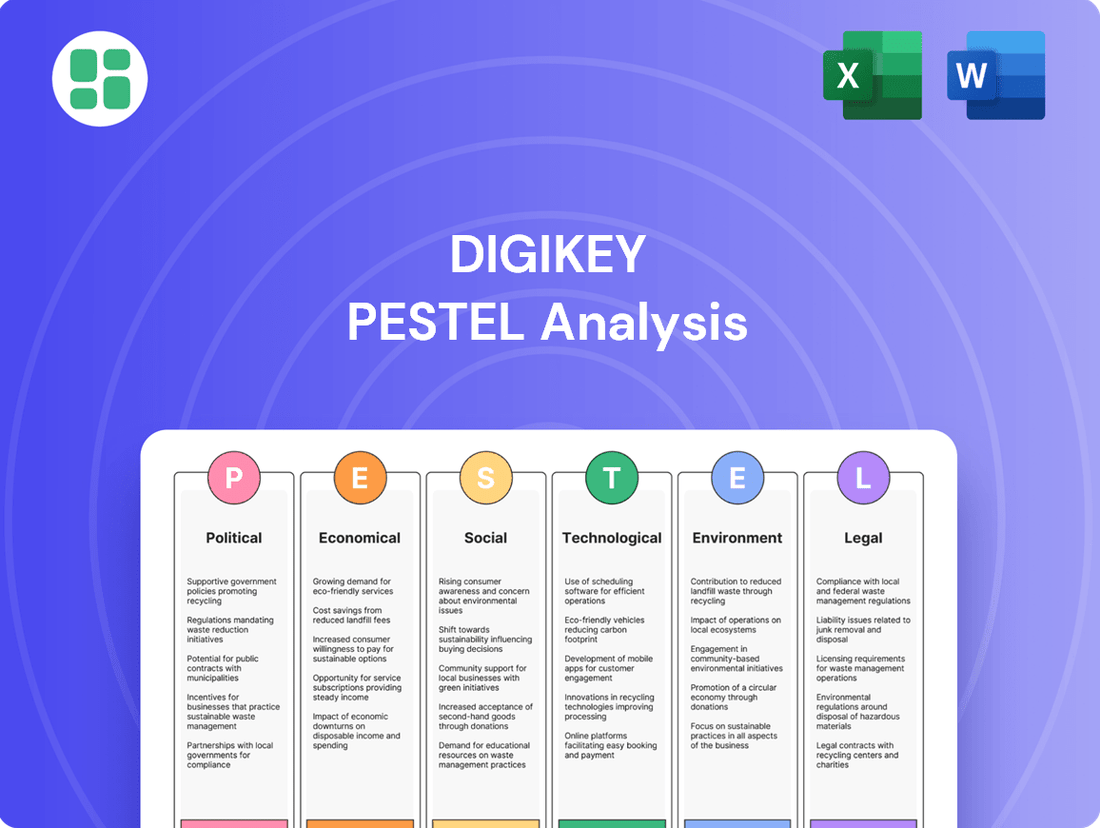

DigiKey PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DigiKey Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping DigiKey's trajectory. Our expertly crafted PESTLE analysis provides the essential context to understand the external forces driving the electronics distribution landscape. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now and gain a decisive advantage.

Political factors

Geopolitical tensions, especially between the United States and China, are significantly influencing the electronics component supply chain. This dynamic is accelerating a trend towards regionalization and nearshoring, as companies seek to reduce vulnerabilities. For a global distributor like DigiKey, these tensions can translate into higher component costs and potential availability issues due to tariffs and trade restrictions.

In 2024, the ongoing trade friction between the US and China has led to increased scrutiny of component sourcing. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) continues to implement export controls on advanced technologies, impacting the flow of certain semiconductors and related equipment. This necessitates that distributors like DigiKey actively manage their supplier relationships and explore alternative sourcing to maintain competitive pricing and consistent inventory levels for their diverse customer base.

Governments globally are actively supporting domestic semiconductor and electronics manufacturing. For instance, the U.S. CHIPS and Science Act, enacted in 2022, allocated over $52 billion to boost domestic chip production and research. This significant investment aims to strengthen national security and reduce dependence on overseas supply chains.

These substantial government subsidies directly impact how components are made and where they originate. For distributors like DigiKey, this means potential shifts in sourcing strategies and a need to adapt to evolving manufacturing landscapes. The trend is towards reshoring and nearshoring of critical technology production.

Export controls and sanctions directly affect DigiKey's ability to distribute electronic components globally. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, restricting exports of sensitive technologies, including advanced semiconductors, to specific companies and countries. This necessitates rigorous compliance checks for every transaction to prevent violations, which can lead to substantial fines and reputational damage.

Regulatory Stability and Policy Changes

The stability of the political landscape significantly impacts the predictability of regulatory environments for global electronics distributors like DigiKey. Sudden shifts in trade agreements or industrial regulations can introduce considerable uncertainty.

For instance, the ongoing trade tensions between major economic blocs, which saw tariffs fluctuate throughout 2023 and into early 2024, directly affect the cost of imported components. DigiKey must remain agile, adapting its supply chain and pricing strategies to navigate these unpredictable policy changes, ensuring continued market access and operational efficiency.

- Trade Policy Volatility: Tariffs on electronic components, particularly those originating from or transiting through Asia, have seen fluctuations, impacting landed costs.

- Export Controls: Evolving export control regulations, especially concerning advanced semiconductors and related technologies, can restrict market access for certain products.

- Government Subsidies: Initiatives like the US CHIPS Act, while promoting domestic manufacturing, also create a dynamic competitive landscape for component sourcing and pricing.

- Regulatory Harmonization Efforts: Progress, or lack thereof, in harmonizing technical and safety regulations across different regions influences the ease of product distribution.

Government Intervention in Supply Chains

Governments worldwide are stepping up their involvement in managing critical technology supply chains, especially those related to semiconductors and advanced electronics. This heightened intervention is driven by national security concerns and a desire to bolster domestic manufacturing capabilities. For instance, the U.S. CHIPS and Science Act, passed in 2022, allocated over $52 billion to incentivize domestic semiconductor production and research, reflecting this trend.

These government actions often translate into more rigorous scrutiny of corporate relationships and demands for greater supply chain transparency and resilience. Companies, including distributors like DigiKey, are increasingly expected to demonstrate how their operations align with national strategic priorities. This might involve detailed reporting on sourcing origins and risk mitigation strategies.

The impact on distributors is significant. They must adapt by ensuring their supply chain practices are not only efficient but also demonstrably robust and compliant with evolving regulatory landscapes. This includes proactive measures to identify and mitigate risks, such as geopolitical instability or single-source dependencies.

- Increased Regulatory Oversight: Expect more stringent requirements for supply chain mapping and risk assessment from governments.

- Focus on Domestic Sourcing: Policies promoting local manufacturing and sourcing will continue to shape global supply chain dynamics.

- National Security Implications: Critical technologies, like advanced semiconductors, are increasingly viewed through a national security lens, leading to stricter controls.

- Supply Chain Resilience Mandates: Governments may impose requirements for companies to demonstrate and maintain resilient supply chain operations.

Geopolitical tensions continue to reshape global supply chains, with a notable trend towards regionalization and nearshoring in the electronics sector. This shift, driven by concerns over trade restrictions and national security, directly impacts component sourcing and pricing for distributors like DigiKey.

Government initiatives, such as the U.S. CHIPS and Science Act, are actively promoting domestic semiconductor manufacturing, allocating significant funds to bolster local production. This policy shift influences where components are made and can create new competitive dynamics for global distributors.

Export controls and sanctions remain a critical factor, with regulations like the U.S. Department of Commerce's Entity List restricting the flow of advanced technologies. DigiKey must maintain rigorous compliance to navigate these evolving trade landscapes and prevent violations.

The political stability of key manufacturing regions directly affects the predictability of the regulatory environment for electronics distribution. Fluctuations in trade agreements and industrial policies necessitate ongoing adaptation in supply chain and pricing strategies.

| Policy/Initiative | Key Aspect | Impact on DigiKey (Potential) | Year of Enactment/Focus |

|---|---|---|---|

| U.S. CHIPS and Science Act | $52 billion for domestic chip production | Shifts sourcing opportunities, potential for increased domestic component availability | 2022 |

| US Export Controls (BIS Entity List) | Restrictions on advanced semiconductors | Requires strict compliance, potential market access limitations | Ongoing (updates) |

| Trade Tensions (e.g., US-China) | Tariffs and trade friction | Increased component costs, supply chain volatility | Ongoing (fluctuations 2023-2024) |

| Regionalization/Nearshoring Trends | Diversification of manufacturing bases | Need for adaptive sourcing strategies, potential for new supplier relationships | Accelerating (2023-2024) |

What is included in the product

This DigiKey PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, offering a holistic view of its external landscape.

It provides actionable insights and forward-looking perspectives, empowering stakeholders to navigate market complexities and capitalize on emerging opportunities.

A concise, actionable DigiKey PESTLE analysis summary that cuts through complexity, enabling faster strategic decision-making and reducing the anxiety of navigating external market forces.

Economic factors

The global electronic components market is poised for robust expansion, with projections showing continued strong growth through 2025 and beyond. This upward trend is largely fueled by escalating demand from key sectors such as artificial intelligence (AI), the Internet of Things (IoT), automotive technology, and industrial automation. These burgeoning fields are creating a sustained need for advanced and diverse electronic components.

Market size forecasts are particularly encouraging, with the overall electronic components market anticipated to reach significant valuations by 2032, indicating a substantial and enduring opportunity. For instance, some analyses suggest the global semiconductor market alone could approach $1 trillion by the end of the decade, a significant portion of the broader electronic components landscape.

This sustained and increasing demand presents a prime opportunity for DigiKey to not only expand its sales volume but also to capture a larger share of the global market. By effectively meeting the evolving needs of these high-growth sectors, DigiKey can solidify its position as a key supplier in the dynamic electronics industry.

Inflation significantly impacts DigiKey by increasing the cost of labor and raw materials throughout the electronics supply chain. This directly affects the pricing and profit margins on the vast array of electronic components they distribute. For instance, the Producer Price Index for electronic components saw a notable increase in late 2023 and early 2024, reflecting these pressures.

Distributors like DigiKey face the delicate task of absorbing these escalating costs while striving to maintain competitive pricing for their customers. This balancing act is crucial for retaining market share in a price-sensitive industry. The ability to manage these rising expenses effectively through strategic sourcing and operational efficiencies is key to navigating this inflationary period.

While electronic component lead times saw some easing in 2024 compared to the previous year, significant variability remains. For instance, lead times for microcontrollers and certain power management ICs still experienced fluctuations, with some extending beyond 52 weeks in early 2024, though improvements were noted for more common passive components. This ongoing unpredictability underscores the critical need for distributors like DigiKey to maintain agile inventory management and resilient supply chain strategies.

DigiKey's ability to ensure prompt delivery for both small-scale prototyping needs and larger production runs is directly tied to how effectively they navigate these fluctuating lead times. By strategically managing inventory levels and diversifying sourcing options, DigiKey can mitigate the impact of potential sporadic shortages, a key concern for their diverse customer base in 2024 and heading into 2025.

Impact of Digitalization on B2B Commerce

The B2B e-commerce landscape is transforming, with digital channels increasingly dominating sales interactions. Projections indicate that by 2025, a substantial portion of B2B transactions will be conducted online, underscoring the critical need for sophisticated digital platforms and seamless purchasing journeys.

DigiKey’s established and comprehensive online presence places it in a strong position to benefit from this accelerating digitalization. The company’s investment in its digital infrastructure directly addresses the growing demand for efficient and accessible online procurement solutions within the B2B sector.

- B2B E-commerce Growth: The global B2B e-commerce market is projected to reach $35.3 trillion by 2027, up from $27.7 trillion in 2022, demonstrating a significant upward trend.

- Digital Sales Dominance: By 2025, it's estimated that over 80% of all B2B sales interactions will be managed digitally, reflecting a fundamental shift in buyer behavior.

- Platform Importance: Companies with robust, user-friendly online platforms are better equipped to capture market share in this evolving digital marketplace.

Investment in Advanced Manufacturing

Global investment in advanced manufacturing, especially semiconductors, is projected to surge in 2025, with estimates suggesting over $200 billion in new fabrication facilities being planned or under construction worldwide. This push aims to bolster production capacity and address ongoing supply chain vulnerabilities. These significant capital expenditures are driven by both government incentives and private sector demand for more resilient and localized component sourcing.

This trend directly impacts component distributors like DigiKey by promising a more stable and diversified supply of critical parts. For instance, the US CHIPS and Science Act alone allocated $52.7 billion for semiconductor manufacturing and research, with many of these investments expected to yield results by 2025. Such initiatives are designed to reduce reliance on single regions and foster a more predictable market for electronic components.

The economic implications include potential price stabilization for advanced components as capacity increases and greater availability of next-generation technologies. This heightened investment signifies a strategic shift towards onshoring and nearshoring manufacturing, which could lead to reduced lead times and improved inventory management for businesses relying on these advanced materials.

- $200 Billion+ projected global investment in new semiconductor fabrication facilities by 2025.

- US CHIPS and Science Act provides $52.7 billion to boost domestic semiconductor production.

- Diversified Supply Chains expected to improve component availability and reduce lead times.

- Price Stabilization anticipated as increased manufacturing capacity comes online.

Inflationary pressures continue to affect the electronics industry, with the Producer Price Index for electronic components showing an upward trend in late 2023 and early 2024. This directly impacts DigiKey's costs for labor and raw materials, necessitating careful pricing strategies to maintain competitiveness. Navigating these rising expenses through efficient sourcing and operations is crucial for DigiKey's market position.

Lead times for certain electronic components, such as microcontrollers, remained variable into early 2024, with some exceeding 52 weeks, although improvements were noted for more common parts. DigiKey must maintain agile inventory management and robust supply chains to ensure consistent delivery for its diverse customer base through 2025.

Global investment in advanced manufacturing, particularly semiconductors, is set to exceed $200 billion by 2025, driven by initiatives like the US CHIPS and Science Act. This surge in production capacity is expected to lead to greater component availability and potential price stabilization, benefiting distributors like DigiKey and their customers.

Preview the Actual Deliverable

DigiKey PESTLE Analysis

The preview shown here is the exact DigiKey PESTLE analysis document you’ll receive after purchase—fully formatted and ready to use. You'll gain a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting DigiKey.

Sociological factors

The widespread adoption of smart and connected devices, from the Internet of Things (IoT) to electric vehicles (EVs) and AI-driven systems, is fueling a substantial demand for electronic components. This trend is evident as consumers and businesses increasingly integrate these technologies into their daily lives and operations, creating a consistent need for diverse and specialized parts.

For instance, the global IoT market was valued at approximately $1.1 trillion in 2023 and is projected to grow to over $2.5 trillion by 2030, according to various market research reports. This expansion directly translates into a higher requirement for sensors, microcontrollers, and connectivity modules, all of which are core offerings for distributors like DigiKey.

The electronics and semiconductor sectors are grappling with a persistent lack of skilled workers, especially in high-demand fields like artificial intelligence and cutting-edge manufacturing. This talent gap directly impedes production capabilities and slows down the pace of innovation, ultimately affecting the availability of essential components.

For instance, a 2024 report indicated that the semiconductor industry alone requires an additional 300,000 workers globally by 2030 to meet projected demand, highlighting the severity of the shortage. This scarcity can lead to increased lead times and upward pressure on component prices as companies compete for limited talent.

Distributors must closely monitor these labor market trends, as they directly influence supply chain stability and component cost structures. Understanding the impact of skilled labor availability is crucial for forecasting inventory needs and managing pricing strategies effectively in the coming years.

The burgeoning DIY and maker culture is significantly reshaping consumer behavior, with individuals increasingly taking on electronics projects. This trend fuels a demand for readily available, smaller quantities of components, a market segment where DigiKey excels through its rapid fulfillment for both prototyping and production.

In 2024, platforms like Etsy and Adafruit reported substantial growth in the maker space, with sales of electronic kits and components seeing double-digit increases year-over-year. This indicates a strong consumer appetite for hands-on creation, directly benefiting distributors like DigiKey that cater to these niche needs.

Customer Expectations for Digital Experience

B2B buyers now demand digital experiences as intuitive and efficient as those found in B2C e-commerce. This means they expect straightforward online navigation, effortless product selection, and a simple purchasing journey, complete with clear visibility into inventory, pricing, and delivery timelines. For instance, a 2024 survey indicated that 78% of B2B buyers prefer to research and order products online independently.

DigiKey's robust online presence, featuring advanced search capabilities, detailed product specifications, and real-time stock availability, directly addresses these shifting customer expectations. Their platform is designed to facilitate self-service, a critical factor as businesses increasingly value speed and convenience in their procurement processes. This focus on digital user experience is a significant competitive advantage.

- B2B Digital Experience Expectations: Buyers want B2C-like online ease for search, selection, and purchase.

- Key Information Demands: Transparency in stock levels, pricing, and delivery is paramount.

- DigiKey's Alignment: The company's extensive online platform meets these evolving customer needs for self-service and convenience.

- Market Trend: Over 70% of B2B purchasing decisions are now made or heavily influenced by digital interactions.

Growing Emphasis on Ethical Sourcing

Societal pressure and corporate responsibility initiatives are increasingly pushing companies like DigiKey to prioritize ethical sourcing and supply chain transparency. Consumers are more aware of the environmental and social footprint of their purchases, demanding that components be sourced responsibly.

This growing concern translates into tangible actions; for instance, a 2024 survey indicated that 72% of consumers are willing to pay more for products from brands committed to ethical sourcing. This trend directly impacts DigiKey's operations, requiring rigorous supplier vetting and a steadfast commitment to ethical standards throughout its supply chain.

- Consumer Demand: A 2024 report found that 68% of consumers consider a company's ethical practices when making purchasing decisions.

- Regulatory Scrutiny: Governments worldwide are introducing stricter regulations on supply chain due diligence, impacting companies that fail to demonstrate ethical sourcing.

- Brand Reputation: Companies with transparent and ethical supply chains, like DigiKey aiming for this, often enjoy enhanced brand loyalty and a stronger market position.

Societal shifts towards sustainability and ethical consumption are increasingly influencing purchasing decisions across all demographics. Consumers and businesses alike are scrutinizing the environmental and social impact of their supply chains, demanding greater transparency and accountability from distributors like DigiKey.

This growing emphasis on corporate social responsibility is not merely a consumer trend but is also being reinforced by evolving regulatory landscapes. Companies that demonstrate a commitment to ethical sourcing and sustainable practices are likely to see enhanced brand reputation and customer loyalty, a crucial factor in the competitive electronics distribution market.

For instance, a 2024 report highlighted that 68% of consumers consider a company's ethical practices when making purchasing decisions, and this sentiment is projected to grow. Furthermore, governmental bodies globally are implementing stricter regulations on supply chain due diligence, compelling businesses to adopt more responsible operational models.

| Societal Factor | Impact on DigiKey | Supporting Data (2024/2025) |

|---|---|---|

| Ethical Consumption | Increased demand for responsibly sourced components and transparent supply chains. | 72% of consumers willing to pay more for ethically sourced products. |

| Sustainability Focus | Pressure to adopt eco-friendly packaging, reduce carbon footprint, and offer sustainable product options. | Growing investor interest in ESG (Environmental, Social, and Governance) factors, influencing corporate valuations. |

| Corporate Social Responsibility (CSR) | Need for robust CSR policies and reporting to maintain brand image and attract talent. | 68% of consumers consider ethical practices in purchasing decisions. |

Technological factors

Technological progress is continuously shrinking electronic components while boosting their power efficiency. This is crucial for creating the next generation of smaller, yet more potent, devices. For instance, advancements in semiconductor manufacturing processes, like those enabling sub-3nm chip production by 2025, directly support this trend.

The burgeoning fields of artificial intelligence (AI), the Internet of Things (IoT), and edge computing are major drivers behind the need for these sophisticated components. The global IoT market, projected to reach over $1.3 trillion by 2026, highlights this escalating demand for specialized, high-performance parts.

DigiKey's product catalog actively mirrors these technological evolutions, showcasing a wide array of cutting-edge components. Their commitment to stocking new product introductions from leading manufacturers ensures customers have access to the latest innovations, from advanced microcontrollers to energy-saving power management ICs.

The digitalization of B2B e-commerce platforms is fundamentally reshaping the electronics component distribution landscape. DigiKey, a leader in this space, leverages advanced data analytics and AI-driven demand forecasting to optimize its operations. For instance, in 2023, DigiKey reported a significant increase in online sales, driven by its user-friendly platform and efficient digital tools.

The integration of IoT for real-time inventory monitoring and AI for personalized customer experiences further enhances DigiKey's competitive edge. This technological evolution allows for more streamlined order management and broader customer engagement, crucial in a fast-paced market where component availability and rapid delivery are paramount.

The integration of Artificial Intelligence (AI) and automation is significantly reshaping operations within electronics distribution. Companies are leveraging these technologies to streamline inventory management, predict demand with greater accuracy, and optimize complex supply chains. For instance, in 2024, many distributors reported a 15-20% improvement in forecast accuracy through AI-powered analytics, leading to reduced stockouts and carrying costs.

AI-driven solutions are empowering distributors to be more agile, anticipating market shifts and customer needs proactively. This enhanced operational flexibility allows for quicker responses to fluctuations in component availability and pricing, a critical factor in the volatile electronics sector. By automating routine tasks and providing advanced analytical insights, these technologies are directly contributing to improved decision-making and overall business efficiency.

Enhanced Cybersecurity Measures

The increasing digitalization and interconnectedness of supply chains elevate cybersecurity to a paramount concern for DigiKey. Companies are making substantial investments in safeguarding both physical and digital assets against escalating cyber threats. This includes implementing stringent vetting procedures for suppliers and adhering to rigorous security standards to protect sensitive data and maintain operational integrity, especially crucial for e-commerce distributors.

In 2024, global spending on cybersecurity is projected to reach $232 billion, reflecting the critical nature of these investments. DigiKey, like many in the electronics distribution sector, must prioritize advanced cybersecurity measures to mitigate risks associated with data breaches and operational disruptions. Adherence to evolving security protocols and the continuous updating of defense mechanisms are essential for maintaining customer trust and business continuity.

- Supplier Vetting: DigiKey likely employs robust processes to assess the cybersecurity posture of its suppliers, ensuring third-party risks are minimized.

- Data Protection: Implementing advanced encryption and access controls is vital for protecting sensitive customer and operational data.

- Compliance: Adhering to industry-specific security standards and regulations (e.g., GDPR, CCPA) is non-negotiable for maintaining legal standing and customer confidence.

- Threat Intelligence: Proactive monitoring and adoption of threat intelligence are crucial for staying ahead of emerging cyber threats.

Predictive Analytics for Supply Chain Optimization

The integration of big data, cloud computing, and advanced analytics is revolutionizing supply chain management, allowing for unprecedented levels of decision-making precision. Predictive modeling, a key component of this technological shift, enables companies like DigiKey to pinpoint and rectify inefficiencies, leading to superior material tracking and operational effectiveness.

This data-centric methodology empowers distributors to fine-tune inventory levels and guarantee punctual deliveries, a critical factor in the fast-paced electronics distribution sector. For instance, advancements in AI-driven demand forecasting have shown the potential to reduce inventory holding costs by up to 20% while simultaneously improving order fulfillment rates.

- Enhanced Demand Forecasting: Leveraging AI and machine learning to predict customer demand with greater accuracy, minimizing stockouts and overstock situations.

- Real-time Visibility: Utilizing IoT sensors and blockchain technology for end-to-end tracking of components, ensuring transparency and security throughout the supply chain.

- Automated Warehouse Operations: Implementing robotic systems and automated guided vehicles (AGVs) to boost efficiency and reduce labor costs in fulfillment centers.

- Proactive Risk Mitigation: Employing predictive analytics to identify potential disruptions, such as supplier issues or geopolitical events, allowing for preemptive action.

Technological advancements are driving miniaturization and efficiency in electronic components, crucial for next-generation devices, with sub-3nm chip production expected by 2025. The growth of AI, IoT, and edge computing fuels demand for these sophisticated parts, with the global IoT market projected to exceed $1.3 trillion by 2026.

DigiKey's commitment to stocking the latest innovations, from advanced microcontrollers to energy-saving ICs, ensures customers access cutting-edge technology. Digitalization of e-commerce, supported by AI-driven forecasting, significantly boosts online sales and operational efficiency, as seen in DigiKey's reported online sales increase in 2023.

AI and automation are transforming electronics distribution by improving inventory management and demand prediction, with distributors reporting 15-20% forecast accuracy improvements in 2024. This agility allows for quicker responses to market shifts and component availability fluctuations.

Cybersecurity is paramount due to increased digitalization, with global spending projected at $232 billion in 2024. DigiKey must prioritize advanced security measures to protect data and operations, with robust supplier vetting and data protection being key strategies.

Legal factors

The global data privacy landscape is a complex and shifting terrain, with significant changes on the horizon. In the United States, 2025 will see a wave of new state-level privacy laws come into effect, adding to the existing patchwork of regulations. For instance, the Minnesota Consumer Data Privacy Act and the Delaware Personal Data Privacy Act are set to take hold, impacting how businesses handle consumer data.

These evolving regulations necessitate that e-commerce entities like DigiKey implement robust privacy policies, establish clear mechanisms for consumers to exercise their data rights, and create effective opt-out procedures. Navigating this fragmented compliance environment requires careful attention to detail and ongoing adaptation to ensure adherence across all relevant jurisdictions.

Consumer electronics safety standards are constantly being updated, with certifications like UL and CE now encompassing newer technologies like wearables and autonomous systems. Failure to meet these evolving requirements can block market entry, especially in key regions like North America and Europe. Distributors are therefore responsible for verifying that the components they offer adhere to the most current safety regulations.

Regulations like the EU's RoHS Directive and REACH are increasingly limiting hazardous substances in electronics, impacting DigiKey's product offerings. Recent updates to China RoHS also add complexity. Furthermore, the growing focus on perfluoroalkyl and polyfluoroalkyl substances (PFAS) presents new compliance challenges. DigiKey and its extensive supplier network must diligently monitor chemical usage and maintain supply chain transparency to ensure market access and avoid penalties.

Extended Producer Responsibility (EPR) Laws

Extended Producer Responsibility (EPR) laws are becoming a significant factor for companies like DigiKey, particularly in the electronics sector. These regulations are expanding globally, pushing manufacturers to manage the entire lifecycle of their products, from creation to end-of-life management like collection and recycling. This shift means a greater emphasis on designing for durability, repairability, and recyclability.

These mandates often translate into concrete actions such as establishing take-back programs and investing in enhanced recycling infrastructure. For instance, the European Union's WEEE (Waste Electrical and Electronic Equipment) Directive, a prominent example of EPR, aims to increase collection rates and ensure proper treatment of e-waste. In 2023, the EU reported a collection rate of 45.7% for WEEE, with targets to reach 65% by 2028, highlighting the growing compliance burden.

While EPR laws directly target manufacturers, their impact ripples through the entire supply chain, including distributors. DigiKey, as a distributor, needs to ensure its suppliers are compliant and potentially facilitate take-back or recycling initiatives. The financial implications can be substantial, involving fees for recycling services or investments in product design modifications.

- Global Expansion: EPR laws for electronics are increasingly adopted worldwide, creating a complex regulatory landscape for global distributors.

- Lifecycle Responsibility: Manufacturers, and by extension their supply chain partners, are now accountable for product collection, reuse, recycling, and disposal.

- Design for Sustainability: Regulations encourage product design that prioritizes repairability and recyclability, impacting product development cycles.

- Financial Impact: Compliance costs can include fees for recycling services, administrative overhead, and potential investments in reverse logistics infrastructure.

International Trade and Customs Compliance

International trade laws, tariffs, and customs regulations significantly influence DigiKey's ability to source and distribute electronic components globally. These rules are dynamic, requiring constant vigilance to ensure compliance. For instance, the Basel Convention, which governs the transboundary movement of hazardous wastes and their disposal, has amendments taking effect in 2025 that will impose stricter controls on e-waste shipments, potentially impacting the logistics of component returns or recycling programs.

DigiKey's extensive international footprint means navigating a labyrinth of varying import/export duties and compliance standards across numerous countries. Failure to adhere to these can result in delays, penalties, and increased operational costs. The World Trade Organization (WTO) reported that global trade in goods saw a 0.6% increase in 2024, but also highlighted ongoing challenges with protectionist measures and complex customs procedures in various regions, underscoring the importance of DigiKey's robust compliance framework.

Key considerations for DigiKey's international trade and customs compliance include:

- Tariff Rate Quotas (TRQs): Monitoring and managing import duties that may fluctuate based on volume or specific trade agreements.

- Export Controls: Ensuring compliance with regulations on the export of sensitive technologies or components to specific countries.

- Customs Valuation: Accurately declaring the value of goods to avoid under or overpayment of duties.

- Product Classification: Correctly classifying components under the Harmonized System (HS) codes to determine applicable duties and regulations.

The evolving digital privacy landscape presents significant legal challenges for companies like DigiKey. With new state-level privacy laws like the Minnesota Consumer Data Privacy Act and the Delaware Personal Data Privacy Act coming into effect in 2025, DigiKey must ensure robust data handling practices and transparent consumer rights mechanisms across its operations.

Compliance with chemical substance regulations, such as the EU's RoHS Directive, REACH, and updated China RoHS, remains critical. The increasing scrutiny on substances like PFAS adds another layer of complexity, requiring DigiKey to maintain diligent monitoring of chemical usage throughout its supply chain to avoid market access issues and penalties.

Extended Producer Responsibility (EPR) laws, particularly the EU's WEEE Directive, are expanding globally. These regulations mandate greater responsibility for product end-of-life management, impacting DigiKey by requiring its suppliers to design for recyclability and potentially involving DigiKey in collection and recycling initiatives, as evidenced by the EU's target to increase WEEE collection rates.

Environmental factors

The escalating global e-waste problem is driving more stringent recycling laws. By January 1, 2025, new international rules under the Basel Convention will require prior informed consent for e-waste shipments, increasing compliance burdens for companies like DigiKey.

These evolving regulations mean manufacturers and distributors must invest in and implement comprehensive e-waste management and recycling programs. This includes ensuring responsible disposal practices and potentially setting up take-back schemes to handle end-of-life electronics effectively.

The electronics industry, including distribution giants like DigiKey, faces mounting pressure to adopt more sustainable practices. This includes a significant focus on reducing carbon emissions throughout the supply chain, enhancing the management of electronic waste, and ensuring that raw materials are sourced with environmental responsibility in mind.

Companies are actively optimizing their logistics to cut down on transportation-related emissions, a key component of their environmental footprint. Furthermore, there's a concerted effort to boost energy efficiency in operations and increasingly invest in renewable energy sources to power facilities. For instance, many logistics companies are exploring electric vehicle fleets for last-mile deliveries, aiming to reduce localized pollution.

DigiKey, as a major global distributor, is intrinsically linked to these industry-wide sustainability efforts. Their role involves not only their own operational efficiency but also influencing and supporting the environmental commitments of their suppliers and customers. This push is driven by both regulatory changes and growing consumer demand for eco-conscious products and services.

Manufacturing electronic components, especially semiconductors, demands substantial resources. This process uses significant quantities of water and energy, contributing to greenhouse gas emissions. For instance, water usage in semiconductor fabrication can be extremely high, with some plants requiring millions of gallons per day.

The electronics industry is actively working to lessen its environmental footprint. This includes efforts to improve energy efficiency, reduce water consumption, and manage waste more effectively. Many companies are setting ambitious sustainability goals, aiming for carbon neutrality in their manufacturing operations by 2030 or 2040.

Distributors like DigiKey feel these upstream pressures indirectly. As their suppliers face increasing scrutiny and regulations regarding environmental impact, they are compelled to adopt more sustainable practices. This can influence supply chain costs and availability, as manufacturers invest in cleaner technologies and processes.

Transition to a Circular Economy

Governments and industries are actively pushing for a shift from traditional linear "take-make-dispose" models to circular economy principles within the technology sector. This means a greater focus on creating products that are built to last, easy to fix, and readily recyclable.

By 2025, new legislation is anticipated to mandate that companies design electronics with enhanced repairability and recyclability in mind. The goal is to significantly prolong the usable life of devices and drastically cut down on electronic waste.

This evolving environmental focus directly influences how DigiKey approaches product design and manages the entire lifecycle of the components it distributes.

- Extended Producer Responsibility (EPR) regulations are expanding globally, placing more onus on manufacturers and distributors to manage end-of-life product streams.

- The European Union's Ecodesign Directive, updated in late 2024, includes stricter requirements for product durability and repairability for various electronic goods.

- Consumer demand for sustainable products is on the rise, with a 2025 survey indicating that over 60% of tech consumers consider environmental impact when making purchasing decisions.

- The global e-waste generation is projected to reach 74 million metric tons by 2030, underscoring the urgency of circular economy initiatives.

Logistics and Transportation Environmental Footprint

The environmental impact of logistics and transportation is a significant concern for global distributors like DigiKey. As pressure mounts to reduce emissions and optimize routes, companies are investing in smart logistics solutions and enhancing energy efficiency within their transportation fleets. For instance, the International Transport Forum reported in 2024 that freight transport emissions are projected to increase by 130% by 2050 without strong policy interventions, highlighting the urgency for DigiKey to address its logistical footprint.

DigiKey's extensive global reach necessitates a keen focus on its logistical operations to mitigate environmental impact. The company's commitment to sustainability means actively exploring ways to minimize the carbon intensity of its shipping and warehousing activities. This includes optimizing packaging to reduce waste and exploring partnerships with carriers employing greener technologies.

- Emissions Reduction: Global freight transport emissions are a critical area, with the EU aiming for a 90% reduction in transport emissions by 2050, influencing supply chain practices.

- Smart Logistics: Adoption of route optimization software and AI-driven inventory management can significantly cut down on fuel consumption and delivery times.

- Fleet Efficiency: Investments in electric or alternative fuel vehicles for last-mile delivery are becoming increasingly common, with companies like Amazon aiming for 100% electric delivery fleets by 2030.

- Supply Chain Transparency: Customers increasingly demand visibility into the environmental impact of their purchases, pushing companies to provide data on their logistics' carbon footprint.

Environmental regulations are tightening globally, impacting the electronics distribution sector. By 2025, new rules will mandate stricter e-waste management, pushing companies like DigiKey to invest in responsible disposal and recycling programs.

The industry faces pressure to adopt sustainable practices, focusing on carbon emission reduction and ethical material sourcing. This includes optimizing logistics for lower transport emissions and increasing energy efficiency, with a growing trend towards renewable energy sources for operations.

Circular economy principles are gaining traction, promoting product longevity, repairability, and recyclability. This shift influences product design and lifecycle management, as seen with the EU's Ecodesign Directive updates in late 2024.

Consumer demand for eco-friendly products is rising, with a significant portion of tech buyers considering environmental impact. Global e-waste generation is projected to reach 74 million metric tons by 2030, underscoring the need for these initiatives.

| Environmental Factor | Impact on DigiKey | 2024/2025 Data/Trend |

|---|---|---|

| E-waste Regulations | Increased compliance costs, need for take-back programs | Basel Convention e-waste rules effective Jan 1, 2025 |

| Carbon Emissions | Pressure to reduce supply chain footprint | Global freight transport emissions projected to increase 130% by 2050 without intervention (ITF 2024) |

| Circular Economy | Focus on product durability, repairability, and recyclability | EU Ecodesign Directive updated late 2024 |

| Consumer Demand | Growing preference for sustainable products | Over 60% of tech consumers consider environmental impact (2025 survey) |

PESTLE Analysis Data Sources

Our DigiKey PESTLE Analysis is meticulously constructed using data from reputable sources including government publications, international financial institutions, and leading market research firms. This ensures our insights into political, economic, social, technological, legal, and environmental factors are accurate and actionable.