Digital Turbine Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital Turbine Bundle

Digital Turbine operates in a dynamic mobile advertising ecosystem, facing moderate threats from new entrants and the bargaining power of buyers. Understanding the intensity of these forces is crucial for navigating this competitive landscape.

The full Porter's Five Forces Analysis reveals the real forces shaping Digital Turbine’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Digital Turbine's reliance on mobile operators and OEMs for app preloading and device integration is substantial. These partnerships grant them direct access to users, a key differentiator. In 2024, the consolidation within the mobile operator and OEM landscape means a few major players hold significant sway, amplifying their bargaining power over companies like Digital Turbine.

Digital Turbine's reliance on first-party data, while a strength, also highlights a critical supplier bargaining power. The ultimate origin of this valuable data often lies with device manufacturers and mobile network operators. These entities control the initial flow of information, making their data-sharing policies a significant factor in Digital Turbine's operational effectiveness.

The quality and sheer volume of data collected are paramount for Digital Turbine's core business functions, particularly its targeted advertising and app recommendation engines. Any perceived limitations or shifts in how these upstream data providers share information could directly impede Digital Turbine's ability to deliver personalized and effective services to its clients.

Digital Turbine relies on a range of technology and infrastructure providers, encompassing cloud services, analytics tools, and critical ad tech components. While this supplier base is generally more fragmented than original equipment manufacturers (OEMs) or mobile carriers, the use of specialized or proprietary technologies can grant certain providers significant leverage.

However, the inherent modularity within the ad tech ecosystem often facilitates a degree of interchangeability among suppliers. For instance, as of early 2024, the digital advertising market sees numerous cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud competing, offering Digital Turbine options for its infrastructure needs. Similarly, the ad tech space, while having dominant players, also features many specialized analytics and ad serving platforms, allowing for flexibility and mitigating the power of any single provider.

App Developers as Content Suppliers

App developers are the source of the content that Digital Turbine's platform distributes and monetizes. While the sheer volume of app developers might suggest low individual power, the reality is more nuanced. Top-tier applications, those with substantial user bases or unique functionalities, can indeed wield some bargaining power concerning their visibility and revenue-sharing arrangements on Digital Turbine's network.

Digital Turbine actively works to mitigate this potential power by fostering an attractive ecosystem for a wide array of developers. By providing robust user acquisition tools and effective monetization strategies, the company incentivizes developers to partner with them. This strategy aims to ensure a steady supply of diverse and engaging applications, thereby reducing reliance on any single developer or app. For instance, in 2024, Digital Turbine continued to expand its app catalog, integrating thousands of new applications across various categories to cater to a broad consumer base.

- Developer Pool Size: The vast number of app developers globally generally dilutes the bargaining power of individual developers.

- Tiered Developer Power: Developers of highly popular or exclusive apps can negotiate more favorable terms due to their content's high demand.

- Digital Turbine's Mitigation Strategy: Offering attractive user acquisition and monetization tools encourages developers to join and remain on the platform, increasing supply diversity.

- Platform Growth: In 2024, Digital Turbine's focus on expanding its app partnerships aimed to further diversify its content offerings and strengthen its position against individual developer leverage.

Risk of Vertical Integration by Suppliers

The bargaining power of suppliers, specifically mobile operators and Original Equipment Manufacturers (OEMs), is influenced by the risk of them pursuing vertical integration. This means they could develop their own app discovery and monetization platforms, thereby lessening their dependence on companies like Digital Turbine.

While building such in-house capabilities demands substantial financial outlay and specialized knowledge, the strategic advantage of having direct control over the device ecosystem could be a strong motivator. This potential move represents a long-term threat to Digital Turbine's supplier relationships and market position.

- Vertical Integration Risk: Mobile operators and OEMs may build proprietary app discovery and monetization solutions.

- Strategic Motivation: Device-level control and direct customer relationships drive this potential integration.

- Investment Barrier: Significant capital and technical expertise are required, but the strategic payoff could outweigh costs.

The bargaining power of suppliers for Digital Turbine is significant, primarily due to its reliance on mobile operators and OEMs for app distribution and data access. In 2024, the consolidation of major mobile carriers means fewer entities control a larger user base, amplifying their leverage. This dynamic is further intensified as these partners possess the capability for vertical integration, potentially developing their own app discovery and monetization platforms, thereby reducing their need for Digital Turbine's services.

While Digital Turbine benefits from a diverse pool of app developers, the power of those with highly popular or exclusive applications can still influence terms. Digital Turbine actively counters this by fostering a robust ecosystem, as evidenced by its continued expansion of app partnerships in 2024, integrating thousands of new applications to ensure content diversity and reduce reliance on any single developer.

Digital Turbine's dependence on technology providers, including cloud services and specialized ad tech components, also presents a supplier leverage factor. However, the modularity within the ad tech sector, with numerous competing cloud providers like AWS and Google Cloud in early 2024, offers Digital Turbine flexibility and mitigates the power of individual infrastructure suppliers.

What is included in the product

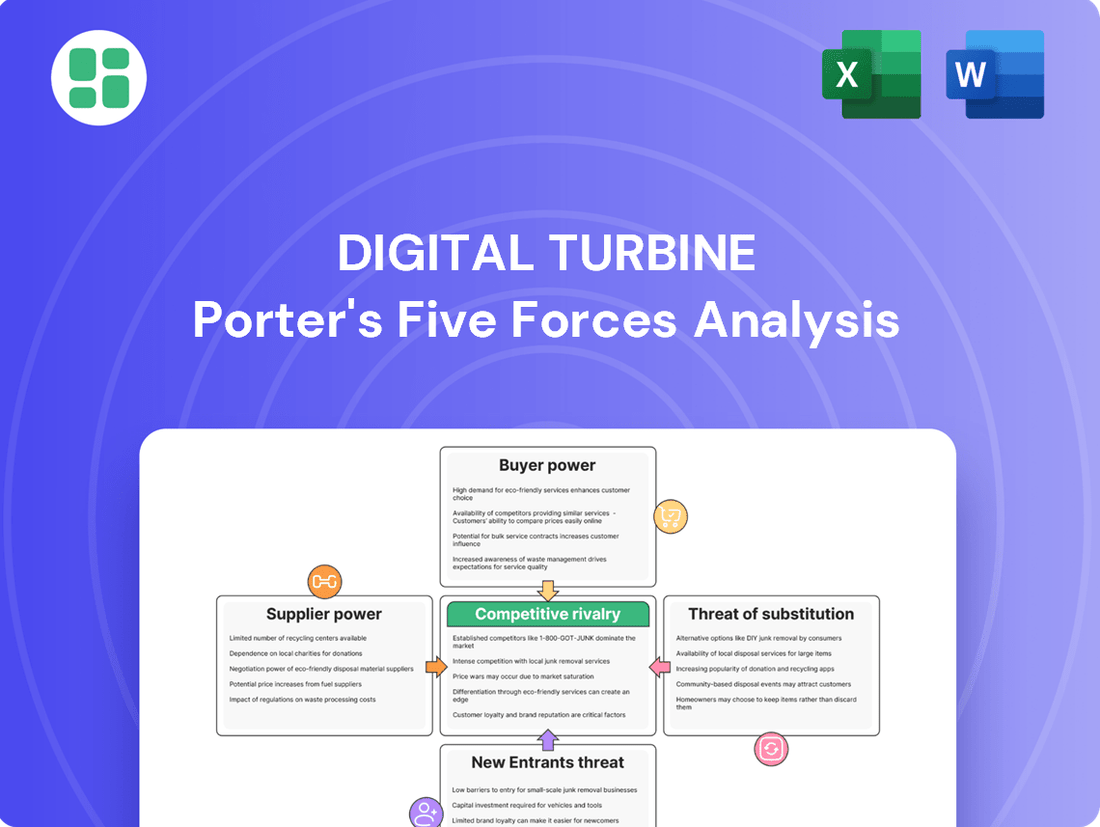

Digital Turbine's Porter's Five Forces Analysis dissects the competitive intensity and profitability potential within its mobile advertising and app distribution ecosystem, examining threats from rivals, buyer and supplier power, new entrants, and substitutes.

Digital Turbine's Porter's Five Forces analysis provides a clear, actionable framework to understand and mitigate competitive pressures, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

App developers and advertisers, Digital Turbine's main clients, hold moderate bargaining power. They can opt for alternative advertising and distribution avenues like direct app store placements or other ad networks. For instance, the mobile advertising market is highly competitive, with numerous platforms vying for advertiser spend.

Mobile operators and Original Equipment Manufacturers (OEMs) represent a unique dynamic in Digital Turbine's ecosystem. While they supply the devices that carry Digital Turbine's software, they also function as customers by benefiting from revenue sharing agreements and enhanced user experiences offered by the platform. Their significant bargaining power stems from their direct control over device distribution channels and access to millions of end-users.

These entities wield considerable influence due to their gatekeeper position in the mobile market. Digital Turbine's value proposition, which includes driving user engagement and creating new monetization avenues, is crucial for maintaining strong relationships and mitigating this customer power. For instance, in 2024, the continued reliance of mobile carriers on innovative software solutions to differentiate their offerings and boost ARPU (Average Revenue Per User) underscores their leverage.

The bargaining power of customers, particularly app developers and advertisers, is significantly influenced by the availability of alternative monetization channels. These customers can easily leverage other platforms like Google AdMob, AppLovin, and IronSource for in-app purchases and advertising revenue. This wide array of choices means Digital Turbine needs to consistently prove its value proposition, offering a demonstrably better return on investment and unique features to retain its client base.

Demand for Performance and ROI

Advertisers and developers are intensely focused on measurable outcomes like campaign performance, the cost of acquiring new users, and their return on ad spend (ROAS). This sharp focus means Digital Turbine's clients will naturally push for better, more optimized results and clear, transparent reporting on campaign effectiveness.

Digital Turbine's strategic investments in artificial intelligence and machine learning are directly aimed at addressing this customer demand. By enhancing targeting capabilities and personalizing user experiences, the company seeks to deliver the superior performance its clients expect, thereby mitigating some of this customer bargaining power.

- Focus on ROAS: Advertisers consistently seek to maximize their return on ad spend, putting pressure on platforms to deliver efficient user acquisition.

- Demand for Transparency: Clients require clear, detailed reporting to understand campaign performance and justify marketing investments.

- AI-driven Optimization: Digital Turbine's use of AI and machine learning aims to improve ad targeting and user engagement, directly responding to the demand for better results.

- Performance Benchmarks: Industry benchmarks for user acquisition cost and ROAS set expectations that Digital Turbine must meet or exceed to retain customers.

Customer Switching Costs

Customer switching costs are a key factor in the bargaining power of customers. For advertisers and app developers, the effort to switch from one ad platform to another can range from minimal to substantial. While integrating a new Software Development Kit (SDK) might involve some technical hurdles, the potential for a more efficient or profitable platform often makes the switch worthwhile.

However, for entities like mobile operators and Original Equipment Manufacturers (OEMs), the decision to switch away from an integrated solution, such as that offered by Digital Turbine, presents a more significant challenge. These integrations are often deeply embedded within their existing systems, making a transition complex and potentially costly.

In 2024, the digital advertising landscape continued to evolve, with platforms constantly seeking to attract and retain both advertisers and developers. The ease of integration and the demonstrable return on investment (ROI) remain critical for these users. For instance, a platform offering a 15% increase in ad revenue for developers might justify the effort of integrating a new SDK.

- Advertisers and App Developers: Switching costs can be relatively low, often involving SDK integration, but are weighed against potential gains in platform effectiveness.

- Mobile Operators and OEMs: Face higher switching costs due to deep system integrations with existing solutions.

- Platform Value Proposition: The perceived benefit of a new platform, such as improved ad revenue or user engagement, must outweigh the switching costs.

- Industry Trends: The ongoing demand for efficient ad delivery and monetization in 2024 influences the willingness of users to invest in platform transitions.

The bargaining power of customers, particularly app developers and advertisers, is moderated by the availability of numerous alternative monetization and distribution channels. These clients can easily shift to competing ad networks or direct app store placements, seeking better performance and cost-effectiveness. For example, platforms like Google AdMob and AppLovin offer robust alternatives, compelling Digital Turbine to continuously demonstrate superior ROI and unique features to retain its user base.

Mobile operators and OEMs, however, exert more significant influence due to their control over device distribution and end-user access. Their leverage is amplified by the deep integration of Digital Turbine's solutions, making switching complex and costly. In 2024, carriers continued to rely on innovative software to differentiate their services and increase Average Revenue Per User (ARPU), underscoring their considerable power in the ecosystem.

| Customer Segment | Bargaining Power Factors | Digital Turbine's Mitigation Strategies |

|---|---|---|

| App Developers & Advertisers | Availability of alternative ad networks, focus on ROAS and transparent reporting, low switching costs. | AI-driven optimization for improved targeting and engagement, demonstrating superior performance and ROI. |

| Mobile Operators & OEMs | Control over device distribution, deep system integration, reliance on software for differentiation. | Providing value-added services, enhancing user experience, fostering strong partnership relationships. |

Preview Before You Purchase

Digital Turbine Porter's Five Forces Analysis

This preview showcases the complete Digital Turbine Porter's Five Forces analysis, providing a thorough examination of industry competition and profitability. You're looking at the actual document; once purchased, you'll gain instant access to this exact, professionally formatted file. This detailed analysis covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Digital Turbine's market landscape.

Rivalry Among Competitors

The ad tech market, particularly for mobile advertising and app growth, is intensely competitive and highly fragmented. This means there are many companies vying for market share, offering a wide array of services. For instance, in 2023, the global digital advertising market was valued at over $600 billion, with a significant portion dedicated to mobile, highlighting the sheer scale and the number of participants.

This competitive landscape includes established ad tech giants, specialized mobile marketing platforms, and even major technology companies developing their own in-house advertising solutions. The presence of these diverse players creates a dynamic environment where innovation is constant, and market positions can shift rapidly.

Furthermore, the industry is shaped by rapid technological advancements, such as the increasing use of AI in ad targeting and creative optimization, and evolving privacy regulations, like the deprecation of third-party cookies and new app tracking transparency measures. These factors constantly reshape how advertising is delivered and measured, intensifying the rivalry.

Digital Turbine faces intense rivalry from companies like AppLovin and IronSource, which is now integrated into Unity Technologies. These platforms compete directly for app developers and advertisers seeking user acquisition and monetization solutions.

The market is characterized by aggressive pricing and feature innovation as competitors strive to capture market share. For instance, AppLovin reported over $3.2 billion in revenue for 2023, highlighting the scale of competition Digital Turbine navigates.

Giants like Google (AdMob) and Meta (Facebook Audience Network) dominate mobile advertising, controlling substantial market share thanks to their massive user bases and deeply integrated digital ecosystems. These platforms offer advertisers unparalleled reach and sophisticated targeting capabilities.

While Digital Turbine's unique device-level integration provides a distinct competitive edge, the sheer scale and resources of Google and Meta present a significant challenge. For instance, Google's AdMob reported facilitating over 1 trillion ad requests annually, highlighting its immense scale.

Product Differentiation and Innovation

Digital Turbine’s competitive rivalry is significantly shaped by its ability to differentiate its product offerings. The company’s proprietary on-device solutions, such as Ignite, and its SingleTap technology, which facilitates seamless app installations, are key differentiators. These innovations directly address user friction and developer efficiency, setting Digital Turbine apart in a crowded market.

Continuous innovation remains paramount for Digital Turbine to sustain its competitive advantage. The company actively invests in areas like artificial intelligence and machine learning for enhanced user targeting and programmatic advertising capabilities. Exploring alternative app distribution channels also plays a crucial role in staying ahead of evolving market demands and competitive pressures.

- Product Differentiation: Digital Turbine leverages unique on-device solutions like Ignite and SingleTap technology for frictionless app installs, a key competitive advantage.

- Innovation Focus: The company prioritizes continuous innovation in AI/ML for targeting, programmatic advertising, and exploring new app distribution channels to maintain market leadership.

- Market Impact: These differentiators and innovations are critical for Digital Turbine to navigate intense competition within the digital advertising and mobile app distribution ecosystem.

Market Consolidation and M&A Activity

The mobile advertising technology sector has experienced a flurry of consolidation, with major players acquiring smaller companies to expand their capabilities. A prime example is Unity's acquisition of IronSource in early 2023 for approximately $4.4 billion. This trend of merger and acquisition activity can significantly heighten competitive rivalry.

These consolidations often result in the emergence of larger, more integrated competitors possessing a wider array of services and greater market influence. For Digital Turbine, this means facing rivals who can offer more comprehensive solutions, potentially putting pressure on its market share and pricing power.

- Unity's acquisition of IronSource for roughly $4.4 billion in early 2023 exemplifies significant M&A in the ad tech space.

- Such consolidation can lead to the creation of larger competitors with broader service portfolios.

- This intensified competition may impact Digital Turbine's market position and ability to compete effectively.

Digital Turbine faces fierce competition from numerous players in the mobile advertising and app growth sector. Companies like AppLovin, which reported over $3.2 billion in revenue for 2023, and Unity Technologies, following its acquisition of IronSource for approximately $4.4 billion in early 2023, are significant rivals.

These competitors offer similar user acquisition and monetization solutions, intensifying the rivalry. Giants like Google (AdMob), facilitating over 1 trillion ad requests annually, and Meta (Facebook Audience Network) also exert considerable pressure due to their vast user bases and integrated ecosystems.

Digital Turbine differentiates itself through unique on-device solutions like Ignite and SingleTap technology, focusing on innovation in AI/ML and exploring new distribution channels to maintain its competitive edge in this dynamic market.

SSubstitutes Threaten

The most direct substitutes for Digital Turbine's app discovery services are consumers choosing to download applications straight from official app stores like Google Play or the Apple App Store. Users can also discover apps through organic search engines or by hearing about them from friends and family. While Digital Turbine aims to streamline app discovery, these alternative methods allow users to bypass preloaded or recommended apps.

Advertisers have a wide array of alternative channels to promote their apps and products. These include established digital avenues like web banners and search engine marketing, alongside the ever-growing landscape of social media advertising and influencer collaborations. Furthermore, traditional offline advertising methods remain a viable option for reaching certain demographics.

While these substitutes may not replicate Digital Turbine's unique device-level integration, they offer advertisers broad reach and diverse engagement opportunities. For instance, a significant portion of digital ad spending continues to flow into search and social platforms, indicating their persistent appeal. In 2024, global digital ad spending was projected to exceed $600 billion, with search and social media comprising a substantial majority of this figure.

For app developers, in-app purchases and subscription models represent significant substitutes for advertising revenue, a core offering of platforms like Digital Turbine. Many popular applications, such as Spotify and Netflix, have built their success on these direct monetization strategies, lessening their reliance on ad-supported models.

This shift can impact companies like Digital Turbine, as a growing number of developers prioritize user experience and recurring revenue streams over ad integration. For instance, in 2023, the global in-app purchase market was valued at over $90 billion, showcasing a strong preference for alternative monetization methods.

Web-Based Applications and Progressive Web Apps (PWAs)

The increasing sophistication of web-based applications and Progressive Web Apps (PWAs) presents a significant threat of substitution for traditional app stores and distribution platforms. These web-native solutions can now offer robust functionalities, often mirroring those found in native apps, without the need for a download. This accessibility directly impacts the demand for app installation, a core service for companies like Digital Turbine.

Consider the user experience: PWAs can be added to a device's home screen, offer offline capabilities, and provide push notifications, blurring the lines between web and native apps. This seamless integration reduces friction for users, making them less inclined to seek out and install separate applications. For instance, many e-commerce platforms are heavily investing in their PWA versions, aiming to capture customers directly through the browser.

- Reduced App Installation: PWAs and advanced web apps bypass the need for app store downloads, directly impacting app discovery and distribution platforms.

- Enhanced User Experience: Features like home screen icons, offline access, and push notifications make web alternatives more convenient and engaging.

- Cost-Effectiveness for Developers: Building and maintaining a single web application can be more efficient than developing and updating separate native apps for different operating systems.

- Market Trends: A growing number of businesses are prioritizing PWA development to reach a wider audience without app store gatekeepers, a trend expected to continue through 2024 and beyond.

Changes in User Behavior and Privacy Regulations

Growing user privacy concerns and evolving regulations such as GDPR, CCPA, and the Digital Markets Act (DMA) are significantly impacting the digital advertising landscape. These changes can prompt a movement away from highly targeted, data-reliant advertising strategies.

If users increasingly opt out of data tracking or if regulations further restrict data utilization, the efficacy of platforms like Digital Turbine could diminish. This scenario might encourage advertisers to explore alternative advertising methods that are less dependent on extensive user data, thereby posing a threat of substitution.

- User Opt-Out Rates: Studies in 2024 indicated a notable increase in user consent management platform usage, with opt-out rates for personalized advertising reaching as high as 30% in some regions.

- Regulatory Fines: In 2023, regulatory bodies issued over $200 million in fines related to data privacy violations, underscoring the increasing enforcement of these regulations.

- Shift in Ad Spend: Projections for 2024 suggest a potential shift of 5-10% of digital ad spend towards contextual advertising and privacy-preserving technologies.

The threat of substitutes for Digital Turbine's app discovery and monetization services is multifaceted, stemming from direct consumer choices, advertiser channel diversification, and evolving web technologies. Consumers can bypass platforms by downloading apps directly from app stores or through word-of-mouth, while advertisers have numerous channels like search, social media, and even traditional media to reach audiences. In 2024, global digital ad spending was projected to exceed $600 billion, with search and social media capturing a significant portion, highlighting the strong appeal of these alternative advertising avenues.

Furthermore, developers are increasingly favoring in-app purchases and subscriptions over ad-supported models, a trend exemplified by the over $90 billion valuation of the global in-app purchase market in 2023. Progressive Web Apps (PWAs) also pose a significant substitution threat, offering app-like functionalities directly through browsers, reducing the need for app downloads altogether. User privacy concerns and stricter data regulations, with notable increases in opt-out rates for personalized advertising reaching 30% in some regions in 2024, are further pushing advertisers towards less data-dependent methods, potentially diverting ad spend from platforms like Digital Turbine.

| Substitution Threat Category | Description | 2023/2024 Data Point |

|---|---|---|

| Direct Consumer Discovery | Users downloading apps directly from app stores or via recommendations. | N/A (Consumer Behavior) |

| Advertiser Channel Diversification | Advertisers utilizing search, social media, influencer marketing, and traditional ads. | Global digital ad spending projected over $600 billion in 2024. |

| Developer Monetization Shifts | Preference for in-app purchases and subscriptions over ad revenue. | Global in-app purchase market valued over $90 billion in 2023. |

| Web-Based Alternatives | Progressive Web Apps (PWAs) offering app-like experiences without downloads. | Increasing investment by e-commerce platforms in PWA versions. |

| Privacy-Driven Ad Shifts | Move away from data-reliant advertising due to privacy concerns and regulations. | Opt-out rates for personalized advertising reaching up to 30% in some regions in 2024. |

Entrants Threaten

A significant hurdle for potential competitors entering the mobile app distribution and monetization space is the sheer difficulty and time investment needed to forge deep, device-level integrations with major mobile operators and original equipment manufacturers (OEMs). These aren't casual partnerships; they are built on years of trust, proven technical capabilities, and a history of successful collaboration, making it incredibly tough for newcomers to replicate Digital Turbine's established network and core advantage.

Digital Turbine thrives on powerful network effects. The more mobile operators and original equipment manufacturers (OEMs) partner with Digital Turbine, the more attractive its platform becomes to app developers and advertisers. This creates a virtuous cycle, as a larger developer and advertiser base, in turn, draws in more operators and OEMs.

For any new entrant, replicating this scale presents a significant hurdle. They would struggle to build the substantial device footprint and the diverse ecosystem of advertisers and developers that Digital Turbine already commands. Without this critical mass, their value proposition would likely fall short of what established players can offer.

The significant capital required for research and development, particularly in areas like AI and machine learning for mobile growth platforms, presents a formidable barrier for new entrants. Digital Turbine's investment in its platform, for example, necessitates ongoing expenditure to maintain a competitive edge. In 2023, the company reported R&D expenses of $118.5 million, highlighting the substantial financial commitment needed to innovate and scale in this sector.

Regulatory and Privacy Compliance

The mobile advertising sector is increasingly shaped by stringent data privacy regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). For new companies, navigating these complex rules and investing in compliance infrastructure presents a significant hurdle, potentially costing millions in legal fees and technology. Digital Turbine, having operated within these frameworks, possesses established compliance processes, reducing the burden for new entrants.

New entrants must also contend with evolving legislation such as the Digital Markets Act (DMA), which aims to regulate large online platforms. The financial and operational investment required to meet these dynamic compliance demands acts as a substantial barrier to entry in the mobile advertising space.

Digital Turbine's proactive approach to regulatory compliance, including its investments in secure data handling and privacy-preserving technologies, positions it favorably against potential new competitors who would face considerable upfront costs and risks associated with non-compliance.

- High Compliance Costs: New entrants face significant investment in legal, technical, and operational resources to adhere to GDPR, CCPA, and DMA.

- Regulatory Uncertainty: Evolving privacy laws create ongoing compliance challenges and potential penalties for unprepared companies.

- Established Frameworks: Digital Turbine benefits from existing compliance infrastructure, reducing its exposure to these entry barriers.

- Risk of Penalties: Non-compliance can result in substantial fines, deterring new market participants.

Brand Recognition and Trust

Digital Turbine has cultivated significant brand recognition and trust within the mobile advertising ecosystem. Newcomers face the substantial hurdle of establishing credibility with mobile carriers, device manufacturers, and app developers, a process that takes considerable time and investment.

Building this trust is crucial because clients in this sector prioritize proven performance and reliability. A new entrant would struggle to match Digital Turbine's established relationships, which are key to securing partnerships and demonstrating value. For instance, in 2023, Digital Turbine continued to expand its reach, processing billions of app installs, a testament to the trust placed in its platform by major industry players.

- Established Relationships: Digital Turbine's long-standing partnerships with mobile carriers and device manufacturers create a significant barrier to entry.

- Credibility Gap: New entrants must overcome a lack of proven track record and build confidence in their ability to deliver results.

- Industry Trust: The mobile advertising space demands high levels of trust due to the sensitive nature of user data and performance metrics.

- Brand Equity: Digital Turbine's brand represents reliability and effectiveness, which new competitors must replicate to gain traction.

The threat of new entrants for Digital Turbine is relatively low, primarily due to the significant capital investment required for technology development and market penetration. Building a comparable platform that integrates seamlessly with mobile operators and OEMs demands substantial financial resources and time. For example, Digital Turbine's commitment to innovation is evident in its R&D spending, which reached $118.5 million in 2023, underscoring the high cost of staying competitive.

Furthermore, the established network effects and deep-seated relationships Digital Turbine has forged with mobile carriers and device manufacturers create a formidable barrier. Replicating this ecosystem, which includes billions of processed app installs in 2023, requires years of trust-building and proven performance. New entrants also face significant hurdles in navigating complex data privacy regulations like GDPR and CCPA, demanding considerable investment in compliance infrastructure and legal expertise.

| Barrier to Entry | Description | Impact on New Entrants | Digital Turbine's Advantage |

|---|---|---|---|

| Capital Requirements | High investment in R&D, technology, and market entry. | Significant financial hurdle for new companies. | Established infrastructure and ongoing innovation. |

| Network Effects | Value increases with user and partner base. | Difficult to achieve critical mass against incumbents. | Large, self-reinforcing ecosystem of operators, developers, and advertisers. |

| Regulatory Compliance | Adherence to data privacy and digital market laws. | Costly and complex to implement and maintain. | Existing compliance frameworks and expertise. |

| Brand Reputation & Trust | Credibility with partners and users. | Challenging to build without a proven track record. | Long-standing relationships and demonstrated reliability. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Digital Turbine is built upon a foundation of comprehensive data, including company SEC filings, investor relations materials, and industry-specific market research reports. This allows for a thorough examination of competitive dynamics.