DigiKey Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DigiKey Bundle

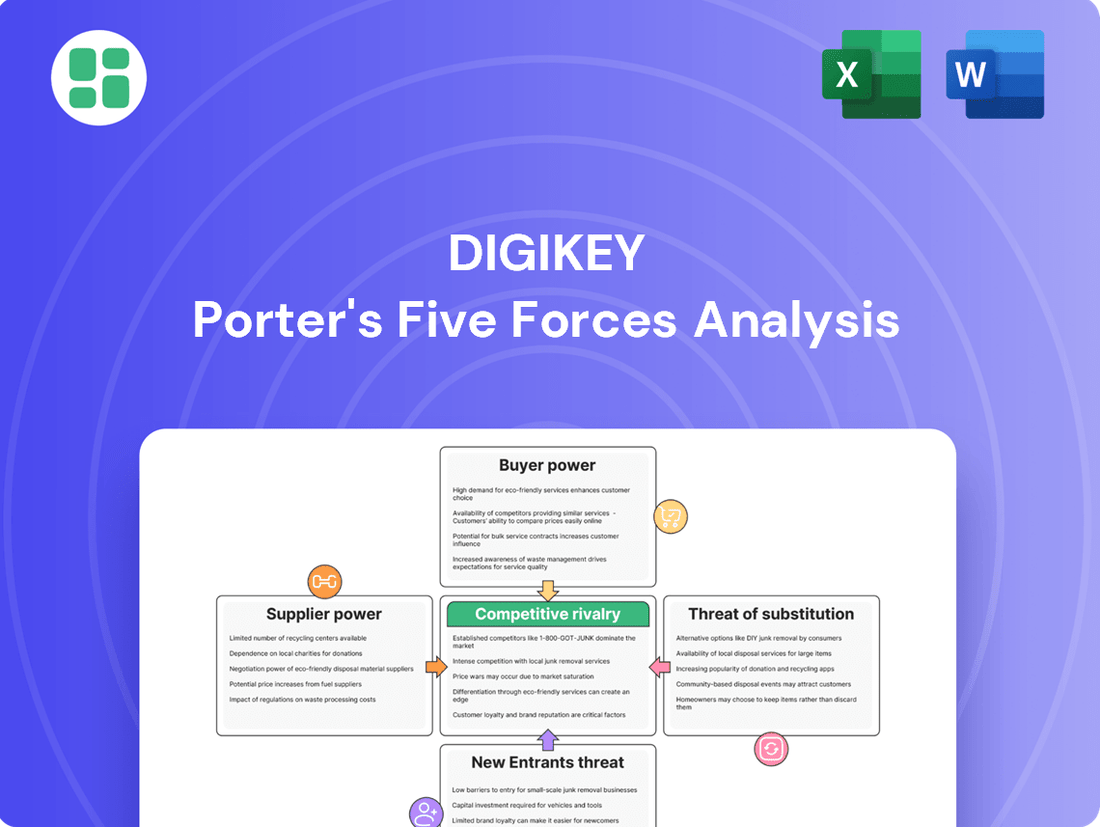

DigiKey operates within a dynamic electronics distribution landscape, where understanding competitive pressures is paramount. Our Porter's Five Forces analysis reveals the intricate interplay of buyer power, supplier leverage, and the threat of new entrants, all shaping DigiKey's market position.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore DigiKey’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

DigiKey sources its vast array of electronic components from a multitude of manufacturers worldwide. This broad supplier base generally dilutes the bargaining power of any single supplier, as DigiKey can often find alternative sources for most items. For instance, in 2023, DigiKey offered over 13.4 million distinct products from more than 2,300 manufacturers, underscoring its diversified sourcing strategy.

However, the landscape isn't uniformly balanced. Certain highly specialized or proprietary electronic components, essential for advanced technologies, might originate from a very limited number of manufacturers. In such cases, these few suppliers can exert significant leverage over DigiKey due to the unique nature and limited availability of their products.

The global electronics market has experienced notable supply chain disruptions and persistent shortages for specific critical components in recent years, including through 2024. Events like the semiconductor shortage have temporarily amplified the bargaining power of suppliers, allowing them to dictate terms and pricing more assertively when demand outstrips supply for particular parts.

DigiKey's extensive global reach and established customer base are invaluable for many component manufacturers, particularly smaller ones or those needing to serve a wide range of order volumes from prototypes to mass production. This broad market access means suppliers often rely on DigiKey to connect with a diverse set of buyers, thereby diminishing their individual bargaining leverage.

For instance, in 2023, DigiKey reported a significant increase in its customer base, serving over 1.5 million customers worldwide. This vast network means a single supplier's ability to dictate terms is often constrained by DigiKey's capacity to source similar components from numerous alternative manufacturers, further strengthening DigiKey's position.

For common electronic components, DigiKey faces minimal switching costs due to a broad supplier base and readily available alternatives. This means they can often shift sourcing without significant disruption or expense for standard parts.

However, the picture changes for specialized or proprietary components. In these cases, switching suppliers can incur substantial costs for DigiKey. These include the time and resources needed for rigorous supplier qualification, potential adjustments to technical support infrastructure, and the risk of impacting customer product designs and timelines, which can lead to higher overall switching expenses.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into the distribution of electronic components, like DigiKey, is generally low. While a few very large manufacturers might sell directly to major original equipment manufacturers (OEMs), the vast majority of DigiKey's customers are engineers, designers, and procurement professionals who require a wide variety of components in diverse quantities. For most suppliers, serving this fragmented market directly would be inefficient and costly, thus limiting their incentive to pursue widespread forward integration.

This dynamic is reflected in the market structure. For instance, in 2023, the global electronic components distribution market was valued at approximately $114 billion, with DigiKey holding a significant share in the broadline distribution segment. The sheer breadth of DigiKey's catalog, stocking millions of parts from thousands of manufacturers, makes it a challenging and uneconomical proposition for individual component manufacturers to replicate this service model across their entire product lines and customer base.

- Fragmented Customer Base: DigiKey serves a broad spectrum of customers, from individual engineers to large corporations, each with varying needs for component types and quantities.

- Supplier Inefficiency: Direct sales by component manufacturers to this diverse customer base would be logistically complex and less cost-effective than utilizing established distributors.

- Market Size and Scope: The extensive product offering of distributors like DigiKey, stocking millions of SKUs, is difficult for individual suppliers to match through direct channels.

Uniqueness of Components

DigiKey's extensive product catalog, which features both widely available commodity components and highly specialized, niche parts, directly impacts supplier bargaining power. Suppliers offering unique, cutting-edge, or difficult-to-source components, particularly those crucial for rapidly advancing fields such as artificial intelligence (AI) and 5G telecommunications, possess significant leverage. This is due to the inherent scarcity and critical importance of their specialized offerings in the current technological landscape.

The bargaining power of suppliers for DigiKey is notably influenced by the uniqueness of the components they provide. For instance, suppliers of advanced semiconductor chips essential for AI-powered devices or specialized connectors for 5G infrastructure can command higher prices and more favorable terms. In 2023, the global market for AI hardware saw significant growth, with the AI chip market alone projected to reach over $100 billion by 2027, indicating the high value placed on such unique components.

- Suppliers of specialized components for emerging technologies like AI and 5G hold greater bargaining power.

- The scarcity and critical nature of these unique parts increase their leverage over distributors like DigiKey.

- This dynamic can lead to higher component costs for DigiKey, potentially impacting its pricing and margins.

DigiKey's bargaining power with suppliers is generally moderate, largely due to its vast network of over 2,300 manufacturers and a catalog exceeding 13.4 million products in 2023. This broad sourcing strategy dilutes the power of any single supplier for common components. However, suppliers of highly specialized or proprietary parts, especially for burgeoning fields like AI and 5G, can exert considerable leverage due to the limited availability and critical demand for their unique offerings, as seen in the booming AI hardware market in 2024.

| Factor | Impact on Supplier Bargaining Power | Reasoning |

|---|---|---|

| Supplier Concentration | Low for commodity parts, High for specialized parts | Many suppliers for standard components; few for unique, high-demand tech parts. |

| Switching Costs | Low for standard parts, High for specialized parts | Easy to find alternatives for common items; difficult and costly for unique, integrated components. |

| Forward Integration Threat | Low | Distributors like DigiKey efficiently serve a fragmented customer base that manufacturers find costly to reach directly. |

| Component Uniqueness | High | Suppliers of critical AI or 5G components have significant leverage due to scarcity and demand. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to DigiKey's position as an electronic component distributor.

Instantly visualize competitive pressures with a dynamic, interactive dashboard, simplifying complex market dynamics for informed strategic choices.

Customers Bargaining Power

Customer price sensitivity at DigiKey can vary significantly. Individual engineers ordering small quantities for prototypes often prioritize speed and availability over minor price differences, reflecting the urgency of their design cycles.

However, when large production volumes are involved, customers become much more price-conscious. This is particularly true in the competitive electronics manufacturing sector, where even small cost savings per unit can translate to substantial overall expenses.

For instance, in 2024, the average selling price for many electronic components remained under pressure due to oversupply in certain categories following the pandemic-induced shortages. This environment amplifies the bargaining power of high-volume buyers who can leverage competitive quotes from multiple distributors, including DigiKey, to negotiate better terms.

Customers possess considerable bargaining power due to the widespread availability of substitutes. Major global distributors such as Mouser and Arrow, alongside numerous smaller, specialized distributors, offer a vast array of electronic components.

For exceptionally large orders, customers can even bypass distributors and source directly from manufacturers. This broad accessibility to alternative purchasing channels significantly empowers customers in their negotiations with DigiKey.

Switching between major electronic component distributors such as DigiKey, Mouser, and Arrow typically involves moderate switching costs for customers. These costs are primarily tied to the time and effort required to become familiar with a new platform's interface, re-establish account details, and re-integrate any previously saved design resources or order histories. For instance, a customer accustomed to DigiKey's extensive search filters and saved project lists might find it inconvenient to replicate that workflow on a competitor's site.

However, the digital landscape significantly lowers these barriers. The prevalence of online comparison shopping, where customers can easily check pricing, availability, and datasheets across multiple distributors simultaneously, effectively mitigates many of these traditional switching costs. This ease of access to information means that a customer can quickly evaluate alternatives, reducing the perceived risk and effort associated with changing suppliers.

Customer Volume and Concentration

DigiKey's customer base is notably broad, which inherently dilutes the bargaining power of any single customer. This wide distribution means that no single client typically represents a overwhelming percentage of DigiKey's revenue, limiting their ability to dictate terms based on sheer volume alone. For instance, in 2023, DigiKey continued to serve hundreds of thousands of customers globally, with no single customer accounting for more than a small fraction of total sales.

However, the landscape isn't entirely uniform. Very large corporate or industrial clients, particularly those placing substantial production orders, can still wield considerable influence. Their significant purchasing volume and strategic importance to DigiKey's overall sales figures can translate into greater leverage when negotiating pricing or terms. This concentration of purchasing power, even within a diverse market, remains a key consideration for DigiKey.

- Diverse Customer Base: DigiKey's strength lies in its vast and varied customer network, preventing over-reliance on any single entity.

- Volume Buyers: Large industrial clients and major corporations represent a segment where concentrated purchasing power can increase customer bargaining influence.

- Strategic Importance: The strategic value of securing large, consistent orders from key accounts can empower these customers in negotiations.

Information Availability and Technical Support

DigiKey's commitment to providing extensive technical resources and support significantly enhances its value proposition. This deep well of information, including datasheets, application notes, and design tools, empowers customers by making them more informed. For instance, in 2023, DigiKey reported over 12 million visitors to its website, with a substantial portion engaging with its technical content. This readily available, high-quality technical support can lessen a customer's bargaining power, as finding comparable, easily accessible expertise elsewhere might be challenging or costly.

The availability of comprehensive technical data directly impacts customer decision-making. When customers can readily access detailed specifications, comparison tools, and expert articles, they become less reliant on suppliers for basic product information. This self-sufficiency can reduce their leverage in price negotiations or other terms. DigiKey's investment in these resources, evidenced by their continuously updated online library, directly contributes to this dynamic.

- Extensive Technical Content: DigiKey offers a vast repository of datasheets, application notes, and design resources.

- Customer Empowerment: This readily available information allows customers to make more informed purchasing decisions independently.

- Reduced Reliance: Customers are less dependent on supplier sales representatives for basic product knowledge, potentially weakening their bargaining position.

- Competitive Differentiator: High-quality, accessible technical support is a key differentiator that competitors may struggle to match.

DigiKey's customer bargaining power is influenced by price sensitivity, the availability of substitutes, and switching costs. While a broad customer base generally dilutes individual power, large-volume buyers can exert significant influence, especially in 2024's competitive component market where price pressure is high. The ease of comparing prices and specs online among distributors like Mouser and Arrow, alongside the option for direct manufacturer sourcing for massive orders, further empowers customers.

DigiKey's extensive technical resources, accessed by millions of users annually, reduce customer reliance on suppliers for information, potentially weakening their negotiation leverage. However, the moderate switching costs associated with changing distributors, primarily related to platform familiarity and data integration, are mitigated by digital comparison tools.

| Factor | Impact on DigiKey Customer Bargaining Power | Supporting Data/Observation (as of 2024) |

|---|---|---|

| Price Sensitivity | High for volume orders, moderate for prototypes. | Oversupply in certain component categories in 2024 increased price pressure on high-volume buyers. |

| Availability of Substitutes | High. | Major competitors (Mouser, Arrow) and numerous smaller distributors offer similar product ranges. Direct sourcing from manufacturers is possible for very large orders. |

| Switching Costs | Moderate, but significantly lowered by digital tools. | Costs involve platform learning and data re-integration, but online comparison shopping simplifies evaluation of alternatives. |

| Customer Concentration | Low overall, but significant for key accounts. | DigiKey serves hundreds of thousands of customers globally, with no single customer dominating revenue, though large corporate clients hold sway. |

| Technical Resources | Reduces customer reliance, potentially lowering bargaining power. | Over 12 million website visitors in 2023 engaged with DigiKey's technical content, enabling informed decisions. |

Same Document Delivered

DigiKey Porter's Five Forces Analysis

This preview showcases the complete DigiKey Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the electronic component distribution industry. The document you see here is precisely the same professionally formatted and detailed analysis you will receive immediately after purchase, ensuring you get exactly what you expect.

Rivalry Among Competitors

The electronic component distribution market is intensely competitive, featuring a few dominant global players like DigiKey, Mouser Electronics, and Arrow Electronics, alongside a multitude of smaller, niche distributors. This crowded landscape fosters significant rivalry across all market segments.

In 2024, the electronic component distribution sector continues to be characterized by a high degree of fragmentation. While DigiKey, Mouser, and Arrow Electronics represent substantial market share, the presence of hundreds of smaller, often regionally focused or specialized distributors intensifies competitive pressures. This diversity means that customers have a wide array of choices, forcing all players to constantly innovate and optimize their offerings to maintain market position.

The electronic component market is poised for robust expansion, with forecasts indicating a 4.7% compound annual growth rate (CAGR) between 2025 and 2033. This surge is fueled by the increasing demand from burgeoning sectors like the Internet of Things (IoT), 5G technology, artificial intelligence (AI), and the automotive industry.

While such healthy growth typically moderates competitive intensity, the electronic component landscape remains fiercely contested. Established players and emerging companies alike are aggressively pursuing market share within these high-growth segments, ensuring that rivalry remains a significant factor.

DigiKey stands out by offering an exceptionally broad inventory of electronic components, coupled with rapid delivery for both small-scale prototypes and large production runs. Their robust online platform and wealth of technical resources further enhance their differentiation.

Competitors are not standing still, often focusing on their own unique product selections, delivery efficiency, and value-added services. These can include crucial design support for engineers and sophisticated supply chain management solutions, all of which contribute to a highly competitive landscape.

Exit Barriers

High capital investment in inventory, sophisticated logistics, and strong supplier ties act as significant exit barriers for major electronics distributors like DigiKey. These factors make it difficult and costly for companies to leave the market, encouraging them to stay and compete fiercely, which in turn sustains intense rivalry.

For instance, maintaining extensive and diverse inventories, a hallmark of distributors like DigiKey, requires substantial upfront capital. In 2023, the global electronics distribution market was valued at over $400 billion, with inventory holding costs representing a significant portion of operational expenses for leading players.

Furthermore, the specialized nature of logistics infrastructure, including warehousing and global shipping capabilities, represents another substantial investment. Companies that have built out these networks face considerable sunk costs, further discouraging market exit. Established relationships with suppliers, often built over years, also create a sticky environment, making it challenging for a departing firm to liquidate assets or transfer these crucial connections.

- High Capital Investment: Significant funds are tied up in maintaining a broad and deep inventory of electronic components.

- Logistics Infrastructure: Specialized warehousing, supply chain management systems, and global distribution networks are costly to establish and maintain.

- Supplier Relationships: Long-standing partnerships with manufacturers can be difficult to sever or transfer, creating a barrier to exit.

- Sustained Rivalry: These exit barriers compel distributors to remain competitive within the market, rather than seeking to leave.

Market Share and Aggressiveness of Competitors

DigiKey, Mouser, and Arrow are locked in an intense battle for market share, each aggressively expanding their supplier relationships and product offerings.

This rivalry is further fueled by significant investments in digital transformation, including the integration of artificial intelligence, aiming to enhance customer experience and operational efficiency.

- Supplier Partnerships: Competitors are actively securing exclusive or expanded agreements with key component manufacturers.

- Product Portfolio Expansion: Companies are broadening their catalogs to offer a more comprehensive range of electronic components and related products.

- Digital Capabilities: Investments in e-commerce platforms, data analytics, and AI are central to differentiating and capturing market share.

In 2024, the electronic component distribution market is characterized by this heightened competition, with companies striving to outmaneuver rivals through innovation and strategic alliances.

Competitive rivalry within the electronic component distribution market is exceptionally fierce. DigiKey, Mouser Electronics, and Arrow Electronics, alongside numerous smaller players, are constantly vying for customer attention and market share. This intense competition is driven by a shared focus on expanding supplier relationships and product portfolios.

Companies are making substantial investments in digital transformation, particularly in areas like artificial intelligence, to enhance customer experience and operational efficiency. This strategic push aims to create a competitive edge in a market where differentiation is key.

| Key Competitor Actions | Focus Area | Impact on Rivalry |

|---|---|---|

| Expanding supplier agreements | Securing exclusive or broader partnerships with component manufacturers | Intensifies competition for component access and pricing |

| Broadening product catalogs | Offering a more comprehensive range of electronic components and related items | Increases customer choice and forces competitors to match breadth |

| Investing in digital capabilities (AI, e-commerce) | Enhancing online platforms, data analytics, and customer service | Drives innovation and creates a gap between digitally advanced and lagging firms |

SSubstitutes Threaten

Large original equipment manufacturers (OEMs) can bypass distributors like DigiKey by sourcing components directly from manufacturers, especially for high-volume, long-term production. This direct sourcing represents a significant threat of substitutes for DigiKey. In 2023, the global electronics manufacturing services market, which includes OEM activity, was valued at approximately $64.8 billion, indicating the scale of potential direct sourcing.

The threat of substitutes for electronic components is significant, driven by rapid technological advancements. Innovations like System-on-Chip (SoC) designs and highly integrated modules are increasingly replacing multiple discrete components, streamlining product development and reducing costs for manufacturers. For instance, the global SoC market was valued at approximately $220 billion in 2023 and is projected to grow substantially, indicating a shift away from traditional component sourcing.

The rise of open-source hardware and DIY ecosystems presents a growing threat of substitutes for traditional electronics distributors like DigiKey. For prototype and hobbyist markets, readily available development kits and open-source platforms allow individuals to source components and assemble projects with less reliance on established supply chains. This trend effectively offers a partial substitute for certain customer segments who can find alternative, often lower-cost, solutions outside of traditional distribution channels.

Component Obsolescence and Lifecycle Management

The threat of substitutes for DigiKey is significantly influenced by component obsolescence and the effectiveness of lifecycle management. As technology rapidly advances, electronic components can quickly become outdated. This forces customers to consider newer, more advanced alternatives or even complete product redesigns rather than continuing to source older, potentially unavailable parts.

This dynamic presents a clear substitute threat. For example, a company relying on a legacy microcontroller might find it more cost-effective and strategically advantageous to adopt a newer generation chip with enhanced features and better long-term support, rather than struggling to find diminishing supplies of the obsolete part through distributors like DigiKey.

- Component Obsolescence: The rapid pace of technological innovation leads to the swift obsolescence of electronic components, creating a natural substitution cycle.

- Customer Preference for Newer Tech: Customers increasingly favor newer, more efficient components, often opting for complete redesigns over sourcing outdated parts.

- Supply Chain Strain: As components become scarce, the difficulty and cost of sourcing them through distributors like DigiKey increase, further incentivizing the adoption of substitutes.

- Strategic Redesign: Businesses may proactively redesign products around newer, more readily available, and technologically superior components to ensure future viability and competitive advantage.

Software-Defined Solutions

Software-defined solutions present an indirect threat by potentially reducing the need for specialized hardware in certain applications. For instance, the growth of cloud computing and virtualization allows functions previously requiring dedicated hardware to be performed by software running on general-purpose servers. This shift can decrease demand for specific electronic components that form the backbone of traditional hardware-centric solutions.

The market for software-defined networking (SDN) alone was projected to reach over $10 billion by 2024, indicating a significant move towards software-based control and functionality. Similarly, the increasing adoption of Network Functions Virtualization (NFV) allows telecom operators to replace proprietary hardware appliances with software running on standard IT infrastructure. This trend directly impacts the sales of hardware vendors in that sector.

- Software-Defined Networking (SDN): Market expected to exceed $10 billion in 2024, enabling flexible network management through software.

- Network Functions Virtualization (NFV): Allows telecom companies to replace dedicated hardware with software, impacting demand for specialized network appliances.

- Virtualization in Data Centers: Software-based solutions for storage and compute reduce reliance on specific hardware configurations.

- Impact on Electronic Components: A shift towards software-defined architectures can lead to a decrease in demand for certain, highly specialized hardware components.

The threat of substitutes for DigiKey is multifaceted, encompassing direct sourcing by large OEMs, technological advancements like SoCs, the rise of open-source hardware, and the increasing obsolescence of components. Software-defined solutions also pose an indirect threat by reducing the need for specific hardware. For instance, the global SoC market was valued around $220 billion in 2023, highlighting a significant shift towards integrated solutions that can replace multiple discrete components.

Customers increasingly opt for newer, more efficient components, sometimes leading to complete product redesigns rather than sourcing older, potentially unavailable parts. This preference, coupled with supply chain strains for scarce components, drives customers towards alternative solutions. For example, a company might switch to a newer microcontroller, a clear substitute for an older, obsolete one, to ensure future viability.

Software-defined approaches, such as Software-Defined Networking (SDN), projected to exceed $10 billion in 2024, also reduce reliance on specialized hardware. This trend impacts demand for specific electronic components by enabling functions to be handled by software on general-purpose servers.

| Threat Type | Description | Example/Data Point |

| Direct Sourcing | Large OEMs bypass distributors for direct component purchase. | Global electronics manufacturing services market valued at ~$64.8 billion in 2023. |

| Technological Advancements | Integrated solutions like SoCs replace discrete components. | Global SoC market valued at ~$220 billion in 2023. |

| Open-Source Hardware | DIY ecosystems offer alternative sourcing for hobbyists and prototypes. | Growth in development kits and open-source platforms. |

| Component Obsolescence | Rapid tech evolution makes components outdated, prompting redesigns. | Shift towards newer generation chips with better support. |

| Software-Defined Solutions | Software replaces dedicated hardware functions. | SDN market projected to exceed $10 billion in 2024. |

Entrants Threaten

Establishing a global e-commerce distribution business akin to DigiKey demands significant capital. This includes substantial upfront investment in a vast and diverse inventory, the development and maintenance of a sophisticated, user-friendly online platform, and the creation of extensive warehousing and logistics networks. These considerable financial outlays act as a formidable barrier, deterring potential new entrants.

For instance, companies like DigiKey invest billions in inventory management and supply chain infrastructure. In 2024, the semiconductor distribution market alone is valued in the hundreds of billions, with major players like DigiKey holding billions in inventory to ensure product availability and rapid delivery. This scale of investment is difficult for smaller, new companies to match, effectively limiting the threat of new entrants.

New entrants struggle to secure access to the vast array of electronic component manufacturers that DigiKey already partners with. Building these supplier relationships takes considerable time and resources, creating a substantial barrier to entry.

Establishing efficient global distribution networks is another hurdle. DigiKey's established logistics infrastructure and worldwide reach, honed over years of operation, make it difficult for newcomers to compete on delivery speed and cost.

Existing customers often have established relationships and familiarity with platforms like DigiKey, fostering brand loyalty. This loyalty, coupled with the time and effort required to learn a new system and potentially re-qualify suppliers, creates moderate switching costs for new entrants seeking to capture DigiKey's customer base.

Economies of Scale and Experience

DigiKey, as a major player in the electronic components distribution market, benefits significantly from established economies of scale. This allows them to negotiate better prices with manufacturers due to high-volume purchasing, which translates into lower costs for their customers. For instance, in 2023, DigiKey reported revenues exceeding $5 billion, indicating substantial purchasing power.

New entrants face a considerable hurdle in replicating these cost efficiencies. They would need to invest heavily to achieve similar purchasing volumes and establish robust warehousing and logistics networks. Without this scale, they would likely struggle to compete on price against incumbents like DigiKey, making it difficult to gain market share.

- Economies of Scale: DigiKey leverages its size for bulk purchasing discounts from manufacturers, a key advantage over smaller competitors.

- Logistical Prowess: Established warehousing and distribution systems allow for efficient order fulfillment, reducing operational costs.

- Pricing Competitiveness: These scale advantages enable DigiKey to offer more attractive pricing, a significant barrier for new entrants.

Regulatory Hurdles and Technical Complexity

The electronic components industry presents significant barriers to entry due to stringent regulatory landscapes and the inherent technical complexity. Navigating international trade regulations, including evolving tariffs and environmental compliance standards like RoHS and REACH, demands substantial resources and specialized knowledge, making it difficult for newcomers to establish a foothold. In 2024, global trade disputes and shifting environmental regulations continued to add layers of complexity for businesses operating in this sector.

Furthermore, success in this market hinges on deep technical expertise for effective product sourcing, rigorous quality control, and providing knowledgeable customer support. Companies like DigiKey invest heavily in maintaining extensive product catalogs and technical resources, a level of investment that new entrants would struggle to replicate. The need for specialized engineering talent and robust supply chain management further elevates the threat of new entrants.

- Regulatory Compliance Costs: New entrants face substantial costs associated with understanding and adhering to diverse international regulations, impacting market access and product development timelines.

- Technical Expertise Requirement: The need for specialized knowledge in electronics engineering, supply chain logistics, and quality assurance creates a high barrier to entry for less experienced companies.

- Capital Investment in Infrastructure: Establishing the necessary infrastructure for warehousing, testing, and distribution, alongside building a comprehensive product portfolio, requires significant upfront capital.

The threat of new entrants in the electronic components distribution market, as exemplified by DigiKey, is generally low. This is primarily due to the immense capital required for inventory, sophisticated e-commerce platforms, and global logistics networks. For instance, DigiKey's substantial investment in its supply chain infrastructure and billions in inventory, as seen in the hundreds of billions valued semiconductor distribution market in 2024, creates a significant financial barrier.

Securing robust relationships with a wide range of component manufacturers and navigating complex international regulations also pose considerable challenges for newcomers. DigiKey's established supplier partnerships and expertise in compliance, like RoHS and REACH, demand resources that are difficult for new entrants to match, further limiting their ability to compete effectively.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment in inventory, platforms, and logistics. | Significant financial hurdle. |

| Supplier Relationships | Established partnerships with manufacturers. | Difficult to replicate, limiting product access. |

| Regulatory Complexity | Navigating international trade and environmental standards. | Requires specialized knowledge and resources. |

| Economies of Scale | Cost advantages from high-volume purchasing. | Makes price competition challenging for new firms. |

Porter's Five Forces Analysis Data Sources

Our DigiKey Porter's Five Forces analysis is built upon a robust foundation of data, drawing from DigiKey's own investor relations materials, industry-specific market research reports from firms like Mordor Intelligence, and publicly available financial filings.