is in its early days with minimal market penetration and substantial upfront investment needed. As of late 2024, the landscape for alternative app stores on iOS is still developing, with regulatory pressures and user adoption being key variables.

Digital Turbine's potential expansion into Connected TV (CTV) advertising represents a significant question mark within its business strategy. While CTV is a rapidly growing sector for advertising spend, with projections indicating continued strong growth through 2024 and beyond, Digital Turbine's current market penetration in this specific niche is likely nascent.

This nascent presence necessitates strategic investment to build market share and capitalize on CTV's increasing importance as an advertising channel. For instance, the U.S. CTV ad spend was estimated to reach $21.7 billion in 2023 and is expected to climb to $32.4 billion by 2025, highlighting the immense opportunity.

Emerging Market Expansion beyond Core Regions

Digital Turbine's strategic push into emerging markets beyond its established regions represents a classic question mark in the BCG matrix. These territories, while brimming with potential for user acquisition and revenue growth, present significant challenges due to nascent infrastructure and varying regulatory landscapes.

In 2024, the company's focus on expanding its device footprint in regions like Southeast Asia and parts of Africa highlights this strategy. These markets, though less penetrated, offer a substantial demographic dividend and a growing smartphone adoption rate, which Digital Turbine aims to capitalize on.

- High Growth Potential: Emerging markets often exhibit faster GDP growth and increasing disposable income, translating to higher demand for digital services.

- Market Penetration Challenges: Factors like fragmented distribution channels, local competition, and varying consumer preferences can hinder rapid market share gains.

- Investment Requirements: Establishing a presence in these new territories necessitates significant upfront investment in marketing, partnerships, and localized product offerings.

- Risk Mitigation: Digital Turbine's success will hinge on its ability to navigate political and economic uncertainties, currency fluctuations, and evolving data privacy laws in these diverse markets.

Strategic Transformation Projects

Strategic transformation projects, while aimed at boosting efficiency and innovation, often land in the question mark category of the BCG matrix. These initiatives require substantial capital outlay with the hope of significant future returns, but their ultimate success in driving revenue growth and profitability remains uncertain. For instance, a company might invest heavily in a new AI-driven customer service platform, anticipating cost savings and improved customer retention, but the actual impact on the bottom line is not guaranteed until the project is fully implemented and its results are measured.

- Uncertain ROI: Projects focused on operational efficiency, like implementing new supply chain software, aim to reduce costs and speed up delivery, but the exact percentage of cost savings or the impact on market share is often difficult to predict upfront.

- Innovation Risk: Developing entirely new product lines or entering emerging markets, while potentially lucrative, carries inherent risks. A significant portion of new product development efforts globally do not reach commercial success, highlighting this uncertainty.

- Execution Challenges: The success of any transformation hinges on effective execution. Delays, budget overruns, or resistance to change can derail even the most promising projects, turning potential gains into losses.

- Market Volatility: External factors like economic downturns or shifts in consumer preferences can significantly impact the success of transformation projects, even if the internal execution is flawless.

Digital Turbine's ventures into AI/ML-driven monetization and new app distribution channels are question marks, demanding significant investment without a solidified market position. The company's continued investment in its proprietary AI platform for personalized recommendations and ad targeting exemplifies this.

The expansion into alternative app stores on iOS, like the collaboration with ONE Store, is another question mark. This targets Apple's ecosystem, a high-growth area, but is in its early stages with minimal penetration and substantial upfront costs. The iOS alternative app store landscape in late 2024 remains dynamic, influenced by regulatory shifts and user adoption.

Digital Turbine's potential move into Connected TV (CTV) advertising also represents a question mark. Although CTV advertising spend is projected for strong growth, with U.S. CTV ad spend estimated to reach $32.4 billion by 2025, Digital Turbine's current market presence in this niche is likely limited, requiring strategic investment to build share.

Emerging markets represent a classic question mark, offering growth potential but facing challenges like nascent infrastructure and varied regulations. Digital Turbine's 2024 focus on expanding its device footprint in regions like Southeast Asia and Africa highlights this, aiming to leverage growing smartphone adoption despite market complexities.

| Initiative | BCG Category | Key Considerations | Potential Impact | 2024/2025 Data Point |

| AI/ML Monetization | Question Mark | High investment, unproven market share | Personalized user experiences, increased ad revenue | Continued investment in proprietary AI platform |

| iOS Alternative App Stores | Question Mark | Early stage, regulatory dependence | Access to new user bases, diversified revenue | Collaboration with ONE Store, evolving iOS landscape |

| Connected TV (CTV) Advertising | Question Mark | Nascent market penetration, high growth sector | Expanded advertising reach, new revenue streams | U.S. CTV ad spend projected to reach $32.4B by 2025 |

| Emerging Markets Expansion | Question Mark | Infrastructure/regulatory hurdles, high growth potential | User acquisition, market diversification | Focus on Southeast Asia and Africa |

BCG Matrix Data Sources

Our Digital Turbine BCG Matrix leverages comprehensive data from company financial reports, app store analytics, and industry growth forecasts to accurately position each business unit.