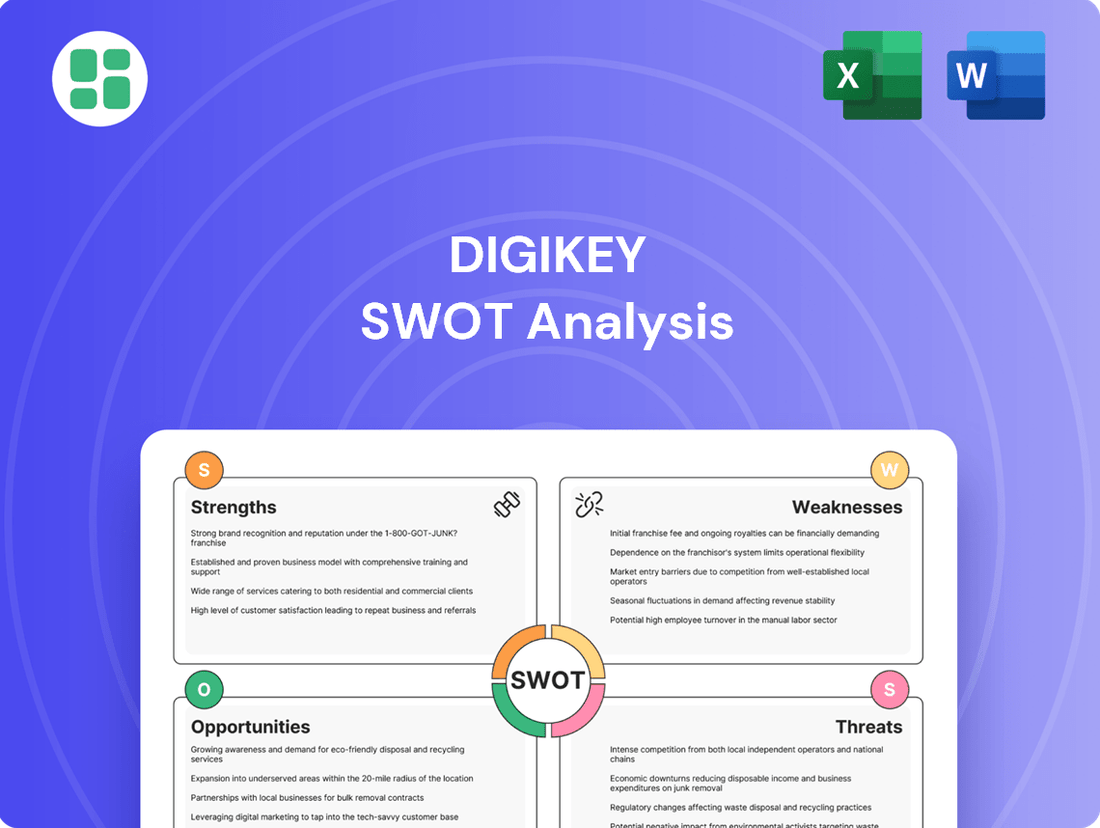

DigiKey SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DigiKey Bundle

DigiKey's extensive product catalog and strong supplier relationships are significant strengths, while their reliance on a specific distribution model presents a potential weakness. Understanding these internal factors, alongside external market opportunities and threats, is crucial for any industry player.

Want the full story behind DigiKey's competitive edge, potential pitfalls, and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and market analysis.

Strengths

DigiKey boasts a truly massive and varied product catalog, featuring over 15.3 million distinct components. This extensive selection, sourced from more than 2,900 reputable manufacturers, is a significant advantage. It means customers, from individual engineers to large production teams, are highly likely to find exactly what they need, whether for a small prototype or a large-scale manufacturing run.

The company's commitment to maintaining this breadth is evident in its continuous growth. In 2024 alone, DigiKey expanded its inventory by adding over 1.1 million new products and onboarding an additional 455 suppliers. This ongoing expansion ensures that DigiKey remains a go-to source for the latest and most diverse electronic components available on the market.

DigiKey's strength lies in its exceptionally strong global e-commerce platform, a critical asset in the fast-paced electronics distribution market. This platform is designed to be highly functional for engineers, offering a seamless experience for sourcing components. It's not just about transactions; DigiKey provides extensive technical resources and support directly through its website, which is a significant draw for its customer base.

The company's reach is truly global, serving customers in over 180 countries. This extensive geographic presence is a testament to the scalability and effectiveness of its digital infrastructure. DigiKey's commitment to enhancing this platform is evident in its ongoing investments in advanced web search capabilities and other digital tools, aiming to continually refine the customer journey and maintain its competitive edge in online sales.

DigiKey's strength lies in its unwavering focus on rapid order fulfillment. For customers needing parts for urgent prototype builds or critical production schedules, DigiKey's commitment to shipping in-stock items the same day is a significant advantage. This operational speed directly addresses the time-sensitive nature of many electronics projects.

The company's dedication to a high service level isn't just talk; it's been recognized with industry awards. These accolades underscore DigiKey's consistent performance in areas like on-time delivery and overall customer support. In 2023, DigiKey was recognized with multiple industry awards for its service and distribution excellence, reinforcing its reputation for reliability.

This efficiency translates into tangible benefits for customers, fostering high satisfaction and enabling them to meet tight deadlines. For instance, in the first half of 2024, DigiKey reported a 99.8% on-time delivery rate for its stocked products, a testament to their streamlined logistics and inventory management.

Record Customer Count and Strong Engagement

DigiKey has achieved a record-high customer count, welcoming over 300,000 new customers in the past year alone. This impressive growth pushes their total customer base towards the one million mark, demonstrating significant market penetration and appeal.

The company's success is further underscored by 21 consecutive months of year-over-year customer growth, a testament to sustained market acceptance and robust customer loyalty. This consistent upward trend indicates strong brand recognition and effective customer acquisition strategies.

These achievements are directly supported by DigiKey's strategic investments in both inventory management and digital infrastructure. These investments are crucial for effectively serving and engaging an ever-expanding customer base, ensuring a positive user experience.

- Record Customer Acquisition: Over 300,000 new customers added in the last year.

- Total Customer Base: Approaching one million active customers.

- Sustained Growth: 21 consecutive months of year-over-year customer count increases.

- Strategic Investment Alignment: Growth supported by investments in inventory and digital platforms.

Strategic Investments in Inventory and Automation

DigiKey's strategic investments in 2024 focused on bolstering inventory and warehouse automation. These moves are intended to reduce overstocking risks and significantly boost order fulfillment speed and accuracy.

The company's commitment to enhancing operational efficiency is underscored by its adoption of advanced AI and automation technologies, which are also being applied to optimize internal customer service functions.

- Increased Inventory: In 2024, DigiKey significantly expanded its product inventory, aiming to ensure greater product availability for its customers.

- Warehouse Automation: Investments were made to upgrade warehouse automation systems, leading to faster and more precise order processing.

- AI Integration: The company is leveraging AI to streamline internal operations, including customer service, thereby enhancing overall efficiency.

DigiKey's extensive product catalog, exceeding 15.3 million components from over 2,900 manufacturers, ensures customers can find virtually any electronic part needed. This vast selection, continuously growing with over 1.1 million new products added in 2024, solidifies DigiKey's position as a comprehensive supplier for diverse project requirements.

The company's robust global e-commerce platform is a key strength, offering a seamless experience for engineers with integrated technical resources and support. Its expansive reach, serving over 180 countries, is a testament to its scalable digital infrastructure and ongoing investments in advanced search and digital tools.

DigiKey's operational efficiency, particularly its rapid order fulfillment with a 99.8% on-time delivery rate for in-stock items in early 2024, directly addresses the critical time demands of the electronics industry. This commitment to speed and service has been recognized with multiple industry awards for distribution excellence.

The company has experienced remarkable customer growth, adding over 300,000 new customers in the past year and maintaining 21 consecutive months of year-over-year customer increases, approaching a total customer base of one million. This sustained growth is supported by strategic investments in inventory management and digital infrastructure to enhance customer engagement.

| Metric | Value | Period |

|---|---|---|

| Product Catalog Size | 15.3 Million+ | Current |

| Number of Manufacturers | 2,900+ | Current |

| New Products Added | 1.1 Million+ | 2024 |

| On-Time Delivery Rate (In-Stock) | 99.8% | H1 2024 |

| New Customers Acquired | 300,000+ | Last Year |

| Consecutive Months of Customer Growth | 21 | Ongoing |

What is included in the product

Analyzes DigiKey’s competitive position through key internal and external factors, detailing its strengths in product breadth and customer service, weaknesses in supply chain reliance, opportunities in emerging markets, and threats from competitors and economic downturns.

DigiKey's SWOT analysis offers a clear framework to identify and leverage strengths, address weaknesses, capitalize on opportunities, and mitigate threats, thereby relieving the pain of strategic uncertainty.

Weaknesses

DigiKey's extensive product catalog, boasting over 13.4 million products from more than 2,900 manufacturers as of early 2024, highlights its significant reliance on third-party suppliers. This dependency creates vulnerability to disruptions in the global supply chain, such as the semiconductor shortages experienced in 2021-2023, which directly impacted product availability and lead times for DigiKey and its customers.

Any strategic decisions made by these manufacturers, including changes in production capacity, product roadmaps, or even exiting certain market segments, can directly affect DigiKey's ability to offer a comprehensive selection and maintain competitive pricing. For instance, a major component manufacturer shifting focus to direct sales could limit DigiKey's access to critical parts.

Despite ongoing efforts to enhance supply chain resilience, DigiKey remains vulnerable to significant disruptions. Geopolitical tensions, natural disasters, and global economic volatility can severely impact the availability and cost of electronic components. For instance, the semiconductor shortage that began in late 2020 and continued through 2023 highlighted these vulnerabilities, leading to extended lead times and increased prices across the industry.

These external factors directly challenge DigiKey's ability to maintain stable stock levels and ensure timely deliveries to its diverse customer base. The scarcity of critical raw materials and the unpredictable nature of global logistics can create significant operational hurdles, potentially impacting customer satisfaction and DigiKey's competitive position.

DigiKey, like many in the electronics distribution sector, faces significant headwinds from economic downturns. The electronics market saw a notable slump in 2024, with many distributors reporting revenue declines. This was largely attributed to customers over-ordering in previous periods and a subsequent general reduction in demand for electronic components.

While DigiKey's revenue forecasts for 2024 and 2025 suggest some growth, these projections underscore the company's susceptibility to broader economic uncertainties. Fluctuations in the demand for electronic components, a core aspect of DigiKey's business, can directly impact its overall financial performance and profitability.

Potential for Inventory Management Challenges

The electronics distribution sector, including DigiKey, faced an inventory hangover in 2023 and early 2024. This followed a period of unprecedented demand during the pandemic, which prompted customers to place larger-than-usual orders to secure components. Consequently, many companies, including DigiKey's customers, found themselves with excess stock as demand normalized.

DigiKey is actively enhancing its inventory management capabilities, investing in sophisticated systems to handle its extensive catalog of millions of electronic components. However, the sheer volume and diversity of products make preventing overstocking and efficiently managing carrying costs a persistent and intricate operational hurdle.

For example, the semiconductor industry, a core market for DigiKey, experienced significant supply chain disruptions and subsequent inventory adjustments throughout 2023. While specific DigiKey inventory figures are not publicly disclosed, industry-wide data from sources like the Semiconductor Industry Association (SIA) indicated a buildup of unsold inventory in the channel during this period, highlighting the broader market conditions DigiKey navigates.

- Inventory Hangover: Post-pandemic demand surges led to customer over-ordering, creating excess inventory across the electronics sector in 2023-2024.

- Operational Complexity: Managing millions of unique electronic components presents ongoing challenges in preventing overstocking and optimizing carrying costs.

- Industry Trends: The semiconductor market, a key segment for DigiKey, saw inventory build-ups in 2023, reflecting broader industry-wide inventory management pressures.

Intense Competition in the Distribution Market

DigiKey operates in an electronic component distribution market characterized by intense rivalry. Major global competitors such as Arrow Electronics and Avnet, Inc. are deeply entrenched and actively pursuing market share growth. These established players are not standing still; they are strategically investing in expanding their distribution capabilities and broadening their product offerings, directly challenging DigiKey’s market position.

To navigate this competitive landscape, DigiKey faces the ongoing necessity of continuous innovation. Providing superior value-added services is paramount to maintaining its competitive advantage. Without such differentiation, DigiKey risks losing ground to rivals who are equally committed to serving the needs of engineers and buyers in the electronics industry.

- Intense Rivalry: Competitors like Arrow Electronics and Avnet, Inc. are significant players with established global networks.

- Strategic Expansion: Competitors are actively growing their distribution reach and product lines.

- Need for Innovation: DigiKey must consistently offer enhanced services to remain competitive.

DigiKey's reliance on a vast network of suppliers, numbering over 2,900 manufacturers as of early 2024, creates inherent vulnerabilities. Disruptions at any of these supplier levels, whether due to geopolitical events or manufacturing issues, can directly impact DigiKey's product availability and lead times. The semiconductor shortage experienced from 2021 through 2023 serves as a stark reminder of how these external dependencies can create significant operational challenges and affect customer satisfaction.

Preview the Actual Deliverable

DigiKey SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You’re viewing the actual DigiKey SWOT analysis, offering a clear glimpse into its comprehensive insights. The complete, detailed report will be available immediately after purchase.

Opportunities

The burgeoning demand for electronic components in sectors like AI, 5G, automotive, and IoT presents a significant opportunity for DigiKey. For instance, the global AI chip market was valued at approximately $20 billion in 2023 and is projected to reach over $200 billion by 2030, highlighting the immense growth potential.

DigiKey can strategically expand its product portfolio to include advanced semiconductors, sensors, and other crucial components that power these high-growth industries. This expansion allows DigiKey to capture a larger market share and become an indispensable supplier for innovation in these key technological areas.

DigiKey has a significant opportunity to deepen customer relationships by expanding its value-added services. The electronic component distribution market is increasingly demanding more than just product delivery; customers are seeking design support, specialized technical expertise, and streamlined inventory management. By enhancing these offerings, DigiKey can position itself as a comprehensive solutions provider, moving beyond traditional distribution.

This strategic expansion allows DigiKey to differentiate itself in a competitive landscape. For instance, offering more robust online design tools and personalized technical consultations can attract and retain customers who value end-to-end support. Such services directly address the evolving needs of engineers and procurement professionals, simplifying their complex supply chains and allowing them to focus on innovation.

The trend towards integrated solutions is evident. In 2024, many distributors reported increased demand for services like kitting, custom cable assembly, and prototyping support. DigiKey’s investment in these areas could yield substantial returns, fostering loyalty and increasing average order values by transforming it into a true one-stop-shop for electronic design and manufacturing needs.

The widespread integration of artificial intelligence and automation throughout supply chains, warehousing, and customer support is a major growth avenue. DigiKey's ongoing commitment to these technologies offers a prime chance to streamline operations, shorten delivery times, and craft bespoke online purchasing journeys for its business-to-business clientele, mirroring the overall digital transformation sweeping the industry.

By further developing AI-driven inventory management and predictive analytics, DigiKey can anticipate demand fluctuations with greater accuracy, minimizing stockouts and overstock situations. This proactive approach is crucial in the fast-paced electronics distribution market, where efficiency directly impacts customer satisfaction and market share.

Enhancing customer service through AI-powered chatbots and personalized recommendation engines can significantly improve the B2B buying experience. For instance, by providing instant, accurate technical support and suggesting relevant components based on past purchases or project needs, DigiKey can foster stronger customer loyalty and drive repeat business, a key strategy in a competitive landscape.

Strategic Partnerships and Market Penetration

DigiKey's commitment to expanding its supplier base, evidenced by the addition of 455 new suppliers in 2024, directly fuels its market penetration strategy. This growth in product availability allows DigiKey to cater to a wider range of customer needs, thereby solidifying its position in existing markets and opening doors to new ones.

Further deepening these supplier relationships and strategically entering new geographic territories, like its recent Importer of Record registration in Japan, presents a significant avenue for mutual growth. This expansion not only diversifies DigiKey's revenue streams but also provides its partners with access to previously untapped customer segments.

- Expanded Supplier Network: Added 455 new suppliers in 2024, increasing product breadth.

- Geographic Expansion: Registered as Importer of Record in Japan, targeting new markets.

- Market Penetration: Leverages supplier growth to reach more customers and industries.

Capitalizing on B2B E-commerce Digital Transformation

The B2B e-commerce landscape is rapidly expanding, with an anticipated 80% of B2B sales interactions taking place online by 2025. DigiKey's strong, existing online infrastructure is perfectly suited to leverage this shift towards digital procurement. As businesses increasingly seek personalized and efficient online buying journeys, DigiKey is well-positioned to meet these evolving demands.

This digital transformation presents significant opportunities for DigiKey to enhance its market share. The company can capitalize on this trend by:

- Expanding personalized digital experiences: Offering tailored product recommendations and customized purchasing workflows for different business segments.

- Streamlining the online purchasing process: Further optimizing website navigation, checkout, and account management for greater efficiency.

- Investing in advanced analytics: Utilizing data to understand buyer behavior and proactively address customer needs within the digital environment.

DigiKey's ability to expand its product offerings by onboarding new suppliers, adding 455 in 2024 alone, directly translates to increased market penetration. This growth in supplier diversity allows DigiKey to cater to a broader spectrum of customer needs across various industries.

Strategic geographic expansion, such as its Importer of Record registration in Japan, opens up significant new revenue streams and customer segments. This move diversifies DigiKey's global footprint and strengthens its partnerships by providing access to previously untapped markets.

The accelerating shift to B2B e-commerce, projected to see 80% of sales interactions online by 2025, presents a prime opportunity for DigiKey. Its robust online infrastructure is perfectly positioned to capitalize on this trend by offering enhanced digital experiences and streamlining the procurement process for businesses.

The increasing demand for sophisticated electronic components in rapidly growing sectors like AI and 5G offers substantial growth potential. DigiKey can further solidify its position by expanding its portfolio to include these cutting-edge semiconductors and sensors, becoming an essential supplier for technological innovation.

| Opportunity Area | Key Driver | DigiKey's Action/Status | Market Data/Impact |

|---|---|---|---|

| High-Growth Technology Sectors | AI, 5G, IoT, Automotive demand | Expanding product portfolio | Global AI chip market projected to exceed $200B by 2030 |

| Value-Added Services | Customer need for design support, technical expertise | Deepening customer relationships | Increased demand for kitting, custom assembly in 2024 |

| Digital Transformation | 80% of B2B sales online by 2025 | Leveraging existing online infrastructure, personalized experiences | Streamlining B2B e-commerce |

| Supplier Network Expansion | Increased product breadth and market reach | Added 455 new suppliers in 2024 | Facilitates market penetration |

| Geographic Expansion | Accessing new customer segments | Importer of Record registration in Japan | Diversifies revenue streams |

Threats

Ongoing geopolitical tensions, particularly between the United States and China, continue to create uncertainty for global supply chains. The potential for renewed tariffs or export controls on critical electronic components could significantly increase DigiKey's operational costs and disrupt product availability throughout 2024 and into 2025.

The electronic component distribution market is intensely competitive, with DigiKey facing numerous established rivals and new entrants vying for market share. This dynamic environment can lead to significant price pressures, potentially impacting DigiKey's profitability if it cannot effectively differentiate its offerings or manage costs better than competitors.

The relentless march of technological advancement means electronic components can become outdated swiftly, posing significant inventory management hurdles for distributors like DigiKey. This rapid obsolescence requires constant vigilance and strategic forecasting to avoid holding devalued stock.

While supply chain issues have eased generally, specific shortages for cutting-edge or niche components persist. For instance, in early 2024, demand for advanced AI-specific chips outstripped supply, a trend that can impact product availability for DigiKey's customers, particularly those requiring specialized parts.

Cybersecurity Risks in Digital Supply Chains

DigiKey faces significant cybersecurity risks due to its highly digitized supply chain and reliance on online platforms. A breach could expose sensitive customer and operational data, leading to severe disruptions and a loss of trust. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

The company must continuously invest in advanced cybersecurity measures to protect against evolving threats. This includes safeguarding against ransomware attacks, which saw a 72% increase in attacks on small and medium-sized businesses in 2023, as reported by Sophos.

- Data Breach Impact: A successful cyberattack could compromise customer information and operational data, impacting millions of transactions.

- Operational Disruption: Threats like ransomware can halt critical business processes, affecting order fulfillment and inventory management.

- Reputational Damage: Cybersecurity incidents can severely erode customer trust, a vital asset in the electronics distribution industry.

- Financial Investment: Continuous, substantial investment in cybersecurity infrastructure and talent is essential to mitigate these evolving risks.

Economic Uncertainty and Inflationary Pressures

Economic uncertainty, including persistent inflation and the looming threat of recession, poses a significant challenge for DigiKey. These macroeconomic headwinds can dampen both consumer and industrial demand for electronic components, leading customers to postpone or reduce their orders. For instance, as of early 2024, global inflation rates remained elevated in many regions, impacting disposable income and business investment, which directly affects the electronics sector.

The fluctuating nature of demand in such an environment necessitates that DigiKey maintain highly agile and flexible sourcing and inventory management strategies. This adaptability is crucial to navigate potential order volume reductions and ensure the company can respond effectively to shifting market conditions. The risk of economic downturns can also lead to increased price sensitivity among customers, potentially pressuring DigiKey's margins.

- Inflationary Pressures: Continued high inflation can erode purchasing power for both consumers and businesses, leading to reduced spending on electronics.

- Recession Risk: The possibility of economic recessions in key markets could significantly curb demand for components across various industries.

- Demand Volatility: Uncertain economic outlooks often result in unpredictable order patterns and a greater likelihood of customers deferring purchases.

- Supply Chain Strain: Economic instability can exacerbate existing supply chain vulnerabilities, making it harder for DigiKey to secure components at stable prices.

DigiKey operates in a highly competitive landscape, facing pressure from both established players and emerging distributors. This intense rivalry can lead to price wars, potentially squeezing profit margins if DigiKey cannot maintain a competitive edge through service or specialized offerings. The rapid pace of technological change also presents a threat, as components can quickly become obsolete, creating inventory management challenges and the risk of holding devalued stock.

Geopolitical instability, particularly trade tensions and potential tariffs, could disrupt global supply chains and increase operational costs for DigiKey throughout 2024 and 2025. Furthermore, the company faces significant cybersecurity risks, with the average cost of a data breach reaching $4.45 million in 2024, threatening operational continuity and customer trust.

Economic headwinds, including persistent inflation and the possibility of recession, pose a substantial threat by dampening demand for electronic components. This economic uncertainty necessitates agile strategies to manage fluctuating order volumes and potential price sensitivity among customers, impacting DigiKey's revenue and profitability.

Specific component shortages, such as those for advanced AI chips in early 2024, can hinder DigiKey's ability to meet customer demand for cutting-edge technology.

SWOT Analysis Data Sources

This DigiKey SWOT analysis is built upon a robust foundation of data, including the company's official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of DigiKey's operational landscape and competitive positioning.